Reader Bruce Hall, opining on the impact of mooted Chinese tariffs on US hog and soybean exports.

As with pork, it looks as if the cost of food is going down for Americans as the Chinese bury their citizens in food price increases.

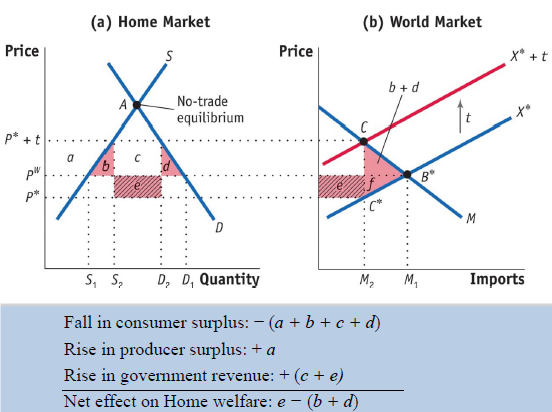

I’m teaching international trade this semester, so this is a good time to remind my students: a tariff’s incidence when the home country is large depends on the relative size (and elasticities) of the import demand and export supply curves.

For instance, a 25% tariff on US soybeans, could result in a 25% increase in prices of imported soybeans in China. Or it could result in 0% if the US is a very small supplier in global markets. Well, the US is pretty large (largest single exporter), so let’s say 15% of the tariff is reflected in Chinese prices. The other 10% is reflected in US prices, both domestic and foreign (as long as there is no other segmentation imposed). I wonder at the equanimity of those contemplate from the safety of afar what 10% price reduction means. See slide 23 of this lecture presentation, presented below. Interpret “home” as China in this context.

Figure 1: Impact of a tariff in a large country, in home market, world market.

In other words, China will impose a terms of trade loss on the US, since it is a substantial purchaser of soybeans. It is incorrect to conclude that China will, unambiguously, incur a net loss.

Tariffs on Gross Value vs. Value Added

While the dollar amount trade covered by retaliation proposed by the Chinese is roughly the same as that of the US under Section 301 (around $50 billion), the tariffs of 25% is on gross value. This matters, since it’s likely for most of the imports from the US to China, the US value added is close to 100%. On the other hand, as noted in this post, roughly 50% of the value of US imports from China is foreign sourced. Taken literally, a 25% tariff on gross value works out to 50% tariff on Chinese value added. Of course, it might be that the Chinese value added in the imports covered by the Section 301 tariffs is a higher proportion than 50% (phones were excluded, for instance). Still, the nominal 25% tariff is likely to translate into a higher tariff rate on Chinese value added. So the pain inflicted on Chinese exporters targeted is higher than that on American exporters, ceteris paribus.

Exchange Rate Management

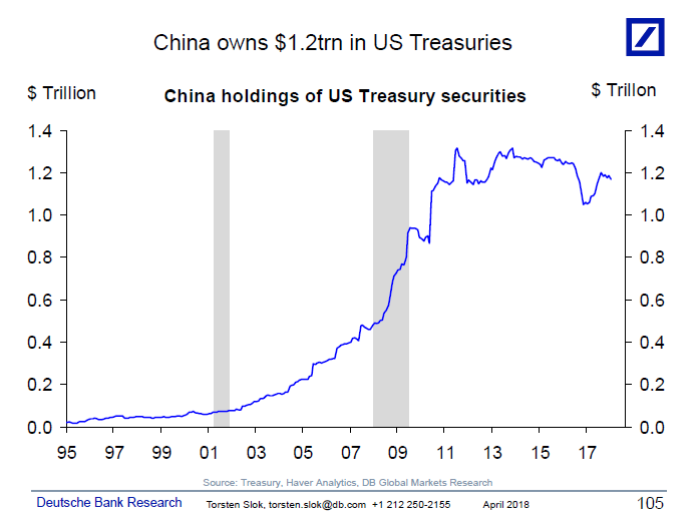

The preceding analysis abstracts from exchange rates. However, China has (still) a partially managed exchange rate. The threat that China would unload its Treasurys I always thought an empty one; the capital losses would be too large (of course stopping purchases would be an option that might not be as obviously costly; some recent estimates of impacts on Treasury yields here).

