1. The deceleration in employment growth is noticeable; 2. Taken with the preliminary benchmark revision, it’s possible employment growth deceleration is even more marked; 3. With accounting for temporary census workers, m/m growth is fairly anemic; 4. Nonetheless, latest vintages of key indicators suggest only a slowdown; 5. Manufacturing employment and hours (as well as production) still below peak.

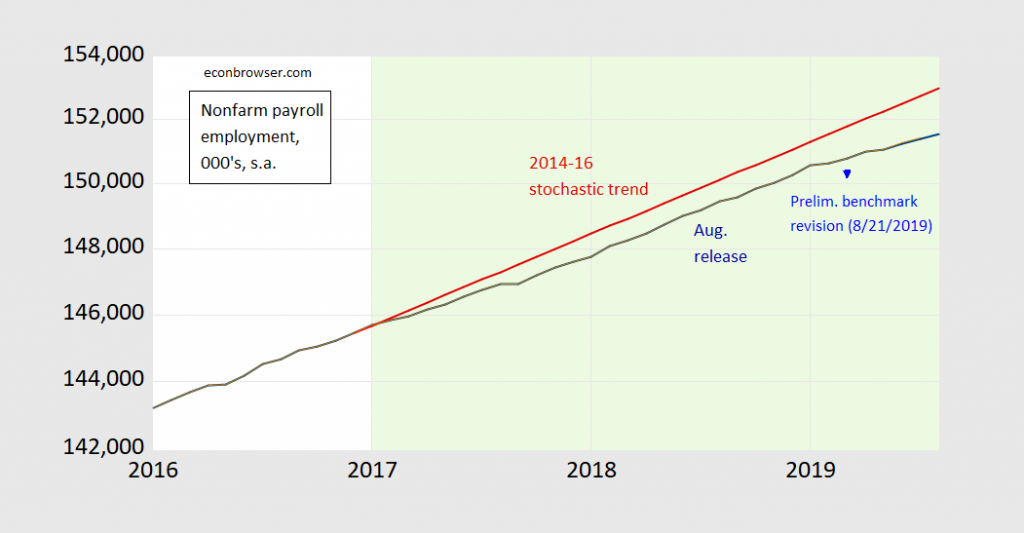

Figure 1: Nonfarm payroll employment, latest vintage (dark blue), 2014-2016 stochastic trend (red), and March preliminary benchmark revision (blue triangle), all on log scale. Light green denotes Trump administration. Source: BLS and author’s calculations.

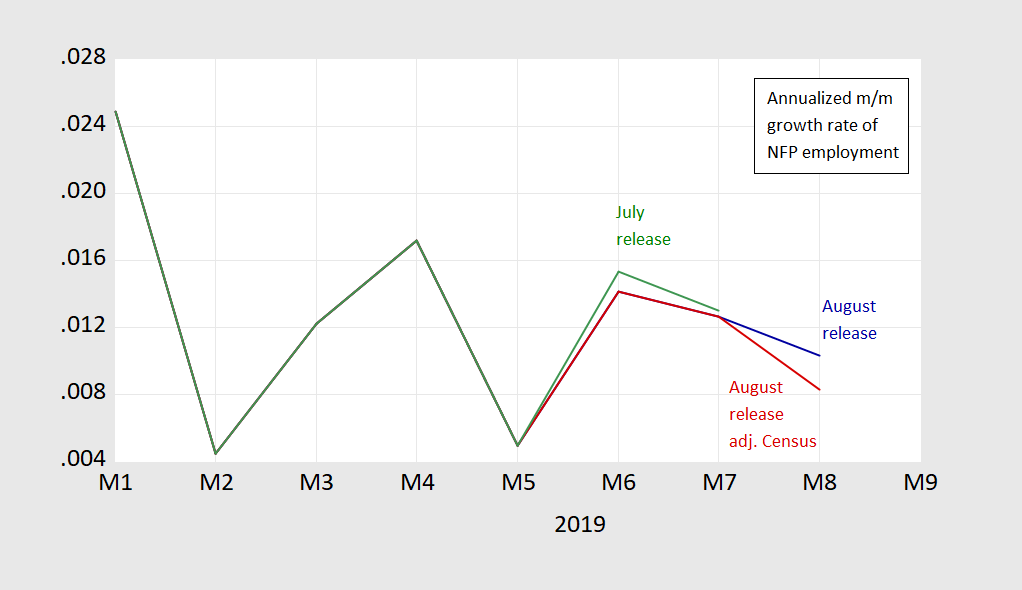

Figure 2: Month-on-month annualized growth in nonfarm payroll employment, latest vintage (dark blue), in July release (green), and in latest vintage deducting 25,000 temporary Census workers in August (dark red). Growth rates calculated as first log differences. Source: BLS and author’s calculations.

