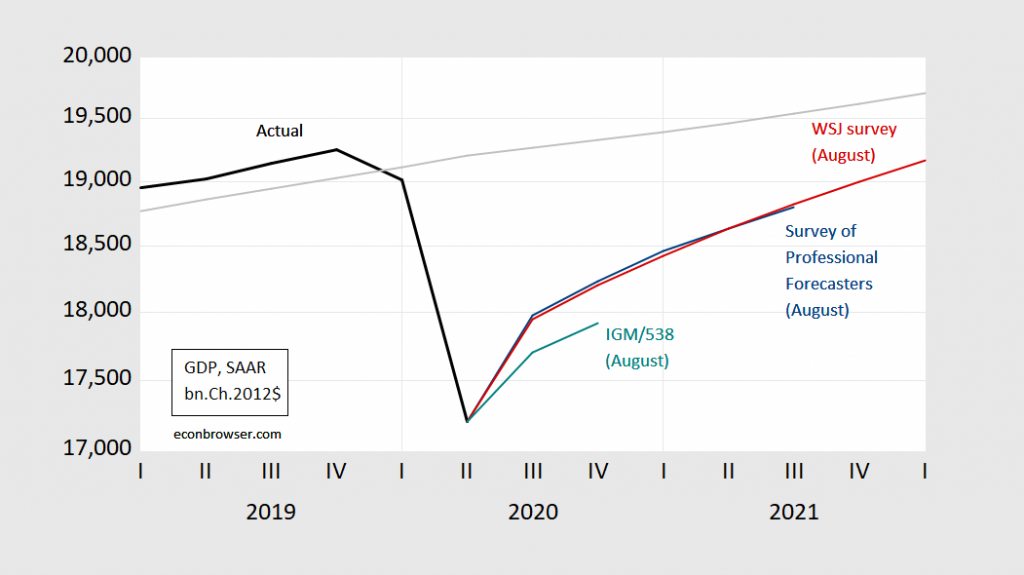

The Survey of Professional Forecasters’ Q3 forecast came out today, the Wall Street Journal August survey yesterday, and the IGM/Fivethirtyeight Covid-19 panel a few days ago. Here’s an opportunity to compare and contrast perspectives – as shown in Figure 1.

Figure 1: GDP actual (black bold), WSJ August survey mean (red), Survey of Professional Forecasters Q3 survey mean (blue), and IGM/Fivethirtyeight Round 6 survey median (teal). Source: BEA 2020Q2 advance, WSJ survey, Survey of Professional Forecasters, IGM/Fivethirtyeight Round 6 survey, and author’s calculations.

Both the Wall Street Journal and Survey of Professional Forecasters panels are dominated by Wall Street economists defined broadly as bank and consulting firm economists. The IGM/Fivethirtyeight panel is composed entirely of academics (including myself and Jim Hamilton). Interestingly, the IGM/Fivethirtyeight consensus forecast (based on medians, so not strictly comparable to the WSJ and SPF based on means) is noticeably lower than the other two forecasts through 2020Q4. The modal forecast from IGM/Fivethirtyeight is consistent with the level of output in 2022H1 as from the mean forecast from the WSJ and IGM/Fivethirtyeight surveys.

