Using Census and BEA data, one can assess at least in first order terms, what states will be impacted by tariffs against US exports — as well as the CNY depreciation that has occurred in the last few months.

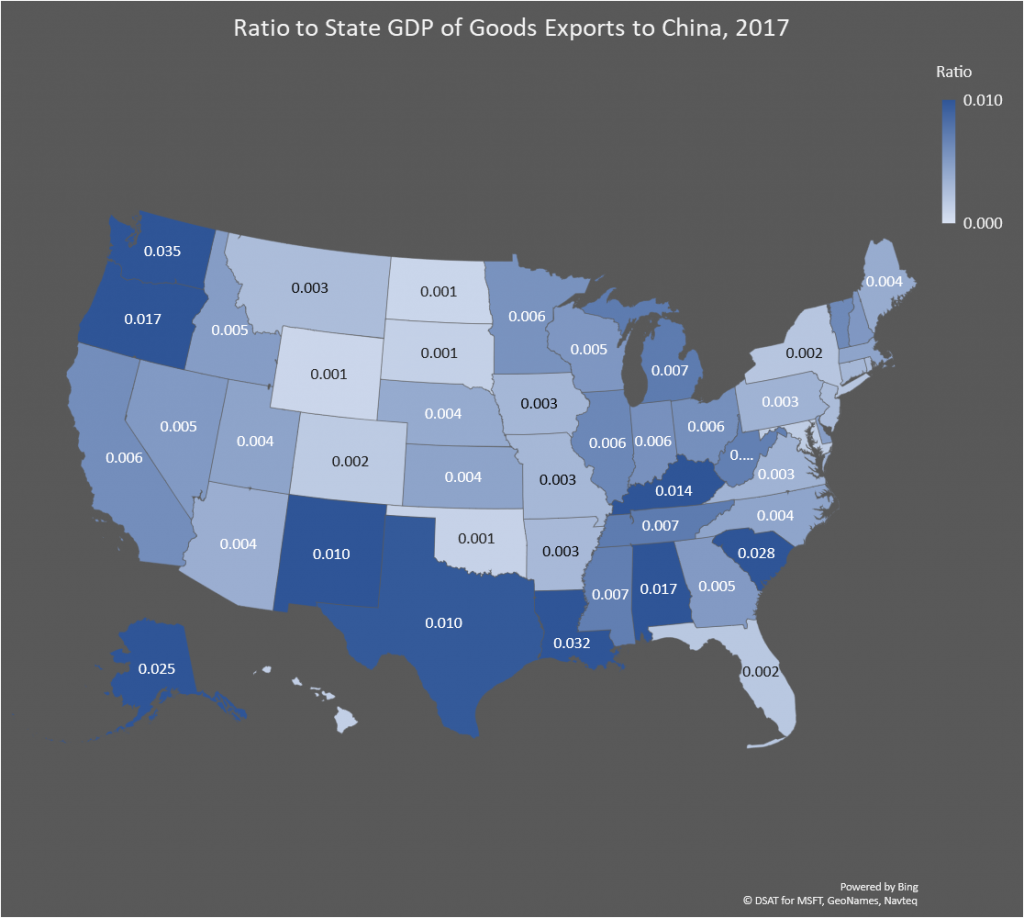

Figure 1: Ratio of goods exports to China to GDP, 2017. Source: Census via ITA, BEA, and author’s calculations.

