The dollar’s value has come under pressure recently. Does this mean the dollar’s role as a key international currency is at threat?

The short answer: not necessarily.

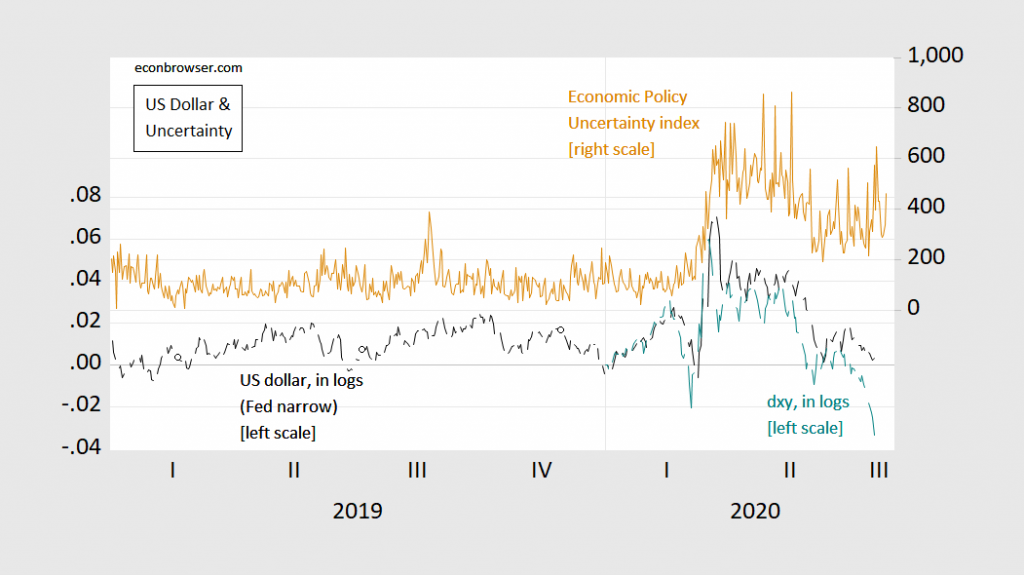

Figure 1: Nominal value of US dollar against major currencies, in logs (black, left scale 1/2/2020=0), dxy dollar index, in logs (teal, left scale), Economic Policy Uncertainty index (tan, right scale). Source: Fed via FRED, tradingeconomics.com, policyuncertainty.com.

The value of the US dollar, like any exchange rate, is a function of macroeconomic fundamentals, like the money supply, the stock of government bonds, relative income, as well as risk appetite (risk aversion) and possibly uncertainty. For some empirical models, see this post (paper). Unlike some currencies, the dollar has a demand based on attributes like liquidity and low default risk for dollar denominated assets; these attributes make the dollar a safe-haven in many cases (like financial crises, but not necessarily geopolitical crises).

The dollar’s role as an international currency has been discussed here in a number of posts [1] [2]. Measurement suggests slight decline, or possibly increase, over the last two decades, depending on the approach (Ito-McCauley). Most of the empirically important factors do not vary much over time, certainly not usually at high (business cycle) frequencies: size of economy, level of financial development, secular inflation rates, and so forth (Chinn and Frankel 2007, 2008). In our papers, Frankel and I emphasized the euro could only come to dominate were the US to pursue incredibly disasterous policies that threatened inflation, open access to US markets, or induced political unrest; we found it difficult to conceive of any situation where we confronted all three in the trifecta. Of course, we did not anticipate a Trump administration.

In other words, these are not usual times, so anything goes. In particular, Frankel notes the arbitrary and incoherent use of financial sanctions might lead to an acceleration away from the dollar as a key international, and maybe even reserve currency. But we have yet to see evidence for that, and in general, the dollar’s dominance (at least as a reserve currency) has remained despite three years of Trump. (If anything, the euro has lost ground in recent years.)

So, it is possible that some of the weakness of the dollar is due to a decline in the dollar’s role as an international currency, but I’d bet more on macro and risk factors, in particular the mounting evidence of a double dip recession and incompetent fiscal and public health policies (a view buttressed by declining real interest rates).

