That’s how Larry Summers described the growth forecasts underpinning the Trump budget released today. And I can’t really disagree, regarding the medium to longer term forecasts.

From the article:

Apparently, the budget forecasts that U.S. economic growth will rise to 3.0 percent because of the administration’s policies — largely its tax cuts and perhaps also its regulatory policies. Fair enough if you believe in tooth fairies and ludicrous supply-side economics.

Then the administration asserts that it will propose revenue neutral tax cuts with the revenue neutrality coming in part because the tax cuts stimulate growth! This is an elementary double count. You can’t use the growth benefits of tax cuts once to justify an optimistic baseline and then again to claim that the tax cuts do not cost revenue. At least you cannot do so in a world of logic.

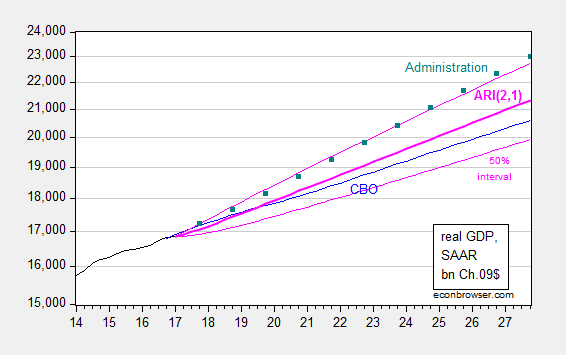

The detachment from reality is shown in this figure, which is an update of a figure in this post.

Figure 1: Real GDP in billions of Chained 2009$, reported (blue), CBO January projection (blue), forecast from ARIMA(2,1,0) estimated over 1997Q1-2017Q1 (bold pink) with ± 0.674 standard errors/50% interval (thin pink), and White House forecast (teal boxes). Source: BEA 2017Q1 advance, CBO Budget and Economic Outlook (January 2017), FY 2017 Budget, Table S-9, and author’s calculations.

Notice that the White House forecast predicts substantially faster growth than the CBO does. Now, it is true that the CBO does a forecast conditional on current law, while this White House does a forecast condition upon implementation of the Administration’s budget, and supply side responses to Lafferian dream measures like massive tax cuts and deregulation. Historically, the CBO’s forecast is more accurate (according to the root mean squared error criterion), despite the conditioning on current law.

Of course, there are dissenting views, including those of the ever-present Stephen Moore. Here is his tightly reasoned, quantitatively buttressed argument:

In this Trump budget the White House is predicting 3 percent plus growth over the next decade once the tax cut, deregulation, and ObamaCare repeal are enacted. Liberals and the media are protesting that Trump can’t deliver 3 percent growth and that his forecast is “unrealistic” and a “rosy scenario.”

What hypocrites. Every Obama budget assumed 3 percent to 4 percent growth and I don’t recall the wailing and gnashing of teeth even though Obama’s policies failed to get us over the 3 percent low hurdle in a single year.

So are we really supposed to believe that Obama could get unleash 3 percent to 4 percent growth by raising taxes, but Trump can’t do it by cutting onerous taxes?

That’s from Mr. (not Dr.) Moore, who is also a collaborator on the information-free ALEC-Laffer state economic outlook ranking.

The stock market seems to be moving higher on expectations of stronger growth rather than on the flood of Fed liquidity. A permanent tax cut may reduce permanent unemployment to raise potential output. And, too much red tapes slows, and sometimes stops, economic growth.

“After the election, stocks soared on expectations that tax cuts would ignite an economic boom. The nonpartisan Tax Foundation was estimating that the Republican tax plan would lift wages nearly 8 percent and produce 1.7 million new jobs over the decade. Harvard economist Robert Barro was predicting Trump’s overall economic agenda could boost the nation’s annual growth rate from 2 percent to as much as 4 percent.”

shameless. Republicans love blowing the deficit don’t they?

Then why did the same program produce more than 3% growth for Ronald Reagan?