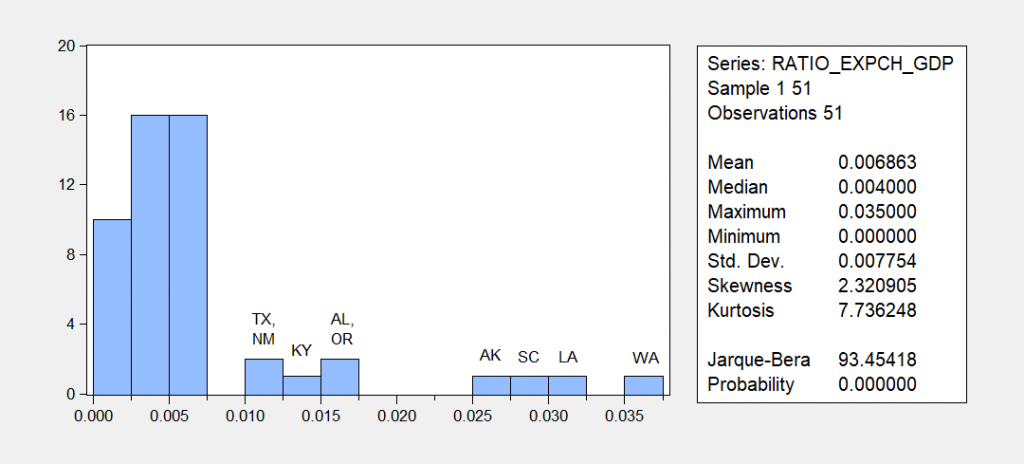

The distribution of ratios is highly non-Normal. A few states are very highly dependent on exports of goods to China.

Figure 2: Histogram of ratios.

It is interesting that the intensity of dependence matches up with the China-agricultural export intensity in some cases (WA) and not in other cases; of course the divisor is different — here the numbers are normalized by state GDP. Illinois doesn’t show up prominently, for instance, which given soybeans, is kind of unexpected. But recall, the US also exports commercial aircraft to China (or used to…we’ll see going forward), thereby explaining WA and SC.

In any case, we are embarked on a great experiment. Mr. Trump has assured us “Tariffs are working big time.”, and we will see if that is indeed the case.

Update, 8/7 7PM Pacific: From Deutsche Bank, most important trading partner by state.

It would be interesting to see this in reverse, exports of goods from China to the US by Chinese province.

Menzie and some others can probably break this down better than myself. But my wild guess would be the coastal areas of China would be hit hardest, with maybe some concentrated areas around Guangdong province. I was told the most “resource rich” area (at least at one time) was around the Heilongjiang region. Although I’m sure over the years Beijing has sucked a lot of those resources out of the area.

http://factsanddetails.com/china/cat9/sub63/item348.html#chapter-2

These are from 2014, but I doubt they would have changed that much: http://english.agri.gov.cn/service/ayb/201511/P020151104554814851102.pdf

And this discusses the Chinese city that produces the most steel, located inside Hebei province: https://www.reuters.com/article/us-china-pollution-steel/chinas-top-steelmaking-city-plans-to-extend-output-curbs-to-mid-november-idUSKCN1GA0Q3

I’ve been in Chaoyang by the way, where they just cancelled the alumina plant (in the 2nd Reuters story down, after the link jump). It is renowned as one of the poorest areas/regions of China. If I remember right one of their big claims to fame is some monk’s tooth inside of some weird pagoda like contraption, and there is a state prison located there somewhere. It’s a little bit of a haze to me now, but I think that is where I saw one of the infamous prisons there. Though one cranky older woman of Chaoyang may be under the impression if their husband is a judge in that city they are lords of all creation. I’m tremendously hopeful she has since choked to death swallowing back on her own tongue while discussing local law with whatever son-in-law passed her scuffed shoes litmus test (joke). But I digress…….

China GDP growth has likely been overstated. From article:

“…economists say that if you use electricity use as a proxy for actual economic growth, provincial GDP ran “between 1.2 percentage points and 3.1 percentage points lower than the official growth rate” between 2011 and 2015.”

Another article:

“The government that magically managed to report 6-8% GDP growth in the midst of the financial crisis, when its exports were down over 25%, tonnage of goods shipped through its railroads was down by double digits, and its electricity consumption was falling like a rock. It is hard to manufacture 8% more widgets with a lot less electricity…China did not suddenly become energy efficient during the financial crisis.”

Negative externalities likely offset GDP growth by 3% to 6% a year. No wonder China desperately needs to cheat and steal from foreign firms.

PeakTrader: What articles? You should provide links. These seem outdated.

Here’s one of the links:

https://www.google.com/amp/s/www.bloomberg.com/amp/news/articles/2018-02-01/china-s-2015-gdp-puffed-up-by-fake-economic-data-analysis-shows

You managed to find only 1 story that is 3 years old? Weak. But I love the title as Fake News / Analysis is the perfect description of every one of your comments. Every single one!

