Today, we are pleased to present a guest contribution written by Joshua Aizenman (University of Southern California) and Hiro Ito (Portland State University) .

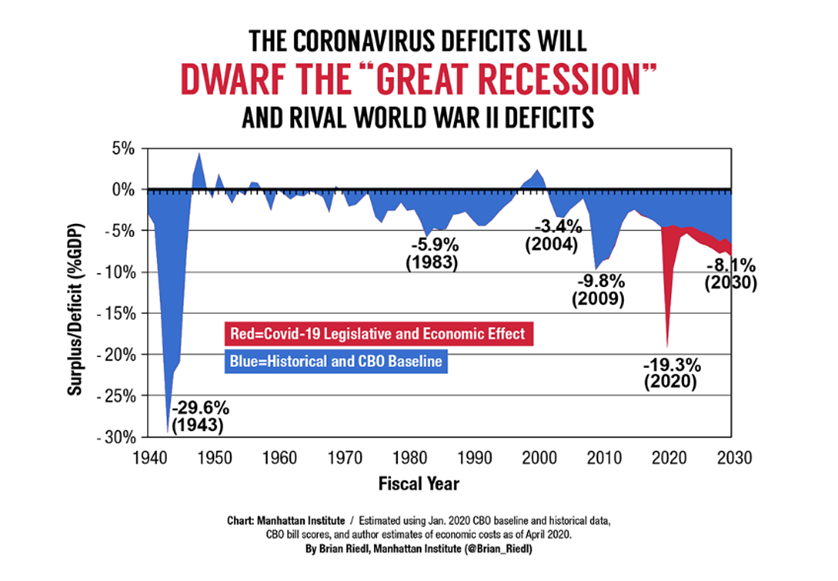

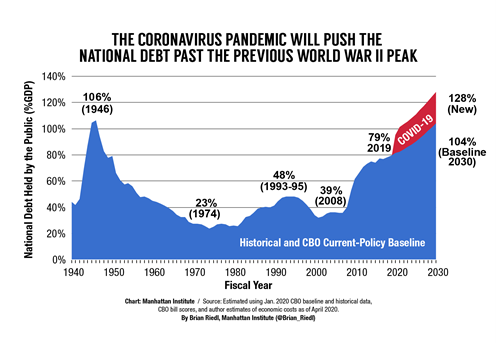

The pandemic of the new corona virus, COVID-19, wreaked havoc of the global economy in 2020. According to the International Monetary Fund (IMF), as of June 2020, the world economy’s GDP is predicted to shrink by 4.4% in 2020, the largest shrinkage since the Great Depression of the 1930s. To calm financial markets and avoid a possible free fall into a Great Depression, many countries, especially AEs, mobilized policy resources. The stimulus packages among AEs have amounted to about $4.2 trillion in 2020, leading these economies to run budget deficits of almost 17% of their GDP. Their central banks rapidly expanded balance sheets to 10% of GDP. According to the Manhattan Institute, the U.S. alone will run a budget deficit of $4.2 trillion, or 19% of its GDP, the largest share since the deficit peak occurring during WWII (Figure 1). That would push the U.S. national debt held by the public to $41 trillion or 128% of GDP by 2030. This level of the national debt would exceed the level that occurred in 1946 (Figures 2 and 3).

Figure 1: U.S. budget deficit. Source: Manhattan Institute

Figure 2: U.S. national debt. Source: Manhattan Institute

Figure 3: U.S. national debt projection, September 2020. Source: Congressional Budget Office, An Update to the Budget Outlook, September 2020

With vaccinations for the virus possibly in sight, it is time to ponder an effective economic exit strategy into the post-COVID era. The road the U.S. will take will have overarching repercussions on the global economy given the size and the pivotal role of the U.S. dollar as the anchor of the global financial system. To gain more insight on the road ahead, in Aizenman and Ito (2020) we compare two divergent U.S. post COVID economic strategies. The first is just ‘kick the can down the road.’ That is, the U.S. government could delay implementing needed macroeconomic adjustments and gamble for resurrection of the economy while continuing to run lax monetary and expansionary fiscal policies. This choice may bring about short-term buoyancy to the U.S. economy, but will more likely come with growing exposure to the risk of a future global crisis, possibly worse than the 2008-2011 crisis.

Alternatively, the administration could adopt a two-pronged policy, reallocating the fiscal efforts first, while aiming at reaching a primary surplus overtime. Specifically, it could retrench from expenditures oriented towards COVID-related challenges, and move towards expenses with a high social payoff (e.g., upgrading K-12 education, investing in medical infrastructures, etc.). With a lag, the restructured fiscal policy together with a rise in tax collection may reduce primary budget deficits, aiming to reach surpluses.