And why would a supporter of Barak Obama’s failed program have any credence? Obama was the only president in the last 60 years to not deliver 3% growth despite MASSIVE deficit spending and a 9.4 trillion dollars in spending.

Trumps estimate of 2-3% has a lot more behind it than than Obama’s 3-4% baloney estimate.

Oh, and these are FACTS lefty loons.

Under Reagan labor force growth was much greater as was productivity.

Trump’s programs will reduce labor force growth to even lower than over recent years.

I have no idea what Trump will do to raise productivity do you?

Are you trolling? Or how much of that do you actually believe? I’m honestly curious, because this is, by far, the most uninformed, ridiculous comment I’ve ever seen on this site (and I’ve read a lot of Peak Trader’s comments).

Mike V, my comments are supported by orthodox economics. You’ve shown you’re ignorant of economics, which explains why you cannot understand my statements, along with being politically biased and closed minded.

PeakTrader: Your statement “my comments are supported by orthodox economics” boggles the mind. At least it boggles my mind. You should try linking to textbooks (as opposed to crazy stuff on the internets) to document how your views conform to “orthodox economics”.

Menzie Chinn, what exactly in my statements don’t conform to orthodox economics? I’m sure, you’re teaching the same or similar economics that I was taught in undergrad and grad school. You seem to defend economic illiterates, like Mike V, simply because they agree with your political views.

My statement is based on the permenant income hypothesis, which seems to be the policy Republicans are adopting, since we’re not in recession (although in depression). Maybe, you believe more regulation in a heavily regulated economy promotes growth. Why is the stock market is rising after Trump’s election?

LOL

One of the interesting productivity features is the jump during the Great Recession, as low productivity people were being laid off. If low productivity people constitute the bulk of recent re-hires, then that could create the impression that aggregate productivity growth is low, when in fact there is a cohort bias.

I haven’t run the numbers, but if that’s the case, then productivity growth may begin to rebound as we reach full employment as the re-employment drag eases. I’d be happy to see an analysis.

Very interestingly, today’s home sales numbers suggest lower income groups are coming to the fore. Very bullish for Trump.

Productivity is highly cyclical. Yes, laying off low productivity employees plays a role.

But the much bigger factor is the lags. When demand first rebounds firms try to meet the increase demand by having the same number of employees produce more. Firms wait to add back employees until they are sure the rebound in demand is permanent and will not quickly reverse. Try comparing hours worked in manufacturing to manufacturing output and you will quickly see that the hours worked variable lags the production. this lag is responsible for the cyclical nature of productivity and you can see the same lags when the cycle peaks.

The wage data where average hourly earnings for all employee is growing faster than hourly earnings for non-supervisory workers implies just the opposite of what you are claiming for housing starts. It implies that supervisory employees are hard to find and that firms are having to pay up to bring them on board while the slower wage gains for non-supervisory workers imply that low quality labor is readily available.

I suspect, productivity growth was high in the fracking boom as capital spending increased and labor learned to become more efficient through actual work experience.

Productivity is highly cyclical. Yes, laying off low productivity employees plays a role.

But the much bigger factor is the lags. When demand first rebounds firms try to meet the increase demand by having the same number of employees produce more. Firms wait to add back employees until they are sure the rebound in demand is permanent and will not quickly reverse. Try comparing hours worked in manufacturing to manufacturing output and you will quickly see that the hours worked variable lags the production. this lag is responsible for the cyclical nature of productivity and you can see the same lags when the cycle peaks.

The wage data where average hourly earnings for all employee is growing faster than hourly earnings for non-supervisory workers implies just the opposite of what you are claiming for housing starts. It implies that supervisory employees are hard to find and that firms are having to pay up to bring them on board while the slower wage gains for non-supervisory workers imply that low quality labor is readily available.

If firms are hiring low quality labor now. how will continued growth allow them to find higher quality labor?

