That’s the title of a new EconoFact article by Michael Klein.

Today’s low inflation has some economists puzzled. The Federal Reserve has persistently undershot its inflation target of 2 percent since 2012, when it established this level of inflation as one of its policy goals.

…

Low inflation can be a signal of economic problems because it may be associated with weakness in the economy. When unemployment is high or consumer confidence low, people and businesses may be less willing to make investments and spend on consumption, and this lower demand keeps them from bidding up prices.…

There have been calls for the Federal Reserve to raise interest rates because the ongoing recovery from the Great Recession represents the third-longest recovery on record and the current low unemployment rate would usually lead the Federal Reserve to set its policy course towards preventing the economy from overheating. It is striking, however, that this recovery has not been accompanied by increasing inflation, even with unemployment rates of 4.3 percent in June and July, the lowest string of two-month unemployment rates in more than 15 years.

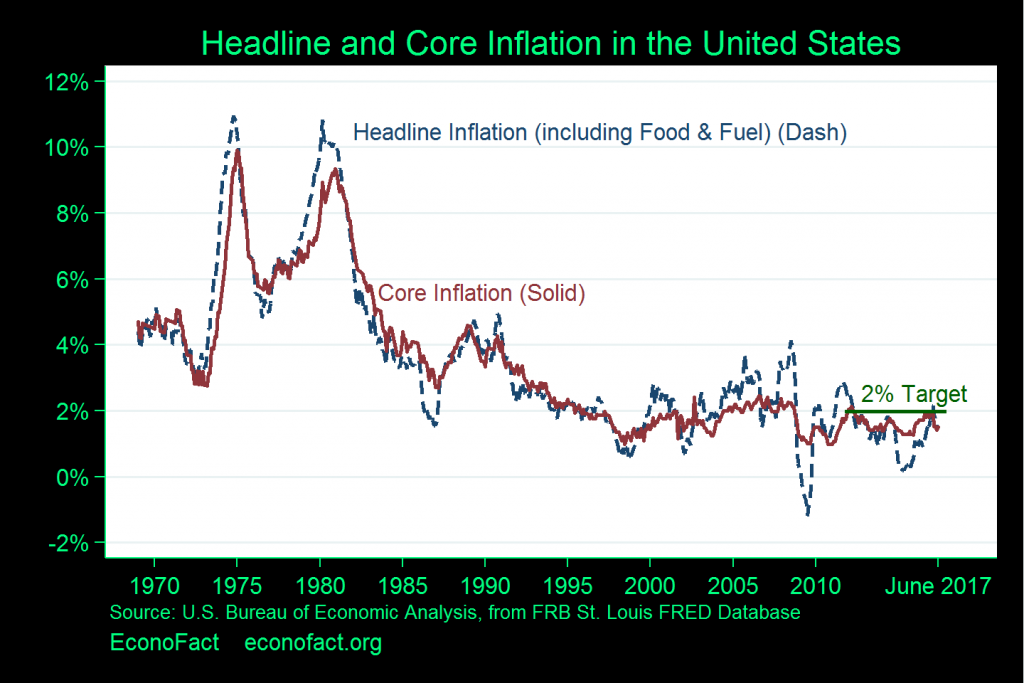

This figure from the article highlights the anomalous nature of recent inflation behavior.

Source: Klein.

