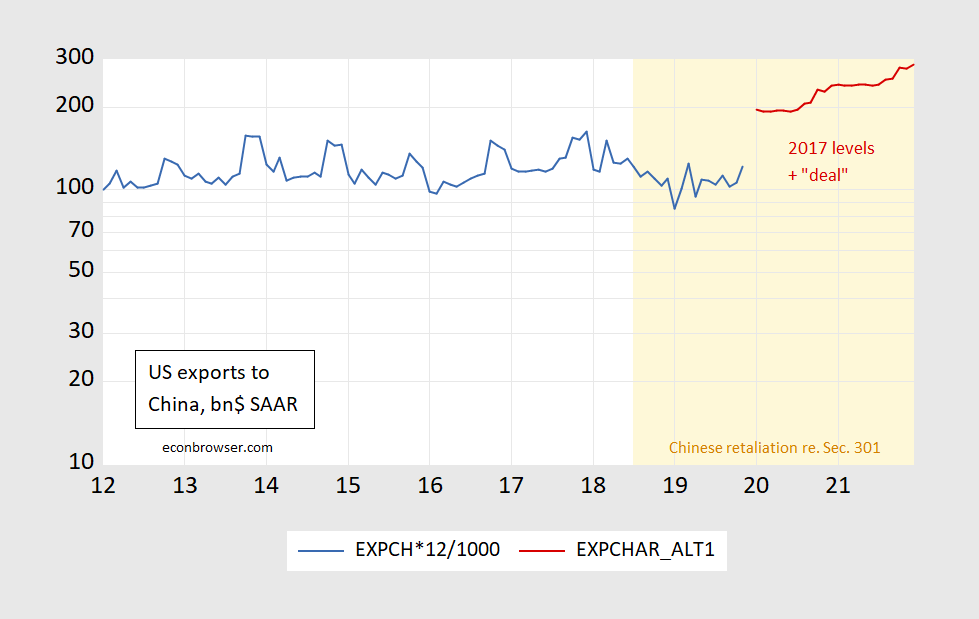

Take a look at what exports to China will look like, with an additional $200 bn exports to China over two years, using the 2017 levels, as reported:

[Graph correct 1/17, Avery Shenfeld at CIBC Capital Markets points out an error in previous version]

Figure 1: US exports to China, bn$ at annual rate (blue), and implied exports to China above 2017 levels, all on log scales. Source: BEA/Census via FRED, USTR, and author’s calculations. [Corrected 1/17, 1:20PM Pacific]

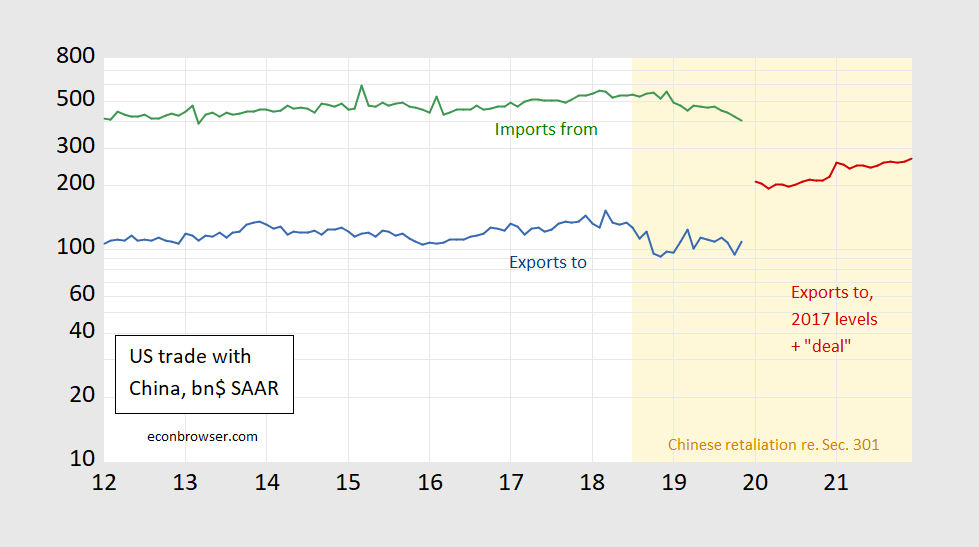

It’s hard to see what’s going on, so I do an ad hoc seasonal adjustment using Census X-11 (probably could do better with accounting for shifting Lunar New Year). This is shown below.

