Lehman Brothers, the global financial crisis and ensuing great recession, plus ten.

In our book, Lost Decades: The Making of America’s Debt Crisis and the Long Recovery (Norton, 2011), Jeffry Frieden and I undertook a historically and economics based assessment of what went wrong. Here are some graphs that underpin our analysis:

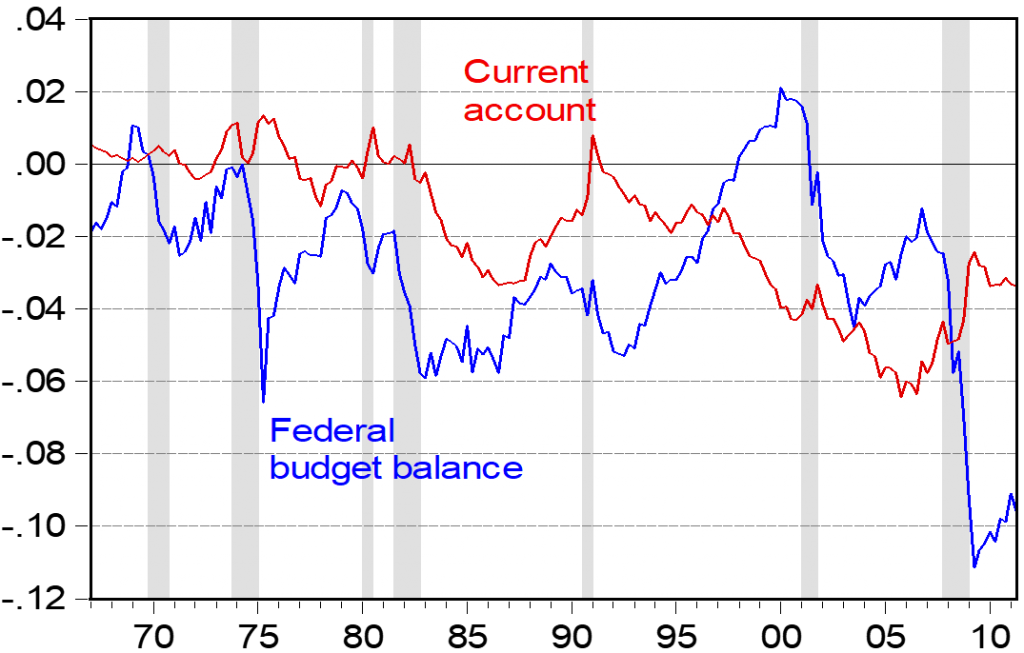

Figure 1: Government borrowing and borrowing from abroad.

