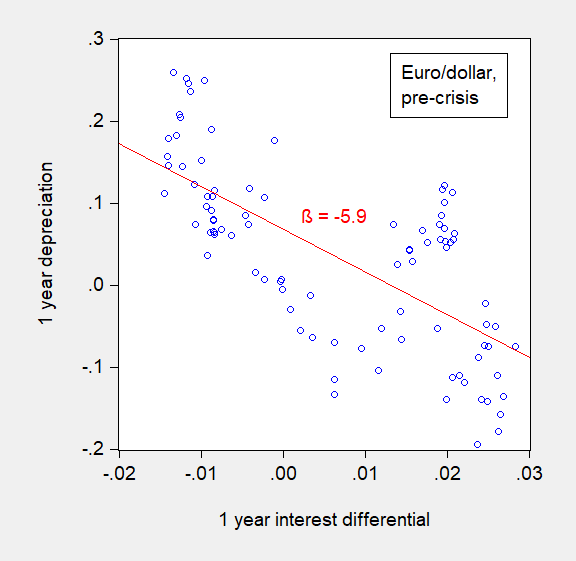

If the joint hypothesis of uncovered interest rate parity (UIP) and rational expectations –- sometimes termed the unbiasedness hypothesis — held, then the slope of the regression lines (in red) would be indistinguishable from unity. In fact, they are significantly different from that value. This pattern of coefficient reversal holds up for other dollar-based exchange rates, as well as for other currency pairs (with a couple exceptions). The fact that the coefficient is positive in the post-global financial crisis period is what we term “the New Fama puzzle”.

In a NBER working paper released today (No. 24342), coauthored with Matthieu Bussière (Banque de France), Laurent Ferrara (Banque de France), Jonas Heipertz (Paris School of Economics), we re-examine uncovered interest parity – the proposition that anticipated exchange rate changes should offset interest rate differentials.

This is one of the most central concepts in international finance. At the same time, empirical validation of this concept has proven elusive. In fact, the failure of the joint hypothesis of uncovered interest rate parity (UIP) and rational expectations – sometimes termed the unbiasedness hypothesis – is one of the most robust empirical regularities in the literature, vigorously examined since Fama’s (1984) finding that interest rate differentials point in the wrong direction for subsequent ex-post changes in exchange rates.

The most commonplace explanations – such as the existence of an exchange risk premium, which drives a wedge between forward rates and expected future spot rates – have little empirical verification.

