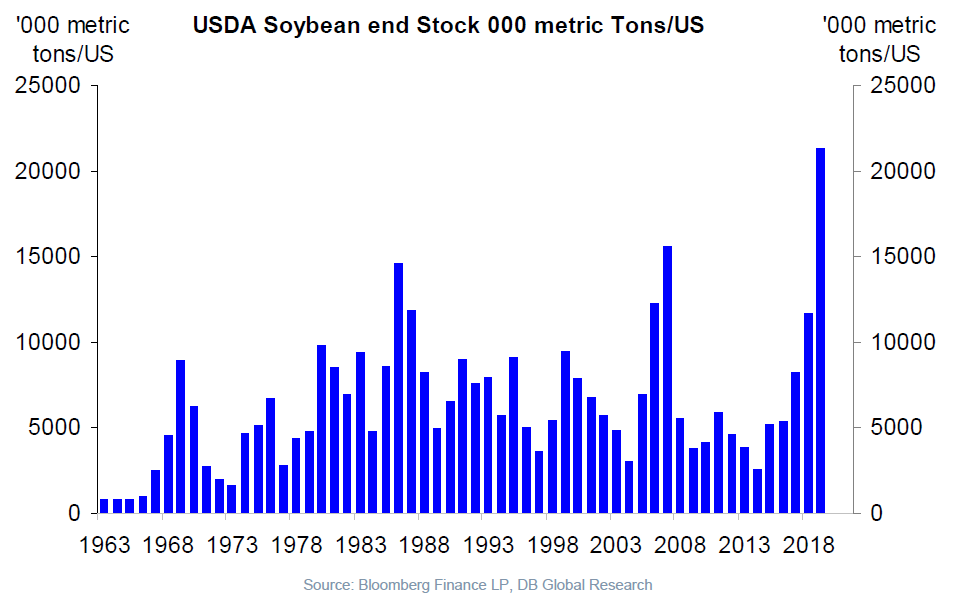

I am dubious. End-market year soybean stocks at record highs.

Source: Slok, “Global markets: US overheating and Treasury supply pushing US rates up. Trade wars and Turkey pulling US rates down,” Deutsche Bank, September, 2018.

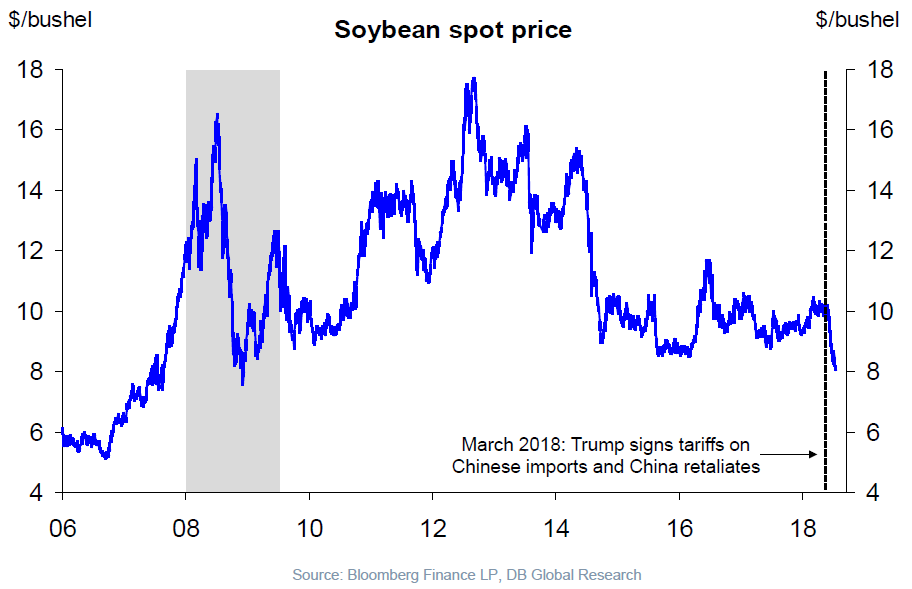

And those stockpiles are now valued at lowest prices in a decade, down 20% from when Mr. Trump started imposing sanctions.

Source: Slok, “Global markets: US overheating and Treasury supply pushing US rates up. Trade wars and Turkey pulling US rates down,” Deutsche Bank, September, 2018.

