Despite repeated explanations, some readers still don’t understand futures contracts and forecasting exercises. One point of Chinn-Coibion (2014) is that at the one year horizon, the best predictor of future soybean prices at a one year horizon is the futures contract expiring one year ahead.

And yet ~$9.34 is NOT $8.72. Neither in July 2019 nor in October 2019 was it a correct estimate.

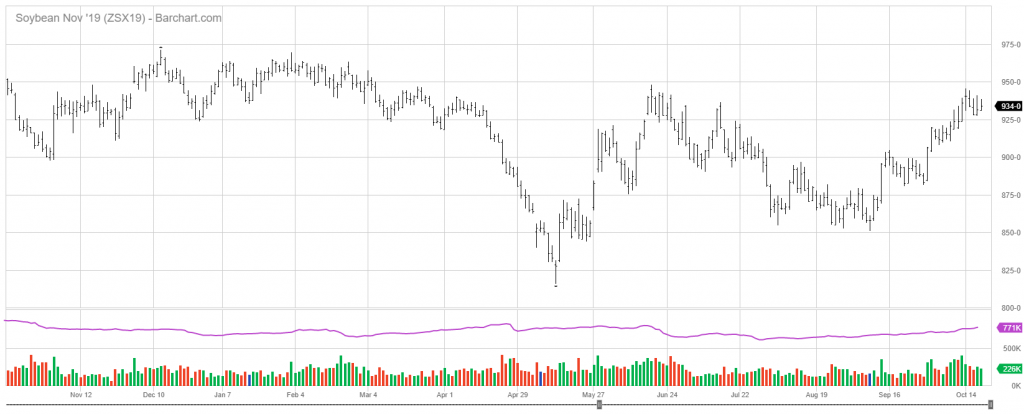

However, the relevant comparison is November 2018 vs. November 2019. As November 2019 contracts expire on 14th , the relevant forecast date is November 14, 2018. On that date, the November 2019 contract closing price was 935-6. Latest (October 18, 2019, nearly a year subsequent) contract price was 934 — pretty close in my book. The relevant question is how close, over repeated realizations, is the futures with one year maturity matching the ex post price one year subsequent. That is exactly what is evaluated in Chinn-Coibion (for 3 and 6 month horizons as well).

Source: barchart.com accessed 10/20/2019.

If I had a student so dense after so many repeated explanations, I would assign a grade of F.

(By the way, I would not make similar generalizations for other commodities, particularly metals.)

You really think CoRev will ever get this? I’m told he has to take his shoes off to count past ten.

Heck, he could never keep same the number of awards he supposedly received for his work on the US space program, with it ranging from I think none to over a half dozen with several numbers in between at different times. I think maybe he has a problem of being spaced out.

It must be annoying when your estimate/’forecast failures and sloppy wording of them are repeatedly pointed out. Your actual wording was:

“Conclusion

Soybean futures are remarkably good predictors of future spot prices of soybeans. Hence, my best guess of soybean prices one year from today is 872. ”

Incidentally using your preferred July 2019 date the price was STILL NOT $8.72.

CoRev: Given continuous variables, the probability of exactly hitting the number is … zero. But we don’t use that criterion in statistical analysis. We look at mean error, mean squared error, or possibly mean absolute error…

Man, you are dumb.

Menzie I’ve been arguing with him for years and years. He truly has no quantitative understanding at all. If you want a good laugh then ask him to explain a principal component analysis. He once cited some badly written global warming denialist garbage that completely botched the PCA. CoRev had no idea what any of it meant or what a PCA was, he only knew that it was a paper with mathy stuff that tried to deny global warming. Pathetic.

Menzie, a typical answer: “…in statistical analysis. We look at mean error, mean squared error, or possibly mean absolute error…

Man, you are dumb.” In real life tell that to the average employee about their earning, or check balance or their required tax payments. Real life finance isn’t a game of horse shoes where being some what close is more important than accuracy.

Accuracy is the validation of any prediction/forecast. Your’s was not accurate! Yes, you had ZERO chance of it being accurate, and many realized that from the original wording. Yet you continued to chastise others. Man, you are too egotistical and sensitive to criticism.