Source: Torsten Slok, April Chartbook, DeutscheBank.

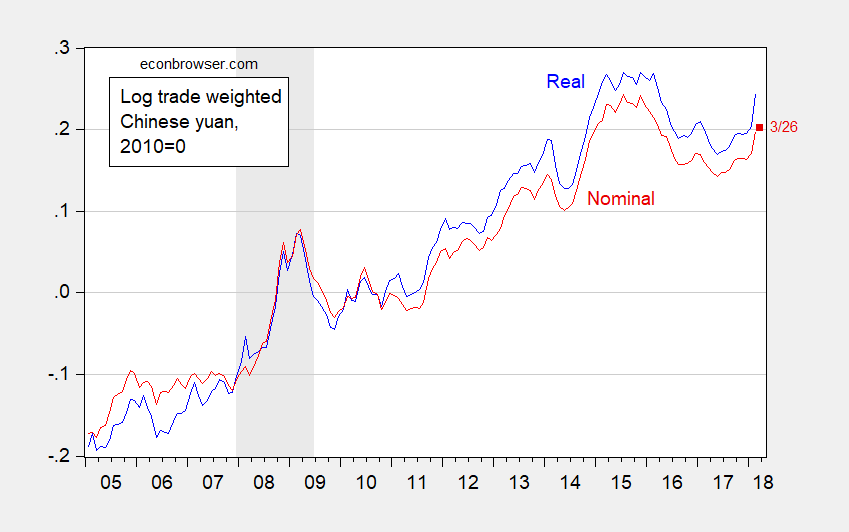

However, China could do the opposite, and buy more Treasurys, strengthening the dollar, i.e., weakening the yuan. There is substantial scope for depreciation, as shown in Figure 2.

Figure 2: Log real trade weighted CNY (blue), nominal (red), 2010=0. March 2018 observation for March 26. Source: BIS.

A 25% depreciation (log terms) would restore the CNY to 2011 levels.

So, in order to restore competitiveness, all China needs to do is to engineer a depreciation/rebuild forex reserves. (Because the Fed does not have a bilateral trade balance mandate, I don’t think the US would respond, via interest rates, in kind.) A managed CNY depreciation would run afoul of charges of currency manipulation by trading partners, and perhaps put China on Treasury’s watchlist for manipulators. But then, you have to wonder: what more sanctions we could place on China for currency manipulation?

Also, relative incomes are important.

A 15% price increase is substantial on the typical Chinese consumer.

Moreover, less trade means lower income in export-led China.

Perhaps, it won’t start a rebellion by the masses.

PeakIgnorance turns Keynesian on us. Of course he does not realize the same thing applies when the US imposes tariffs on goods imported from China. And which nation went through a massive recession in the last decade? Hint – it was not China.

@ pgi

Isn’t it amazing how what would be an “egregious sin” under a Democrat administration becomes a welcome edict by God under Trump?? An “evil conspiracy” undertaken during a dark-skinned President’s term becomes “a benevolent act by God” under the reign of a adulterating, multiple times bankrupt, lady-parts grabbing money launderer.

I’ve been imagining a few times lately, all the shrill cries that would have been made by PeakIgnorance and the Alex Jones fan club of “Martial Law Soon to be imposed!!!!” “Obama’s Secret Conspiracy To Impose Martial Law!!!!” had he tried the same stunt with military troops that Trump is attempting now on the border. We would have never heard the end of it, and Alex Jones would be telling everyone to this very day that it was his shrill cries that saved us all from certain doom of US military controlled death camps.

Pgl, the point is it’s not the “same thing.”

Do you really trust Chinese economic statistics?

