Reader Jesse Livermore thinks he’s discovered Wisconsin is in actuality doing really well vis a vis Minnesota. He writes:

Wisconsin personal income growth dramatically outperformed Minnesota in Q1.

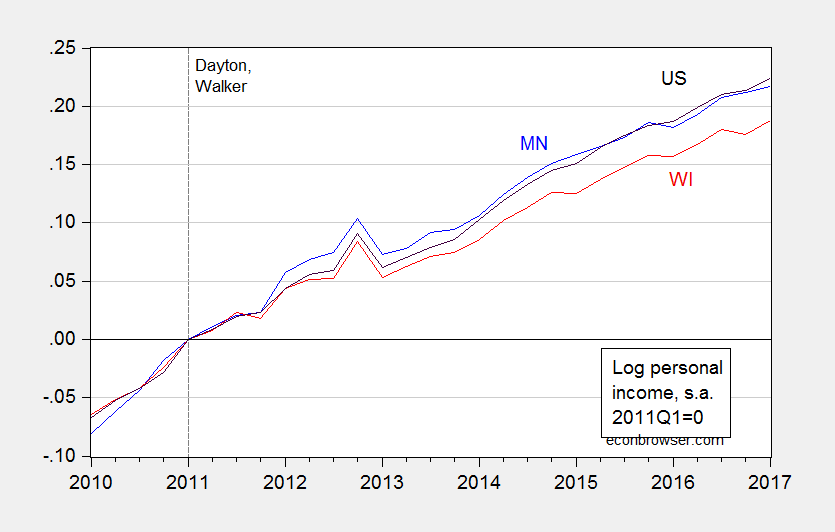

Well, I’ll just say the level is sometimes just as important as the first derivative. That’s why I plot time series, rather than just quoting a quarter’s worth of growth. Here is a comparison of personal income over the past few years.

Figure 1: Log nominal personal income for Minnesota (blue), Wisconsin (red), and US (black), all normalized to 2011Q1=0. Source: BEA, June 27, 2017, and author’s calculations.

On a per capita basis, cumulative Minnesota personal income growth remains 0.7 percent higher (log terms) than Wisconsin’s. It has been higher since 2011Q1.

My advice to anyone trying to assess relative economic performance: plot the time series.

What am I missing?

Real Median Household Income in Minnesota

2015 1 Year Change 3 Year Change

US $55,775 +3.83% +5.17%

Minnesota $63,488 +3.15% +4.40%

Real Median Household Income in Wisconsin

2015 1 Year Change 3 Year Change

US $55,775 +3.83% +5.17%

Wisconsin $55,638 +5.61% +5.56%

http://www.deptofnumbers.com/income/wisconsin/

http://www.deptofnumbers.com/income/minnesota/

Jesse Livermore: You started talking about nominal personal income in 2017q1. Now you’re talking real median household income in 2015? I thought the point was to expand state economies by enticing more people etc. isn’t total income — which you originally cited– a better indicator.

But please feel free to glom onto any indicator you think will buttress your case ad hoc.

I’m looking at how Scott Walker has performed since Jan. 3, 2011. Median family income is certainly a measure. The 2016 data will be available in September.

Why would Foxconn pick Wisconsin?

https://www.wsj.com/articles/apple-supplier-foxconn-looks-at-producing-display-panels-in-wisconsin-1500884344

Why would Foxconn pick Wisconsin, Jesse? Because the state might give them $1 BILLION+! Of course the state can’t fund its schools and has a $1 Billion+ deficit in Transportation, but hey, who needs to deal with that when you can get cheap headlines and other stunts, right?

By the way Jesse, Q4 2016 had Wisconsin DEAD LAST for income growth in the Midwest, and it’s been below the regional average for most of the 6-year Reign of Error under Walker. And our wages already were low to begin with.

https://jakehasablog.blogspot.com/2017/07/right-wing-uw-hack-back-at-it-and.html

Jake, maybe Wisconsin should become more like Oregon? 30 years of Democratic rule and the liquidation begins.

Gov. Kate Brown selected the seven private- and public-sector executives on the advisory panel and tasked them with examining “uncomfortable” options, including selling some state lands and privatizing agencies, to hit that target, with the proceeds going to PERS.

PERS’ current $22 billion unfunded liability “looms over nearly every decision that we make,” Brown said this spring when announcing the task force.

Pension costs for many Oregon public agencies — school districts, state agencies and local governments — are increasing by 20 percent this year. Similar hikes are expected again in 2019 and in 2021, despite strong stock market returns. Even though agencies are paying exponentially more into PERS, that’s still not nearly enough to knock down the unfunded liability — the projected long-term payouts PERS must make to government retirees.

http://registerguard.com/rg/news/local/35796838-75/governors-pers-task-force-mulls-uncomfortable-revenue-boosts.html.csp

I’d love to trade our economy and finances for Oregon’s. T

Would you rather be Portland or Milwaukee these days? There’s a reason they’re booming while we stagnate.

