Finally, Ironman at Political Calculations understands what an externality is. Instead of this:

If a deadweight loss exists, it represents the amount of economic activity that has been directly lost because of the imposition of the tax, which tells us the degree to which the city’s economy may have shrunk as a result.

…many claim that such a [soda] tax would fix what in economics is called a “negative externality”, which in this case, represents higher costs to public health systems for treating conditions such as obesity and diabetes, where sweetened beverages are targeted by soda tax advocates for their contributions to the problems they proclaim because of their popularity and their sugary calorie content.

I am thankful for small blessings.

Regarding the Philadelphia soda tax, Ironman concludes:

We’ve already run the numbers for the increased calories of alcohol-based beverages sold within the city, whose sales surged during 2017, which totaled the equivalent of an additional 114 12-ounce containers of beer consumed by each Philadelphian over the year. Assuming 149 calories per container per person, the average Philadelphian consumed an additional 16,986 calories during 2017. With 3,500 calories corresponding to the gain or loss of a pound of body weight, that increased alcohol consumption would, when spread over every man, woman and child in the city, put an average of 4.9 pounds back onto the bodies of every Philadelphian!

Now, I can’t say this estimate is wrong. But it is counterintuitive. So when one encounters a counterintuitive result, it behooves a researcher to investigate further the likelihood of such an outcome. Unfortunately, as is wont with Ironman’s assessments, there are no confidence intervals, p-values, etc. (To paraphrase Elaine in Seinfeld, “standard errors, what’re they good for?”) Fortunately, we have another study using a diffs-in-diffs methodology. From “The Impact of the Philadelphia Beverage Tax on Purchases and Consumption by Adults and Children,” by John Cawley, David Frisvold, Anna Hill, David Jones (NBER Working Paper No. 25052):

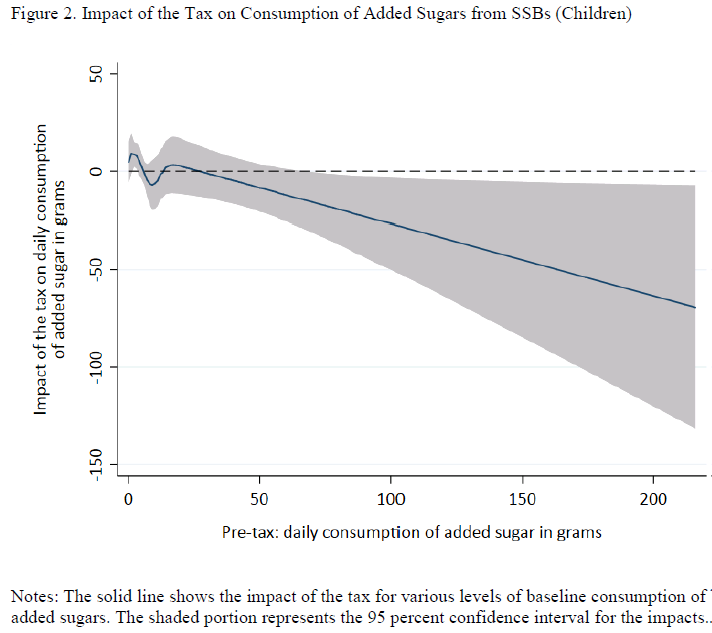

… we find that the estimates of the impact of the tax on the consumption of added sugars from SSBs and the frequency of consuming all taxed beverages are negative but not statistically significant for children and adults. Additionally, the point estimates are modest in size. For children, the estimate for added sugars is a decrease of 2.4 grams per day, which is a decrease of 12.5 percent. A gram of added sugars is 4 calories, so this estimate implies a decrease of only 9.6 calories per day or roughly 0.6 percent of the daily recommended caloric intake. For adults, the estimate of a decrease of 5.9 grams of added sugars per day translates to a reduction of 23.6 calories per day or roughly 1.2 percent of the recommended 2,000 calories per day; this estimate is not statistically significant once we control for demographic and socioeconomic characteristics. To illustrate the magnitude of the point estimate, Hall et al. (2011) estimate that a sustained reduction in consumption of 10 calories per day leads to an eventual weight loss of 1 pound, with roughly half of the weight loss occurring after one year. Thus, the estimated reduction of 23.6 calories per day by adults implies a long-term reduction of slightly more than 2 pounds. The estimates for changes in the frequency of consumption for all types of beverages are modest in size and not statistically significant for children. The point estimate for regular soda is -0.2 or less than 1 percent.