How has weather affected prices?

OK – more incredibly stupid babbling but let’s deal with your close:

“How has weather affected prices?”

Gee CoRev – where is your superior model. Try answering your own question. We will wait while you take your shoes off because you may need to count past 10.

CoRev – if you have a forecast model that forecasts future variables perfectly all the time down to the 3rd decimal point, you need to send it immediately to the Journal of American Statistical Analysis as you will win the next Nobel Prize. What? You have no such model? Then as usual – you are full of $hi% as usual.

Was doing my usual late night wandering. Found this graphic and thought it interesting enough for sharing. I’m not sure the source is 100% reliable but seems silly they would lie about it when it’s verifiable by public record:

https://www.270towin.com/historical-presidential-elections/

Maybe he isn’t a Nazi, but guys like Mulvaney lay the groundwork for Nazis. So……

https://i.redd.it/7jgo9anbast31.jpg

Mulvaney is protecting and facilitating an administration where Stephen Bannon and Stephen Miller are still calling many of the shots, and Sebastian Gorka was only kicked out because of public pressure, so how far are we stretching it here calling Mulvaney a Nazi?? IMO, not very far.

I am very afraid this soldier will be punished for wearing the patch, when he should be commended. I hope some good journalists out there will find/follow his story and make sure he is not reprimanded solely because of the patch, which was an honorable act. He is supporting his brothers, and he is not a betrayer of men—like donald trump is:

https://www.dailymail.co.uk/news/article-7594671/US-Special-Forces-soldier-wears-BANNED-Kurdish-patch-troops-pull-Syria.html

Menzie

I have no problem with as study that concludes that for some commodities, a good predictor of current price was the future price from one year ago. Is that a good way to state your conclusion?

Of course there is a but. I see that your paper came out in 2014. The years previous to 2014 in my memory were years of reasonably steady trade and trade policy. My memory says the last time of unusual actions by countries who vacillated from promises of big purchases to ending such purchases on a moments notice was the 1970’s with Russia and wheat. The US, during these years, also complicated the times with withholding wheat and by boycotts. Does your paper cover wheat, and did it examine the 1970’s?

My point being, I find it commendable that future prices have a good record of anticipating supply issues such as weather, disease, as well as world wide demand.

But (there it is again), does the current times of strong political exogenous variations effect the different error gauges?

Ed

Ed Hanson: I have one word for you: “news”. As in new information impounded into prices, a la the efficient markets hypothesis. I see no reason why soybean futures would become inferior predictors as compared to time series models, or structural models. But if you can find a study that validates your conjecture, please do tell me. There is a thing called “Google Scholar”. So far a cursory examination indicates no such finding (you can start by punching Chinn Coibion into Google Scholar, and searching the citations).

” I find it commendable that future prices have a good record of anticipating supply issues such as weather, disease, as well as world wide demand. But (there it is again), does the current times of strong political exogenous variations effect the different error gauges?”

Your second sentence here is word salad. But if you are saying what I think you are saying (Ed – please learn to write in the English language) then you seem to think news about things like trade policy should not affect market prices. Anyone who thinks that has not studied economics since David Ricardo.

Ed Hanson: Would it kill you to look at the data, plotted in the paper? There is incredible volatility in commodity prices particularly in the period just before and during the Great Recession.

menzie, quit being so hard on the little critter. remember, his real forte is analyzing global climate data. his economics work is simply a hobby.

“his real forte is analyzing global climate data.”

I think this needs an edit. Either you meant manipulating rather than analyzing. Or maybe you meant to say “his real folly” not forte.

i know its off topic, but this is a very relevant story with respect to some of the trolls on this site like peaktrader, corev and rick stryker, who have denied the impact of past racism on the poor living conditions of many current minorities in this great country.

https://www.cnn.com/2019/10/21/us/tulsa-race-riot-black-wall-street-watchmen-trnd/index.html

it is sickening what some segments of american society will do to others who are “different” from them.

