That was the title of a conference organized by Istituto Affari Internazionale (with support of the Italian Ministry of Foreign Affairs and International Cooperation and Banca d’Italia) that I attended a couple of weeks ago in Rome.

The conference brought together scholars from seven think tanks from the G7 countries (CEPII/France, Chatham House/UK, CIGI/Canada, IAI/Italy, JIIA/Japan, Kiel/Germany, PIIE/US), to present their views on how best to address challenges in the coordination of macroeconomic, trade and financial regulatory policies (papers here). I must confess that at the time, I found the conference proceedings simultaneously fascinating and anxiety-provoking. Clearly, this is a time when we are confronting serious policy problems, and that is always stimulating from an intellectual perspective. On the other hand, many of the problems are self-inflicted; in this case they include the economic policy uncertainty arising from Brexit, and more importantly, from the alternatively incoherent policy proposals emanating from the Administration (or ill-advised when they are coherent).

Several of the papers suggested coordinating investment, both private and public (the latter in infrastructure) as a means of accelerating sustainable growth (read growth in potential output). This makes eminent sense on economic grounds — both types of investment have been depressed relative to expected or desired since the end of the last recession. Short term multipliers for infrastructure investment are typically higher than for government consumption. Over the longer term, augmentation of the net infrastructure stock (either through new investment or maintenance) seems to have large effects.

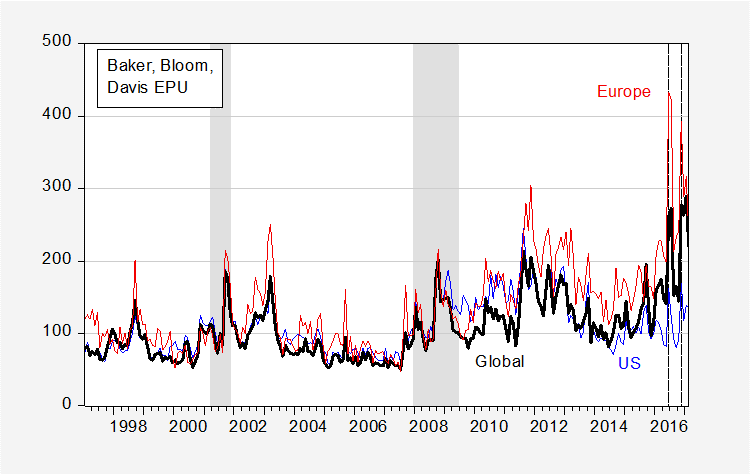

But higher private investment growth is going to be hindered by high economic policy uncertainty (even if the slow economic growth was the primary factor dragging investment before). And if public-private partnerships are going to be the main mode of undertaking infrastructure investment, then uncertainty is not helpful there.

Figure 1: Economic policy uncertainty index (news based) for US (blue), Europe (red), and Global (black). Source: policyuncertainty.com.

Overarching all the discussions was the issue of how to coordinate any policies when uncertainty is so high. And I’ll go further and say the uncertainty is particularly high when it’s clear the US administration is itself deeply divided on the path forward.

Now, as of yesterday, we seem to have a remarkable turn of events. No longer does China appear to be a currency manipulator, wholesale exit from NAFTA is off the table, a drastic change in the composition in the Fed Board less likely, and so forth [1] That being said, the fact that the President can change his mind so swiftly on some issues he so vociferously campaigned upon can be taken in (at least) two ways: (1) he has made a decisive change to accommodate facts and reality, or (2) he is subject to changing his positions on a whim. If the latter is more the truth, then economic policy uncertainty could remain very high. (Consider, first health care reform is critical, then we’re on to tax reform, then we’re back to health care reform, now tax reform is going to be some time off…)

The conference agenda is here, and the think tank papers are here. My comments are here. The discussant comments (by Richard Cooper, Giancarlo Corsetti, Claudio Borio, Richard Portes, and Iain Begg, among others) to be published later.

Trump campaigned and won on many extreme positions. We should be glad he has become more moderate. The Democrats can be much more helpful shaping policies. I think, Trump would be open to bipartisan solutions.

The problem isn’t just Trump….it’s the GOP’s self-inflicted wound known as the “Hastert rule.” There probably are a number of issues on which Democrats and some moderate (i.e., not full blown crazy) Republicans could find agreement, but the Hastert rule blocks any possibility of this happening as long as the House has a large plurality of crazies. For example, fixing Obamacare is a relatively easy problem and there’s plenty of room for some horse trading. The Democrats might be willing to compromise on the premium spread between old and young. The GOP wants 5:1 and the Democrats want 3:1. They could probably compromise on 4:1. The Democrats might also be willing to give some on limiting liability in exchange for some GOP promises on Medicaid or something like that. But there’s no chance of compromise if your going in position is that Obamacare must be entirely repealed. And as long as we’re stuck with the Hastert rule the crazies in the GOP will prevent compromises with Democrats even if Trump is willing to pretend that fixing Obamacare is equivalent to replacing it.

