Today, we are fortunate to present a guest contribution written by Ashoka Mody, Charles and Marie Visiting Professor in International Economic Policy, Woodrow Wilson School, Princeton University. Previously, he was Deputy Director in the International Monetary Fund’s Research and European Departments.

The recent celebratory comments on the euro’s 20th anniversary mainly used high-minded but meaningless words. European Commission vice president Valdis Dombrovskis, for example, tweeted, “Being part of the Euro means being part of a common journey. … European nations will be stronger if they travel together.” European Central Bank president Mario Draghi attempted a more considered, but nevertheless cheery, economic scorecard. To convey cheer, he repeated worn storylines and disregarded mounting contrary evidence.

The single market needs a single currency. No, it does not.

Draghi’s central theme is that monetary union was “a necessary consequence of the [European] Single Market.” He leans on the authority of Nobel laureate Robert Mundell, who asserted that uncertainty in exchange rate movements constituted a “barrier to trade.” To that, Draghi adds, “And the single currency has further enhanced the process by eliminating the costs of foreign exchange payments and settlements and of hedging exchange rate risk.”

The earliest—and, for long, the most influential—econometric analysis cited in support of the proposition that exchange rate uncertainty and costs of transacting across currencies hampered trade was a 1989 study by two Italian economists, Francesco Giavazzi and Alberto Giovannini. In fact, the authors found that uncertain exchange rate movements and transactions costs made no difference to the volume of international trade. Yet, Giavazzi and Giovannini were committed to the proposition they had set out to prove and they asserted that Europe’s exceptional economic and political characteristics required fixed exchange rates.

The Giavazzi-Giovannini empirical finding—as distinct from their preferred conclusion—would not have been a surprise to Otmar Emminger, president of Germany’s Bundesbank, who had noted some years earlier that exporters routinely and inexpensively hedged against foreign currency risk. In 1993, in a now-classic Journal of Literature article on the proposed monetary union, the University of California, Berkeley, economist Barry Eichengreen challenged those who claimed that transactions costs of converting currencies limited international trade.

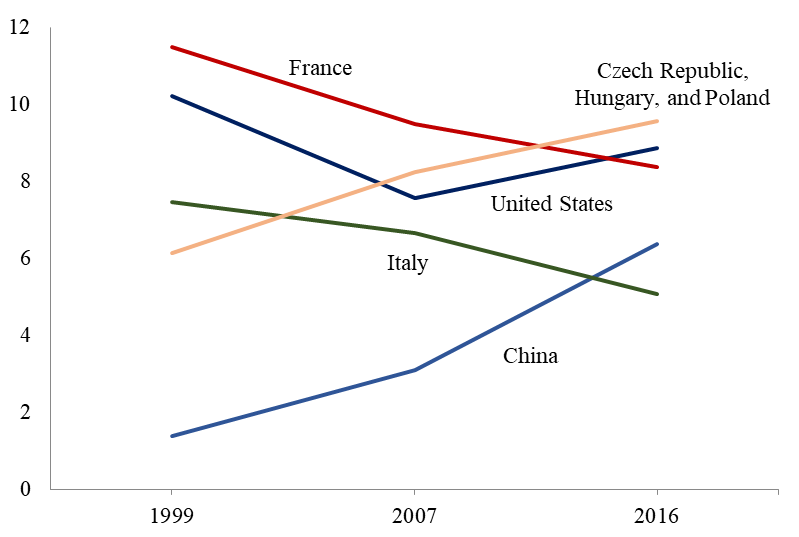

Fast forward to today. Here is the evidence. Germany’s trade within the European Union has grown most rapidly with three non-euro countries: the Czech Republic, Hungary, and Poland. It is only a matter of time before Germany’s trade with these countries exceeds the sum of trade with France and Italy, the two largest eurozone countries after Germany. So, no, a single market does not need a single currency.

Draghi repeats the persistent European mantra that the risk of continuing devaluation of the Italian lira would have deterred German exports to Italy. Well, the evidence is in. The euro fixed the lira’s value vis-à-vis the D-mark, and German exporters lost interest in the Italian market regardless. Draghi further claims that “value-added chains”—the dispersal of intermediate production steps across countries—requires a single currency. Yet, value-added chains are most extensive with the three non-euro countries with whom German trade has grown most rapidly.