I can tell you they are literally still looking for the bodies of blacks murdered in those riots. They are using something I believe is called “GPR” (ground penetrating radar) within the last 3 months to scan land areas for those bodies that have never been “ID’d” or recovered. I think there are probably places they have long been rumored, or the city officials actually know but have decided to remain quiet about for fear it will stir up anger again. But they claim to be making a good faith effort to find those bodies. I could tell you at least one personal story from when I drove semi around the Tulsa area, but you’re just going to have to take my word on it, the KKK and white supremacy is still strong in the Tulsa/ Northeast Oklahoma region (arguably the entire state of Oklahoma). Notice the dates on these stories:

https://www.readfrontier.org/stories/state-officials-investigate-oklahoma-lake-named-for-tulsa-klansman/

https://www.readfrontier.org/stories/the-employment-of-a-tulsa-county-employee-with-alleged-kkk-ties-our-hands-are-tied/

https://www.readfrontier.org/stories/tu-board-oks-removing-rogers-name-from-law-school-building-due-to-kkk-links/

https://www.readfrontier.org/stories/updated-group-accuses-tulsa-county-court-clerk-employee-of-ku-klux-klan-ties/ <<—this one has a very offensive video at the bottom of the link after the link jump, you've been warned.

https://www.readfrontier.org/stories/city-councilor-defends-complicated-legacy-of-early-tulsan-tate-brady-despite-his-being-a-ku-klux-klanner/ <<—-notice this story is dated late 2018 and you have a Tulsa City councilor publicly defending a KKK member at a PUBLIC meeting on Economic Development.

If you wanna know the general attitude of the state, in which not a SINGLE county tipped for President Obama in either '08, or '12, then all you have to do is read above. And the quality of the state's public education system as implied by the above situation is exactly where you would expect it to be. This is the same type state where the Mitch McConnells and Lindsey Grahams of the world thrive and feed off of mass ignorance. Which is another reason Republicans are diligently trying to kill off public schools by siphoning off state tax money away from public school over to "private" schools. And because MAGA idiots, largely succeeding in this effort.

Just out of curiosity, why not metals?

Ithaqua: It’s an empirical finding. I don’t know why it’s so. Just like I don’t know why for exchange rates, forwards *and* futures fail to be unbiased predictors (although at long horizons, they look like they are better than random walk forecasts).

May I answer this as a finance grad who rarely ever uses his major?? I think precious metals markets lend themselves to market manipulation and corruption much more than farm commodities. That’s not saying there are a FEW good ways to play metals, or that manipulation doesn’t occur in farm commodities as well, just saying metals “lends itself” MORE to that.

*That’s not to say there aren’t….. Excuse me, I think a lack of alcohol over an extended period of time is having bad effects on my brain.

Are you thinking of Glencore? Remember Marc Rich who RUDY tried to put in jail. He now lives in Switzerland and his making more income than even Trump can imagine!

There’s been tons of those scandals or events. Sprott screws people left and right with commissions and fees and how things cash out. The list is endless there. There’s only one Canadian fund I trust on that stuff, I forgot the name as it was ages ago I invested, but it has to do with the gold they keep on hand as people trade in and out of it. Other than that it’s just so many cons and scams. You can also tell from the audience they are targeting–the programs they choose to run their advertising spots and the time of day they run them.

I am not sure it is conscious manipulation, but there is much more concentration in the production of a lot of metals (and also oil) than one finds in most agricultural commodities. There are many thousands of farmers, probably millions globally, who produce soybeans and each of the other major crops, such as wheat and corn, even if not that many nations are net exporters. But for metals there are far fewer producers, most of which are large companies, and often with a high concentration regarding exporting nations.

Thus, to pick one of the more important metals, copper, about half of copper exports come from two nations: Chile and Peru, and in each of them there are relatively few producers. So even if there is not some conscious manipulation, production is quite sensitive to events that might happen to a few producers in a few nations. Of course with oil we have seen off and on efforts by OPEC to control and manipulate production and prices.