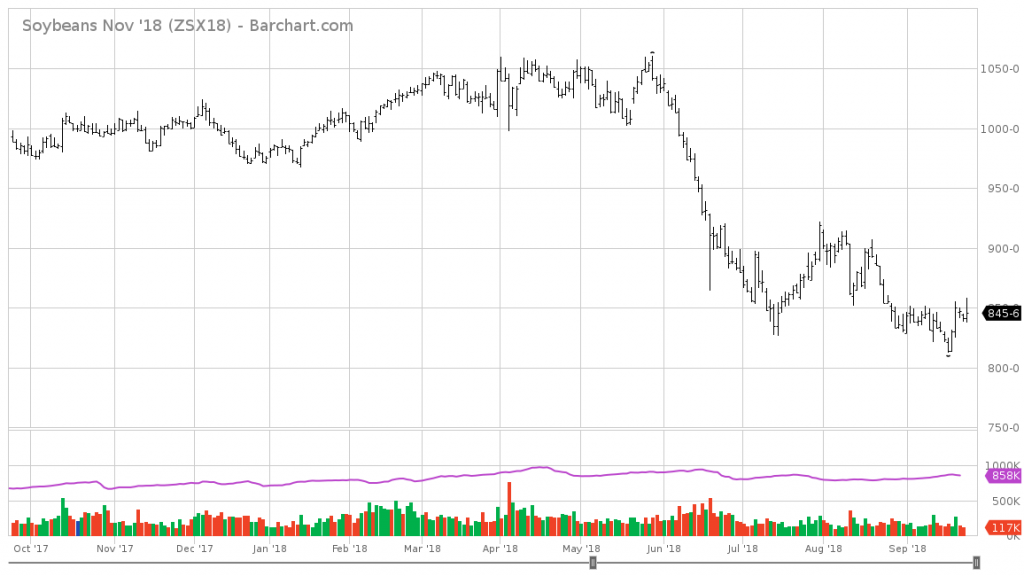

There have been numerous voices commenting on this weblog arguing that US soybean prices will recover during the harvest period in the US when Brazilian soybean sources are exhausted. Thus far, futures prices (for November, etc.) have not exhibited such behavior. Since several studies (Chinn-Coibion, 2014; Reichsfeld-Roache, 2011) have documented that futures are unbiased predictors of future soybean prices, I do not think the market’s sentiment is in synch with such predictions.

Source: barchart.com.

Interesting article from FoxNews today, entitled Farmers fear China will never return to the US soybean market:

“The short-term worry is a significant number of farmers are unable to meet their cash flow needs, Heck tells FOX Business. He says he’s been able to use hedging strategies to limit his losses, but knows some others farmers aren’t as fortunate. He fears they may soon lose their farms, or at least have to refinance their mortgages. Adding to that, Heck says he has heard China may cut back on direct purchases of U.S. soybeans by as much as 75 percent. The question he and other farmers now have to face: Will the Chinese buyers ever return?

…“As of the beginning of March, the Chinese are working to not ever have to buy U.S. soybeans until trade disputes are resolved,” says Burke in a telephone interview with FOX Business from Beijing. “They made every effort to purchase every last soybean they can find from Brazil. That allows them to get through November, and maybe December.”

Burke and other observers are just looking at the calendar, and using history as a guide. China turned so heavily to Brazil because poor weather in Argentina damaged the crop in that country. Next year, that will presumably be corrected, giving China more options. The more options it has, the fewer U.S. soybeans it’s likely to buy.

The impact is already being felt in price. “If there was no tariff, China would be buying U.S. soybeans at a premium to make up for the short crop in Argentina,” says Burke. “U.S. soybeans are usually the most expensive in the world. Now they’re the cheapest.” …

donald “Orange Excrement” trump branching out into comedy:

https://www.youtube.com/watch?v=PfoRDgJPCAg

Maybe the VSG trump and Bill Cosby can form a comedy duo in federal prison.

https://www.youtube.com/watch?v=FaLyasJPyUU

Not NAMING NAMES on the “numerous voices on this weblog arguing that US soybean prices will recover during the harvest period in the US when Brazilian soybean sources are exhausted.”??? This is precarious looking. Not even to mention perilous and disconcerting. Never thought I would see the day when Menzie got soft on us.

