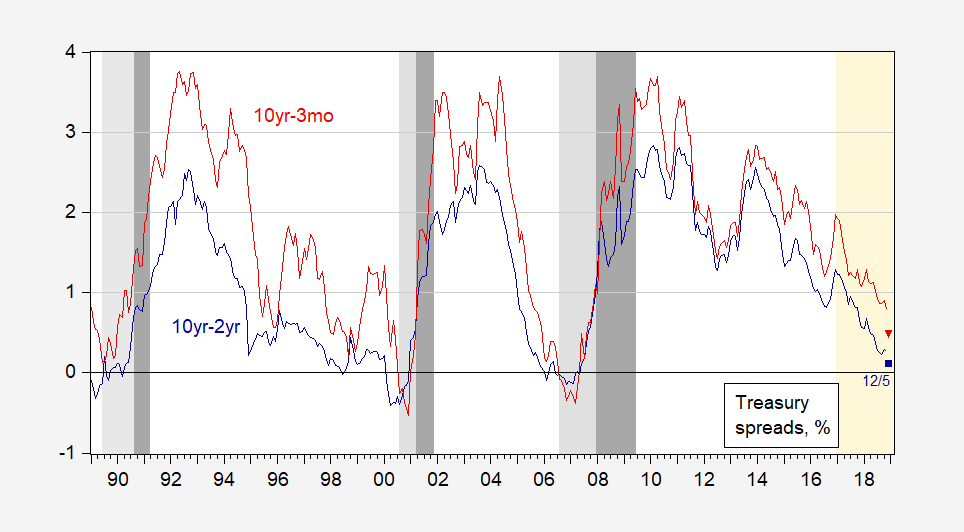

That’s the amount of time between 10 year-3 month yield curve inversions and the beginning of the subsequent NBER-dated recession (these are the three recessions in the Great Moderation period). This is shown in Figure 1.

Figure 1: 10 year-3 month Treasury yield spread (red), and 10 year-2 year spread (blue), %. December observations are for 12/5. NBER dated recessions shaded dark gray. Light shading denotes beginning of inversions of the 10yr-3mo spread onward. Source: FRED, Bloomberg, NBER, and author’s calculations.

It looks like we are on pace for the 10yr-2yr inversion I predicted in this post. For the 10 year-2 year spread, the corresponding numbers are 19, 13, 22 months.

Interestingly, the 10yr-3mo spread did not actually invert before the 1990-91 recession (the gray shading starts from the minimum, in 1989M06).

More formal econometric evidence on spreads and recessions, see Chinn-Kucko.

Update, 12/6 7:30PM Pacific: The Richmond Fed questions the conventional wisdom, focusing on the downward trend in the estimated term premium:

The recent flattening of the yield curve has raised concerns that a recession is around the corner. Such concerns stem partly from the fact that yield curve inversions have preceded each of the past seven recessions. However, other factors affect the yield curve’s shape besides the expected future health of the economy. In particular, a low term premium — as has been observed in recent years — makes yield curve inversions more likely even if the risk of recession has not increased at all.

Menzie, I assume others have been sending you emails or letting you know, the site keeps giving some kind of a “port 80” error and mentioning an Apache server or something. It’s been an intermittent issue roughly the last 3 days. Not the end of the world but something you may want to look into or get someone to troubleshoot. Right now, it’s ok, but I would say roughly the last 72 hours it been “touch and go” on the links here.

I think these last 2 days have been quite eventful, You had the 800 point drop (that was Monday right??) then just tonight you had the S&P 500 mini-futures contract have the bottom fall out from underneath it. Some have mentioned the curve inversion, and some have mentioned the Huawei CFO detainment in Canada (she’s female). The question is, is it a legit detainment?? They are talking about sanctions in Iran—but it has the bad odor of being connected to the trade talks.

https://www.bloomberg.com/news/articles/2018-12-05/huawei-cfo-arrested-in-canada-as-u-s-seeks-her-extradition?srnd=premium

https://www.bloomberg.com/news/articles/2018-12-06/s-p-500-futures-plunge-leaving-traders-grasping-for-reasons?srnd=premium

I’m not against these things if they are for legitimate reasons, but if the Huawei CFO is being used as a “bargaining piece” this is sick, it’s immoral and it needs to be stopped by whoever the proper USA parties would be. China has done this before with mostly Chinese-blooded expats or citizens of other nations who happen to be of Chinese ethnicity, and therefor the Chinese government believe will garner less sympathy from Western citizens (no backlash). We expect this from the Chinese government leaders and not much we can do about it. When we copy this type of immoral behavior we lower ourselves. To compete in this world, we needn’t bring ourselves down to the lowest moral common denominator.

