Q/q Chinese growth in 2018Q3 is estimated at 1.6% (not annualized), after downwardly revised 1.7% rate in Q2. Y/y growth was 6.5%. [1] [2]

There are two things to remember. First, reported GDP growth is implausibly smooth; even so, this is not proof that GDP is overstated. There is widespread belief that services are undercounted; hence the level of GDP might be higher than reported, even if the growth rate is lower. On this second count of growth rates, we might profitably refer to alternative estimates.

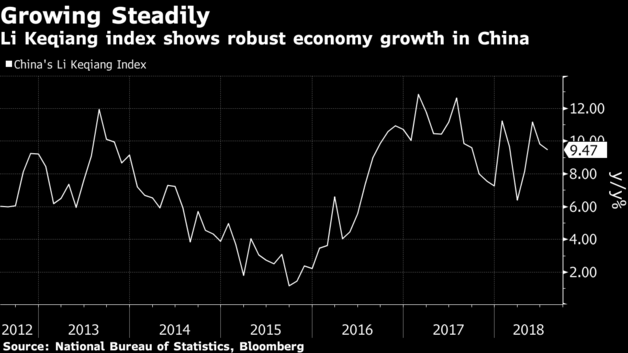

The Li Keqiang index (40% electricity consumption, 40% outstanding loan growth, 20% rail freight) is the most common reference. This index provides a different perspective.

Source: Ailing Tan.

Fernald, Malkin and Spiegel (2013) show that the Li Keqiang index correlated well with y/y GDP growth through 2012. If there has been a subsequent tendency to overstate GDP growth, then a deviation should have shown up since then.

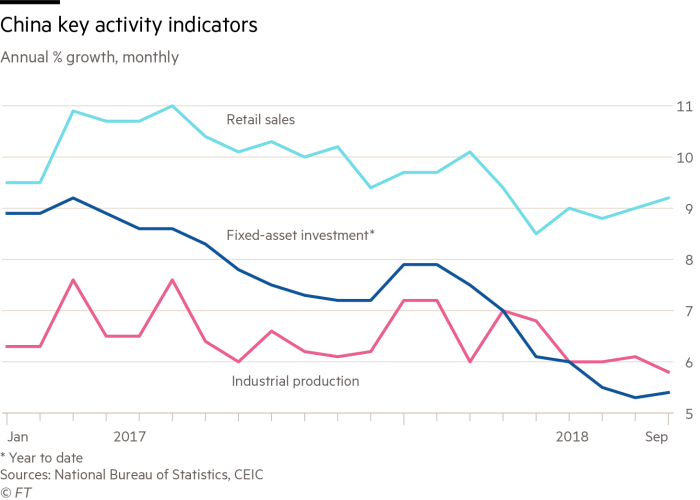

Here are some other indicators.

Source: FT.

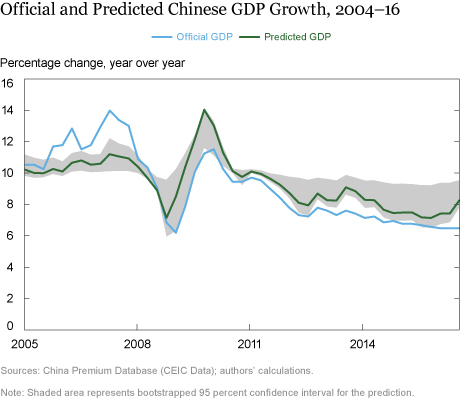

Finally, it would be nice to see what a more recently suggested proxy measure — satellite based measurement of light generation (i.e., luminosity) — indicates. Clark, Pinkovskiy, and Sala-i-Martin (2017) use such a measure, and develop an alternative estimate of GDP growth for the 2004-16 period.

Source: Clark, Pinkovskiy, and Sala-i-Martin.

Owyang and Shell (2017) also examine luminosity data. Unfortunately, I haven’t been able to find a recent luminosity-based estimate of Chinese economic activity.

So, based on the Li Keqiang index (as estimated at mid-September) it does look like the floor is not falling out from under the Chinese economy. On the other hand, I would never disagree with Eswar Prasad, who warns in FT:

“China’s slower but still strong headline growth masks rising domestic and external vulnerabilities that are likely to presage a further growth slowdown in the absence of concerted policy measures.”

I have faith in the ability of the Chinese policy authorities to sustain growth in the short term (likely at the expense of incurring a buildup in already high debt levels, over the longer term).

