At the NBER IFM Summer Institute session on exchange rates yesterday, the debate over the use of survey data rekindled. In Exchange Rate and Interest Rate Disconnect, Şebnem Kalemli-Özcan and Liliana Varela used survey data on exchange rate depreciation. The discussant Adrian Verdelhan (MIT) and audience members questioned whether such data actually measured what we thought they measured market expectations.

I was somewhat surprised at this debate. Thirty years ago, the rational expectations hypothesis dominated. Now, survey data on inflation expectations is regularly cited, and used in academic studies. Market practitioners look at confidence indicators as means of tracking economic activity. A few months ago, the NBER Reporter had an article entitled “The Return of Survey Expectations”.

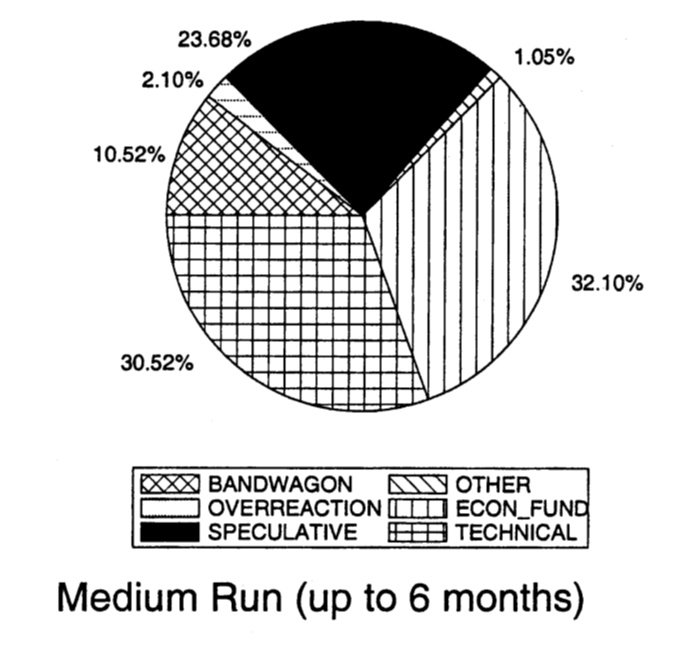

One particularly common refrain is that in forex, the survey respondents either just use interest rate parity, or are so poorly informed that they use a random walk forecast. In my survey of forex traders, Yin-Wong Cheung and I asked how traders formed their expectations. At horizons of up to six months, a variety of “models” or “dynamics” were used (economic fundamentals is roughly interest rates).

Source: Cheung and Chinn (2001).

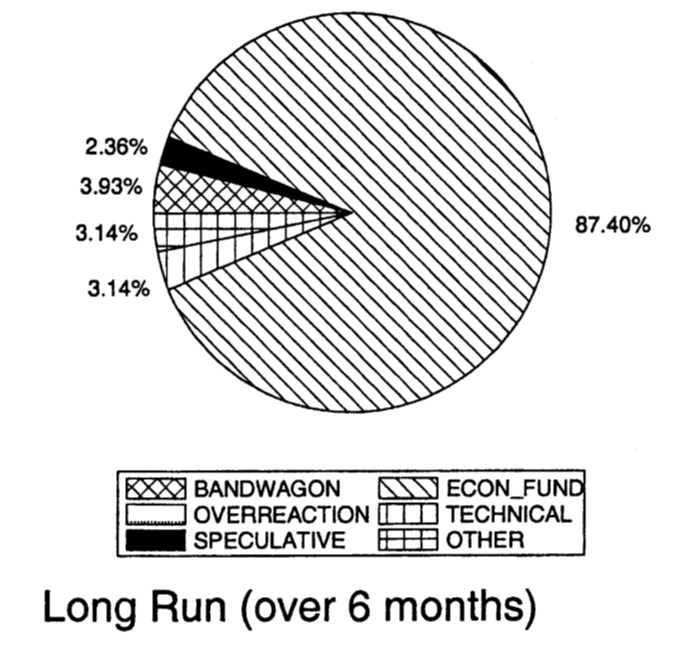

At over six months, interest rates and other economic fundamentals dominate, while at short run other dynamics dominate.

Source: Cheung and Chinn (2001).

