That’s the title of a new paper by Joshua Aizenman, Hiro Ito and me.

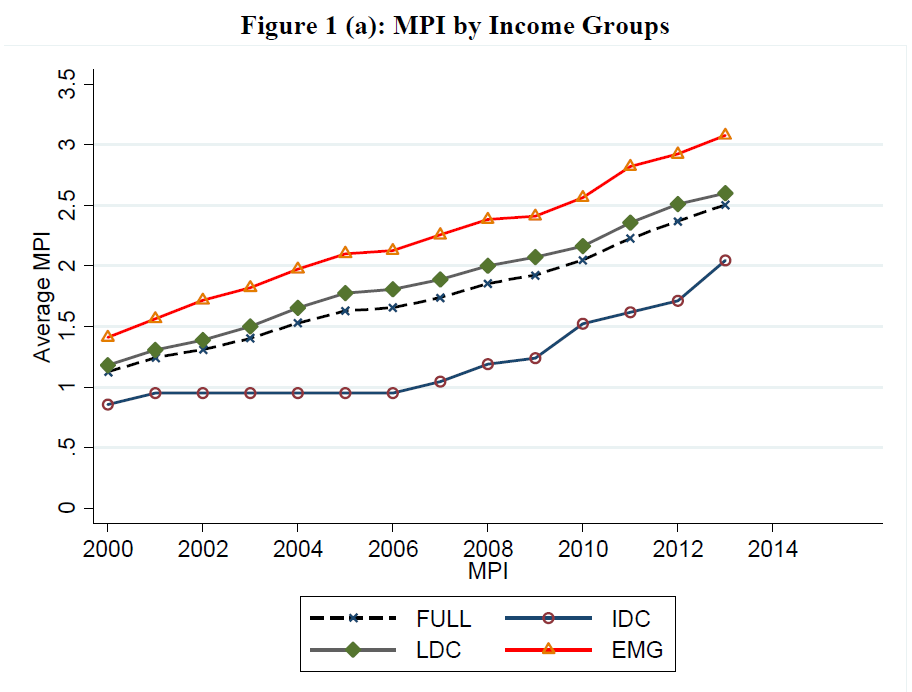

Figure 1: Macroprudential policy index, sum of 12 components, by country income group. Source: Aizenman, Ito, and Chinn (2012).

The abstract:

We investigate whether and to what extent macroprudential policies affect the financial link between the center economies (CEs, i.e., the U.S., Japan, and the Euro area), and the peripheral economies (PHs). We first estimate the correlation of the policy interest rates between the CEs and the PHs and use that as a measure of financial sensitivity. We then estimate the determinants of the estimated measure of financial sensitivity as a function of country-specific macroeconomic conditions and policies. The potential determinant of our focus is the variable that represents the extensity of macroprudential policies. From the estimation exercise, we find that a more extensive implementation of macroprudential policies would lead PHs to (re)gain monetary independence from the CEs when the CEs implement expansionary monetary policy; when PHs run current account deficit; when they hold lower levels of international reserves (IR); when their financial markets are relatively closed; when they are experiencing an increase in net portfolio flows; and when they are experiencing credit expansion.