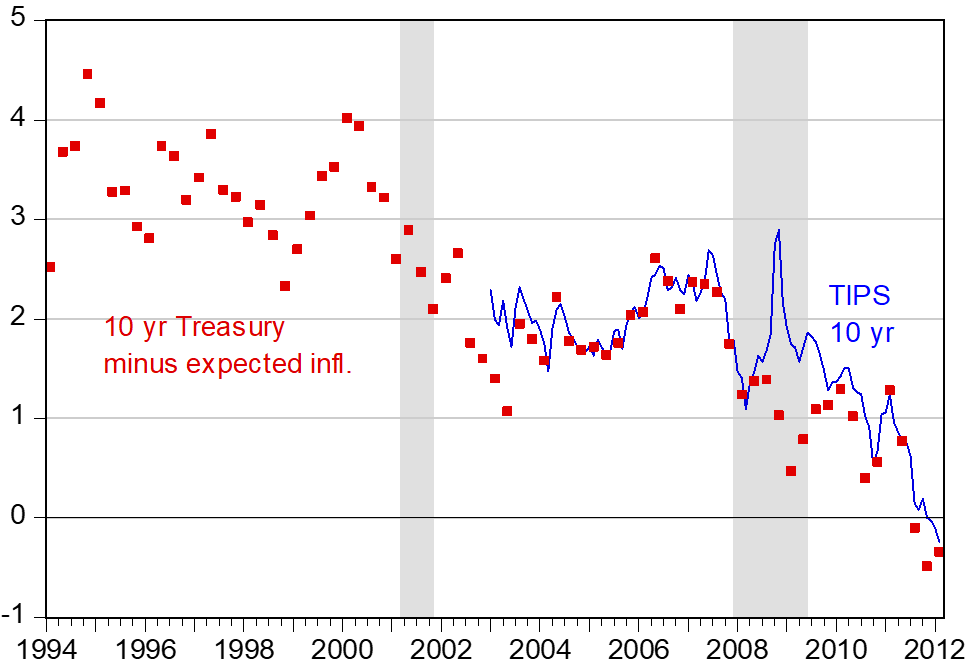

Figure 2: Low real interest rates encouraged borrowing

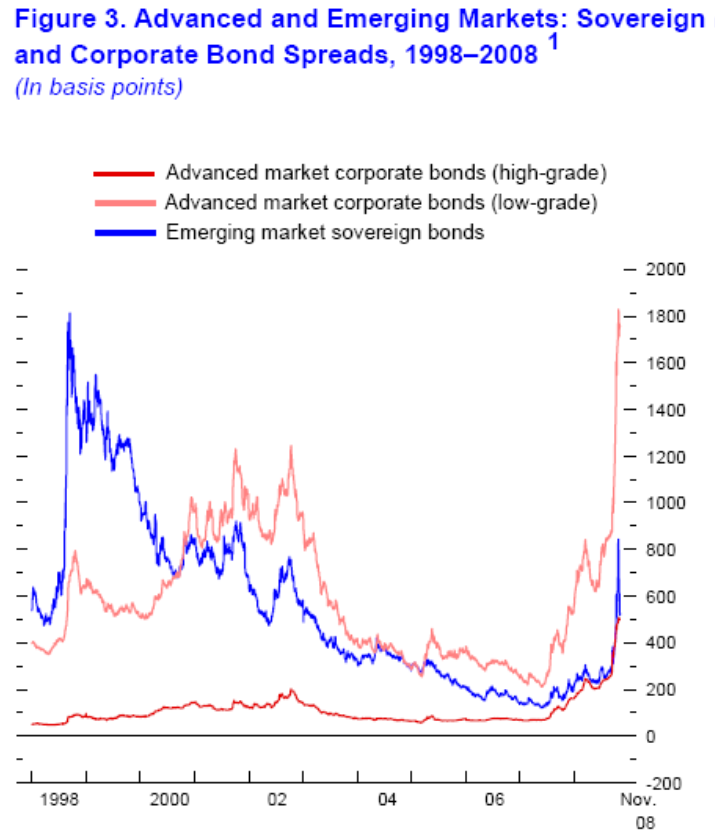

Figure 3: More importantly, perceived risk disappeared

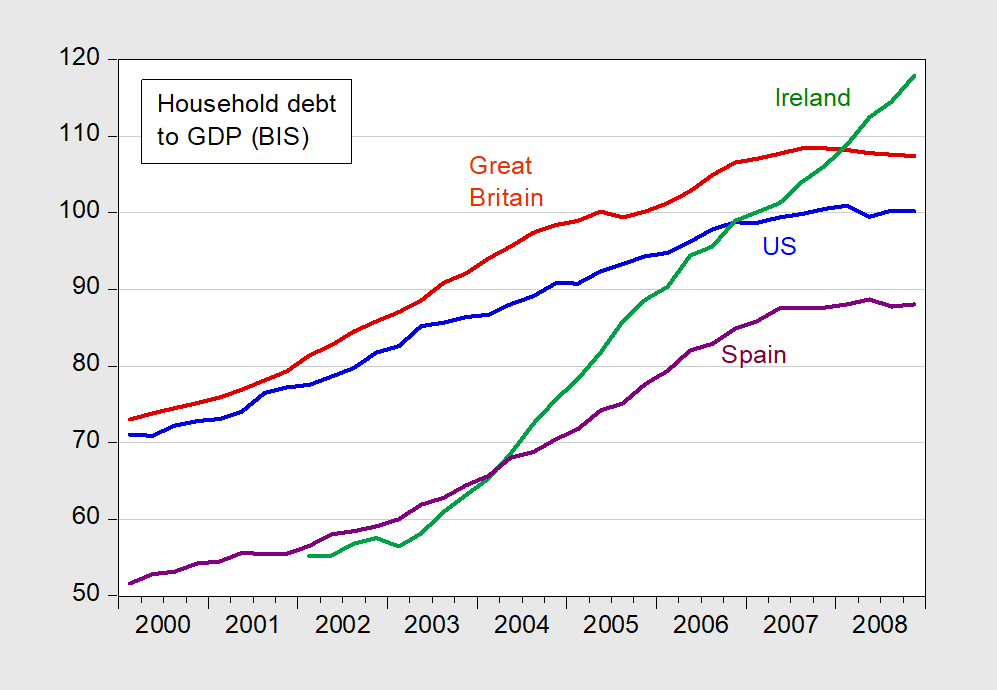

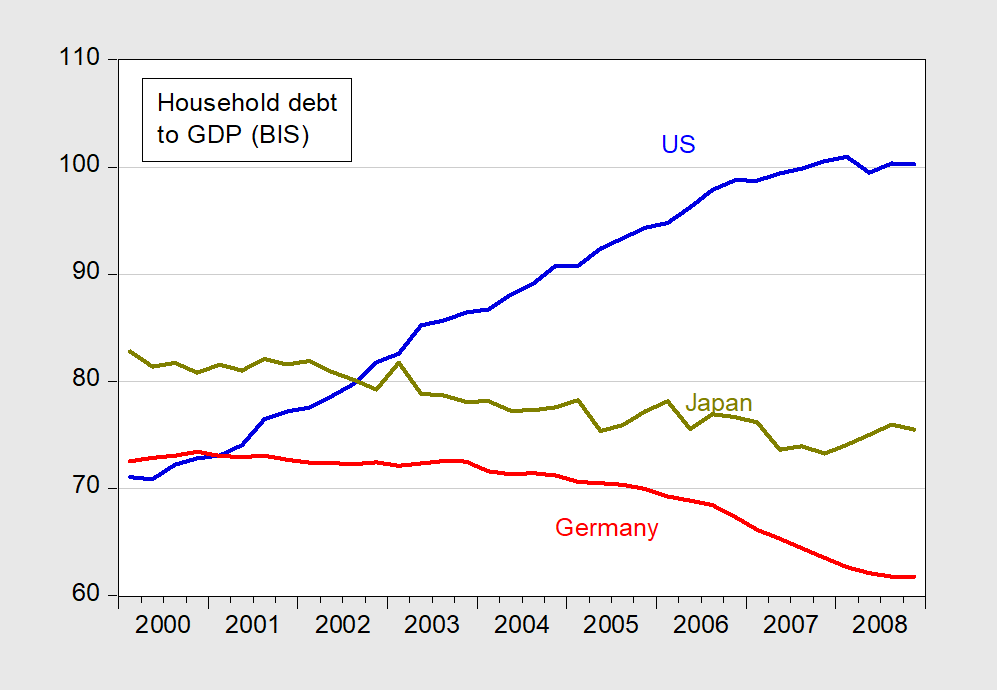

Figure 4: Household debt rose in crisis countries

Figure 5: But not in non-crisis countries

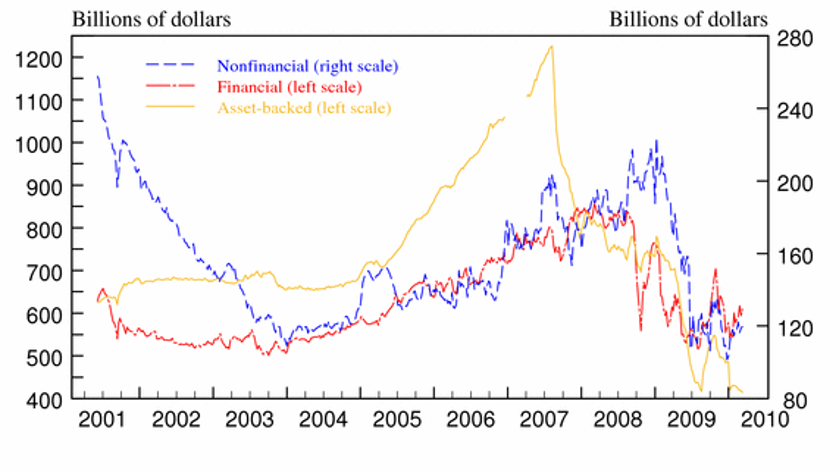

Figure 6: In the US, housing booms fueled by lending, particularly in asset backed securities