Somebody!!!!—-Quick!!!!! Squirt some liquid form testosterone in Menzie’s birthday noodles and birthday hard-boiled egg before this gets embarrassing and Menzie starts telling us public education is being killed by a “lone voice” in the Wisconsin state capitol.

Moses Herzog: I could name names, but then I would need to document (i.e., include hyperlinks to specific comments). That takes time. Gotta do real work…anyway, the offending parties know who they are. Hopefully, they have learned something (although I doubt it).

Real work?? never heard of it. Going to google it now.

@ Menzie

I think I found this “real work” stuff you referred to. It seems to be related to public education and public schools. If you buy into that whole improving society thingy.

https://www.youtube.com/watch?v=VBdyp1N8-k0

Sounds like a cult to me and I suspect it is a branch off of this NXIVM stuff they have been talking about in NYT. I’ve done my best to teach family members the “w” word is filthy and disgusting, but I can only influence them so much.

https://www.youtube.com/watch?v=ebanS7YL6V4

OK – I’ll bite. Take that Fox News story you linked to. It contradicts just about everything CoRev has claimed. But I betcha CoRev will claim it somehow confirms what he has been saying.

Now one could argue that Menzie is being unfair pulling out the one thing Fox News has gotten right this month!

Well Trump made it explicit at the UN. He will brook no multi-lateral agreements and embraces only protectionist policies.

Anyone who believes this man is a free-trader is as stupid as Trump is. At least he has age as a major reason for his lack of cognitive skills.

Did you read the details of the so called “free trade” agreement he just signed with South Korea? In Trump World more protectionism equals more free trade. It’s a step backward. But I’m sure PeakTrader will continue to believe that deep down Master Eleven Dimension Chess Grandmaster Trump is really working towards freer markets.

Was that why the UN was laughing at Trump yesterday – he did mention this trade deal with South Korea!

I wonder if the protectionist agreement that trump signed with South Korea will have to be voted on by congress.

OZ academic outlines perils of new cold war.

https://theconversation.com/the-risks-of-a-new-cold-war-between-the-us-and-china-are-real-heres-why-103772

From your link: During such periods of turbulence, it is not surprising that scholars and commentators look to the past for parallels to current crises. Not long ago, the trend, prompted by the centenary of the outbreak of the first world war, was to see Asia on the cusp of 1914-like conflagration. This proved a highly imperfect point of comparison.

Well, we better hope that the “1914-like conflagration” is an imperfect comparison. And if things do go that way those who live in the Land of Oz better hope you’ve got another General John Monash waiting in the wings. Monash was probably the only true military genius to emerge from World War I. You even named a university after him!

If there’s anyone out there who spent time in China (by “time” here, I mean 6 months or more) and has affectionate feelings to those days, I’m putting this link up (I am not the one who posted it in Youtube). Although this is an animated film, I think it is done relatively realistically, including both the visuals and the “vibes” Chinese will give you. It is called “Have A Nice Day” by Jian Liu. I’m assuming the city depicted is Nanjing or maybe a suburb near Nanjing. But it has a “general” Chinese look and feel to it.

This leans a bit to the “darker” parts of China, This isn’t the part shown in the 2008 Olympic brochures—but MUCH more realistic (it features crime, but in a semi-romantically portrayed way, such as you see in Tarantino films where you may find yourself “identifying” or connecting to “the bad guy” but it’s important to remember mainland Chinese people are pragmatic because largely the system and environment forces them to be pragmatic). I could go down the list of items visually presented in this film that I feel strong affection to (a good 40+ if I wrote them down while watching) as I tie them to certain times in my life, but if you’ve been there 6 months consecutive or more, you will know the things I am talking about. There are in fact many things I love that aren’t in the film–but for a feature under 80 minutes long, I had many more memories brought back watching this than I had expected going into it. Consider this an “educational” post:

https://www.youtube.com/watch?v=-8i-bYo9xKM

The discussion relating to sending children to USA and the South Korean cosmetic surgery were very realistic to my experience of interactions with Chinese. Young people’s unrealistic dreams of eventual wealth, along with the TV adverts selling them. Visiting Hong Kong is also “a thing” to Chinese and also, believe it or not, Bangkok is a popular destination for weddings which also includes visiting the gender modified “adult” workers, which for Chinese seems to be like some kind of “freak show” amusement park experience that many of them openly desire visiting, nearly like an American’s curiosity to Vegas (admittedly a bad analogy on my part, but it’s hard to think of a parallel example)

https://www.youtube.com/watch?v=UyBw_dStqrg

The irony of this, is that one of the very few things trump is right on, is Germany’s dependance on Russian energy. This is a FACT and it is an OBJECTIVE FACT which cannot be denied if we look at the pipelines and percentage of Russian gas going to Germany.

