I’ve written up a draft set of notes for my undergraduate macro students. Here is my interpretation of Modern Monetary Theory for them. Comments welcome. [Revised version incorporating comments now available here (3/26).]

This post is for those who are unable to read an entire completely verbal exposition regarding Modern Monetary Theory (MMT). MMT has been the source of some debate recently. Instead of critiquing the literature, I attempt to illustrate the approaches for “paleo-Keynesians” relying on Wray (2011), Bell (1998), and the interpretations by mainstream macroeconomists Rowe (2011).

The main components of MMT are:

- The interest sensitivity of investment is zero.

- High powered money finances government spending.

- If a government can borrow in its own currency, that is a sovereign currency which will be demanded elastically.

- Below potential output, the price level is fixed; at potential, output is fixed.

- The government will adjust spending to keep output at or below potential.

- Interpretation in the Neo Classical Synthesis (IS-LM AD-AS)

These components can be interpreted in the IS-LM AD-AS framework thus:

- The IS curve is vertical.

- The LM curve is horizontal.

- The AS curve is horizontal below Yn, and vertical at Yn.

- Government spending is endogenously determined, to maintain output below Yn.

- The central bank and treasury act as single entity, so as to keep the interest rate at target.

- The change in money base demand rises one-for-one with change in wealth, measured as sum of government bonds and money base.

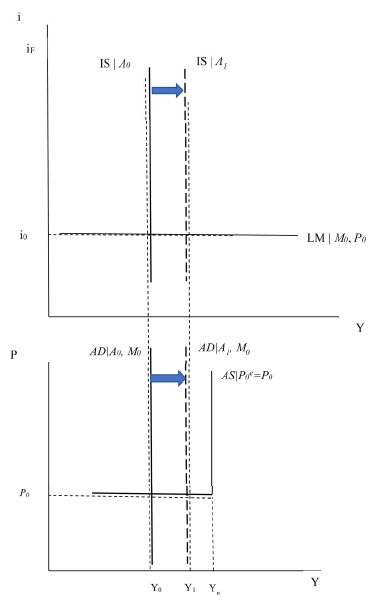

This combination is illustrated in Figure 1; output is initially at Y0 < Yn, i.e., the economy is experiencing a negative output gap. However, there is no self-correcting mechanism in this economy, as the price level is fixed.

Figure 1: Expansionary fiscal policy, where final output remains below Yn.

Fiscal policy can shrink the negative output gap, without consequence. An increase in government spending shifts the IS and AD curves out horizontally (blue arrow). There is no crowding out of investment, given (i) the LM curve is horizontal, and (ii) in any case investment is interest insensitive.

Monetary policy is completely ineffective given no exogenous monetary policy is possible (high powered money only increases with government spending). Should interest rates tend to increase for some reason, the central bank-treasury composite will target the interest rate, using open market operations.

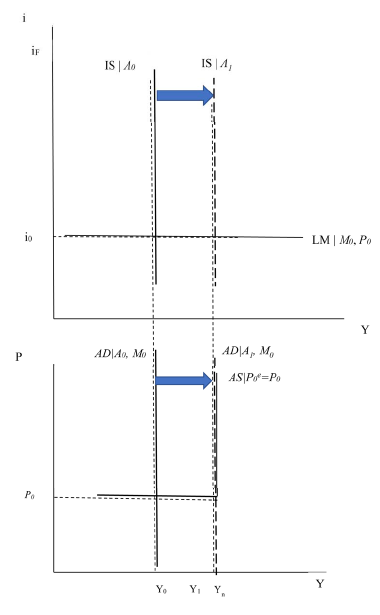

A slightly more complicated outcome results if aggregate demand is increased so as to set Y = Yn. This is shown in Figure 2.

Figure 2: Expansionary fiscal policy, where final output is at Yn.

Technically, the price level is indeterminate (it could be anywhere at or above P0). In any case the price level is inconsequential to output, given that the LM curve does not shift with the price level, and even if it did, investment is interest insensitive.

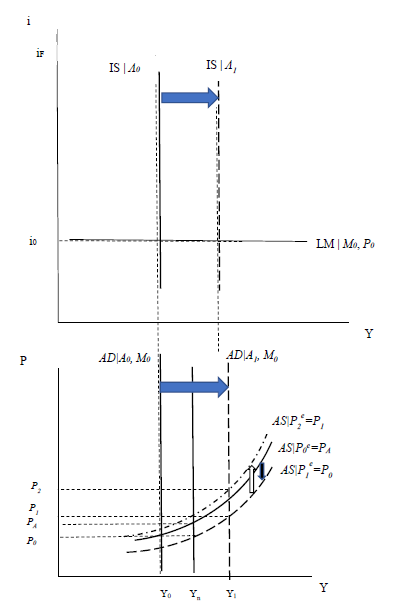

A slightly different result occurs if the AS curve is upward sloping. Incorporating a standard AS curve (as in Blanchard, 2018), where supply equals Yn such that P0=Pe0, one obtains Figure 3.

