Following up on the dollar’s status as an international currency (and how threats of default are not helpful), here is what we know about the dollar’s role as a reserve currency.

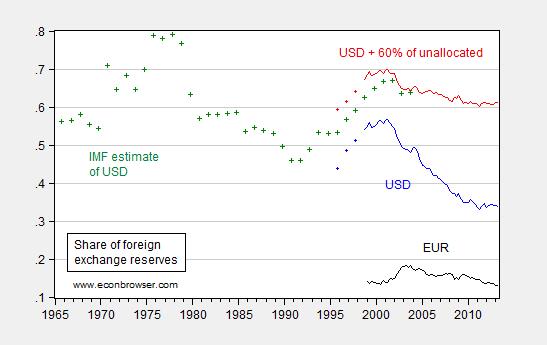

Figure 1: Share of foreign exchange reserves held in USD (blue), EUR (black) and USD plus 60% of unallocated (red), and IMF estimated share in USD (green +). Source: IMF COFER for 1999Q1-2013Q2 and IMF (estimates, 1965-2003).

In other words, we really don’t know how much of reserves are held in USD, although we can guess (60% seems a popular guess for the share of unallocated reserves in USD). It appears that USD shares are stabilizing after eight years of decline 2001-2009.

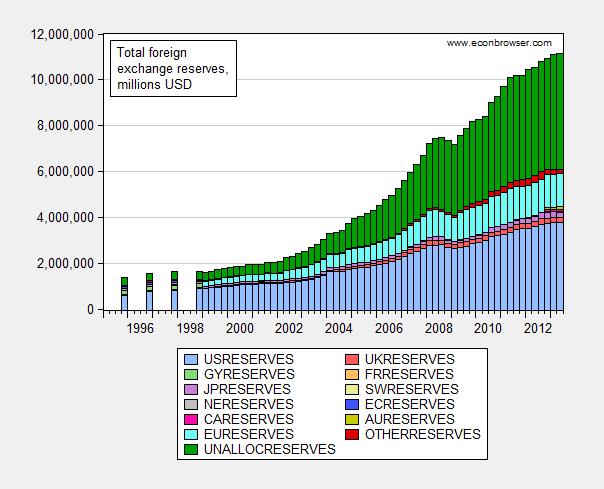

Figure 2 depicts the levels of reserves. Note the increasing portion in green, which is the unallocated share.

Figure 2: Foreign exchange reserves, in millions of dollars. Source: IMF COFER.

It’s interesting to note the deceleration in overall reserve accumulation. More on that in a (near) future post.

For more on international currencies, see Frankel, as well as [1] [2].

This is me professing some ignorance here in the hope of arriving at some greater knowledge or at least how to think about this, so bear with me. The unallocated reserves are a known amount, so presumably we (a global “we” in this case) have some idea where (institutionally or geographically) they’re from. Is that information available? I’m ignorant enough on this I’m not sure where to look without undertaking a fair amount of effort. Google-ing it really quickly didn’t yield much.

I guess what I’m trying to get at is once we know that is it possible that based on some other correlated indicators associated with the holders of the unallocated reserves we might be able to get a sense on how good of a guess that 60% figure is?

Thanks for both any reply and patience with my ignorance on the topic.

-Brian

Actually currency held in reserves does not say much. The more important question is which currency is used more in trades? Now the dollar is of course the king of transactions primarily becuase oil is priced in dollars, but it would be curious to see a trend. China is making great strides in replacing the dollar with the yuan in international trade with China. Whether this translates into reserve currency status is highly speculative, but removing the dollar as the currency of choice could be just as devastating to the US scheme of pushing its inflation and monetary woes off on the rest of the world.

Brian Q: As noted on the IMF website, currency composition data (COFER) are reported to the IMF on a voluntary and confidential basis. Some countries do not report COFER data and are not required. IMF obtains total foreign exchange reserves without regard to currency composition from other sources.

It appears that the IMF assumes that the 62 percent share for the U.S. dollar in total allocated reserves applies more or less to unallocated reserves. That may be a reasonable assumption, but it really depends on the COFER non-reporters. The rapid growth in the share of unallocated reserves that started around 2005 may be suggestive.

Hi Menzie,

Are your figures polluted by exchange rate valuations? For example, will a strong depreciation of the dollar (such as has been engineered by Chair Bernanke’s policies) cause the share of euro reserves to appear to grow?

To me, the more important question is who holds the reserves, i.e, who is using currency manipulation to steal scarce AD?

Brian Q: There are people whose job is to infer the currency holdings of central banks. My guess is that takes a lot of institutional knowledge (e.g., what banks are purchasing bonds on behalf of PBoC, what accounts are held in dollars, etc.).

don: Yes, valuation changes enter into the calculations; these are the appropriate measures if you use a portfolio balance interpretation of holdings.

Ted Truman (formerly Fed), made adjustments for valuations. See some graphs here.