It should be added that in the end this will make America look weak. Why?? Because most likely the USA or Canada will blink before China does and it makes us look like a laughingstock in the process.

https://www.bloomberg.com/opinion/articles/2018-12-06/huawei-arrest-gives-u-s-leverage-over-china-on-technology

https://www.bloomberg.com/news/articles/2018-12-06/how-huawei-arrest-extends-troubled-history-with-u-s-quicktake?srnd=premium

I should also add, punishing Hong Kong for Beijing policies is dumb-ass as dumb-ass can get. You’re punishing maybe the biggest zone or nesting bed for the pro-democracy movement in China. Who in the hell is that supposed to help?? Beijing would laugh it off and say “thanks Bruh” to donald trump.

https://www.bloomberg.com/news/articles/2018-12-05/hong-kong-fears-trump-will-trigger-end-to-special-trading-status?srnd=premium

I just had SMOKED cheddar cheese from Wisconsin with some off-brand saltines. So GOOD. Friends….. sometimes it’s the simple things in life that bring joy. It would be much better with wine or hard liquor. But paupers can’t be choosers, paupers can’t be choosers.

I have a relative who is so dumb, she signed something to get her own paycheck that was called an “advance”. I doubt she read it. She just wanted the paycheck they promised and when was asked to sign for it, she signed it. Now I don’t think that had any connection to this story, but it’s interesting. This is a girl who has graduated college, and was put in “gifted” classes when she was in grade school. Major?? A degree in English.

(Why would someone who majored and has a degree in their own native language, and knows the importance of oral and written communication, sign a contract to get cash handed to them, that they haven’t even read the contract?!?!?!?! Your guess is as good as mine, and it’s frightening for me to to be conscious of the fact I’m related to this woman).

People often sign things where they are promised money (both large payments and small) and never have any idea what they are signing. Folks, it is dangerous as hell to sign anything you have not read—for any kind of cash payment or loan. I think if you read this story, it will give you a small idea why you should never sign things that you haven’t BOTH read and FULLY understand:

https://www.bloomberg.com/graphics/2018-confessions-of-judgment/?srnd=businessweek-v2

“Payday loans” have ALSO ruined many lives in many states. Don”t do it

The 1991 recession data is no surprise, as it was linked to an unexpected and short oil shock related to the Kuwait war. It wasn’t a normal recession, as such.

If you look at the time frame, the probabilities for a complete wipe-out of the Republicans is 2020 is pretty high. As it is, Trump’s popularity is consistent with an administration in a recession. If the US actually finds itself in a recession, it could be much, much worse.

@ “Princeton”Kopits

Any original content numbers on the Republican members of House of Representatives “death count”??? You’re so good at those.

https://www.youtube.com/watch?v=_G4tGg86xPk

“The 1991 recession data is no surprise, as it was linked to an unexpected and short oil shock related to the Kuwait war. It wasn’t a normal recession, as such.”

More fact free babbling from Princeton Steve. C’mon Steve – are you incapable of providing ANY data:

https://fred.stlouisfed.org/series/DCOILBRENTEU

Yes oil prices temporarily shot up in 1990. This is certainly not the first time this ever happened. Note we had an oil price spike after 2009. And gee we had economic growth.

Your macroeconomic “skills” are not going to get you a job at the economics department at Princeton University. Get over it!

James Hamilton

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.892.5796&rep=rep1&type=pdf

“1990-1991: First Persian Gulf War. By 1990, Iraqi production had returned to its

levels of the late 1970s, only to collapse again (and bring Kuwait’s substantial production

down with it) when the country invaded Kuwait in August 1990. The two countries

accounted for nearly 9% of world production (see Figure 15), and there were concerns at

the time that the conflict might spill over into Saudi Arabia. Though there were no

gasoline queues in America this time around, the price of crude oil doubled within the

space of a few months. The price spike proved to be of short duration, however, as the

Saudis used the substantial excess capacity that they had been maintaining throughout the

decade to restore world production by November to the levels seen prior to the conflict.

The ninth postwar U.S. recession is dated as beginning in July of 1990.”