If the GOP takes a big hit in 2018, then I wouldn’t be surprised if they passively allow Trump to be impeached in the hope that Pence would be a more viable 2020 candidate than Trump. More uncertainty.

” I think, Trump would be open to bipartisan solutions.”

What folks like PeakTrader consider a “bipartisan solution” is Obamacare repeal that only takes away health insurance from 12 million people instead of the original Republican plan which would take away health insurance from 24 million people.

Trump is not a person that Democrats can do any deals with because he is not trustworthy. His only skill is as a used car salesman. A used car salesman has no principles. He will say whatever it takes to make a sale. And if the first position doesn’t work, he will immediately flip to the complete opposite, even if both are lies. Truth is meaningless. He is a huckster, a conman.

there are many people urging various angles on infrastructure, both private and public or combined, as a means to enable sustainable growth. i am all for this. however, in order for a lot of this infrastructure to provide growth and value over the longer run, we need to make some changes in how we fund these projects. this includes both the initial costs, and the total life cycle costs. we are developing a habit of building things and then forgetting about them. maintenance costs can be tremendous long term. as you see in the highway system, these costs have not been managed very well. in addition, to actually gain value over time, one needs to make some investments in “smarter infrastructure” for the next few decades-meaning using IT, sensors and analytics in order to make our infrastructure systems grow in value over time. you build a highway for a certain capacity. once that capacity is reached, you need to makes changes either by building more infrastructure (expensive) or creating a “smart” transportation system that provides improved efficiency on the existing infrastructure (cheaper). we don’t seem to be creating any budget for this latter step. but since we are constrained in how much we can expand, especially in our major cities, that is a shame. does anybody believe trump is the leader to help us overcome this problem?

First, to Joseph. I would agree that Trump is best considered an opportunistic salesman, not moored by any given set of principles or world view.

Now, this can be used as a feature and not only a bug. Even the used car salesman will sell you the car if it makes economic sense, although it’s certainly caveat emptor.

Thus, the challenge for Trump’s staff is to give him stuff to sell, give him big, shiny stuff to sell. They haven’t done that, in significant part because Bannon doesn’t have a coherent worldview (ie, he lacks the Three Ideology Model). However, if staff can feed Trump interesting stuff to sell, Trump will go out and put gold-plated ‘TRUMP’ all over it and push as the Best or Even Better. If you give him something to sell, he can sell it.

Now, one of my particular peccadillos is that I spend time thinking about what this Trumpian list might actually comprise. One of the big ticket items for Trump is a massive infrastructure program. I have to admit less than unvarnished enthusiasm for this program. Most the roads I drive on are reasonably well paved; most the airports I use have adequate capacity. The projects that really need spending — the widening of I-95 north of New York to six lanes each way, for example — are obstructed by politics, not the lack of money. Furthermore, as I earlier pointed out, spending money on maintenance capex — repaving an existing road or renovating an airport terminal — does not increase GDP beyond the actual spend on construction. Rather, it prevents GDP from falling (at some point). Well, that’s not too exciting to me. So what could we do that’s interesting in infrastructure?

As it turns out, I was visiting at Trinity College in Hartford yesterday. Like many colleges — Hopkins, Penn, Yale and Wesleyan comes to mind — Trinity sits adjacent to fairly run-down communities. These areas could be purchased, demolished and used to create satellite communities to the respective universities. (At Hopkins, this has been well underway for some time.) This includes more upscale housing and academic-related businesses (vc, data services, etc.). Thus, universities could be used as the key agent of urban redevelopment. We could probably spend $100 bn there fruitfully.

The Hartford Courant adds some color:

“They pay pretty well in Boston too,” he said, where jobs are growing robustly, and where GE decided to move its headquarters. But Boston has world-class universities and hospitals, he noted.

“Unfortunately Hartford does not have that offsetting advantages that make it worthwhile to pay the cost of living there,” he said. “That generates outmigration. Quite frankly, that outmigration is going to continue.”

“…it’s young people, not retirees, driving the trend.

“A tiny, tiny percentage of people over the age of 55 ever move,” Francese said. “They’re rooted to where they are. They’ve got friends, they’ve got networks. The people who leave are 75 to 80 percent young people.”

Frey said students who go to Boston for college and end up staying to work “tends to be the case where there aren’t a lot of jobs being created. There’s a lot of research on being a cool city, but what’s more important is being a prosperous city.”

Hartford Metro Area Has Country’s 10th-Largest Population Loss

http://www.courant.com/business/