Manipulation may be able to happen for odd agricultural products produced in only a few places, but for major crops and products, the major exogenous factor going most of the time is the weather, as CoRev has noted, although weather today is generally not a bad predictor, if imperfect, of what supply will look like a year from now globally, which is a major reason why year forward futures markets can forecast actual future spot prices pretty well.

Of course occasionally there is news that comes in that upsets the apple cart and makes a forecast go off for awhile, with indeed some large scale policy variables, such as the unexpected appearance of a major trade war an example. But mostly policy regarding most major ag products is not changing all that much most of the time, which is why a lot of the time weather is often the most important driving force.

Metals (and oil), however, by their much greater concentration, are much more sensitive to odd local events that can pop up suddenlty.

I note that the speculations by Moses and me may be right and explain the discepancy, that may not be the case. Ultimately Menzie’s summary holds: that futures markets forecast future spot prices for certain agricultural commodities, especially soybeans, than they do for metals, but the reason why this is the case is not clear.

More on economists and demographics, this time Christine Lagarde on “60 Minutes” last night:

At the European Central Bank, Lagarde faces weak growth spurred by a slump in manufacturing, raising fears of a European recession.

What’s worse, Lagarde’s main tool to stimulate the economy, lowering interest rates, may be useless. That’s because, in Europe, rates are already negative — which was once unthinkable.

Christine Lagarde: There’s a limit to what central bankers can do. There’s a limit to how far and how deep you go into negative territory.

John Dickerson: So there’s a bottom?

Christine Lagarde: There’s a bottom to everything, but we’re not at that bottom at this point in time.

President Trump likes the idea of low, even negative, interest rates. So much that he’s spiked the decades long tradition of presidents not interfering with the Federal Reserve, even calling the chairman, Jerome Powell, and his colleagues “boneheads” for not cutting rates more.

Lagarde’s advice for the president? Be cautious.

Christine Lagarde: When the unemployment rate is at 3.7%, you don’t want to accelerate that too much by lowering interest rates. Because the risk you take is that then prices begin to go up. You have to be very careful. You know, it’s like navigating a plane. And you have to watch everything, altitude, speed, winds. And that’s what a central banker has to do.

So I remain confused. Is a 3.7% unemployment rate too low for the US? Does it risk generating inflation? What about 3.1%, which is the OECD’s estimate of Germany’s unemployment rate? Is the NAIRU rate structurally lower in Germany than the US? Why? Given that Germany’s inflation rate is 1.2% and Germany’s 3 month EURIBOR rate (if I am reading this right) is -0.4%, shouldn’t these have raised inflation? If it hasn’t in Germany, and hasn’t to date in the US with the CPI at 1.7% in September, why would we think a 3.7% rate is too high? Why wouldn’t we want to push that rate down by easing interest rates farther? Or is a 3.7% unemployment rate unsustainable?

Doesn’t all this speak to the bankruptcy of monetary policy? If negative interest rates cannot generate inflation, and QE raises interest rates and therefore seems to lack a mechanism to raise inflation, then is there any realistic scope for monetary policy at all beyond MMT? Wasn’t the ex-Fed guy’s question trenchant: Isn’t the Fed in the current regime all but out of tools? Sure seems that way.

And by the way, should we be stimulating the German economy a la Frankel when the German Chamber of Industry and Commerce (DIHK) says Germany lacks about 400,000 skilled workers? What’s the logic of stimulating an economy at full employment? Doesn’t that give you exactly what we got in the US with the Trump tax cut: a couple of quarters of marginally above-trend GDP growth, no change in trend employment, and a lingering structural deficit? Isn’t that the most likely outcome?

I stand by what I said: the economists profession has not gotten its head around the implications of fundamental demographic changes. Lagarde, like Williams, would have sounded great in, say, 1995. I would have agreed with everything they said (although I would have been utterly clueless as to what a ‘QE’ is). But today, I get the sense the Lagarde lacks a road map. She doesn’t have a clear idea of what unemployment rate is low or high. She doesn’t know what to do about low interest rates. She doesn’t have a clear concept of how to counter a downturn using monetary policy.

