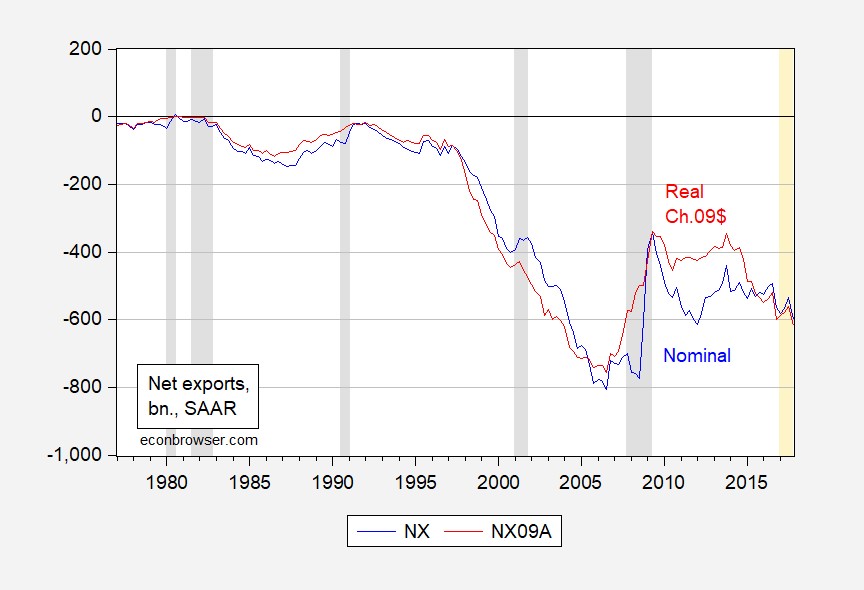

The conventionally reported trade balance (or “net exports”) for the United States from the National Income and Product Accounts (NIPA) is net exports of goods and services, in nominal terms. (There are also trade balance measures on a Census basis and Balance of Payments basis, which differ in coverage and definitions.) The inflation adjusted trade balance is hard to calculate correctly, given the use of chain weighted measures of exports and imports. Here I plot a (Törnqvist) approximation to the real trade balance.

Figure 1: Net exports in billions of US$ (blue), and in billions of Ch.2009$ (red), SAAR. NBER defined recession dates. Orange denotes 2017Q1 onward data. Source: BEA 2017Q4 second release, and author’s calculations.

Notice both in nominal and real terms, net exports have deteriorated over the year 2017. This development is consistent with the picture in Figure 2.

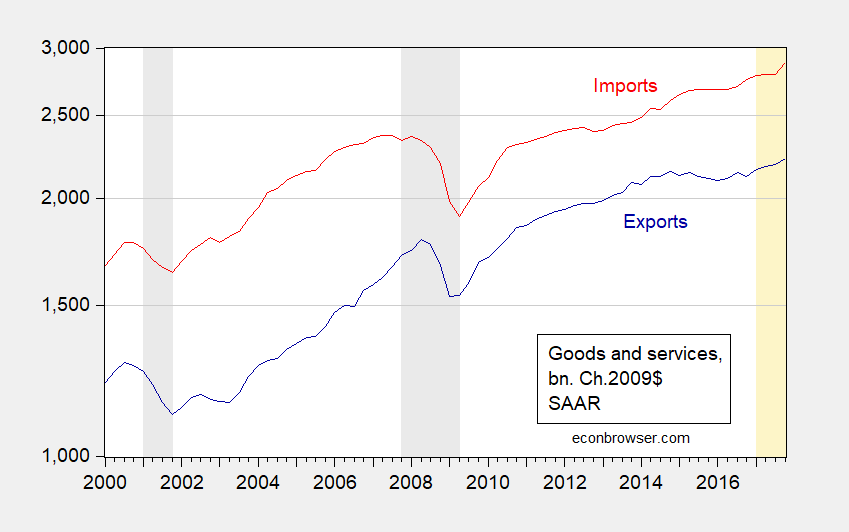

Figure 2: Real exports of goods and services (dark blue), and imports (dark red), in billions of Ch.2009$, SAAR, on log scale. NBER defined recession dates. Orange denotes 2017Q1 onward data. Source: BEA 2017Q4 second release.