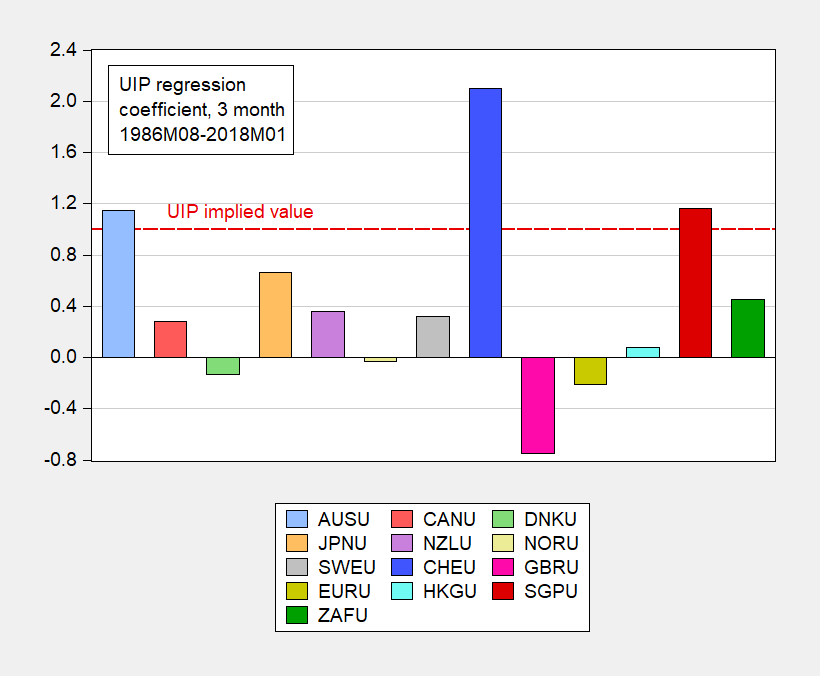

If indeed forex traders merely read off the interest differential their expected depreciation, then in a regression of survey-based depreciation on the relevant interest differential, the coefficient would be one.

Figure 1: OLS regression coefficient of 3 month expected depreciation on 3 month interest rates. Source: forthcoming revision of Chinn and Frankel (2019).

These estimates are obviously different from the value of unity, and significantly so in the cases of Norway, Britain, Hong Kong currencies (against the dollar).

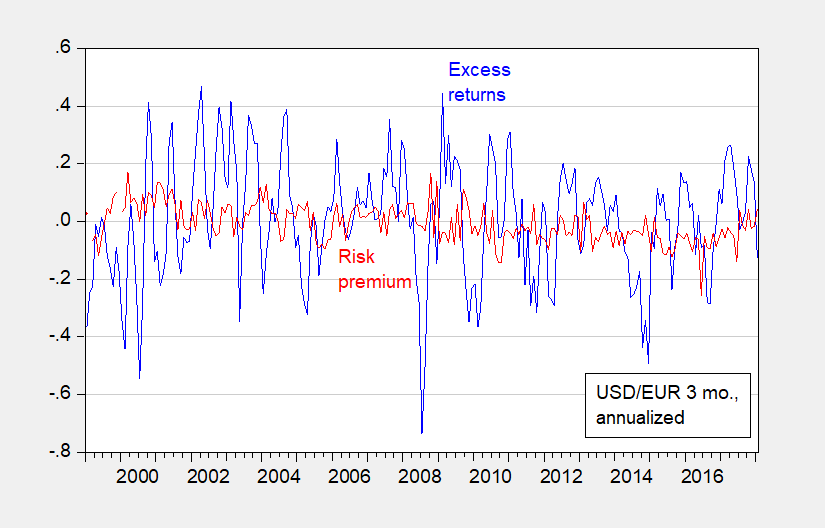

Finally, as pointed out in Jeff Frankel’s comments during the session, even if survey data are imperfect, we have even more information that the rational expectations hypothesis (forecast errors are true innovations) is also imperfect, imparting a lot of noise in our estimates of expectations.

As an example, consider these two measures of the exchange risk premium for the euro.

Figure 2: Excess returns (risk premium using rational expectations hypothesis) (blue) and risk premium calculated using survey data (red), both for euro/dollar at 3 month horizon. Source: Chinn and Frankel (2019).

If you thought risk premia were persistent and time varying, I think you’d consider the survey based version more convincing than the ratex-version…

Menzie,

I am not surprised surveys are back. I remember Frankel and Froot (Froot and Frankel) using those to test things like whether risk premia were really moving around as much as implied by ratex formulations (ratex did not do well then either).

You list as the main “economic fundamental,” but it is my understanding that I think I have seen you support that PPP is the best predictor for long run forex rates. So is that part of the “other economic fundamentals” in the longer than six months range forecsts?

More bad typing and proofreading. Meant to say in second paragraph, “You list interest rate differentials as the main ‘economic fundamental’…

Sorry about leaving out interest rate differentials, although that was probably obvious.

Barkley Rosser: Fundamentals are things like interest rates and potentially purchasing power parity. However, as shown in Figure 11 in the article, almost none of the respondents at any horizon attribute importance to PPP.