China reported 6% to 8% GDP growth during the last recession, yet, electricity production was way down, railroad tonnage was down double digits, exports way down, etc.. China’s huge amount of fiscal spending created a huge misallocation of resources and massive inefficiencies.

I trust data from China more than I trust the endless lies from you. Now if you had a better and reliable data set – let us know. Oh wait – you peddle in disinformation. Never mind.

PeakTrader: Man does not live on soy alone, even in China.

One man’s soy is another man’s sow. Actually I enjoy pigging out on soy.

But always remember, you can feed soy to your sow, but not sow to your soy.

Which reminds me of an old Charlton Heston joke. What do you get when you mix soy and kale?? Soylent Green. This joke was commonly shared between horridly melodramatic movie actors in the ’70s.

https://www.youtube.com/watch?v=KBN21umK9BM

Really super appreciate the slides Menzie, you are the best. Masterful analysis and breakdown as per usual.

Isn’t it kind of weird that China would purchase US Treasuries as part of a trade war?? I’m not saying I don’t think it would happen, I’m saying it’s very counterintuitive.

This seems like some MenzieChinn/DaveLetterman style dry humor here—>> “Because the Fed does not have a bilateral trade balance mandate, I don’t think the US would respond, via interest rates, in kind.”

You know one guy I haven’t consulted yet online in this whole mess?? And it just dawned on me as I was thinking “What white dude/ professor would be as objective about this as Menzie is as a Chinese ethnicity dude??” ( I hope you believe me that I consider you as American , or more so, as anyone, but “you know what I mean” yeah??) You know who popped in to my brain?? Michael Pettis. A lot of people like Stephen Roach as a China expert, and I like Roach to a degree, but with Roach I always feel like he’s “talking his book” (his personal investments and careerism style answers), whereas Pettis strikes me as more objective.

Pettis describes the importance of capital flows here, which I think Menzie would agree are quite important in these trade “battles”

http://carnegieendowment.org/2018/01/25/protectionism-can-t-fix-trade-imbalances-pub-75363

Here is a Soundcloud audio discussion of Trump initiated trade tariffs with China by Pettis,

https://soundcloud.com/diplopod/michael-pettis-on-us-china-trade-relations

And lastly here is Michael Pettis discussing the mild version of the “What if China suddenly dumped U.S. Treasuries??” trope, which, like most intelligent people have been saying for years now, Pettis says is very unlikely to occur. Article from January 2018

https://carnegieendowment.org/chinafinancialmarkets/75248

I see the Chinese leaders as better Chess players than Trump (not much of a compliment to Chinese leaders BTW, but a compliment). And they are certainly willing to dig their Li Ning heels into the ground in battles with foreigners:

https://goo.gl/images/KE4yYY

I was looking via Google for something on the foreigner will pay aspect of tariffs, which Menzie so ably demonstrates and look what came up!

https://www.jstor.org/stable/1230520?seq=1#page_scan_tab_contents

Who Pays the Tariff Duties?

B. H. Hibbard

Journal of Farm Economics

Vol. 13, No. 4 (Oct., 1931)

Hibbard apparently taught agricultural economics at the University of Wisconsin!

Okay, then. From what I can gather through the arguments made, the response to my conjecture was “maybe”.

It’s interesting that there hasn’t been much argument against the propositions that China was dumping (as in the EU) or has or would manipulate currency [A managed CNY depreciation would run afoul of charges of currency manipulation by trading partners, and perhaps put China on Treasury’s watchlist for manipulators.] or has practice intellectual property theft. China is an unethical trader. So, the response is, “Yes, but their too big to fail.” Yeah, I’ve heard that before.

China earned a reputation for dubious, unethical business practices. Perhaps that is changing, but perhaps it has a way to go.

“they’re” too big to fail.

BTW, off topic, but since Trump has been a target here, I thought I’d share a reaction from a Hong Kong newspaper:

http://www.scmp.com/comment/insight-opinion/article/2140266/trump-no-dangerous-idiot-his-nifty-diplomacy-north-korea-and

To wit: unconventional doesn’t necessarily mean ineffective.

