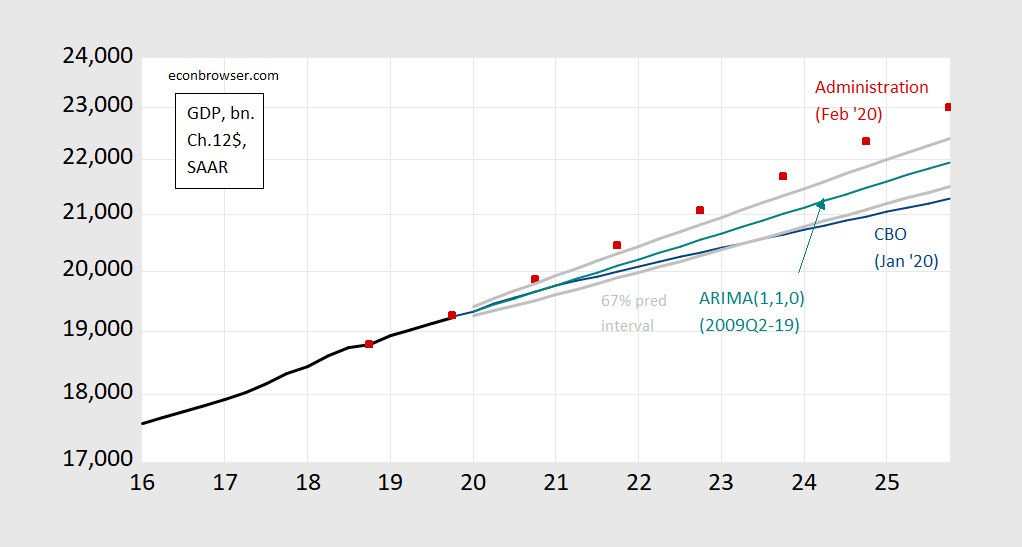

As has been noted, the Administration’s forecast is about a percentage point higher than CBO’s. This seems like a large economic difference; as I’m teaching econometrics this semester, how does this seem in terms of statistical significance. Figure 1 below summarizes.

Figure 1: GDP in bn Ch.2012$ SAAR as reported (black), Administration forecast (red square), CBO January 2020 projection (blue), ARIMA(1,1,0) on log GDP 2009Q2-2019Q4 (teal), and 67% prediction interval (gray lines). Source: BEA, 2019Q4 advance release, CBO, Budget and Economic Outlook, January 2020, OMB, Budget for FY2021, February 2020, Table S-9, and author’s calculations.

Notice that an ARIMA(1,1,0) on post-recession data (which includes the relative rapid recovery in the first year of expansion) still predicts noticeably slower growth than does the Administration. A plus/minus one standard error band suggests that the difference is also statistically significantly different at the 33% msl.

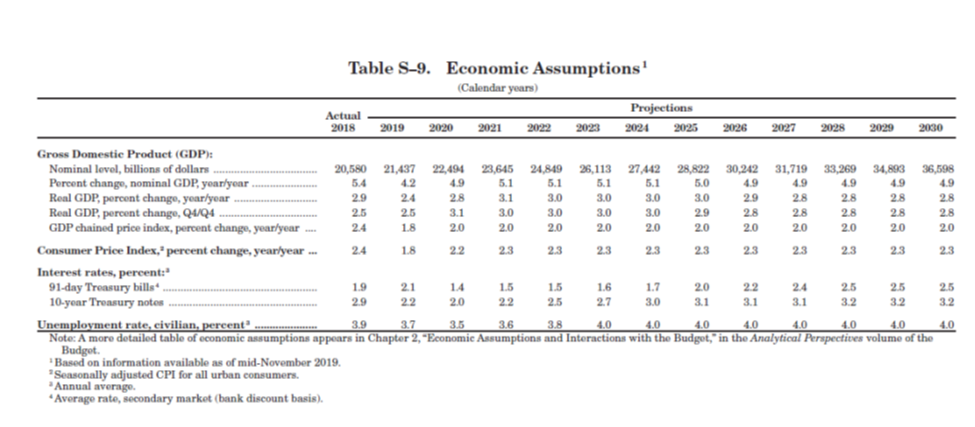

Table S-9 shows the economic assumptions in the budget.