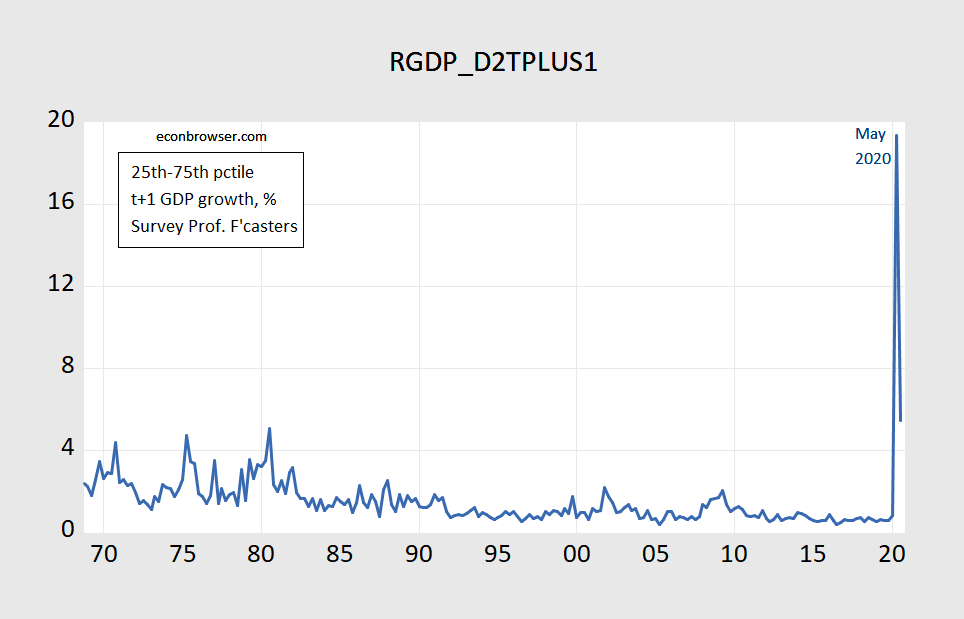

Update, 8/15: macroduck asks for uncertainty of forecasts. The data from the surveys don’t include direct measures of uncertainty, but we can measure dispersion of individual forecasts from the SPF. Using the 75th-25th percentiles for growth in the next quarter (so the Q3 observation is for Q4 growth, SAAR), one finds the dispersion was historically high in Q2 for Q3 growth.

Figure 2: 75th-25th percentile gap, %, for real GDP growth in period t+1 (blue). Source: Survey of Professional Forecasters.

We are at the moment of reckoning for sure. Either it’s going to happen or there are some seriously mispriced assets.

I was late to this post because the Samsung oven was getting repaired. I thought it was probably a short in the electronics, but it turns out it was a worn out “regulator” or something er another. I think, I will take an indirect “shot” at Menzie here (if you want to “read it into” that). And say that generally I would take private forecasters’ economic calls over most academic economists’ calls. In other words a random chose private economist vs a random chose academic economist.

However…… If I could cherry pick my favorite say 20 academic economists (or the ones I thought could forecast the best, of which Menzie and Prof Hamilton would be in that grouping, I could give a laundry list pretty easy if it was requested) and cherry pick my favorite 20 private economists, well, then I am not sure who I would go with in the “head-to-head” 20 vs 20 economic boxing match of the century. It would be interesting I think.

In the above blog post’s scenario, if a gun was held to my head I would bet on the IGM/538 horse to win.

There are very few TV shows I enjoy any more. I find myself watching “Seinfeld” and “Frazier” repeats, or the Carson monologue and asking myself what happened to good television (outside of maybe PBS). This has become a regular routine in my day, and wanted to share it with any other “Lynch Heads” out there:

https://www.youtube.com/watch?v=Eco9O7nH1vc

There’s many things I like about Lynch. I like people who are strange and different and take out of the monotony of life. Lynch qualifies. Also Lynch has this “sensibility” about him, clear to the way he talks in real life that reminds me of my father and my father’s generation (although one could strongly argue, Lynch is actually one generation younger than my father, as he was born just after World War 2, which creates quite a different mindset. There’s something there in Lynch’s eyes and deadpan delivery that reminds me of when my Dad talked to me, on those rare occasions my Dad ever looked me directly in the eyes (usually when he was pissed off about something I had done, or didn’t do). This subtext right behind the eyeballs saying “I’m telling you this for your benefit, even though I’m certain you’re not listening to a damned word I’m saying”, and a subliminal message of an eternal foreboding and expectation of being disappointed. Super sunshiny stuff.

That being said, if the rest of “What We Do In the Shadows” holds up and gives me as many laughs as the first episode did, there’s still hope for TV. I am also hopeful on Brian Cox’s new show, but haven’t watched any episodes yet.