Defenders of the monetary union may nevertheless argue that trade with non-eurozone countries has increased because those countries are growing rapidly; and absent the euro, trade between member countries would have fallen even faster. Briefly, Andrew Rose of the University of California, Berkeley, in collaboration with other scholars, created a flutter by claiming that European monetary union would create an explosion of trade within member countries of the eurozone.

But Rose’s econometric evidence did not pass the “smell test,” as the then Federal Reserve Board governor Ben Bernanke pointed out. In 2004—at the fifth-anniversary stocktaking of the euro—Bernanke noted that the share of trade within the eurozone countries was declining, rather than increasing. To him, that was sufficient reason to worry that Rose’s estimates were not credible.

In a sophisticated econometric analysis, reported in 2010, João Santos Silva and Silvana Tenreyro noted that countries that had joined the euro area had long had strong historical trade ties with one another; once these ties were accounted for, the euro’s influence on trade between member countries was essentially “zero.”

Later, Rose himself, in a 2015 mea culpa, acknowledged that his earlier studies improperly extrapolated from the trade gains achieved within other currency unions to the likelihood that the eurozone would also experience a within–member states trade upsurge. With nearly 15 years of eurozone functioning, Rose concluded that the data were a fog, making any definitive statement impossible. He conceded, however, that the euro “had a mildly stimulating effect, at best.”

In 2018, two new studies lifted that fog by completing the econometric task that Rose had left unfinished. The first used exactly the same extended data that Rose employed and advancing the superior Santos Silva and Tenreyro techniques (a superiority that Rose himself has acknowledged), this study established more firmly than before that the euro had “zero” influence on trade.

More remarkably, another study (ungated working paper), again using the Santos Silva and Tenreyro method, finds that neither the original eurozone members nor the more recent members trade more with each other just because they share the euro. Projecting into the future, the authors conclude that the euro will not enhance trade for additional members either. Their blunt conclusion: Possibly the euro generates some political and economic benefits, but “we do not believe that increased trade integration with the eurozone should be considered one of them.”

Draghi’s position has evolved. In a November 2013 speech, he unaccountably said, “The empirical evidence suggests that sharing a currency has indeed boosted trade.” There was no basis for such a statement then; the evolution in the shares of trade was clear and the Santos Silva and Tenreyro study was state-of-the-art. Now, in his 20th-anniversary retrospective, Draghi has steered away from making an obviously incorrect claim. Instead, he has retreated to a hazy view that the euro “protects” the single market. Draghi’s latest assertion—whatever it means—has no support either in the trends in the direction of trade or in the continuing econometric evidence.

Monetary sovereignty creates more problems than it solves, Draghi says. Is that so?

If euro area countries could set their own monetary policy, they would only abuse that autonomy. They would run large fiscal deficits and misuse the central bank to finance those deficits. So Draghi concludes based on behavior of national authorities during the 1970s and 1980s. Such damaging behavior, he believes, would have inevitably continued.

The 1970s and 1980s were exceptional decades during which irresponsible fiscal and monetary policies were common worldwide. In part, governments were responding to the two oil price hikes, which raised inflation rates alongside a sharp slowdown in growth. That macro outcome—popularly described as stagflation—proved a policy challenge everywhere. Widespread public discontent led to political pressures for government handouts, which widened budget deficits and encouraged monetary financing of the deficits.

Western nations that did not adopt a single currency learned to discipline themselves. The learning occurred at different times over the course of the 1990s and early 2000s. In the United States, Fed chairman Paul Volcker—in a forceful show of central bank independence—raised interest rates to draconian levels in the early 1980s. Inflation fell and remained relatively low through the subsequent era of the Great Moderation.

In Europe, the U.K. was the first to make a major break from the stranglehold of fixed exchange rates. On “Black Wednesday,” September 16, 1992, speculators forced the sterling out of the bands specified under the Exchange Rate Mechanism (ERM), designed as a precursor to the single currency. But the ignominy of being forced out of the ERM proved to be a blessing in disguise. In steps, the British government gave increasingly greater independence to the Bank of England, which managed monetary affairs with much success, and Britain experienced golden years of growth with stability. Other European countries went through their own macroeconomic and financial travails but also moved to independent central banks with inflation-targeting mandates. Sweden at the high end of the economic ladder and Poland at the lower end were among the countries that successfully made this transition.