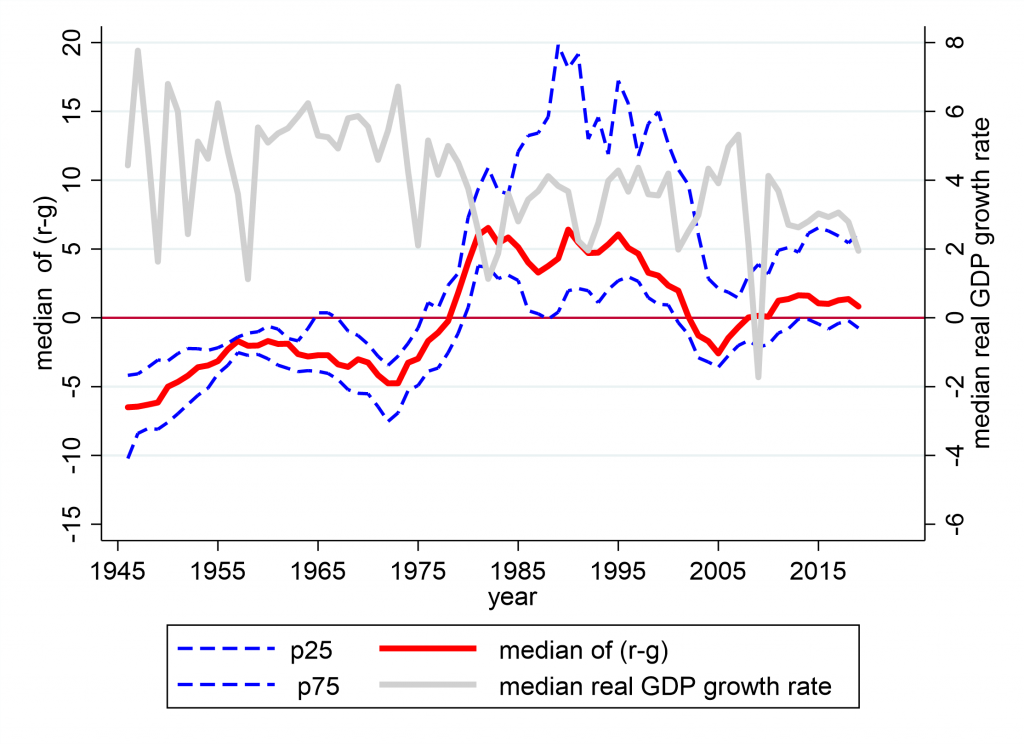

In this paper, we analyze these divergent policies in terms of their implications on the gap between the interest rate paid to service government debt, denoted by r, and the growth rate of the economy, denoted by g. This gap, r – g, aka the “snowball effect,” is the exponential growth of the public debt/GDP in countries with zero primary deficit. It is tempting to presume that the new normal for the future comprises negative snowball effects associated with secular stagnation. Yet, there are several concerns to keep in mind. First, Wyplosz (2019) pointed out that negative snowball effects are not the rule, and even in the US, r – g < 0 happened in 56% of the years. Furthermore, the past performance of the U.S. as the safe anchor of the global financial system does not guarantee maintaining the “exorbitant privilege” status into the future [see Gourinchas, Rey and Govillot (2010), Eichengreen (2011) and Carney (2019)]. The two-pronged U.S. post COVID exit strategy discussed in our paper may mitigate the growing discontent with the dominance of the U.S. dollar. Greater attention on the part of the U.S. to scaling down overtime its public debt overhang will mitigate the present centrifugal forces working towards multipolar global currencies discussed by Carney (2019). An additional concern is that the record of predicting future changes of the snowball effects is mixed, at best. Presuming that the new normal is a negative snowball effect may increase overtime the risk of a deeper future crisis, as was the case in the late 1990s and early 2000s when the presumption of an enduring ‘Great Moderation’ permeated policy makers.

Specifically, we examine the interest-rate-growth differentials in the post-WWII period. In the period of 1946-1956, the post-WWII U.S. fiscal policy facilitated global growth where the U.S., Western European countries and Japan successfully grew while repressing the interest rate. Their snowball effect, r – g, was often negative during that period. This helped to load-off the public debt overhang associated with the war and reconstruction efforts. In contrast, during 1974-1984, the snowball effect became unsustainably high for many EMEs, triggering a series of financial crises. Next, we investigate whether and to what extent the cost of serving the public debt affected real output growth. The flow cost of serving debt is estimated by the snowball effect times the public debt as a share of GDP. A higher flow cost of serving the debt may lead investors to question debt sustainability, raising the interest rate, reducing the growth rate, further increasing the snowball effect. This negative feedback may induce costly market corrections, financial instability and crisis. The Emerging Markets’ lost growth decade during the 1980s, and the Eurozone sovereign debt crisis affecting mostly the Southern Eurozone states illustrate vividly these dynamics.