Anyway one slices the evidence presented – China has an impressive growth rate. But wait – you are not presenting the Kudlow metric. The stock market is down. Oh noooo – China’s economy is terrible!

pgl,

You are correct: China has an impressive growth rate. Over the past decade the average Chinese factory worker has seen about a 64% rise in wages… to a whopping $3.50 per hour! (Chinese factory workers are now getting paid more than ever: Average hourly wages hit $3.60 last year, spiking 64 percent from 2011, according to market research firm Euromonitor.) https://www.cnbc.com/2017/02/27/chinese-wages-rise-made-in-china-isnt-so-cheap-anymore.html

We should be more like the Chinese! Damn, U.S. workers pay only increased 12% or something like an additional $2.60 per hour. Oh wait, the U.S. worker’s increase was about 75% of the total that Chinese workers made.

You can seen on whose backs the Chinese government has increased its wealth.

Bruce Hall: And here I thought it was the transfer of labor from the rural sector to the urban sector, increasing the marginal product of labor, a la Lewis/ Fei-Ranis model. Silly me.

Menzie,

Turns out that “made in China” is not so cheap anymore as labor costs have risen rapidly in the country’s vast manufacturing sector.

Chinese factory workers are now getting paid more than ever: Average hourly wages hit $3.60 last year, spiking 64 percent from 2011, according to market research firm Euromonitor. That’s more than five times hourly manufacturing wages in India, and is more on par with countries such as Portugal and South Africa. https://www.cnbc.com/2017/02/27/chinese-wages-rise-made-in-china-isnt-so-cheap-anymore.html

I’m sure that workers moving from local poor farms to factories are getting a substantial raise… if by substantial you mean up to $3.60 per hour. However, that’s paltry when compared with the overall wealth these highly paid workers are generating for their government and corporate/feudal overlords who use this low cost labor to be very price competitive. Perhaps the U.S. should follow suit? Strip away benefits and protections and make our labor “competitive” with those Chinese essentially indentured servants? Amazing what you can do with communism and dictatorial rule.

Also, I seem to remember sometime around 5th grade that a big percentage increase of a small base can be quite a bit smaller than a small percentage increase of a large base.

Interesting article in Forbes: https://www.forbes.com/sites/katinastefanova/2017/12/19/chinas-rising-wealth-gap-and-implications-to-markets-and-the-world/#64d2e1142311

Bruce Hall: I thought we were talking about income increases, not comparative advantage. I suggest you think about PPP calculations, and then look at about a gazillion articles on the worldwide decline in intercountry income distribution.

If you want to say, we could have higher wages if we got rid of monopsony power, I’m with you; although the gain in the US from such an effect might be bigger than in China in dollar terms…(i.e., I think monopsony power in the US is part of the reason for the decline in labor share in the US).

“I seem to remember sometime around 5th grade that a big percentage increase of a small base can be quite a bit smaller than a small percentage increase of a large base.”

If I make $20 an hour and someone else gets $4 an hour and if my % is 10% and his is 20%, you may have a point. But then you also have no clue about US economics. Real wages – which is what matters here – are not rising nearly that fast. Over the last decade we have not seen anything close to a 10% increase in real wages. So redo the example assuming I got only a 1% raise.

Yea – we will wait as we know first grade arithmetic is not your forte. Economic data clearly is not.

Bruce Hall Instead of articles in CNBC and Forbes, let me recommend a more serious treatment of global income inequality:

https://www.amazon.com/Great-Escape-Health-Origins-Inequality/dp/0691165629

The author, Angus Deaton, won the Nobel Prize in economics a few years ago (2015).

Productivity growth has been slow in low wage U.S. industries. For example, in the fast food industry, productivity growth increased less than 0.5% a year over a recent 40 year period, while the real minimum wage declined over 30% and low wage workers are getting less in wages and benefits at the end of the 40 year period than at the beginning.

Productivity will continue to increase in low wage industries. However, it can increase at a faster rate.

You seem to have even a weaker grasp of basic growth theory that PeakTrader. Which is amazing since Peaky cannot remember what he used as a text book when he took those classes in Colorado.

It’s easy to achieve a high GDP growth rate when a country is very poor, like China when a large part of the population was living on less than $2 a day.

Oh wow – maybe in the last 20 years, you may one day figure out what the Solow growth model looks like! When you do – please help Bruce Hall out as he is even more clueless than you are!

Of course, in the case of China, it’s poor quality growth.

Why is it poor quality? Because it is not going to their white population?

