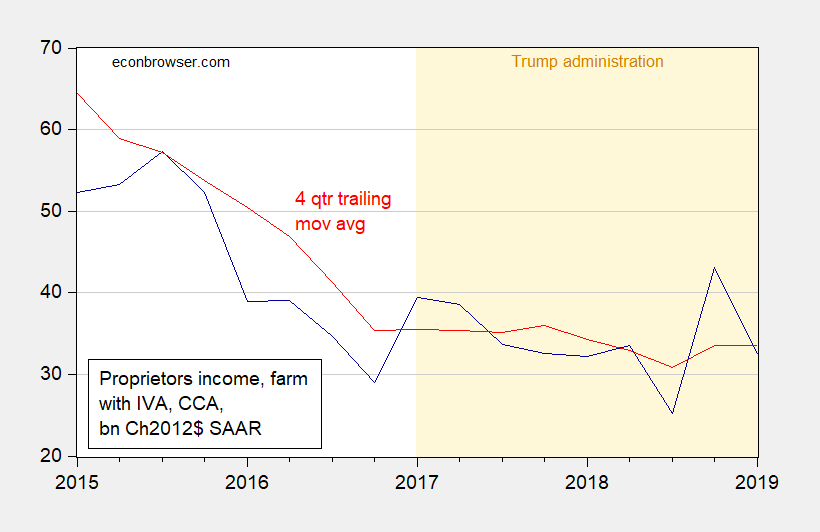

Figure 1: Real proprietor farm income with inventory valuation adjustment and capital consumption allowance (dark blue), and 4 quarter trailing moving average (red), both in billions of Ch.2012$, SAAR. Deflated using GDP deflator. Source: BEA 2019Q1 advance release, and author’s calculations.

That’s obviously weather related. You ask “How is it weather related???”. Every time there’s a draught in Brazil CoRev’s IQ goes down. I tell yeh…….

(Some humor, done in the vein of my personal comedy mentor, JBH)

https://www.youtube.com/watch?v=peW0eywLr-k

Note that it is entitled “Real proprietor farm income with inventory valuation adjustment and capital consumption allowance”.

Bruce Hall is looking for a graph of Real proprietor farm income WITHOUT inventory valuation adjustment and capital consumption allowance. That will show Menzie!

This video link below is 3 weeks old, but still some interesting points made as to the prime periods for planting. Whether farmers start to switch some of their land usage from Soybeans over to corn. Even a little bit of talk about inventories. One thing it seems like to me people are missing about this, is how much American export business will be permanently lost to Brazil. And I’m not convinced that’s registered with people yet. i.e. that some of this soybean business is never coming back to America as Brazil’s farmers become more efficient.

https://www.youtube.com/watch?v=Dtp-GcIcpnE

There’ quite a few weekend Ag shows you can find on youtube–but some of them the price data or market advice isn’t terribly reliable because it’s commodities brokers or futures brokers “talking their book” or trying to drum up trades for commissions. So, I may do some more wandering around to see if I can find more recent videos like this, but I’m not going to put them up on Menzie’s and Jim’s site unless the info seems reliable—and many of them don’t.

OK, I found another one that to me the analysis is pretty damned good, and this is only about 2 weeks old. And I would even advise Menzie to watch this, because some of the data, especially as the video goes on, is pretty solid. It’s 17 minutes, take your wi-fi tablet to the dinner table or your fast food to your desktop and watch while you eat, whatever. I think it is worth it to watch this, even for Menzie. The worst you can do watching this is have a “review” of the facts as they basically stand now—and really he has some pricing data that possibly is new even to Menzie, so….

https://www.youtube.com/watch?v=Wcmksef_YmU

Here is the nominal series:

https://fred.stlouisfed.org/series/B042RC1

Our host inflation adjusted it for us since around 2014 but take this nominal series back before 2009 and you will see it was rather low back before Obama’s 1st term. We had a yuuuuge surge in this income during Obama’s first term which has retreated since.

