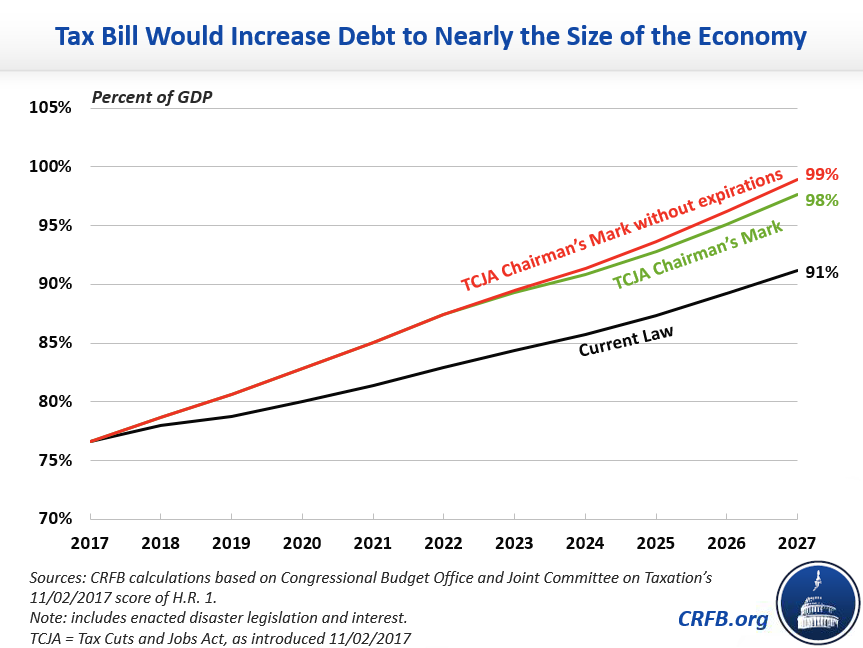

It (the debt picture under the Tax Cut and Jobs Act, H.R.1) is not pretty, especially after taking into account the accounting gimmicks (that change the “reported” number but not the actual numbers).

Source: Committee for a Responsible Federal Budget (Nov. 3, 2017).

Note that plausible dynamic scoring is unlikely to change the trajectory of debt-to-GDP substantially.

So let me get this straight. Back in 2009, when the economy was in a deep recession, deficit hawk Tea Party types were upset as hell about the debt from the 2009 ARRA; but those same deficit hawk Tea Party types are quite relaxed about Dear Leader’s tax cuts that are at least twice the size of the ARRA deficits…and all this against an economy well into recovery. Have I got that right? Oh my.

Exactly. Republican deficits good. Democrats deficits bad.

Well, I had my reservations about deficits during the Great Recession, and I distinctly dislike them now.

The argument against the vast deficit spending of the GR were two-fold:

The first line of reasoning holds that deficits were essentially a waste of money. During the Obama administration, 2008-2016, debt held by the public increased by 36% of GDP, while growth summed about 15% of GDP. Thus, for the deficit to have been worth it, the GDP would have had to have been more that 4% (percentage points) lower every year of the Obama administrations than as the case. I don’t believe that’s any more credible that Heritage’s Ryan plan analysis. Thus, the Keynesian argument for the vast expansion of the deficit is unfounded. There is a case to be made on humanitarian grounds, as I have said several times before, but in terms of return on investment, the Obama deficits were simply a waste of money. Deficits did not pay for themselves, anymore than Brownback’s overly ambitious tax cuts.

Second, any fiscal conservative knows that politics will tend to make temporary deficits permanent, and I strongly suspected we would exit the recession with a large structural deficit, and that fear has not proved unwarranted. Thus, the addiction to deficit — like the addiction to opioids — have survived the underlying injury.

That was the hawkish argument against deficits in the Obama era.

In the Trump era, I have repeated;y asked Menzie whether the US should be running a surplus at this point in the cycle. If I recall correctly, Menzie felt a deficit was warranted while there was an output gap. In other words, in Menzie’s cyclical analysis, we have perhaps five years of deficits for every one year of surplus, or perhaps not even that.

I have stated before– and let me state it again — that the US should be in budget surplus today. I remain highly skeptical that much additional money can be raised on the revenue side. Therefore, the vast majority of the adjustment should come on the spending side.

A BS tax plan for a BS pres. He already announced he is holding Mnunchin responsible. Next to go?

Let’s see. For a scant 8% projected debt increase, the tax paying public is going to keep 930 Billion dollars that they earned through there own means. Feel free to be sorry for the government not getting that money, but no sympathy from me.