And she’s the head of the ECB now.

https://www.cbsnews.com/news/international-monetary-fund-european-central-bank-head-christine-lagarde-60-minutes-interview-2019-10-20/

https://www.reuters.com/article/us-germany-merkel-immigration/merkel-says-german-multiculturalism-has-failed-idUSTRE69F1K320101016

More proof that Princeton Stevie pooh is a clueless idiot:

“So I remain confused. Is a 3.7% unemployment rate too low for the US? Does it risk generating inflation? What about 3.1%, which is the OECD’s estimate of Germany’s unemployment rate? Is the NAIRU rate structurally lower in Germany than the US? Why? Given that Germany’s inflation rate is 1.2% and Germany’s 3 month EURIBOR rate (if I am reading this right) is -0.4%, shouldn’t these have raised inflation? If it hasn’t in Germany, and hasn’t to date in the US with the CPI at 1.7% in September, why would we think a 3.7% rate is too high? Why wouldn’t we want to push that rate down by easing interest rates farther? Or is a 3.7% unemployment rate unsustainable?”

So many questions so little insight. Ah Stevie – there is an entire literature on how unemployment rates are calculated differently. We have tried to tell you this before but of course you were too stupid to pay attention. If you think this is a comment on the alleged bankruptcy of monetary policy – may we suggest your brain is bankrupt. But do waste our time with your incessant stupidity laced with your own pointless arrogance!

Steven,

I have two gripes with this that are different fro pgl’s (not that I am saying his are wrong or irrelevant).

One is the you started by saying you were going to show us Lagarde having something to say about demographics and economics, but there was nothing about demographics in what you quoted.

The other is about Germany. Germany is currently in recession, so your comments on it are just off.

I happen to agree that central banks are facing a paucity of effective tools, and I have already expressed my doubts about the usefulness of the NAIRU concept, especially now.

Where there is a problem for Trump is that he wants to push interests down now so as to help his reelection next year, and the apparent slightly positive response of single famiily housing permits, shows he may be getting some boost for his efforts as the Fed has sort of done his bidding a bit. The real danger is not some outbreak of inflation from lowering US interest rates into negative territrory to help Trump get reelected. It is that getting rates down into that territory while the economy is still growing pretty much completely removes that policy tool from being usable when we do finally go into a recession. And indeed, Lagarde seems to have complained about that, that ECB rates may not be able to go much lower, so not able to help with recession hitting Germany and spreading.

Re: Lagarde. I think I was stating that she seems to be using models that are not relevant in the way they were, say, twenty years ago. I am implying, if not stating, that’s because neither she nor the economics profession more broadly has integrated changing demographics into their paradigms. But you could make the case that low interest rates are caused by something else. I have been begging that question. Are they caused by something else?

As for Germany in recession, as I understand it, Germany’s economy is marginally weak due to weak demand not domestically, but from key export partners, notably the US, China and the UK, essentially due to the tariff wars and Brexit. None of these have to do with the German economy per se.

Right now, this is something like a technical recession. It looks like GDP may have fallen by 0.1% in the last quarter, and I think, something like that the previous quarter.

But, says the FT: “the labour market has cooled in Germany recently, but unemployment continues to fall, the Bundesbank said. In September the number of people registered as unemployed fell by 10,000 from the previous month to 2.28m, its first fall in four months.”

Al Jazeera adds: “That has tipped German industry, which accounts for a fifth of its economy, into recession but unemployment is holding up at almost record levels.”

And Reuters notes: “Data published earlier on Monday showed German unemployment fell unexpectedly in September and retail sales rose in August, temporarily allaying concerns that a manufacturing slump is taking its toll on a consumption-driven growth cycle.

Data from the Federal Labour Office showed the number of people out of work fell by 10,000 to 2.276 million in seasonally adjusted terms. That compared with the Reuters forecast for a rise of 5,000.”

So, Germany does not seem to have an aggregate demand problem, but a Brexit and Donald Trump problem. If exports are going to be lower, then the economy will have to adjust, but the losses should be one-time, or something like that. Moreover, these marginal gain/loss numbers in GDP are what we would expect with low labor supply growth (or outright decline).