Lurkers and infrequent posters: This harkens back to a comment of mine to the Sugar Highs post last Sunday. If you want to be a better economist, the first thing is to put aside your political ideology. Obviously if ideology is more important than doing competent economics, then this does not apply. Ideology can and does calcify the mind. Ideology-laden thinking interferes with the rational mind’s ability to stay open to new ideas. Unbiasedness suffers. New ideas are how science advances. The test in science is the ability to forecast. In 2007, the gross inability of the economics profession to see the train wreck of the Great Recession coming was as glaringly obvious as a second sun in the sky. This time the whole world could indeed see the degree of ineptitude of the profession, though few were able put their finger on why.

When logical arguments fail, nearly always they do so because the initial premise is wrong. (You may have to think on this.) The fallacy of the initial premise is so important that it’s nearly a universal rule. To this rule there is a corollary. When one hasn’t the foggiest clue that a novel new premise is in fact actually true, human nature is such that many if not most dismiss it and then dismiss out of hand the rest of the argument too. Their head is filled with so much they think they know and that they think is better. Yet ideology is hard-driving. It can and does blind economists, most of whose thoughts around economics are often quite ideologically-based. So at times they cannot see an elephant in the room. Debt is this elephant.

In my Sugar Highs comment, I laid out a straightforward argument – quite in line with the empirical data — whose point of departure was optimal debt. The two commenters who responded were all over the place with futile, empty arguments against what I so crisply laid out. They did not understand my argument in the slightest. Because they mindlessly denied the main premise of optimal debt.

Sit back and contemplate. Every process in the universe has an optimal! For even the lowly act of scratching an itch, there is an optimal amount of time, pressure, direction and so on for the fingers apply. The great mathematician Kurt Godel could easily have proven the general case I’m stating here in the short time between ordering morning coffee and when it arrives. So profoundly obvious is this concept.

Let’s look closer at optimality and debt. The debt I refer is found in the first column table D.3 of the Fed’s Z.1 release, total US non-financial public and private sector debt outstanding. Ratioed to GDP, of course. I then define the burden of debt to be the erosive action or constraining pressure the debt – not the interest on the debt but the level of debt – has on purchasing power. The need to repay interest and principal is what effectuates the burden, what makes it meaningful to the flow of economic activity and thereby necessary to pay attention to.

It matters little what the optimal level of debt actually is for the purposes of laying out the argument about debt affecting GDP growth in a shadow but very real way. The exact number is never a constant etched in stone, as it so so slowly evolves along with everything else in the economy. The exact level of optimal debt per the series I’m talking about here is empirically based. It’s modulated by the context of the economy at the historic juncture in question, including the institutional underpinnings of the US economy. Getting a rough estimate of the optimal is a task for research. A fairly easy task in fact, as you only have to get the estimate of what optimal is inside the ballpark. One thing for sure, the debt ratio in the US has in recent decades gone far beyond optimal. That I myself have a refined judgment of approximately what that level is, and roughly when some decades debt still near optimal, is not at issue here. What is at issue is that ideology precludes most economists from even considering that there is such a thing as optimal debt.

I shall give an example from which induction can take you the rest of the way. Suppose an ordinary household with ordinary income. There are two poles to household debt, no debt at the one pole, and say $1 billion at the other. Clearly for 99% of households that far pole cannot optimal. It will not even be possible. Hence we first make note that the optimal must lie below $1 billion. In this modern world, zero debt can hardly be optimal either. If anything, credit card debt even if paid off monthly will be some non-zero amount. Of course there’s home mortgage debt as well, which for the typical home-owner type household will be positive too. Summing over all households, it can hardly be the case then that zero economy-wide debt is optimal. Hence, by logical inference there must be some level between the two poles that is optimal. Even though we might not have the slightest notion of what this level might be. Similarly for the business and government sectors. These three of course will then sum to the society-wide optimum optimorum.

Going back to my original post and reading it with this insight on optimum debt, you will find that everything else I said follows as well. If need more proof, here’s an additional line of reasoning. Suppose the debt burden climbs exponentially. This of course is what’s been happening. Take the debt ratio from 1947 to present. A simple polynomial fit to the data has a positive coefficient on the x-squared independent variable, with an R-squared of .95. Debt is exploding. As one of the twentieth century’s giants, Kenneth Boulding, said famously: “Anyone who believes that exponential growth can go on forever in a finite world is either a madman or an economist.”

