“For many, many years, the United States has suffered through massive trade deficits. That’s why we have $20 trillion in debt. So we’ll be changing that.”

This statement was made during the meeting with the South Korean President on June 30th [1]

Observations

- The United States has experienced large trade deficits for years, starting with the Presidency of Ronald Reagan.

- Gross Federal debt at the end of 2017Q1 was $19.8 trillion.

- The US trade deficit is the excess of exports over imports. It is measured in a variety of ways. On a national income and product accounts (NIPA) basis, net exports is -$562.8 billion (Seasonally Adjusted at Annual Rates, SAAR) in 2017Q1.

- The gross national debt is the cumulated Federal budget balance, including interest accrued, and includes debt held by other agencies of the Federal government (e.g., Social Security trust funds).

- Net Federal government saving on a NIPA basis was -660.3 billion (SAAR) in 2017Q1.

- The budget balance and the trade balance (net exports) are:

Budget balance ≡ taxes – government transfers – government spending

Trade balance ≡ exports – imports

- These two accounting identities are pertain to different sectors – one is the (Federal) government sector, the other the aggregate economy with respect to the rest-of-the-world.

The fact that the two deficits are unrelated in accounting terms does not mean that they are not somehow economically related. However, a causal mechanism has to be laid out in order to make the argument they are. Take a look at Figure 1.

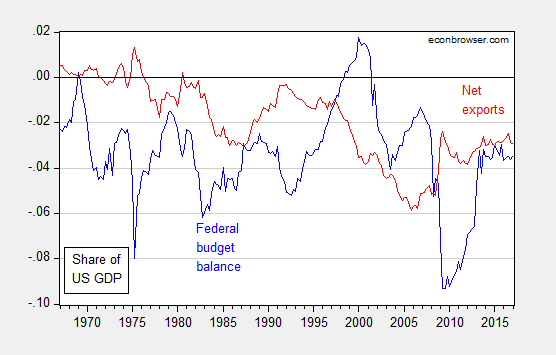

Figure 1: Share of Federal government net saving (blue), and net exports (red), as share of nominal GDP. Source: BEA, 2017Q1 3rd release.

It’s clear the correlation, even with a lag, does not always fit in with President Trump’s story. And the correlation changes over time. To the extent they are related, I would say the causality more likely goes from budget balance to trade balance, rather than the reverse. For instance, higher government spending leads to a budget deficit, and at the same time higher imports due to higher consumption of imported goods, and less exports and higher imports due to an appreciated currency (Figure 2).

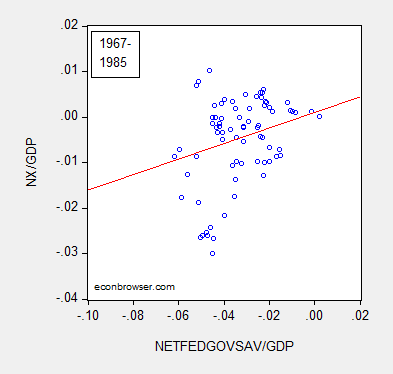

Figure 2: Share of Federal government net saving vs. net exports, as share of nominal GDP, 1967-85. Source: BEA, 2017Q1 3rd release.

Or, a positive shock to investment leads to higher income, a boom in tax revenues, so the budget balance improves. But higher economic activity draws in more imports (for consumption, investment purposes).

Figure 3: Share of Federal government net saving vs. net exports, as share of nominal GDP, 1986-07. Source: BEA, 2017Q1 3rd release.

Or something else, like the US growing faster than the rest-of-the-world.

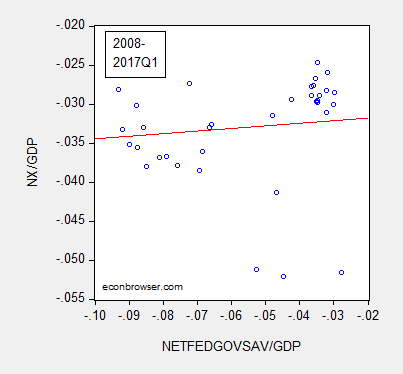

Figure 4: Share of Federal government net saving vs. net exports, as share of nominal GDP, 2008-2017Q1. Source: BEA, 2017Q1 3rd release.