Peak, may be you could explain to Trump that he should not be too worried about threats from a poor country with poor quality growth.

Benlu, the communist Chinese are stealing and coercing the hard work and big risks of foreign intellectual property to dominate future industries at lower cost, but at higher Chinese wages to avoid the Middle Income Trap, and making it harder for foreign firms to compete to gain market share in China’s consumer market.

Navarro estimates 2 million good U.S. jobs are lost – high tech jobs are being transferred to China. It slows U.S. innovation that benefits the global economy. Stopping the theft and coercion of IP and China opening its market to fair competition will increase U.S.production and exports, to raise U.S. GDP growth, tax revenue, and shrink the trade deficit with China.

” the communist Chinese are stealing and coercing the hard work and big risks of foreign intellectual property to dominate future industries at lower cost”

Seriously? We used the hard work of the Japanese and Germans when making cars here in America. I guess they should sue Ford and GM is your weird view of the world. IP is created all over the place and in a truly competitive world, it is used universally. But leave it to you to say China cannot participate.

And then you tout the fact that our manufacturing wages are higher than theirs. Why is that Peaky? Think about it in the standard neoclassical production function. Oh I’m sorry – you do not know what that means. OK, I will say it SLOWLY. Try to keep up. We have a somewhat higher capital to labor ratio but China is catching up on that score. We also used advanced technology that we in part stole from other nations. But China is not allowed to use the same technology? Yea – you would say that as it is the core of your blatant racism.

Peak, ask the victims to go to US or China court to prove thefts of any US IP, otherwise you are making baseless accusations.

speaking of coercion, it appears one is required to sign a nondisclosure form if one is to keep a job in the trump white house. i assume this type of coercion is acceptable to peak trader? after all, its only a government job that is at stake here.

This is a very good post, one of Menzie’s better ones. I have a lot of affection to the country of China (there is some “love/hate” there, but affection ends up carrying the day). I see these lower GDP numbers as good news. Now why would someone who claims he overall likes the people of China think lower GDP numbers are good news?? Because I think, in part, it means the numbers are more realistic and more accurate and there is less fictionalizing of numbers by provincial heads and the Politburo. This will serve them well if they keep going down this road and not making up Economic barometer numbers that most educated Chinese are not buying anyway.

“PeakTrader

October 19, 2018 at 1:27 pm

Productivity growth has been slow in low wage U.S. industries. For example, in the fast food industry, productivity growth increased less than 0.5% a year over a recent 40 year period”

Gee Peaky – low productivity growth in a service sector? I see you never heard of William Baumol. I guess he explanation of this was something you skipped out on at your junior Ph.D. program in Colorado!

It’s amazing how the liberal/socialists on this blog defend communist and socialist regimes, along with making ridiculous and irrelevant assertions.

IP is the lifeblood of the U.S. economy, which leads the world in new ideas, in its firms and universities, and gives the U.S. a competitive advantage.

Some believe China shouldn’t pay for the research and development. And, U.S. firms can be out priced and killed off.

You can’t argue with the liberal/socialists, because they really don’t know what they’re talking about, including when they support my statements by believing they’re arguing against them!

“IP is the lifeblood of the U.S. economy, which leads the world in new ideas, in its firms and universities, and gives the U.S. a competitive advantage.”

Lord – you really do not get the real world. I just noted to Benlu a company called Celgene. How did it get so profitable? By taking the research from the local university and selling goods for 25 times the product price. And how much did they pay the local university – not a damn thing. Talk about stealing IP. Of course its CEO is a white dude running as a Republican so I bet this clown is your hero. And yea – he uses transfer pricing manipulation to evade taxes so you must really love this cheat.

PeakTrader What’s amazing is how ignorant you are of basic economic facts. How ignorant? Let me count the ways:

(1) The US record of IP theft isn’t exactly snow white pure. It wasn’t until the turn of the last century that the US even recognized foreign IP rights. A lot of things that drove our industrial revolution were stolen; e.g., the telegraph, the steamboat, locomotives, gasoline engines, the incandescent light bulb, and a few thousand other things. So we should be a little more humble about our own record before we throw stones.

(2) China ranks second in the number of patents granted each year, so they aren’t exactly slouches. Are you really sure that US companies aren’t stealing Chinese IP???

(3) Most Chinese IP theft is copyright theft of movies and digital music. Do you really want to go to the wall defending some Hollywood or music mogul’s monopoly rights to a 75 year old movie or song??? Do you really care if the Chinese make pirated copies of the next Vin Diesel “Fast & Furious” movie? And this gets to the next item.