It’s important to recall that we are comparing different types of forecasts here. The CBO’s projection is conditional on current law. The Administration’s forecast is conditional on Mr. Trump’s policies being implemented, with the Administration’s assumptions regarding effects (like how they assessed the impact of the Tax Cut and Jobs Act), and extension of tax cuts. In other words, the two forecasts condition on different things. Finally, the time series model is unconditional in the sense that all that is assumed is that the future is like the past.

Two things that might be particularly relevant, then, is that the Administration forecast implies extension in tax cuts, and interest rates that are in line with CBO’s estimates, even though the administration predicts growth roughly a percentage point higher than CBO. In other words, the Taylor rule has (seemingly) been assumed away. More from the Committee for a Responsible Federal Budget.

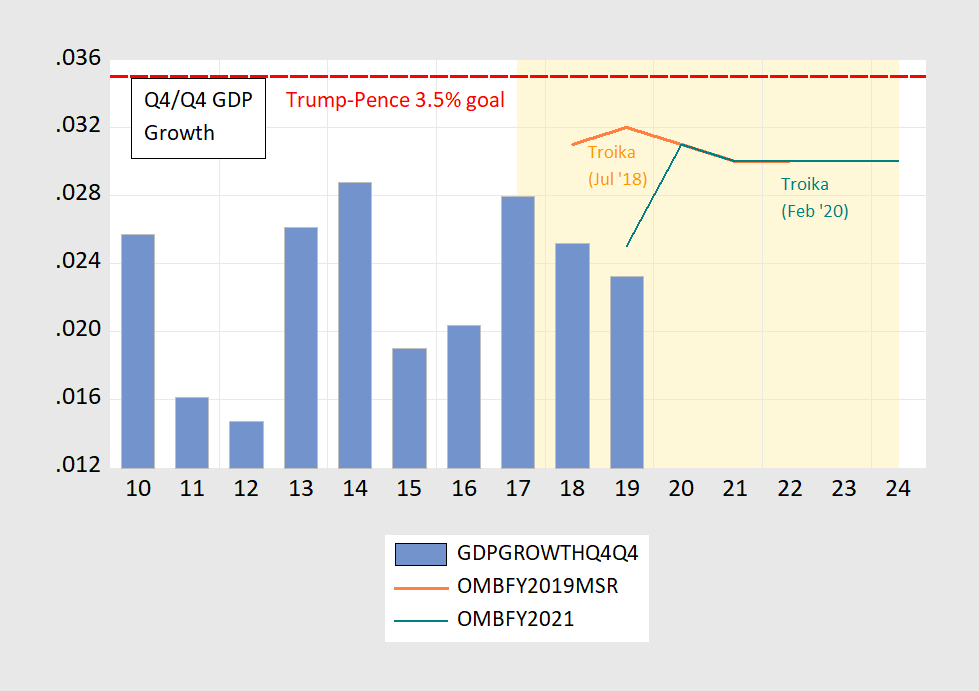

It might be of interest to see how the Administration forecasts fared in the FY2019 Mid Session Review.

Figure 2: Q4/Q4 real GDP growth (blue bar), Trump-Pence campaign promise (red dashed line), FY2019 MidSession Review (orange line), FY2021 Budget (green line). Source: BEA, OMB, author’s calculations.

The Administration is not revising downward its out-years forecasts, despite the big misses in 2018 and 2019.

Discussion of the historical record of CBO vs. Administration vs. Fed forecasting in the CBO analysis from December of last year.

Tom Steyer goes left of Bernie!

https://www.marketwatch.com/story/democratic-hopeful-tom-steyer-calls-for-22-an-hour-minimum-wage-2020-02-09?fbclid=IwAR2mLSrHz9DGXwKmfZwfHmsAB9r5JTP7hVa8eXBDLhjZY4PT-mV1KLXhcSM

“Democratic hopeful Tom Steyer calls for $22-an-hour minimum wage”

I get the argument that raising the minimum to say $12 an hour would not reduce and might increase employment demand as the labor market has monopsonistic features. I even concede that raising the minimum wage to $15 an hour might not reduce employment. But $22? Is Steyer nuts?

I wonder if this is worth a blog post discussing the actual evidence on this issue.

This post is much appreciated as I just had to endure the blatant lies from Kevin Brady on MSNBC. He was talking to Ali Velshi who just smiled and got along with Brady. Of course Velshi only pretends he gets economics. Which makes MSNBC almost as bad as Faux News on these topics.