So at 3.1% unemployment with the recent job numbers headed in the right direction doesn’t make a slam dunk case for fiscal stimulus.

https://www.ft.com/content/effc1c60-f3f3-11e9-b018-3ef8794b17c6

https://www.reuters.com/article/us-germany-economy-unemployment/german-economy-set-for-weaker-growth-but-still-showing-bright-spots-idUSKBN1WF1AO

As for Trump wanting lower interest rates, well, he’s not the first president to do so.

But would it do much in the way of stimulus? Hasn’t in Germany, hasn’t in Japan. With the economy humming along, I don’t think it would do a lot in the US, frankly, a lot like the tax cut, which did not very much at all.

I was addressing the point more to Lagarde, who was arguing that somehow with low unemployment in the US, a rate could would unleash some sort of terrible inflation. I just don’t see it. If interest rates were, say 4%, and were reduced to say, 0%, then sure, that’s big. But if we we reduce short term rates from 1.75% to, say, 1%, do I think it will unleash armageddon? Probably not.

Steven Kopits: Just so you know… Christine Lagarde’s training is not in economics.

Yes, I was aware of it. Best I can tell, she has a degree like you might get at SIPA or SAIS. Here’s Wikipedia on her education:

“She graduated from Paris West University Nanterre La Défense, where she obtained master’s degrees in English, labor law, and social law.[19][20] She also holds a master’s degree from the Institut d’études politiques in Aix-en-Provence.”

https://en.wikipedia.org/wiki/Christine_Lagarde

She was not my top choice to head the IMF, which I would prefer be run by a PhD economist. But she always sports an excellent tan, and as a politician, I do not think she is bad.

I had assumed, after eight years at the helm at the IMF, she might have picked up some greater depth in economics. Clearly, some felt her preparation adequate to run the ECB, which again, I would prefer were run by a PhD economist.

https://en.wikipedia.org/wiki/Christine_Lagarde

Steven Kopits: Well, you have an inkling of what she did by the fact she practiced law in a US law firm, focusing on labor and antitrust. I don’t think it necessarily better the ECB run by a PhD economist; I’m just pointing out that her training is not in economics.

I think there is a fine balance between the politics of running a central bank, and the actual banking part of it.

If you’re running the IMF, then you’re responsible for a lot of the economic firefighting around the globe. And if you run the ECB, you are first and foremost responsible for the aggregate economic performance of its member countries to the extent policy-makers are in control. I don’t think an econ PhD is everything, but one would think you could find a good macroeconomist with some decent political instincts.

The funny thing is that right wingers talk a lot about the brilliance of the market. Then, when something like futures contracts, which are the market speaking, don’t agree with them, they turn all dense. It’s a mystery.

Conservatives also talk about evidence. Well they did until 1994 when that paper on the effects of the minimum wage did not confirm their precious Econ 101 model.

An interesting paper which clearly Princeton Stevie pooh has never read:

https://ideas.repec.org/p/iab/iabfob/201706.html

The most commonly used statistical sources for the analysis of unemployment are registered unemployment (RU) at the national level and internationally harmonised unemployment data provided by the European Labour Force Survey (EU-LFS) according to the International Labour Organisation (ILO) standard. The logic behind both unemployment statistics is to count people ‘without work’ only when they are ‘actively looking’ and ‘available for work’. This logic does not coincide necessarily with the understanding of unemployment in the general public. That’s why governments and Public Employment Services (PES) are often blamed to ‘hide’ unemployed individuals participating in active labour market measures or being temporarily ill. Our methodological study provides an in-depth analysis of the discrepancies between registered unemployment (RU) and internationally harmonised unemployment (LFSU) in a comparative view. For ten selected EU-countries (Austria, Finland, France, Germany, Ireland, Netherlands, Poland, Spain, Sweden and the UK) we show in which countries the registers are more restrictive than the survey and vice versa. We then identify the populations groups which help to understand the discrepancies between both figures in most countries (young and older people, marginally employed, participants in active labour market programmes) and extend the view to additional indicators of non-employment. Finally, we explore differences in the calculation of the length of individual unemployment spells between both data sources and show that neither register based national nor survey based international statistics adequately reflect the long-term exclusion from regular, genuinely market-based employment.