By all the above, the profession ought to get busy analyzing GDP growth in light of the level of debt and its dynamic. Reinhart Rogoff pointed the way. You will find that the current record level of debt is stifling real growth by a considerable amount. Other things equal – like factor endowments, technology, and so on – the only way back to the desired path of maximum potential economic growth is by policy-wise targeting the debt ratio back toward optimal. Of course if you don’t comprehend the concept of optimal, you’ll be ignorant of all the new avenues this opens up. Godel, for example, could easily have proven another corollary: To keep the system near its overall dynamic optimum, each sub-part must be kept in the neighborhood of its optimal, too.

JBH,

Sorry, but there is no such thing as “optimal debt.” I am the one who said that the real measure is burdent of the debt, the interest payments on it. If interest rates are constant, then debt/GDP ratio proxy well for that. R-R’s book is good, but it focused on long history over which one does not worry about interest rate variations. Of course their 2011 paper was a disaster because of data errors, but even without those there are these obvious outliers such as Japan whose debt/GDP ratio far exceeds 200 (this just govt debt), but they have very low interest rates so the burden is not a big deal at all.

Keep in mind, JBH, that the issue is not “paying off the debt.” This is true for private individuals, but for governments and large corporations they just roll it over. As long as they are making their interest payments, and their ability to do so looks solid (a major reason why interest payments/GDP is the important matter) they can do so, no ptoblem, and they do so all the time. The only time the US ever paid off its national debt was in 1836, which was followed in 1837 by a major financial crisis and depression, which led to the national debt reappearing, never to get fully paid off again.

I do not see any ideology in my response to you. You are simply wrong: there is no such thing as “optimal.debt,” and bloviating on for several paragraphs suggesting that somehow those like me who disagree with you are doing so for ideological reasons is simply false. But then, you are hardly the only person showing up here who makes lots of false arguments and fails to correct them when this is pointed out.

I would also suggest you leave Godel out of this. He is somebody that both my late father and I have published papers about. I think you have no idea what you are talking about regarding his ideas or work, far less than this silly theory of “optimal debt.”

Barkley, JBFH sais this: “When one hasn’t the foggiest clue that a novel new premise is in fact actually true, human nature is such that many if not most dismiss it and then dismiss out of hand the rest of the argument too. Their head is filled with so much they think they know and that they think is better.”

And then you come immediately back with:

“JBH,

Sorry, but there is no such thing as “optimal debt.” …”

Whether you meant to make his point or not, it appears you may have.

I don’t know if any of us have a clue if there is an Optimum Debt, nor what it may be, but discrediting out of hand shows you might be relying on ideology instead of objectivity, one of JBH’s points.

Hey CoRev – please educate us as to why Modigliani and Miller got this all wrong. Oh wait – you have no idea who these two financial economists even are. Never mind!

CoRev,

As Menzie notes there is discussion of “optimal debt.” As Menzie notes, “it depends on the model” and also the case and the interest rates and is this corporate or national or total and a lot of other things, although last time I checked, not the weather or the climate. There is no general answer to what is “optimal debt.”

As it is, what one finds in these discussions is basically never a specific answer. What one finds are limits for certain kinds of debt beyond which one is “unsafe” or “will face higher borrowing costs,” no amount that is “optimal,” just a general idea that the entity in question should stay below the danger cutoff. If this is what JBH means, this is well known, but that is not what he talked about, which was that there is some sort of “optimal debt” ratio that a nation should try to get back to if it is not there. That does not remotely exist, and to the extent this is his “new idea,” it is a very stupid one.

So, for corporate debt, the widely used rule of thumb is a debt-equity ratio not exceeding 0.5. Of course, as I think pgl noted, the fundamental theory is Modigliani-Miller, which says that capital structure between debt and equity does not matter, although that outcome depends on a bunch of simplifying assumptions, such as no taxes, although in general debt has looked superior to equity on tax grounds.

A longstanding national public debt ratio/GDP viewed as an important limit has been 0,6 or 60 percent, which has long been what the EU set out as the upper limit for prospective members to stay under. More recently higher cutoffs have been put forward, with lots of people saying 100 percent. The messed-up paper by Reinhart-Rogoff in 2011 put it at 90 percent, claiming nations with debt levels above that have lower growth rates. The latest research suggests that there is no specific such level at which there is some sudden change in a nation’s prospects. Indeed, as I noted earlier, this depends on other conditions of the nation, including interest rates it must pay. So low growth nations with histories of going bankrupt, such as Greece, face much more serious problems, but a place like Japan with its very low interest rates has a debt/GDP ratio far above these levels talked about and has no problem managing it. Also, it depends on who owns the debt, locals oe foreigners.

So, CoRev (or JBH), do you see any ideology in any of what I have said here? I do not think there is any. This is a pretty straightforward consideration of facts and practices.