What about net exports for the year? From Deutsche Bank US Economic Notes (23 March 2018):

With respect to the latter, Wednesday’s advance trade goods balance (-$76.0 bn vs. -$74.4 bn) for February will provide key data on the trends in the external sector. While we had expected net exports to contribute meaningfully to current-quarter real GDP growth after subtracting -113 bps from Q4, this looks increasingly unlikely as imports appear to be vastly outpacing exports. Case in point, based on the port statistics available for February, imported containers are up 11.3% month-on-month (seasonally adjusted), while exports are up only 1.6%.

One might think that applying tariffs would tend to reduce the net exports deficit. In partial equilibrium — if tariffs applied to a substantial portion of imports and all else remained constant — that conclusion would make sense. However, to the extent that planned national saving and investment drive the developments in financial flows to the US, income, production and exchange rates are likely to adjust in ways that offset relative price changes induced by tariffs.

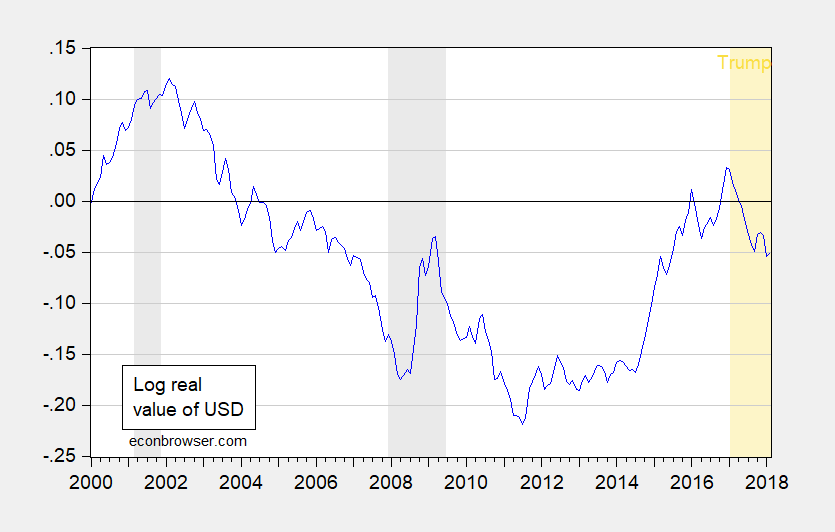

In that context, the worsening of the budget balance in the wake of the tax cut bill will clearly have a negative impact on net exports. Moreover, while the depreciation of the dollar by 8.3% (log terms) since December 2016 should help reduce drag from rising imports, the combination of incipient expansionary fiscal and tightening monetary policy could reverse that weakening trend in 2018.

Figure 3: Log trade weighted value of US dollar (broad index). NBER defined recession dates shaded gray. Orange shading denotes Trump administration. Sourece: Federal Reserve via FRED.

You may have lost us with Törnqvist but hopefully this helps:

http://www.imf.org/external/np/sta/tegppi/gloss.pdf

It is no surprise to anyone that the new tariffs will not reduce the trade balance. It is not the direct purpose. The purpose is to change behavior and policy of certain trading partners to lower barriers in place against our goods and services. This is obvious since every time the tariffs are discussed by the administration, negation is paced as a top priority.

Ed

“negation is paced as a top priority.”

A Freudian slip. Yes – Trump says he wants to negotiate but c’mon man. How are those negotiations with the attorney for Stormy Daniels going?

What can I write in reply but to extend hat Menzie has suggested about stock market reaction. Today the stock market is up a ton on the news that both the US and China are open to negotiations.

Ed Hanson: Bloomberg has a different take.

MenzieBloomberg has a different take.

All depends which Bloomberg at which time.

Hope thelink works,

Ed

The two events “negation” and “negotiation” could intersect one another, where D meets D’ (D prime). I call it “The Stormy Daniels Theory”. Otherwise known as the “You Can Eat Cake AND Ice Cream Supposition”

https://goo.gl/images/jD3j8Z

[ Current Vegas odds on this making it past the Menzie filter, 20:1 ] For the record, and in defense of myself, I was 2nd person to mention Daniels in this thread.

