That’s the title of my article at EconoFact today.

The Issue:

The Trump Administration has proposed a number of trade related measures purportedly on the basis of national security. The first involves invoking a seldom-used provision of the trade law to investigate whether imposing import restrictions for steel and aluminum is justified by national security reasons. The second is the creation of a new White House office, the Office of Trade and Manufacturing Policy, superseding and replacing the National Trade Council established at the outset of the Trump Administration.

The question is whether the threats posed to national security are genuine, or merely a means of protecting domestic industries under the guise of national security.

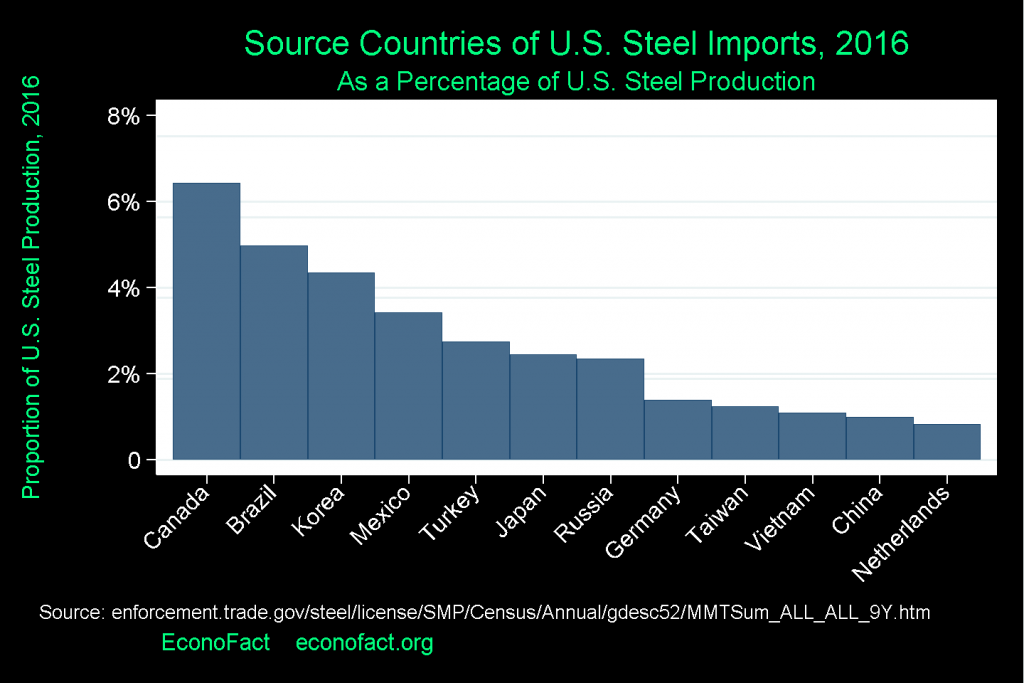

Here is a graph of steel import sources, from the post.

Update, 5PM Pacific:

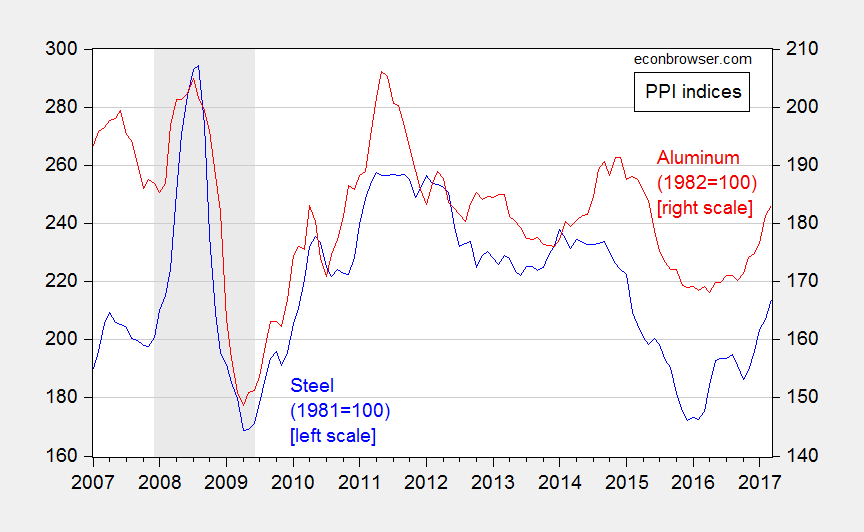

Steel and aluminum prices have risen in recent months, partly as a consequence of other trade measures (countervailing duties, anti-dumping duties).