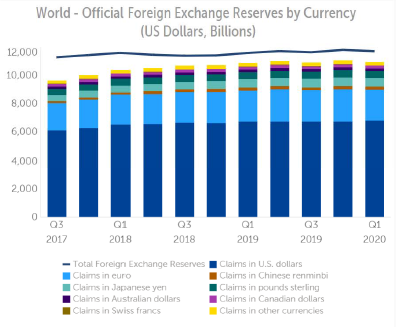

The IMF tracks central bank reserve composition (which is different than use in international transactions such as invoicing, banking transactions, etc.), in its COFER database. Here is a snapshot of latest data.

Source: IMF, COFER, accessed 7/27/2020.

The IMF also has just released work on dominant currencies.

Menzie, I am especially glad you have stressed low interest rates under a Republican President lately. This has happened before under Republican Presidents. When it happens under a Democrat President, we see 50+ U.S national level Republican legislators making the rounds on the cable networks etc saying seniors are suffering because they aren’t making any money on their savings. When it happens under a Republican President, Nancy Pelosi is busy shopping for ice cream and whatever frumpy ugly dress she will only wear once under the guise of buying something for her grandkids. Not to mention her scarf in 98 degree heat that I would prefer she wore over her frozen face sh*t eating grin. And Schumer is busy seeing how many campaign funds he can get from TBTF banks to falsely pretend he gives a crap they are robbing the American taxpayer blind.

I noticed you have made two posts on this shortly after I made this observation/ whiny remonstration related to how Democrats never take out their boxing gloves when interest rates are low. I suspect you came to this conclusion long before my comments or for other more fundamental economics related reasons. However, please don’t tell me this, I prefer to live in my fantasyland to think I may have influenced a couple posts.

I’m a bit confused by relative interest rate performance right now. The real 10-year rate is falling (with an odd resemblance to dxy in the first chart), while the nominal rate is fairly steady. That’s mostly because inflation expectations (implied by TIPS pricing) are rising. Term premium (Kim and Wright) is historically low, but not falling very much. If recession worry is growing, and various building blocks of interest rates were behaving normally, rising recession worries should be driving term premium and inflation expectations down together. That’s not hat’s happening.

One possible explanation is that pandemonium in the treasury market earlier this year led to portfolio misalignments that are being sorted out.

For the purposes of this article, it is clearly true that eur/usd and dxy are behaving more like real than nominal rates. It is also true that term premia are on the floor, signalling either recession concern, central bank intervention or both, but not falling in a way that implies a big increase in recession worry. TIPS implied inflation expectations are rising – consistent with declining recession concern – but that could represent a market distortion being worked out.

I agree, Menzie, and said it here in another thread, that the euro is the only other possible currency in the near term to be a possible rival for the USD as the leading reserve currency also used predominantly for trade and investment. And both Japanese yen and pounds sterling are still ahead of Chinese rmb in the accounts, although increasingly there is trade being denominated in Chinese yuan (holding to the idea that “yuan” refers to the PRC currency as a unit of account while “renmimbi” refers to the money itself, my current understanding of the matter).

But, heck, no SDRs in those accounts? Gosh. However, if Nancy Pelosi would only stop eating ice cream it might suddenly surge forward to become the dollar’s rival.

@ Barkley Junior

Your great repartee in arguments, is only rivaled by Harald Uhlig, whom with BTW, you share many of the same personal traits:

https://twitter.com/haralduhlig/status/1286086897467641857

I really don’t respect your opinions on much of anything Junior, as I remember you are the same pseudo-intellect who said China’s RMB “is not a reserve currency”. Shall we once AGAIN “go to the video tape evidence” with Junior’s continued asininity:

https://econbrowser.com/archives/2019/12/guest-contribution-the-currency-composition-of-foreign-exchange-reserves#comment-232972

About 7 months ago, Junior said the following: “the Chinese yuan/rmb simply is not used as a reserve currency,”

Can you find the RMB color code up on the graph, oh great “mathematical economist” of the Shenandoah Valley?? Or do your eyes now work as poorly as your brain??