Why does Menzie tolerate you, pgl? What do you add? Absolutely nothing, just the continued destruction of this once noteworthy blog.

Gee Gilligan! You find something that noted what I noted. Yes – oil prices doubled. I said that. Dr. Hamilton gave us the reason – Kuwait oil production fell. Good analysis.

But oil price increases always lead to recessions? Really?

Why do we tolerate YOU?

The abstract of the article that Dr. Hamilton linked to by Princeton Steve included:

“Key post-World-War-II oil shocks reviewed include the Suez Crisis of 1956-57, the OPEC oil embargo of 1973-1974, the Iranian revolution of 1978-1979, the Iran-Iraq War initiated in 1980, the first Persian Gulf War in 1990-91, and the oil price spike of 2007-2008. Other more minor disturbances are also discussed, as are the economic downturns that followed each of the major postwar oil shocks.”

Now how could Princeton Steve write this?

“The 1991 recession data is no surprise, as it was linked to an unexpected and short oil shock related to the Kuwait war. It wasn’t a normal recession, as such.”

It was abnormal? Excuse me but Hamilton is noting we had recessions in 1974, the late Carter years, and starting in December 2007. But 1991 was different? WTF?

BTW – we also had Ford’s WIN (tight monetary policy to fight inflation), Volcker I (tight monetary policy to fight inflation, and tight money before the Bush41 recession. But I guess Princeton Steve thinks monetary policy played no role here? Just wow!

If Princeton Steve had an ounce of research skills, he might have shared with us this 1993 analysis of the 1990/91 recession from Carl Walsh of the SF Federal Reserve:

https://www.frbsf.org/economic-research/files/93-2_34-48.pdf

Yes – the Gulf War is mentioned. But Walsh attributes much of what happened in this short recession – which BTW was rather prolonged in terms of employment staying weak (same story for the 1st Bush43 recession) to tight monetary policy.

Everyone who knows US macroeconomic history knows this. But not Princeton Steve.

Steven,

While undoubtedly the oil price spike with the First Gulf War aggravated the 90-91 recession, it actually started in July 1990 before either the invasion or the oil price spike. One can debate what triggered it (most likely it was tightening monetary policy, although the Bush tax increase may also have played a role), but you happen to be dead wrong that it was due to the oil price spike.

BTW, the first economic commentator to call the recession was a guy who tracked Mac and Cheese sales. It is an inferior good, and when he saw sales of that venerable dish rise in July, 1990, he publicly declared accurately that the US economy had gone into a recession.

The Mac and Cheese method of forecasting. You really know your economic history!

That’s not how I read it.

The NBER states that “the economy reached a peak of activity in July 1990. The eight-month period between July 1990 and March 1991 is a recession in the NBER’s chronology.” The invasion of Kuwait was on August 2, 1990, which coincides with an oil price spike which lasted until February 1991.

Real Gross Domestic Product, Billions of Chained 2012 Dollars, Quarterly, Seasonally Adjusted Annual Rate (GDPC1) shows only two quarters of negative GDP growth, that is, 1990 Q4 and 1991 Q1, although 1990 Q3 is just barely positive (again suggesting that GDP growth in July was most likely positive). Thus, the downturn coincides very nicely with the Invasion of Kuwait and First Gulf War, which saw Brent double from $16.20 / barrel in May-July 1990 to $32.70 in Aug-Oct 1990, and stay above $20 into February 1991. It fell back under $20 in February and the recession ended in March.

As for interest rates, these had peaked more than a year before and were on their way down.

I don’t see anything in the data to make me revise my view, and everything I see supports it.

https://fred.stlouisfed.org/series/GDPC1

https://www.nber.org/March91.html

https://en.wikipedia.org/wiki/List_of_recessions_in_the_United_States

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=RBRTE&f=M

https://fred.stlouisfed.org/series/FEDFUNDS

For the love of God – even by what you typed here, this recession preceded the increase in oil prices. How you read it? You clearly have not read that 1993 paper I linked to. Until you do – then you will only continue to prove you are beyond clueless.

“I don’t see anything in the data to make me revise my view”

We should call you Mr. Magoo. Please stop with these rants as they are incredibly Stooooopid.

“As for interest rates, these had peaked more than a year before and were on their way down.” with a link to the Federal Funds rate.

The may be the dumbest comment you have ever made – and there are SO many. I have noted what happened to interest rates on long-term corporate bonds with credit rating BBB. Gee – Steve, which rate would most people think is relevant for business investment decisions? Oh wait – why am I asking someone as clueless as you are. Never mind!

