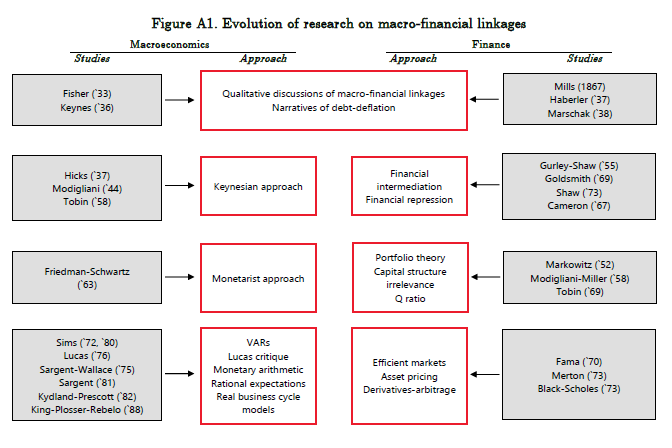

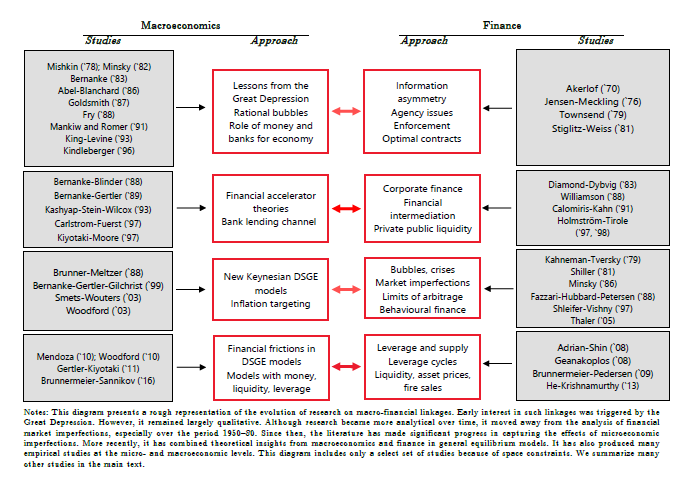

I tire of hearing people who had one (or no) class in economics saying “the magic of the marketplace” will lead to the optimal outcome. What teaching finance has made me realize is that information problems are rife in many economic interactions. And one can’t be a student of currency crises without being even more convinced. The paper by Stijn Claessens and Ayhan Kose, “Macroeconomic Implications of Financial Frictions: A Survey” is a must-read for those who want to keep up with the literature. It has this fantastic schematic:

Source: Claessens and Kose (2017).

From the conclusion:

…In particular, extensive evidence documents how the state of borrowers’ balance sheets affects their access to external finance. Demand side imperfections in financial markets have been shown to lead to an amplification of shocks (monetary, real and financial) because changes in the net worth of borrowers affect their access to finance and, therefore, to consumption, investment and output. Empirical studies confirm that these imperfections tend to affect small firms and households particularly strongly, especially during periods of financial stress. Although most findings support the roles played by financial imperfections, there is nevertheless an ongoing debate about the quantitative importance of the financial accelerator.

The GFC has shifted attention to the critical role played by amplification channels operating through the supply side of finance. Earlier theoretical work on the bank lending channel analysed the possible general equilibrium effects arising from the special role of banks in financial intermediation. Empirical studies documented how the dependence of some firms on bank financing influences the transmission of monetary policy to the real economy. Since the GFC, there has been a broader recognition that the supply side of finance (beyond the specific role played by banks for some firms) can be a source of shocks, amplification and propagation.

I think those who are analyzing the macro/business cycle implications of the enormous give-away to financial institutions and already-cash rich corporations that is the Tax Cuts and Jobs Act would do well to contemplate what a non-neoclassical approach implies for the near future. (Does one really think that full expensing of short term capital expenditures will matter that much for investment? See this post for discussion.)

See also this post on macro/finance linkages.

I am not sure what a ‘short-term’ capital expenditure is. To the best of my knowledge, all capex are long term, ie, they are depreciated and not expensed.

I have every confidence that capex expensing will bring investment forward big time for companies with the prospect of taxable income. If you don’t invest the money, it’s just lost to taxes. So, yes, it will stimulate investment, and materially so, I think.