Figure 4 shows that the median interest-rate-growth differential, r – g, is mostly low and in the negative territory during the 1940s and 1950s – Our sample is composed of 23 traditional OECD countries and 34 EMEs. For the interest rate, we use the 10-year government bond yields for the countries for which such data are available. Thereby, the U.S., Japan and Western European countries benefited from low costs of serving their public debt during the post-WWII recovery decades. The snowball differential continues to be in the negative territory through the 1970s. In the early 1980s, the differential rises up rapidly to the positive territory and mostly remains there until 2000. The 75th percentile (dotted blue) line hovers at high levels in the 1980s and 1990s, indicating that the top 25% of countries in the interest-rate-growth differentials faced very high costs of serving their public debt. These countries include mostly Latin American states, experiencing debt crises and hyperinflation spells during the 1980s. In the mid-2000s, the differential drops towards negative figures, but rises up again to the positive territory in the 2010s.

Figure 4: The interest-rate-growth differential (percentage points)

The grey solid in in Figure 4 is the median growth rate of real GDP (in local currency), measured by the right scale. A casual observation is that there is a negative correlation between real output growth and the interest-rate-growth differential. Our empirical work validates that a rise in the cost of external debt would lead with lags of two to three years to output growth slowdown, and these effects add up, explaining the lost growth effects of Latin America and other EMs during 1980s. A faster rise in the flow cost of serving external debt has a negative impact on output growth, and this effect is dampened if the country experiences real appreciation. Consequently, U.S. post COVID exit policies reducing the odds of rapid increase in snowball effects may reduce future volatility, stabilize and increasing the global growth rate.

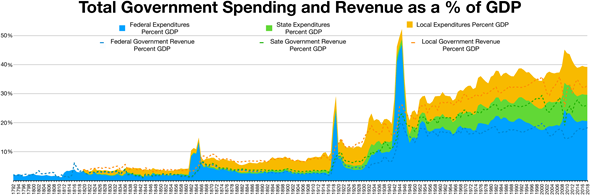

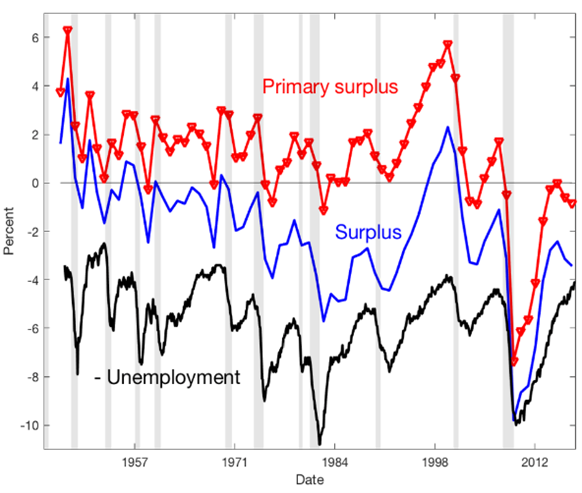

The history of the U.S. after WWII provides a vivid example of the success of a two-pronged approach in facilitating the exit from a public debt overhang, stabilizing the global economy, and solidifying the global role of the dollar. The rapid decline in public debt/GDP from 1946 to 1955, exhibited in Figures 2 and 3, was accommodated by financial repression inducing lower r, mild inflation (~ 4.2%), higher taxes and robust GDP growth [Aizenman and Marion (2011), Reinhart and Sbrancia (2015), Reinhart, Reinhart and Rogoff (2015)]. Figure 5 shows vividly the sharp drop of WWII U.S. fiscal revenue mobilization from 50% GDP points in 1944 towards 20% by 1946. Starting in 1947, this large revenue contraction was followed by an upwards trend, increasing the fiscal revenue/GDP to 35% in the 1970s. Remarkably, the US government was running mostly primary surpluses during that period (Figure 6). These policies supported a solid economic growth, reducing the public debt/GDP from 106% in 1946 to 23% in 1974.