I’m looking at the components of real GDP for the Bush41 era:

https://apps.bea.gov/iTable/iTable.cfm?reqid=19&step=2#reqid=19&step=2&isuri=1&1921=survey

Table 1.1.6. Real Gross Domestic Product, Chained Dollars

The one component that took a sustained nose dive was real investment spending. Flat for the first half of 1991 at $1252 billion (2012$) but then boom it fell til it hit rock bottom at $1121 by 1992QII. It SLOWLY recovered getting back to its original level only by late 1992.

What does this sound like? Oh yea – tight monetary policy. And the investment slump was not short lived as Princeton Steve Magoo has repeatedly claim. Mr. Magoo says he does not see it. Of course as he is both blind and incompetent at real research!

Going into the summer of 1990 the economy was already on shaky legs. In Dec 1989 the Fed sharply cut the FFR in response to the S&L crisis, and the Fed cut rates again in Jul 1990. On top of that, there were plenty of exogenous shocks as Europe reorganized and the USSR started to dissolve. Then in Jul 1990 things started to get hot in the Persian Gulf, with Saddam making some none too subtle threats against Kuwait. The open question is whether or not the economy would have slipped into a full blown recession absent the Gulf War. NBER dates the peak of the business cycle as occurring in Jul 1990; however, that date was assigned retrospectively long after the recession ended. As a counter-factual it’s entirely possible that absent the Gulf War the economy might have skated past the slowdown in GDP growth without that slowdown lasting long enough to justify NBER calling it a recession. In other words, even though NBER dates the recession as beginning in Jul 1990, I don’t think the recession was inevitable in Jul 1990. There’s a difference between one weak quarter and an outright recession.

What’s not plausible is the claim that Bush’s 1990 tax increase triggered the recession. The recession was half over before the tax increase took effect. I suppose someone could argue that the tax increase resulted in the weak GDP growth in 1991, but the Fed consistently cut rates throughout 1991, which ought to have offset any contractionary effects of the tax increase. In any event, GDP growth in 1992 was quite strong, so that should have helped Bush’s re-election chances.

That’s consistent with my understanding, Slugs.

Really? It totally blows away what you wrote. But it is consistent with your understanding? LORD!

The other thing Princeton Steve aka Mr. Magoo does not seem to get is how long the employment to population ratio stayed low. Guess what caused Bush41 to loose to Clinton in Nov. 1992. The weak economy which the Bushies rightfully blame Greenspan for. They got but not Steve Magoo.

My guess would be that a downturn will come sometime in 2020. The federal reserve will be short of ammunition for this one (it won’t have enough room to lower interest rates), so it will engage in nontraditional monetary policy (inflation targeting). We will have (unanticipated) inflation and it will effectively reduce debt burdens.

@ don

Long-term, it’s much more apt to be an insipid economic growth problem than an inflation problem. But I’m not a forecaster, so I would very interested to hear Menzie’s thought on that, or some of the other better economists out there. But let’s put it this way, I would be SHOCKED if at anytime inside of the next three years, let’s say at least to December 2021 if inflation becomes any kind of an issue.

Moses,

I’d guess this is not a case of arresting a bargaining chip. Rather, it’s a case of putting China in a position of negotiating while facing the regime to which we are asking them to comply. There is every reason to expect China will try to come out of the 90-day period having agreed to something that prevent sanction escalation. There is less reason to believe they will comply.

The investigation of Meng has apparently been underway for months, so the case is not a sudden decision. However, the question of when or whether to make the arrest looks like it would be kicked up the ladder and reach the cabinet level – at least as an advisory if not initially seeking permission. The arrest went ahead, so the White House is OK with a high-profile affront to China when the issues are compliance, Iran and China. It is now China’s turn to decide whether to lose face and go ahead as if nothing has happened, or refuse to agree to something that we intend to enforce against China’s wishes.