It remains to be seen if his unconventional approach to trade (tariffs, treaty renegotiations) will have a corrective or exacerbating effect on perceived problems… longer term.

“Michael Chugani says despite heavy criticism, the US president’s gunslinging diplomacy has got the US where it wants to be – around the negotiating table with nuclear-armed North Korea, and outplaying China on trade”.

I’ll pass on the North Korea angle but the idea that Trump has outplayed China on trade proves one thing – Michael Chugani is a moron. China declared yesterday that they will win any trade war. Likely correct.

Bruce Hall: The assertion that China is currently manipulating its currency so as to gain competitive advantage is dubious. See this post. I would say that that particular point is disputed. As for dumping, well, whether it’s bad or not depends, aside from legality. You really should someday take a course in international economics.

With China, you sell you soul for cheap goods and then wonder what happened when the bill comes due.

As to currency manipulation, I simply quoted you. As to dumping, what can I say? Who needs laws?

UK and EU urged to act on Chinese steel dumping after US raises …

https://www.theguardian.com/…/uk-and-eu-urged-to-act-on-chinese-steel-dumping-aft…

May 18, 2016 – It has to decide where its priorities lie: in giving this core industry a fighting chance or cosying up to the Chinese? When it comes to steel it cannot do … it meets in Japan this month. China denies that its mills have been dumping their products in other countries, arguing that its steelmakers are more efficient.

China’s role in the global steel downturn – Financial Times

https://www.ft.com/content/7cb7dc02-fa4c-11e5-b3f6-11d5706b613b

Apr 6, 2016 – With steel plants from Wales to Australia threatened with closure, China has been accused of destroying other nations’ steel profits by propping up its domestic industry. Below is what you need to know about the country’s steel sector. What is China’s role in the global steel industry? China is both the largest …

The real question, in my view, is whether or not you feel comfortable becoming dependent on China as a primary supplier of anything. Obviously, some products are not strategic and there are alternatives. This is all a matter of trust. There are those who believe China’s intention is to be number one militarily and economically and present economic relationships simply enable that. Others see a co-dependence. Still others see China as an adversary and trading with them as undermining U.S. interests. 50 shades of gray?

China has been much better on the currency issue in recent years. Although there was no room for anything but improvement. But let’s give Chinese officials some semi-credit on this. It we bitch when they act up then we can give them a light pat on the back when they at least halfway try to do it right. In 2001 it was pretty locked in at 8.2, now it’s 6.3. Unless my math is bad that’s a 23% move. That’s not “nothing”.

I learned a new term for an old idea ala Paul Krugman’s latest:

https://www.nytimes.com/2018/04/04/opinion/trade-wars-stranded-assets-and-the-stock-market-wonkish.html?partner=rss&emc=rss

Stranded assets refers to some piece of machinery that has become obsolete before its time because the market for what it produces turned south. Classic example is the value of oil drilling rigs which fell when oil prices declined as the demand for finding new oil dried up.

Krugman argues that the stock market decline of late is due to Trump’s trade war. If one is selling farm equipment to Iowa’s farmers, you get the idea big time!

The logic for stranded capital assets also applies to land and skilled labor inputs. Over the (very) long run all inputs are elastic, but people live and die during the short to medium run. Krugman’s post also reminds us that the overall supply chain can become a stranded asset.

Here’s what the Iowa Soybean Association has to say:

Purdue University recently projected how a 30 percent Chinese tariff on imported U.S. soybeans would impact both countries. The study, funded by the soybean checkoff, was done at the request of the U.S. Soybean Export Council.

Research indicates a 30 percent tariff would reduce:

Chinese soybean imports from the U.S. by 71.2 percent.

Total U.S. soybean exports by 40.3 percent.

U.S. soybean production by 16.9 percent.

U.S. producer soybean price by 5.2 percent.

U.S. economic welfare by $3.3 billion.