Figure 3: Expansionary fiscal policy, where final output exceeds Yn

In order to analyze the evolution of macro variables, one needs to define the way in which price expectations are formed. For simplicity, I assume the current expected price level (P) is set to the previous period’s price level, viz.:

Pt=Pet-1

Assuming this price expectations scheme, one can trace out the economy’s dynamics. Output begins below Yn. In period 1, government spending increases shifting out the AD and IS curves (blue arrows). The deficient aggregate demand in period 0 results in a downward shift of the AS curve (black arrow). Output rises to Y1.

In period 2, output remains above potential output, so the price level rises again (white arrow), and again, and again. This implies that the price level rises continuously.

- Financing vs. Resource Constraints

The preceding discussion highlights the fact that the government faces no financing constraint, although its actions are circumscribed by a resource constraint (the vertical AS curve). Since government spending injects money base (MB), the greater the amount of government spending, the more accommodative monetary policy is. In an equation:

-P×(T-G) = ΔB + ΔMB

Which is the standard government budget constraint, with T is tax revenue net of transfers and G is government spending on goods and services. The government will always be able to sell bonds; if not, the central bank will necessarily buy the bonds[1]

-(T-G) = Δ(MB/P)s

Since the central bank/treasury government sector can be treated as a unitary actor, then all bonds can – and will be – purchased by the central bank so:

Money base is demanded elastically because of the requirement that taxes be paid in the national currency (sufficient but not necessary condition). Reductions in quantity demanded are absent since inflation is ruled out (because it is assumed that the government will keep output below Yn).

3. Math Appendix – See PDF of Notes

4. References

Bell, Stephanie. “The hierarchy of money.” The Jerome Levy Economics Institute Working Paper Series 231 (1998). http://www.levy.org/pubs/wp/231.pdf

Blanchard, Olivier. Macroeconomics. Pearson (2018).

Palley, Thomas I. Money, fiscal policy, and interest rates: A critique of Modern Monetary Theory. No. 109. IMK Working Paper, 2013. https://www.econstor.eu/handle/10419/105973

Rowe, Nick. “Reverse-engineering the MMT model.” A Worthwhile Canadian Initiative. (2011). https://worthwhile.typepad.com/worthwhile_canadian_initi/2011/04/reverse-engineering-the-mmt-model.html

Tymoigne, Eric, and L. Randall Wray. “Modern money theory 101: a reply to critics.” Levy Economics Institute, Working Papers Series 778 (2013). http://www.levyinstitute.org/pubs/wp_778.pdf

Wray, L. Randall. Modern money theory: A primer on macroeconomics for sovereign monetary systems. Springer, 2015. Online version 2011. http://neweconomicperspectives.org/modern-monetary-theory-primer.html

Notes

[1] “[I]n that extreme case where nobody wants to buy bonds from the Treasury, the central bank will intervene, or the Treasury will finds ways to avoid having no funds in their coffers. They have done so for centuries now due to their privilege in the monetary system. They have done so not only to finance Treasury but also to avoid financial instability that results from a federal government that does not perform its monetary duties properly.” Tymoigne and Wray (2013: 27).

Do we dare say that Ocasio-Cortez is the main reason MMT has entered a broader public consciousness?? Some parts of MMT are hard to “buy into”. It does (at least at first glance) have a “pie in the sky” flavor to it. But economists tend to slough it off too quickly without giving it a fair/full hearing. Many things which were once seen as heretical are now mainstream and seem “obvious” after the fact. It has attracted a lot of very intelligent people “into the fold”. I would argue for that reason alone, it deserves the theories to be “played out” and tested in as close to empirical fashion as possible and not to be the target of derision.

Youtube has many videos and lectures up for MMT beginners. Just input the obvious keyword searches and it can be helpful for those having a hard time grasping it initially. There are still large parts of MMT I don’t understand, some due to my own laziness and some due to the breadth of the material.

Moses Herzog I’m cautiously skeptical about MMT. Not a believer, but I’m open to being persuaded that it could work on the blackboard. But I have some serious real world concerns about the way Bernie Sanders and AOC have jumped on the MMT bandwagon. The MMT debate has moved out of the seminar room and is now being used (or misused) by the Green New Deal (GND) folks as a kind of painless way to implement GND. Even if you accept the seminar version of MMT, the government still has to take away the punch bowl just as the party gets rolling. I don’t believe the Sanders and AOC folks want to hear that part of it. Now I’m a big fan of many of the GND issues, but I think they’re being intellectually dishonest in trying to use MMT as a way avoid the pain that would have to come from any policies that address climate change.