Semi-vicious. I don’t watch Velshi (is that the bald East Indian or the semi-attractive middle aged chick??) that much, but I suspect you’ve probably hit the bullseye there. One could argue discussing economics is at least a step in the right direction. I mean, if they’re quoting someone like Krugman or Alan Krueger, even if they don’t know whether it’s empirical or not etc, I’m not sure if I mind too much, if they are quoting the right people.

Klobuchar is running in 3rd place in NH right now. The numbers are still too early to call (about 45% of precincts) but color me shocked she is in 3rd. I am very happy she is in 3rd place, as I have grown to like her over time, but no way in hell did I see her coming in 3rd. Happy news.

Menzie, I’m about to get semi-sauced, so if you wanna block my comments (music links??) I’m apt to put up, I mean you can block me for like 16 hours or something on here if it makes your life easier.

my brother called for klobuchar to be the nominee a little while back. i disputed him. i did not believe a woman could beat trump (not against women, simply looking at how the electorate voted last time). i pushed for buttigieg, but was concerned that he was too young. but he had a presence about him. i still think he is too young and inexperienced. but klobuchar is rising. and she does have experience. changing my mind on her. i was wrong. voters were not turned off by a woman last time, but by hillary and baggage. i think the electorate might very well be open to a klobuchar. bloomberg and buttigieg might split her vote here. which leaves a bernie to sneak in the same way trump did in the republican primary last time. bernie is a problem-he is not a democrat, and will get crushed by trump. democrats do not need a far left liberal to run for office. they need somebody who can win. in think the choices have become klobuchar, bloomberg and buttigieg.

Menzie Why did you begin your ARIMA with 2009Q2? NBER dates the trough of the recession as June 2009, so I would have expected 2009Q3 to best represent the beginning of the recovery. I reran the ARIMA (1,1,0) model using the 2009Q3 start date and while it didn’t affect the bottom line conclusion, it did improve the information criterion scores. The real howler in all this is Table S-1, which shows the projected budget deficits. I do hope that you won’t require your students to read the OMB document. Aside from Eighth Amendment considerations, I believe it would be more appropriate for them to complete their core requirements in literary fiction from the English department.

2slugbaits: No particular reason – I just picked the trough quarter. 2009Q3 would’ve probably made more sense.

I’m checking with FRED on what it reports for potential real GDP which is forecasted through the end of 2030. This series has average annual increases in potential GDP of only 1.82%. OK FRED’s reporting is also suggesting we have a GDP gap equal to only 0.6% as of the end of 2019. So maybe we get 2.4% growth for 2020 if Trump’s stupid economic policies does not derail the Obama recovery. But if this estimate of potential GDP into the future is correct, we see growth of only 1.8% for the next decade not 3%. So where does Team Trump come up with its forecast? Oh yea – they pulled it out of Trump’s fat (expletive deleted).

Professor Chinn,

Do I understand correctly that the model using 2009Q2 to 2019Q4 data is calculated as:

dlog(GDPC1) c AR(1) ? My AR(1) coefficient is not significant.

AS: Yes; I could’ve left off AR(1), but thought it better to keep to retain serial correlation in growth rates in forecast.

Professor Chinn thanks for the response.

Not complaining, criticizing, or trying to be a “pain in the a_ _, just trying to understand.

AS: Didn’t take it as a criticism. Just sayin’ — one could’ve gone either way in terms of including. A simple random walk w/drift would’ve been ok as well.

Menzie (or anyone else) won’t believe this, but I’m actually feeling quite melancholy about this, here with my Zinfandel. I think it’s incredibly sad. I think it’s sad that a man with a great message about science and mathematics got ignored buy a large section of America, Was the universal income “here’s $1,000 to EVERYONE” a little “gimmicky”?? Yeah it was. but the underlying message there was something very sincere and very genuine, Andrew Yang reminded me of some of my “pragmatic” friends is Liaoning China. Was he pragmatic, did he kinda “lie” sometimes?? Yeah, but underneath that “lie” was pretty good guy with the right intentions. I wish everyone like a Yang, like a Klobuchar, like A Bernie 2016, could listen to the 2nd link and not quite give up so easily on a nation that needs a good message so badly right now:

https://www.youtube.com/watch?v=N8azpwqrWtc

https://www.youtube.com/watch?v=pNo1nS_JV5k

Menizie, I used to listen to this one in my apartment right on the tip of the ocean there in Dalian or Liaoning China, it was a shitty poor part, but it was by the ocean:

https://www.youtube.com/watch?v=vi7cuAjArRs

They put Americans by Americans there in the teacher’s dorm being the TRUE Xenophobes they are. Well, actually that was wise as I drove all of my American friends NUTS when I played music thinking about some girl

https://www.youtube.com/watch?v=wykpaRzi9SM

https://www.youtube.com/watch?v=fpigDGf6vXM

https://www.youtube.com/watch?v=1iFwqXSQn20

https://www.youtube.com/watch?v=RSht5j3Cnh0

https://www.youtube.com/watch?v=RlNhD0oS5pk

https://www.youtube.com/watch?v=V7sty6rd6Hw

https://www.youtube.com/watch?v=6umKShwSVQA&list=RDV7sty6rd6Hw

https://www.youtube.com/watch?v=2amyCWvGZVc&list=RDV7sty6rd6Hw&index=2

https://www.youtube.com/watch?v=2aQeiG0KAzU

https://www.youtube.com/watch?v=fAktV72_nnE

LARGE SCRUPT………… HERE next to corona beer virus,,,,,,

https://fivethirtyeight.com/live-blog/new-hampshire-primary-2020/

Klobuchar?? Hello?? Jhuan-uh-daudha??? <—-phronetitic???

https://www.youtube.com/watch?v=E-Xna3ny6KY

China gives “no quarter”, same as Menzie, cuz he respects each individual to “do their thing” and each individual GETS their RESPECT

https://www.youtube.com/watch?v=kW3xDZrlBQs

Menzie, I’m wandering around in my mind in Chaoyang, Bro, you ever been there?? look for the Buddhist Monk’s tooth in some kinda, monastery

Really, actually

https://www.youtube.com/results?search_query=i+don%27t+wanna+hear+about+it+later+halen

Dear Folks,

This may sound a bit ridiculous, especially to Menzie, but it there a statistical form that tracks the Administration forecasts? That might be more informative than trying to track the actuals, since it might reveal specific areas in which the Administration forecasts are mistaken. From the looks of the “Troika” graph above, it seems that they have an upward bias, but are also lagging about a year and a half.

Julian

Hi Julian,

One could run a set of models and verify which of those best replicate official forecasts. The problem might be that their models evolve over time. In addition, official forecasters face another difficulty. They have to forecast other variables and need to produce a narrative coherent from economic point of view. It often happens that the best performing models deliver an incoherent narrative (e.g. an increase in rGDP and a simultaneous increase in the unemployment rate). In such cases, they depart from the best performing model, for say unemployment rate, in favour of a model that delivers a forecast consistent with the rGDP’s forecast. Sometimes they use discretion to correct the forecast, they constrain coefficients, introduce an add-on and such… The whole process involves a lot of discretion, which is why it might be hard to replicate their set of models on a continuous basis. Overall, I agree with your point entirely! The forecasts tend to be over-optimistic. Even if you exclude the 2007 crisis (check the yesterday’s article on voxeu). You might be interested in the following paper, written by Jeffery Fankel (he makes all these points and more):

https://www.jstor.org/stable/23607100?seq=1

It would be a miracle if any country with strong economic ties to China meets its previous growth expectations due to the coronavirus disruption.

Many large U.S. corporations have already felt the impact of their operations shutting down there or exports to China halted. Much of this is because of the uncertainty of the coronavirus. Many have pointed out that this virus is causing less deaths than the flu this year, but with questionable data it’s difficult to project the actual impact.

For the moment, China is the nation most suffering from the coronavirus outbreak. It could get worse as some predict: https://seekingalpha.com/article/4323286-china-brutal-post-coronavirus-economic-reset or the outbreak could resolve itself quickly like the cold/flu season: https://www.channelnewsasia.com/news/commentary/hot-climate-wuhan-virus-vaccine-12389694

An experimental antiviral drug has shown the ability to stop the virus, but it’s not readily available yet: https://www.theverge.com/2020/2/4/21122327/coronavirus-experimental-medication-treatment-wuhan-china-gilead-hiv?fbclid=IwAR3FspYWC5c0Cl0kqBuKGaN4huLSiz4_R0EdcsK4mdlFAjYTzMAHSb5O-R4

Regardless, the Trump administration has been overly optimistic about GDP growth and would not have reached its 2020 and beyond targets. But that’s not to say that the economy is in bad shape by any stretch of the imagination. 2% growth may be the new normal until there is a recession, consumer spending dries up, businesses consolidate operations, and the economy “reloads”. That may be a “comfortable” level given the low inflation and relatively low unemployment levels.