Figure 1: PPI for steel and iron, 1981=100 (blue, left scale), and for aluminum, 1982=100 (red, right scale), both not seasonally adjusted. Source: BLS via FRED.

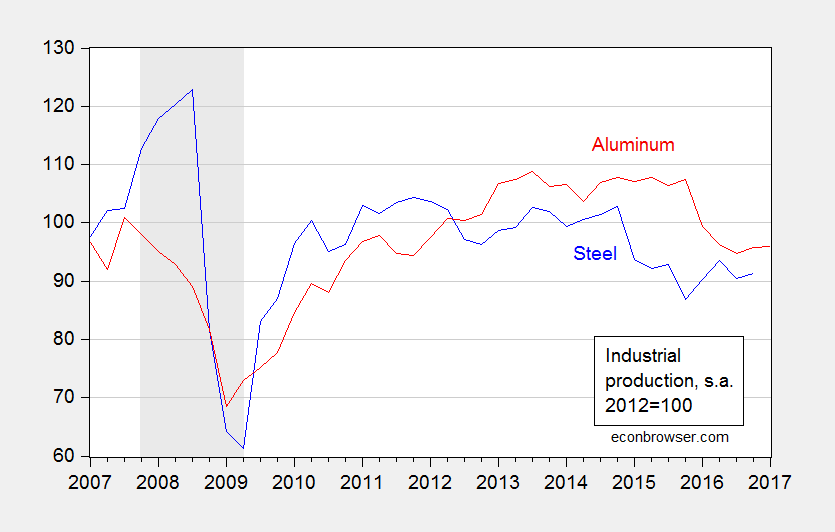

Production is down for both categories, although steel is recovering.

Figure 2: Industrial production for raw steel (blue), and for alumina and aluminum production and processing (red), both 2012=100, seasonally adjusted. Source: Federal Reserve Board via FRED.

The entire post is here.

Update, 2:15PM Pacific:

From Peter Navarro, The Policy Game (Wiley, 1984), p.82, some germane arguments.

National Security Benefits and Costs. On the benefit side, protectionism within certain basic industries like autos, steel, and electronics helps to create and sustain and industrial base that, in times of war or national peril, can be shifted to defense purposes. However, this national security argument–and the existence of any benefits resulting from protecting these industries–can legitimately be called into question for several reasons.

First, the existence of any sizable benefits rests on the assumptions that import competition in our defense-related industries would not only reduce the size of these industries but also shrink them to the point where they would be too small to support our defense needs…

Second, it is highly possible that our defense capability might actually be enhanced–not damaged-by import competition. Without the umbrella of protectionism, our defense-related industries would be forced to operate at lowest cost, engage in more research and development, aggressively innovate to stay one step ahead of the competition, and modernize their plants at a faster pace. …

On the national security cost side, the major effect of protectionism is to threaten the stability of the international economic order through a global trade war. …

If the Trump administration is doing it, it’s probably bad. But let us imagine a better liked administration was doing this, just for the sake of argument. Mainstream economists have been wrong about many things in recent decades.

“If the investigations do result in protectionist measures, these are likely to raise prices for downstream consumers in the defense industry, as well as the overall economy.”

Isn’t the Federal Reserve in charge of maintaining a certain rate of inflation? Bernanke recently suggested that a price level target may be worthwhile.

“A finding that leads to protectionist measures is also likely to invite retaliation by our trading partners, which could lead to a process of escalating protection.”

This seems to me to be more of a political calculation something economists have been notoriously bad at performing. It may be true but one needs to look at the historical record. Germany, China, Japan, South Korea, etc. have engaged in forms of “protectionism” or economic nationalism without necessarily suffering retaliation from trading partners.

Peter K.: The Fed can control the price level (kind of), but not necessarily relative prices. Ceteris paribus, protection will raise relative prices of protected goods, both imported and domestic substitutes. Might be worth it, might not — something that should be investigated in a serious and informed fashion.

Fair enough but I don’t think economists focus enough on whether the economy is at full employment or not. They just assume it is for arguments of ceteris paribus. In other words so-called protectionism will not necessarily raise prices as much if wages are stagnant b/c of unemployment and slack labor markets and overall price inflation and price pressures are low.