“The MMT debate has moved out of the seminar room and is now being used (or misused) by the Green New Deal (GND) folks as a kind of painless way to implement GND.”

I never understood why the GND crowd has not adopted the carbon tax proposal to pay for GND. Yea I get Mankiw wants a revenue neutral carbon tax where rich people get more tax cuts. But he eventually signed onto the version where the tax rebates go back to all of us on a per head basis.

pgl: I suspect because taxes are not necessary to finance government expenditures, then taxes would only spur political opposition.

Yea – every time we Democrats suggest even the least of a tax increase Republicans go screaming gloom and doom and refuse to provide even a single vote. And yet these Republicans pretend to be all for fiscal discipline. Go figure!

A carbon tax (or some kind of cap-and-trade arrangement) makes the most economic sense. I think the main problem is due to the very long lag between when economic agents enjoy the benefits of emitting GHGs and when the bill comes due. If you’ll be long dead and buried when the bill comes due, then you probably have very little incentive to cut back on current consumption of GHG emissions. Given human selfishness there is no hope of achieving an ethically defensible way to discount across several generations. People who drive gas guzzling 4WD F-150s simply don’t care how their actions today will continue to reverberate a 100 years from now. Politically it’s a lost cause hoping that myopic and selfish voters will accept the discipline of an economically rational carbon tax approach. So what to do? One option is to recognize that most people are selfish idiots and turn that into an advantage. In other words, adopt policies that promise a free lunch and count on people’s inability to understand money illusion. In that regard using a crass form of MMT to advance the GND agenda makes some shrewd political sense. If people are dumb enough to fall for supply side economics or Trumponomics, then they’re probably dumb enough to fall for a snake oil version of MMT. That kind of MMT would reduce economic welfare over the long run relative to a carbon tax solution, but over the short run people would only see a roaring economy and full employment. And they might not notice all of the destruction of carbon intensive capital that would be happening all around them.

If you think voters are mature adults, then a carbon tax is the right approach. If you think voters more closely resemble toddlers, then sometimes you have to tell them that green brussel sprouts are really green gumdrops. Put another way, advocating MMT in the service of the GND can be seen as a kind of noble lie. Maybe a noble lie is justified if it’s the only way to save the planet. That’s not a very uplifting view, but it might be the most politically realistic. It’s just too bad people can’t learn some economics because we’d all be better off if they did.

Slugs,

Your comment is rather insulting and misguided. I drive a 4WD F150 because I also own a small tree farm and need the ability to haul supplies and drive down a 1000 foot driveway in the winter. You have no idea why other people drive pickup trucks, and you are in no position to speculate. It is still a free country and people are allowed to make their own choices.

Moreover, your insinuation that voters who make different choices than you are “toddlers” rather than “mature adults” is despicable. Again, your speculation about the motives of other voting adults is misguided. Your priorities are no more laudable than those of any other voter’s.

it is unfortunate that your general description of people and their behavior is probably correct. worse still, your policy to lie in order to achieve ones goals is greatly aligned with rick stryker’s belief that lying to achieve ones goals is ok. now, you are advocating lying to achieve a greater good, while rick advocates lying to fill trumps coffers, but the similarities are there nevertheless. what a morbid world we have right now.

” I drive a 4WD F150 because I also own a small tree farm and need the ability to haul supplies and drive down a 1000 foot driveway in the winter. ”

tom, have you ever advocated for a good electric pickup truck that could do the same thing without the environmental damage? or do you not care about the environmental damage?

Tom There are certainly many environmentally responsible reasons for owning a 4WD F150. Planting trees is probably one of those good reasons. But light truck sales haven’t been rising because more people need them for their jobs.

You have no idea why other people drive pickup trucks, and you are in no position to speculate.

I know why advertisers think people want to buy light trucks with all the creature comforts.

Moreover, your insinuation that voters who make different choices than you are “toddlers” rather than “mature adults” is despicable.

If you’re making choices based on presenting a rugged self-image without regard to how your choices affect others, then you are behaving as a self-centered toddler. No one is perfect and we all make environmentally destructive choices. Most of the time those choices are unconscious. The point of a carbon tax is to impose a little more self-reflection into our choices. And we don’t always have a lot of control over the choices available to us, which is why it’s important to design policies that make responsible choices possible. The carbon tax approach is the adult way to address climate change. But if voters don’t want to adopt the adult approach, then Plan B is to adopt the toddler approach. My larger point was that one of the hidden political agendas behind MMT is to present it as a palatable way to get toddlers to eat their vegetables.

Your priorities are no more laudable than those of any other voter’s.

I don’t think there is anything laudable in a six figure executive driving a gas guzzler light truck from his McMansion driveway to his reserved parking spot at the office. I don’t think there is anything laudable in purchasing large vehicles as a way to compensate for one’s small hand size. Light truck sales are not dominating the market because car buyers are becoming leaner and more rugged. Not all priorities are equally laudable.