As for those who think the deficit hawks tea party types are not capable of seeing the difference of increase debt hike that happen during the 8 Obama years compared to an 8% hike over ten years; need to find better glasses for their own biased vision.

Ed

Ed Hanson Apparently you are arithmetic challenged. If you increase the debt by 8 percentage points, then people are also accepting increases future taxes by that same amount plus interest. Like a lot of Trumpsters, you’re always looking for a free lunch. People might be earning money through their own means, but they are also earning future debt through their own means…unless of course you think it’s okay for today’s rich folks to enjoy tax cuts today so that future generations get left holding the bag. That would be the Trump Way, wouldn’t it?

As for those who think the deficit hawks tea party types are not capable of seeing the difference

There three differences. First, the Obama deficits happened when the economy was in a deep recession The Obama deficits should have been larger. The second difference is that the Obama deficits were financed with near real zero interest rates (r g). Third, the Obama deficits were transient and cyclical. The Trump deficits are structural. Huge differences. Do you understand those differences?

Slug,

We have a fundamental difference in theory. You believe a persons earnings is what the government allows them to keep, while i believe the government should be given only the minimum necessary to achieve its limited constitutional duties.

One other thing, the amount of debt incurred to be paid in the future is seldom if ever the “same amount plus interest” but a different amount depending on growth. The Obama debt is will cost more in the future due to his slow and no growth policies, while the growth policies of Trump will result in less cost for the present debt increase.

I suspect you will deny it but we have seen such growth policy result in less deficits (slower debt increase) in the past. Both the Reagan and the Harding/Coolidge had the effect given time. The Obama policy has been shown to aggravate debt in the past, the Hoover/Roosevelt are prime example.

Ed

Ed Hanson: Your second paragraph is nonsense in terms of accounting. The amount I have to repay, for instance, on my credit card debt is unrelated to growth in my annual income. If you want to say the interest burden is felt more profoundly when my income growth is lower, that’s fine. But that’s not what you wrote.

(By the way, if what you wrote were true, then Barro has a lot of ‘splainin’ to do about his theory about whether government bonds are net wealth, in the JPE).

I appreciate that you realize my meaning the burden of debt, sorry for the imprecise writing on my part. But it is important to remember that deficit came to zero directly because of the higher growth of GDP due to Reagan tax policy. Incentives matter. People in general will work harder when they can keep more of the rewards of their efforts. This translate to the faster GDP growth than occurs when tax policy takes too much a cut into personal earnings.

Thank-you for the Barro reference, just found the paper and am reading it.

Ed

Ed Hanson You believe a persons earnings is what the government allows them to keep, i believe the government should be given only the minimum necessary to achieve its limited constitutional duties.

No. I believe that under normal steady state conditions the government should tax people based on the amount that voters want to spend. If you want 20% of GDP in benefits, then you need to tax at a rate that will generate revenues of 20% of GDP. What you want is a free lunch.

the growth policies of Trump will result in less cost for the present debt increase.

So you say without any evidence whatsoever. Let me tell you what will happen. The economy is very close to full employment, so any additional aggregate demand stimulus from Trump’s deficits will be offset by Federal Reserve rate hikes. It’s textbook macro, so you can pretty well count on it. At the end of the day we’ll have higher debt and higher interest rates. Worse yet, Trump’s deficits won’t be cyclical; they’ll be structural. Do you understand the difference between a cyclical deficit and a structural deficit? That’s a serious question because I’m not sure you do.

but we have seen such growth policy result in less deficits (slower debt increase) in the past. Both the Reagan and the Harding/Coolidge had the effect given time.

Well, according to the OMB historical tables, this just ain’t so. The budget deficit in FY1981 was 2.5% of GDP. The budget deficit in FY1988 was 3.0% of GDP. But it’s actually worse than that because those are the unified budget numbers. Remember, the SS Trust Fund was running large surpluses during the Reagan years because the FICA tax was increased. The on-budget deficit was 2.4% of GDP in FY1981 and had ballooned to 3.7% of GDP in FY1988. Sorry, dude, but you got your facts wrong.

Slug

Yes, for a while we will have higher debt and higher interest rates. The debt because the Congress will not cut spending, and higher interest rates because the distortion of the Keynesian approach to the economy which caused terribly low growth as well terribly expanded debt, will finally be mostly removed or modified. No, not enough so to my liking but that is reality. In the years out, as the reduced taxation, and reduced regulation take hold the deficit will reduce despite the Congress. And remember, although increase interest rates will happen it will be a long time before they approach the historical norm.