@ macroduck

The problem for you seems to be you can’t keep up on current events. You can’t unilaterally pull out of an international agreement with Iran and then expect other countries to abide by it. These investigations on international weapons sales and international technology sales are always ongoing. Meng Wanzhou is nothing new on that count. As of May 2018 all bets are off—and you have donald trump to thank for that:

https://www.aljazeera.com/news/2018/09/eu-iran-agree-payment-system-skirt-sanctions-180925050920569.html

https://www.cbsnews.com/news/iran-nuclear-deal-donald-trump-payments-iranian-oil-britain-france-germany-russia-china/

https://qz.com/1401690/unga-can-the-eu-china-and-russia-beat-us-sanctions-on-iran-with-a-special-slush-fund/

BTW, I normally try to filter myself from these type predictions, but I would say there’s less then a 15% China will have agreed to anything inside of the 90-days deadline. They have much less to lose politically than donald trump does, so unless it is trump who blinks or trump who buckles, there is no way they are going to have an agreement inside that 90 days. trump is just starting to figure this stuff out, that’s why when he shakes Chairman Xi’s hand now trump looks like he just swallowed a large scoop of cow turd. You are making the same mistake many of donald trump’s economic staff are making right now—the assumption that China gives a crap about the lower segments of Chinese society suffering when they have no right to vote/choose their leaders. They will bite down hard on the mouthguard, like a patient getting shock therapy, before they give in to trump on this, or really even meet him halfway. trump is the one who’s going to pay the political (and economic) “penalty fee” for this tariffs fiasco.

Bloomberg website has been friendlier to non-subscribers recently. Maybe they finally figured out there’s decent substitutes out there. Here’s the FYI on the panic stock market sell off. S & P down about 0.30% and oil futures down about 2%

https://www.bloomberg.com/news/live-blog/2018-12-06/the-latest-updates-on-the-market-sell-off?srnd=premium

I made a mistake there when I said oil “Futures”. I just meant the current spot price when I commented there. I apologize if that misled anyone out there. I have some strong subjective opinions, but I try to get my facts right, so I’m sorry about that.

To add to the impending recession thesis, the arrest of Meng Wanzhou, CFO (and vice-chair?) of Chinese telecom giant Huawei or violation of sanctions on Iran would seem to point in that direction.

Here is a story on this brazen move:

https://www.usatoday.com/story/news/world/2018/12/07/huawei-cfo-meng-wanzhou-arrest-china-says-u-s-trying-stifle-its-rise/2236365002/

Are we trying to start an actual war with China?

Terrific journalism and must reading—how trump is killing the CFPB, which in the past has protected many consumers and borrowers across America from fraud and illegal property possession from large banks and mortgage lenders etc.

https://www.washingtonpost.com/investigations/how-trump-appointees-curbed-a-consumer-protection-agency-loathed-by-the-gop/2018/12/04/3cb6cd56-de20-11e8-aa33-53bad9a881e8_story.html?noredirect=on&utm_term=.a3b673159efd

Also, a MUST read, Utah Republican Chris Stewart saying that the killing of journalists happens all the time, and he’s totally cool with it. Maybe Republican Chris Stewart has little celebrations after journalists are murdered and stabbed to death and cut into small pieces?? Did HW Bush call this “compassionate conservatism”??

https://www.washingtonpost.com/politics/rep-chris-stewart-defends-trumps-response-to-khashoggi-killing-journalists-disappear-all-over-the-country/2018/12/04/f81fa53e-f803-11e8-8d64-4e79db33382f_story.html?utm_term=.dbafdff2991b

@ Menzie

Menzie, you’re well aware I pretty much bow down to you on all issues economics (I’d lick your leather shoes as well, but that’s taking it too far even for me). But you know, just to nudge you in the lower ribs a little here. One of the commenters in that prior post had said that if you narrowed down the time frame in your graph, it would take the time point of the actual curve inversion to February 2019. Did you have any “Nyaaaa!!! Nyyaaaaaazz!!!!” or “I told you sos” or “the book is still outs” on that one??

Professor Chinn,

Any thoughts to share on the New York Federal Reserve Bank staff report which discusses how to predict recessions? Link shown below

What Predicts U.S. Recessions?

September 2014 Number 691

JEL classification: C52, C53, E32, E37

Authors: Weiling Liu and Emanuel Moench

https://www.newyorkfed.org/research/staff_reports/sr691.html

The six month forecast uses:

1. USRECM

2. The GAP in the GS10 and 3month TBill rates

3. The six month lag in the GAP

4. The S&P 500 12 month percent return.

Using this method, I found about a 13% chance of recession within six months of 11/30/2018.

Thanks for posting your paper on spreads and recession.

Menzie notes:

“Interestingly, the 10yr-3mo spread did not actually invert before the 1990-91 recession”.

