The CBO has just released an assessment of the President’s budget proposal. Balancing the budget looks unrealistic, even given massively sweeping (and unrealistic) spending cuts.

Here are the projected budget balances, under CBO baseline (blue), as claimed in the Budget submitted by the White House (red), and as assessed by the CBO (green).

Figure 1: Federal budget balance under CBO baseline (blue), President’s budget (red), and President’s budget assessed by CBO (green), in billions of dollars, by fiscal year. Source: CBO, An Analysis of the President’s 2018 Budget, and CBO, An Update to the Budget and Economic Outlook: 2017 to 2027.

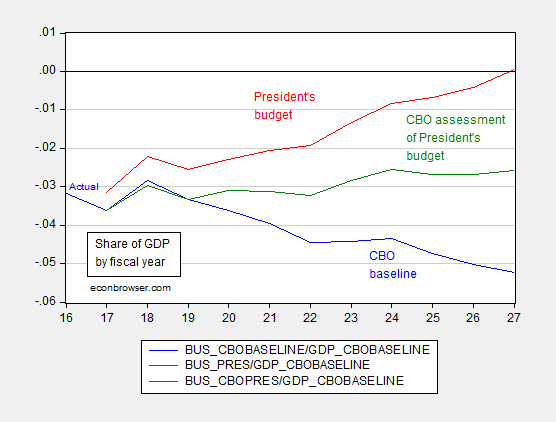

Normalized by GDP under baseline CBO projections:

Figure 2: Federal budget balance under CBO baseline (blue), President’s budget (red), and President’s budget assessed by CBO (green), as share of GDP, by fiscal year. Source: CBO, An Analysis of the President’s 2018 Budget, and CBO, An Update to the Budget and Economic Outlook: 2017 to 2027.

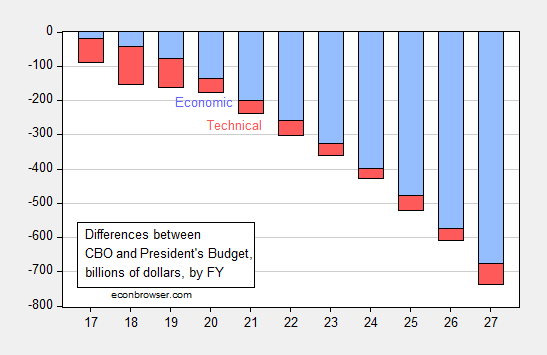

There is a lot of wishful thinking in the President’s budget. Consider a decomposition of the differences in estimates. Figure 3 shows that Economic assumptions account for the majority of the difference in estimated deficits, particuarly true in the out years (FY2020 and onward). Of the economic differences, the bulk shows up in revenues — the Administration assumes much faster income growth and hence tax revenue growth.

Figure 3: Federal budget balance under CBO baseline (blue), President’s budget (red), and President’s budget assessed by CBO (green), in billions of dollars, by fiscal year. Negative numbers indicate that such differences make the CBO estimate of the deficit larger than the Administration’s estimate. Source: CBO, An Analysis of the President’s 2018 Budget, and CBO, An Update to the Budget and Economic Outlook: 2017 to 2027.

One could argue that the President’s proposals would accelerate GDP growth. CBO has taken this point into consideration, specifically with respect to increased government saving leading to feedback effects.

Such economic effects would feed back into the budget and make deficits smaller than they would otherwise be. Taking into account the smaller deficits under the President’s budget, CBO estimates that the effects of that economic feedback would further reduce deficits by roughly $160 billion over the 2018-2027 period.16 During those years, deficits would be lower by an average of about 0.1 percent of GDP because of the feedback…

The other effects arising from deregulation, health care reform, etc., were deemed too difficult to judge given the insufficiently detailed nature of the Administration’s proposals.

In other words, a plausible increase in growth is unlikely to make the deficit shrink in the way the Administration has asserted; see today’s Econofact post on the subject.

Ha! The CBO report throws some shade on the Trump budget:

“The President’s budget includes a set of principles to guide deficit-neutral reform of the tax system. Because that proposal lacks the specific details that CBO and JCT would need to estimate any effects on the budget and the economy (which could be significant), this analysis includes the Administration’s estimate of no effect as a placeholder; many combinations of policy changes could have such an effect.”

In other words, Trump plans trillions of dollars of tax cuts and just assumes that those tax cuts will be budget neutral without providing any details to support that assumption. He then simply directs the CBO to use this phony assumption in their analysis.

This is the same old Paul Ryan scam in which he refuses to enumerate the unpopular spending cuts which he may or may not ever enact to offset his tax cuts — the so-called “magic asterisk”. Hey, maybe they can just make up the difference in Dynamic Scoring (Trademark).

Oh, and it looks like Mitch McConnell is unsatisfied with the Obamacare repeal scores provided by the Republican CBO chief hand-picked by HHS Secretary Tom Price two years ago.

So Republicans are going to go with Alternative Scoring (Trademark) by Tom Price’s personal staff and forego the CBO. Hey, they have their own facts!

Big improvement over the baseline.

For those who believe it’s mostly a demographic shift rather than poor government policies, the last of the Baby Boomers will leave prime-age in 2018. So, we can expect even slower GDP growth. Unfortunately, we squandered many trillions of dollars for an economic depression, since 2009. And, so, Trump and the Republicans are very limited what they can do.

However, we can reverse the explosion in entitlements, which is crowding out other government spending, reduce the costs of health care and education, which have become luxury goods, reform Social Security and pensions, etc.. Then, we have some room for student debt forgiveness, rebuilding the military, infrastructure spending, etc.. Leave tax rates on “the rich” intact and reduce middle class and corporate tax rates. We can’t afford excessive regulations and chronic budget deficits.

We need stronger growth, than otherwise, to raise tax revenue and reduce spending on the unemployed. When a real recovery is underway, we can raise tax rates to slow the expansion to a sustainable rate.

“reduce the costs of health care and education, which have become luxury goods”

what you mean to say is that if you were born to privilege and wealth, you can maintain your health and get a good education. if you were not born with a silver spoon, start digging a ditch and pray at least your parents passed on healthy genes if no inheritance.

What I mean is making it affordable to the masses.

Obviously, you have a lot to be jealous about.

peak, you are selling the same crap as trump. we are going to make health care cheaper and more people will have health care. great. show me your plan that makes this happen. i am all for those goals. you do not have a plan to accomplish those goals. what you want is to cull the herd to control costs.

what am i jealous about? strange attack coming from an unemployed banker.

It’s easy to play around with numbers to show the outcome you want. It will take at least 1 year to see if Trump is bringing about any real change.

http://freedomnews.today/

Obviously this is all just a big misunderstanding. You see, the Trump Administration’s revenue estimate is based on Russian rubles as the unit of account and expenditures are based on the US dollar. It’s just a matter of confusing units of accounting. Easy enough to understand if you’re a Trumpster…all that going back and forth between rubles and dollars. It’s all so confusing.

The only way to improve an economy is to produce more net value.

There’s no way to avoid the baby boomer drag, but also no legitimate reason that productivity can’t be good.

However, since the 70’s we’ve seen that markets warped to illegitimately favor the oligarchs/takers over the makers damages productivity.

Current events predict that productivity will continue to sink toward Banana Republican (e.g. Guatemala, Venezuela, Sudan, Ceausescu Romania, etc) levels as the oligarchs gain increasing asymmetric power through “government”, mass media, leverage in employment and retail markets, etc.