Freedom from excess taxation and spending is a human right, not a command of mobacracy.

So, you’re saying that deficits caused by increased spending are bad, while deficits caused by reducing taxes are good? I’m not sure if that’s what you meant, but if so, isn’t that kind of a fallacy, in that the optimum current deficit shouldn’t really depend on what the earlier figures were? I get that you want overall lower Government spending, but

“how much to spend” is a different question from “how much of it to pay currently, and how much in the future.”

Maybe the confusion arises from the fact that “deficits bad” was really always an argument of convenience on the right, which instead adheres more to the policy view of “spending bad.” All that ink spilt over “deficits” wasn’t really about deficits at all, as I think we all knew all along. So conservatives (I’m not one, so kind of guessing a bit on their thinking here) are not displaying inconsistent policy goals, only inconsistent rhetoric.

The real argument, then, is more about whether the Government should take on a little more, or a little less. My own view is “a little more,” based on my observation that leaving more cash in the hands of the middle class is likely to translate sooner or later into higher prices, such that the cash “trickles up” to the corporate overlords, and the intended beneficiaries are no more able to afford things like education and health care than they were before; whereas, if we let the Government do those things, and pay taxes to enable that, then those things will actually get done.

I imagine (guessing again) that the argument for “a little less” would be something along the lines of Government inefficiency, and denial of the inflationary effect of tax reductions? Maybe some would find those arguments telling, but I would be interested in any data to prove it, one way or the other.

while i believe the government should be given only the minimum necessary to achieve its limited constitutional duties.

If that’s the case, we should have raised taxes to cover the war in Afghanistan and Iraq but was borrowed in addition to the tax cuts in 2001 and 2003 that led to increased deficit. It is your thinking is where you are incorrect.

The deficit is a by product result of economic policies by both the administration and Congress setting the budget and how the economy is moving. If the economy goes on a downward trend, the deficit would increase as a result of people not working (laid off or not hired) due to no taxes being paid to provide the necessary programs for a functioning economy.

Your argument of Obama’s deficit missed the period before he took office and the financial crisis which Congress approved TARP bailout of financial firms taking on risky and unnecessary risk along with laisse faire economic policies of the Republicans plus the temper tantrum of the Republicans trying to sabotage the economy fighting Obama on everything and the expansion of program to mitigate the effect of it. Even economists of every stripe agreed that if Obama had not done anything the economy would have gone in a depression (same kind that Hoover had to deal with before he got booted out because he kept saying that “the good times is around the corner.”

As for the argument that Reagan’s policies led to slower deficit miss several things: Reagan cut taxes in 1981 and 1986 along with increased spending in the military that led to more overseas borrowing to make up the difference. It should be noted that Reagan did proposed to cut many programs but Congress did not support such endeavor. As a result of that, Reagan was forced to raise taxes several times to cover the shortfall. The economy improved due several outside factors: FED lowered the interest rate and oil price dropped dramatically Even better David Stockman said it best: Tax cuts does not pay for itself.

This is nonsense, Ed.

Prof. Chinn,

Dynamic scoring includes estimates of a boost to economic activity resulting from tax cuts. Does it also include estimates of declines in economic activity from reductions in government spending?

Left Coast Bernard: Depends on who is doing the dynamic scoring. CBO includes spending effects in short run, and to a partial degree at long run — see here.

Left Coast Bernard There’s also another aspect of dynamic scoring that gets almost no attention, and that’s the adjustment cost of moving from one tax regime to another. The adjustment costs are deadweight welfare losses. Way back when dinosaurs roamed the earth I had a public finance professor who used to emphasize that the best tax is an old tax because everyone has had a chance to settle in to some equilibrium position. Rich people are always talking about changing the tax code because the short run changes almost always benefit the rich. The reason is simple; rich people have more elastic labor supply curves than poor people, which means that the adjustment costs associated with any tax change will necessarily fall more heavily on the poor with less elastic labor supply curves. This is a fairly subtle point that doesn’t usually get brought up when stupid politicians talk about “tax reform.”

Federal spending as a percentage of GDP is over 20 1/2%. Government is too big, although defense spending has been in decline. We need to bring it down and limit it to 18%, except in times of recession.

Lower income and corporate taxes will raise GDP by making work more attractive and promoting investment. Moreover, the children of the Baby-Boomers are about to enter “prime-age” and Americans living and working longer will further raise GDP.