On the other hand, we find that, due to the tax, adults in Philadelphia consumed regular soda 10.4 fewer times per month, which is a reduction of approximately 30 percent. Put another way, adults in Philadelphia consumed approximately one regular soda per day before the tax, and the tax reduced consumption by roughly one soda every three days. The tax reduced adults’ probability of consuming regular soda daily by 11.1 percentage points or approximately 31 percent.

Here is Figure 2 from the paper, depicting the impact for high consumption youth.

A similar conclusion regarding decreased soda consumption was obtained by Zhong et al. (2018).

Ironman loves to run numbers so much that he does not realize he is contradicting himself. His first post on the cost of the soda tax assumes that the reduction in soda consumption is not offset by consumption of something else such as sparkling water. But later he assumes that the reduction in soda consumption has been offset by more beer consumption. SAY WHAT?

Look maybe Eagles fans did consume more beer last year. After all – they went to the Super Bowl and actually won it. Dilly, dilly!

Just heard Trump say the U.S. is the fast growing economy in the world. And he has the numbers to back this up. Yes – the U.S. economy has grown by $10 trillion according to Trump. That would represent a 50% increase given GDP is near $20 trillion. Now that is much faster than China is growing. Of course one should fact check this $10 trillion claim – right? Could it be true? And if not – which of the usual nitwits on his economic team gave him such an incredibly bogus number?

PGL,

We downunder are currently growing faster than you on a SAAR basis which is the ONLY way to view it.

First, an 18-cents tax per 12-ounce can is basically… nothing. But $1 per six pack or $4 per case might give purchase pause, but not for real soda addicts. Regardless, it’s a tax for the city to use so the money doesn’t just disappear, it just gets redistributed. We can just ignore the reduction of product demand since it is insignificant to the producers and their workers. Sort of like tariffs.

Okay, let’s wait for the rationalizations.

Bruce Hall Not at all like tariffs. The soda tax is supposed to correct for a negative externality. Do you understand what a negative externality is? An externality is an economic cost that is not captured (or internalized) in the market price. As a result the price is too low and consumption too high. The point of an externality tax is not to grab income, but to reduce consumption to where it would be if all costs were internalized in the market price. A negative externality is a market failure. The soda tax is intended to correct that market failure. Tariffs are completely different in intent and effect. Not even close.

The tax was, by its framers’ own admission, not geared to correct the negative externality of obesity. It was geared as a regressive tax principally on lower income people in a city where the tax base has largely moved out.

https://www.pewtrusts.org/~/media/legacy/uploadedfiles/wwwpewtrustsorg/reports/philadelphia_research_initiative/philadelphiapopulationethnicchangespdf.pdf

Your link is entitled “The Racial and Ethnic Changes in Philadelphia Over the Last 20 Years” which has nothing to do with the motivation of the sugar tax. So when you claim – “The tax was, by its framers’ own admission, not geared to correct the negative externality of obesity. ” I’m calling BS on this sentence.

I wondered if you had any clue what this is about. Good to know you do not.

“Do you understand what a negative externality is?”

Good question but please direct it at Ironman.

2slug, “supposed to”… but not really. It’s someone’s perceived negative externality. It’s true that someone who drinks soft drinks exclusively or excessively may end up with health issues, but the city is not the entity that is negatively impacted. No, it’s basically a tax for the city’s coffers. As to tariffs, workers who lost their jobs to outsourcing (read: China) might consider that a negative externality. Someone’s negative is usually someone else’s positive (read: soft drink companies/employees, doctors, health care systems). It’s not a market failure; it’s a market feature. Meanwhile, a tax is a tax is a tax.

Bruce Hall So if I rob you of your wallet, that’s not a problem because your loss is my gain and they both cancel.

“the city is not the entity that is negatively impacted.”

Well some level of government ends up paying more for the health care of these fatsos. And if that government did not have to do so – more funds could end up in the city’s hands.

I was trying to defend you but maybe you do not get this externality argument after all.

pgl you presume that the city ends up paying health care costs for these (body shaming) fatsos. I’m calling BS on that. The city is simply exacting a tax on soft drinks. You are attempting to assign a negative impact onto the city, but that’s soooo questionable an argument. Please provide the link to the Philadelphia’s medicare program for residents.

Bruce Hall A tax on externalities does not raise net income for the city, it just changes the source. If you don’t see why that’s true, then try scribbling a little algebra and see if you can’t figure it out.

