Just released – results from the 3rd round of the IGM/FiveThirtyEight survey – growth paths and downside risks

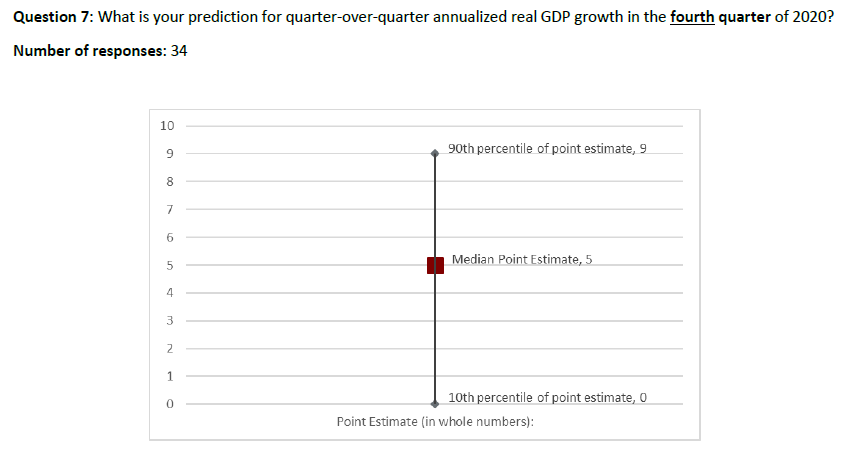

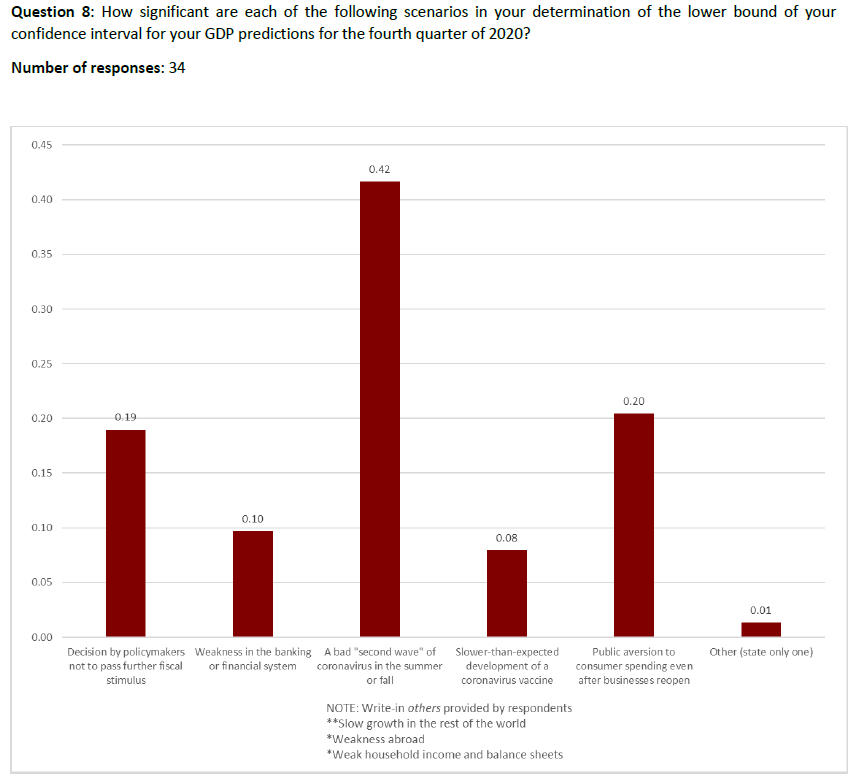

From the survey tabulation (not online):

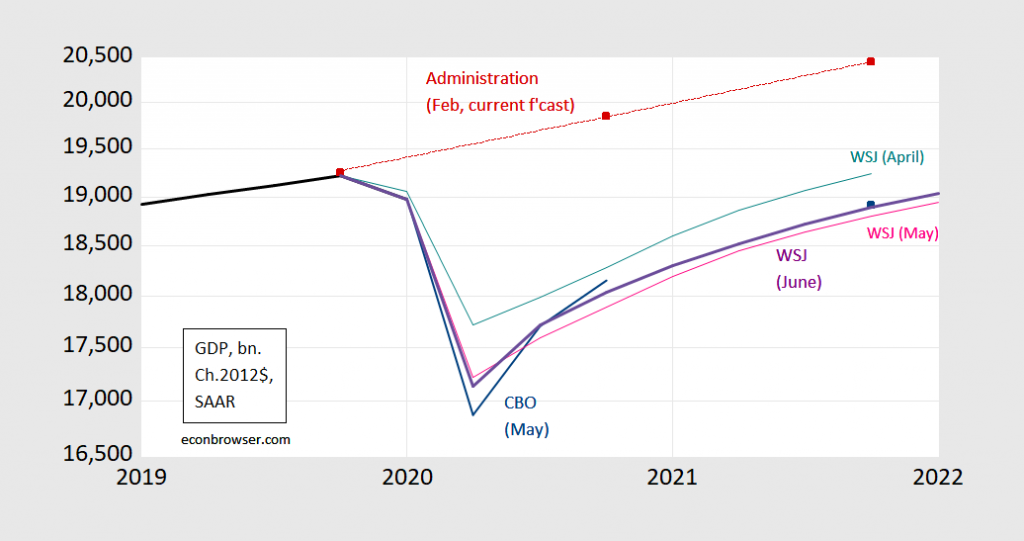

Here’s the growth path from the Wall Street Journal June survey, compared against CBO and Administration.