It could be that Mr. Trump meant to point to US net indebtedness with respect to the rest-of-the-world, as summarized by the US Net International Investment Position. However, this is not quite correct, as the NIIP (which includes equities and direct investment) does not match up with the cumulated current account deficit. External debt kind of does, but even that is not exact (and it’s not clear why cumulated current account balances should equal only the net position in debt).

So, I am forced to conclude (and here I’m going out on a limb(!)), Mr. Trump is (not for the first time) confused.

I suspect that statements like this come from Trump’s mercantilist impulses and a zero sum view of the world. It’s fairly common with people who have spent much of their lives in the private sector.

Trump’s policies help the domestic working poor. Firms have been offshoring production, e.g. to China or Mexico, and importing those goods at lower prices and higher profits, while real wages of lower skilled workers go down. Moreover, millions of illegal low skilled immigrants and their children also drive down low income wages and the domestic poor compete with them for government services.

Trump’s tax and healthcare policies do not help the domestic working poor. They do active harm. Trump’s trade policies may or may not help the domestic working poor. That is an open question. Nativists don’t like to admit that the answer is unclear.

So in sum, Trump’s policies are harmful to the poor in some areas, ambiguous in others. There is no Trump policy that is clearly advantageous for the poor.

So, Trump’s policies toward the domestic working poor are bad or neutral – nothing good.

Public debt is cumulative budget deficits (plus revaluations).

Private sector net lending tends to a small positive relative to GDP, although fluctuates, goes negative sometimes.

So cumulative CAD reflects in the public debt because of the identity.

Good post. I do not think that Bannon`s mantra “we are the good , the others treat us bad” is factually right.

When Did Our Federal Debt Ever Hurt Us?

Our federal debt as of 01/01/2017 was 886 times bigger than in 1933 at the nadir of the Great Depression and the dollar is now the reserve currency of the world’s economy. Were we better off in 1933 when the debt was only $22 billion?

Debt fear mongering serves the same purpose for cynical politicians and journalists that racism served in the past: spreading irrational fears to manipulate voters. Trump is Exhibit A.

When did your debt ever hurt you?

My debts have never hurt me. I took on a big mortgage to buy a house and now the mortgage is paid off while the house is worth much more than I paid for it. Likewise, I have borrowed money for cars and education which have both benefited me enormously, just like most Americans do.

But for some reason, the federal government, which can print money to pay any debt, should not borrow money according to the “Freedom Caucus” and Tea Party. Everyone else in the country borrows money, including state governments which only balance their operating budgets, but the federal government should not likewise borrow money for capital expenditures.

OTOH, when it comes to war spending, then federal borrowing any amount of money is just fine with all the “patriots” who want to cut Social Security and Medicare.

Fortunately, you worked to pay your debts.

Building-up debt and not paying it through work is a problem.

And, I guess, you believe there’s never too much debt.

The US is working to pay its debts. Think of GDP as approximating its wages; at $18.96T in 2016, total debt is about 104% of GDP https://en.wikipedia.org/wiki/National_debt_of_the_United_States

Banks are prepared to lend and individual/household about 300-400% of wages. If you want to view the country as an individual, it seems to me that US’s debt load is quite low.

Yes, there is such a thing as too much debt; what is debatable is the level at which it becomes too much.

“In a 2010 paper Carmen Reinhart, now a professor at Harvard Kennedy School, and Kenneth Rogoff, an economist at Harvard University, argued that GDP growth slows to a snail’s pace once government-debt levels exceed 90% of GDP.”

IIRC that paper’s conclusions were controversial and not generally accepted.