(4) Patents and copyrights are legally sanctioned and temporary monopoly licenses. The economic rationale for granting those monopoly rights is to allow the owner of the license a temporary windfall in order to spur future R&D and innovation. The key here is that the license is supposed to be temporary, not indefinite and practically forever. Permanent monopoly rights discourage new R&D and innovation. Permanent monopoly rights also hurt future economic growth because of the way monopolies work. If you ever took Micro 101, as you claim, then you would know that monopolists restrict supply; i.e., the owners of patents make money by restricting the use of the patent, which hurts economic growth. That’s why a monopoly license must be temporary. Look at how US patent and copyright laws have evolved. The length of our patent and copyright licenses has become an international embarrassment. I’m very sympathetic with companies whose recent patents have been stolen because that hurts future R&D; but I have zero sympathy with US companies whose 20+ year patent and copyright licenses have been stolen. Those kinds of companies are simply bandits in power suits who expect US taxpayers to act as accomplices in their crimes. To paraphrase one of Trump’s favorite lines WRT those corporate criminals: “Locke ’em up!”

(5) You also don’t seem to understand the difference between outright IP theft and simple business decisions to make a company’s IP available to the Chinese in exchange for access to the Chinese market. I have some news for you: You don’t own those patents anymore than the Chinese. It’s not your place to tell a company that it can’t make it’s IP available to the Chinese. You have zero say in the matter. Mind your own business.

2slugbaits, obviously, you chose to remain ignorant and wrong.

Those are the same talking points on justifying massive theft and coercion of IP I responded to before, except for Chinese patents.

India awards many more engineering degrees than the U.S., but the average quality is much lower.

PeakTrader You never really respond to anything; you just repeat your same old garbage. Instead of actual economic arguments we get a boatload of “Thus Spoke PeakTrader” nonsense announced in your best ex cathedra voice. Companies are not being “coerced” to hand over IP. Companies doing business in China are managed by big boys and girls. They understand their business better than a failed banker. If those companies are making mistakes in dealing with China, then that’s their shareholders’ problem, not your concern. No one died and made you Lord Protector of Apple. Get over it.

if a company trades IP rights for business in china, where is the theft? i don’t see you complaining about the profits these companies are making while gaining access to a very large consumer market?

it is a distinct possibility that preaktrader is simply part of the russian troll farm used to incite social media in the states. his contradictory positions indicate he has no clear position, other than a voice of complaint.

peak, once again 2slugs gave you a free lesson in economics. please keep your trap shut and learn the lessons, you will be better off in the long run. unless you are simply a russian troll farm.

“India awards many more engineering degrees than the U.S., but the average quality is much lower.”

BS. Do you even know anyone from India. The ones I know are very bright. Of course you would not know as you would run away as soon as you saw their darker complexion.

“India awards many more engineering degrees than the U.S., but the average quality is much lower.”

engineering innovation is not a function of the number of degrees, but the quality of your top degrees. that is where the innovators reside. and the IIT’s in india are top quality programs, which produce quality engineers. i won’t argue that india produces a lot of low quality engineers-and they are trying to fix that problem. it was the same path we were going down in the us, where the for profit tech colleges were providing poor tech education as well-resulting in a significant buildup of student debt and default in those for profit schools. yet we still have a political party trying to protect those for profit interests. at any rate, not sure why peak was trying to denigrate the indian engineers.

Peak,

“Some believe China shouldn’t pay for the research and development. And, U.S. firms can be out priced and killed off.”

Could you itemise the specific US R&D that China should pay for?

Many commissions have estimated monetary amounts of China’s massive IP theft.

It’s also estimated China has an army of 100,000 involved in IP espionage, and is by far the largest robber of IP.

Here are some examples:

https://www.theamericanconservative.com/articles/the-unreal-scope-of-chinas-intellectual-property-theft/

The examples in the article just show that the right course of actions against IP thefts is to seek legal redress in the courts. Applying tariffs across the board is very crude and unnecessary hurts innocent exporters and importers from both countries.. May be you could make trump team understand better.

Granted. Note even this right wing nutjob article admitted the following:

‘it’s important to note that much of China’s IP theft isn’t entirely illegal. The Chinese government forces foreign companies to partner with Chinese companies in several key industries. Hence, many U.S. businesses have begrudgingly handed over their IP in order to gain access to the Chinese market.’