Health care costs can be reduced dramatically without affecting quality by allowing the free market to work, to raise discretionary income or lower compensation costs and reduce government spending. It’s particularly important given the aging population. And, given people are living longer, Social Security retirement age should be raised to between 65 and 70 (no Social Security at 62).

We can achieve a dramatic decline in federal debt to GDP in the 2020s, without compromising national security, which will also lower interest payments on the debt.

“Health care costs can be reduced dramatically without affecting quality by allowing the free market to work, to raise discretionary income or lower compensation costs and reduce government spending. ”

Ah yes – the magic fairy dust of the perfectly competitive market place. Your trolling never ceases to amaze.

Pgl, fairy dust comes from trolling socialists like you, who believe other people will pay either for your expensive Obamacare or cheaper low quality socialized health care. Even Keynes didn’t believe that:

“His (Keynes) vision was one of reformed capitalism, managed capitalism — capitalism saved both from socialism and from itself…Fiscal policy would enable wise managers to stabilize the economy without resorting to actual controls. The bulk of decision making would remain with the decentralized market rather than with the central planner.”

Just curious. You cite Keynes a lot. Have you ever actually read The General Theory…I mean cover to cover? Keynes was many things, but a good writer isn’t one of them even if he did hang around literary types.

Money & Central Banking and International Trade were my two fields of specialty, where I passed the comp exams, although I took two grad Labor Economics classes. Nonetheless, I understand many of the concepts and models of Keynes. Maybe, I learned them in undergrad Econ.

The books I read were so condensed with information, one page could easily be expanded to well over a hundred pages, if the the terminology was defined, models and concepts explained, intermediate math steps included, etc.. Also, I had to research lots of journal articles for papers, e.g. in American Economic Review, Journal of Economic Literature, Econometrica, etc.. I spent most of my time in grad Econ classes writing equations as fast as possible.

PeakTrader We need to bring it down and limit it to 18%

This is a completely arbitrary number. My completely arbitrary number is that government spending should be 23 percent of GDP. Why is that a better number? Because as a country become wealthier its citizens tend to demand more of what we think of as public goods. For example, people put more value on clean water, safe streets, honest police, green spaces, cultural events, better health, etc. All those things cost money. If there’s one thing we know about economic development, it’s that rich countries demand more government services and public goods than poor countries. That’s just a fact of life. Deal with it. The gap between what people demand from government and what they are willing to pay in taxes represents the nitwit voter wedge. The American electorate has a relatively high nitwit wedge factor. BTW, if you’re really concerned about reducing government spending, then you should join my cause to abolish the fifty states. States and local governments spend almost twice as much as the federal government as a percent of GDP. Go check the BEA tables. Getting rid of the states would reduce a lot of inefficient redundancies. If any private equity company took over the government the first thing that firm would do would be to eliminate the wasteful layer of state government; i.e., government’s version of “middle management.”

Health care costs can be reduced dramatically without affecting quality by allowing the free market to work,

Another example of simply assuming away the problem. There are good reasons, known to economists since Kenneth Arrow was a pup, as to why health care is not and cannot work as a free market. Try to keep up with the literature.

given people are living longer, Social Security retirement age should be raised to between 65 and 70

Actually, low income white males are not living longer. See the Angus Deaton study. The mortality rate for low income white males is increasing. In any event, people might be living longer, but human bodies are pretty much the same as they’ve always been. Increasing the SS retirement age is effectively a huge tax on labor. Why not just be explicit about it and raise payroll taxes for people while they are in their prime working years rather than effectively imposing a large tax increase after age 62? And the one thing we should not have done was to raid the large SS Trust Fund surpluses in order to pay for income tax cuts for the rich. And then when those SS Trust Fund bonds come due we find ourselves listening to fat cat Republicans whining about higher income taxes today in order to pay for those SS bonds being redeemed by the Trust Fund.

2slugbaits, federal tax receipts averaged 17.9%, since WWII and never been above 20%, perhaps due to Hauser’s Law (disincentives).

I’ve explained to you many times why only catastrophic health insurance is needed.

You’re also completely wrong about American’s higher quality of life, since the 1930s, when Social Security was enacted.

I doubt you want to promote work. I guess, you believe mooching off other people is a “right.”

“federal tax receipts averaged 17.9%, since WWII and never been above 20%”

They have never been above 20% because we have never tried. But do spin on with your usual Rush Limbaugh fairy tales.

I guess, you believe mooching off other people is a “right.”

