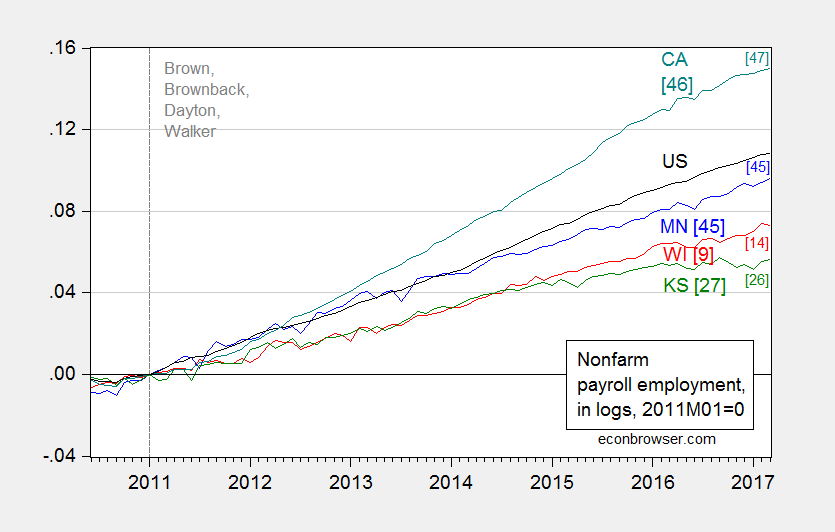

Since 2011 — when Scott Walker and Sam Brownback came into power — California has powered far ahead of Wisconsin and Kansas. The newly released Rich States, Poor States, 2017 allows us to look at how four states, both low and high ranked by Arthur Laffer et al., fared, employmentwise.

Figure 1: Log nonfarm payroll employment for Wisconsin (red), Minnesota (blue), California (teal), Kansas (green) and the US (black), all seasonally adjusted, 2011M01=0. ALEC-Laffer State Economic Outlook rankings for 2016 and 2017. Vertical dashed line at beginning of terms for indicated governors. Source: BLS, Rich States, Poor States and author’s calculations.

Wisconsin was ranked 9th in RSPS 2016, and had what at best was lackluster employment growth over the subsequent year. California has been consistently ranked very low by ALEC, and yet has outperformed.

For formal statistical analyses relating ALEC rankings to economic outcomes, see this post.

7 or 8 of the 15 variables are “taxes” as if taxes are the most important driver of a states “economic outlook.”

Another variable is minimum wage. I guess a low wage is “good” and a high wage is “bad.”

Take Alabama. (The first state on the list). The historical “Outlook” rankings given have ranged from 17-20. Their actual performance is 39. The RSPS ranking is obviously meaningless. Imo the metrics are selected solely to make California look bad.

It gets you funded, I guess.

Cost of living and quality of life are important (even for workers): a

http://www.cnbc.com/2017/01/23/best-and-worst-states-to-retire.html

RSPS ranking is just another example of “economists” who don’t let facts and evidence get in the way of their theories. Laughable nonsense from ideologues who have never been right about anything and yet have credibility among politicians. Go figure.

Three month coincident indicators are better in KS and Wisconsin than Minnesota.

http://www.calculatedriskblog.com/2017/04/philly-fed-state-coincident-indexes_18.html

In unemployment rates, Wisconsin (3.4% unemployment rate) has moved up 6 places to 11th. Kansas (3.6%) is now 15th, and Minnesota (3.8%) has fallen to 16th.

And the miracle of California ties for 35th, 4.9%.

https://www.bls.gov/web/laus/laumstrk.htm

Problem: those three states have a combined population of about 14 million, or about 25 million less than California.

There are pockets in California where the population is equivalent to any of the three where employment is higher or certainly the equivalent. There are also pockets where unemployment is higher but where economic diversity is practically nonexistent. Solidly red northeastern California would be one such area, the San Joaquin Valley another.

It would be unfair to compare Kansas with the Greater Bay SF Metro area–much smaller geographically– which has about 1.5 million more people, a lower unemployment rate, and a GDP at least 10X greater.

I erred. GDP of the Greater Bay Area (including San Jose) would be “only” 5X great than that of Kansas.

Menzie made the comparison.

Steven, it is even more telling if you use January, 2007 as your base point for unemployment rates (peak to peak?).

California is 4.9% now versus 5.0% 1/07.

Kansas is 3.8% now versus 4.3% 1/07.

Wisconsin is 3.4% now versus 4.9% 1/07.

Minnesota is 3.8% now versus 4.4% 1/07.

Menzie chose trough to peak, but peak to peak is also meaningful. On a peak to peak basis, Wisconsin and Kansas are significantly better than California, Kansas is about the same as Minnesota, and Wisconsin is significantly better than Minnesota. California’s performance only appears better because it performed so badly during the recession.

https://www.bls.gov/eag/eag.us.htm

I’d probably use 12/07 if I were going to take that approach.

I think it’s challenging to lean too hard on a single indicator. That said, I think it’s fair to say that all of Kansas, Wisconsin and Minnesota are doing very well by traditional unemployment metrics.

Colorado, at 2.6%, is just blowing the doors off. Nebraska has faded to 3.1%, if you want to deem that a failure.

California, in my opinion, is still under-performing significantly. Who has the greater natural advantage, California, Wisconsin or Nebraska? That shouldn’t even be close. California has more of everything, all the comparative advantage you could want. And yet the unemployment rate is a pedestrian 4.9%. In this deck, California is the laggard.

