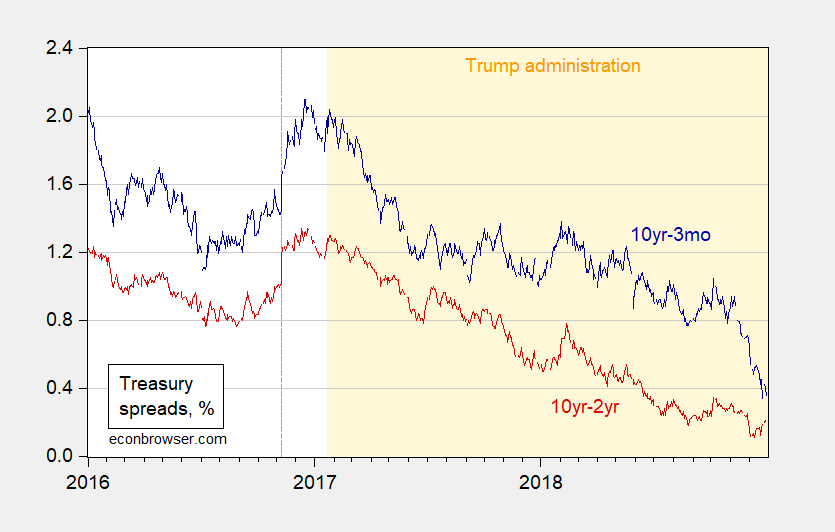

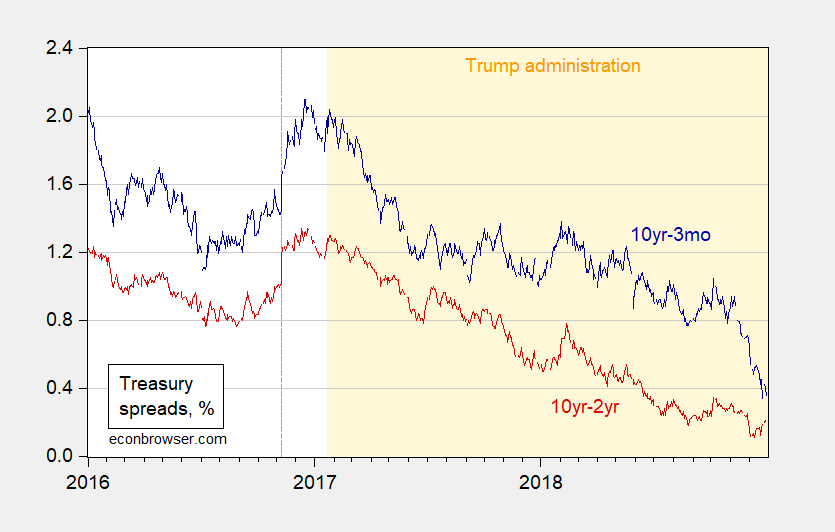

That’s all you need to know.