Well – we did see a significant rise in the interest rate on long-term corporate bond rates with credit ratings BBB. This is a metric a lot of Bernanke students know to watch. As that 1993 SF FED paper contends – monetary policy was indeed tight before the 1990 recession which is borne out per long-term government bond rates. And the credit spread (corporate bond rate minus government bond rate) also rose.

I’m not going to say this recession was unusual. I’ll leave that babble speak to Princeton Steve. After all Bernanke attributes part of what happened during the Great Depression as well as the Great Recession to financial market disruptions.

Regarding the arrest of Meng, if the reports are correct that what she was arrested for was allegedly violating the US sanctions on Iran rather than some of the other things people have been accusing Huawei of, I do not understand why the Canadian government would do this given that they disagree with the US sanctions, especially the freshly imposed ones due to the US withdrawing from the JCPOA. If anybody should be arrested it should be US officials for their illegal imposition of those sanctions and imposing them on other nations.

How does a Chinese company fall under the dictates of US law? If I were Meng’s lawyers, I’d be marching into Federal Court right now demanding that she be released. Trump is turning the US into a lawless state.

My GUESS is, (and that is all it is really, is a wild guess) is that Trudeau did this as a “courtesy” to our country as a long standing ally (and arguably the best, ally America has ever had, this move in part proves that). It has no relation to trump in the sense of loyalty, but more as a way of showing Canada will stand firm with America on most of these things.

My guess is behind closed doors that Trudeau is saying to trump’s people “Are you sure you wanna do this?? Because it going to be YOUR funeral, not ours.”

I think Canada might even backtrack and set her loose. Meng also remaining in Canada gives trump “an out” when he realizes this is a dumb move, and for the illiterate MAGA crowd he can say this was a “Canadian error” and not a trump error as long as Meng is on Canadian soil—which is also why the “slow walk” since she was actually detained on December 1. She MAY be released today (Friday), but then the question is will they take her passport and apply an electronic ankle bracelet etc. (That is risky in the sense Canada has a “porous” border and Chinese can get creative on these things)

My guess is, as a human being, Meng Wanzhou is a spoiled [xxxx] (and of very low ability, that’s how it usually goes on this nepotism stuff in China, and really the world over). But being a spoiled [xxxx] is not a legal crime. So….. the woman should probably be released and let go back to China with a firm “return at your own peril” warning.

@ Menzie

1) I am not upset about the filter, from a “decency” standpoint you did the right thing. You could have barred the entire comment, I’m grateful you didn’t.

2) Believe it or not I get not much thrill from using vulgarity. My thrill is not zero, but the thrill approaches zero to infinity.

3) I hold that in this particular case it was the factually correct noun. That said, Meng should probably be let back to China (barring any publicly unknown facts).

How do we know a recession in imminent?

Kevin DOW 36000 just declared that the probability of a recession right now is zero. His source seems to be some forecasting approach ala Marcelle Chauvet of UC Riverside. I think FRED has a historical chart:

https://fred.stlouisfed.org/series/RECPROUSM156N

FRED notes these papers:

Chauvet, M. and J. Piger, “A Comparison of the Real-Time Performance of Business Cycle Dating Methods,” Journal of Business and Economic Statistics, 2008, 26, 42-49. (http://pages.uoregon.edu/jpiger/research/published-papers/chauvet-and-piger_2008_jour.pdf)

Chauvet, M., “An Economic Characterization of Business Cycle Dynamics with Factor Structure and Regime Switching,” International Economic Review, 1998, 39, 969-996. (http://faculty.ucr.edu/~chauvet/ier.pdf)

Hey – we may have AEI style cherry picking – sorry I meant research. So who can doubt his conclusion!

Incredible.

https://twitter.com/realDonaldTrump/status/1071132880368132096

@ “Princeton”Kopits

Orange Excrement has a very sharp mind, it’s hard for his White House staff to keep up with his great mind:

“but you also had people that were very fine people, on both sides,” Trump said.

https://www.thedailybeast.com/james-fields-found-guilty-of-murdering-anti-racism-protester-in-charlottesville

Hopefully, one day in the future, trump’s staff can catch up with his progressive thinking. Remember, trump does ALL of this for the children.