Tariffs and Pigouvian taxes are very different. Tariffs result in a deadweight loss because social marginal costs exceed marginal benefits. A deadweight loss is a welfare loss that does not accrue as a benefit to anyone. Externality taxes eliminate the deadweight losses that comes from over consumption or overproduction due to not all costs being fully internalized in the market price.

Please buy one of those overpriced microeconomics textbooks. Maybe you and CoRev could form a study group.

2slug, the city collects a tax on the basis of perceived negative health impact on individuals; the city does not pay for those individuals’ health care expenses. Hence, no negative externality for the city… unless you think looking at overweight people is a negative externality.

Bruce Hall So the city doesn’t have to worry about first responders for people that slip into diabetic comas? And the city doesn’t have to care about property values due to the effects of obesity on earnings? And didn’t you know that health insurance rates are determined by zip code, so an unhealthy population will drive up health insurance costs for everyone in that zip code. And then there’s that deadweight loss issue you keep ignoring, which reduces welfare because of the misallocation wedge it creates. I assume you’re ignoring it because you don’t understand it. This is an econ blog. Try schooling yourself in a little economics instead of playing the role of the wise & world weary curmudgeon who’s convinced that government’s sole interest is in stealing your money.

2slug,

Your arguments about emergency ambulance runs for diabetics and zipcode health insurance rates are a bit feeble. Of course, there may be some healthcare providers that try a zipcode approach, but they would soon be out of business. Individuals, not zipcodes, are rated. What does affect premiums by zipcodes are the cost structure of providers by zipcode. A rural provider has lower costs and generally lower rates than a Manhattan provider.

Obesity may factor in… if an area has an unusually high proportion of its population considered obese. Does Philadelphia? More commonly, age is a major factor. A community of younger people will generally have lower premiums than one with more older (but not yet 65) residents. Is Philadelphia an old-age city? https://www.point2homes.com/US/Neighborhood/PA/Philadelphia-Demographics.html . I guess if you consider 34-years old median as old age.

Nah, it’s just a tax.

Bruce Hall First, buy a micro textbook so you’ll understand how a Pigouvian tax works. Second, health insurance companies no longer use pre-existing conditions. They use zip codes. Third, the point of a Pigouvian tax is not to raise revenue, it’s to discourage certain types of economic behavior in which 100% of the costs are not internalized in the market price. Whether or not the city government incurs a direct cost is largely irrelevant. The reason for the tax is to correct a market failure. Again, read a micro textbook.

I don’t believe there is any externality. The costs of obesity are fully internalized by the obese person. Any externality is essentially uncovered healthcare expense related to obesity which must be borne by the taxpayer. If this justifies a soda tax, then by definition, the ‘makers’ can force any lifestyle or behavioral changes on the ‘takers’ that they please. Very paternalistic and certainly not egalitarian.

“I don’t believe there is any externality. The costs of obesity are fully internalized by the obese person.” This nonsense is immediately followed by this correction:

“Any externality is essentially uncovered healthcare expense related to obesity which must be borne by the taxpayer.”

My oh my – are you one confused dude!

Steven Kopits Not all of the costs are internalized by the obese person; society incurs some of those costs. And since low income people are most likely to drink high sugar products as a cheap way to obtain calories, it’s even more likely that taxpayers will bear some of the costs. And if you’re worried about excessively paternalistic policies that would limit sugar intake, then I would think you would approve of a market based approach in the form of a Pigouvian soda tax. It’s the least intrusive way to correct market failures.

“Not all of the costs are internalized by the obese person; society incurs some of those costs.”

Note that he concedes your point. But he says there is no externality. I suspect Stephen does not know what the word means or the topic even is about.

But you’d agree, Slugs, that if I’m a rich fat guy and drink a lot of soda and need medical treatment for which I pay myself, there is no externality, right?

Steven Kopits Note my response to Bruce Hall: “Tariffs result in a deadweight loss because social marginal costs exceed marginal benefits.” I did not refer to “private marginal costs,” I quite specifically referred to “social marginal costs.” Is it really plausible that someone who is addicted to sugar can fully internalize all private costs; i.e., not just the direct cost of private healthcare, but also regret costs 30 years from now? Do you believe that a young teenager who drinks too much sugary soda is likely to correctly internalize all costs future costs? No teenager that I know? And that’s only dealing with the private healthcare costs.

Steven Kopits: “You keep using that word. I do not think it means what you think it means.”

