The release of the final release for GDP, and the international investment position provides an opportunity to assess progress on the trade war. I for one have gotten tired of “winning”.

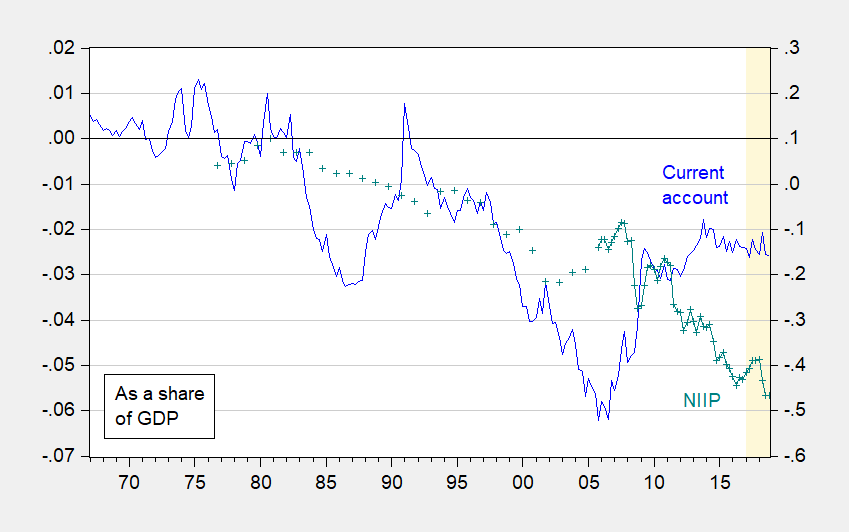

Figure 1: Current account (NIPA definition) (blue), and Net International Investment Position (green), both as a share of GDP. Orange shading denotes Trump administration. Source: BEA, 2018Q4 final release, 2018Q4 international investment release, author’s calculations.

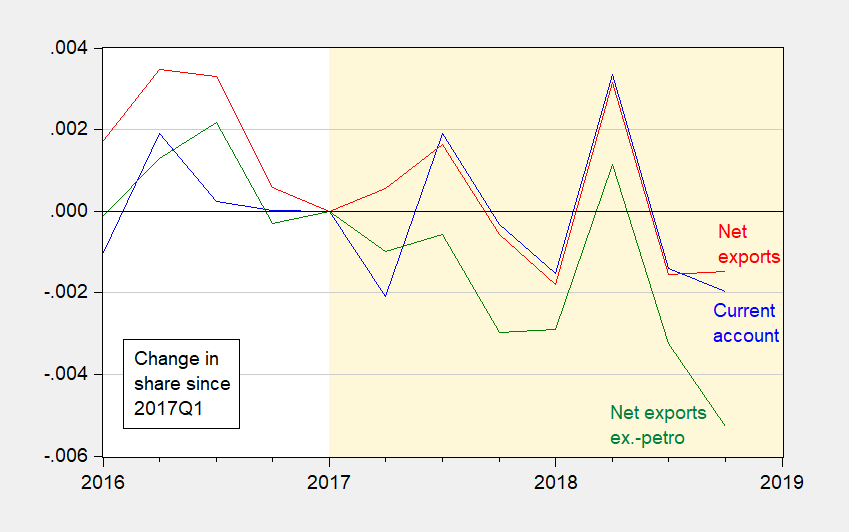

There’s been some volatility in trade flows in recent quarters; it’s likely that that is partly due to the timing shifts aimed at avoiding Chinese tariffs. Note the spike in net exports in 2018Q2.

Figure 2: Change in current account (NIPA definition) (blue), net exports (red), and net exports excluding petroleum (green), as a share of GDP, since 2017Q1. Orange shading denotes Trump administration. Source: BEA, 2018Q4 final release, and author’s calculations.