Barkley, you now discredited your original statement with this: “it depends on the model”. Which do you believe? Your absolute statement: ““JBH,

Sorry, but there is no such thing as “optimal debt.” …” or your later models-based version version?

CoRev I might be misunderstanding Barkley, but my reading is that his most recent comment was really addressing the issue of a maximum sustainable level of debt as a percentage of GDP, whereas his initial comment was attacking JBH’s claim of there being an “optimal” debt level in the literal sense of “optimal.” If you take JBH literally, countries or individuals or firms with debt below the “optimal” level should run out and acquire new debt…of course, that assumes there’s an equal number of willing lenders. And JBH’s somewhat confusing comment about home mortgages being one end of the pole suggests that he had this sense of “optimal” in mind. But then in the very next sentence JBH seems to be understanding “optimal” as sustainable. When someone says “optimal” in an economics blog that word has a very specific meaning.

JBH also said that optimal debt (whatever that means) varied with time:

The exact level of optimal debt per the series I’m talking about here is empirically based. It’s modulated by the context of the economy at the historic juncture in question, including the institutional underpinnings of the US economy.

Worse yet, JBH also suggests that this optimal debt level is currently unknown to economists:

Getting a rough estimate of the optimal is a task for research.

But fortunately our hero JBH has a refined estimate:

That I myself have a refined judgment of approximately what that level is, and roughly when some decades debt still near optimal, is not at issue here.

I beg to differ, but that is precisely what’s at issue here. All that JBH will tell us is that:

, the debt ratio in the US has in recent decades gone far beyond optimal.

So where are we? JBH has told us that the optimal debt level ought to be an urgent research project for economists. OTOH, JBH already has a “refined estimate” which he will not share because his estimate is “not at issue here” even though he wrote two long posts arguing that we should all believe US debt has “gone far beyond optimal.” I’m sorry, but JBH’s post was a ball of confusion from start to finish. He writes in the voice of a preacher warning us that the Rapture is near but refuses to explain himself any further.

If JBH had simply argued that the US is on track for an unsustainably high level of debt, then he would have been making an arguable and defensible claim. Reasonable people might disagree over the primary surplus and interest rate and growth rate you need to plug into the sustainable debt formula, but at least JBH wouldn’t have sounded like some crazy evangelist on the street corner. At the end of the day JBH treated us to yet another fruitless stroll down a dead end.

CoRev,

It it not only the model but the condition of whatever one is looking at and what the goals of that entity are. Let me spell this out more. Aside from the fact that JBH has neither informed us of how one determines what an optimal debt level is or what it is for the US right now, although he claims to know what it is, the problem is much worse. Claiming that there is an “optimal debt” level for a nation assumes that we can aggregated the heterogeneous desires and interests of the citizens into a collectively agreed upon such level, or on the things that would determine that level, which would include a time path for spending and taxes as well as the composition of both as well as a time path for Federal Reserve policy. Since you and he have been wanking on about “ideology,” let me note that asserting that such an aggregation can be made it will be done by an authoritarian, probably socialist, leader. It is not doable by a democratic process, as shown by the late Kenneth Arrow in his Impossibility Theorem.

This problem of aggregation will also include even private entities that have more than one person in them, such as corporations and partnerships. The only possible level where it might be meaningful to talk about an optimal debt level is for an individual proprietor of just person, who has well-defined preferences, especially intertemporally over the finite time horizon of their lifetime and not beyond, no “bequest motive.”

So, CoRev, we can imagine you at age 35 (a half century ago, I understand) starting a business. it will not have equity, so Modigliani-Miller becomes irrelevant. You plan to run this business until you retire at a definite age, say 65, and then shut it down. You need to buy some capital equipment for your business, which will work properly until your business ends and then promptly shut down (“One-hoss shay capital”). maybe it would be a space satellite so you can observe soybean plantings around the world as well as keep track of both weather and climate conditions, as well as make sure all space vehicles are operating on the same clock times as their associated ground clocks.

In that case, assuming you have a given subjrective time preference rate as well as a well-defined risk preference so a prope CAPM adjustment can be made, as well as your initial wealth, there may be an optimal amount of the capital stock you need to buy, which, given interest rates, will imply an optimal amount of borrowing and even a time pattern of that, which then can be interpreted as an “optimal debt” level until it is paid off. These are the kinds of conditions and model for which it may be meaningful to talk about such a concept. Otherwise, it is completely vacuous and does not exist, and the only ideology here is strictly market-oriented individualism.