Maybe we have different ideas about mooching. For me, I believe capturing monopoly rents is mooching. So people in the banking and finance world are moochers of the first order. I also believe that reneging on SS bonds in order to give fat cat billionaires big tax breaks is mooching. And let’s be clear, that’s exactly what Trump is doing. The Trump/GOP tax plan makes virtually all of the tax cuts for the rich permanent, but the crumbs for the little folks mostly expire after six years. Then we’ll hear all about how entitlements need to be cut because of the exploding deficits after year 10. In fact, on Friday I heard one Trump apparatchik make exactly that argument.

When people are promised a certain set of retirement benefits, then those promises should be kept. If you’re (say) 55 years old and based on decades of government promises you expected to retire at age 62, then suddenly telling that worker that he or she will have to work until 70 before getting any benefits is effectively a huge tax. Funny that you don’t seem at all concerned about raising that effective tax, but you cry a river of tears for the rent seeking billionaire.

Expanding work and investment to raise GDP is not rent seeking. And, government spent and squandered the Social Security money. You’re making a case for a smaller, and less selfish, government. There’s a lot of market power in the U.S. Information Revolution. However, the U.S. economy has also benefited from that market power, including through multiplier effects and at the expense of foreign competitors. Mooching to me are free riders, although I agree there are some who actually work, get paid, and people are willing to make the exchange. However, many want something for nothing.

2slug,

My completely arbitrary number is that government spending should be 23 percent of GDP.

Well, as long as it is arbitrary, one can simply exchange arbitrary opinions forever. With all of the brain power available for such things as IPCC climate models, there ought to be enough economists (such as yourself) who can create an optimal taxing and spending model that provides 3-4% economic growth, limits inflation to 2%, minimizes unemployment, eliminates annual deficits, reduces the national debt by 5% each year, and ensures “fair” distribution of incomes… all the while providing universal health care and free college tuition.

The test, of course, would be to restate what would have happened if we had only followed that model in the past.

Bruce Hall there ought to be enough economists (such as yourself)

I am not an economist. Economists are OPM job series 0110. Much of my academic background was in econ, but my OPM job series is 1515 (operations research). ORSA types tend to be more applied math.

create an optimal taxing and spending model that provides 3-4% economic growth, limits inflation to 2%, minimizes unemployment, eliminates annual deficits, reduces the national debt by 5% each year, and ensures “fair” distribution of incomes… all the while providing universal health care and free college tuition.

You forgot to include curing cancer and wiping out global hunger. I think I’ve made it pretty clear that I don’t believe sustained 3.5%-4.0% growth is possible. At least it’s not possible if you want to follow a balanced growth path, which is what I assume you mean by “optimal taxing and spending model.”

2slug

All right, we’ll scale back the 3-4% growth to 2-3% (present rate) and forget global hunger (although curing cancer would be nice).

I think you understand my point that there are tradeoffs and no arbitrary percentage of GDP assigned to government spending means much of anything without other policy drivers working in concert. Growth (as defined by GDP growth) is only one aspect of a “balanced path”.

“States and local governments spend almost twice as much as the federal government as a percent of GDP. Go check the BEA tables. ”

Before PeakTrader goes off on another one of his rants, let’s note you are referring to government purchases. Nondefense Federal purchases are around 2.5% of GDP with defense purchases around 4% of GDP.

Peak is clearly talking about slashing Federal health care benefits and Social Security so the NYC billionaires can spend more time in the Hamptons.

I believe in progressive taxes.

I just want socialists, like you, to contribute something besides nonsense.

“I just want socialists, like you, to contribute something besides nonsense.”

i am willing to bet, today, my household tax contribution is greater than yours peak trader. so i would like the ayn rand acolytes to contribute something besides nonsense as well. society needs people besides the selfish narcissists we see on this blog peak. besides being a leech on the economy through your career as a failed financial type, what have you actually contributed for the good of the country and society? or were you another of the goldman types doing “God’s work” during the financial crisis?

Federal, state, and local tax receipts are roughly $3.8 trillion and GDP is $19.5 trillion.

That’s less than 20% of GDP.

FRED:

https://fred.stlouisfed.org/series/GDP

https://fred.stlouisfed.org/series/W006RC1Q027SBEA

https://fred.stlouisfed.org/series/W070RC1Q027SBEA

Try http://www.bea.gov

Table 3.1. Government Current Receipts and Expenditures

It shows total tax receipts are over $5.4 billion but then that includes Contributions for government social insurance.

Your FRED charts do not.

Pgl, yes, you’re correct, although the important point is disincentives implied by Hauser’s Law holds.