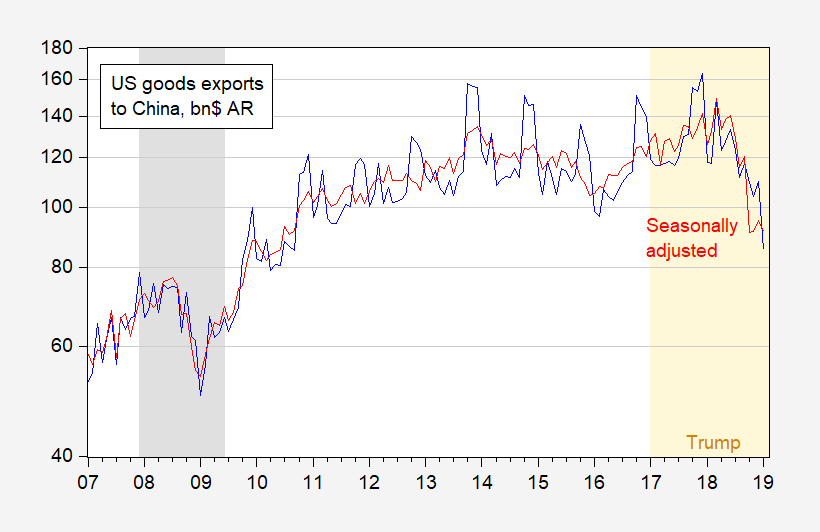

Last week’s release for January 2019 trade data also allows for a finer-detail look at the war to export more to China.

Figure 3: US exports of goods to China (blue) and seasonally adjusted (red), in billions of US dollars, annual rates, on log scale. NBER defined recession dates shaded gray. Orange shading denotes Trump administration. Seasonal adjustment implemented using X-13, ARIMA X-11. Source: BEA/Census January international trade release, NBER, and author’s calculations.

The plummet in exports is glaring. The export series shows little evidence of recovery (although the seasonally adjusted series has stabilized at roughly 40% lower than peak levels).

Correct me if this is wrong but isn’t the net international investment position (NIIP) a stock as in our holdings for foreign financial assets minus foreigner’s holding of U.S. financial assets aka our net financial wealth with respect to the rest of the world?

The current account is a flow as in the annual change in NIIP. Current account deficits as such leads to a more and more negative NIIP.

Of course we know Trump loves debt so it is no wonder he might pursue policies that would make the current account deficit even worse.

pgl: Delta(NIIP) doesn’t equal exactly CA because of measurement issues *and* valuation changes.

Re: Trump, you wouldn’t be surprised to know the $20 trillion he’s referring to is actually the national debt, i.e., Federal government debt, not the net NIIP (which means that he understands even less than you thought).

This is why if I was President, Menzie would be an “unofficial” adviser, with, like, one of those laminated pins on his suit that says he could walk into the Oval Office ANY time HE wanted. Then even if I had to turn to the left where Menzie was sitting with an inquisitive look on my face before all of “my” major economic decisions, they would be intelligent decisions, moving in the right direction. So see, I do have ONE quality that makes me suitable for U.S. President. [ happy sigh….. basks in the warm sunlight sensation of my own self-admiration ]

I am beginning to think we may be into a recession by the fourth quarter of this year. Construction is up for the time being, but there are enough other things on their way down that I’m beginning to think we are on our way to a slowdown. Fuel prices are up, which is good for Texas and North Dakota, but will pinch everyone else and cause another level of economic stress. Add the Brexit fiasco and the likelihood of an economic shock, even a small one, pushing the economy over the edge is far higher now than it was even a month ago.

That’s my fearless outhouse economist view of things.

@ Willie

Hey, everyone’s opinion on it counts. Isn’t that why Michigan U does their famous survey?? On some levels, moods and feelings count, or even “armchair” economists “back-of-the-envelope” calculations are worth considering. A lot of Krugman’s “quickie” type analysis is done using IS-LM. Sometimes you can actually get better grip of things thinking of IS-LM than using things like DSGE.

But that’s coming from someone who sometimes feels sad and morose over his own “not quite up to the task” math abilities. So take it for whatever it’s worth.