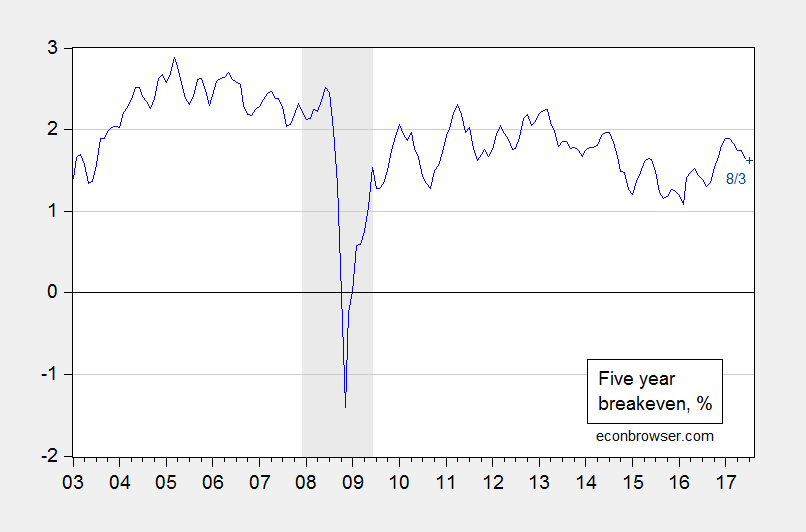

What are the prospects for accelerated inflation? The market’s expectation inferred from Treasury spreads is shown below:

Figure 1: Five year nominal Treasury yield minus five year TIPS yield, % (blue). July 2017 observation (dark blue +). Source: Federal Reserve Board.

As noted, such quiescent current and expected inflation at (what is widely acknowledged to be) near full employment does pose something of a mystery.

In the past, I’ve argued that the inflation target should be higher than the current 2%. [1] [2] I still believe that’s the case.

In the bigger picture, what’s wrong with low inflation or even deflation? Due to process automation, lots of things are cheaper to make than they used to be, which puts downward pressure on prices. Plus, politicians (and economists of some schools) constantly berate the public for not saving enough – but why should they save, when they know full well that the Fed will relentlessly confiscate their savings via inflation?

And we need to devote less and less (aggregate) paid time even to “creative” activities, not just production. “Creative” work product – designs, writings, and so on – is reproduced automatically at ever-exponentially-increasing scale, someitmes billions of times nowadays instead of hundreds or thousands as in the not-all-that-distant past. As efficiencies and automation saturate markets, why not simply react as in the past, namely by reducing the socially-expected standard of working hours per unit of calendar time? What’s so sacred about 40 hours/week?

It seems, wage growth of the top 20% are rising faster than inflation, while the other 80% have slower, stagnant, or falling real wage growth. I suspect, a lot of businesses want to pay their workers more, but can’t, because of regulations, taxes, and competition. I don’t know how so many people can live on $8 to $12 an hour, particularly when full-time or overtime work is unavailable.

“I suspect, a lot of businesses want to pay their workers more, but can’t, because of regulations, taxes, and competition.”

if that were true, then why does the top group of workers continue to see significant wage increases. profits are at record levels. money is available. it seems that management has explicitly chosen not to increase pay for the majority of their workers. regulations and taxes are not making managers direct their profits to a select group of high pay workers. this is an accounting choice.

When relatively few people can perform a job, demand is stronger and they’re paid more. Management wants to keep production costs low and attract investors, who benefit from shareholder value. It’s very competitive. Smaller businesses pay a disproportionately higher percentage to comply with regulations. The top 20% pay almost all the income taxes, which include business owners, and corporate taxes are high.

Businesses, particularly smaller firms, can absorb a higher minimum wage with reduced regulations and lower income and corporate taxes.

“When relatively few people can perform a job, demand is stronger and they’re paid more.”

except that i have seen limited evidence that these folks are as efficient and desirable as your argument would imply. it is just as likely a breakdown in oversight of upper management. for instance, corporate boards should provide oversight to ceo’s and upper management. but many many boards fail to provide this oversight. often times because the upper management and boards operate in a closed loop system, with a given ceo serving on another corporate board.

“The top 20% pay almost all the income taxes”

and this would be expected if all of the income gains were collected by the top tier as well. you cannot complain about paying too much in taxes if you rig the system to collect all of the profits.

Conservatives traditionally have a great horror of inflation, likely because it cuts into the yield from bonds and other investments with fixed payoff rates. This distress becomes increasingly evident whenever inflation rises to levels appreciated by economists. Now that they have control of the White House and both Houses of Congress, it’s not hard at all to imagine distraught panic-stricken Republicans casting about wildly for cuts in government spending which might be blamed for rising inflation rates, cutting into Medicaid, whacking off much of the Affordable Care Act, etc.

Perhaps we should be happy with things as they are?