“Income taxes contribute $1.836 trillion, half of the total. Another third ($1.224 trillion) comes from your payroll taxes. This includes $892 billion for Social Security, $270 billion for Medicare and $50 billion for unemployment insurance.

Corporate taxes add $355 billion, only 10 percent. Customs excise taxes and tariffs on imports contribute $146 billion, just 4 percent.

The Federal Reserve’s net income adds $70 billion. Its revenue comes from a variety of activities. The remaining $23 billion of federal income comes from estate taxes and miscellaneous receipts. (Source: “FY2018 Budget.Table S-4,” Office of Management and Budget, May 23, 2018.)”

Hauser’s “law” debunked:

https://angrybearblog.com/2010/11/hausers-law-is-extremely-misleading.html

Not completely debunked. Federal tax receipts have been limited, because of disincentives. Don’t be so simple.

https://fred.stlouisfed.org/series/FYFRGDA188S

Hauser has shown no analysis indicating anything remotely close to some Laffer curve claim. Of course Hauser is not an economist. No Peak – you are the one being simple minded here.

Ed Hanson claims:

“it is important to remember that deficit came to zero directly because of the higher growth of GDP due to Reagan tax policy. Incentives matter.”

Deficits were very high from 1981 to 1995 so this came to zero is just false. Real GDP growth from 1981 to 1992 was only 3% whereas it averaged around 3.5% for the last years previous and the 8 years after. Can we get more fact free here?

pgl

What you wrote are close to the facts. Of course you left out other vital facts such as the huge and marvelous reduction of interest rates, as well as the cold war victory due to the government putting money where it was Constitutionally mandated – the defense of the country.

But back to your point. It was the Reagan supply-side tax cuts that brought on the sustained prosperity and the eventual zeroing of the deficit. True reductions in tax rates work like compound interest, things just keep on getting better as the years go by. If only the government and its elected appropriators could restrain themselves in the good times like they re forced to so eventually in the bad, then we would see prosperity for even more years.

Ed

“Of course you left out other vital facts such as the huge and marvelous reduction of interest rates”.

Not quite. Expected inflation fell by more than the reduction in nominal rates. So real interest rates went up a lot. And private investment suffered. Which is why long-term growth FELL. Find Mankiw’s first macroeconomic text book as he laid this out very clearly.

pgl It’s hopeless. Way too many posters learned their economics from bumper stickers and AM radio. And it shows.

Aside from getting the basic facts wrong, notice that Ed Hanson seems to have completely forgotten the role that the Fed played in first increasing and then decreasing nominal interest rates beginning with the end of the Carter Administration.

Peak showed his total ignorance when he claimed that total Federal and state tax revenues were less than 20%. Of course he provided his proof by leaving out payroll taxes. Now that is either really dumb – or really dishonest hoping the rest of us are dumb.

And you have to love Ed arguing that interest rates fell under Reagan. Nominal yes but real interest rates rose a lot.

I guess we need better right wing trolls.

“Which is why long-term growth FELL.”

When? What years are you writing about?

I said. From 1981 to 1992, real growth averaged 3.0%. Before that and after that, the average growth rate averaged 3.5%. Try actually checking the FACTS.

Bruce Hall Growth (as defined by GDP growth) is only one aspect of a “balanced path”.

Now here you’ve made an interesting comment. When we talk about a “balanced growth path” what we mean is a constant exponential rate…say 2% per year. But over the short run the economy doesn’t always (in fact, rarely) follows that kind of path. Instead what we see are dynamic transition paths. For example, in the short run capital deepening raises output level, but over the long run it does not raise the growth rate because other factors adjust. But moving from one level to a higher level is a transition path that is not part of the long run balanced growth path. The point is that over the short and even medium term it is possible to have transient higher growth rates that exceed the balanced growth path, but in order to sustain that over the long run the economy must operate on an unbalanced growth path…and I don’t think we want to go there.

BTW, going back to 1870 the long run per capita growth rate has been around 2%. If you fit the data in logs you will get a very linear (i.e., constant) growth rate, except for the Great Depression. Here are some numbers from Stanford economist Charles Jones (“The Facts of Economic Growth”, unpublished preliminary draft) that make the point:

1870 – 2007: 2.03%

1900 – 1950: 2.06%

1950 – 1973: 2.50%

1973 – 2007: 1.93%

I grabbed the statistics from this site: https://www.thebalance.com/us-gdp-by-year-3305543

I believe these are chained 2009 dollars.