In France, during the debate on ratification of the Maastricht Treaty to adopt the single currency, the conservative politician Philippe Séguin led the opposition, making the case for retaining the franc managed by an independent central bank that would keep inflation under control. Séguin lost his bid to change the course of French—and European—history by a whisker. But just because France and other European countries adopted the euro, officials such as Draghi do not have license to keep alive a blinkered and patronizing view that today’s eurozone nations would not have achieved the macroeconomic discipline that the Swedes and Poles did.

Indeed, the political economists Jesús Fernández-Villaverde, Luis Garicano, and Tano Santos have argued the opposite: the euro weakened macroeconomic discipline. A common monetary policy for the eurozone brought interest rates down too quickly for countries with weak institutional structures. Governments in these countries took advantage of the lower interest rates to increase fiscal entitlements for politically favored groups rather than engaging in the harder business of investing to raise their potential growth rates. Far from instilling discipline, the single currency subverted it.

Draghi puzzlingly does not consider the most important benefit of monetary sovereignty, the ability to absorb large economic shocks through exchange rate depreciations. While continuous devaluations to compensate for lack of productivity growth is a path to economic decline, depreciation to absorb shocks is unequivocally desirable. Moreover, to the extent that exchange rate depreciation shortens the period of distress following the shock, it also helps avoid drawn-out recessions, which recent research emphasizes undermine long-term growth potential.

A common agricultural policy required monetary union. No, it did not.

Draghi uses Europe’s appalling common agricultural policy as justification for the single currency. “Absent a single currency,” he says, the promised compensation to farmers needed adjustment whenever exchange rates changed. Those price adjustments, Draghi melodramatically claims, “jeopardised trust in the market” and “poisoned intra-Community relations.” First, the rendition of history is, at the very least, controversial. Andre Szász, the former Dutch central banker, is his brilliant little book in 1999 on the European monetary union’s history, dismissed this as a consideration that European leaders used for introducing the single currency. The European bureaucracy used well-understood formulas, Szász reported, to make needed price adjustments.

But the deeper problem with Europe’s agricultural policy as an argument for a single currency is that the policy itself was so egregious. The subsidies soaked up large amounts of the scarce European budget, favored larger farmers over smaller farmers, and protected inefficient farming in Europe. When European farmers dumped their large surpluses on world markets, they lowered world prices, which hurt farmers from developing nations. European agricultural policy never had any redeeming feature and was a creature only of a dysfunctional domestic political economic bargain. To claim, then, that an incomplete monetary union, with its known risks, was required to preserve Europe’s murky agricultural bargain is another case of dredging for reasons to justify ex post the creation of the monetary union.

The eurozone promotes economic convergence. No, it does not.

The euro’s founding fathers were right, Draghi says, in their belief that the single currency’s “culture of stability” would promote higher growth and employment. A valuable manifestation of such gains, he postulates, would be “convergence,” the narrowing of per capita income differences between member countries of the eurozone. Draghi acknowledges that Portugal and Greece—oddly, he does not mention Italy—have stagnated and so diverged rather than converged. Yet, in defense of the convergence thesis, he points to the Baltic countries and Slovakia as successes.

Such casual use of evidence is deeply problematic. Slovakia joined the eurozone in 2009, Estonia in 2011, Latvia in 2014, and Lithuania in 2015. They were on an impressive convergence path well before they adopted the euro, as documented here and here. They converged for reasons well established in traditional growth theory and empirical findings. Their strong inheritance of human capital from years under socialist planning, their transition to market economies, and, especially after they joined the European Union in 2004, reinforcement of rule of law and protection of private property, primed them for economic convergence.

If the argument is that the prospect of eventually entering the eurozone (and the fixed exchange rate regime these countries worked under in prior years) added to the pace of convergence, there simply is no evidence for that. Other countries that did not join the eurozone and apparently have no near-term plans for doing so—the Czech Republic, Hungary, and Poland—have also converged towards living standards in higher-income European economies.

The contrary argument that a single currency increases

divergence rather than promoting convergence, goes back to British economists Nicholas

Kaldor and Alan

Walters. Both noted that a single monetary policy would be too tight

for the weaker country, further weakening short-term growth prospects; the same

monetary policy will spur higher growth in the stronger country. The evidence

is consistent with this more pessimistic view. Once the global financial crisis

began, the one-size-that-fits-none monetary policy clearly increased economic

divergence, as

I document.

The single market is Europe’s great achievement. Yes, but don’t idealize it.