Chinese economic welfare by $2.6 to $8.4 billion.

https://www.iasoybeans.com/news/

slug

Interesting world. It was the same Global Trade Analysis Project (GTAP) Model, that produced the research relied on for the 25% tariff on steel.

I have looked high and low for the original study on Chinese soybean tariffs by Global Trade Analysis Project researchers Wally Tyner and Farzad Taheripour and it does not seem to be available. If you run across it, sure would appreciate the link. I hate to rely on press releases.

Ed

In this post I related stranded assets and the trade war to Wilbur Ross’s former shipping company:

http://econospeak.blogspot.com/2018/04/trumps-trade-war-stranded-assets-and.html

One can make sense of these numbers if one assumes world production of soybeans is 300 metric tons per year. China produces only 4% of this while the US produces about 35% of this. China consumes as much as the US produces. These are the facts. Now you decide whether Don’s claim that Menzie’s analysis is simplistic.

PeakIgnorance’s comment on this issue is very confused:

“less trade means lower income in export-led China.”

The subject matter in Menzie’s post was the reality that China is restricting imports of US agricultural goods. Yes – there will be less trade from this expenditure switching policy move but the direct effect of this specific move would be an increase in China’s aggregate demand while there is a decrease in US aggregate demand. That is how one does international Keynesian economics at the basic level.

Of course the basic level assumes fixed exchange rates – more on that in a moment. Even in a world of fixed exchange rates, Joan Robinson reminded us that beggar they neighbor policies do not increase world aggregate demand and trading partners like the US can do their own protectionism. Of course this is the whole criticism of starting trade wars – a message that the 3 stooges (Trump, Navarro, and Ross) do not get. Apparently – their mouthpiece known as PeakIgnorance is confused as well.

But let’s turn to perhaps the real world of floating exchange rates. As Robert Mundell taught us over 50 years ago, expenditure adjusting policies lead to offsetting exchange rate changes. Which would imply China’s trade protection would not change aggregate demand in either nation. US trade protection would not either – another fundamental point that the 3 stooges and PeakIgnorance fail to grasp.

Pgl, so, you agree with me by disagreeing with me, and trying to prove it with a pointless and ignorant mess.

No I do not agree with you but you clearly have failed to grasp why. Your inability to follow basic economics is just staggering.

Bruce

You were right to ask the question and right with your analysis of the answer; “maybe.” I’ll add – maybe not – just for emphasis.

Nice link to the South China Morning Post. Best line of the article,

“If you think all of that happened by accident, then you are the idiot, not Trump.”

As for currency manipulation, two things first. One, Menzie is very good on monetary matters, I would always take very seriously what he says. Which brings us to two, he says two words, “dubious” and “disputed”. Those words are a concession to fact that China fails at the only real test in this world of fiat currency. That is to truly float currency to the international markets while maintaining transparency of actions by the central bank. If you follow Menzie’s link, you will see his work showing, despite the fact that China does not follow international norms of large economies toward their currency, it might be possible that China currency is in the range of value that a true float would determine. Disputed, dubious and maybe may be the nicest thing that could be said.

One other fact in the mix throws doubt on a conclusion of know manipulation. There would be no need for the huge foreign reserves held by China if the value of their currency was correct. That large of a reserve is a terrible waste of resources in country with such a high GDP growth.

Ed

“In other words, China will impose a terms of trade loss on the US, since it is a substantial purchaser of soybeans. It is incorrect to conclude that China will, unambiguously, incur a net loss.”

While the statement is true, I think the analysis may be too simple. For example, if transport costs were negligible, China would not import any soybeans from the United States. Instead, they would import soybeans previously grown and consumed in other countries, which would now consume soybeans imported from the United States and export their domestic crop to China. Even if transport costs are not negligible, changes in shipment patterns may completely eviscerate any effect of China’s tariffs. Terms of trade effects for bilateral trade are especially unlikely to come bilateral tariffs on relatively homogeneous commodities, unless the trade between the importer and exporter bulks truly huge in global consumption, or transport costs are structured such that there is little opportunity for arbitrage flows to offset the effects of the tariffs.