Steven, I chose 1/07 because by the end of 2007, many states had already shown significant increases in the unemployment rate (California had already gone from 5.0% to 6.0%) so, while it might be difficult to select a “peak” employment point consistent for all states, January 2007 was probably more representative of a point that was near the peak.

Kansas 4.3% >>> 4.3%

Minnesota 4.4% >>> 4.7%

Wisconsin 4.9% >>> 4.8%

When I worked with the Governor’s Office of Economic Development in my state, they reported that “desirable” companies — those paying better than $25/hr plus benefits — looking to relocate or expand here asked about things in roughly this order of importance: educated workforce, communications, transportation, higher ed, K-12 ed, quality of life factors, housing costs, and taxes.

Firms that pay that much typically don’t create many jobs.

What about small business start-ups and expansions, which create most new jobs?

I think, regulations, lawsuits, and taxes would be much more important.

I know Wisconsin has been dead-last for startups, according to the Kaufmann Foundation. Probably because to need to ATTRACT TALENT to have startups, and that’s the last thing that ALEC states want to do.

Also, you don’t think people making $60K buy more houses and cars and services and go out to eat more than people making $30K, do ya? And that’s not important in an economy that’s got70% of it based on consumption, is it?

All firms want talent. I think, it has become even more risky to start a business, because of federal and state regulations. And, high middle class taxes don’t help. There won’t be many $60K a year jobs, if small businesses can’t grow into big businesses to expand the economy. I doubt, if you start a business, you can afford to pay your employees $60K a year to start.

Firms that pays much have less turnover and the workforce stable is something you ignored. Take Costco, they pay employees far more than what is typical in a retail industry. They get the stability compared to others who have high turnover rate.

Regulations are set equally to all companies operating in the state. Cain is correct on the order what companies look for when relocating provided they get incentive packages (this does nothing but poach jobs from other states).

Wages and turnover have nothing to do with my comment. Big firms, which tend to pay better, don’t create many jobs compared to small firms. And, excessive regulations hurt small firms much more than big firms.

Sure, big firms work in or near big cities where there’s more infrastructure compared to small cities or towns.

A good general education is important through high school. However, we spend a lot on education and get poor results. Also, in college, not enough valuable degrees are earned, e.g. in computer science, engineering, or the medical field. There’s enormous waste in education.

You get the impression PeakTrader doesn’t actually, you know, interact with real work and the outside world economy and just sits on his backside trading paper?

SUPPLY SIDE DOES NOT WORK. THE JURY IS BACK. Regulations and taxes are the last reasons an economy grows or contracts, and given how low our rates and regulations are these days, all cutting them does is increase negative externalities and inequality, and encourages CEO hoarding and rent-seeking over job creation.

Jake, you give the impression you’re living in your parent’s basement playing video games all day and have no connection to the real world, which includes me.

You seem to believe piling on anti-business policies has no effect on the economy, including demand. Don’t be so ignorant.

Yes, small firms do create more jobs.

But they also destroy more jobs.

On balance, small firms share of employment is not increasing and actually falls in most years.

See:http://www.census.gov/econ/susb/historical_data.html

Here’s what the NBER states:

“The real driver of disproportionate job growth, they find, is not small companies, but young companies. It is the startup firms that generate the surge of jobs that earlier research attributed to small companies.”

Also, it seems financial incentives help:

“Boeing was offered an incentives package [by South Carolina] reportedly worth $450 million provided the company create 3,800 jobs and invest $750 million over the next seven years.

Later calculations determined that the state-offered incentives package will be worth in excess of $900 million in property and sales tax breaks and state bonds. State lawmakers stood by the deal, insisting that the economic advantages of the package would justify a sizable investment by the State.”

Peaktrader,

These incentive is nothing more than moving a job from one state to another, not creating new jobs. That amounts poaching other states’ workforce just to say you are creating jobs.

I used to live where Fidelity National is currently headquartered. Prior to that, the company used to be in California. When I went to the interview, many people I was supposed to talk to were in California visiting their families.

PeakTrader: “Boeing was offered an incentives package [by South Carolina] reportedly worth $450 million provided the company create 3,800 jobs …”

Actually the millions in incentives did not create one single new job. They just moved some jobs in Seattle at higher pay to South Carolina at lower pay. In other words a net loss for the workers and the economy.

Yes, financial incentives is a more important factor to attract jobs than some believe.

And, a wage substantially higher than the equilibrium wage, e.g. unions, can reduce work and hurt the economy.

you argue that a wage substantially higher than equilibrium, which you accuse the unions of creating, is bad for the economy. what about the inverse. in an area where there are no worker protections, and the business has all of the leverage, wages are paid substantially below the equilibrium. that is how you get stagnant wage growth. that also hurts the economy.

We don’t have that problem in the U.S.. However, we had a flood of low skilled immigration and high compensation costs to reduce low income real wages. Moreover, higher production costs from excessive regulations and high taxes can reduce real wages. Over this “recovery,” we had lots of low paying and part-time jobs. Of course, I’d like to see higher low income wages, including a higher minimum wage.

“We don’t have that problem in the U.S.”

i think you fail to understand the conditions around america. we do have this problem-exacerbated with the decline of unions. corporations have record profits, and the higher end and management folks have seen income increases. not so much for the worker bees. why do you deny this reality?

“e.g. unions, can reduce work and hurt the economy.”

Germany is a perfect example of unions hurting an economy.

Yes, that’s right. The decline in German unions helped its economy. Germany is much less unionized than many other European countries.

https://hbr.org/2017/03/the-real-reason-the-german-labor-market-is-booming

but the us has also had a significant decline. and you seem to argue, on any given day, that the us economy is poor and in a depression. so which is it? does the loss of unions help or hurt the economy?