https://www.politico.com/magazine/story/2018/07/11/what-trump-should-have-told-germany-about-russian-gas-219000

Now if Democrats (of which I consider myself one) want to jab Trump and laugh at him for asinine statements at the UNGA, I am all for it. But if they wanna criticize Orange Excrement for pointing out reality of the European Theatre and what could happen if Russia turns the natural gas spigot off, then Democrats can no longer cry “foul!!!” to the VSG trump on the ignoring of objective realities, as Democrats themselves then take part in it.

https://en.wikipedia.org/wiki/European_theatre_of_World_War_II

“But if they wanna criticize Orange Excrement for pointing out reality of the European Theatre and what could happen if Russia turns the natural gas spigot off, then Democrats can no longer cry “foul!!!” to the VSG trump on the ignoring of objective realities, as Democrats themselves then take part in it.”

Historical facts:

You understand that Russia has been providing NG already for West Germany during the cold war, that Germany inherited additional contracts of the GDR in 1990?

During almost 40 years Russia has not once used the NG as weapon agianst Germany. In contrast, Ukraine and to lesser extend Poland used their pipelines as leverage against Russia a few times – with clear implications for Germany..

Political/economic consideration:

As long as Ukraine could be considered a reliable partner, the current pipelines would be sufficient, with the situation in the Ukraine it does not make longer senes for Germany to accept the uncertainty. Add complains of customers, that Ukraine does a bad O&M job in case of the pipelines but gets around 1.5-2 billion USD per year, the 10 billion EUR for NS2 is economically a bargain. 2019 the pipelines will be switched off or will see least a 75% reduction of NG flow. That Poland, the Ukraine and the USA are not happy is understandable, who likes to lose leverage?

Physical facts:

The LNG volume availableon the international market is not sufficient to cover German demand.

If you want to make a CONSTRUCTIVE critique, you have to provide an alternative.

It’s amazing to see these kinds of comments: “We must not fool ourselves again. High intensity geopolitical competition is increasingly likely. Unless the US and China can step down from the escalatory cycle they are on, we are sliding into another period in which great power rivalry, militarised competition and dangerous nationalism once again dominate the region.” (From Not Trampis’ link)

Some how they have missed the past decade+ where China has increased its “militarised competition and dangerous nationalism ” in the region. It’s not new, but an ongoing struggle.

This trade war is just another example of what has been going on. When will it end? Only after the parties get together and negotiate a new agreement. Then the process will begin anew.

CoRev The issue is whether the “Thucydides Trap” is inevitable or if it can be avoided. You seem to believe the former.

https://thediplomat.com/2015/05/the-real-thucydides-trap/

BTW, Thucydides is required reading at the US military academies. You should give it a try.

Too busy skewing Kennan’s “containment theory”. Thucydides was lost on early cold war US leadership acting like Athens wrt Vietnam (Korea as well) …………… good thing the Soviets were not hard as Spartans!

Peloponnesian Wars was required in Air War College in the late 80’s.

Not making much of an impression today: Syria looks like Syragusa (Vietnam).

Good thing Putin is not hard like a Spartan.

And the precipitating cause of the Peloponnesian War was the way Athens directed the evolution of the Delian League into the Athenian Empire. Athens went to war with one of its clients over an issue (a silver mine) that was far removed from the original purpose of the Delian League; viz., defense against the (by then) defanged Persian Empire. That prompted Sparta to intervene. Lots of modern day warnings there.

High stocks imply low sales. So low prices do not equate to low sales or low revenues, for now. The price differential is not being arbitraged away because producers are not selling, except in distressed cases, and it’s those distressed sales setting the price.

However, the post correctly notes that this storage is offset by a need to finance cash flow in the interim.

If this goes on another six months, then things start getting ugly.