Regarding JBH’s basically incoherent mumblings, if indeed there is an optimal level of US debt, and he knows what it is, and it is much lower than our current level, that raises yet another issue he (and nobody else) recognizes: what is the optimal path to getting to that level? After all, if we need to drastically cut our national debt to get down to that supposed optimal level and reasonably quickly, what that would imply is something that Donald Trump would absolutely and totally oppose, massive cuts in government spending accompanied by massive increases in taxes so that we can start running the huge budget surpluses as fast as possible so that we can get back down to that optimal debt level as fast as possible. Of course the obvious problem, which Trump would be all too aware of, is that such a policy would essentially immediately plunge us into a massive recession. But, hey, nobody asked JBH to have all the answers, I guess. I mean we still do not know which university he took grad math and econometrics at, just as we do not know what that diploma is inside that tube you have is either.

CoRev: You do see right through them. It is sad and exasperating to interact with such people. They are not normal. They are two degrees removed from normalcy. The first degree is they cannot see, in two senses of the word they have no vision. In the ordinary sense and in the visionary sense of looking at common ordinary things with childlike awe that something new may be revealed to me here if only I look closely enough. This doubly berefts of them of the ability to have creative thoughts.

The second degree of distance from reality is their attack mode of response. Instead of scientific give and take their comments quickly degenerate into bash and attack. I’ve given form to this odious practice by saying that their ideology (amongst other things) is what blinds them. Ideo- as in groundless mental supposition. Look at how many times orange man or some variant thereof appears in this comment section. This alone reveals that ideology drips out of their every pore. A part of their brain is so diverted by the emotional charge around their ideology that it is not available to reflect on novel (to them) ideas that may or may not have merit.

I believe excessive debt is our economy’s number one problem. Of course this is open to debate. I’ve found that the concept of optimal debt sheds phenomenal light on this pressing issue. It helps one think about overall debt differently. Once the debt ratio goes beyond optimal, which it did years ago, increments of excess credit cumulate to ever-larger debt which then bears down on purchasing power to stifle the economy’s growth. Having this epiphany, one can stand in this newly opened doorway and contemplate what can, should, and will be done about it? Instead, from those who are two degrees removed from reality, what we get is a bashing of Reinhart Rogoff’s seminal work. A besmirching my knowledge of Godel. And on and on. What’s more, the bashing is 100% predictable.

Menzie comes out and says there is such a thing as optimal debt. Menzie may not know its real-world constituents. To my knowledge there’s nary a paper in the literature on it. But to his credit Menzie gets it. Furthermore, the burgeoning deficit will raise the debt ratio to an ever-higher record level in coming years. (Now as lesser lights read this word deficit, their thoughts will zoom to public debt. And they’ll find some small fiscal blemish with which to disparage the point I’m making. Whereas from the outset I was clear that I was speaking about line such and such of the Z.1.) Predictably, the acolytes here will swing over to the other side of the ship. Their ideologically liberal mindset congers up bad JBH, so what he says must be wrong; bad Trump, so what he says must be wrong; good Menzie, so what he says must be right. Why put up with this kind of stuff? Did PeakTrader and others over the years get fed up? Was Gresham right? Does bad money drive out the good? Are we not dealing with the fractional equivalent of adults, fractional since emotionally they’ve never grown up?

JBH: Seriously, until you forward a specific theoretical model, it’s hard to say what’s an optimal debt level (which may conceptually differ from a sustainable level).

JBH,

There is not a shred of intellectual analysis in this rant. It is all personalistic whining and false accusations that people are not accepting your so-far totally vacuous idea on ideological grounds. Read carefully my latest reply to CoRev. The ideology is market capitalistic individualism and notes that in fact to the extent that your idea is useful or exists for a national level economy, it implies an authoritarian probably socialist approach, which I realize you cannot imagine yourself advocating. But that is in fact what you are dong.

So, nobody here (aside from maybe CoRev) will take you serious if you fail to provide a method of determining a national optimal debt level is and also what you think it is for the US. I would further add the point I made at the end of my last post, if indeed out current debt level is too high, how rapidly should we lower the debt to get it to that optimal level and is it worth throwing the US economy into a major recession to do so?

On the matter of sustainability, those cutoffs one sees thrown around out there are possibilities, for public national deb 60, or 77, or 90 or 100% depending on other circumstances. However, the more serious measure, as I already pointed out, is the ratio of interest payments on debt to GDP, with this being what determines if a nation can continue to borrow to roll over its existing debt at stable interest rates or not. Nations (and companies) fall into bankruptcy when they are unable to do that.

On people bashing R and R, I praised their book, but their 2011 paper was an embarrassment with serious errors in it.

As for Godel, I am indeed the person to tell you you do not know what you are talking about. Got any publications on his work? Did you work on those while you were attending your mystery grad program in math and econometrics?