The way I understand public goods and externalities is that they affect society as a whole and cannot be allocated to any given person. The classic example is air pollution.

Here’s the Wikipedia definition:

“A negative externality (also called “external cost” or “external diseconomy”) is an economic activity that imposes a negative effect on an unrelated third party. It can arise either during the production or the consumption of a good or service. Pollution is termed an externality because it imposes costs on people who are “external” to the producer and consumer of the polluting product.”

If I eat pizza and get fat, that cost is all internalized. It’s only an externality if the public has to pick up the related healthcare cost, but this was never the principal definition of an externality. By this metric, for example, if someone didn’t study hard enough in school or didn’t show up on time to work, taxpayers should be entitled to place an extra tax on their Comcast cable account or charge them more for a PlayStation.

Steven Kopits: Well, this is what I learned in Ec 10 in my first year at Harvard University, taught by Otto Eckstein. An externality exists when the marginal private benefit deviates from the marginal social benefit, or marginal private cost deviates from the marginal social cost. Hence, in a world where we do not let people die on the streets (that may be optimal from your standpoint, but society has decided otherwise), then the social cost of obesity will exceed the private cost.

I believe the externality is not the cost of healthcare. The externality is the way the public feels about the health issues of obese people. If you doubled or halved healthcare spending, the value of the externality is unchanged. The amount is damage caused by a hurricane is not a function of the money spent to fix things afterwards. The value of the externality is not measured, among other reasons, because we have no such thing as fat people health policy.

Conceptually, you have two ways to handle the issue. You can say that you know what the right weight for a person is, and therefore, if they are not that weight, then you are allowed to tax them–and as a group, not as individuals. That is, anyone who drinks soda is assumed to be fat and therefore meriting taxation. That’s the soda tax, conceptually.

Alternatively, you can argue that you are entitled to modify what poor people, who can’t pay for their own healthcare, are allowed to eat. The latter view considers poor people to be wards of the state, in a sense, with political leadership entitled to guide them in the personal lifestyles. That’s either real communist or real conservative, but liberal it is not.

Steven Kopits My understanding of a public good is a little different. As I understand it, a public good is one in which consumption is non-rivalrous. In other words, your listening to a radio broadcast does not reduce my enjoyment of a radio broadcast. Of course, as a practical matter it is sometimes hard (or at least not costless) to exclude free riders from enjoying that public good. So it’s common for many public goods to also be non-excludable, but that is not always true. In the case of air pollution, that is an example of a negative externality with a kind of “public bad” as opposed to a public good; but that’s a strange way to view it. Instead, we would say that clean air is a public good and negative externalities subtract from that public good. When estimating the social value of a public good we vertically sum the private benefit curves, whereas with private goods we horizontally sum the private demand curves. Air pollution subtracts from that vertical summation and that is why it affects everyone.

Steven Kopits I believe the externality is not the cost of healthcare. The externality is the way the public feels about the health issues of obese people.

Think about the geometry. In order for what you say to be true, the social cost would have to be zero and the private benefit curve would have to be perfectly inelastic; i.e., our sugar addict would have to drink the same amount of soda without regard to price. If the private benefit curve is in any way elastic, then there will be a wedge which represents the private welfare loss due to misallocating consumption choices.

Slugs –

So now you’re calling poor people who drink soda ‘sugar addicts’?

If the cost of obesity is carried by the obese person, there is no externality, Consumption is a private decision with private consequences. Period. You want to be fat, that’s you’re right.

The exception would be if we consider soda drinkers ‘addicts’. This implies a lack of volition, that they are a slave to the sugar desires. OK, but then why not tax sugar rather than diet drinks with no sugar? And why not tax weight directly? A lot of people who drink diet soda are pretty heavy, so clearly they are compensating with calories from other sources (eg, beer).

The metric of success should be the observed change in weight, particularly in at-risk classes (ie, very obese). Or more directly, healthcare provision. Has the amount of insulin or dialysis or heart attacks changed in Philly since the soda tax? Shouldn’t be that hard to find out.