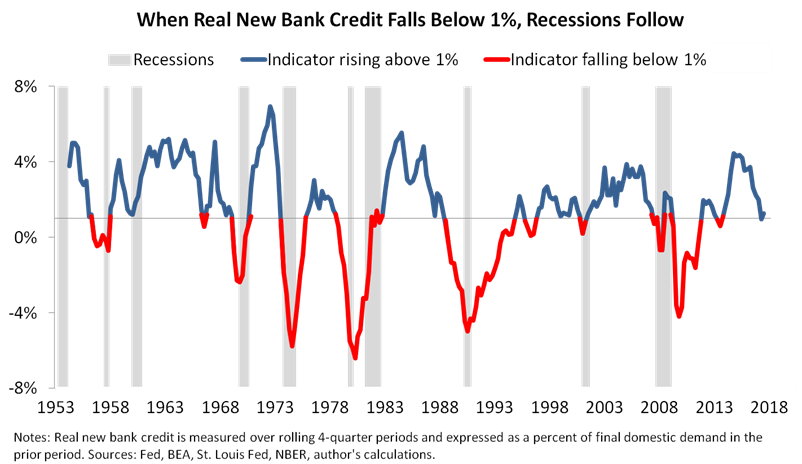

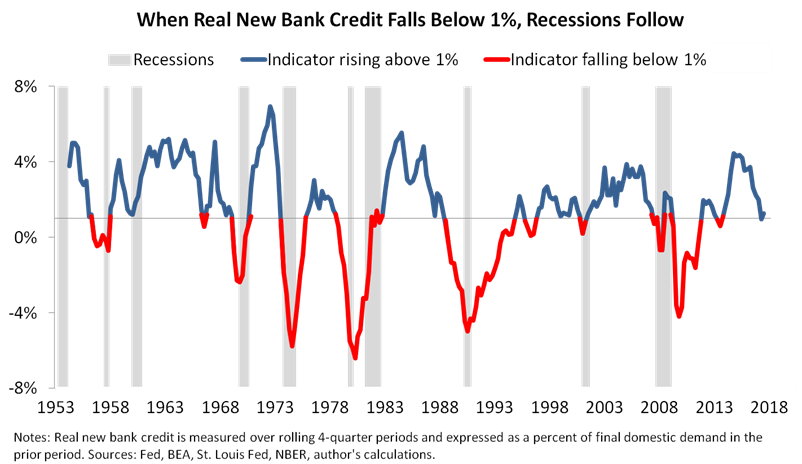

Update, 1/1/2019: Bob Flood sends this graph which — as he characterizes it — “seems to good to be true” (in a social scientist sort of way).

That’s all you need to know.

Update, 1/1/2019: Bob Flood sends this graph which — as he characterizes it — “seems to good to be true” (in a social scientist sort of way).

All we need to know? How much of this comes from a decline in the 10-year rate versus higher short-term rates? Inquiring minds want to know!

I agree. It makes a load of difference. I am a yield curve junkie

Mainly on the short side. 3 month notes have risen from 1.46% to 2.41% since January 2018 while 10 years have remained relatively flat over the same time frame.

Short term while the 10 year has fallen somewhat the 3 months have been continuing their rise.

Abe I think it depends on how you define “short term.” Menzie defined it as two weeks (presumably 14 – 28 December), and over that timeframe it looks like it’s the fall in the 10 year that’s doing all the work.

Yep. Over the last 2 weeks the 10 year has fallen about 10 basis points, so…

It’s not the first time this has happened in the last few months and I’m not clear what this indicates today. It’s definitely not “all you need to know.” Not sure if Menzie is saying that a recession is that much closer or something else. After all the decreasing spread (and the possible crossover of rates) is usually brought in to tell us that “The Recession is Coming, The Recession is Coming!”

I for one would like a little more clarity on what the good Dr./Professor is bringing this up for.

One thesis is that only when the Fed renormalised his Balance Sheet can the long-term rate float up again. At the current rate of normalisation it’s going to take more than 30 years.

Economists as Larry Summer contributed to bringing about the Great Recession.

“Economists as Larry Summer contributed to bringing about the Great Recession.”

FYI – he was not part of the Bush43 economic team. He did advocate fiscal stimulus in early 2009 as part of the Obama economic team but I’ll concede that we should have listened to Christina Romer who wanted even more fiscal stimulus.

But please continue with this nonsensical Summers bashing as ilsm sucks at it.

Zi Zi Blaming Larry Summer for the Great Recession is a bit of a stretch, although I don’t think he is entirely blameless. Admittedly, Larry Summer did support some of the financial deregulation stuff during the Clinton years and arguably those actions set the stage for a later disaster. But Summers had been out of government for over six years before the Great Recession hit, so he hardly deserves to be singled out for blame. “There’s many a slip ‘twixt the cup and the lip” and all that.

I suspect that you meant to say “Economists such as Larry Summers…” rather than “Economists as Larry Summers…” I think you’d be on safer ground if you put the blame on pseudo-economists, banking lobbyists and supply side crackpots who posed as economists. In other words, people like Larry Kudlow and Art Laffer and Stephen Moore. Larry Summers had it right when he argued for fiscal stimulus. The problem was when he took off his macroeconomist hat (which argued for an even bigger stimulus) and put on his political judgment hat (which argued for a smaller stimulus). Larry Summers made the mistake of believing that Obama would get a second bite at the stimulus apple. Larry Summers is a brilliant economists, but sometimes his political skills leave something to be desired. That might explain why Janet Yellen got picked as FED head over Summers.