The question should be: growth from what level? The New York Times asked the question 3-years ago: https://www.nytimes.com/2017/02/24/upshot/the-big-question-for-the-us-economy-how-much-room-is-there-to-grow.html

Bruce Hall I agree that the new normal is something slightly above 2% absent a recession. Of course, that’s not what Trump promised. In the Feb 2018 Economic Report of the President Team Trump said that without the Dec 2017 TCJA economic growth would settle in at 2.2%, but with the tax cut growth would average at least 3% through 2028. The Administration was predicting 3.2% in 2019. It’s safe to say that they badly missed the mark even though the Administration got everything it wanted in the TCJA and there were no external economic shocks except those that were self-inflicted (viz., Trump’s trade war). You could have forecast better with a simple random walk with drift forecast using data from 2009:Q3 thru 2017:Q4. That forecast would have been off by 0.7 percentage points whereas the Administration’s forecast was off by 0.9 percentage points.

What’s worrisome is that most of the growth has been coming from increased consumer spending. Household debt is not yet at an alarming level, but it has been rising steadily. Investment in equipment has been anemic at best, which doesn’t bode well for future productivity growth. And thanks to Trump’s huge deficits at the tail end of a long economic recovery, how much fiscal space will we have when the next recession hits? What happens to household wealth as climate change strands capital? My concern is that Trump has adopted the economic philosophy of the grasshopper. Instead of relying upon consumer spending and subsidizing dead & dying industries, we should be raising taxes and using a balanced budget multiplier to invest in much needed public infrastructure. But voters and politicians are myopic, so we won’t. And it’s this myopia that leads many to believe all is well with the US economy.

“I agree that the new normal is something slightly above 2% absent a recession.”

I suspect CBO would disagree slightly. I pulled the FRED series on real potential GDP which is produced by CBO and goes out to the end of 2030 (yea they forecast this stuff). Average annual growth in real potential GDP appears to be just over 1.8%.

Of course this is based on a very modest growth rate in working age residents. I guess we could allow a flood of immigration which would lead to faster labor force growth.

It is also based on the capital accumulation we would expect given the really low national savings rate, which has likely decreased by Trump’s tax cut for the rich and his increases in military spending.

Finally, a surge in new technology might increase the growth rate. But something tells me that this Administration is not exactly promoting the kind of R&D that would facilitate technological progress.

“2% growth may be the new normal until there is a recession, consumer spending dries up, businesses consolidate operations, and the economy “reloads”. ”

bruce, this is quite interesting. during the obama years, 2% growth was termed a failure by some on this blog (see peakloser). in fact, he used to throw out his favorite output gap to point this out

https://www.advisorperspectives.com/dshort/updates/2020/01/30/q4-real-gdp-per-capita-1-40-versus-the-2-08-headline-real-gdp

now i don’t really like this graph or data, but in remembrance of peakloser i will repost it. notice how that output gap is closing under trump? me neither. i am just curious bruce, why 2% growth is acceptable as the new normal under trump, but it was decried as a failure under obama? why is 2% growth acceptable when, according to dear leader, we have the greatest economy ever, powered by politically driven low fed rates?

I am going to poach this quote from Mary McCarthy about Lillian Hellman:

https://www.newyorker.com/magazine/2002/12/16/lillian-mary-and-me

“Every thing this administration says is a lie, including the “and” and the “the”.”

Talking Points Memo gets into the Econ game with this piece on the manufacturing recession:

https://talkingpointsmemo.com/cafe/theres-no-resurgence-in-american-manufacturing-its-a-myth

it is implausible. Thanks to the failed economic policies , women are not having children and the hostile immigration policies are insuring low population growth . therefore, low growth in the labor force. Productivity. has been low during this expansion (sorry no robots taken over jobs), thanks to the tax cut that companies are using to buy their own shares. therebefore the growth potential is low. therefore, the economy will not grow at 3% .