Forgot to leave this in my prior comment:

http://www.sca.isr.umich.edu

Not to worry. Our President gonna shut down the border and everthing gonna be good. Why, in Janawary, we exported bout $22 Billion in goods according to Census numbers, but we took in about $27Billion in return. Bunch a that come from Mexico.

Sure, Mexico is Texas’ biggest trade partner, but they love them some Trump down there.

Boy, did I buy my stovetop, rangehood, and oven at the right time. See, GE had them made in Mexico and assembled in Georgia. So, when the border is shut down, that kinda stuff won’t be allowed in. Bout time, I say!

It ain’t personal. It’s just bidness. Somebody gotta show them three Mexican countries whose boss.

Hahahahaha, funny!!!! You know, I’m pretty certain you meant this as satire, but some new Econbrowser readers might think you’re serious. Or maybe that is MAGA cheering I hear off in the distance??

https://www.youtube.com/watch?v=8rzAlNtEKxc

If that doesn’t remind readers here of a slightly milder version of Hitler’s speeches, all I can say is, your way of viewing the world and mine are different.

The non-educated people in this crowd and all over America are the REAL problem for America. Guys like donald trump only have the power that the people such as those in Grand Rapids FREELY GIVE to him.

If you’re hearing MAGA cheering off in the distance, you should contact an audiologist. If you’re hearing it up close, contact your physician.

Any new EB readers who might see it as reality are on the wrong blog.

I’m not certain if Barkley Junior would call this uniformly distributed or a “skewed” distribution.

https://www.nytimes.com/2019/03/31/us/politics/elizabeth-warren-fundraising.html

I guess if you misuse statistics terminology *and/or* misquote papers you use to support your own argument, anything is possible.

Mose,

I realize your question is supposed to be a snarky poke, but I shall provide a straight response. Indeed, Warren’s fundraising approach can be considered in these terms. Her possibly noble refusal to accept big money means that the distribution of her funding is less skewed than the distributions for other candidates. She has been the policy wonk candidate and has put forward a lot of good ideas, although I disagree with some of them. She has a strong core of support, but I doubt she will be able to break through sufficiently to get the nomination, with her idealistic approach to fundraising not helping her.

I would still label myself as relatively neutral on Kamala Harris run for U.S. President. But her “adaptability” on some issues, at rather “convenient moments”, is something that is starting to appear as a pattern for her. From Juliet Linderman and Tami Abdollah of Associated Press:

Within months of her swearing-in, she sponsored a bill urging states to eliminate cash bail, denouncing the system as a scourge on the poor and communities of color.

That position would become a key part of her criminal justice reform platform. But her choice surprised some bail reform advocates back in California. In her seven years as a district attorney, and then six as attorney general, Harris was absent on the issue, they say. In fact, less than a year earlier, her office defended the cash bail system in a pair of federal court cases, shifting course only weeks before she entered the Senate.

“For her entire career she used some of the highest money bail amounts in the country to keep people in jail cells and saddle poor families with financial debt,” said Alec Karakatsanis, an attorney who has brought several legal challenges to California’s bail system, “and as soon as she had no influence on that issue practically, she announces she has a different view on it.”

https://apnews.com/0e7dd2e5b2564a25b6266f0632da651e

She has a little bit of the same of President Obama’s “oreo” quality to her. Most African American voters “let that slide” in 2008. Will they “let that slide” past in 2020 for Harris?? I am white male (for transparency’s sake) but if I was a black voter, I would be “taking note” of such things.

Something tells me, that our good friend, and gentlemanly scholar of the old school, Mr. Ashoka Mody took note of these numbers, and wasn’t surprised in the least

https://www.reuters.com/article/germany-economy-industrialorders/update-1-german-industrial-orders-slump-42-percent-in-february-idUSL8N21M0XA

Well, it’s Ashoka Mody vs the German Central Bankers on increased fiscal stimulus policy. Who’s right?? I think Ashoka Mody is the guy with the increase fiscal stimulus harmonica and the German Central Bankers brought 2 too many austerity horses.

https://www.youtube.com/watch?v=CTltxRGVJR4

https://youtu.be/LvLxAS5LO2M?t=530