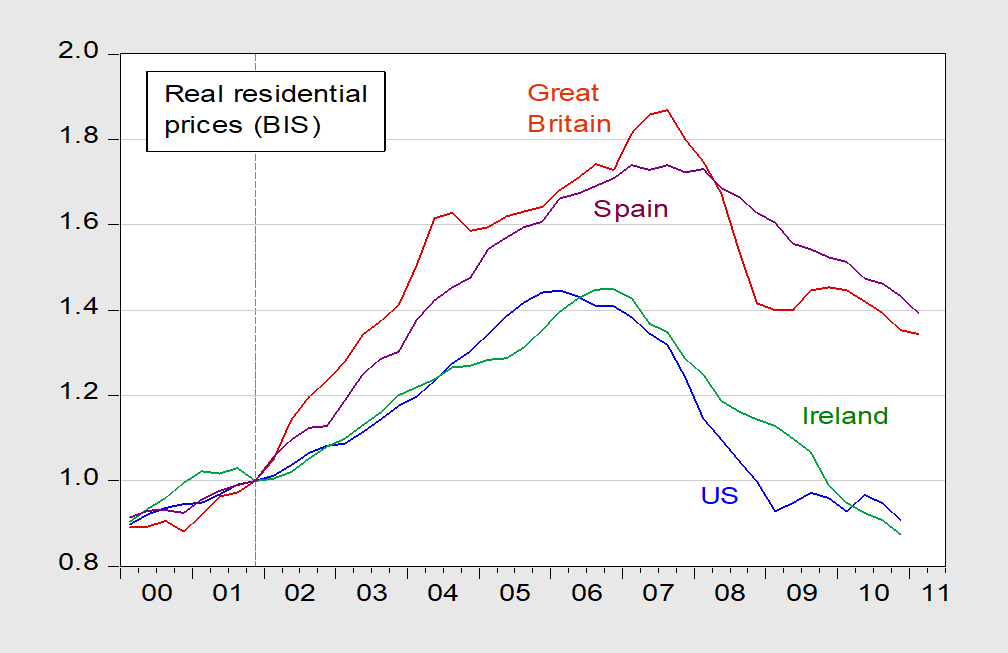

Figure 7: Debt accumulation drove, and was driven by, housing booms in crisis countries

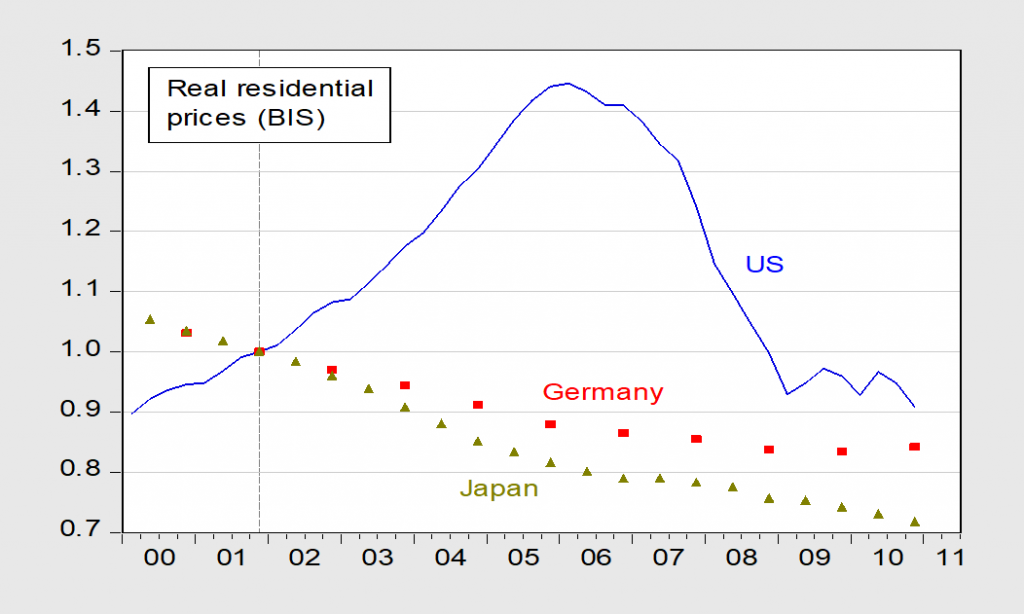

Figure 8: But no in non-crisis countries

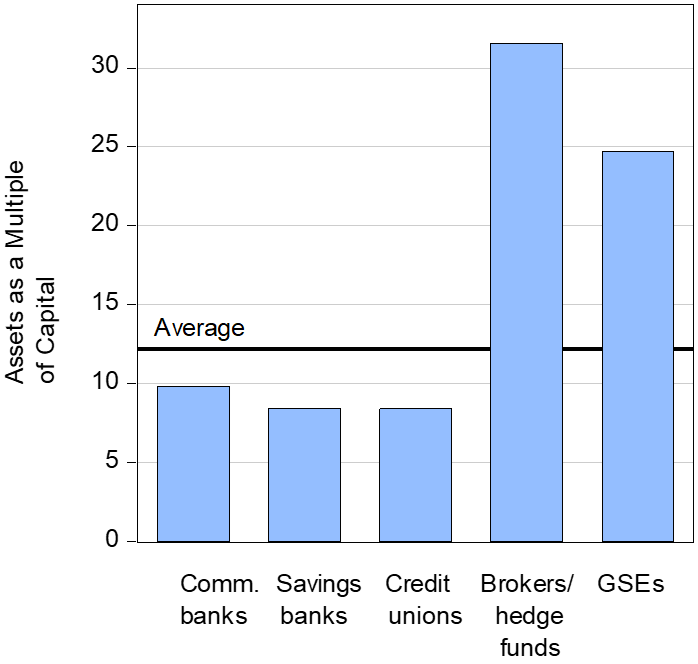

Figure 9: The financial system was leveraged up, particularly in investment banks, GSEs

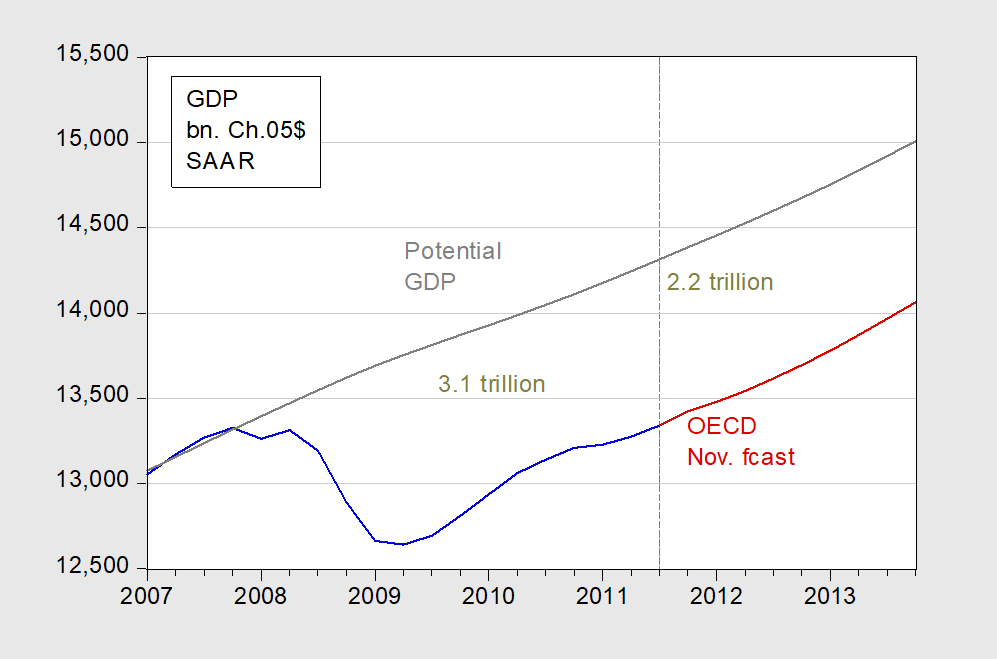

Figure 10: Financial crisis had massive impact on real side of the economy, via credit crunch, wealth loss, uncertainty