And since the only conceivable way to get anything in your brain is to spoonfeed it to you, I shall present you with some other data. See if you manage to see the share that countries such as Germany and America have in the table, Oh Great Cloudy Headed Dahnawa Danatlihi.

https://www.imf.org/external/np/sec/memdir/members.aspx

Moses,

I very recently laid out the exact order of the top currencies held as reserves in central banks accurately before Menzie provided the list here: USD, euro, Japnese yen, UK pound sterling, and rmb, with there being zero SDRs as they do not exist, although you were loudly declaring that the nonexistent SDRs are the leading rival of the USD for world’s leading currency. Not.

Your link does not provide numbers on currencies as reserves of central banks. It shows accounts at the IMF, but that is not what determines this.

Instead I simply went to Menzie’s link. Here are the current percentages that lie behind those colored bands that got you so worked up. Again, these are the percentages of reserves in central banks around the world, not at the IMF.

US dollar 61.99%

euro 20.05%

J yen 5.70%

UK pound 4.43%

PRC rmb 2.02%

So I recently said that there was a very small use of the rmb as a reserve currency but more use of in international trade. That is exactly correct. Two percent is completely trivial, although not completely nonexistent. What I have said is nonexistent, completely zero, is SDRs as central bank reserves, the nonexistent currency you touted as the great rival of the USD as leading world currency, and that is also correct. Deal with it, Moses.

BTW, I am not sure what it is that I have in common with Harald Uhlig. I once saw him give a talk in Paris, and he was pretty intelligent. He has gotten into trouble recently as editor of the JPE for making reportedly racist remarks, although apparently the U. of Chicago Press has decided to keep him on as JPE editor after considering the matter carefully.

So, does this mean you have caught me making reportedly racist remarks, Moses? Exactly what are those? Can you tell us about all of my racist remarks? Or have I been eating too much ice cream while identifying elephants as being hippos on dementia tests?

BTW, Justin Wolfers is way overrated, frankly someone who has seriously misrepresented the work of others. That he has become so influential on Twitter is serious evidence that Twitter is a pile of garbage. I mean, that is where Trump does his most outrageous lying.

Oh, I get it, Moses. You think Uhlig and I are similar because he has called for Paul Krugman to stop being an NY Times columnist. But I have done no such thing. I have no problem with him as an NY Times columnist and hope he continues. Sorry, you are just wrong again, as usual.

I noted that he has had a bad history of not appropriately citing others who expressed certain ideas before he did. Funny thing is that I recently posted about the late Swedish economist, Tonu Puu, on Econospeak, “RIP Tonu Puu.” I noted in that piece that he was another of the economists who predated Krugman on some of his crucial ideas. Krugman would eventually recognize Fujita and coauthor with him. But he never recognized Puu or several others. I once confronted him in person at a meeting on this, but he was chairing the session and said, “We can discuss citations later, next question.” Needless to say there was not any further time to “discuss citations” and it did not happen.

In any case, all this has nothing to do with Krugman’s ability to be a competent NY Times columnist, completely separate issue.

“That he has become so influential on Twitter is serious evidence that Twitter is a pile of garbage.”

https://www.cnbc.com/2020/07/28/twitter-limits-trump-jrs-access-after-he-shared-coronavirus-misinformation.html

twitter is the only social media site beginning to combat falsehoods. i do not want them to be the censure police. if you have an OPINION, state it clearly as such. if you tweet a FACT, that is fine. but when you tweet or retweet items that are FALSE, it should be shut down. trump is here today because social media has protected the propagation of FALSE statements as truth, creating the current era of alternative facts we now deal with. at least twitter is moving in the right direction. have my doubts if facebook will do the same. but social media bears some responsibility for our current situation-and needs to act properly going forward.

Lack of transparency will hamper the RMB’s likelihood of becoming a reserve currency. Why would anybody sane use a currency issued by a completely opaque government that operates a capricious economy at times?

Willie,

There also continue to be some capital controls on the currency, which is probably even a bigger problem than the lack of transparency, which is indeed a problem.

It turns out that the Chinese yuan/rmb is down with two other ones at nearly the same level: the Canadian dollar that is 1.78% of central bank reserves and the Australian dollar at 1.55% of those resevres, compared to 2.02% of reserves that are rmb. These are noticeably below the 4 and 5% levels for the pound sterling and Japanese yen respectively, which are real reserve currencies, if minor ones. Pretty much all of those rmb, loonies, and Ozzies are held by major trading partners of those nations to assist in managing trade rather than as serious long tern reserve currencies the way the USD and euro are.