Electricity generation and consumption are no longer useful proxies for GDP. Shut down an aluminum plant for routine maintence and electricity consumption drops off, quite sharply in some places. Introduce more energy efficient appliances, and ditto.

More quotes without a link or a proper citation? C’mon Peak – stop it with these racist lies.

Nonetheless, without China’s trade barriers and foreign IP, U.S. exports would be much higher, and trade deficits much lower.

Menzie

It would be better if you analyzed the products being exported by the high percentage states as you have done, more or less, with the farm states. Washington I suspect is high, not only because of its port facilities, but because of aerospace and computer related products. Missing from then analysis of state exports is separation of the value from goods to services. Analysis of the tariff tiff here has been very much limited to goods. So I suspect that Washington will be less affected than its percentage might indicate. Louisiana, the state with the second highest percentage deserves a fuller analysis. What is it exporting to China? Is it finished oil and gas products? Is it being credited with the farm products being shipped through its port, and should that percentage be distributed to the farms states? And finally Alaska. Are its products greatly subject to the tariffs?

I find it somewhat curious you are so concerned with individual states and producer who might get hurt from the current trade dispute, but showed next to no concern for the producers and states being hurt by high tariffs on steel and aluminum that other country had placed on US producers for years.

Ed

Ed Hanson: Regarding port facilities in WA (are you saying exports are attributed to WA because that’s where they’re exiting the country? — that would be wrong), you really should read the BuCensus notes regarding the state of origin data.

As I understand it, foreign countries have not been placing really high (i.e., non-WTO compliant tariffs) on US steel, partly because we don’t have comparative advantage in steel production. Rather, we have imposed anti-dumping duties and countervailing duties on foreign country sourced steel. Do you know anything about the US steel industry? I’ve been studying the US steel industry on and off for the past 36 years.

In any case, I have previously highlighted on this blog the impact on downstream industries of steel tariffs we would be putting in place, as shown in this post. See also here.

As to services, you will note I didn’t need to separate services as the exports tabulated are only goods. This is noted in (1) the legend *in* Figure 1, (2) the notes to Figure 1, and (3) the line right after Figure 1.

But, who am I to say. I just teach international trade…

Menzie, you don’t think China and other foreign nations (or as Okies say “damned fur’ners”) want to buy overpriced US steel?? Didn’t you know foreign companies are just dying to find highly expensive inputs of near the same quality for their end products?? Special-Ed Hanson is trying so hard to teach you some of his “common sense” here.

Also, Special-Ed Hanson wants to know why you haven’t broken down Iceland’s exports of hot tamales to Mexico. Really Menzie, get with the program!!!!

Menzie

Just once I would like it if you would not intentionally try to misinterpret what I write. It is still quite true that the closer one is to a port facility the more likely one would export. Thus it is expected that the excellent port facility being so convenient, more companies would choose to export. This is a reasonable assumption for part of the reason Washington exports more. Aerospace and Microsoft are, of course other major reasons.

Now, repeating myself, just once I would like it if you would answer my questions instead of intentionally deflecting the subject.

I will ask again, maybe you might understand this time.

Is it true that tariffs changes so far have been directed at goods rather than services?

Is the assumption that export percentages used in your post include both goods and services?

Assuming the answers above are yes, would it not make a clearer analysis if the percentage used were of goods alone, being that goods are most affected by the new tariffs?

Are much of the exports from Washington service oriented due to the large presence of Microsoft and other software firms?

What are Louisiana’s exports? How much of them are directly effected by China’s tariffs?

The subject you broached is interesting but deserves much further analysis.

Ed

Ed Hanson: Need a port for Microsoft? Having grown up in southern Seattle, I don’t think so… an airport, yes. A port, no.

1. Yes, tariffs have been directed at primarily goods. To my knowledge, no tariffs have been directed at services.

2. No, the export percentages include only goods. That is what is stated in (1) Title in Figure 1, (2) Description in caption to Figure 1, and (3) the sentence after Figure 1.

3. Many of the exports from WA are services, I’d guess. But none of those are included in these statistics. See item (2) above.