China’s debt-to-GDP ratio is officially 260%, while the U.S. ratio is only 106%. China’s Real GDP for the past 20 years has averaged 8% growth, more than triple our rate. https://fred.stlouisfed.org/series/CHNGDPRAPSMEI

FlagReply 12Recommend

Your figure includes corporate and household debt.

Government debt is well below 90% of GDP.

You are wrong on the fact, Peak.

https://qz.com/990570/moodys-downgraded-chinas-sovereign-credit-rating-for-the-first-time-in-nearly-30-years/

May 25, 2017

“China has plenty of ammo left. One option is a bank bailout that could push government debt from 55% to 90% of GDP, according to Capital Economics.”

http://money.cnn.com/2017/05/25/news/economy/china-debt-economy/index.html

The federal budget balance is only part of the story. What you need to look at is the gap between savings and investments and the federal deficit enters the calculation as a negative item in savings. So the key identity is savings – investments equals the current account deficit. That is why the current account deficit and the federal deficit only has a very loose connection.

But since the Reagan tax cuts the US has had a large structural federal deficit so investment exceeded savings and the gap was financed by foreign capital inflows. Interestingly, if you assume that the federal budget was balanced at $0, savings would have exceeded investments every year since 1970 except during the late 1990s capital spending boom and the short lived federal budget surplus under Clinton.

So you can directly blame the trade (current account) deficit on two or three things. One is the republican tax cuts . A second is inadequate savings while the third is excess business investments. I guess you could also throw in excess federal spending.

The real lesson to take from this is that the things Trump is blaming are just the symptoms, not the true under-lying cause of the trade (current account) deficit. It is like going to a doctor with cancer and she gives you pain killers to mask the symptoms of the cancer. You may feel better, but the cancer will continue to grow unabated.

To see the very tight relationship between the savings-investment gap and the current account deficit go to where I posted on it at Angry Bear.

http://angrybearblog.com/author/spencer

Spencer, it’s timely you cited the liberal Angry Bear blog, since they often censored my comments and I stopped posting there just when my comment above was also censored, which explained how Trump’s policies are helping the domestic working poor – solving the real problem – and why a segment of the population voted for Trump.

I stand corrected.

It should be noted, the Information Revolution created a lot of jobs. After the 2000-02 creative destruction process, Information Age firms became more productive and profitable, while offshoring jobs accelerated in the 2000s.

Where were all those IT jobs. I just checked the BLS data on employment in the computer industry. They report that employment in computers rose in only two years since 2001 —

by + 0.8% in 2011 and +0.4% in 2015. In every other year employment in computers fell– including – 10.1% in 2003 and – 8.6% in 2009.

If this is typical of your analysis I can see why Angry Bear banned you.

Spencer, why are you citing data after 2000 that supports my statement and then imply they don’t support my statement? Obviously, Angry Bear will never censor you.

Can you provide an example of a policy that Trump enacted that helped the working poor?

I strongly suspect that deregulation will show up largely in better profits, not better jobs.

Yes, I admit i have not evaluated every policy proposal. But meeting regulatory requirements is really a cost cutter, and part of those lower cost may stem from lower employment.

I watch his actions closely and I can not think of one.

There’s a surplus of low-skilled labor in the global economy and in the U.S..

Reshoring and reducing low skilled illegal immigration may help the domestic working poor.

Excesssive regulation doesn’t help workers.

Too much regulation can be as bad as too little.

deregulation will show up largely in better profits, not better jobs.

When conservatives “deregulate” OSHA, they shorten lives of blue collar workers.