I note also that over 2% are from other nations, so indeed there is a long list of nations that one could argue have their currencies being “reserve currencies” because some itty bits of them ate being held somewhere or other, with places like Switzerland, India, and Indonesia at the top of this more miniscule list, with, as like PRC, Canada, and Australia, most of these being held by major trading partners to aid in facilitating trade, not as serious long tern reserve currenices.

For the record I was fully aware of all this, if not the precise numbers we now have, when I inaccruately said that the Chinese yuan/rmb was “not being used as a reserve currency.” That was techinicaly incorrect, but adding the word “serious” before “reserve currency” would have made it correct. I apologize for may borderland hateful failure to have done so, evidence that I probably would identify an elephant as a giraffe on the next dementia test I take.

OTIOH, it remains the case that the number of SDRs being held as reserves in central banks is zero, absolutely zero, not one at all anywhere, again for the simple reason that they simply do not exist. They are only a unit of account at the IMF, with their “issuance” simply amounting to the IMF being more willing to lend out various actually existing national currencies to borrowing nations.

Oh, and given the declining value of the dollar, maybe just as well it has become hard to travel abroad now for Americans.

Whatever sick perverted reasons I may or may not have for mentioning this, I think Gita Gopinath has a lot of stuff about dollar “invoicing” for international trade in her research papers. My understanding is that if it’s not “groundbreaking” work that it comes close to that descriptor. I don’t understand all of it (but I would pretend I understood all of it if she wanted me to. Gita?? Gita are you there??). All silliness aside, the papers are interesting reading.

I can’t find the explanation on this. Are we to assume it is the usual reason these things aren’t discussed openly?? I hope not. I think this may need to be examined as it relates specifically to the profession itself if this is what I fear. Yes, COVID-19 creates some “extenuating circumstances” related to mental health. But it also seems it may be “exposing” a problem that was already there in the profession, much the same way donald trump has exposed the higher amount of racists who have always been in our society.

https://twitter.com/rodrikdani/status/1287379935829655552

https://news.harvard.edu/gazette/story/2020/07/leading-harvard-economist-emmanuel-farhi-dies-at-41/

https://www.livemint.com/opinion/columns/emmanuel-farhi-a-brilliant-economist-gone-too-soon-11595863189730.html

I am only an armchair wannabe economist. This is obvious. I don’t have anywhere near the knowledge base to know how that feels being inside the profession. However my “sense” is (and I consider myself relatively perceptive about people) is that there is way too much pressure to publish papers and books “just for the sake of publishing”. When you add that in with the type of personality mix is attracted to economic work, it’s not a good mix I think. Maybe some of this “publishing for the sake of publishing” mindset, needs to “let off” a little.

Even starting at a “healthy baseline” that tunnel vision on. publishing has to “wear” on people.

It is too bad about Farhi, who was so young. However, at least so far it appears he died of natural causes, although what have not been reported so far, rather than committing suicide as did Alan Krueger, Marting Weitzman, and most recently William Sandholm.

Oh dear. I have now seen a report that indeed Farhi “died by his own hand,” although that is not from an official source. There is also speculation going around about his sexual orientation, although I find this unfortunate, whatever the facts in the case. It is certainly the case that he was highly successful and respected by all, so did not need to end his life because of some sort of professional failing, although he may well have felt under professional pressure anyway.

There continues to be no official word on the cause of Farhi’s “unexpected” death, although Claudia Sahm, who gets a lot of attention, is now claiming he did it to himself.

OTOH, longtime Georgist economist Mason Gaffney just died at age 96 of Covid-19. That is official.

Maybe more economists need to do this on their next holiday break:

https://www.wsj.com/articles/rv-rental-buy-how-to-drive-repair-camp-park-coronavirus-11594132322

But Uncle Moses says, always make your turns very WIDE (even sometimes grab part of the other far lane if you need to, to clear objects on the passenger side you can’t see in your mirror), and never back up the RV without a spotter your trust walking in the back near the bumper that you can clearly see in your driver side mirror. And make sure that person (your potter) knows they need to be viewable in that mirror at ALL times.