But I am not convinced the plan is a good idea. We could get exactly the opposite of the tax losses issues pre-Reagan. Instead of trying to create tax losses, we’ll be trying to create capex opportunities, which in turn means that ROI could (and will) fall. It could lead to over-investment.

Apologies. It’s not entirely clear what ‘short-lived’ investments are, other than that they are not real estate structures like buildings and warehouses. It’s less clear to me whether it includes all other plant and equipment.

A lot of plant and equipment is not ‘short-lived’. For example, an aircraft would have a pro forma life of, say, 25 years, and a service life of as much as 40 years. Is that expensed? Ditto for, say, a GE power plant turbine.

Does this include imports and exports? For example, if I buy a printing press and rent it out to my subsidiary in Germany, can I expense that? What about an oil production platform I purchased for $2 bn from Korea? Can I expense that?

Can Hertz expense its rental car fleet?

What about oil wells? That’s capex, but not machinery per se. Is that expensed? Certainly the drilling rigs and fracking equipment look like they can be expensed. Can the wells themselves be?

Today I heard some lobbyist say that next year they would try to get the five year expensing timeframe changed to permanent. The ink is barely dry on this monstrosity of a tax bill and already Trump’s alligator friends are growing hungrier in the swamp. BTW, whatever happened to Trump’s campaign promise to eliminate the carried interest provision? That was something he Trump-eted on the campaign trail but seems to have conveniently forgotten about it when it came down to crunch time. Just like his promise that the tax bill would make him poorer. The sad thing is that there are millions of idiot voters who believed and still believe the Liar-in-Chief.

Steven Kopits: “I am not sure what a ‘short-term’ capital expenditure is. To the best of my knowledge, all capex are long term, ie, they are depreciated and not expensed.”

Ah, I can see that you have never run a business and don’t know the most rudimentary principles of business taxation yet feel free to opine on the subject.

Capital expenditures are the purchase of assets with an expected life of one year or more. These generally must be depreciated over a period of 3 to 39 years, depending on the class and expected life of the asset.

In the new tax bill they are allowing qualified tangible property classified with a life of 20 years or less to be immediately expensed instead of depreciated. This does not include real property with a life of longer than 20 years.

This new full, immediate expensing has a cost to tax revenue since an immediate deduction is more valuable to a company than a deduction spread out over a number of years.

This immediate expensing proposal was originally debated as a possible trade off for eliminating deduction of interest on debt. But instead, businesses will now get both — full, immediate expensing and deduction of interest on debt. So companies can now borrow money to purchase assets and take a deduction on the asset and simultaneously take a deduction on the interest for money borrowed to purchase the asset — a fine case of double dipping. Expect to also see some tax gaming using borrowed money to essentially buy an asset expense deduction to time tax obligations favorably.

Actually, I graduated at the top of my MBA class in finance and accounting, but yes, I loathe tax accounting. Like the English language, it is all about exceptions and changing rules. It is mostly memorization rather than logic, and rules learned a long time ago do not necessarily obtain today. So, yes, you have me there.

Best I can tell, the topic category for depreciable tangible assets (ex real estate), is 20 years. So to answer my own question, it appears all equipment can be expensed, including aircraft, printing presses and oil tankers. Is that your understanding, Joseph?

joseph, you must understand the conservative business model to politics is to opine over long term entitlements, but enact rules that provide short term benefits. long term problems are left to the democrats. short term pulses to the economy are the only concern of the republicans-they win votes. the democrats can come back in a few years and clean up the mess-and be blamed at the same time. for example, peak trader contributed to the financial crisis, and now blames the democrats for the failure during the cleanup process. the pattern has been repeated over many generations.

The state of Maryland set forth clear guidance for LLC tax filings regarding short term capital investments. IIRC, computer software was depreciated over 3 years and computer hardware over 5. Those were my only capital investments for my one person consulting shop. It was a pain in the ass to do the filing every year making sure to track the depreciated property.

Regarding the new tax law, expect to see a lot of gaming of the system. It’s uncertain whether the Democrats will help to solve any of the problems the legislation creates as the Republicans never helped out to fix Obamacare. I can’t wait to see how much money I save on my taxes this coming year!!!