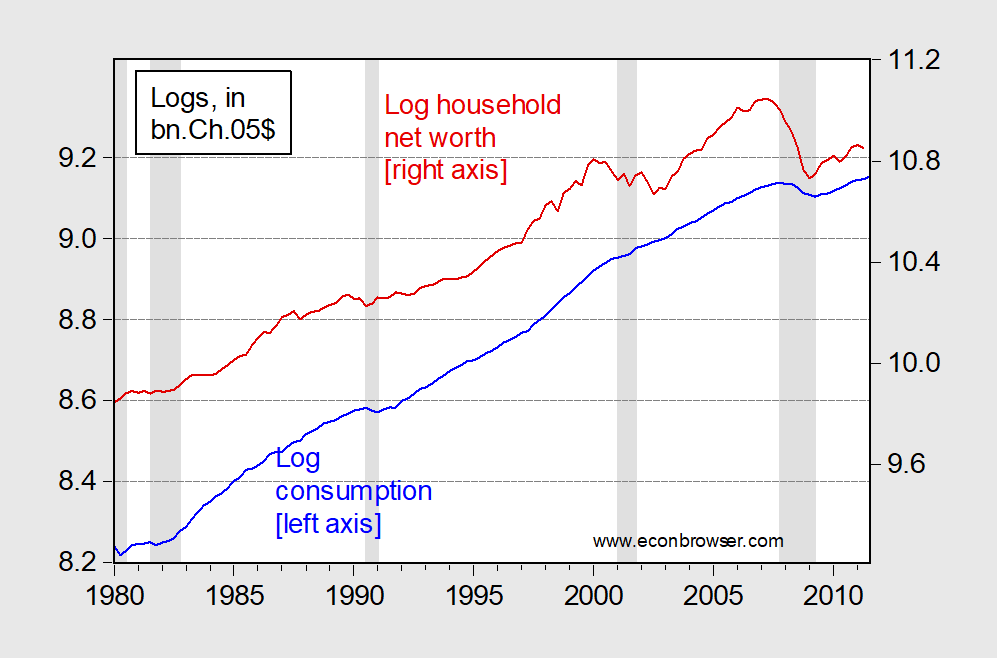

Figure 11: Deleveraging explains part of the slow recovery – typical post-financial crisis

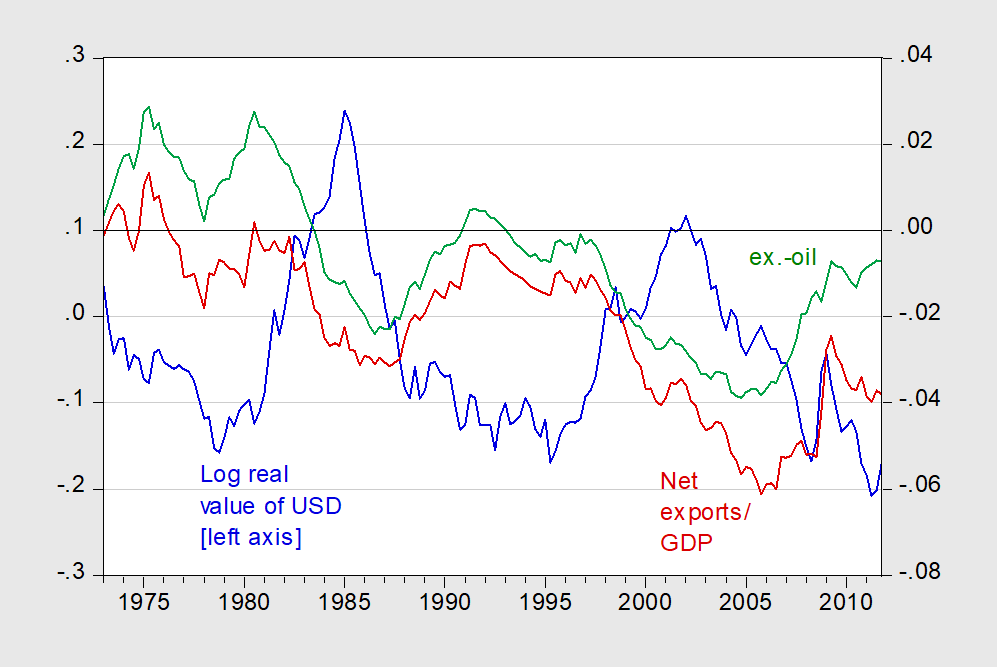

Figure 12: Lots of adjustment in external accounts

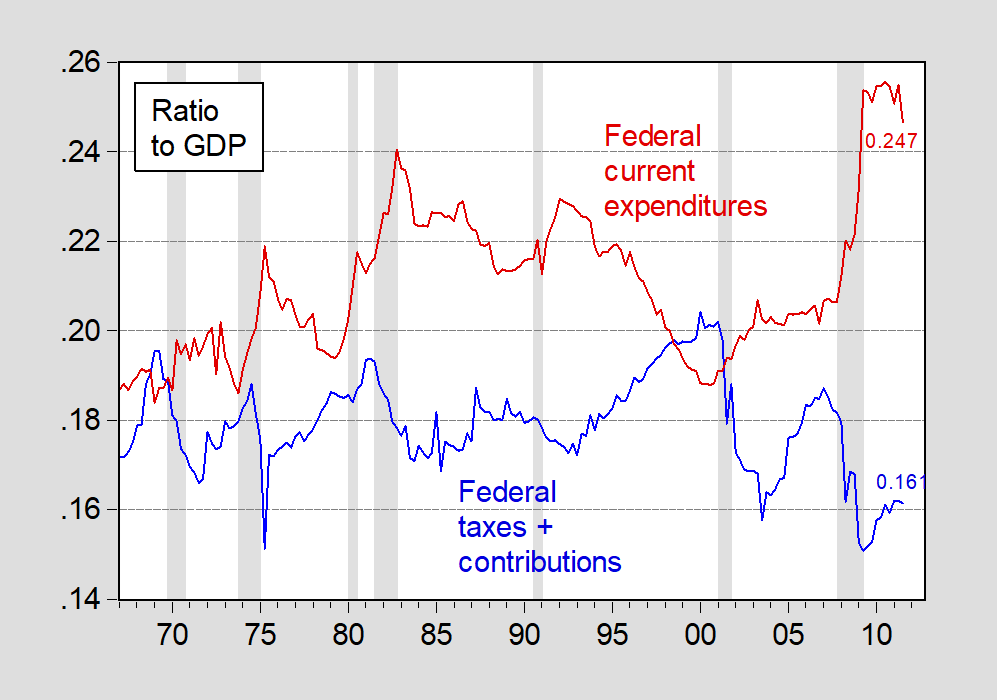

Figure 13: Federal government embarked on stimulus (but post 2010, states worked to reverse)