I believe in the virtues of the Single Market—they are not as grand as touted, but they are real. Unfortunately, Draghi makes absurd claims: “the Single Market was designed to reap the benefits of openness while also tempering its costs for the most vulnerable; to promote growth while protecting the people of Europe from the injustices of untrammelled free markets.”

Whatever the social protections in European legislation, the most vulnerable in Germany, France, and Italy have lost their manufacturing jobs to or seen their wages deeply compressed by East European workers.

Controversy has also swirled around “posted workers,” the signature symbol of a single market in services. Such workers—the fabled Polish plumber, bricklayers, and truck drivers—are typically posted by their Eastern European employers in the richer European countries. French president Emmanuel Macron describe posted workers as a form of “social dumping” because they receive benefits in line with the lower Eastern European standards. Macron lobbied for and succeeded in imposing more constraints on posted workers—and Draghi applauds that achievement as a worthy effort to “curtail unfair labour practices.” That is not the view of Eastern European governments, who insist that the new directives curtail free trade in services.

The truth is that under the gloss of protecting labor rights, European governments have been pursuing the creation of “flexible” labor markets, the word “flexible” being a euphemism for making it easier to fire workers. Yes, employment has increased because workers are forced to accept temporary jobs at lower wages. To the realist, such an outcome merely reflects the more efficient working of the market economy. Yet, temporary work contracts are associated with lower productivity; hence, lower wages provide no boost in competitiveness. Meanwhile, the underbelly of vast numbers of monthly, even daily and hourly, contracts creates unsustainable social anxiety.

The consequences of a false narrative can be dire

The Nobel laureates George Akerlof and Robert Shiller highlight the crucial role “stories” play in determining economic policies and outcomes. Repeated endlessly, the stories we tell ourselves become our motivating force, impelling us to ignore contrary evidence. As Shiller more dramatically says, because a story is an “easily expressed explanation of events,” it sometimes propagates like a disease. It can “go viral.” As it spreads, he warns, the story has an “economic impact.” Often a more dire political impact, he may well have added.

For the 10th-anniversary celebration in June 2008, former ECB president Jean-Claude Trichet gushed that the euro had been extraordinarily successful. This at a moment when the eurozone was already experiencing gale force winds. Describing Trichet’s speech, I paraphrased George Orwell in my book EuroTragedy: A Drama in Nine Acts. Trichet, I wrote, was narrating the history of the euro as it ought to have been rather than how it was.

Draghi is more careful in his 20th-anniversary speech. He acknowledges that the eurozone remains an incomplete monetary union with its attendant risks.

However, Draghi then recites long-held but repeatedly refuted myths about the euro’s economic virtues. And, especially in his closing, Draghi is unable to resist the high-minded political rhetoric of his compatriots to describe his desired—rather than the actual—historical evolution. The monetary union, he says, is the “defining” symbol of the European “political project,” which unites Europeans “in freedom, peace, democracy and prosperity.” Such gloss only serves to undermine credibility, especially since European nations are more divided than at any time since World War II, and the euro has contributed greatly to deepening euroskepticism.

Monetary union, Draghi continues, was necessary to end centuries of “dictatorships, war, and misery.” Draghi has so much of his economics wrong—it is scary to contemplate the consequences if he has his politics backwards.

This post written by Ashoka Mody.

Well, the euro is more convenient for American tourists!

That is true. Therefore the European should consider implementing The Matheo Solution (TMS), starting with Italy.

In the TMS-structure all the advantages of both the single currency and national currencies are combined, while eliminating the disadvantages of both systems.

See here:

https://gefira.org/en/2018/12/20/how-italy-can-set-its-own-monetary-policies-and-keep-the-euro/

I was interning on a foreign exchange trading desk around the time of the EU formation. And that was the big thing “We’ll have one single currency, and that will eliminate a lot of inefficiency” I thought, this doesn’t make sense as there is an extremely active market in exchanging one currency for another, what is exactly the great inefficiency? Turns out the EU is nothing more than a pretext for the subversion of individual European countries’ sovereignty. Well that is not what the majority of their people’s want. They identify with their country, be it France, Italy, etc. whatever more so than a Global World Order. It’s the elites vs. the masses.