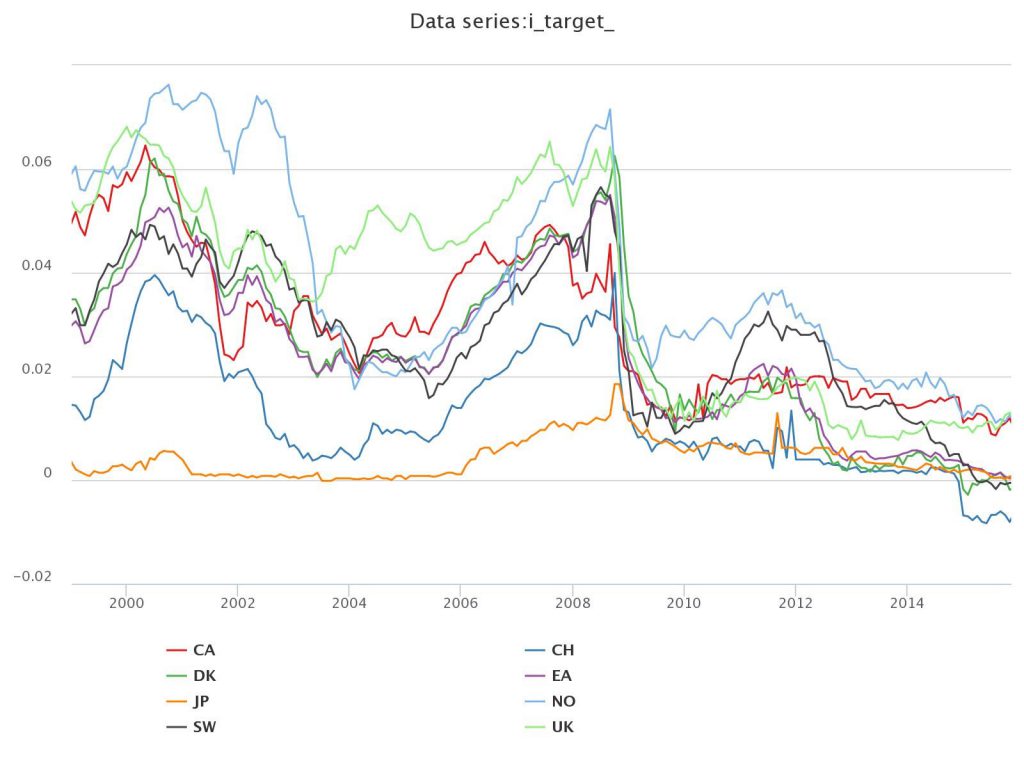

Several developments prompt this revisit. First and foremost, the last decade includes a period in which short rates have effectively hit the zero interest rate bound. This point is clearly illustrated in Figure 1 where we plot three-month interest rates for a set of eight selected countries. This development affords us the opportunity to examine whether the Fama puzzle is a general phenomenon or one that is regime-dependent.

Figure 1: 3-months yields on Eurocurrency deposits.

Second, we now have more indicators for risk aversion for extended period of time. This potentially allows us to distinguish between competing explanations for the failure of the unbiasedness hypothesis. Specifically, we can examine whether the inclusion of these risk proxies alters the Fama puzzle.

We obtain the following findings. First, Fama’s result is by and large replicated in regressions for the full sample, ranging from 1999 to February 2016. However, the results change if the sample is truncated to apply to only the most recent decade, the period for which interest rates are essentially at zero. For that period, interest differentials correctly signal the right direction of subsequent exchange rate changes, but with a magnitude that is altogether not reconcilable with the arbitrage interpretation of UIP. In other words, we obtain positive coefficients at exactly a time of high risk when it would seem less likely that UIP would hold.

The use of survey based expectations — thereby dropping the rational expectations hypothesis — data provides the following insights. First, interest differentials and anticipated exchange rate changes are positively correlated, consistent with the proposition that investors tend to equalize at least partially expected returns expressed in common currency terms (see also Chinn and Frankel (2016) for results 1986-2009).

Second, the switch in the β coefficient at the one year horizon arises because the correlation of expectations errors (defined as expected minus actual) and interest differentials changes substantially between pre- and post-crisis periods. This is important, as can be seen by examining the probability limit of the β’ coefficient in a Fama regression:

s+1 – s = α’ + β'(i-i*) + error

so:

plim(β’) = 1 – [A] – [B] – [C]

Where

[A] ≡ cov(covered interest diff.,i-i*)/var(i-i*)

[B] ≡ cov(risk premium, i-i*)/var(i-i*)

[C] ≡ cov(forecast error, i-i*)/var(i-i*)

covered interest differential = – [(f – s) – (i-i*)]

risk premium = f – ε(s+1)

forecast error = ε(s+1) – s

f is the forward rate for period +1

s is the current spot exchange rate

ε(s+1) is subjective market expectations of the future spot exchange rate (proxied using Consensus Forecasts survey data).

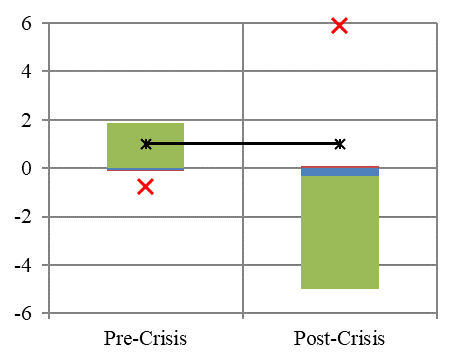

The decomposition for the euro/dollar β’ is shown in the Figure 2 below, for the 2003M01-2016M02 period (defined by the survey data).