4. You can look up for yourself in the ITA link I provided what Louisiana exports to China. You can then correlate yourself with the list MOFCOM has distributed (although the proposed $60 billion retaliation list is only in Chinese, as far as I can tell).

I agree that the subject deserves much greater analysis. I suspect my friends at PIIE are working on it.

@ Menzie

If that MOFCOM list has a specific number connected to the announcement I may be able to find an English list for those products. Is there an Announcement NUMBER tied in with that list?? “MOFCOM Announcement Number ____” ??

@ Menzie and @ Ed “Constipated Lower Intestine” Hanson

OK, bear with me. I think Google translate is actually pretty good at this stuff (or better than they were 10 years ago). I’m gonna put this link up, and after I upload the link, if you guys can see the same thing I am seeing, then I will put the “2nd list” up, or what I am assuming is the 2nd part of the same list. Cross your fingers, ‘cuz I actually went through some trouble to do this:

https://translate.google.com/translate?hl=en&sl=zh-CN&tl=en&u=http%3A%2F%2Fimages.mofcom.gov.cn%2Fwww%2F201806%2F20180616015345014.pdf

@ Menzie and @ Ed “Constipated Lower Intestines” Hanson

Ok, I’m like 75% sure this link is working like I was hoping it would, so I’m gonna go ahead and put the 2nd grouping up and hope you guys see what I am seeing. The first list started with Chicken pieces er something and the second list starts off with coal stuff. This is obviously the MOFCOM stuff in case I didn’t make it clear enough:

https://translate.google.com/translate?hl=en&sl=zh-CN&tl=en&u=http%3A%2F%2Fimages.mofcom.gov.cn%2Fwww%2F201806%2F20180616015405568.pdf&sandbox=1

@ Ed “Full of Consternation” Hanson

I’m lazy type, I didn’t see this either until Menzie answered your question (that’s my mistake obviously)

Just as Menzie said it is in the ITA, it’s actually a stupendous little website. If you fumble around in there you can find it. You can change origin state, destination country, and the years you like. It even gives you a big ol’ pie chart for those not so into numbers. I’m actually semi-glad you were your usual ____ self today because I want to look at my home state numbers and I wouldn’t have noticed this link if Menzie didn’t humor you.

http://tse.export.gov/tse/TSEOptions.aspx?ReportID=102&Referrer=TSEReports.aspx&DataSource=SED

Trump is a protectionist who just wants excuses to increase tariffs on imports. This is from his twitter.

Donald J. Trump

Verified account @realDonaldTrump

Tariffs are working big time. Every country on earth wants to take wealth out of the U.S., always to our detriment. I say, as they come,Tax them. If they don’t want to be taxed, let them make or build the product in the U.S. In either event, it means jobs and great wealth…..

4:59 AM – 5 Aug 2018

https://twitter.com/realDonaldTrump/status/1026075214227165185

Trump is not alone. President Lincoln once said:

“I do not know much about the tariff, but I know this much, when we buy manufactured goods abroad, we get the goods and the foreigner gets the money. When we buy the manufactured goods at home, we get both the goods and the money.”

Lincoln was at least honest about not knowing much about tariffs!

BTW – I found this alleged quote from a source who claimed Lincoln could not have said “steel” as opposed to “manufactured goods” because steel production somehow did not exist before Lincoln’s day. Of course it did and Europe had found a way to make it inexpensively. Which of course was the whole point behind Whig (later Republican) protectionism.

I guess there are a lot of people who know nothing about economic history!

Trump: “Tariffs are working big time. Every country on earth wants to take wealth out of the U.S., always to our detriment. I say, as they come,Tax them. If they don’t want to be taxed, let them make or build the product in the U.S.”

There’s Trump again under the delusion that tariffs are a tax paid by foreigners. He really is the dumbest president ever.

There are also reports that Trump is using corruption and graft to pick and choose which companies using steel and aluminum will get exemptions to the tariffs.

“There are also reports that Trump is using corruption and graft to pick and choose which companies using steel and aluminum will get exemptions to the tariffs.”

Yep – and Wilbur Ross is doing a lot of trading on inside information.