Steven Kopits Part of the problem is that you’re relying upon the Wikipedia definition of an “externality”, which is not really quite right. The Wiki definition focuses on the actors. So the person who drinks the soda and everyone else is external. That definition is close, but not really quite right. The argument about externality isn’t just about who is impacted, but primarily about whether or not all of the costs are internalized in the market price. It’s not about people, it’s about price. It will very often be the case that external actors are the ones who end up bearing the cost, but that is not a definitional requirement. All you really need for an externality is a difference between the competitive market price and the total social marginal cost. Let’s take an example. Suppose the competitive marginal cost to produce and distribute a bottle of Coke is $1.00 and that equals the market price. But suppose each bottle of creates another 10 cents in additional costs; e.g., higher health insurance premiums, greater risk of amputation, kidney disease, lower future income, future regret, etc. Notice that all of those costs are internal to the individual who buys that bottle of Coke. Those are all part of what we would include as “social costs” even though they don’t include anyone other than the Coke drinker. So total costs equal $1.10, but the market price is only $1.00. If the Coke drinker responds only to the market price, then that drinker will be incurring an externality of 10 cents. The drinker is overconsuming beyond what he or she would have consumed if the market price reflected the total cost of $1.10 rather than $1.00. That creates a wedge. There is nothing in the definition of an externality that says only those external to the transaction must incur a cost. Only that the market price does not fully internalize all of the costs. It’s about price, not people.

Now if the Coke drinker is not myopic and is fully rational and can correctly calculate the discounted value of all future costs of drinking the marginal bottle of Coke, and then makes his or her beverage decisions on the total cost rather than the market price, then there would not be any negative externality (assuming no one else is impacted). How likely is that? The econometric way to test for this is to see whether or not a soda tax impacts soda consumption. If it does, the soda drinkers are responding to the market price. If not, then you might conclude that they are fully incorporating total costs and not just responding to the market price.

Right, Slugs, but you have to deduct from that the utility they received from drinking the Coke. So if they are rational actors under no internal or external compulsion to purchase the Coke, then they are making what seems to them a rational trade-off between current consumption and future health problems.

Now, you can argue that it’s not a voluntary transaction, that they are addicts. As a guy who likes sugar, I am sympathetic to that argument. But then the calculation is internalized value differential to the individual. It’s not because it’s a cost to society, but because it’s a cost to the individual himself, which, had he been able to control his cravings, he would have done. Put another way, you are arguing about economics of addiction, not externalities.

I suppose this will become very topical if Bloomberg runs for Prezi. For the record I am against Bloomberg running. Maybe around the time he first became mayor of New York would have been a good time, and I would have happily and enthusiastically voted for Bloomberg. But I am afraid now Michael Bloomberg is entering the Wilbur Ross phase of his life. Either be the “King Maker” and fund someone like Zephyr Teachout etc. or go home, drink some prune juice and ramble on to friends who don’t care about how you took all the “adult fun” out of Times Square. OK?? Get a grip. You either had the gonads to run for U.S. Prezi in 2001 or you didn’t. Family Feud survey says: NO, you didn’t.

https://www.youtube.com/watch?v=Y__iv23yVuQ

We New Yorkers sort of like THE BLOOMBERG for his first two terms but that 3rd term showed us he is just one the rich elite. He might be better than most Republicans but we could do a LOT better.

By my count, sales of sodas fell by 250 m ounces per month. Sales of beer increased by 180 m ounces per month.

Thus, 70 m ounces of drinks by logic must have been sourced from outside the city (assuming people drank as much as they used to). That translates into $1.7 m of lost revenue / month, $20 million per year (measured at retail), quite in line with Ironman’s estimates for economic losses to Philadelphia.

Interestingly, the NBER study did not pick up the increased beer consumption. Why? Probably because people failed to disclose it. (“We used to drink Pepsi, but now drink Miller.” Maybe not. This is why, beyond the survey, you might ask, “Can I look in your fridge?” The beer’s sitting right there on the shelf.)

And I thought Ironman had gone off the deep end!

pgl:

And I thought Ironman had gone off the deep end!

If Kopits isn’t trolling, I think we are seeing cognitive degeneration. No joke.

Sluggsy,

a wonderful explanation.

You should write a text book.

A price on carbon is another example of a negative externality

Maybe I should. With the obscene price of textbooks I could be a very rich man if I could find enough suckers to buy it.

surely that would be a positive externality and I won’t call you shirley again. What you] did not watch flying high?

“Steven Kopits

September 25, 2018 at 11:24 am

The way I understand public goods and externalities is that they affect society as a whole and cannot be allocated to any given person. The classic example is air pollution.

Here’s the Wikipedia definition:”

Princeton Steven relies on Wikipedia? OK! BTW an externality does not have to affect everyone in society. Yes – Steven has no clue what this discussion is about after all!