Figure 5: Spending as a % of GDP. Source: https://www.usgovernmentrevenue.com/revenue_chart_1960_2018USp_18s1li011lcn_F1fF0sF0l ; https://www.usgovernmentrevenue.com/revenue_chart_1792_2018USp_18s1li011lcn_F1fF0sF0l ; https://en.wikipedia.org/wiki/Government_spending_in_the_United_States#/media/File:Government_Revenue_and_spending_GDP.png

Figure 6: US fiscal surpluses/GDP after WWII. Source: Cochrane (2020).

This post WWII success story illustrates the feasibility and gains from a two-pronged fiscal strategy. Looking forward, reallocation of fiscal spending from fighting COVID’s medical and economic challenges towards physical, medical and social infrastructures may provide a welcome burst to future growth. With a lag, following the resumption of robust growth, increasing taxes and reaching primary surplus may stabilize the U.S. and the global economy. Such a trajectory may solidify the viability and credibility of the US dollar as a global anchor, stabilizing thereby Emerging Markets economies and global growth.

References:

Aizenman, J. and Marion, N., 2011. “Using inflation to erode the US public debt.” Journal of Macroeconomics, 33(4): 524-541.

Carney, M. 2019. August. “The growing challenges for monetary policy in the current international monetary and financial system.” In Remarks at the Jackson Hole Symposium (Vol. 23).

Cochrane J. 2020. The Grumpy Economist Perpetuities, debt crises, and inflation.

Eichengreen, B., 2011. Exorbitant Privilege: The rise and fall of the Dollar and the Future of the International Monetary System. Oxford University Press.

Gourinchas, P. O., Rey, H., & Govillot, N. (2010). Exorbitant privilege and exorbitant duty (No. 10-E-20). Tokyo: Institute for Monetary and Economic Studies, Bank of Japan.

Reinhart, C.M., Reinhart, V. and Rogoff, K., 2015. Dealing with debt. Journal of International Economics, 96, pp.S43-S55.

Reinhart, C.M. and Sbrancia, M.B., 2015. The liquidation of government debt. Economic Policy, 30(82), pp.291-333.

Wyplosz, C. 2019. “Olivier in Wonderland,” VOX CEPR’s Policy Portal (June 17, 2019).

This post written by Joshua Aizenman and Hiro Ito.

two divergent U.S. post COVID economic strategies. The first is just ‘kick the can down the road.’

Voters and politicians are myopic. Guess which strategy they will take?

Alternatively, the administration could adopt a two-pronged policy, reallocating the fiscal efforts first, while aiming at reaching a primary surplus overtime. Specifically, it could retrench from expenditures oriented towards COVID-related challenges, and move towards expenses with a high social payoff (e.g., upgrading K-12 education, investing in medical infrastructures, etc.)

And I’ll add some version of a Green New Deal-ish kind of program. Of course, that means stranding capital investment in dirty industries. So does it make sense to bail out the airlines during the pandemic only to strand airline capital investment after a vaccine comes along?

the restructured fiscal policy together with a rise in tax collection

Voters are stupid, so we’ll probably need to rely on less efficient hidden taxes with greater deadweight loss. Sad.

reduce primary budget deficits, aiming to reach surpluses.

Do the markets need to see actual surpluses or just credible movement towards primary surpluses?

Some dirty industries, like airlines and aerospace, won’t be stranded by a Green New Deal for a long time. Technology and investment may shift. New forms of transportation and infrastructure will arise with ot without a Green New Deal. But people will still do the same things for a long time. Draft horses didn’t disappear until sometime in the 1930s or 1940s. Maybe later in some places.

Looking at FRED series: NETEXP from 1947Q1 to 1970Q, the US seemed to enjoy a net surplus for most of the period. It does not seem like we will enjoy this benefit to help us out of the debt situation this time.

https://fred.stlouisfed.org/series/NETEXP

I notice that real imports FRED series, IMPGSC1 seem to exceed real exports FRED series EXPGSC1 from about 1950Q3 to the present( most of the time), but were much closer together in the early periods starting in 1947, compared to the present.

https://fred.stlouisfed.org/series/IMPGSC1

https://fred.stlouisfed.org/series/EXPGSC1

If we were in 1995, this would be an excellent analysis.

http://www.prienga.com/blog/2017/7/20/japans-lost-century

@ “Princeton”Kopits

Your comments on geopolitics are nearly always laughable. Which is fine, provides an extra source of humor on this blog. For example your prediction of the crumbling of the Chinese Communist Party~~~which in the near eternity of time you gave yourself to be wrong (most likely because you are similar to Barkley Junior, so starved for attention you’re willing to knowingly state falsehoods just to cause a commotion) I hope if Menzie is still writing this blog “in 2025” he holds your feet to the fire on this asinine comment:

https://econbrowser.com/archives/2018/03/wisconsin-manufacturing-employment-boom-revised-away#comment-206452

Not only did this buffoon Kopits predict a revolt against Xi Jinping by the proletariat, the moron predicts a Chinese Communist Party split, and even manages to hint at an “oil shock” instigating the whole thing. If “Princeton”Kopits was any dumber, we’d have to assume he went to “Bruce Hall’s Inclusive Vo-Tech School for Mentally Impaired Geopoliticians”.