Tom, ignore Baffeled’s comment re: EV Pick Ups. He also believes in pink unicorns. Most EV Pick Ups are concept or proposals , and few (if any) are currently available in the US. When you use present5 tense, he automatically transforms it to future tense.

Next he’ll propose you replace those useless silent deer whistle additions ( if you have any on your vehicles) with teeny tiny wind mills to generate electricity while moving. https://www.ebay.com/itm/332653585375

corev, i never said tom had to buy one. but i did say if he lobbied for one, then he can put pressure to develop and sell them. tesla has one on the way. a few years ago, corev, you would have made the same argument against me if i had argued tom should lobby for an electric sedan. once people shared their desire to purchase an EV, the market has responded vigorously. however, one will not lobby for an EV if one is a denier. such is the life of corev.

baffling I never said I was endorsing the “noble lie” approach. I said that it would be a shrewd political option if voters and governments can’t find a way to do the adult thing and enact a global carbon tax with real teeth. I don’t think it’s on quite the same moral plane, or should I say sewer, as Rick Stryker’s willful ignorance of the damage that Trump’s policies will do. Another big difference is that any moral defense of the “dirty hands” problem ( I recommend Sartre’s book by that name) insists that those who lie for good cause should still suffer consequences and should not reap personal benefits from getting their hands dirty.

http://fs2.american.edu/dfagel/www/walzerDirtyHands.pdf

Oh…I also don’t believe that Sanders, AOC and others pushing MMT as a painless way to implement a GND are being deliberately disingenuous. I suspect that they quite sincerely believe that a crass and painless form of MMT could be implemented without bad economic consequences.

@2slugbaits

Let’s say for the moment (or the sake of argument) that you are largely correct (all of what you said is certainly a valid argument). Let’s say that Miss Ocasio-Cortez and Sanders are just using MMT as a way to “sell” or “market” more government spending (or spending on their favored policies). MMT, up to now, has largely been seen as a “side show”. If a person has doubts about MMT they should be happy that Sanders and Ocasio-Cortez are bringing it into the spotlight. This is going to put MMT’s “feet to the fire”, such as Menzie’s post above and many journalists are doing now.

Can I swear that Menzie never would have done the post up above (or certainly timed it now) if not for the existence and political rocketboost of a very sharp lady from the Bronx?? NO, but I would bet a very large sack of cash in Vegas or on “PredictIt” that Menzie wouldn’t have.

I would also say this: this is another classic reason why Democrats/liberals nearly always are losers in the public square debate. Because you are now seeing people on the left give MMT a much harder time than they ever gave supply-siders. Certainly in the Reagan years, and I can make a strong argument clear up to this very day.

This fire MMT is being put through is a good thing, and I am all for it (It will apparently forever be my personal fantasyland that liberals/Democrats would give this much energy and initiative to attacking Supply-siders). The comical part to me here (in the sense of people’s actions over their rhetoric) is how many people are MMT’ists and don’t even know it yet.

“I would also say this: this is another classic reason why Democrats/liberals nearly always are losers in the public square debate. Because you are now seeing people on the left give MMT a much harder time than they ever gave supply-siders.”

I wish I had better access to my past Angrybear posts where I routinely mocked the supply-siders. I still try but I’m getting too old for this stuff!

I take your word on it, that is enough proof. So no need to hunt down old posts. And hopefully it went without saying I wasn’t including Menzie in that criticism. But two people does not a “broad attack” make. Menzie published a book on it (which I have in this house hiding somewhere) so, even if we don’t look at Menzie’s research papers that pretty much leaves him “in the clear” on that criticism.

If I have an issue with Menzie (a rarity) I think he knows I would take him on very directly. I think no one here has doubts in my ability to be blunt, wherever they rank my intelligence quotient.

I love how Nick Rowe entitled his paper – ““Reverse-engineering the MMT model”. All good stuff but something tells me that some in the MMT crowd are going to argue with how you framed what they are trying to say. The debate between Krugman and Kelton was at one level brilliant (how Krugman posed the questions) and at another level very sad (her replies).

pgl: True, but I wrote it for my students – don’t think there’s anything new (hopefully) and hence uncontroversial.

I had the pleasure of sitting through 2 semesters of James Tobin presenting his version of macroeconomics when I spent one year at Yale. There is nothing that the MMT crowd has written that was not in some way covered by Tobin. Paul Krugman must have done the same given how he warmly remembers the late Dr. Tobin. And yet we have to endure their long winded lectures on how we are not living up to the true tradition of Keynes. Really? All because Krugman supported Hillary and not Bernie I guess.