And why did you change the topic, anyway? WEAK. At least you could be man enough to admit defeat.

Oh, and now the incentives for Fox-Conn will allegedly reach $3 BILLION in Wisconsin. In a state that cannot fill the potholes on their highways, while we have record debt and lagging job growth. Idiocracy, indeed.

“Why would Foxconn pick Wisconsin, Jesse? Because the state might give them $1 BILLION+!”

You vastly underestimate Walker. He’s paying $3 billion to Foxconn — best case about $230,000 per job, all non-union, hopefully more than minimum wage.

Governor Scott Walker — Governor of Wisconsin

Foxconn and the State of Wisconsin will sign a Memorandum of Understanding today for the single largest economic development project in Wisconsin history and one of the biggest in the history of the nation. In fact, this will actually be the largest greenfield investment by a foreign-based company in US history as measured by jobs.

Foxconn, which is the largest electronics manufacturing services company in the world, will invest $10 billion in Wisconsin that will create 13,000 jobs. In turn, the state will provide $3 billion worth of performance-based incentives – which is comparable with other major economic development projects across the country.

The 13,000 jobs will have an average wage of more than $53,000 plus benefits. In addition to the 13,000 jobs directly created by Foxconn, the project is expected to create at least another 22,000 indirect and induced jobs throughout the state.

Foxconn’s manufacturing campus will be combined of multiple buildings totaling 20 million square feet. That’s three times the size of the Pentagon. Or more appropriately for Packers fans: the area is big enough to hold 11 Lambeau Fields.

Some 10,000 construction jobs will be needed to build this new campus. This will employ people from all over the state.

The project is expected to have at least a $7 billion annual economic impact on the state. Foxconn will make $4.26 billion in supplier purchases annually, about one-third will be sourced within Wisconsin. The project will generate $181 million in state and local tax revenues annually, including $60 million in local property taxes. Once the company is fully staffed, their payroll will be an estimated $700 million a year.

Foxconn will build the first facility in the United States that will build LCD panels for everything from automobiles to healthcare and entertainment. Going forward, these panels will be Made in America, right here in Wisconsin.

Foxconn’s new ecosystem will transform Wisconsin. In fact, we will call the region Wisconn Valley because it will be the new global home to cutting edge technology and innovation. Wisconn Valley will help us attract top talent from across the country and around the world. And it will be one more tool to keep our graduates in Wisconsin.

We are ready. A deal like this comes along once in a lifetime. Thankfully Wisconsin is ready. We made positive changes to the business climate over the past six years: Massive tax relief, regulatory reform, reigning in frivolous lawsuits, right to work, labor force investments and many more. These reforms helped get to a point where more people are employed in our state than ever before.

Before we took office, Wisconsin ranked in the bottom 10 for business. Today, for the first time, we rank in the Top 10. The positive outlook in Wisconsin played a big role in the Foxconn announcement. Wisconsin is ready.

All, the real problem with this debate is its me vs. you expanded to Republican vs. Democrat, there must be only one way line of thinking. Have the Dems in Oregon been 100% right with policy or 100% wrong (seemingly, there can be no mix of successes and failures) and similarly Walker in Wisconsin? The obvious answer to non-partisan observers (for example, from this professional international economist living in Asia) is that the evidence is compelling that the extremes of the dogma of both parties are deeply flawed.

Whether Walker has done something right with some policy I do not know about I cannot say. But what is absolutely clear about his tax policy experiment – to lets say an observer from Mars – is that this rare controlled experiment has been an abysmal failure. And although it is rare, it is not the only experiment in Laffernomics. Similar examples under Reagan and W (disclosure, I voted for Reagan and against W) showed similar results, though not quite so spectacularly as with the Walker example, probably because the smaller scale of the experiment – one state vs. the whole country – reduced exogenous influences and the capacity for diversity to muddy the result.

Thus, as the US Congress perhaps shifts from inability to reform healthcare to attempting to reform the tax system I would hope that folks who read this and similar blogs do is put aside for a moment the “there can be only one” holy war of Republican vs. Democrat ideology in order to try to learn something from the data. Massive tax cuts, particularly for high income groups, do not pay for themselves by raising economic growth sufficiently to generate the same level of revenue from the lower tax rates. With due respect to other aspects of tax change, for example Raj Sethi’s work, this is not to say that tax cuts have no effects on the structure of employment or activity. But the the historical experience, including with Wisconsin, makes clear that they will not raise economic growth dramatically and will definitely result in lower revenues. Those revenue losses lead to either higher debt levels or spending cuts or, more likely both.

At this point we can return to the holy war. Those who believe in shutting down the Federal government by “starving the beast” can use this information to justify their tax cuts rather than BS that it will pay for itself by boosting growth to heretofore unimaginable rates.

PS: returning to the data, never mind that the beast of federal spending is not so bestial as a percent of GDP when compared with the rest of the OECD. That spending may well be inefficient and in may cases misdirected, but it is not relatively large.