@ Sammy

You may have identified another thing I disagree with Menzie on (a rarity, with the possible exception of certain gender issues, I tend to agree with Menzie pretty straight along the board). My guess is (and maybe it’s unfair of me to guess) Menzie reads what you just wrote and sees it as a mildly humorous conspiracy theory. I think you nailed it on the head Sammy. And you and I may disagree on other things as well—but what you wrote in that specific comment—I think you nailed it exactly Sir. And it’s extremely dangerous and why the region is very weak right now, and more threatened by Russia then it has been since Chernenko was running the ship. This is what Yanis Varoufakis has been trying to stress to people—that this EU “experiment” (more like force-feeding badly tasting food to a captive audience of adults) is killing off democracy

I see a very big difference between the European Union (common market), and the eurozone (a monetary union unaccompanied by a fiscal union).

Yeah, that’s something a lot of people miss (and I confess to short stints of absent-mindedness on it myself). Saying a person agrees to a common market vs saying one is for using one currency are very different things. Some of these cats, Trichet and Wolfgang Schauble strike me as guys that don’t really care if heavy and hard boot imprints are left on ordinary Europeans’ backs in this process were the EU starts transferring power from democratic voters to “technocrats”. Evil personified in my not so humble opinion. I’m not against a common market as long as voters of individual countries still have voting power over their own destiny.

I suppose some think this is comparing apples to oranges, but it’s actually not that much of a stretch to say that these European countries like Greece, Britain, Spain etc are now fighting for their rights in a very similar way that Taiwan is fighting for its right to keep their vote. And although my voice has no leverage in that, I will still speak up or blog or “troll” for their democratic rights on that. I used to tell my mainland Chinese students (who I cared about and for more than they ever perceived) America really didn’t give a damn about Taiwan outside of believing that Taiwanese had/have a right to vote and self-determination. Of course none of them believed me, but I knew that was how it would be before I opened my mouth.

Agreed. Let’s make this easy for Americans to grasp. The 50 states known as the USA are akin to the EuroZone. NAFTA created a common market (akin) to the EU for all of North America but Mexico kept its peso (even if it is symbolized with a $) and the Canadian dollar has always floated against the US$. Of course the USA is a fiscal union except for how we treat (or abuse) Puerto Rico.

Moses,

One thing I have to give you props for is that you are an independent thinker. And an interesting poster.

Very well thought out and well written by Ashoka Mody. I want to give a better response and more thorough thoughts on this in a later comment in this same thread, but just a quick/abbreviated impression.

Over many many months (and years if you count intermittent visits) I have only ever really disagreed (that I can remember) with Menzie relatively strongly on two things (and maybe not disagreeing with Menzie so much as disagreeing with the BEA). I thought the 3rd quarter numbers on USA GDP were pure bullcrap and way too high. I still hold those views but I haven’t heard or checked the “revised” numbers, which I kind of had stated I would concede I was wrong if there wasn’t a major revision downwards (I believed/believe the numbers to be closer to 2%, and no higher than 2.5%, but really closer to 2%). I have no tangible economic data to support that, just my own “intuitive sense” (yes subjective, only my feeling)

The other thing that I think I disagreed with Menzie on (and Menzie can correct me if I am getting this wrong) is, I was pro-Brexit, and I think Menzie was anti-Brexit. This article by Ashoka Mody, although he’s not discussing Britain specifically for the vast majority of this article, really states many of the basic ideas behind my thought of “How is Brexit really ‘hurting’ Britain??” Short term…..maybe, even that is debatable. But when push comes to shove, having the ability to negotiate independently on trade, still having the USA on the trade phone anytime (post trump era), and the ability to control/adjust their own currency, and I am supposed to believe Britain is the “loser” here?? Sorry, not biting on that one.

And I wanted to say, although there are many standout points Mr. Mody makes, this sentence and the graph are by far the most powerful statements he makes in the entire article (hence Mr Mody’s use of the graph??)

“Fast forward to today. Here is the evidence. Germany’s trade within the European Union has grown most rapidly with three non-euro countries: the Czech Republic, Hungary, and Poland. It is only a matter of time before Germany’s trade with these countries exceeds the sum of trade with France and Italy, the two largest eurozone countries after Germany. So, no, a single market does not need a single currency.”

“But when push comes to shove, having the ability to negotiate independently on trade, still having the USA on the trade phone anytime (post trump era), and the ability to control/adjust their own currency, and I am supposed to believe Britain is the “loser” here?? Sorry, not biting on that one.”