BTW – in an open economy model with floating exchange rates I would think monetary policy would still have a transmission mechanism as long as it could influence interest rates. When this is brought up some MMTers revert back to closed economy thinking. I guess if the Trump trade wars continue, this assumption might become valid!

pgl: The point is that MMT contends that the interest rate can be completely controlled.

Wait a second – doesn’t the Taylor envision using interest rates as the policy instruments. At which point some MMTers get all huffy and puffy and start lecturing us on how banks actually work in the real world. Which is sort of funny as they seem to be copying and pasting from my old money and banking notes.

Here lies the problem. MMTers strike me as some old dog chasing its own tail. I sort of lose track with their real point even is.

That’s about as “naive” as it gets, isn’t it??

https://www.washingtonpost.com/business/2018/10/24/we-have-serious-problem-paul-volcker-is-worried-about-something-worse-than-inflation/?noredirect=on&utm_term=.f3d95708e154

Where do MMT’ists get such ideas?? I’m sure Paul Volcker has no idea. Nor would the man who followed Volcker, who pushed out the bubble to hydrogen bomb expansion and then shrugged his shoulders afterwards.

Menzie MMT contends that the interest rate can be completely controlled

Which interest rate? Doesn’t that return us to the old Hicks IS-LM debate that assumed the “speculative” interest rate versus the New Keynesian FOMC FFR interest rate?

2slugbaits: From what I can tell, it’s the risk free rate.

@ Menzie

I’ll tell you one question I would sincerely love to know the answer to. We’re told interest rates are largely “market determined”. Yet I have never heard a clear answer on if rates are “market determined” how traders manipulated the LIBOR rates, for YEARS just by tossing in ridiculous (false) submissions, from roughly 1991 to 2012?? These were called “benchmark” rates??/ Correct??

How many bankers got charged with crimes in the end?? Laugh riot.

Moses Herzog: I don’t know how many were charged, but certainly fines were levied, and LIBOR is being replaced as a benchmark.

See Economist.

I kind of like these two “interfluidity” links to the MMT debate:

https://www.interfluidity.com/v2/7083.html

https://www.interfluidity.com/v2/7097.html

The first link offers several different perspectives as to what MMT is and isn’t. The link to Jo Michell has an interesting picture of a page from a 1973 textbook that identifies the vertical IS and horizontal LM curves as “Extreme Keynesian”.

All worth the read. I like the ending:

“Which brings us to the third level of MMT controversializing. Economics debates are often passionate, and frequently become too personal. But MMT debates are stuck on infinite recursion, and they take place in a thunderdrome entirely their own. The depth of the resentments between veteran partisans is astonishing. MMT arguments escalate almost immediately to thinly veiled campaigns to publicly expose ones opponent not merely as mistaken, but as a fraud, an idiot, a hypocrite, or a traitor to some Left cause. Like members of hostile tribes doomed over centuries to share the same tiny valley, each side points to perfidies and massacres perpetrated by the other, the Twitter horde that harassed for weeks, the line taken out of context and publicly mocked.”

But you know – we do live in Trump world so such overhyped arguing with little purpose has become the norm.

Did Waldman give examples of which specific MMT economists were bickering?? Because I’m also curious which segment of economics which he found so peaceful in the debate department??

I like Steve Waldman’s writing on finance—he’s quite good at Finance posts—but when he crosses over from finance into economics is usually when he gets into the deep end of the swimming pool.

2slugbaits: Agree. Meant to include those in references, but couldn’t remember where I’d seen them. Thanks!

With all of these excellent links and discussions, maybe some graduate student with an interest in History of Thought might write a dissertation on Keynes v. MMT. Hicks did well with his Keynes v. the Classicals!

2slugbaits: Reference to Chick’s 1973 book added memo. Thanks!

A lot depends on the assumption (which MMT seems to accept, curiously) that there is a unique, supply-determined level of ‘full employment’ output. If there is hysteresis and it works in both directions, this debate gets a lot more complicated. I’ve written some papers that your students might benefit from using the 3-equation model as a platform, BTW.

tom michl: Thanks, I’ll take a look. I agree hysteresis is an issue which would change the results. I think it was (kind of) implicit in the Friedman interpretation of the Bernie Sanders plan; see here.

I still don’t get it. We have lots and lots of empirical episodes where govt control of resources through money printing led to high inflation. Are there any empirics attached to MMT?

I don’t think so.

We do have Gerald Friedman’s little “study” for whatever it is worth (or not)!

I think the debate over MMT will become very serious if a substantial downturn comes in near future, because the traditional monetary policy response will be hampered by low interest rates and expansionary fiscal policy will look dangerous owing to the big deficits and climbing debt, but painful unemployment will exert pressure for policy makers to do something, just about anything.

Good point but let’s note Krugman was noting that back in 1998 (something about Japan) and even neoliberal Lawrence Summers agrees.

