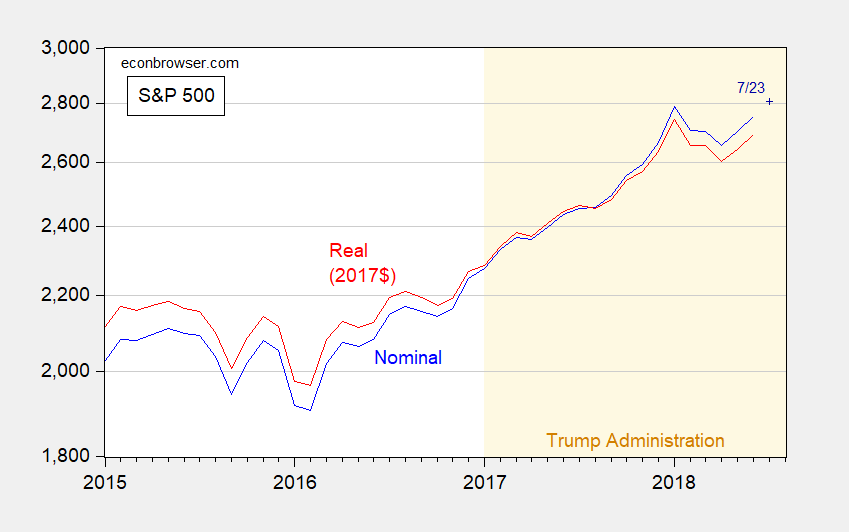

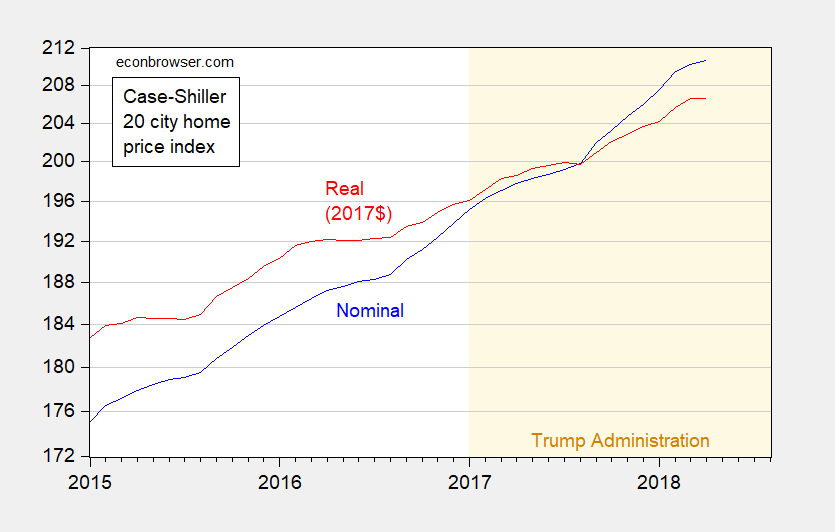

Nominal asset prices, including S&P500 and home, continue to rise, but real prices have not regained prior levels (S&P500) or have plateaued (home prices).

Figure 1: Nominal S&P 500 index (blue) and real S&P 500 index, 2017$ (red), both on log scales. July observation is 7/23 close. Real calculated using CPI-All. Source: FRED, author’s calculations.

Figure 2: Nominal Case-Shiller 20 city home price index (blue) and real Case-Shiller 20 city home price index, 2017$ (red), both on log scales. eal calculated using CPI-All. Source: FRED, author’s calculations.

Things to remember:

- Paul Samuelson noted “The stock market has forecast nine of the last five recessions.”

- Ed Leamer thinks housing volume matters in terms of forecasting recessions, while Jan Hatzius thinks home prices are important.

“Nominal asset prices, including S&P500 and home”.

Two questions – does this series account for things like mortgage debt (aka is it a measure of net worth)? How would it look relative to GDP?

pgl: No, these are just prices, not wealth (gross or net) per se.

The wealth data is useless for forecasting, and well nigh useless for any other analytic purpose since it has become so disconnected from the real physical economy.

The stock market in real terms leads the economy at both peak and trough of the cycle. Always! That it has thrown off a small number of false signals over the years in the expansion phase of the cycle is not something to be held against it. Samuelson’s old worn canard does have a nougat of truth though regarding false signals, and so should be a warning to the unwary to not trust without verifying. That said, the market must never be disregarded.

<Leamer wins hands down. There are few peaks indeed in home prices, real or nominal. Go back and look at the full series. Permits and starts, however, are for the most part quite reliable though still imperfect warning devices.

There has been some re-steepening of the yield curve, since late last week.

Fed unwinding of government bonds will accelerate, over time, and reverse Operation Twist.

It seems, the U.S. economy being much stronger than many other economies, e.g. the E.U., flattens the yield curve.

A stronger dollar hasn’t seemed to slow foreign demand for higher yielding U.S. bonds much, since many foreign bond yields are so low, and expected to remain low, in comparison.

It’s unusual U.S. economic conditions. The economy is strengthening with possible accelerating inflation, while the Fed keeps long bond yields low, which helps fuel growth, selling short-term bonds in the tightening cycle, and unwinding longer-term bonds slowly, while foreigners buy long bonds. So, stronger growth with a flattening yield curve.

Bill McBride, Calculated Risk, thinks housing is the business cycle.

I have always been skeptical of house prices as wealth indicators because we are all born with the liability that we gotta’ live somewhere. So when prices and rents go up so do explicit and implicit expenditures on living someplace. There is all sorts of stuff such that the asset and liability values do not match exactly of age cohorts etc.

Bob Flood: I agree — people probably treat that sort of wealth as more transitory than other assets. On the other hand, debt is — not quite forever — more durable. Hence, net worth is something that has to be treated with caution.

“Paul Samuelson noted “The stock market has forecast nine of the last five recessions.””

The popular expression is that the stock market managed to forecast the last 12 out of 6 recessions.

Figure 1 looks like a double-top. A double-top is supposed to precede a decline. For TA fans. TA = technical analysis. I am always blown away by the smart, knowledgeable people I meet that use TA to guide trading/investment decisions.

As far as I know “Twin Peaks” is not a technical analysis term.

Erik Poole: Agree, “Twin Peaks” is not a technical analysis term. It’s me trying to be “pop culture aware” — something my wife tells me not to even try.

This says there is a Return to Twin Peaks!

https://www.imdb.com/title/tt0098936/

Must see!

Menze Chinn: These days in my book, you get extra points for being pop culture thick.

The Twin Peaks was a popuar TV show in the 1990s. I never watched it; too busy.

Just to clarify, I was being serious about smart, intelligent people using TA to guide investment/trade decisions. One person that comes to mind is a successful ‘heavy hitter’ (i.e., a dozen pages of publications, many in top journals).

I use ad hoc TA to guide purchase and sale timings of equity and derivatives. Sometimes works, sometimes not so well. Never have used it for commodities.