This is something Black players have had to endure for decades. Be abused by the system, wreck your own long-term health—or lose your scholarship and lose your ticket for higher education. My question is When are Black athletes/laborers going to GET SMART and unionize??

https://thespun.com/pac-12/washington-state/pac-12-football-boycott-washington-state-players-cut-we-are-united-message-kassidy-woods

Black athletes/laborers being recruited to Washington State be warned: Coach Nick Rolovich views you as an unthinking bondslave, to be stepped on so he can collect a 7 figure salary, on your backs, and at the detriment to your own personal health.

More of the same. You can bet there are many stories which mirror this one, which haven’t made it to the public at large yet:

https://www.washingtonpost.com/sports/2020/08/05/colorado-state-investigating-claims-that-football-players-were-told-not-reveal-coronavirus-symptoms/

We always hear coaches’ lip-service that their players are “important” to them. But what are NCAA head football coaches’ and NCAA athletic directors’ ACTIONS telling us?? Are Black athletes viewed as humans or as revenue streams for the schools??

How about less empty slogans in TV ads from these joke NCAA institutions and more actions showing their supposed “care” about what Black athletes are going through.

“Ivory Tower”

What an awful expression, telling us just how removed from actual life we need to be. Phooey.

ltr: I’m not sure what you mean by your comment. Ivory tower is a standard turn of phrase in American English (possibly even British English).

Obviously, Menzie Chinn has it ‘right on the language’ but I think ltr is onto something. Between public intellectuals and celebrity academics, something coarsening and cheapening has happened. ‘Guns for hire’ is great for lawyers (i guess) but not so great when it comes to expertise based contributions to policy making–you end up with people like that silly tw

Anyhow, never underestimate the power of the self-fulfilling prophecy. Or forget the silent ‘p” in economics (as in ‘political economics’). There are some pretty powerful forces exogenous to most econometric models. Still my bet would be with the ivory tower types, although perhaps not until after the election. And that ignores the possibility (probability/outlier?) of a discontinuity.

Menzie,

I am interested to know your level of certainty in your forecast, relative to earlier, non-plague forecasts. I am also curious about the dispersion of forecasts now compared to earlier, non-plague periods. Eggheads and vampire squid types alike are stuck with tools that aren’t well calibrated for this economy.

macroduck: IGM/Fivethirtyeight only started the panel after the pandemic began, so I have no actual pre- and post-. We can look at dispersions of forecasts from each panel for WSJ survey, and Survey of Professional Forecasters. Pretty sure dispersion increased, but that’s not what you’re looking for.

Kinda what I’m looking for. I’m equally interested in whether there is a strong central tendency. There should not be, I think. If there is a cluster of forecasts right now, that would mean a clustering of assumptions about a bunch of things, or (just as likely) an unwillingness on the part of many to stand out from the pack. Either condition would reduce the value of the forecasts.

They’re not traditional forecasts. They’re educated guestimates. You know all this, I’m just saying.

Look at the Guardian Live feed (seems to be more active at night time USA time) and then tell me there’s any way you can forecast this virus in global terms. And I think you’re even pushing it on national terms.

Ireland’s head of tourism just got canned for traveling against the official government guidance. He traveled to…… wait for it……. wait for it…… wait for it…… Italy. I wonder if he can get a job as donald trump’s new White House MAGA tourism director or deputy Attorney General??

Ireland is now having it’s biggest breakout of COVID-19 infections since May.

I should rephrase this, I hope Menzie knew what I actually meant even though I expressed this extremely poorly—-the forecasts themselves may be traditional, but the context in which they are made (with the virus and herky-jerky policy combined) is super unusual, so it’s much more difficult to get “standard” forecasts to work right here.

By the way, since timing of approval and distribution of a Covid-19 vaccine is among the big assumptions in any forecast right now, a best-guess about vaccine timing might come in handy.