“If firms are hiring low quality labor now. how will continued growth allow them to find higher quality labor?”

When labor is scarce and wages are rising, employers have an incentive to invest in capital goods and improve their work flow. Thus, if we measure productivity as output per hour (is that in volume or dollars? — probably deflated from dollars to real), then employers have an incentive to increase productivity in tight labor markets.

I can see a big change happening now in check-out lines. A year ago, I always went to a cashier at Wal-Mart, Home Depot, Stop-and-Shop and McDonalds. (What high rent establishments I frequent!). Nowadays, I self-check out at all these places except McDonalds, and that’s coming. The software has really only recently become sufficiently robust to make the option reliable. So, we’ll see on productivity, but I think we need to be careful about projecting too much from the current part of the cycle.

Also, Moody’s downgrades China. Expected. And it will get worse.

Menzie,

More partisan analysis, Larry Summers edition. Trump’s ability to produce derangement of the Left is truly astonishing.

First, where does Summers get his numbers? He doesn’t tell us. Both the 2017 Obama budget and the 2018 Trump budget reports nominal GDP forecasts over comparable time periods. Nominal GDP appears to be growing at an average rate of 4.3% under the Obama forecast while it grows about 4.9% under Trump. So, yes the Trump forecast is assuming faster economic growth on average, about 0.6% in nominal terms. Other things equal, the higher economic growth assumption will produce more revenues in the Trump budget forecast.

But other things aren’t equal. There is a second assumption important for revenue projection that Summers fails to mention: the percentage of nominal GDP assumed to be collected by the government. Over the past 50 years, over a wide variety of tax regimes, that percentage has averaged about 17.5%. The Trump budget assumes that the percentage will be about 18% over the forecast horizon. However, the Obama 2017 budget forecast made the assumption that the collection percentage will climb to about 20% at 2020 and stay there. As a consequence, the Obama budget forecasted higher overall revenues over a comparable period than does the Trump budget forecast.

Thus, the 2017 Obama budget forecast compensated for its lower GDP growth forecast by making the tooth fairy assumption of higher rates of collection so that overall it ends up being more aggressive than the Trump forecast.

Why didn’t Larry Summers (or you) write an angry article on the Obama budget forecast last year? That’s Moore’s point and he doesn’t need a PhD to make it.

Rick, we are nearly 6 months into the trump administration. you need to stop living in the past, and trying to use obama to avoid blame for trump.

then again, you are already on the record as accepting trump lies as acceptable behavior.

“First, where does Summers get his numbers? He doesn’t tell us.”

same could be said about trump and his numbers.

Oh my. I see that the usual slow learner has chimed in, and so I say:

Once more unto the breach, dear friends, once more…

Let’s go over this yet again. Observed economic growth can be due to cyclical factors (i.e., changes in aggregate demand) or shifts in potential GDP (i.e., the supply side). If you don’t understand this (PeakTrader and Ralph Schwartz, I’m talking to you), then you really don’t belong here. The big surge in GDP growth that we saw for a few quarters during the Reagan years was almost entirely a snapping back to long run growth following a very deep recession. The Fed cut rates and Reagan primed the pump (sorry, Donald, you didn’t invent the term), and this spiked aggregate demand and brought the economy closer to the long run potential GDP. After that, GDP growth rates pretty much returned to their long run trend. The Obama era growth rate projections were not inherently out of line because throughout most of those years the economy was running well below potential GDP. So projecting 3% growth was not ridiculous on its face given the potential GDP gap. Of course, Obama didn’t achieve those growth rates, but that’s a different discussion for a different time. The point is that there was nothing absurd about 3% given the potential GDP gap.