I’m wondering about the crazy world of economics in which half the economists say that wages are low because robots are taking over jobs and the other half at the Fed say that they have to raise interest rates because there are too many jobs which will cause inflation.

Hey, instead of the Fed raising interest rates, why don’t they demand or scold Congress to raise taxes on the rich. It seems that the Fed is working hand in hand with Republicans when they raise interest rates to slow the economy just so that Republicans can lower taxes on the rich to speed up the economy. Why is the Fed acting to help Republicans increase income inequality? This is why we can’t trust an “independent” Federal Reserve Bank.

corporate profits are at near record levels. money is available, but it is not being redirected into the real economy. it stays with the higher earners, who simply use it to drive up the asset bubbles in bonds, stocks and real estate. if more of that money made it back into the real economy, through raises for the working class, then inflation would occur. but it is effectively held out of the economy. while i do not like deflation (negatively impacts the middle class who are saddled with debt), i do not see the need for much inflation. unless you get the current environment, where money is not going back into the real economy. higher inflation may help combat this problem, but it is probably better addressed through higher taxes on those profits to begin with.

One of the problems with defining the US to be at full employment as the reliance on the unemployment rate even as labor force participation rates are still low. Yea – some of this may be “demographics” but not all. Ten years ago Brad DeLong and I were suggesting that the natural rate of the employment to population ratio was 64%. I would argue we need to revise this number to 62%. But the current rate is only 60.2%.

Asking “What’s wrong with deflation?” is a pretty amazing question. Deflation wrecks economies. For one thing, all debtors will watch their debts grow in value. Given the astronomical level of college debt, consumer credit card debt, and so on, this should be a real concern. For another thing, as economist Mark Blyth has pointed out, the developed world has shifted from full employment targeting with associated govt/industry policies and high inflation from 1945-1970s to low inflation targeting with associated govt/industry policies from 1970s to today. And this low inflation targeting is blowing up the middle class, wrecking the U.S. economy (unless you think a continual drop in median earnings for people with college degrees post-200 is a great trend, or that more than half of all recent college grads now work at jobs that traditionally didn’t require a degree, like barista), and generating enormous political rifts in U.S. society.

Interestingly enough, if you strip the bizarrely skyrocketing rents out of the CPI, you wind up with a negative number. So, aside from ever-increasing rents due to the current Wall Street buy-to-rent housing bubble in all major U.S. coastal cities, we’re now in actual deflation.

It’s even more amazing that the Federal Reserve Board is actually talking about raising rates in a deflationary environment. No doubt someone will chip in soon to ask why that’s bad, with the appropriately baffled expression.

It’s really interesting to what the U.S. economy self-destruct courtesy of a “digital ‘ economy plus the crazy rental real estate housing bubble Part Deux. While 94% of all new jobs created since 2005 are low-wage low-hours “gig’ jobs that don’t even pay a living wage, housing costs are zooming at such fantastic rates that no one but elite professionals with advanced degrees and/or professional credentials (MD, LLD) and afford to live in major U.S. cities anymore.

https://www.theatlantic.com/business/archive/2014/10/why-are-liberal-cities-so-unaffordable/382045/

https://www.wired.com/2016/12/year-housing-middle-class-cant-afford-live-cities-anymore/

https://qz.com/851066/almost-all-the-10-million-jobs-created-since-2005-are-temporary/

To an observer from Mars, it’s obvious why inflation is low and dropping. America no longer produces jobs that pay a living wage, while housing costs and spiraled so far out of control that workers who aren’t living crammed 4-to-a-studio-apartment are living in their cars. The bigger question, namely how any economy is supposed to work under these kinds of crazy unsustainable trends, remains unanswered. Where does the tax base come from to support our roads, bridges, military, SSI, etc. when almost all U.S. jobs are part-time Uber gigs or eLance gigs that pay chump change? And how does a society work when the only people who can afford to live in a major U.S. city are $150K/yr professionals? Who waits tables? Who’s going to clean the hotel rooms? It’s crazy and unustainable. Also, very low inflation. But talking about low inflation in an economy like this is like talking about the color of the smoke coming from a five-alarm fire burning down a city block.