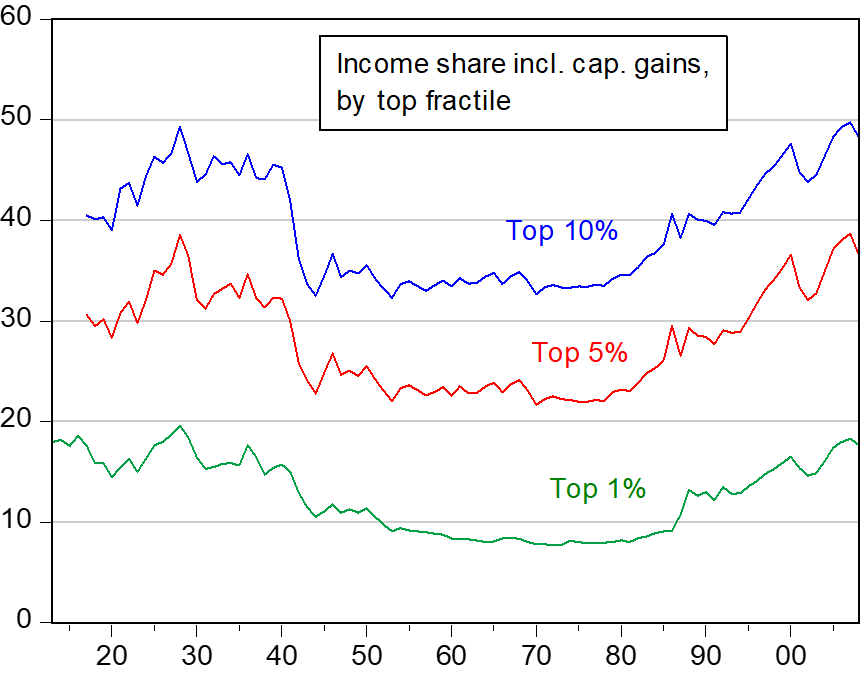

Figure 14: Income inequality was increasing pre-crisis

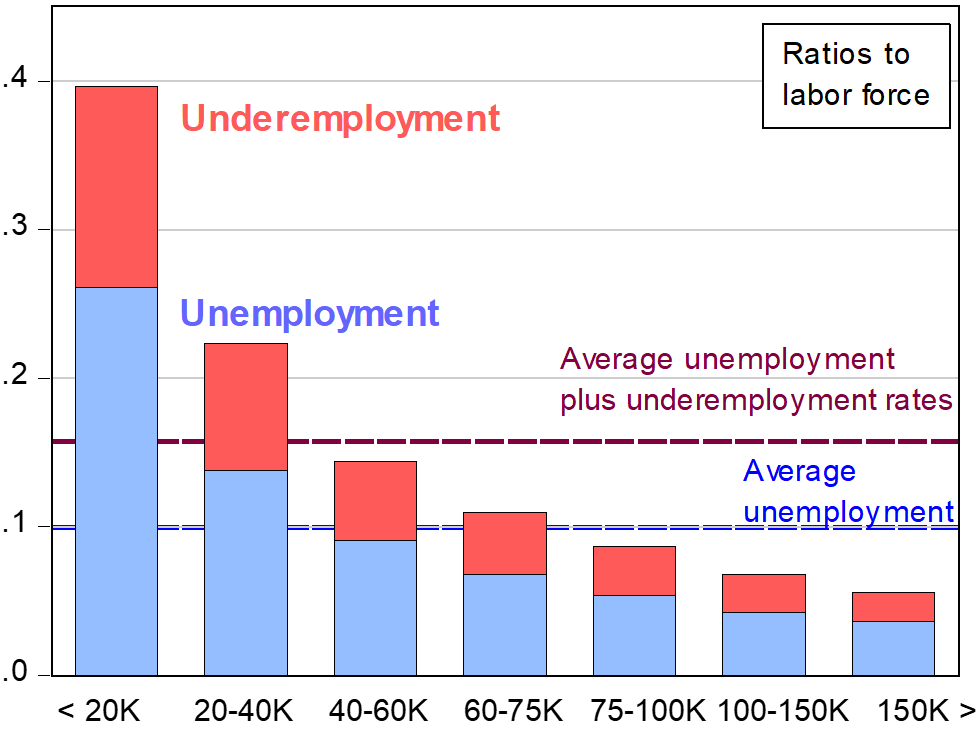

Figure 15: Recession hit low income households the hardest

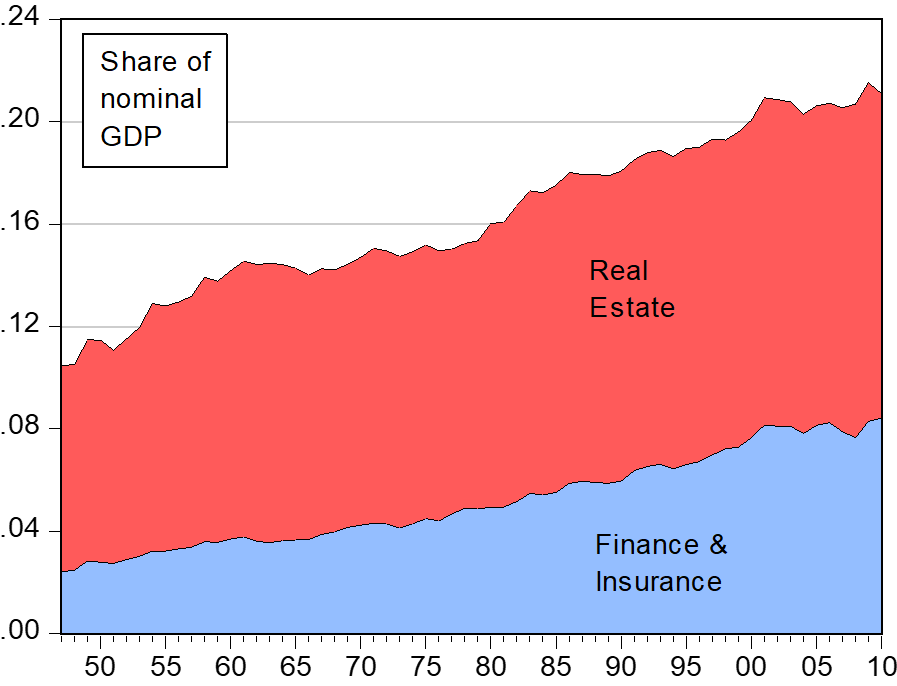

Figure 16: Finance gained prominence pre-crisis, and after a negative shock, regained