PeakTrader Echoing spencer’s comment, I cannot thing of anything Trump has done to help the domestic working poor. So far (and blessedly), he hasn’t overseen a single significant piece of legislation. And his executive orders have all been about making life worse for the working poor. How does coddling to fraudulent “for profit” universities help the working poor? How does gutting consumer protection help the working poor? How do cuts to environmental pollution regulations help the working poor? And what the hell would any of his fat cat Cabinet billionaire cronies know about the lives of the working poor? How does reckless talk about trade wars help the working poor? How does a 50 basis point increase in the 10 yr help the working poor? Did Trump care about the working poor when he stiffed 40,000 people to whom he owed money? Did Trump care about the working poor when he snookered them into Trump University? Trump cares more about pleasing his masters in the Kremlin who own him lock, stock and barrel than he cares about the working poor in this country. The only difference between Trump and an unethical used car salesman is the quality of their suits.

Dear Menzie,

When it becomes clear that Trump’s policies will increase both deficits, it is highly likely that he will change his tune.

J.

I think Mr Trump is talking more about the Twin Deficits hypothesis – which is macro 101. Although much of the research on this topic hasn’t been able to establish an empirical link, I can’t agree with the point that Mr Trump is confused per se

The latest data point of which I am aware is the collapse of the US oil trade deficit in the wake of surging US production and imploding oil prices, notably after mid-2014.

Were the trade balance driven by an imbalance in consumer preferences, ie, because OPEC makes oil and Germany makes cars that we like, then the trade deficit should have shrunk with the collapse of the oil trade deficit.

But it didn’t.

Instead, the US dollar appreciated and the US imported more goods from non-oil producing countries, and the overall trade deficit remained unchanged.

This suggests, therefore, that the driver of the deficit was in fact the capital account, that the world needs a certain amount of US debt to function and is willing to depreciate its currencies to induce the US to generate the needed debt.

Using the twin deficits model, a reduction in the national budget deficit would lead to an appreciation of the US dollar and leave the US trade deficit essentially untouched, with private imports replacing government imports.

It should be noted that drivers of systems can change. Thus, if the global economy did not require US debt, then the reduction of the oil trade deficit might have shown up as a lower trade deficit overall with a lesser impact on the exchange rate.

How the system behaves is a function of which of the variables are independent and which are dependent.

Take a + b = c

Here, we normally think of a and b and independent, and c as dependent. But if you’ve followed a given market, say, oil for a number of years, you’ll notice that the variables change up from time to time, and what used to be a dependent variable becomes an independent variable, and vice versa. Thus, sometimes the equation is

a + b = c

but at other times, it’s

c – a = b

Sometimes you can change b directly, and sometimes you can’t. And sometimes, if you change a, the effect is seen on c, and at other times, on b.

This is banal in its own way, but I only internalized it while watching oil markets over a long period of time. I might also argue that the swapping of dependent for independent variables constitutes a regime change, ie, it necessitates a change of causal model for explanatory purposes.

“swapping of dependent for independent variables”

IAMNAM, but assuming the variables are properly defined (including discontinuities),what you see are large changes in significance/influence/response/sensitivity/dominance. AFAIK, it is mathematically impossible for a variable to truly switch from dependent to/from independent.

“…the NIIP (which includes equities and direct investment) does not match up with the cumulated current account deficit. External debt kind of does, but even that is not exact (and it’s not clear why cumulated current account balances should equal only the net position in debt).”

NIIP = Cumulated CA deficit + Revaluations

Revaluations = Price Change + Exchange Rate Change + Other Changes (except transactions)

think the reason why the current account deficit (cumulative) should be equal to the net external debt in the US case is straightforward. Net equity inflows have generally been small (empirically speaking) v the size of the external deficit, so as a practical matter, most of the flow has been financed through an increase in the stock of debt.

Menzie called Trump begging him for an invitation to Mar-a-Lago–he said no! This is why Trump is president, and he’s not.

“For many, many years, the United States has suffered through massive trade deficits. That’s why we have $20 trillion in debt. So we’ll be changing that.”

There’s not much, much there to ascertain Trump’s econ views.

Larger, larger and longer, longer recent, recent impression has determined that:

1. Trump is, is senile, senile, and

2. Any subtle suggestion of views – beyond Trump salving, salving his ego, ego – come from Bannon/breitbart.com.