Figure 2: US exports to China, bn$ at SAAR (blue), and implied exports to China above 2017 levels (red), imports from China (green), all on log scales. Note seasonal adjustment on log transformed series using Census X-11. Source: BEA/Census via FRED, USTR, and author’s calculations. [Corrected 1/17, 1:20PM Pacific]

Can you tell what’s changed? It’s all lost in the noise, at least for me. The implied change in the bilateral balance is noticeable [MDC 1/17 3:23PM] Note that China might have raised imports from the US even in the absence of the deal, given shocks in China (African Swine Fever, etc.).

More comprehensive analyses, first from Eswar Prasad (formerly at the China desk at the IMF). While hailing progress on some issues pertaining to intellectual property and technology transfer (commitments at least), he writes:

As part of the deal, China has agreed to increase its purchases of products from the United States. This is largely a symbolic issue meant to mollify President Trump, since this will not, by itself, affect the United States trade deficit with China in a durable way. Such deficits are more of a reflection of other policies that influence a country’s consumption and output.

What of the key issue of industrial subsidies and Made in China 2025:

The United States has deferred its more substantive demands to the next phase of trade talks. These include China’s corporate subsidies, which give its companies a leg up on foreign competition, the dominance of state-owned enterprises in its economy, as well as a mechanism to review China’s progress on meeting its commitments on these issues.

Brad Setser is also more upbeat than me on the trade issue more narrowly.

No matter what measure you use, China’s imports from the US had stalled after 2012 (well before Trump’s trade war). And if China delivers its commitments, there would be a meaningful increase in US exports to China (tho not necessarily US exports to the world).

“Take a look at what exports to China will look like, with an additional $200 bn exports to China over two years, using the 2017 levels”

I’m looking at:

https://www.bea.gov/data/intl-trade-investment/international-trade-goods-and-services

Table 1. U.S. International Trade by Selected Countries and Areas – Exports of Goods and Services

Exports of goods and services to China in 2017 = $186.29 billion but this figure fell to only $177.97 billion in 2018. You note how far 2019 exports seem to have fallen due to this stupid trade war. An extra $100 billion per year is not exactly likely since this deal does not have China lower its tariffs on U.S. exports. Even if we did get back to 2017 levels, we would still have a massive bilateral trade deficit.

There is no dispute resolution scheme in the agreement.

Farce bordering on farce

The charts tell me that we’re right back where we started from before Trump launched his “easy to win” trade war. In other words, Trump fought China to a draw. This is the equivalent of hitting your head with a hammer and then noticing how good it feels when you stop. Are MAGA hatters really that dumb?

Trump has called this “Phase I.” I always get nervous when politicians start talking about phases. It reminds me of Nixonomics Phase I, Phase II and Phase III. And we all know what a success that was.

Finally, “Phase I” just reinforces what we already know; viz., Trump is an old school mercantilist. Notice that his first priority seems to be increased exports to China while still keeping the tariffs on Chinese imports. In Trump World allowing other countries to export to the US is a concession we have to make in order to send exports to other countries. And here I was always taught that exports were the price we had to pay for enjoying imports at lower prices. Silly me.

” Trump is an old school mercantilist. Notice that his first priority seems to be increased exports to China while still keeping the tariffs on Chinese imports. ”

AS Joan Robinson might say – Beggar Thy Neighbor.

Dear Folks,

A dopey question. Would using X-12 or X-13 make any difference to the results?

J.

Julian Silk: It surely depends on the time series in question. I applied X-13, EViews implementation detected no seasonality, so I just used ARIMA X-11 (both in logs). Only differences I usually can *see* (eyeballing) are doing standard arithmetic or multiplicative seasonal adjustment (i.e., using seasonal dummies) vs. X-11 or vs. X-13.

How is Trump’s stupendous deal with China NOT socialism?

Instead of the market determining the volume and price of the trading, GOVERNMENTS determine how much will be sold and at what price. Managed trade is not free trade or market capitalism.

Of course we all know that China will “cheat” on its obligations anyway, so this whole drama is just a farce by the world’s greatest con man.

I have posted on this on Econospeak, labeling it a “Nothing Burger” of a trade deal. Heck two thirds of the Chinese goods that have tariffs on them will continue to have tariffs on them.