How does MMT account for the phenomenon of capital flight?

Since merely raising interest rates will not prevent capital flight, the only option is to peg the currency to a stable foreign currency.

But then the government has lost control of its borrowing.

The conclusion must be that MMT only works at ZLB and perhaps not even then, according to Keynes:

“For whilst an increase in the quantity of money may be expected, cet. par., to reduce the rate of interest, this will not happen if the liquidity-preferences of the public are increasing more than the quantity of money; and whilst a decline in the rate of interest may be expected, cet. par., to increase the volume of investment, this will not happen if the schedule of the marginal efficiency of capital is falling more rapidly than the rate of interest; and whilst an increase in the volume of investment may be expected, cet. par., to increase employment, this may not happen if the propensity to consume is falling off.

“Finally, if employment increases, prices will rise in a degree partly governed by the shapes of the physical supply functions, and partly by the liability of the wage-unit to rise in terms of money. And when output has increased and prices have risen, the effect of this on liquidity-preference will be to increase the quantity of money necessary to maintain a given rate of interest.” The General Theory, p. 173.

” endogenously determined”……. when I was an undergraduate (BS late 1960’s) student I would have needed a dictionary, In truth I do now.

pgl thanks for bring up Gerald Friedman in a thread about MMT [and OAC/Bernie progressives today in Moses at top of replies].

Is it coincident? That anti progressive democrats opposed to what appeals to OAC and Bernie?

@ ilsm

Your question seems to be, “Do people’s personal (subjective) beliefs in politics effect which economic theories/policies they buy into?? (which should form from a more objective viewpoint). I think the answer is, a high percentage of the time “YES”. I like to think I am immune to that. Beings that I am a lefty on most things (with the possible exception of gender politics where I tend to lean farther to the right) and that I am very sympathetic to Keynesian economics (and yes, also at least to a degree sympathetic to MMT economics). Is that a coincidence?? I am forced in the spirit of truthfulness to very begrudgingly tell you “NO” that is not a coincidence. And if people “on the right” are similarly honest as I am being now, most would also say “YES” their political beliefs to a degree effect which economic theories they buy into.

Moses,

Thank you.

I spend too much time the past week reading about Boeing 737 Max 8 accidents. There we have science which implies decisions that are made and risks accepted and the ‘hand of chance’ takes what it will……. I have worked on military aircraft design, delivery and support. My philosophy is challenged.

So much is not determinate!

https://www.youtube.com/watch?v=YnyDRwSqp2E

I’ve always (at least since roughly high school age) thought that bonds are in large part a type of welfare for the rich, that are often (not always) abused. I’ve heard very very few others verbalize this thought—that bonds are a welfare for the wealthy—for obvious reasons. The moment you express it you become a “heretic”. Recently our town issued some municipal bonds. What for??? Part of it went for Public School tennis courts, There are tennis courts here in some public parks, Often unused for hours or DAYS on end. And YES, the same with the public school tennis courts. Who uses those?? What income bracket do most of these kids playing tennis fall into. low-income residents are paying on bonds, and interest on bonds so some rich bastard’s kid has a tennis court, so he can get a scholarship to attend school for near free?? They have money for tennis courts but “no money” for teacher salaries. Fascinating…….. Ok, yes that’s one isolated example of how bonds are used. But when the municipal taxes get down-voted, and then the municipal leaders say “Hey, no need to raise taxes, we’ll issues bonds!!!” How disingenuous is that??—and who does it benefit?? Who contracts out that work to the vendors?? Meanwhile we have guys like Buffett, Trump, and Romney not even paying a 20% federal rate while they’re collecting interest on their bonds, lecturing poor people on their tax contributions.

I meant to say/ask “What income bracket do the parents of the kids who play tennis fall into??”. Hopefully that was semi-obvious what I meant when I expressed that wrong.

Moses,

Some one said years ago…. government debt is deferred taxing. Some one here might recall whom said that? I think he was far to the right of the latest critics of MMT.

My feeling is ‘cut my taxes and I will certainly use the extra cash to lend to you’; whether you be Uncle Sam or my local property tax setter. I would be very happy to keep rolling it if you do not want to tax me to pay me off!

@ ilsm

It’s a nice circular logic you’ve got going there. But that’s the whole point between bonds and taxes. People like you don’t seem to realize there’s always someone else on the other end of the transaction. You want the roads, bridges, police, and fire dept, but you don’t want to PAY for them. The revenue to pay for the bonds (pay YOU, if you are the bond holder) doesn’t come from the sky or the void of interstellar space. Someone is paying. My point is, if the public is paying ANYWAY (tax revenues eventually get used to pay the bondholders PLUS INTEREST, why the F__K am I paying 3% interest to bast*rds like Mitt Romney, Bain Capital etc…. who refuses to contribute his share to the tax base??