@ “Princeton”Kopits

The good news for you Kopits, is that trump is doing his best to get rid of all these “damned dirty” immigrants. Thank God trump never stooped so low as to employ them at nearly all of his hotels and resorts, as trump already knew how “filthy” and “disgusting” they are, and would be a “huge safety risk” to all his customers and lodgers.

https://www.nbcnews.com/storyline/immigration-reform/trump-s-new-jersey-golf-club-employs-undocumented-immigrants-women-n945056

Brings back happy memories of FOX Business News’ Lou Dobbs:

https://www.businessinsider.com/lou-dobbs-hired-illegal-immigrants-2010-10

https://www.thenation.com/article/lou-dobbs-american-hypocrite/

https://www.politico.com/story/2010/10/report-dobbs-hired-illegal-immigrants-043263

Aaaaawww, good times…….

I heard a rumor this Navarro cat at one time worked with an “up-and-coming” Chinese American economics guru and policy wonk. I forgot that Chinese American’s name but he was known as quite the sharpie even at a young age. I don’t know, if I was that guy, I would try to keep it a deep dark secret I had ever worked with Navarro. Seems like a blemish on an otherwise outstanding career.

https://www.cnn.com/videos/politics/2018/12/07/huawei-meng-wanzhou-peter-navarro-erin-burnett-china-ebof-vpx-new.cnn

@ Menzie

Menzie, once again you have proven what a sometimes unbelievably cerebral person you are, and how sharp your mind is with the Richmond Fed update ( ZERO sarcasm here). Because, you know why??? (besides the fact it is an excellent point). Because it had reminded me of FOMC member Lael Brainard’s comments, which had temporarily and absolutely slipped my mind (How could I forget Brainard’s logic?? Too much https://goo.gl/images/MGRwzY in the ’00s???). These comments by the Richmond Fed kind of feed into, strongly relate to Brainard’s comments as regards the inversion of the curve and the ZLB, do they not???

Lael Brainard: “I am attentive to the historical observation that inversions of the yield curve between the 3-month and 10-year Treasury rates have had a relatively reliable track record of preceding recessions in the United States,” she said. “But unlike these historical episodes, today the current 10-year yield is very low at around 3 percent, which is well below the average of 6-1/4 percent during the decades before the crisis.”

https://www.bloomberg.com/news/articles/2018-09-12/brainard-sees-fed-gradually-raising-rates-over-next-year-or-two

This is one of those I would appreciate even the most cursory of replies from you Menzie. (Even if you strongly disagree with me) That is that I tend to agree with Brainard’s stance in the quote above.

Moses Herzog: I think she’s got an excellent point. In principle, what one should do is subtract the estimated premium from the actual spread, and then re-do the regression analysis. I think that might be in one of the SF Fed Economic Letters, but can’t recall the result.

Thank you Menzie, as always, appreciate it greatly. I will see if I can hunt that SanFranFedRes letter down, and either put it in this thread or the following thread with the oil prices graph. Thanks again.

I think I found at least one paper close to what you’re talking about, but it looked like an NYFRB thing. Pretty amazing all the data available free there. When I get a better grasp I will put links in the following thread. Just doing shotgun style searches, like 2 feet down into the rabbit hole there is tons of stuff on “Affine Term Structure Models” which—as usual for me—I grasp some of the broader concepts but when they hit the calculous symbols I start to hit a brick wall. But some of the papers and stuff is interesting, Found one by a venerable James Hamilton and Cynthia Wu (2012), and tons of other names seem to always pop up if you scan these papers a lot. Darrell Duffie, and one you mentioned recently related to Government Economic data, Jonathan Wright.

Recession probability is proportional to the strength of the Fed’s denial about the policy error inherent in the Fed continuing to raise rates in the face of an inverted yield curve. Sure, this time might be different, but it rarely is. Fed governors live in cushy houses and will be employed even as millions of Americans aren’t, so their incentives are not aligned with average Americans. If they make a policy error nothing happens, to them.

FOMC is rarely more than one policy error away from losing their independence.

Was looking for any updates on Meng Wanzhou and found this. 4 hours old. My local news usually calls things like this that happened hours ago “breaking news”. So…… don’t say Uncle Moses never brought you the “breaking news”.

https://www.nytimes.com/2018/12/08/us/politics/john-kelly-chief-staff-trump.html

This issue in part turns on whether Huawei effectively owns a company called Skycom Tech:

https://www.reuters.com/article/us-huawei-skycom/exclusive-huawei-cfo-linked-to-firm-that-offered-hp-gear-to-iran-idUSBRE90U0CC20130131

The Chinese government is threatening Canada with retaliatory measures if they do not release her.