Again, bottom line is that if you can neither say how one figures out what an optimal debt level is or even what you think it is for the US, nobody aside from maybe CoRev here will take your arguments on this remotely seriously. Sorry.

Good news, CoRev. You won’t be among those 92,000 (at last count ) “ rousted” from their beds in the middle of the night and shipped to Guantanamo to stand trial in a military court.

Oh, boo hoo! Woe is you! Poor JBH. Nobody here realizes how smart he is , and how unfair that he must deal with “lurkers”, i.e., those who hurt his feelings by not recognizing his obvious superiority.

My late mother was fond of bringing me down to earth and off my high horse with a quick “You’re full of yourself.” Only she rarely said “yourself,” usually substituting a single syllable scatological reference instead.

Proving the arguments of others wrong has little to do with inflating your own self worth. In these—or any— discussions, your intelligence and a quarter add up up to 25 cents.

There is no such thing as optimal debt. I tried to get JBH to think in terms of Modigliani and Miller but it seems he has no clue what I was talking about. He could have done a little research but NOOOO – he had to write another long winded and rather dumb rant instead.

JBH At some points in your comment you clearly referred to total debt; i.e., public and private. But the overall tone of your comment came across as only referring to public debt. You need to be more consistent.

If you believe there is something called “optimal debt” then you must also believe there is something called “optimal wealth.” Wealth is simply the other side of the coin. One man’s debt is another man’s wealth.

You’re also confused about stocks and flows. Debt and wealth are stock variables. GDP is a flow variable. As a stock variable debt diverts the GDP flow from the debtor to the holder of the wealth asset; however, that diversion does not directly affect the flow rate of GDP unless there is an asymmetry in the tolerance of debtors relative to bond holders. In other words, wealth inequality is the problem, not debt per se.

Other things equal – like factor endowments, technology, and so on – the only way back to the desired path of maximum potential economic growth is by policy-wise targeting the debt ratio back toward optimal.

This sounds like the language of optimal control theory. If that’s the case, then show us your ideology-free Hamiltonian. If you can’t, then it’s just word salad.

Reinhart Rogoff pointed the way.

The R-R paper was a mess even if we overlook the silly Excel error.

Take the debt ratio from 1947 to present. A simple polynomial fit to the data has a positive coefficient on the x-squared independent variable, with an R-squared of .95.

The debt-to-GDP ratio is an unambiguously unit root time series. The ADF cannot reject the null of a unit root and the KPSS rejects the null of stationarity. A simple polynomial fit might indeed be simple, but it’s also wrong.

There is a pretty standard literature regarding the sustainability of public debt. You might want to try reading it instead of flattering yourself with some new revolutionary theory that ideologically blinded economists have failed to grasp until you came down from Mt. Olympus and removed the scales from their eyes.

JBH: Optimal debt depends on the model. Now, consider a small open economy, with infinite lived agents — what’s the optimal debt assuming the psychological rate of discount at home equals that abroad?

By the way, you keep on alluding to my ideology. I’ll just say that in 2005, I warned about debt, in a Council on Foreign Relations report — does that mean I’m not ideological?

@ Menzie

Of course, as you say, there are different categories of debt. As far as government debt, I thought you have made strongly convincing arguments that high levels of federal government debt contributed to a current accounts deficit. I can’t remember the exact paper now, but I read it all the way through and thoughtt it was one of your more enjoyable research papers.

I’m directing this last comment more to readers in general than to Menzie, but at one time the Phillips Curve was taken to be near to the Word of God. When I was attending college in fact (oh shit, giving away my age again) Phillips Curve really was not doubted. So I think we needn’t get to carried away about some exact percentage of debt that is “optimal”.

Could we say that as far as individuals and small businesses that sometimes a high amount of debt might be optimal and other times a low amount of debt might be optimal and so the same might be true of large governments?? I think it is possible. On a personal level I have a strong aversion to any kind of debt. But I don’t know if I’m willing to lecture to others what an exact percentage of “optimal debt” would be. (Although on an individual level, if it was someone I cared for/loved, I might be tempted to lecture on that)

Moses Herzog: I still believe in the Phillips Curve. Might not be the nice shape in the textbook, and inference about its position and shape is complicated by not knowing what Nairu is. But I think it’s still there as an empirical relationship.