I’m pretty certain Menzie thinks what I am saying is largely hogwash and that we “need” bondholders. But out of kindness (or passivity to people taking odd stances on this blog) Menzie has decided he’s not going to use the planetary death ray on me at the moment.

Always remember kids, life is tough in the big bad city:

https://www.cnbc.com/2019/03/21/skeptical-dem-donors-tell-biden-they-will-not-raise-funds-for-him.html

Well Joe, it’s time to head back to the hometown abbey and ask Father Murphy and Father O’Brien why they keep touching all the kiddies:

https://www.youtube.com/watch?v=FwbjNovSWAs

@ Menzie

Menzie, I’m not certain, but you might be interested in the introductory notes of Wynne Godley and Marc Lavoie’s 2007 book, both the Preface and the Introduction. It is pretty thorough and discusses the relationship between alot of the post-Keynesians and how the relationship between all these researchers and theorists is interwoven in their work.

It even mentions the post Keynesian economist Victoria Chick. Or as Frank Sinatra often called her on stage “that crazy chick”.

Inversion Alert. This morning the yields on the 2yr, 5yr and 10yr all fell below the yield on the 3mo.

Dear Menzie,

This is a little late, and my apologies. I am basically going to agree with PGL, whose thinking seems to match mine.

The only issues I might have with this are 3.

1) If you push aggregate demand above potential output, yes, you will have inflation. Lerner had this conversation with Alvin Hansen that is recorded in “The Coming of Keynesianism to America: Conversations with the Founders of Keynesian Economics” by Colander and Landreth. He mentioned a particular way expectations change, and you might check that. So the inflation formation might not be a straight increase, in which percentage increases in inflation map percentage of output over potential one for one.

2) I would think the issue might be that the monetary authority could control interest rates to the extent of managing the domestic economy, but still might be unable to deal with external shocks to the interest rate, such as exchange rate collapses or the like.

3) Keynes criticized Lerner’s functional finance for ignoring debt. You might mention that. It appears government debt and the government budget constraint is never mentioned, or that there is an implicit assumption that it will be like the old model in which it was assumed that government would raise taxes in cases of surplus and cut them in deficits, so that budgets would balance over time and debt would not explode. It was connected to the full-employment measure to evaluate government spending.

Julian

Menzie,

Back in Dec 17 you highlighted the 3mo/10yr spread had dropped below 1%, and that the average time to recession was 16 months (May19). That spread is now inverted, the FED has signaled no more rate hikes this year, and the Eurodollar and Fed Funds futures are discounting a cut next. Given the Bond market seems to be signaling a recession may be near, I’d love to see your updated thoughts!

https://econbrowser.com/archives/2017/12/post-war-how-many-times-has-the-10yr-3mo-spread-fallen-below-1-without-a-recession-following#comment-203603

JD44: Thanks! Post up: https://econbrowser.com/archives/2019/03/inversion

Haven’t had time to re-run regressions…

Hi all;

I’m not an Economist or even an Econ student, I’m a US citizen trying to understand fiscal policy choices in order to be a better informed voter.

So here is my naive view of MMT after reading Warren Mosler (“Soft Currency Economics II” and “The Seven Deadly Innocent Frauds of Economic Policy”)

and watching Mr. Mosler and Stephanie Kelton on YouTube. PLease let me know what, if anything, is wrong with what I (think I) understand.

The US Dollar(USD) is a “fiat” currency. Which means that the US government will not convert it into any other form (gold, for instance). Also, it has no intrinsic value and its value derives from the fact that it is a tax-credit, that is, it is the only form of payment acceptable for obligations to the US government(USG).

The US government holds a monopoly on the creation of the USD. (Only the USG may legally create new USDs.) It is my understanding that “credit” money is just leveraging the extant USDs and doesn’t add new dollars to the private money supply.

Because of the rules of double entry accounting, if the USG goes into deficit, the non-USG side of the ledger goes into surplus. The so called “US debt clock” that used to be in Times Square, could, therefor, be called the “private savings clock” without abusing the rules of accounting. If the entire US debt were to be retired, there would be no USG securities. If I understand it, there would also be no currency, as greenbacks are also tax-credits; one person who worked at the Federal Reserve called them “zero-coupon perpetual debt”.

Since the USG is the sole creator of USDs, it does not need to tax or borrow in order to spend. In fact, the USG does not have any USDs until it creates some while spending it. (Yes, there is a small amount in reserve to replace damaged currency.) Taxes paid serves to destroy money.

The USG can never default on debt denominated in USD because it can always create more USD.

As I understand it, that pretty much sums up the descriptive aspects of MMT. From there on, the debate becomes one of policy implications due to the above.

The biggest debates appears to surround: At what point will deficit spending cause the economy to go into inflation, and how much debt is too much?