Never forget kids, life is tough in the big bad city:

https://www.theguardian.com/world/2018/aug/07/china-bans-winnie-the-pooh-film-to-stop-comparisons-to-president-xi

I’m not an Alex Jones fan.

But I have heard true things on his show, no one else was talking about (I can give those examples if anyone likes, no it was not the “jewish cabal”, the Illuminati, martians, or Soros). And I think if you want to destroy a beast, you have to understand the beast. What these platforms don’t understand with Alex Jones is what they didn’t understand with Trump, that is, the more the media showed an emotional disdain for Trump, the more it fed into his popularity among rural southerners. The more mainstream Republicans and the Republican party apparatus showed open disdain for Trump (think roughly February 2016 time mark here), the more it fed into his campaign. And what you will see with Alex Jones being knocked off these platforms is the same phenomena. All it will do is further cement Jones place (right or wrong) in the cultural lexicon of America.

https://www.theguardian.com/technology/2018/aug/06/apple-removes-podcasts-infowars-alex-jones

Washington exports a lot of goods to China. Apples? I thought China was a major supplier of apples. Maybe Boeing airplanes! Oh wait – China is thinking about setting up its own airplane manufacturer. OK – who is winning?

trump has lots of supporters in Alabama (the intelligence and literacy levels fit perfectly with trump’s target demographic). Now, Alabamans are quite “slow to the take” (voting for a pedo judge for U.S. Senator for example). But how long does it take to register in the brains if they lose $2.2 Billion in car exports to China??

https://www.montgomeryadvertiser.com/story/news/2018/07/02/u-s-chamber-tariffs-put-3-5-b-alabama-exports-risk/750684002/

I’m thinking even for Alabamans, the little light bulb has to pop up over their head that this could be connected to Orange Excrement in the White House.

https://www.montgomeryadvertiser.com/story/news/2017/02/01/trumps-tough-trade-stance-may-cost-alabama-auto-jobs/97352460/

The automotive industry accounts for about 10 percent of the state’s economy, Auburn Montgomery economist Keivan Deravi said….The industry employs nearly 40,000 people in Alabama and assembly plants here rolled out more than a million vehicles in 2016, with the Hyundai plant in Montgomery topping the production list. Hyundai directly employs about 3,000 full-time workers, and thousands more work at Hyundai supplier plants throughout the state. Hyundai was not able to immediately provide details on Mexican parts used in its local production process. On average, nearly 12 percent of the parts in cars made in the U.S. come from Mexico, according to CAR.

Something tells me that Wilbur Ross has short sold Honda stock!

The “Seattle Times” has reported that China has placed no orders for new planes with Boeing in 2018. Boeing has continued to deliver new planes that were ordered in previous years. Those deliveries will count as 2018 exports, but the lack of new orders is worrisome. Can China’s orders for new Airbus planes specify “none from the Alabama plant?”

Other significant exports from Washington State to China include wheat, sweet cherries, apples.

Plus hops, potatoes, grapes, growing wine varieties, seeds, seafood, et. al.

The state ag bureau says Washington exports about $15 Billion/year, $7billion from Washington itself. Top destinations: Japan, Canada, China/Hong Kong, South Korea.

Regardless of your position about the the tariffs, this article seems to be a good primer on the value/type of goods/services exported to China by state.

https://www.uschina.org/sites/default/files/final_uscbc_state_report_2018.pdf

there was an interesting article by pettis this week in barron’s. he seems to think, among possible outcomes, the trade war with the us will allow china to continue to evolve its economy internally, with a better overall distribution of wealth across the population. this will also allow the country to continue to move towards a consumer driven economy-something i believe the leadership desires.

us firms want to be a part of a consumer led chinese economy. unfortunately, trumps trade war will probably allow china to continue to extract from foreign companies in exchange for an opportunity to access this market-the exact opposite of what trump is fighting his war to achieve. this was hinted at with the recent comments from china about apple. they can continue to have access to the market, but it is going to cost them to do so. companies who decide to avoid the market will simply leave the market open to domestic chinese firms to grow. if us firms are effectively locked out of the domestic chinese market, this will not be a sign of “winning”. it is the most desirable growth market of the next 50 years.