UK exports are mainly services tailored for the EU market. Brexit allows Europaen countries to introduce a lot of red tape and as result forces many companies to move to continental Europe. Manufacturing supply chains are damaged by Brexit. Overall the operation is economic selfmutilation on a large scale. There are no markets that can compensate for the losses in the EU. Why do you assume a different outcome?

@ Ulenspiegel

Generally our argument is a fair one. I have no “issues” with what you have stated, they are all relatively factual. Up until this sentence: “There are no markets that can compensate for the losses in the EU.”

You don’t know that, no one does, anymore than Draghi knows his revisionist history of the EU. In fact most of that red tape is created by the original EU agreement, which can be tapered off over time by mutually agreeing parties. I suspect new agreements with Europe will be made over the long term which largely benefit Britain, (i.e. Europe itself compensating for the loses of EU membership) and I also suspect contrary to the dogma you end your otherwise factual statements with, there will be plenty of markets that can meet and exceed those losses over the long-term. I suspect that if Europe decided to go completely menopausal over this, that America and Canada would be more than happy to pick up the slack. But long-term Europe won’t be, because they’d be cutting off their own nose in the process.

And, let me add, all of my arguments, and yours, assume EU holds together. What happens if it doesn’t?? My argument (which holds even if the EU stays unified), becomes even more strong.

“You don’t know that, no one does,”

Sorry, YOU based your brexit argument the possibility to compensate for the loss of the EU market. Which market allows to sell UK services?

How do you compensate for EU comapnies moving their UK production into the EU-27?

In Asia only India is interesting because it is a large developioing market and in principle offers some advantages for UK. However, in the past it was UK that blocked EU-Indian negotiations for fear of too high immigration of Indians. Now you explanin me what will change after brexit? India will get a trade deal with the EU-27 long before the UK and India has UK wirthout the bargain power of the EU over the barrel.

@ Ulenspiegel

Do me an additional favor??

Could you tell us the current unemployment rates for France, Italy, Spain, Greece, and then tell us the unemployment rate for the United Kingdom?? Or maybe a 10 year graph showing those annual changes for those 5 countries if you prefer. I assume that this Brexit announcement has utterly destroyed UK’s unemployment numbers by now……. Maybe you can check with Jean-Claude Trichet, I know Trichet doesn’t go 5 seconds without checking those unemployment figures. Trichet’s empathy for the EU masses is only matched by HIllary’s concern for rural America. That’s why right now Hillary is on her “Please Cry for Me America” ticket selling tour of armory buildings and high school gyms. It’s just Hillary’s way of “giving back”.

What is your argument? In southern European countries the unemployment was always high. Therefore, a comparison with UK is a little bit strange.

However, YOU could check unemployment of the UK before EU membership and during. The UK was called the sick man of Europe in 1970. Why did that change later? 🙂

@ Ulenspiegel

That’s a very cool way to evade my question about current unemployment rates. You actually picked a very friendly year for my argument, if you look at unemployment in the UK around 1970, it’s about 4%. Recently it’s about 4.1%. Since you’ve decided to make a vacuous argument, you should have at least gone with 1982 or 1984, which was more related to oil issues than the EU.

It tells me a lot, and it tells the readers a lot, that you don’t want to look at or discuss the current unemployment numbers. And I should add you’re wrong about south Europe. If we just look at Greece alone, not long ago it was in the 10% range (even below that for a short period). It is now pushing 20%. I can quote Italy, Spain, and France vs Britain if you like, but I don’t think you will like those answers either.

BTW, If you think India is the only country in the world that trades goods and services with the EU, I am sorry to inform you, it is not. India is competitive in that sense because they can provide cheap labor. They win those trade deals the same way (generally speaking) that China does. Low cost labor. I doubt Britain is interested in competing on those grounds. Maybe you can ask a member of the House of Lords if he’s angry Bangladesh is killing Britain in textiles trade right now. Might be an educational conversation for you.

As for Indian immigration to UK, again a very strange argument for you to make, as Indian migrants to UK are apt to benefit from Brexit. Why?? Their workers tend to be more highly skilled than other migrants to Britain, and will get better treatment post-Brexit in the “immigration queue”. In the past EU migrants got preference, and many of them were lower-skilled. Rest assured that higher-skilled Indian immigrants wanting to go to the UK are dancing in the streets about Brexit.

https://economictimes.indiatimes.com/news/international/world-news/indian-professionals-dominate-brexit-hit-uks-visa-hike/articleshow/66870312.cms

https://www.hindustantimes.com/world-news/post-brexit-uk-to-treat-indian-eu-citizens-on-par-for-visas/story-7oqTBP7nelt3V2XYYAajBM.html

https://www.businesstoday.in/current/world/indians-likely-to-benefit-as-uk-unveils-brexit-immigration-plans/story/283515.html

“YOU could check unemployment of the UK before EU membership and during. The UK was called the sick man of Europe in 1970.”