MMT proponents suggest that deficits “should” be as much as is needed to ensure full employment (in real terms, i.e. , if someone wants a (full-time) job and can’t get one, she is un- or under-employed) or put another way, the economy is producing at 100% capacity. If the economy overheats, increase taxes to remove excess money from the system.

At to how much debt is unsustainable, as far as I can tell, Japan is the closest exemplar.

As I said earlier; What am I missing?

Thanks

I have held off on this discussion until now, but comments by both Silk and Maloney have me deciding to weigh in. One preliminary is that I think Menzie has done a decent job in his post in showing how one can fit MMT into more or less standard ISLM and AS-AD analysis, while leaving out some background material suggesting MMTers have larger problems with both of those. The other preliminary is that I have long been friendly with the MMT gang, having coauthored with Randy Wray in the past and knowing Stephanie Kelton since she was Stephanie Bell, as Menzie cited one of her early papers. While I like them and think they are right about a lot, nearly two decades ago they tried hard to get me to really join the club, which I resisted, more due to some of these background matters that appear in the comments by Julian Silk and Mike Maloney, where I have problems.

1) Silk brings up Abba Lerner’s functional finance, and indeed they themselves agree that he was a major source of their views. There was indeed an issue of how to deal with possible inflation, given his support for basically strongly stimulative monetary and fiscal policies. Eventually he would team up with a young David Colander to propose the MAP idea that relied on market forces to incentivize firms not to raise prices, something never adopted anywhere, for better or worse. It should be noted that he published his main work on functional finance in 1943 in the midst of WW II, when the US economy was a temporary command economy with price controls that controlled inflation, along with direct commands on what to produce (no private automobiles, tanks instead), as well a massively expansive fiscal and monetary policy. It may not be an accident that some tying the GND to MMT are also using language that suggests that the GND is inspired by the WW II economy.

2) Maloney brings up the underlying ideas about money, where I have some problems. MMT follows what is called “chartalism,” which Keynes briefly nodded to in his Treatise on Money but abandoned more or less in the GT. This says that money is whatever taxes are paid in. I prefer the more general view that says it is what is used as the medium of exchange as well as serving as the numeraire and also as a store of value, although that last is less important and served by many assets clearly not money. Where I think things get off is when they get into all this stuff about money being created by budget deficits, and so on. The argument Maloney cites only holds in a closed economy, which we are not in, with a lot of US national debt held abroad.

3) MMT is famous for arguing that money is always and everywhere endogenous. Certainly when ,monetary policy targets interest rates, pretty much all economists agree that money is endogenous. But even sometimes MMTers recognize that a central bank can halt an economy’s growth by tight monetary policy, although they tend to focus on the related high interest rates involved as the main culprit. But in fact as was seen in the tight Volcker policy between 1979 and 1982, the policy focused on limiting money supply, with higher interest rates arising as a result.

4) They are right to distinguish between debt in one’s own currency rather than in a foreign currency. But I think they overstate the impossibility of defaulting in one’s own currency. if one is a small open economy with most of one’s debt held by foreigners, even if in one’s own currency, and especially if one has gotten into a high or hyperinflation situation, foreigners may not accept the newly issued money except at economy-crashing interest rate levels. And we have certainly seen this in quite a few nations over time, although the US is very far from such a situation.

5) Finally, and I think that Moses H. sort of got near this, if one lets debt-to-GDP rise too high, interest payments-to-GDP will rise, with these more onerous if going abroad. Japan has not had that much of a problem because its high debt levels have very low interest rates attached to it and it is overwhelmingly domestically held. Right now interest-to-GDP level in US is much lower than it was in say 1990. But if one lets that rise substantially, this will be an income redistribution towards the wealthy, a point I rarely see MMTers acknowledge.

6) Finally, Pavlina Tcherneva’s (and Bill Mitchell’s) full employment proposal has long been advocated by the core MMT group. But I note that it is both intellectually and politically distinct from MMT. It could be carved off to stand on its own or be removed from an otherwise MMT policy.

One may believe that Rate is “strongly exogenous” around the moment the Central Bank takes an action. When no Fed action it is almost endogenous but the market never anticipates “too wrongly”.

Rate structure and Volatility Index are the topmost indicators that influence private agents’ actions.

I believe MMT is about “right” but implementing it is “suicide”. Long-term decision-making becomes strongly driven by short rate. When a shock comes the current wealth “disappears “ and the future generations are damned.

ZiZi: Congratulations. Your comment is the most incomprehensible I have read in a year (or two).

Given statistical evidence, one may interpret that…

In the current developed worlds, before a shock comes, high price led to offshoring, the labour is already damned.

Ricardo before the jokes of Krugman and AOC??? (Liberal ideal is not wrong; but come up with substantially better means. Challenge for you, Professor!)