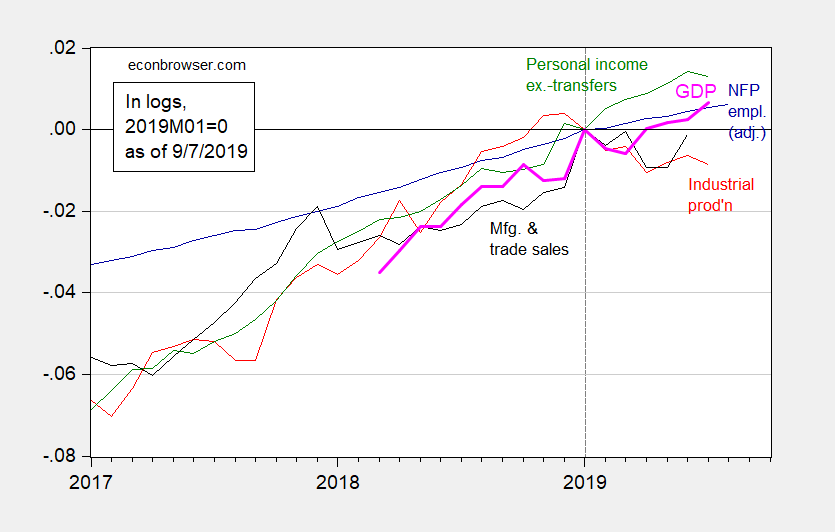

Figure 3: Nonfarm payroll employment (blue), industrial production (red), personal income excluding current transfers (green), manufacturing and trade sales (black), and monthly GDP (pink), all in logs, normalized to 2019M01=0. Source: BLS, Federal Reserve Board, BEA via FRED, Macroeconomic Advisers (29 August 2019), and author’s calculations.

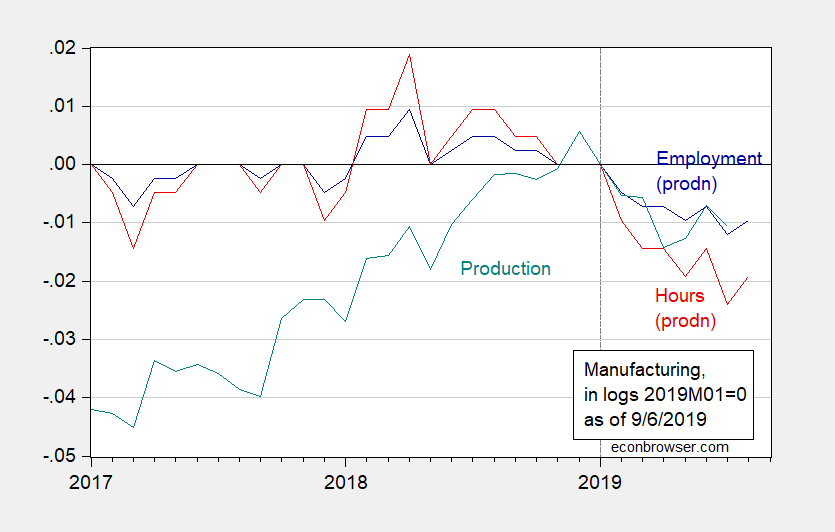

Figure 4: Employment in manufacturing (blue), aggregate hours of nonsupervisory and production workers in manufacturing (teal), and manufacturing production (red), all in logs, 2019M01=0. Source: BLS, Federal Reserve via FRED, and author’s calculations.

Interesting as Mr Spock would say.

I would prefer to see three month employment growth at an annual rate rather than annualised monthly figures which would be relatively noisy.

not looking good for Mr Trump.

“3. With accounting for temporary census workers, m/m growth is fairly anemic”

This caught my error as some troll over at Angrybear claimed that the BLS numbers are distorted by the hiring of millions of Census workers.

Time to check with the actual data:

Census 2020 temporary and intermittent workers and Federal government employment

https://www.bls.gov/ces/tables/census-temporary-intermittent-workers-government-employment.htm

also, that is not all. the BLS lowered the previous two month’s figures by 41000, sot the job market is signaling recession something that the bond market could have told you by the inversion early this year.

Recession is not here. The fearless but probably too timid amateur says mid-2020. It will be nothing like 2009. Provided nobody really screws up.

And this slowdown is abnormal at the current uneployment rate? How about the AHE and 3mnt ann rate?

Dear Folks,

Willie is right, but the signs are not good. Consumption is keeping things up, but personal income growth is slowing. See

https://www.bea.gov/news/2019/personal-income-and-outlays-july-2019

J.

First time for everything. See the post about shipping. We haven’t hit the flashing red light with that yet.

My big concern is that consumption overshooting income means a longer hangover when the inevitable tightening finally hits. I was watching football yesterday afternoon, and one of the credit agencies was offering some kind of instant credit rating upgrade. I don’t know what that involves, but when I see that kind of thing, it means too much credit is being extended and there will be problems shortly.

It’s the banking and insurance herd cycle:

Some genius somewhere figures out that lending money and offering coverage to this or that person or entity is profitable. Others in the banking and insurance industry see this, and they all start jumping on the bandwagon. Pretty soon, the party is in full swing and every possible banker or insurance company is lending money or offering coverage to anybody who is breathing, and underwriting standards get lax. Then the problems start, and the entire pipeline slams shut, cutting off people who are responsible as well as those who shouldn’t have had credit or insurance in the first place. Then everything gets tough. Nobody will offer credit or insurance to anybody, live, dead, rich, poor, or otherwise. Then some genius somewhere figures out that lending money and offering coverage is profitable. Rinse, repeat. As a long-time construction contractor, I saw this cycle many times. Right now, all I would have to do to get some vast line of credit is show up with a pen in hand. In about a year, I expect that to be 100% the opposite, and unless I don’t need the money, nobody will loan it to me. I’m very happy to be away from that routine these days, but I sure do recognize it when it is in full swing. We are in party mode now, and when it slams shut, it will be sudden and ugly. As it always was and ever will be.

Also note in the productivity release unit labor costs are starting to rise

faster than the nonfarm business deflator.

This implies that profits growth is turning negative.

But be careful with this. Even though the spread between unit labor costs

and prices is a powerful determinate of profits, the series is subject to

significant revisions when it is first published.