I have on idea whether they are any good, but a group of so-called superforecasters is on the job: https://goodjudgment.io/covid-recovery/#1363

An economic forecaster who wants to avoid the bias that can creep into assumptions could simply adopt a publicly available third-party forecast as their own.

That there “on” should have been “no”. I have NO idea whether they are any good.

So best bet is late 2020 or early 2021. No wonder Trump wants the election delayed. Of course he would prefer it be canceled entirely.

My personal rule bends to “worst case scenario”, which bends more to realism. I think you’re looking at the earliest reliable vaccine post June 2021. Think about the fact high risk and medical staff goes first, and high risk also probably needs a booster shot (the booster shot , like a dumdum I was not thinking about at the beginning of this).

Reading the WSJ this AM it reported retail sales volume went up 1.6% in July. This along with the decreased unemployment should change several forecasts.

1.2, .6 real. Going to contract in august, so nope

CoRev July consumer spending was unambiguously higher than June’s spending; however, since the last week of July consumer spending has fallen about 1.9 percentage points.

https://tracktherecovery.org/

Yes, sampling period begins late in the previous month. Real retail sales will contract in August, notably.

Gee – real GDP in 2020QII was almost 11% lower than it was as of 2010QIV but CoRev celebrates victory if a subset of national income rises by 1.6%. Of course this is only the 2nd dumbest statement I have heard this week. The dumbest? CoRev crowing victory over the virus even after the daily death count more than doubled in July simply because it has come down a wee little bit from its July high.

Hey CoRev – Kelly Anne Conway could use a talent like you. Alternative Facts will exceed all expectations!

Apologies for multiple comments, but here’s another one…

Menzie or James,

On the assumption that we will, in a little over 5 months, a national government with a much stronger interest in the economic welfare of the nation, would a discussion of policy under such a government be possible here?

In particular, how much do we know about government palliatives for “scarring”? Government has as much control over the short run outlook as deep pockets and good science can provide. Over the longer term, hysteresis can be a greater or lesser problem, depending on lenders, courts, immigration policy, education policy, basic research and so on. The list is longer than that, and amounts to every economic policy debate that has ever been, Something narrower than that would probably be more useful.

Couple of examples: Business start-ups rely on personal wealth and the wealth of friends and family to a great extent, and that wealth has been diminished by the pandemic. Where does the capital come from for start-up businesses after such a loss? How much education has been foregone and can anything be done to make up for that loss, for the economy as a whole and for those whose prospects have been damaged?

Not to be too grand in my aspirations, but I think the wider the discussion of long-run policy, the better the odds of improving the long-run outlook. We need the Biden honeymoon to be productive.

Something about counting eggs. I would be more worried about US Postal Service, mail-in ballots, and a mentally unbalanced orange creature refusing to respect the voter count. Make certain if you have a Mail-in ballot you know the rules of your state, and it’s better to have some “lead time” when you send your ballot in. If you feel your local state’s rules are somehow cumbersome, in this case I think it’s worth it to go in person, even if you’re over 65 if you follow COVID-19 safety protocols in this case the risk is worth it. Wear a mask with a tight fit over your nose, have some hand gel in the car, go during down times in voting. Here in my area we’ve noticed something like 10:00am in the morning is a sweet spot to vote. Because morning rush hour has passed and it’s still too early for the office lunch break.

Anybody that believes bailing out mortgage holders is good policy is a moron.

Securitization. Look it up.

SMH

The Ivory Tower looks most accurate to me. There is no axe to grind and no commissions involved. Even so, my take is that they all may be optimistic up to a point. A W is coming, especially if out leaders cannot get their act together. And that is a near forgone conclusion.

So, Menzie, besides that one group is looking at means and the other at medians, can you figure out other sources of difference? Are ther particular sectors of the economy that your group is projecting is growing more slowly than the WSJ group? How much spread is there within each groups or is only an average being reported? If individual projections are known are any showing the “wiggly w”?

Barkley Rosser: No, can’t do it with the data available to me. For instance, the IGM/538 results don’t go into detail of components of GDP, and I don’t have individual forecasts. And the “conditions” (i.e., for the conditional forecasts) are not listed for any of the forecasts.