Ask Wilbur Ross about the cost of shipping as he used to be a major shareholder of Navigator Holdings – see my Econospeak post re its “stranded assets”.

“they would import soybeans previously grown and consumed in other countries, which would now consume soybeans imported from the United States and export their domestic crop to China.”

You need to do some research on how produces soybeans. The US is not exactly a minor player here. We may produce more soybeans than the rest of the world combined. And 1/3 of them are bought by China.

I think I provided this earlier but here it is again – soybean production by nation:

https://www.worldatlas.com/articles/world-leaders-in-soya-soybean-production-by-country.html

The US dominates but Argentina and Brazil combined produce a bit more than we do. Bunge is a multinational known for its sales of soybeans produced in Argentina and Brazil. There are stories from left wing groups that I have a ton of respect for that claim Bunge is abusing transfer pricing but on this one I have to suggest that these claims are odd as Bunge’s consolidated operating margin is a mere 2%.

So Don might say the Chinese could buy soybeans from Latin America I guess but I still remain stunned at comments with zero factual foundation. Fellows – do some real research!

Canada (6.0 million metric tons)

Paraguay (10.0 million metric tons)

India (10.5 million metric tons)

China (12.2 million metric tons)

Argentina (53.4 million metric tons)

Brazil (86.8 million metric tons)

USA (108.0 million metric tons)

From the above, it looks like S. America could replace a lot of the U.S. exports to China.

The shipping costs at issue are the marginal costs of changing the destination, e.g., U.S. to China vs. U.S. to alternative destinations, and S. American sales to current destinations vs. sales to China.

Let us get back to basics

you have a Presidents who is not very smart. As evidence read the transcript of his conversation with our PM. He thinks trade is a zero sum game say no more.

He breaks agreements.

He tells lies a lot

His advisors are very poor.

his policies were based on extreme ignorance. Most president grow in the office and realise when said policies are bad. This man is incapable of that.

His actions are totally against WTO which is why he aint going there.

This means of course he has no time for rules in trade. This has long term implications for trade and it isn’t positive.

No-one wins in a trade war and only a complete moron would try and bring one on.

Hi, Professor.

Suppose China and the US does proceed to impose tariffs on each other, but not the rest of the world. Would trade than simply go through third countries? So a long-term outcome is that emerging countries like Brazil would engage in more trade? And production moves to those countries?

Would appreciate your thoughts on how the pattern of trade and production will be affected for the rest of the world, especially the emerging countries. My expectation is that emerging economies will become more important over time, and less trade between US and China could accelerate the growth of emerging economies. Is this too optimistic?

“Suppose China and the US does proceed to impose tariffs on each other, but not the rest of the world. Would trade than simply go through third countries? ”

This is Don’s argument which has me rethinking what I said about stranded shipping assets in that Econospeak post (see link above). Maybe I have this backwards. Maybe the Wilbur Ross plan is not to reduce trade but to increase the demand for ships by inducing different shipping routes. The stock price of his shipping company would rise from the increase in the demand for shipping. OK that is a deadweight loss on the rest of us but his shipping buddies enjoy stock appreciation. Wilbur Ross is a genius! An evil genius.

Kien and Don – it seems John Cochrane has stolen your insight. Check out his first argument here as it is exactly yours!

https://johnhcochrane.blogspot.com/2018/04/unraveling.html#more

Thank you for posting this, Dr. Chinn. It is very helpful.

One area that interests me is agricultural trade.

It seems that most countries would first attempt to be food secure.

Given that, how might a country like China deal with increased prices for a major staple such as soybeans?

How likely is it that they will seek other more reliable trading partners for this staple?

Or invest in more domestic production?

Or develop alternatives and substitutes?

It seems likely that this administration’s reduced cooperation will impact especially agricultural trade long term and place the U.S., as I have read elsewhere, “…in a lagging rather than a leading position in future economic and political partnerships.”

Thank you.