Figure 1: Reported GDP (black), WSJ survey mean from April (teal), from May (pink), from June (purple), CBO projection, May update (blue), Administration from February 2020 (red). Source: WSJ, CBO, OMB, and author’s calculations.

We won’t see a second wave of COVID so much as an enhanced tail on the first wave. Sick and dying people do not contribute much to economic growth. When the federal COVID stimulus runs out, there will be plenty of people who lose any source of income. My son, the musician for one. He has the advantage of being able to find other work, and he has a family to fall back on. Not everyone is in that position. That’s a shock to the economy that doesn’t seem to have been figured in. In addition, as the economy slowly reopens, there will be ongoing damage as people and businesses run out of money. Things will slow down again, in my opinion. As always, this is strictly the non-technical outhouse economist speaking. No mathematical models were harmed in coming up with my opinions. Just observations over the years.

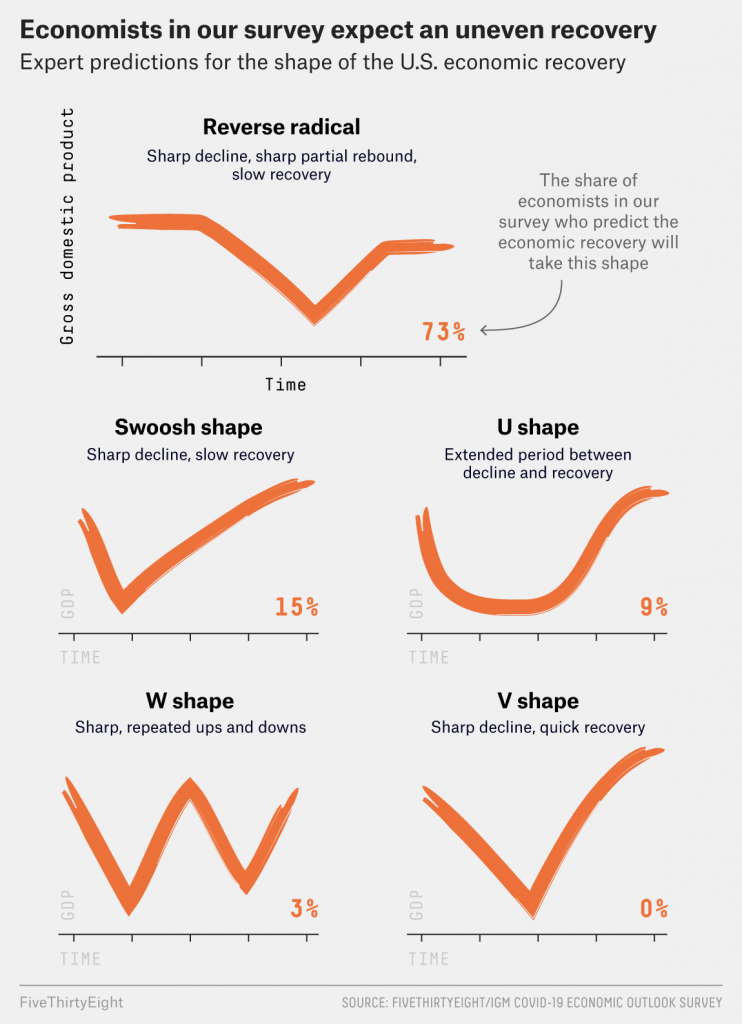

The 73% odds put on a brief-v-then-meh recovery implies the chance of a second wave of infections is no higher than in the high-20% range. While a second wave is the favored cause for low-end forecasts, it is still just at 42%. Economists tend to be optimistic about recovery. If they are making their own estimates of the odds of a second wave, that could be a place for an optimistic bias to creep in. Does anyone know of a survey of epidemiologists on the odds of a second wave of infection?

I’m not aware of any survey of epidemiologists and I spend 3-4 hours a day reading COVID-19 literature (see: https://agoldhammer.com/covid_19/ for all my past daily reports). However, this paper by the CIDRAP group is probably the best set of scenarios: https://www.cidrap.umn.edu/sites/default/files/public/downloads/cidrap-covid19-viewpoint-part1_0.pdf

I agree with @Willie comment above. The recovery is going to be ugly from what I see in some of the newsletters I have been reading. GNC, the big vitamin purveyor, has filed for Chapter 11 today and wants to close around 1000 stores. There will be a lot more brick and mortar businesses that can’t service their debt load that will also be in trouble. These employees won’t have jobs and have little prospects of employment. State and local governments are facing money problems and there will be furloughs in that sector which will further depress spending. I’m still thinking 12-14% unemployment by the end of the year but really hope to be proven wrong. It’s going to be a struggle to get the economy back to the 90% mark and even that should not be thought of as a victory.