We concluded:

Over the course of the past decade, the potential benefits of the international financial machinery were swamped by its malignant misuse. Lenders were irresponsible, borrowers were reckless, and regulators were negligent. The results were disastrous. Instead of putting scarce capital to good use, Americans squandered it on unnecessary tax cuts, indefensible budget deficits, and unwise purchases. The United States lost a decade by living on borrowed time and spending it badly.

Many of the decade’s failures were the result of a perversion of otherwise reasonable ideas, distorted for suspect motives. There are legitimate reasons to reduce taxes: to fuel spending and promote entrepreneurship. There are valid grounds for a government to run deficits and finance them abroad: to stimulate the economy and further investment. There are sensible arguments in favor of promoting home ownership: to stabilize communities and reward thrift. And there are defensible motives for deregulating finance: to increasecompetition and foster efficiency.

But in America’s lost decade, taxes were cut to curry favor with wealthy and middle-income voters, to make it easier to starve programs the ruling party did not like, and to tie the hands of future governments. Budget deficits and foreign borrowing were encouraged to allow Americans to engage in politically popular spending sprees.

Home ownership was promoted to cater to electoral constituents and special interests in pivotal regions. And finance was deregulated to kowtow to powerful interest groups. The people responsible for all of this compounded their failings by cynically abusing philosophical principles, espousing pseudo-theories and misrepresenting real

ones, in order to provide an ideological pedigree for policies that were patently political and openly opportunistic.Whose fault was it all? Bankers and their allies among the regulators are perhaps the most common, and most satisfying, culprits. Financiers did, after all, get rich as they led the country to reckless levels of debt, and they did eventually bring the entire system down with them when they fell. Certainly there is much foundation to the fury directed at financial shenanigans. Nonetheless, it should not be exaggerated. For one thing, countries with much more tightly regulated banking systems, and many fewer reckless bankers, got into just as serious trouble (Spain). For another, American financial institutions were largely playing with the cards they had been dealt.

The country’s foreign borrowing brought $5 trillion into the American financial system over the course of a few years; the need to lend out these additional trillions inevitably reduced the average quality of loans. America’s lenders and borrowers were responding to incentives created by others.

And a cautionary note about the advice of academics.

And the experts did warn. While the Bush boom was gathering, academic authorities sounded plenty of cautionary notes. The country’s leading specialists in international macroeconomics attempted o alert policymakers to the dangers of the global macroeconomic imbalances driven by American borrowing. Analysts of fiscal policy expressed rising concern over the federal government’s deficits,

while many monetary analysts warned that uncommonly low real interest rates were fueling unwarranted increases in asset prices. America’s most prominent housing economists cautioned that the real estate market was in a classic bubble. Those with knowledge and experience of debt cycles past and present pointed out that the

United States was following a well-known path from borrowing boom to bust.

A video of the presentation at the IMF, here.

A lot of information in those graphs but how to pull this altogether? We appreciate the few quotes you offer which i’m sure will cause a flurry of discussion but it seems I need to go buy the book and read it in its entirety. NOW that is how one advertises!

I concur with PGL.

We avoided a recession downuder by quick and large fiscal stimulus. I might note every country that adopted classical economics as their policy suffered a depression i.e a fall in output of 10% or more.

People wanting to read about the 10 year anniversary can visit my blog where i have a number of links on this topic including this one.

Brilliant post but depressing, Menzie.

Politicians created a giant social program providing risky home loans to people, who normally wouldn’t qualify, raising the homeownership rate, and believing they didn’t have to pay for it.

They wanted to replace the Nasdaq bubble. A big tax cut would’ve been much better, till the economy reached full employment, and then raise taxes to slow the economy to a sustainable rate.

“Politicians created a giant social program providing risky home loans to people”

perhaps menzie can directly comment on this, but i get the feeling from the data he presented that while politicians deserve some blame, you would be hard pressed to make a valid argument that they were the cause of the financial crisis. poor behavior by the financial types and failed bankers was probably a bigger cause for the resulting financial crisis.

Bernanke has an excellent discussion on the credit disruptions. Check it out:

https://www.brookings.edu/blog/ben-bernanke/2018/09/13/financial-panic-and-credit-disruptions-in-the-2007-09-crisis/

Of course don’t expect Peaky to do so as it might contradict his incessant spin.

I’m proud to say I bought the book maybe slightly under a year after it came out, the hardcover edition. Slightly embarrassed to say I never read it all the way through (maybe about 25% read). Due to my own laziness. I’ll make it through to the end one day though. It was well done and the numbers presented in a way that was easy to digest and yet didn’t insult the reader’s intelligence. I have, what do they call them—widgets (??) on my blog that advertises the book if that counts for anything. Maybe if Menzie is ever stuck at Will Rogers Airport he’ll use the “Lyft” app, hop in a car and sign it for me. No??

Hey, we can dream to meet our mathematical/policy analysis heroes in life—even if their blog topic filtering policies suck *ss

In the dream sequence, I tell Menzie I was totally clueless to the fact humans actually had “racial characteristics” until Prof Hamilton introduced it to me as a dirty, nasty, disgusting, and….. deplorable(??) topic that civilized and sophisticated blog hosts filtered discussion of, and further, that all this time I thought Chinn was an Irish name and I have no idea why the hell he would bring the topic up. Then I tell Menzie that Norm MacDonald is a “detestable human being” who is a worse misogynist than Rush Limbaugh, and I have no idea why the hell Menzie would bring the topic up—then we both laugh (with frozen frames added) like one of the endings of the “ChiPS” TV shows.

https://youtu.be/3A2OfazglPM?t=1m20s

Here is an awesome, and realistic, dramatization of the crash: https://www.youtube.com/watch?v=Hhy7JUinlu0

Most think this is Goldman Sachs (although it is Midtown). They were the first out. Lehman was second. They went bankrupt.