@ Ed Hanson

This “slouch” economist doesn’t seem to be interpreting this the same way as you. Oh well, he was educated at Princeton and got the Nobel Prize for his work in Trade Theory, so what the hell could he possibly know??

https://www.nytimes.com/2018/03/22/opinion/trade-war-china-trump.html

Menzie

He is no slouch economist but is a slouch political commentator. He never fails to slant his political commentary against President Trump , Republicans in general, small government advocates specifically. His slant continues to generally support Democrats, specifically Socialist and leftist. This article is a prime example of all this. To strengthen his hack political commentary he intentionally leaves out important details needed for a complete and balanced economic analysis. He asserts that it is not trade balance that is critical the US, but that IP theft is. He intentionally leaves out what is most important to China which is trade balance of goods. China has for years been an unfaithful negotiator of IP protection, by for years not fulfilling promises made. If IP protect was important to China it would have acted on its promises. The Trump administration has made the important decision of realization of the this fact and has brought pressure to bare on China on what China considers most critical. Also intentionally left our out of both economic and political analysis is the current success of the Trump administration strategy. Through out the world, serious country to country negotiations have been initiated with success. Which is the stated purpose of the new declared tariff policy.

Ed

Ed Hanson: I think you should be addressing your comment Moses Herzog.

But let me ask, is it time to put up a “Mission Accomplished” banner, given our success in renegotiating agreements (i.e., dissolving the postwar trading regime which has proven to be a positive sum game)?

@ Menzie

I keep seeing the word “superlative” used to describe some of the types of XMPI’s. Is that just a way to say that that particular way of calculating the index you are apt to get a number that is artificially high?? i.e.—They are saying that the number you get is apt to give you a higher number than the real number?? Of course I know it’s near impossible to be exact with any XMPI.

Professor Chinn looking at my question: “I wonder when this dumbshit ‘Moses’ is ever gonna learn how to use Google search??”

https://stats.oecd.org/glossary/detail.asp?ID=2608

The Tornquist index provides a very close approximation to the Fisher index used by BEA and is much simpler to calculate. Both are superlative indexes.

See Diewert’s seminal article: http://sites.psu.edu/scottcolby/wp-content/uploads/sites/13885/2014/07/Diewert1976_Exact-and-Superlative-Index-Numbers.pdf

Comment: The impact of tariffs on prices and nominal imports depends partly on pass through. Tariffs will not necessarily be completely passed through.

@ Ben Arownd

Much of the paper is Swahili to me, but I still appreciate you putting that Diewert link up. Apparently there is no “XMPI For Big Dumdums”?? I took enough Calculus to get through bachelor’s in finance, but apparently my mind is not as adroit as it once was. Maybe I need a refresher on how to read the math variable subscripts er something.

This link is the closest thing I can find to a “XMPI For Dumdums” if anyone else is similar to me and trying to get half a grasp on this. It would be nice if the SOBs plugged the numbers in so you could see the equation, but I guess you can kinda decipher it from the tables. This is a UK link and it downloads it pretty much the same moment you click on the link–so there is no “heads up” before it DLs to your comp. Blim-blam it downloads it. Something just occurred to me–it maybe on Youtube somewhere, and if I find Tornqvist/IdealFisher crunched out on Youtube, I’ll put the link in this Econbrowser thread in less than 24 hours.

https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&ved=0ahUKEwjfi5nXsovaAhVK-2MKHWusBpgQFggsMAE&url=https%3A%2F%2Fwww.ons.gov.uk%2Fons%2Frel%2Felmr%2Feconomic-and-labour-market-review%2Fno–3–march-2007%2Fmethods-explained–index-numbers.pdf&usg=AOvVaw1QOXG2W1TAH4CoODR0BscZ

“Economists” should stay out of politics. Otherwise you always tarnish yourself like a pig in a pond.

You would know, about the latter.

As of January,in the real trade data, imports are 155% of exports. This means that if imports and exports both grow at about the same rate the real trade deficit will expand rapidly. If it grows at recent rates ( 3.4% for imports and 1.5% for exports) the 2018 trade deficit would increase about 12%,or about a half percent per month.

Maybe with this massive difference in imports and exports the current account deficit could expand like the federal deficit without a big change in the trade weighted dollar being necessary.