You also see some really large increases in the value of Iowa farmland beginning around 2004 with the run-up in asset prices generally except for a small dip in 2009. In 2014 the bottom started to fall out. Notice the effect of Reagan’s strong dollar policy in the 1980s; it was a disaster for farmers, but yet they continued to support him. The estimated 2019 price for soybeans is $8.50/bushel for soybeans, rising to $9.79/bushel in 2023:

https://www.extension.iastate.edu/agdm/wholefarm/html/c2-70.html

The problem is that ISU also estimates the cost or producing soybeans will be above $8.50/bushel this year:

https://www.extension.iastate.edu/agdm/crops/pdf/a1-20.pdf

But just like Honest Abe’s Used Cars, farmers lose a little on each deal but make it up in volume!

@ 2slugbaits

I’m not criticizing your source, in fact I would go so far as to say, you couldn’t have chose any better. And I trust these economists at the better known Ag universities more than I do the commodity brokers and futures brokers as I have already stated. That being said….. I used to like the Illini site on Ag, they had academic papers and even youtube videos breaking things down. But certainly on that Illini site, I found over time the future commodity price scenarios to be WAY too rosy, and it reminded me of many Universities’ thoughts (rationalizations) on the environmental damage of fracking when their geology departments etc were getting hundreds of millions of dollars in donations from oil companies and oil businessmen.

Are they “untrustworthy”?? I would say NO, but these Ag dept at schools are so closely tied in financially with the industries they are doing metrics on—-I think the forecasts tend to be on the falsely rosy side. So unless Menzie can show me a futures contract that equates to $9.79 per bushel for 2023, I’m thinking it’s lower than that.

And one more blathering here—I would love to give Menzie some truth serum and ask him if he thinks that economists at Ag departments are too “cozy” with the Ag industries— particularly the farm commodities that are CASH crops of the state the Universities are located in. Now, economists are very similar to MDs—they rarely criticize other doctors they share the golf course with, or send/receive patient referrals to. But I think I would pay about $5 for Menzie’s thoughts on that.

Moses Herzog: Don’t interact too much w/ag economists per se. Do, with economists in “applied econ” departments — UW’s department is “ag and applied”. These days, we’re required to say who we get money from, so at least we know who’s funding.

Personally, I’d worry more about departments like those at GMU than ag&app.

This matter of ag econ depts getting lots of money for crops in their states used to be very much the case, but has been declining for a long time, which is why as Menzie noted for UW they have added “applied econ” to their name, something that has happened in one for or another to lots of former “ag econ” depts. Yeah, UW used to get a lot of money for dairy research, and Iowa State was famous for the late Earl O. Heady and his 15,000 equation model of corn production (and I understand the largest building on campus is, or was, named for him). But those days have long passed.

To Moses, I think Jim H. for sure at least would prefer discussion here to lean more to the high minded sort that you find boring. I do not know about Menzie, who, at least, seems to be more tolerant some of the crazier carryings on here.

@ Menzie I agree with you on GMU. And I genuinely respect your thoughts on that or wouldn’t have asked (remember I’m a cheap b*stard. $5 is a big thing to me). I certainly don’t view it as a “conspiracy” in the Ag departments…..more like it “colors” their thoughts or “blurs” their vision?? A “subtle” creating of bias—not as severe as my fracking example, which I do view in conspiratorial terms at some schools. That relates more to Geology departments and/or connected disciplines though.

Moses Herzog: I think money colors everything more or less. Typically, state universities have lots of safeguards against waste, fraud, abuse, as well as business/political tampering. The Walker administration+WI GOP sought to erode those protections; witness their FOIA of UW historian Cronon’s emails.

From the “2018 Farmland Value Survey – Iowa State University”:

‘There were two negative factors listed by more than 10 percent of respondents who identified at least one negative factor. The most frequently mentioned negative factor affecting land values was lower commodity prices, mentioned by 36 percent of respondents. Higher long-term interest rates were the second-most frequently mentioned negative factor, mentioned by 18 percent of respondents. Nine percent of respondents cited recent tariffs on U.S. soybeans and pork and other agricultural products, making it the third- most frequently mentioned negative factor.’

Do they get that it was the tax cut for rich people that may lead to higher interest rates? Some seem to be making the connection between the Trump trade wars and their prices falling.