MH,

About the only time that the classic downward-sloping PC was “near to the Word of God” was between 1960, when the Samuelson-Solow paper on it came out, and 1968, when Milton Friedman argued that in the long run it is vertical. Then came the stagflationary 1970s when it looked like the PC was upward sloping as both unemployment and inflation rose, although one could argue that downward sloping PC was simply shifting outwards, presumably because of supply-side issues. Then in the 90s, when I think you were in college, it was going the other way, with unemployment and inflation both falling. More recently we have had unemployment declining with basically no change in inflation, which makes it look like it is horizontal, to the extent that it exists. This might be Menzie’s position, but I do not know. However, in the 90s the Principles textbooks showed it as sloping downwards, which is still the case for intro textbooks, even though most professional economists do not believe in a downward sloping PC anymore

As for an optimal debt ratio or level, it simply does not exist, not for anybody, not no how. As debt rises, its costs rise, which is a problem for anybody or any entity, but what it is used for and how well an entity can handle those casts simply varies widely. Hence the widespread use of these essentially rule of thumb cutoffs are out there, such as the one for corporations that they should not go above a debt/equity ratio of 50 percent, even as pgl has repeatedly pointed out the longstsnding fundamental theory based on Modigliani-Miller says there is no optimal structure or ratio.

You know, I thought a few seconds about taking Barkley Junior’s gracious offer to be my RA. It would be good for him to know the 1% advantage of a heavy underdog (Harris) over the strongly favored candidate (Biden) in a political poll he quoted only amounted to 6 surveyed people. That type case example Barkley would learn being my RA could be highly educational for Barkley. And then I thought “Wow, this would be the widest differential in co-author IQs since Chinn and Navarro!!!!” (me being Chinn in this analogy, OK, given, a stretch).

Yeah, see, the wide chasm of differential in IQs for co-authors would make that libretto very unrealistic. Still, it could be entertaining in a Neil Simon dialogue kind of way.

@ Menzie

Menzie, you’re not going to believe this, as it falls so out of character for me, but I have two semi-serious questions to ask, as I am making half an attempt to read one of these papers.

1) How much weight do you personally give to “delayed overshooting” effecting or clarifying UIP??

2) How much were you thinking of equity flows when you decided to see the connection of VIX to UIP?? In other words how much were equity flows connected to your query on VIX before you co-authored the paper vs other issues which drove you to think VIX might have a connection to UIP??

Menzie I noticed that in your 2019 paper with Prof. Frankel you allowed for volatility by including a VIX term, but I didn’t see anything that considered a GARCH-in-Mean. I don’t regularly follow papers on FX and UIP (…frankly, I don’t understand them!), but most of what I’ve read tends to find conditional heteroskedasticity in the residuals. And just an eyeball view of the graphs seems to shout GARCH. Am I missing something?

Whatever medication Pelosi is taking to inhibit the progression of Alzheimer’s is not working:

https://youtu.be/1ne8gjk_T7g?t=78

Really, MH, can you not ever get off any of your totally discredited and sick memes? Absolutely nobody remotely agrees with you that Nancy Pelosi has Alzheimer’s, and even at one point some time ago Menzie made it clear he did not agree with you on this. Nobody does, and again, the inside info I have, and it is top headlines in WaPo level, says Pelosi is smarter than even Warren and Harris, both of whom are very smart, although maybe you have sick problems regarding all of them.

Look, MH, I would like to like you. We mostly agree on most things. But can you at least not shut up about these sick views that nobody agrees with? Please, really, I am begging you. You make many reasonable posts, but this despicable garbage utterly and totally discredits you. Please get some help, and in the meantime, STFU about Pelosi. We can disagree about her policy decisions, but as of now, the most informed view of her is that she is the smartest person in the entire Congress, not someone afflicted with Alzheimers. You look like the one afflicted with it, although I think you are too young, boy.

As it is, impeachment is a tough call, given that there are not more people supporting it than opposing it, although a close call. Maybe Muellr’s testimony will change that, but maybe not. GOPsters seem set on trying to lie lie lie about the Steele dossier and Hillary and other ttivia.

However, if they do go for it, I would like to see them make a big deal about Trump’s massive and blatant violations of the Emoluments clausee of the Constitution. I mean, if there was ever a grounds for impeachment the Founding Fathers would approve of, this is it, and by last coutn something like 22 nations have been funneling money to him pretty openly. We simply have never had a president even accused of this before. I gather one committee in the House is looking at it, but this is seriously impeachable stuff, maybe more so than obstruction of justice, which seems to bore much of the population, even if it was what got Nixon out. It is too bad the lawsuit brought by MS and DC got tossed out. But indeed, this is not a states matter. This is a federal and constitutional matter, an impeachable matter, big time. I really do not get why so few are talking about this.

Sorry, really should have proofread that. Main substantive error is that it is MD (Maryland), not MS, whose suit with DC on emoluments going through the Trump Hotel in DC has been tossed out.