Handed over? Strange description for a mutually beneficial business deal. Now if you see a Starbucks in China – guess what? Its owner pays royalties = 6% of sales back to the US parent. Of course I don’t drink their overpriced weak tea coffee as the only theft going on there is out of your pocket.

Maybe a meal at a Chinese run McDonald’s which has to pay royalties = 5% of sales back the US parent.

If Peaky calls this IP theft – he is dumber than we give him credit for.

Maybe, you can understand proving espionage in court is not easy, although most of the worldwide cases discovered by the FBI lead to China and it’s just the tip of the iceberg.

Moreover, the economic damage is often far greater than the fines.

The solution is a serious crackdown by the communists. I wouldn’t count on that.

so peak, you dislike the chinese forcing a company to share ip in order to access the marketplace. what about here in the us, where a company can force a worker to sign a concompete clause, and keep that technical engineer from pursuing work in his field of expertise for years if he leaves the company. even worse, if he leaves the company because they are simply bad people and he wants a better work environment. do you support those noncompete agreements as well? is it ok for a company to silence a workers innovation and knowledge for years with a noncompete clause?

US should give a list of solid cases of all discovered IP violations to be convincing that US suffers great losses due to IP thefts, not just a few cases which were already redressed in court.

Many commissions and you point to only one which happens to be some right wing nutjob shop. Lord Peaky – this kind of intellectual garbage would not even make it to Fox and Friends!

Here in New York we have to endure the New Jersey Senate campaign between the two Bobs. The GOP candidate made a fortune running Celgene whose product price is 25 times its production cost. Why – because their IP is protected from competition. I bet people like Peaky think that such incredible rip offs are the American way. Of course Celgene evades US taxes by diverting 80% of their profits offshore mainly to Switzerland. Of Peaky admires this kind of tax evasion too.

Pgl is full of ignorant comments, including about the large numbers of Indian engineers.

A College Education Without Job Prospects

November 30, 2006

“The job market for Indian college graduates is split sharply in two. With a robust handshake, a placeless accent and a confident walk, you can get a $300-a-month job with Citibank or Microsoft.

With a limp handshake and a thick accent, you might peddle credit cards door to door for $2 a day.

But the chance to learn such skills is still a prerogative reserved, for the most part, for the modern equivalent of India’s upper castes — the few thousand students who graduate each year from academies like the Indian Institutes of Management and the Indian Institutes of Technology.

Their alumni, mostly engineers, walk the hallways of Wall Street and Silicon Valley and are stewards for some of the largest companies.

In the shadow of those marquee institutions, most of the 11 million students in India’s 18,000 colleges and universities receive starkly inferior training, heavy on obedience and light on useful job skills.

But as graduates complain about a lack of jobs, companies across India see a lack of skilled applicants. The contradiction is explained, experts say, by the poor quality of undergraduate education.

Teaching emphasizes silent note-taking and discipline at the expense of analysis and debate.

“Out! Out! Close the door! Close the door!” a management professor barked at a student who entered his classroom at Hinduja two minutes late.

Soon after his departure, the door cracked open again, and the student asked if he could at least take his bag.

The reply: “Out! Out! Who said you could stand here?” A second student, caught whispering, was asked to stand up and cease taking notes.

“When we are raising our children,” said Sam Pitroda, a Chicago-based entrepreneur who is chairman of the Knowledge Commission and was an adviser to Prime Minister Rajiv Gandhi in the 1980s, “we constantly tell them: ‘Don’t do this, don’t do that. Stand here, stand there.’

It creates a feeling that if there is a boundary, you don’t cross it. You create boxes around people when we need people thinking outside the box.””

PeakTrader: You couldn’t find a more recent article to serve as a representation? That article is 12 years old.

if you notice, most of peaks references are a decade plus old-on any topic. its like he has not absorbed any new knowledge since the reagan years. which is why he is still fighting the cold war-just looking for a new enemy these days.

baffling: At least it beats Trump, who’s referring to the 1980’s for economics (China = Japan, etc.)

Have you noticed that most of his links are some Google search? Of course when one opens the link, one finds some insanely stupid rant from some highly unqualified nutjob. I seriously think Google has rigged Peaky’s comments to send the dumbest links ever to him.

2006? LOL! Lead line:

““The job market for Indian college graduates is split sharply in two.”

One can say the US education system is also split sharply in two. I guess that is why some of us got a Ph.D. and you got something you cannot even define. BTW – there are a lot of high paid people from the Indian education system as your very outdated article notes.