MOses,

Wow, you really are a piece of justr worthless garbage. I have never “knowlingly stated falsehoods” here, or anywhere ese. This is just a sleazy lie, you disgusting scumbag. I have certainly made mistakes. I mean heck, you caught me misspelling Ronald McKinnon’s name, and I have made others, although a bunch of things you have claimed I was wrong about I was right about. But all of my mistakes have been real mistakes, where either I was careless or just misinformed. You have now accused me of lying several times.

Go to hell, scumbag. I think you should be banned from this blog.

https://youtu.be/8CvfeUbpoFg?t=3

Life is so satisfying sometimes.

Is the market punishing the US government for borrowing vast sums of money? No. Will it in the future? No (until it won’t). So what is the incentive to stop running up the credit card balance given the realities of democratic politics? Not much.

How does this end? Either with an Argentine-style fiscal collapse or the end of democracy as we know it, or both. But not for a long while, barring a war with China.

As for K-12 and healthcare spending:

I think we are getting a pretty poor return on monies spent on education. The key is greater efficiency — more output for given inputs — rather than simply putting more inputs — money — to work.

Second, increased healthcare spending does not increase welfare. It prevents welfare from falling. Completely different thing, and it’s high time we started to differentiative nets from grosses.

…differentiate…

Well, now we know why “Princeton”Kopits writes and communicates like a peabrain:

“I think we are getting a pretty poor return on monies spent on education.” <<—–The perpetual mating call of all American white trash.

Kopits should become an honorary member of the trump family on that sentence alone.

https://www.alec.org/article/increasing-education-spending-equal-higher-test-scores/

https://www.americanexperiment.org/2017/06/link-school-spending-student-achievement/

Baltimore City public schools spent $16,150 per student in 2019 (or perhaps it was 2018). The tuition at the elementary school of the Cathedral of Mary our Queen — also in Baltimore City — is $12,065 for the 2020/2021 school year for non-parishioners. For the record, I think the vast majority of teachers there are lay, not clergy. Baltimore City public schools don’t have heat, if one believes the press. I attended the Cathedral School, and we had books and were never cold. The building was and remains well maintained.

https://www.bizjournals.com/baltimore/news/2019/05/21/baltimore-city-third-in-u-s-for-per-pupil-spending.html

https://www.schoolofthecathedral.org/admissions/tuition

Trump put his 60 Minutes interview up on the FB. Follow this and enjoy all the lies:

https://talkingpointsmemo.com/news/you-know-thats-not-true-60-minutes-reporter-calls-out-trump

I hope Team Biden is watching this as preparation for the debate as Trump is just another baffoon here.

CoRev has been silent of late (thankfully). Did he head down to Florida for a little voter intimidation?

https://www.wfla.com/news/pinellas-county/armed-guards-at-st-pete-early-voting-site-told-deputies-they-were-hired-by-trump-campaign-election-officials-say/

PINELLAS COUNTY, Fla. (WFLA) – A spokesperson for President Donald Trump’s campaign says two people who were dressed as armed security guards outside a Pinellas County early voting location on Wednesday were not hired by the campaign. Pinellas County Supervisor of Elections Julie Marcus told 8 On Your Side Wednesday night the two people set up a tent outside an early voting site in downtown St. Petersburg and claimed to be with the Trump campaign. “Sheriff [Bob Gualtieri] told me the persons that were dressed in these security uniforms had indicated to sheriff’s deputies that they belonged to a licensed security company and they indicated – and this has not been confirmed yet – that they were hired by the Trump campaign,” Marcus said in a video interview with 8 On Your Side’s Chip Osowski Wednesday night.

Somebody is lying here. An investigation as to whether Team Trump paid these clowns or not should be done ASAP.

CoRev has been silent of late (thankfully).

He went to his attic looking for his old Tea Party hat and the poor guy got lost. Probably sitting there in the attic drooling all over his bathrobe and slippers.

Not to mention his varying number of fake awards for his work on the US space program.