The economic landscape is very different today. No one believes we have a large output gap, which means there isn’t much that fiscal or monetary policy can do to improve observed real growth rates. That means Trump has to get his 3% (or 4%, depending on the tweet) from the supply side. And if you know anything at all about growth accounting using something like the Solow growth model, then it should be obvious why 3% (or 4%) is ridiculous. Potential GDP growth is dominated by two factors: growth in the labor force and technology (broadly understood). We know the labor force growth rate with a high degree of certainty. That’s baked in the cake. If anything, Trump’s policies will tend to shrink the labor force (think repealing mobile health insurance, restricting immigration, building a big, beautiful wall, etc.). So that leaves us with technology. It’s hard to see how cutting education funding helps labor productivity. And if you believe cutting regulations will unleash growth, then I’ve got a bridge to sell you. You might want to learn what growth economists mean by the term “convergence rates.” It’s kinda central to understanding growth theory.

And yes, the stock market has been on a pretty good run since the election, but the trend isn’t all that much greater than it was prior to the election. The stock market anticipates big corporate tax cuts, which improve profits. That’s what’s driving the run up in equity prices. Notice that real interest rates and inflation have been basically flat since Trump won, which suggests that Mr Market doesn’t really expect strong economic activity as much as it expects tax cuts.

2slugbaits, obviously, you have a comprehension problem. I’ve never stated output changes are neither cyclical nor structural. I’ve stated before, some of the destruction in potential output can be explained by demographic shifts. However, that doesn’t explain the sudden, substantial, and sustained drop of output in this “recovery,” which would’ve been worse given smaller trade deficits and the fracking boom. Given so many able bodied people dropped out of the workforce or work part-time and with the glut of low-skilled labor, there’s potential for strong labor growth, along with potential of employing the trillions of dollars of idle capital.

The people put a successful businessman in because the economy needs to be run like a business, not by economists or other weather forecasters from Harvard. Like any good businessman, the President is underpromising and overdelivering, since he believes we can get to 4% or even 5% growth.

President Trump will have the last laugh and America will be better off for it.

considering the bankruptcies of trump owned enterprises, this is probably not the best businessman to complete your model.

Businessmen take big risks. Sometimes those risks don ‘t work out. The really good businessmen like Trump survive to win another day.

Only someone who is willing to take big risks will have a fighting chance to drain the swamp in Washington.

trump takes big risks, and typically loses in the big picture. he is very effective at extracting his money from a deal, but usually the deals are a net negative-see the atlantic city casinos. when he leaves a situation overall as a net negative, somebody else is paying for his risk taking. if you applaud that as a businessman, fine. but i certainly do not like to be in business with a man who leaves me holding the bag. integrity counts in the long run.

on the other hand, as president, he will simply leave the country and taxpayers holding the bag. he will never own up to his mistakes. never has, never will. not the sign of a good leader. for president, you elect a leader not a businessman.

You sound like you are jealous of Trump. He’s had a highly successful business career. Trump is worth billions. Recently, his businesses have earned a very high margin with low risk.

Since when has Trump been a “good businessman”? He has no business skills whatsoever. He barely got through college and would have been tossed out except for his rich daddy. He’s gone through several bankruptcies and stiffed over 40,000 people to whom he owes money…especially ironic given Trump’s comments today about lecturing NATO countries for not paying their fair share. Based on the best estimates we have on Trump’s net wealth, the Stanford business school estimates that he would be roughly twice as rich as he is today if he had simply invested the money he inherited in a passive index fund that tracked the S&P 500. Trump seems to love the thrill of making deals, but that doesn’t mean he makes good deals. If you’re top priority is closing a deal, then you’re probably going to make a bad deal.

In any event, I have no idea why you think businessmen understand macro. Back when I was in college the business majors (except for finance) were at the bottom of the macro classes. They never seemed to get it.

When did Stanford business school do a study on Trump’s business success compared to the stock market? Are you making that up? Some journalists wrote some articles about that but they don’t know anything about business.