Note that the 12 years you chose began and ended in recession.

Choosing the 7 years between the recessions, the growth in GDP average more than 3.9%

If the years are chosen after the initial recession, corresponding when the first Reagan tax cuts were finally fully implemented, then the growth was 3.2% over 9 years.

1981 $3.211 $6.618 2.6% Reagan tax cut. (begins to be phased in)

1982 $3.345 $6.491 -1.9% Recession ended.

1983 $3.638 $6.792 4.6% Tax hike and defense spending.

1984 $4.041 $7.285 7.3%

1985 $4.347 $7.594 4.2%

1986 $4.590 $7.861 3.5% Tax cut.

1987 $4.870 $8.133 3.5% Black Monday.

1988 $5.253 $8.475 4.2% Fed raised rates.

1989 $5.658 $8.786 3.7% S&L Crisis.

1990 $5.980 $8.955 1.9% Recession.

1991 $6.174 $8.948 -0.1% Recession.

1992 $6.539 $9.267 3.6% NAFTA drafted

———————————————————————–

But, there is no reason to assume the effects of the Reagan tax cuts ended in 1992. The growth because of them continued despite attempts of Bush I and Clinton to damage the economy. They lasted until Bush II and the Congress of the time, finally damage the economy enough to end these effects. It is unfortunate that Bush II did not correct his mistakes rigorously enough and, of course, growth of the economy was never a prime goal of the socialist minded Obama.

The stage is set for the Trump tax cuts, that is, if the Congress has the courage.

Oh yes, by the way, from the same site the 11 years (1970 thru 1980) averaged 2.9% growth ( not to mention the horrible inflation). I’d rather not live through that decade again. So much for facts.

Ed

“Note that the 12 years you chose began and ended in recession.”

Yes – I picked a beginning and ending date with the same GDP gap, which is the right way to do this. Of course if one looks at potential GDP, you get the same result.

So thanks for implicitly pointing out that the Laffer crowd does not do this right but I do.

In case you do not wish to visit the cited website, the columns are: year, nominal GDP, real GDP, growth rate, and the site’s thought of major news.

Ed

“But, there is no reason to assume the effects of the Reagan tax cuts ended in 1992. The growth because of them continued despite attempts of Bush I and Clinton to damage the economy.”

I see – a tax cut in 1981 finally led to an investment boom 15 years later. I guess that is Milton Friedman’s long and variable lag.

there is no limit to the accolades that will be thrust upon st reagan in the name of his conservative ideology. he has almost reached prophet status in certain conservative cults.

pgl

Note my analogy to compound interest. The effects are more visible further the years out.

Action by the political class is one way that the effects eventually end. It could have ended sooner, economically, Bush I was a bad steward. That was recognized and Clinton was elected. And fortunate for Clinton, he was restrained when he tried to make major mistakes. First by his party, which still at this time had something independent and thoughtful members, when Hilary Care was turned down. Then he was restrained by the electorate by a Republican majority created in the House. I think you have to be my age to realize what an extraordinary event this was. Clinton’s mistakes remained minor and his adjustment to political reality great. And the restraint by both Clinton and the House kept the Reagan revolution moving. The economy had the strength to quickly recover from the tech crisis.

It is unfortunate that the Republicans would not retrain Bush II as they had Clinton. Rather than recognize the strength in the country due to Reagan revolution, giving the country the inner strength for the recovery from 9/11, The Congress and the President returned to the curse of big government, the became appropriators instead of protectors of freedom. The era of restraint ended. The country finally reacted by electing Trump, who was the closest to a leader which would show both restraint and return to a tax system more capable of rewarding individual work.

ed, conservative leadership lead directly to the great recession and one of the greatest financial calamities in history. we had conservative enacted deregulation and tax cuts. you saw the results. you seem too blind to the cult of reagan to understand what actually occurred, and fail to take responsibility for the conservative ideology which was implemented.

Baff

Rather than deal with your definition of Conservative, why don’t you just list which de-regulations they were solely responsible for, that cause the great recession. Then explain exactly how tax cuts cause recessions, great or not.

And by the way, stating it was “one of the greatest financial calamities in history” is quit an overstatement.

the tax cuts led to increased deficits with weak growth under bush. considering his economic woes were not caused by a financial crisis, his policies should have been able to produce better growth. they did not. the policy failed to strengthen the economy and gave us a weaker economy when the financial crisis hit home.

“And by the way, stating it was “one of the greatest financial calamities in history” is quit an overstatement.”

apparently you have not listened to the experts in the room as the lehman moment came to a head. it is not an exaggeration. it is the view of those who dealt with the crisis first hand. why deny the significance of this event?