Margin Call was a good movie. Robert Ebert’s critique:

I think the movie is about how its characters are concerned only by the welfare of their corporations. There is no larger sense of the public good. Corporations are amoral, and exist to survive and succeed, at whatever human cost.

And, with appropriate fiscal and other economic policies out of Washington, after the crisis, the output gap would’ve closed by 2011, although slightly slower growth is expected.

I know you are in love with your incessant babbling but take a moment and read what Krugman wrote:

https://www.nytimes.com/2018/09/12/opinion/botching-the-great-recession.html?partner=rss&emc=rss

“So we needed fiscal expansion, some combination of spending and tax cuts. And we did, of course, get the ARRA — the Obama stimulus. But it was too small and, even more important, faded out much too quickly; see Figure 3…Why, then, didn’t we get the fiscal policy we should have had? There were, I’d say, multiple villains in the story. First, we can argue whether the Obama administration could have gotten more; that’s a debate we’ll never see resolved. What is clear, however, is that at least some key Obama figures were actively opposed to giving the economy the support it needed. “Stimulus is sugar,” snapped Tim Geithner at Christina Romer, when she argued for a bigger plan. Second, Very Serious People pivoted very early from concern about the unemployed — hey, they probably lacked the necessary skills — to hysteria over deficits. By 2011, unemployment was still over 9 percent, but all the Beltway crowd wanted to talk about was the menace of the debt. Finally, Republicans blocked attempts to rescue the economy and tried to strangle government spending every step of the way. They claimed that this was because they cared about fiscal responsibility — but it was obvious to anyone paying attention (which unfortunately didn’t include almost anyone in the news media) that this was an insincere, bad-faith argument. As we’ve now seen, they don’t care at all about deficits as long as a Republican is in the White House and the deficits are the counterpart of tax cuts for the rich.”

Alas poor Peaky will NEVER admit that the main villain here was the Republicans who want only tax cuts for the rich.

PeakTrader the output gap would’ve closed by 2011

Wow! You sound pretty sure of yourself. Did you publish a refereed paper on that? I’d like to read it. I went to the NBER site and searched for any working papers by “PeakTrader” but I didn’t get any hits. Could you describe your model that showed how the output gap should have closed by 2011? Did you use a structural model? Or a DSGE? If so, how did you calibrate it? This could be a genuinely important finding because most of the empirical literature says that the US economy came out of the Great Recession a little better than we were entitled to expect.

Had we listened to Christina Romer – we would have had a much larger fiscal stimulus. But as we read the really dumb babble from PeakTrader, it is clear he never had a clue what Dr. Romer was saying.

About a week ago I was listening to Steve Schmidt (Sen. McCain’s campaign manager) talk about the Lehman collapse and how it fatally affected McCain’s presidential bid. I remember how clueless and befuddled McCain was at that big pow-wow that Bush 43 had organized in which he wanted to include both presidential candidates. Anyway, in that interview Schmidt said that shortly before the Lehman collapse the campaign team had concluded that Sarah Palin was shockingly unqualified and they were trying to figure out a way to get her off the ticket. They knew early on that she was somewhat ignorant, but they had no idea just how profoundly ignorant and corrupt (according to Schmidt she had been stealing boatloads of cash from the campaign) she really was. But after Lehman Brothers and the collapse of the financial system everyone in the campaign new that McCain had no path to victory, so they decided to just let the Palin issue die a natural death. So in that regard we have Lehman Brothers to thank for making sure Sarah Palin never became Vice President. And oh yes…CoRev thought Palin was a great choice. He also thought (and still thinks) the Iraq War was a great idea as well.

McCain should have listened to Mark Zandi who was supposed to be his economic adviser. Zandi got the enormity of of the Great Recession early on and tried to convey the policy implications to McCain. Why the Senator ignored him is beyond me.

2slugbaits, you may want to at least look at prior economic recoveries, like under JFK, Reagan, and Bush 43 for a clue.

We had the most expensive and weakest economic “recovery” in U.S. history under Obama. To assume that’s better than expected is a joke.

And, every recession has a financial crisis. The Panic of 1907 didn’t have a recession.

“The Panic of 1907 didn’t have a recession.”

Why does PeakTrader insist on making one stooopid statement after another?

https://www.federalreservehistory.org/essays/panic_of_1907

“The Panic of 1907 was the first worldwide financial crisis of the twentieth century. It transformed a recession into a contraction surpassed in severity only by the Great Depression.”

Pgl, you’re correct about the 1907-08 recession, but still wrong about everything else.

peaktrader, your commentary about the panic of 1907 is representative of most of your arguments here. simply wrong. you cannot be taken seriously when half of what you say turns out to be factually incorrect, and only stated as a means to promote your ideology to begin with. your inability (stoopidity or deceit, or both?) to understand the difference between different types of financial shocks which lead to different types of recoveries is indicative of somebody who is not interested in solutions, but in promoting a certain ideology.

PeakTrader You clearly do not know the literature. Economic historians distinguish between various kinds of recessions; supply side shock, balance of payments, Fed intended, financial crisis, etc. You’re the one who always likes to point to Rogoff & Reinhart. Perhaps you should familiarize yourself with their work on why financial recessions are special cases and typically take 10-20 years to achieve full recovery.

“Instead of putting scarce capital to good use, Americans squandered it on unnecessary tax cuts, indefensible budget deficits, and unwise purchases.”

Tax cuts are used best by each taxpayer, while government allocates capital poorly.

In the 2000s, we had a consumption boom, including Americans buying foreign goods and foreigners buying U.S. Treasury bonds (trade deficits reached $800 billion a year or 6% of GDP by the mid 2000s).

Government should’ve refunded consumers to reduce a downturn, which the Bush tax cuts in early 2008 did, since the U.S. was on a path to a mild recession, till Lehman failed in September, and allow the spending to go on, including servicing household debt. Instead, government selfishly spent and squandered too much, perhaps, because it arrogantly believed it could spend trillions of dollars more wisely than the sum of all households.

“Tax cuts are used best by each taxpayer, while government allocates capital poorly.”

More incoherent babbling. What we needed in 2009 was a massive infrastructure investment drive. What we got from your team was more tax cuts for the rich of which part was spent on Rodeo Drive. It was your team that watered down the fiscal stimulus by going for low bang for the buck tax cuts.

Any college freshman knows this but it cannot sink into your brain? Either you are really stupid or you are once again babbly incoherent dishonesty.