When I was in business school, we were forced to take a few economics courses. We all thought that taking macro was like taking a course in astrology. Completely useless. A lot of business guys just tuned out.

they also tuned out their ethics education. big mistake. see the financial crisis as example. fortunately, business schools, like harvard, are working to bring ethics back into the education model.

as for valuing trump, that is hard to do. his value varies by billions throughout the day, depending upon his mood. but in the late eighties his estimates were in the several billon dollar range, similar to today, 25 years later. that rate of return does not compare well to the stock market over same period of time.

Actually, business people are among the most ethical. Clearly, you have little real experience in the business world.

You sound just like the other guy, 2slugbaits. Are you making that up about Trump? What estimates?

well jonathan, many of the top business schools in the country recently revamped their curriculum because of the perceived failure in ethics as one of the causes of the financial crisis. take your argument up with the deans of those business schools.

trump himself is quoted often in reference to his net worth. unless you consider that an unreliable source.

The kind of reasoning Stephen Moore uses would have broad appeal to ordinary voters.

3% growth is possible. Targeting a substantially higher rate of real growth is a mistake, fraught with risk.

2slugbaits: I would argue that Trump was a good business man. He was a good risk manager from his own personal perspective. The fact that much of what he accomplished has a zero-sum game aspect to it is irrelevant as long as he managed to make others carry the losses.

The question is, do you want a leader who excels at zero-sum business deals to lead the national economy? Would you naturally reach for a successful venture capitalist who made a fortune playing in micro- and junior resource companies where the ex ante chance of success of less than 1 in 2000?

Trump reminds me of politicians who advance get-rich-quicker and easier policies in the resource-denominated economies of western Canada. The inevitable result is a boom ‘n bust economy characterized by far more severe fluctuations in real GDP output and employment.

It’s amazing how some people completely ignore reality to create false narratives. Trump is a very successful businessman. His net worth is billions of dollars. How many billionaires are there? He created value and economic activity. Many people made money from Trump, including the mass media. Playing political games and inventing conspiracy theories are more important to some than reality or the real world.

Exactly.

The Central Park Skating Rink and Trump

“Having fallen into utter disrepair during the New York City fiscal crisis, unable to make ice, the city’s Parks Department embarked on a total refurbishment of the facility in 1980, estimating it would take two years to complete. After six years and having flushed $13 million down the drain, the city announced they would have to start all over again and it would take another two years to complete. Wollman Rink had quite visibly failed. The Wollman Rink fiasco amplified the public perception of the general incompetence of government and their inability to complete even the simplest projects.

Enter the Donald. In late May of 1986, the 39-year-old Trump made an offer to Mayor Ed Koch. Trump would step in and take over the construction and operation of the project for no profit and have it up and running in time for the holiday season. Koch tried mightily and quite sneakily tried to reject Trump’s offer. A very public Trump-Koch feud ensued; Donald ultimately prevailed taking on the responsibility to finish the rink in less than six months for no more than $3 million. The city politicos could only hope that when Donald failed it would divert attention from their own incompetence.

Instead of failing, Trump finished the job in just four months at a final cost 25% below the budget. It wasn’t rocket science according to Trump. It was common sense and “management.”

Continued…

“City officials stopped attending press conference because it was actually becoming an embarrassment. The rink which had been a perpetual money loser started making money immediately, which Trump donated to charity.”

This comment is for Baffling.

Yes, they did based on the “perceived” failure of ethics. That perception came from the liberals, who pounded away, blaming everyone else except themselves. Doesn’t change the fact that businessmen are among the most ethical of the professions.

Plus, you didn’t answer my question. What estimates? You keep giving vague answers. Truth is, you are just making it up as you go along.

This is why we need Trump in the Whitehouse. Politicians and academics and people like you who defend them are all talk and no action. In the business world, you get fired for giving vague answers.

Just think how many jobs could be created if every Trumpkin woke up one morning, realized what they’d done, and then set themselves on fire. They’d get to go out just like their bestie Adolf, and we’d have a lot of carpets to replace…