Figure 2: Decomposition of euro/dollar β’. [A] is red, [B] is blue, [C] is green; red X denotes estimated β’, black X denotes theoretical β’ under unbiasedness hypothesis. Source: BCFH (2018).

Exchange risk comovement with the interest differential does not appear to be the primary reason why the Fama coefficient has been so large in recent years (although the altered behavior of exchange risk does play a role). Rather, how expectations errors comove with the interest differential appears of central importance — that is the [C] component. This correlation changes because in the pre-crisis period, the dollar depreciated more than anticipated, while that is no longer true post-crisis.

Ungated version of the paper, here.

“The use of survey based expectations — thereby dropping the rational expectations hypothesis — data provides the following insights. First, interest differentials and anticipated exchange rate changes are positively correlated, consistent with the proposition that investors tend to equalize at least partially expected returns expressed in common currency terms”

Consistent with Frankel’s earlier paper on this. UIP still holds but not rational expectations.

I thought I was “so clever” for finding your paper with the French Bank folks on my own, then noticed you had politely put it up there in the footnotes. The Fama paper is harder to find a FREE version of, so if anyone has any links there, I’d be grateful.

With all the algebra and complications involved in this post, this is where PeakIgnorance should really shine and show us all his deep economics knowledge. Maybe he’ll share the Phd dissertation he did at Trump University. Let’s all cross our fingers. I know PeakIgnorance’s “vast talents” go unappreciated on this site, so this could be his “Olympic moment”.

That being said, I don’t consider myself a complete bozo and this one is a little thick for me. I’m thinking I’m gonna need 2–3 days to add anything insightful on this one. But time and fruition of cerebral cortex based headaches allowing, maybe something constructive might hit me. I’m guessing Menzie put this up more for his students to digest than all us “Joe-Six-packs” out here in the internet wasteland.

@Menzie

Not that I’d actually be able to understand it, but do you have a link for your NK DSGE model??

Moses Herzog: The program is not online, but the details of the model are contained here.

@Menzie

Stupid yet earnest question of the day: Could the manipulation of the Libor rate have had any effect on these numbers?? And or other such as yet to be uncovered scandals related to rates?? i.e. Could things such as the Libor scandal account for PART of the “lack of empirical validation” of the UIP concept??

https://www.theguardian.com/business/2017/jan/18/libor-scandal-the-bankers-who-fixed-the-worlds-most-important-number

This is a good question if he is using LIBOR rates to measure interest rate differentials. But there are other measures of short-term interest rates.

Moses Herzog: The interest rates are offshore CD rates, rather than LIBOR, so LIBOR manipulation shouldn’t have an impact. The expectations errors are so large relative to interest rate differentials I doubt even if we used LIBOR we’d end up with this affecting our results particularly at the one year horizon.

@Menzie

I greatly appreciate both this response and your answer on the NK DSGE. I guess even though the Libor was being manipulated those were “only” “basis points” changes, which might be huge in terms of profit for a trader, but as you said doesn’t account for the larger difference. Obviously parts of this are hard for me to grasp, my original thought was “Well if Libor affects rates around the world, wouldn’t this affect the rates in the research paper?”. But even in the Guardian article I think it indicates that Libor was out of whack with other interest rate barometers, so…..

On a side note Menzie, I have wondered before if they have changed the Libor regulations from what they were during the derivatives/swaps crisis (2007—2009)?? I presume that’s mostly British regulators that would make that decision and make those changes?? I mean, wouldn’t the assumption be that if the same economic crisis popped up again (where banks had incentive to “make up” their own overnight rates) that there would be one or more “Tom Hayes types” that would pop up out of the woodworks again??

Interesting that UIP at least has the right sign precisely in the period when Covered Interest Parity fails?

tom: Yes, but still quantitatively small in impact — see three month horizon results in this post.

Well, after dedicating more brain time than any exceedingly lazy man (that would be myself) cares to dedicated to any endeavor, this is what I’ve decided about the New Fama Puzzle. This is my definitive answer to the problem (empirical anomaly, what-evuh). And I have no doubts as to my conclusions:

https://www.youtube.com/watch?v=xHash5takWU