I think unless you’re looking at the original projections in one of the first IGM/538 surveys, the green line above is going to be the best answer you’re going to get on your last question.

Professor Chinn,

Any chance of some coaching on forecasting GDP, if your methods are not proprietary?

I found an article about using monthly data to predict quarterly output

https://www.researchgate.net/publication/5033462_Using_monthly_data_to_predict_quarterly_output, .

which is helpful, but it would be great to have some coaching from an expert.

Thanks for considering

AS: I’m relying on other forecasts, and then adjusting by what I think will have in terms of policies (which is the wild card in my view). I don’t have a proprietary model, but my base is IHS-Markit, formerly Macroeconomic Advisers, which is the program that the forecaster run at CEA when I was there.

Thanks for the response.

Using the advice from the article cited, I was happy to derive a Q3 annualized forecast for FRED series GDPC1 of 18%, which agrees with the 18.3% average of the WSJ economic survey. I notice that the WSJ survey has a sample standard deviation of 6.8 percentage points.

My goal is to have some fun and have a reasonable forecast with the simplest model I can determine. I find if I make too many sub forecasts, I can get lost in the weeds.

If you have time, it would be very instructive to see how your policy wild card estimates affect the IHS-Markit forecasts. I certainly would have no idea how to make such adjustments.

AS,

I have a suggestion. Go back to earlier quarters, using the data available at the time, and see if you are satisfied with those forecasts, too. You’ll get some practice and learn how well the model works.

One thing a good many forecasters do, and which is found in a number of econometrics texts is to adjust the model’s forecast if it does not match their views. For some, the adjustment is a crude as “I’ll add a couple of tenths” to the annualized growth estimate. Others employ a data series or two a as check on the model’s output. In the good old days, the ISM factory index was a favorite. More recently, a composite of the ISM factory and non-factory indices is sometimes used. The idea is to nudge the output of the model in the direction suggested by the other data series.

This may seem like cheating, but if the goal is to provide the most accurate forecast possible, the rule is “whatever works”.

By the way, it’s a good idea to know why you disagree with the model’s forecast before you go changing it.

Macroduck,

Thanks for the comments.

Using the same model as before, and using data from 2008Q1 to 2018Q4, I got the following GDP dynamic forecast results shown in the table below for 2019Q1 to 2020Q3.

The dynamic forecast for 2020Q3 is 9.2% compared to the static forecast of 16.4% . When I shortened the period and used data from 2012Q1 to 2020Q2, I got the 18.0% static forecast mentioned previously.

Dynamic Forecast

GDP Forecast

2019Q1 2.9 1.9

2019Q2 1.5 2.0

2019Q3 2.6 3.1

2019Q4 2.4 2.3

2020Q1 -5.0 -4.4

2020Q2 -32.9 -37.3

2020Q3 9.2

Personally, I think bankruptcy filings rather than GDP will be a better measure of what is going on.

Weighted by business size?

Many things have been written on the shortcomings of GDP.

https://www.amazon.com/Mismeasuring-Our-Lives-Why-Doesnt/dp/1595585192

The problem is you have to propose something better before you trash the thing that isn’t perfect. So, you add things to supplement GDP—and bankruptcy filings is a solid gauge. One problem with bankruptcy counting is, “How does that measure efficiencies??” You could conceivably have a communist country where very few state subsidized companies (“SOEs””) go bankrupt. They could be hemorrhaging funds and never-ending government loans, and not going bankrupt. But how efficient are they and are they providing a product in fact beneficial to society?? This is part of the reason many people don’t buy China’s GDP numbers. TONS of China’s “GDP” is in construction projects that sit empty and unused or on vendors where the store manager sits idle all day staring at the walls because his uncle is in the provincial government. But in that system, or a crony capitalism system (many people proffer America has this system now) you’re not necessarily going to know by bankruptcy counts what the efficiency is.