I agree. For sure, any item under $10,000 should be expensed. It’s just not material in the big scheme of things.

I could make a case up to $100,000–which would include most vehicles. Most such assets are going to have a life of five years or less, so I don’t think expensing would greatly upset the bigger picture.

Beyond that, however, I think depreciation with some relationship to useable life is appropriate. If you’re buying a million dollar printing press, that will be in use for decades, most likely. It should be depreciated accordingly.

Uh, the tax bill isn’t about investment or economics but as Sen. Corker has show it is about theft.

As with S. Kopits, I am unclear on the meaning of short term capital investments. However, the results of Zwick and Mahon, AER, Jan 2017, who analyzed the effects of bonus depreciation, suggest that expensing will increase capital expenditures, especially among small and medium size firms.

I am very puzzled that in a survey that purports to be comprehensive, the whole field of New Monetarist macroeconomics is omitted. These are macro models that are not constructed on the framework of a price-taking equilibrium model, but instead introduce fundamental liquidity frictions. It is a well established macroeconomic field with more fundamental financial frictions than the models included in the survey. Indeed, New Monetarist models are arguably DSGE models (though they are very uncomfortable for those who are used to price-taking equilibrium).

One of the thing that has been happening over the last decade or two is that more short lived high technology equipment has been increasing its share of capital spending while more long lived traditional capital equipment has seen its share decline. Consequently, net capital expenditure after depreciation has been declining faster than the gross data reported in GDP. We are having to run faster and faster just to stay even and net capital expenditures are much smaller than gross capital expenditures. This is a very important factor in the poor performance of productivity as the net capital stock per employee has been growing much slower than it use to == it has actually been negative in several recent years.

I’m not sure how that change in the tax code will impact this. But I am not optimistic.

AT&T response to the Tax Cut and Jobs Act:

https://www.google.com/amp/s/www.cnbc.com/amp/2017/12/20/tax-reform-reaction-att-is-giving-bonuses-to-200000-employees.html

I’m going to do my share by upgrading my over two year old Apple 6 Plus iPhone through AT&T (that’s Tax Cuts and Jobs Act).

Article recently updated with Comcast.

Steven Kopits: “For sure, any item under $10,000 should be expensed … I could make a case up to $100,000 — which would include most vehicles.”

Sheesh Steven, is there no subject about which you know absolutely nothing that you will nevertheless opine upon.

Businesses have been about to expense relatively small tangible capital expenditures since 1958 under Section 179. This year they could expense up to $500,000. The new Republican tax cut for the rich now allows expensing up to $1 million — and that includes vehicles.

PeakTrader: “AT&T response to the Tax Cut and Jobs Act”

AT&T is a lying sack. The $1000 bonus was planned long ago as an inducement to settling a strike by union members.

AT&T invented this story just to butter up Trump whose administration has been opposing its merger with Time-Warner, mainly because of Trump’s personal beef with CNN. Just some good old fashioned quid pro quo mixed with Trump’s adolescent ego. He hates CNN — but he loves it when corporations praise him. I can see where it’s going to be a tough choice for the dementia suffering fool.

This kind of corporate propaganda works wonders on dimwitted folks like PeakTrader who are its prime target.

Just some good old fashioned quid pro quo mixed with Trump’s adolescent ego. He hates CNN — but he loves it when corporations praise him

Did you see all the fawning sycophant GOP politicians in the Rose Garden lining up to praise the wisdom and energy of King Donald? It was sickening. Reminded me of that obscene display of sucking up that we saw in the early days of this administration when the Cabinet members had to stroke his….ummm, ego. The Dickens character “Uriah Heep” had nothing on these GOP creeps. Later I had to check if any of the sewerage water spilled onto my carpet.

And of course Trump’s first Presidential pardon just went to a cruel corporate crook who exploited undocumented workers. Figures.

You may want to read the article:

“AT&T told CNBC the bonuses announced on Wednesday are above and beyond any existing agreements, which means some workers would get two $1,000 allocations: One with a new contract, and one when the tax reform bill is signed.”

https://www.cbsnews.com/news/no-tax-cuts-for-christmas-trump-might-delay-bill-signing/

“Celebrations aside, President Trump may wait until next year to sign the tax bill into law, delaying the $120 billion in automatic cuts to popular programs such as Medicare and sparing Republicans from having to explain them in an election year.”