I’m catching up on these old WSJ’s, and was reading an editorial, in of all places, the “Life and Arts” section. And of course the guy is basically defending slave owners. And as I’m reading it he’s discussing statues, and it suddenly hits me—-

Let’s take any of these “conservatives” “so concerned” about the preservation of history…….. what would they say about the taking down and smashing of Stalin and Lenin statues?? Were any of of them voicing concerns when those Lenin statues got torn down?? What about Marx?? I’m assuming there must have been some Karl Marx statues torn down at one time another. Do they think a swastika in a public park is appropriate in Germany—to remember history?? What about Erwin Rommel?? Should Rommel have a big statue up at a park near central Berlin?? Should Hong Kong have a large statue of Mao Zedong, and what would all the “offended” conservatives at “WSJ” say if they tore down an already standing Mao Zedong statue?? Does anyone in their right mind NOT think WSJ’s editorial board would nearly all ejaculate in unison upon hearing a Mao Zedong statue was torn down in Beijing?? So…. if we take guys like Stonewall jackson, Robert E. Lee and yes, even Washington, all basically guys with a license to murder because they led a war time Army. Do we think someone like George Washington really had “consensual” relationships with slaves laboring for him that he “owned”??? And young people want to tear these things down?? Yeah, I think the young people of this nation are teaching the old people of this nation, maybe something we should have figured out a long time ago —these guys are not “heroes” and they shouldn’t necessarily define who we are now or what we want to be. We don’t need statues of Hitler, to know what the history record is. We “get it”, even without large statues. And Apparently young people “get it” better than us old folks do.

Regarding Karl Marx statues, there is one of him and one of Engels still standing next to each other amidst some trees in what used to be a platz named for them in the former East Berlin, now just plain old Berlin. There is also a pretty large one of him sitting that remains across from the Bolshoi Ballet in Moscow, just outside the Metropole Hotel now made famous from the novel, A Gentleman in Moscow.

However, in 1990 when I visited Budapest for a conference at what had been Karl Marx University and had just been renamed “The Free University of Budapest,” they had the very large statue of him sitting in a main lobby all covered up. I am not sure what was done with that statue later. Of course these days, Budapest is not quite as free as it was some years ago.

Isn’t lower interest rates and currency devaluation the appropriate monetary policy when a nation goes into a deep recession? In other words, the FED should be given credit for doing the right thing. Oh wait – Judy Shelton would call this currency manipulation.

Not when you have excessive debt expansion. Capital flight begins and loans dry up.

Except when she wouldn’t. It’s …. complicated?

Depends:

Republican is in the White House= low interest rates “good”

Democrat in the White House= low interest rates “bad”.

I think Mrs. Shelton just consults with Stephen Moore when she feels confused. She can just meet him in the middle of town at the courthouse when he’s trying to stiff his children out of child support.

https://www.theguardian.com/us-news/2019/mar/30/trump-stephen-moore-federal-reserve-board

Moore is trying to tutor Shelton on the proper way to exhibit “family values”. It means you spread your seed around, divorce your wife “on the low-down”, and then tell your children to go F— themselves. It’s in the new “Republican Handbook on Family Values” by Stephen Moore, soon to be a bestseller at the Hoover Institute. 3 “easy” payments of $19.95 to Hoover Institute, but only if you call now!!!! You’ll find it on the Hoover Institute bookshelf right next to John Cochrane’s book “How I Get Paid A Regular Salary Defending Racist Colleagues”.

This is a huge mistake–of course—celebrated by WSJ’s editorial section. Nothing like performing s*d*my on poor people to make the editorial section of WSJ get giddy and unleash tingles all over their body:

https://www.npr.org/2020/07/07/888499021/cfpb-strips-some-consumer-protections-for-payday-loans

I’m guessing a lot of regular readers here have read my link to the WaPo or Bloomberg article detailing Nancy Pelosi’s husband magically getting some of the PPP money for his business. I’m also guessing many who read it thought “What’s the big deal?? It’s a relatively small business, so they hand out loans and subsidies to small businesses, why should we care if Nancy Pelosi’s husband got some of that money??” I want the people who think Pelosi’s husband getting government money is “no big deal” to read about the people in Michael Tracey’s “human interest story” here, and then AFTER you read it in its entirety, I want you to tell me “It’s no big deal” Nancy Pelosi’s husband magically got a government gift handed to him on a silver platter.

https://www.wsj.com/articles/riot-torn-twin-cities-are-already-forgotten-11594163162

And regular readers here can be sure that none of that money went to keep anybody employed at her husband’s business still employed. Without doubt every last cent of it went to buy Nancy Pelosi yet more super expensive ice cream!