“The relevant question is how close, over repeated realizations, is the futures with one year maturity matching the ex post price one year subsequent.”

Not quite: The question is whether futures are an unbiased predictor of ex-post spot price. Spot prices have inherent uncertainty, so one may never be “close,” as measured say by standard deviation of spot prices. By “unbiased” I mean E{X}-X, the statistical definition.

One also must be careful because commodity prices tend to be heavily skewed. The short term supply curve for many commodities is inelastic. This is obviously a function of inventory and storage capacity: With a lot of inventory/storage capacity, supply may be elastic, whereas if storage is scarce supply is much more inelastic. But even if storage capacity is high, if inventories are low an upside demand shock can skew prices to the upside. Depending on inventory and remaining storage capacity, the short term supply curve can be kinked since the ability to store a commodity is a finite resource (and storage shrinks, storage costs go up due to scarcity). With some commodities, like coal, you can always make the pile bigger. With others (gas, soybeans), special storage is required. If you want to see an extreme example of excess commodity and full storage, Google “negative natural gas prices in Texas”. Conversely, natural gas in the Northeast in winter is very heavily skewed to the upside if an unexpected cold front comes in (because storage is far from demand and there are transport costs). Uncertainty decays with time (that is, if there is a 50% chance of an upside/downside 5% demand or supply shock one year from now, it might be only a 50% chance of a 1% upside/downside shock 3 months from now). So the skew or bias declines with time as the future becomes more certain. Skew/bias is more apparent over short horizons where the short term supply curve is inelastic, not necessarily the long term horizons where producers can throttle production and storage.

Its an extreme oversimplification to say that futures should be “close” to spot “over repeated realizations.” The “unbiased” hypothesis is a function of predictive timeframe vs producers ability to ramp production and storage (i.e. short run supply elasticity). So I’d have to give an F for that for failing Econ 101 supply/demand analysis, lol. None of this contradicts the efficient markets hypothesis, btw. Over the long term, efficient markets is fine as supply curves are more elastic. Over short runs however, supply elasticity, storage scarcity,and transportation costs, matter. The “efficient market” may say that the marginal value of the next soybean is literally zero (or negative) because you cannot store it and it costs to get rid of it. A low demand/high supply shock will have an asymmetric effect on prices.

The question in my mind is whether soybean storage capacity is near full or nearly full (i’ve heard its scarce). If it is, it would not surprise me that prices are skewed and futures reflect some bias to the downside, even one year hence.

dwb: Well, for me there are two separate questions. One is efficiency as in EMH (which includes unbiasedness). The second is which one is better forecasting method (and the better might have a smaller RMSE while being biased). I’m focusing on the second, and not on the first.

DWB, YUP! “So I’d have to give an F for that for failing Econ 101 supply/demand analysis, lol. ”

Menzie, “The second is which one is better forecasting method (and the better might have a smaller RMSE while being biased).” and wrong. But writing a 1 year prediction as if it was 100% accurate, is just plain egotistical or ignorant. ” I’m focusing on the second, and not on the first.”, although both is probably more likely.

CoRev You’re clueless. You have no idea what dwb was saying, so quit pretending that you did. And apparently you’re the only person here who believes we live in a deterministic and stochastic free universe. Good luck with that.

dwb Did you read the paper? I’m asking because the question of forecast bias was addressed throughout the paper. When we talk about forecast accuracy we are normally referring to some kind of loss function; e.g., a linear loss function such as MAPE or a quadratic loss function such as RMSE. There’s no single right answer and it basically comes down to how tolerant you are with outliers. Another way to evaluate forecasts is to examine the Theil decomposition of the bias/variance/covariance proportions, which is one of the forecast evaluation tools in EViews.

DWB, YUP! “So I’d have to give an F for that for failing Econ 101 supply/demand analysis, lol.”

Corev, please explain.