MC, great pics. I give a talk with similar to old people at my Florida 55+ community and to kids at Bates and Colby, both near my place in Maine. My only difference is my starting the talk with internal migration in China – around half a billion people moved to the cities from subsistence agriculture starting in the mid 1970s – (say ’78). Next I do the US wages and productivity picture with the divergence starting about the same time. The inequality pic next. Then Stopler Samuelson, but updated for extreme capital mobility. So US in the 80s and 90s was confronted with wage stagnation different from anything seen previously. Now I wave my hands a bit and talk abt Fannie& Freddie and lax lending standards allowing US consumers to cash in housing equity. Then move to junk bonds, junk bond insurance and regulators and rating agencies ignoring covariance….

“Tax cuts are used best by each taxpayer, while government allocates capital poorly.”

just curious, other than blind ideology, what evidence do you have to support this blanket statement?

Give him some time – Kevin Hassett will write another dishonest CEA analysis so Peaky cana quote it!

“which the Bush tax cuts in early 2008 did, since the U.S. was on a path to a mild recession, till Lehman failed in September”

somebody is in denial with reality. paths to mild recession do not end in wall street bankruptcies and financial crisis. those take a great deal of time and effort to create.

Peaky just jumped the shark in more ways than one. Your reply is spot on. But if he thinks the 2008 teenie tiny tax cut was a sufficient response to the slowing of aggregate demand – we have to review whether he even past 1st grade arithmetic.

Let’s help Peaky out with some facts ala http://www.bea.gov

Table 1.1.1. Percent Change From Preceding Period in Real Gross Domestic Product

He just suggested we had a really mild slip of aggregate demand in early 2008 which a tiny tax cut could have offset. I guess he does not even know what was happening in 2007. Real GDP growth in 2007 was already below 2%. Consumption was still doing OK but real investment declined. Government purchases rose by less 2% as well. We sort of got saved by a nice burst of exports but even that was short lived. There were plenty of signs of aggregate demand weakness but I guess anyone who thinks Donald Luskin is an economist would have not known that.

give peak a break, at the time he was a banker living in a fantasy land of ill gained profits from others. by the time he became a failed banker, the events had passed him by. he still seems to have no clue about what caused the financial crisis to begin with. perhaps he is suffering from ptsd?

I think, people forget, we also had an oil shock, since oil reached $150 a barrel in mid-2008.

Many believed we reached “peak oil” at the time and that was before the U.S. fracking boom.

You make a lot of stupid statements but this one takes the cake. 2008 was not an oil supply shock. Get a clue Peaky – China was bidding up the demand for commodities including oil. Yuuuuge difference which I guarantee you do not get.

I forgot when James Hamilton posted his take on the work of Lutz Kilian on this blog but it is clear that Peak Trader never read his work. I found one version of his work:

https://ideas.repec.org/p/cpr/ceprdp/9823.html

“Research on oil markets conducted during the last decade has challenged long-held beliefs about the causes and consequences of oil price shocks. As the empirical and theoretical models used by economists have evolved, so has our understanding of the determinants of oil price shocks and of the interaction between oil markets and the global economy. Some of the key insights are that the real price of oil is endogenous with respect to economic fundamentals, and that oil price shocks do not occur ceteris paribus. This makes it necessary to explicitly account for the demand and supply shocks underlying oil price shocks when studying their transmission to the domestic economy. Disentangling cause and effect in the relationship between oil prices and the economy requires structural models of the global economy including the oil market.”

Anyone who has read this research would not write the stupid intellectual garbage Peak Trader has just now. Peaky – pardon me for saying this but please SHUT UP and READ!

This post is about what went wrong in 2007-8. It is exceedingly important to understand the deep causalities as this understanding sheds vast light on the state of the profession and on the Federal Reserve itself. A confluence of factors came together to cause the Great Crisis. Take away any one and the crisis would have been less severe. The crisis was a brew of (a) excess liquidity created by the Fed, (b) joint government (under Clinton) and housing industry push to increase the Homeownership rate (at the time 64%) by Act thereby overencouraging subprime mortgage borrowing by families that would never with their normal flow of incomes have been able to maintain payments and by requiring Fannie and Freddie to purchase securities based on these loans, (c) toxic securities such as CDOs and CDS, (d) the greed of Wall Street banks and mortgage lenders like Countrywide, (e) complicity of the rating agencies which uniformly overrated both ordinary MBS and all the insane toxic securities. And to drive the nail even deeper, (f) the sharp increase in the price of crude which alone would have been enough to precipitate a mild recession as by May 2008 crude exceeded the 80% year-over-year which is an historic trigger of recession. Without four plus years of excessively easy money — one month longer than during the stagflationary 70s – crude demand could never have risen to this height. Easy money is proxied by an outright negative real fed funds rate and small positive real rates both of which kept actual real below unobservable neutral for over four years. It goes without saying that home prices could not have risen to the height they did, either, without excessively easy money for such a protracted period. Note carefully how the Fed’s role is downplayed.

The nuts and bolts of the main transmission mechanism were the Homeownership Act and other federal malregulation enabling silo I to fill with far too many mortgage whole loans, regulatory laxness including insufficient oversight of the private ratings agencies in allowing the surfeit in silo I to overflow into silo II of MBS (both agency and private), and an utterly blind eye by the Fed and other banking system regulators that let the MBS created in silo II to flow over into the hypertoxic mix of securities created in silo III. The latter are what brought the house down in such catastrophic fashion, though it was still coming down. In effect, the Fed was blind to the entire shadow banking system in which in the most risky and most operative elements were occurring. Fed either blind or perhaps worse. Figures 3, 6, 7, and 9 are apropos, but illustrate only part of the story. Most of the other graphs are not important to the crisis itself. Figure 2 completely occludes the far more informative picture that a graph of the real fed funds paints. From the graphs here, the lion’s share of the story is left out. So readers will not learn the holistic cause of the crisis from this post. This lacunae will then spill over into not truly understanding what happened after and what is happening today.

your blame on the fed and federal regulations is overblown. there were massive numbers of subprime mortgages completely within the private sector realm, and not being mandated by any federal regulations. take a look at ground zero, the miami condo market, to understand what was happening. those condo’s were not in redline districts being hoisted upon the bankers by some minority law. this was fraud, on a massive scale, committed by the entire spectrum of the real estate and financial industry-as well as the consumers themselves. same applied to many of the other tract housing developments in florida and nevada. it is quite possible a bad recession would have been the outcome, if not for the huge buildup of financial derivative products like cds linked to the overpriced housing. and this source was not finite-you could use the same overpriced property over and over and over in various derivate products. in particular, this was the aspect of the financial crisis that was criminal on the part of the bankers, and soooo dangerous. those folks became detached from reality with those derivatives-and we saw the outcome. there was more value tied up in these derivative products than produced by the entire world! talk about leverage.

JBH, I like your explanation. Expect the regular Doodyville occupants here to go berzerk