And I’ll bet it works. Trump voters aren’t exactly the sharpest knives in the drawer.

So let’s look at this AT&T sharing of the wealth. Let’s say they give the $1000 bonus to all 200,000 employees. That’s $200 million. Last year AT&T had net profits of $13 billion. As a result of the Republican tax cuts for the rich, let’s say their tax rate goes down by 10 percentage points. Their net profits will increase by roughly $1.3 billion. And the share going to employees is $200 million.

That means only 15% of the Republican largess is going to employees. Oh, but wait. The bonus is only for one year. The tax cuts are forever. If they really meant to share the wealth they will have made a wage increase, not a one-time bonus.

Only a tiny fraction of the tax cuts will go to employees — maybe 2%. That’s Republican trickle down at its best.

That’s a very narrow view of how labor benefits. Lower corporate taxes can generate more jobs, including more investment-related jobs, and jobs from foreign investment. It’ll likely result in higher wages or compensation, including 401(k)s, and higher productivity. It use to be said what’s good for General Motors is good for America – the same can be said about AT&T. Do we want to bankrupt AT&T, like GM, or maximize shareholder value? Why tax a corporation to death to give run away entitlements to free riders?

GM likely had high effective corporate tax rates, similar to AT&T, when profit margins were highest in the ‘50s and ‘60s. A lower effective tax rate would’ve helped fund pensions and healthcare benefits, along with raising wages. Moreover, there would’ve been more capital investments. Instead, much of that money went to government programs, many of which turned out counterproductive.

2slugbaits: “President Trump may wait until next year to sign the tax bill into law, delaying the $120 billion in automatic cuts to popular programs such as Medicare and sparing Republicans from having to explain them in an election year.”

Trump might be too clever by half. McConnell has said that he expects a routine waiver of the PAYGO cuts, taking the heat off the Republicans. If the PAYGO cuts took effect in 2018, Democrats would be likely to have to immediately cooperate with Republicans on the 60 votes they need in the Senate for a PAYGO waiver to prevent Republicans from shooting the hostages.

But if the PAYGO cuts don’t start until 2019, Schumer should be in no hurry to help dig the Republicans out of their unpopular hole. He should wait until after the 2018 elections and every single day for the next year remind the public that their Medicare and farm subsidies are about to be cut because of the Republican tax cuts for the rich.

Speaking of PAYGO – recall the Lawrence Kudlow rule. PAYGO applies only to spending changes but not to tax cuts. Republicans have always practiced the fine arts of fuzzy arithmetic.

Companies starting to pass on some of the tax cut to workers:

http://money.cnn.com/2017/12/20/news/companies/wells-fargo-bonuses-tax-cuts/index.html

PeakTrader: “GM likely had high effective corporate tax rates, similar to AT&T, when profit margins were highest in the ‘50s and ‘60s. A lower effective tax rate would’ve helped fund pensions and healthcare benefits, along with raising wages.”

PeakTrader once again demonstrates he is an idiot. He doesn’t know the first thing about business or business taxes.

Pension contributions and wages are 100% deductible from corporate income taxes. The easiest way to reduce their tax burden was to increase pension and wage payments. So high tax rates weren’t their problem. Their problem was short-term greed by management.

In fact, the very high marginal tax rates of the 50’s and 60’s, approximately 50%, were the incentive for the great research labs like Bell Labs and Xerox PARC. Would you rather keep your profits and give half to the government or would you rather spend your profits on blue sky, long term research and keep all of it.

High tax rates encouraged large capital and research investments for companies that had long-term growth goals. Low tax rates encourage profit stripping and low investment.

Yet, we’re not seeing that with the lower corporate tax rate. Corporations tend to earn at least an accounting profit (vs an economic profit) for shareholders, and profits are needed for dividends, share buybacks, mergers & acquisitions, etc..

And, you may want to read what the largest corporations will do, thanks to the lower corporate tax rate:

https://www.washingtonpost.com/graphics/2017/business/corporations-tax-cut-gop-tax-bill/?utm_term=.bd74794614b8

GM would’ve been in a stronger after tax financial position, if the tax rate was lower, including after funding pensions and healthcare.