Wow – someone has bought into the CoRev’s storage model! Dude – there has been so much debunking of what CoRev claimed. Try paying attention next time!

Pgl, commodity storage is not a model it is reality. Look up the term Granary. Farmers use it. Resellers use it. Governments use it. http://www.learneconomicsonline.com/bufferstock.php Even Menzie understands its use. He brought up terms such as carrying costs, opportunity costs, etc. Where have you been?

BTW, care to elucidate: ” Dude – there has been so much debunking of what CoRev claimed. ” or are you going to just run again?

Lord CoRev – no one denies that there is something called storage. I was referring to your upside down inside out attempt to model this stuff out. Yea – we get you want to deny your past incredibly stupid statements. After all – they are legendary. But it is really funny that when Fox News writes just the opposite of your claims, this is the one place where Fox News got something right.

“The price differential is not being arbitraged away because producers are not selling, except in distressed cases, and it’s those distressed sales setting the price.”

how sure are you of this statement? from what i gather, the chinese are explicitly not purchasing us stocks. is it that there are no producers selling, or that the chinese and other buyers (china could be influencing other countries as well?) are simply not interested in purchasing at the current price? in most markets, prices fall because buyers refuse to purchase rather than producers refuse to sell.

Baffs –

Given the usually high level of inventory, we can say that the market is not clearing. Why not? It could be a lack of buyers or a lack of sellers. The current price already factors in China’s tariffs, so price should not be an obstacle to China sales. Moreover, European buyers of, say, Brazilian or Argentine soybeans should be more than willing to sell those on to China and buy US soybeans at a 20% lower price. There should be arbitrage, if indeed, soybeans are a fungible commodity.

But we’re not seeing this. Instead, the US harvest appears to have largely been put into storage and producers are holding out in the hope of a price recovery. The cost of holding this position is the associated debt, but if you’re paying, say, 10% for storage and capital per year, then it makes sense to hold out and hold for better conditions. That appears to be the case.

Notwithstanding, there will always be a few sellers for one reason or another, and these may be setting the price, that is, these are distressed sales from producers unable to wait, for one reason or another, who are willing to accept a low price.

For the moment, it will come down to a cost of debt issue, since no doubt this crop is serving as collateral for related loans. But if this drags on another six months, then producers will be forced to both sell at a large discount and pay for six month’s storage. It could be a real train wreck.

Meanwhile, traders must be looking to arbitrage volumes destined for non-tariffed markets to China, with US product displacing South American exports. These are large volumes, but in theory, it should be happening.

So, for the moment, US producers have large paper losses, but they appear to be for the moment not yet realized. The underlying position, however, is not sustainable.

“how sure are you of this statement?”

I get the sense that Princeton Steven understands this issue even less than he understands the externality issue. Maybe he can find some Wikipedia quote for us!

@ Menzie

Off-topic: Menzie I know this is “putting you on the spot”, and no joke a little unfair. But if you have an pragmatic “matter of fact” opinion on who will win the Evers vs Walker race I think it would make a couple fun posts between now and November.

We know you are stupendous at math (enough to make me damned jealous and resentful of you in that department), and we also know Nate Silver has always (in essence) taken an amalgamation of the different polls to make his predictions. You know which polls count in Wisconsin and you definitely have the math skills to crunch out the numbers.

[ said the man inviting the sage to offer his head on the chopping block ]

Listening to Trump’s press coverage. OK – this man is babbling BS as usual. But he just made a statement that soybean prices are up and farmers will do great. I bet CoRev will love this comments but c’mon man. We have either an idiot or a blatant liar for a President!

pgl Agree. Trump was rambling and babbling. He also claimed that he got 52% of the women’s vote. Another lie…and a very telling lie. This isn’t the first time he said this. The WaPo fact checked it before. Trump got 41% of the female vote. The 52% number comes from the percent of WHITE females who voted for him. Apparently he only worries about white votes. Very telling.

sluggsy,

Give him a break he is over 72 years old. He can’t be expected to remember exact things like that!

CoRev A few days ago I told you that the US-Mexico trade deal was on life support. Well, time to call the coroner. See Barkley Rosser’s excellent post:

http://econospeak.blogspot.com/2018/09/the-us-mexico-trade-deal-dies.html

In this case death is a good thing.