I noticed you provided no source for this claim that the UK unemployment rate was high before the EU. Try this:

https://tradingeconomics.com/united-kingdom/unemployment-rate

Back in the 1970’s it was not that high. Yes the Thatcher recession drove their unemployment rate up. So did our recession around this period of time.

C’mon – if you are going to make a claim, bother to back it up with facts.

The UK did join the EU in 1973 for a different reason:

https://voxeu.org/article/britain-s-eu-membership-new-insight-economic-history

“The ratio of UK’s per capita GDP to the EU founding members’ declined steadily from 1945 until 1972 but was relatively stable between 1973 and 2010. Such prominent structural break (and to the best of our knowledge one not previously detected and analysed) suggests substantial benefits from EU membership especially considering that, by sponsoring an overpowered integration model, Britain joined too late, at a bad moment in time, and at an avoidably larger cost.”

FYI. Income per capita is a different concept than the unemployment rate.

Hey Menzie, when you gonna get Gita Gopinath a guest post on here?? I’m eager to comment on anything she has to say about economics or finance. I’m not going to say why though. I will only state that Roy Orbison has become my official spokesman in my campaign and lobbying effort to get math whiz Gopinath on this blog:

https://www.youtube.com/watch?v=jI34XzlRAyE

@2slugbaits

Interesting observation. I would be curious to know if the euro has positively impacted tourism, for all tourists in and out of Europe.

A lot of great material. Let me focus on one very narrow part:

“Germany’s trade within the European Union has grown most rapidly with three non-euro countries: the Czech Republic, Hungary, and Poland. It is only a matter of time before Germany’s trade with these countries exceeds the sum of trade with France and Italy, the two largest eurozone countries after Germany…Draghi further claims that “value-added chains”—the dispersal of intermediate production steps across countries—requires a single currency. Yet, value-added chains are most extensive with the three non-euro countries with whom German trade has grown most rapidly. Defenders of the monetary union may nevertheless argue that trade with non-eurozone countries has increased because those countries are growing rapidly”

His graph shows Germany’s trade with China is also growing. China – like the Czech Republic, Hungary, and Poland – is growing rapidly. “Value-added chains” suggests processed trade by contract manufacturers, which China is known for. It turns out that processed trade is a big deal in the Czech Republic, Hungary, and Poland. Germany is outsourcing certain manufacturing functions to low wage nations. Having floating rates hasn’t exactly slowed this down.

Another interesting discussion:

“Western nations that did not adopt a single currency learned to discipline themselves. The learning occurred at different times over the course of the 1990s and early 2000s. In the United States, Fed chairman Paul Volcker—in a forceful show of central bank independence—raised interest rates to draconian levels in the early 1980s. Inflation fell and remained relatively low through the subsequent era of the Great Moderation.

In Europe, the U.K. was the first to make a major break from the stranglehold of fixed exchange rates. On “Black Wednesday,” September 16, 1992, speculators forced the sterling out of the bands specified under the Exchange Rate Mechanism (ERM), designed as a precursor to the single currency. But the ignominy of being forced out of the ERM proved to be a blessing in disguise. In steps, the British government gave increasingly greater independence to the Bank of England, which managed monetary affairs with much success, and Britain experienced golden years of growth with stability. Other European countries went through their own macroeconomic and financial travails but also moved to independent central banks with inflation-targeting mandates. Sweden at the high end of the economic ladder and Poland at the lower end were among the countries that successfully made this transition.”

Let me add that New Zealand has maintained a floating exchange rate. They had high inflation until 1988 which was their Volcker moment. Since then, they have successfully targeted a 2% inflation rate.

May we also talk about the power play, eskewed export-oriented business, transfers and outputs, and geopolitical ramifications, basically everything “non-economics”?

I’ve always been curious about this, and you’re uniquely positioned to answer a question I’ve had for awhile now. Do Chinese government trolls have a daily quota you have to meet??

Moses, STOP NAME CALLING. You liberal Gestapo.