Peter K.: Understood, but while I am sympathetic to the view of some slack in the economy, it’s hard to argue there is a lot. CBO has estimated a bigger (negative) output gap than the Fed, and still indicates a 1% gap in 2017Q1. The GDP deflator rose 2.2% (log terms, annualized) in the first quarter.

Again, good point, but we aren’t seeing much in the way of wage gains. As Larry Summers pointed out in a recent column, the Phillips Curve relation between unemployment and inflation seems to have broken down somewhat. I’d bet we won’t see accelerating inflation in the near future. The Fed will tighten too quickly before that happens.

http://cepr.net/data-bytes/prices-bytes/prices-2017-05

May 12, 2017 (Prices Byte)

By Dean Baker

A core CPI that excludes rent is up by just 0.8 percent over the last year.

In spite of concerns about the economy approaching full employment, the Consumer Price Index continues to show no evidence of acceleration. The overall CPI rose by 0.2 percent in April while the core index rose by just 0.1 percent. Over the last year the overall CPI has risen 2.2 percent, while the core index increased by 1.9 percent. Comparing the average price level for the last three months with the prior three months, the core rate has risen at just a 1.8 percent annual rate.

The difference between the overall and core index is due to a 1.1 percent jump in energy prices after two months of sharp declines. With world oil prices falling again in recent weeks, this increase will not continue and may be reversed.

The main item pushing core inflation higher continues to be rents. The index for rent rose by 0.3 percent in April, while the index for owners’ equivalent rent rose by 0.2 percent. For the year they are up by 3.8 percent and 3.4 percent, respectively. The core index excluding rent is up by just 0.8 percent over the last year.

…

A lot of the steel used in the defense industry actually comes from France. A bigger national security concern is with counterfeit parts. In fact, I believe there’s a Congressional hearing scheduled for next Wednesday on that very problem.

2slug,

I can’t believe I’m agreeing with you, but you are absolutely correct about counterfeit parts… and not just for the DoD. This has been a “trade war” in which the U.S. has been engaged, but not very willing to fight. It goes from software to all sorts of hardware costing U.S. producers billions, maybe trillions, of dollars each decade.

There are those who argue that consumers benefit from copyright and patent infringement, but in the long run it simply makes the U.S. producers poorer and less able to compete.

The other “trade” issue is the loss of trade skills which has been flying under the radar. From the mundane to the highly specialized, the U.S. has been losing the knowledge and skills necessary to produce whole classes of products. That’s more of a “national security” issue than some imported steel. If you import the steel and don’t have the skills to work the steel, you’ve just purchased some expensive dust collectors.

https://www.constructionequipment.com/solving-skilled-welder-shortage

Steel is a highly differentiated product, with many different formulations available depending on its end use and manufacturing requirements.

There’s no mention of China’s espionage activities. They’ve been proven to have stolen trade secrets from US Steel regarding some newer advanced types of steel so that they can then turn around and dump that steel on the world market. I know fairness isn’t terribly relevant, but that sure doesn’t sound fair to me.

And like slugs mentioned, counterfitting is a huge problem too. Think the bolts and fasteners used in jet airplanes are just hunks of steel with threads on them? Guess again. But it’s often hard to tell a different until they fail prematurely.

Tom: Obviously, there are many different types of steel and grades of aluminum. I still have yet to see an account of loss of productive capacity in defense-critical steel (as opposed to steel for general purposes). If you have an account, I would welcome seeing it.

I have absolutely no doubt the Chinese (like the Russians) are actively engaged in industrial espionage. Thinking in terms of the targeting principle, does it make sense to use of trade policies to remedy this problem? Would imposing trade sanctions make the Russians or Chinese change their policies when they do not admit to espionage.

However, imposing targeted financial sanctions against specific firms and individuals responsible for espionage seems more appropriate than going to a trade war.

Menzie, you point out that:

I have absolutely no doubt the Chinese (like the Russians) are actively engaged in industrial espionage. Thinking in terms of the targeting principle, does it make sense to use of trade policies to remedy this problem? Would imposing trade sanctions make the Russians or Chinese change their policies when they do not admit to espionage.

However, imposing targeted financial sanctions against specific firms and individuals responsible for espionage seems more appropriate than going to a trade war.

The problem with argument lies here: https://www.ft.com/content/adffb2b4-4464-11e6-9b66-0712b3873ae1 You are not dealing with specific firms or individuals… you are dealing with either the Chinese national government or local units of government. So, in order to impose financial sanctions, you have to be targeting some level of the Chinese government.