No, spending new caused the increase deficits, but, I agree, the first round of the first round of Bush II tax cuts were Keynesian in design and damaging. His other tax cut was better but too small and too late.

I am still waiting to read your list of Conservative de-regulations that caused the financial crisis.

History is a long period, this financial crisis will not be listed. It will be studied, though, as a example of poor management by the President and Congress. And no, the conclusion will not be that not enough money was thrown at the problem.

ed, let’s be clear. tax cuts were implemented as a solution to a struggling economy, and failed to produce anywhere near the growth which were expected from them. period. you present excuses for failure.

as for deregulation, perhaps i should better describe the era as laissez-fare approach to the markets. there were several items that came into play, including moves by the SEC to have greater oversight of financial institutions. however, they never really increased their oversight. and the marketplace responded with carelessness. the lack of active oversight allowed financial institutions (some banks, some not) to continue with too much leverage, and piss poor risk management, most likely due to a warped incentive structure. but you cannot overlook the mood of the era was to let the markets produce the most efficient solution-and the solution they created failed. a lack of interest in regulations, and banks knowing this to be the case, was detrimental in a major sense. hence bear sterns and lehman failures-with aig not far behind.

Sorry for the delayed response Baff but my entry seemed to disappear during upload.

I do not completely agree with your analysis but it is a reasonable interpretation.

I point out what it is not, though. It is NOT a Conservative de-regulation leading toward the crisis.

What you describe is what happens in big government. :Lack of accountability, incompetence, and simply being incapable of managing the power it has assumed.

My advice, quit advocating programs that increase the power and xcope of government. It simply leads to incompetence, corruption, and loss of liberty.

Ed

ed, a primary problem was a laissez faire attitude taken by the bush government with regards to financial behavior. the conservative approach is let the markets be, they will sort out the best outcome. that did not occur. the regulators should have been on the lookout for weaknesses in the financial system-that is their job. very high leverage combined with terrible risk management and incentives created a huge problem in places like bear sterns and lehman. it is not unrealistic to believe regulators should have been more aware of these conditions. but the anti-regulation mood of the administration certainly discouraged this from occuring. this failure was not “big government”. it illustrates the difficulty in believing the financial system can effectively police itself. what would you advocate which would have solved the problem of bear sterns and lehman, without contaminating the rest of the financial system?

Baff, you wrote

” this failure was not “big government”. it illustrates the difficulty in believing the financial system can effectively police itself. what would you advocate which would have solved the problem of bear sterns and lehman, without contaminating the rest of the financial system?”

A difficult problem indeed. But perhaps a such a huge problem that should never had occurred.

Much of the reason the crisis happened was the expectation of Government Bailout. Why not take extreme risk when you are certain the a bailout will occur.

Without big government, such a bailout could not happen an it follows no expectation of one would develop.

It is a problem of Too Big Government.

For a recap, here are the problems from a Too Big Government.

Given responsibility to regulate a sector too big for the people of government to manage.

Regulator capture.

Cronyism.

Logical expectation of bailout.

Result of some of the powerful being treated different from the many.

Too many laws allow for the pick and choose of those to enforce, a small tyranny eventually to become large.

There are more problems inherent to a 0To Big Government, but that is for others.

Ed

“Much of the reason the crisis happened was the expectation of Government Bailout. Why not take extreme risk when you are certain the a bailout will occur.”

i do not believe that was the case with respect to bear sterns or lehman. i don’t believe anybody expected a bailout to occur when they were racking up risk. they simply had nobody in house who stepped back and asked the question “what happens to us if this trade goes south”. the bankers were probably arrogant enough to believe they would never be wrong. bankers had very poor incentive programs that did not punish the for being very wrong. if was a very asymmetric risk/reward structure. this was not the problem of big government. it was an example of how the unfettered belief in the free market system is not necessarily a wise viewpoint. the bankers showed they could not police themselves. the regulators failed, indeed. but don’t let that excuse the stupidity of the bankers in that era.

I remember reading a story about the bankers’ holding a meeting about mitigating the effect of Lehman, Bear Stern and AIG under the assumption that the government would not bail them out. The general feeling at the time they could handle it however each of the senior executives from these firms were withholding information from each other to the point that they did not trust the numbers they provided.

You’re correct on one thing: they had a systemic risk built into the capital along with incentive programs and what’s worse many of these leaders still does believe that they did nothing wrong.