I just endured some podcast on intercompany interest rates in China from the arrogant but stupid people at PwC. So much blah, blah, blah which I will not bore anyone with but they kept talking about how low interest rates have become during COVID. Now government bond rates in the US have declined even as credit spreads have risen but I had to check on what was going on in China. This is an interesting story that notes that China’s 10-year government bond yield was almost 3%, which is a lot higher than in other nations. Which begs the question – did PwC consult with Judy Shelton about currency manipulation?

https://www.cnbc.com/2020/06/19/the-chinese-bond-market-is-a-standout-globally-says-ubs.html

Right, but its a capital attraction. Low interest rates create imbalances which cause capital to die.

I passed on your first rant as you have become very boring. But the same basic rant twice now? Come on Rage – you are trolling. Please stop.

Don’t normally post, so I first want to express appreciation for your years of blogging. Thanks.

First, my back of hand calculation was we would spend at least ¼ of GDP, perhaps as much as half in new debt. I saw a McKinsey graphic that showed the US at 12.9% through the first iteration. Germany was at ⅓. (I’m not going into how one evaluates what is spent versus commitments, etc.; I’ll just cite them.) That’s a lot of money. Yes, we had a lot of debt coming out of WWII, but we were helped immensely by the post-war period where we dominated. We don’t have the same economic future in sight now.

Second, assuming that level of debt is acceptable – which makes sense because the rest of the world is also taking on debt – what could tip the cart would be large new spending programs. As an aside, I’m an Independent who did not vote for Trump. Biden’s plan for housing rests on $68B more a year for Section 8 vouchers. (That would, I think, mean national rent control because federal rules would insist landlords take vouchers, and thus federal determination of fair market rent would act as rent control. There would be a massive shift in investment.) There are hundreds of billions more in ‘green initiatives’, and in other programs. I picked housing because the Biden plan says an exact number. If I said ‘health spending’, you get arguments about what that number might be. So, one thing would be large new or expansions of social programs on top of the new mountain of debt.

How could this happen? One way is the Senate eliminates the filibuster and enacts these programs by majority. That signals political destabilizing through the literal jettisoning of what has been a political stabilizer.

Let’s take it further: the Democrats decide to pass a wealth tax. It’s attractive when you need money. The argument for the wealth tax has less behind it than the faithless elector creative idea to manipulate things to come out the way you want despite the Constitution. To be blunt, our legal tradition roots in limit of the Crown to take your wealth, going back to the Magna Carta. There is a long legal history – e.g., attainders – against which there is the clever idea that it isn’t specifically excluded. So the Supreme Court says no. Or perhaps people worry the Supreme Court will say no. In the latter, they threaten to change the composition of the Court, and that tells the world the US might change its governance, that the legislature has taken control of the Judiciary. If they actually file a bill to do this, even if it doesn’t pass, that signals the world the US is changing its system, that now threats of legislative takeover looms over the Court. (And of course if the legislature tries this, then of course the Executive, who is the party leader, is involved, and that could mean a takeover of the government.)

So sure, it could happen and it could happen fast because the world is very, very wary. And the charts of components shows a way; you don’t need a single currency replacement. As you know, the Chinese have been arguing for a basket, which means something that abstracts a combined value. That could take over at large levels very quickly, and the effects would cascade downward to hit the people who hoard $20’s in countries all over.

Thought of another lever to dethrone the dollar. I noticed the competing aid packages differ over the federal government bailing out states. Let’s say the Democrats win and that becomes true: we’ve just signaled that the federal government is de facto responsible for state debt in an entirely new manner. And somehow, we need to generate a lot of jobs to make up for long-term bad prospects, which we might add to by eliminating insurers and some ancillary employment in medical billing.

It’s not enough to assert the US is the reserve currency. A basket currency can be invented and could take over quickly. I’ve watched the peaking and decline of American power. Watching the dollar lose its status seems to be looming as next.