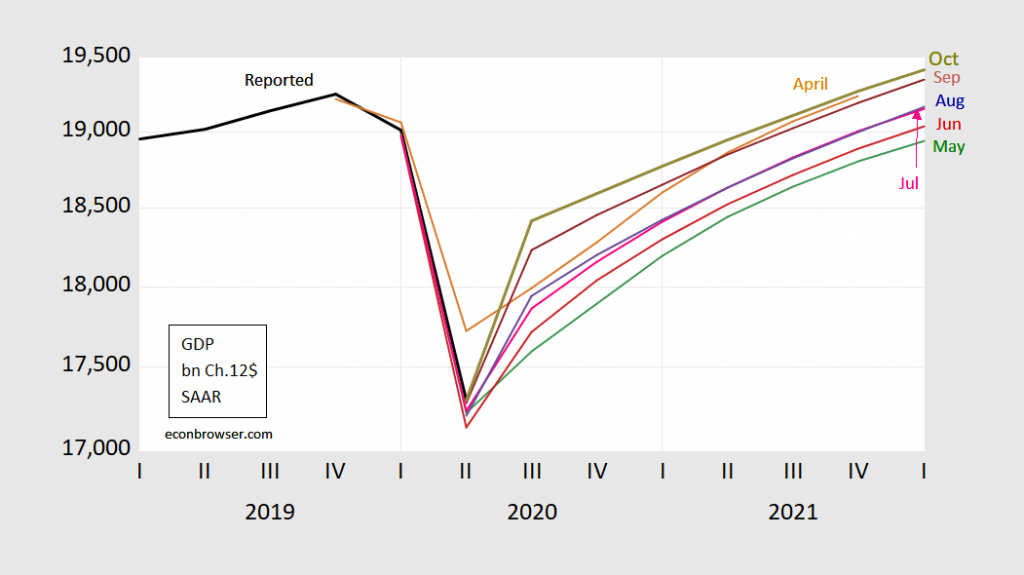

In levels (incorporating revisions to actual GDP):

Figure 1: GDP as reported in 2020Q2 3rd release (black), WSJ April survey (tan), May survey (green), June survey (red), July survey (pink), August survey (blue), September (brown), and October (chartreuse), all in billions Ch.2012$, SAAR, all on log scale. Source: BEA, various vintages, WSJ survey, various vintages, author’s calculations.

The three most recent forecasts are for rising levels of Q4 GDP — arising partly from higher reported Q2 GDP at each revision, and mostly from upwardly revised estimates of Q3 growth (even as Q4 is revised downward). GDP does not exceed previous peak level until 2021Q4, according to the mean survey response.

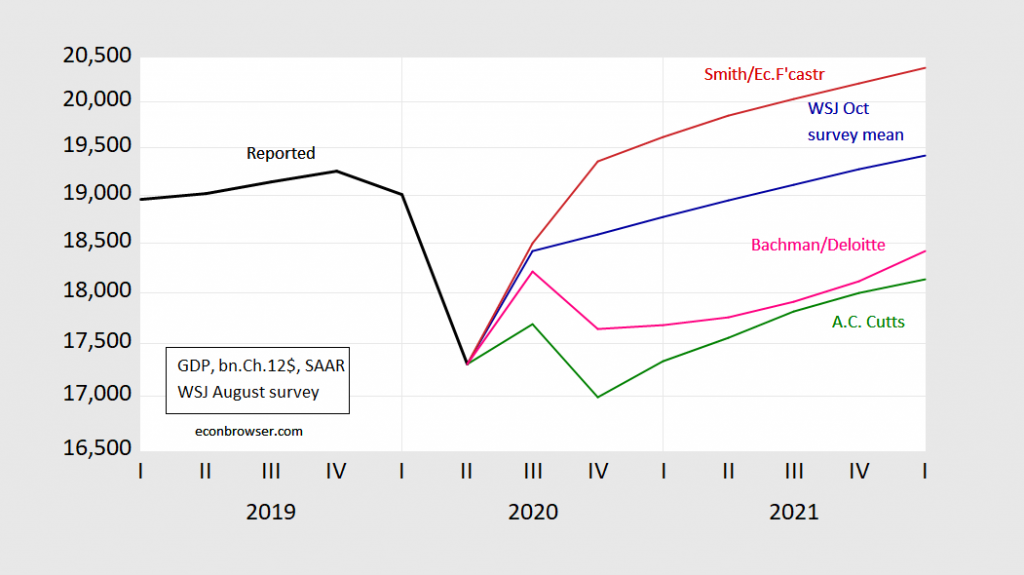

The most optimistic forecaster (for the remainder of 2020) remains the ever consistently optimistic James Smith of EconForecaster. The most pessimistic is A.C. Cutts.

Figure 2: GDP as reported in 2020Q2 3rd release (black), James Smith/Economic Forecaster LLC (red), Amy Crew Cutts/A.C. Cutts & assoc. (green), Daniel Bachman/Deloitte (pink), all in billions Ch.2012$, SAAR, on log scale. Source: BEA, 2020Q2 3rd release, October WSJ survey, and author’s calculations.

Daniel Bachman of Deloitte had the most “W”-ish recovery forecast — although the last stroke of the W is a bit limp.

The survey was taken between October 2-6. This period largely predates Mr. Trump’s announcement of the end of negotiations on the Phase 4 recovery package. It’s hard to know how to incorporate this annoucement, given the lack of credibility on the part of the administration. I compare the forecasts from Goldman Sachs research from early September and late “no deal” in this post.

Based on your second chart, I’ve decided to return to this: https://organizationalphysics.com/wp-content/uploads/2013/02/tealeafreading1.jpg

Due to the massive transfers from Cares, it looks like real personal income won’t contract this cycle. Instead, revert to mean. Even with fixed non residential components contracting as corporate debt deleverages. Slow growth until q3 2021 then upward explosion.

Although it’s not a national type story, I thought Menzie might be interested in this.

https://stateimpact.npr.org/oklahoma/2020/09/03/tempers-flare-after-oklahoma-county-sends-cares-money-to-jail/

I think Menzie touched lightly on how the PPE (if I got the acronym right) and stimulus money was spent in his very articulate and knowledge dropping interview on Wisconsin Public radio. Menzie saying “aside from”~~ knowing it would be endless and boring to listeners “going into the weeds” on that (a wise decision by Menzie not to, unless asked to detail it, when on “MSM”). But I thought this is a prime example (in a Republican state run by a Republican Governor) of how CARES act money and stimulus money is often misspent. I think, the federal government will sue the Oklahoma government on this misallocation of the CARES money and/or withdraw future federal funds, because this is actually ILLEGAL. And if the federal government doesn’t sue and/or withdraw money, why would states follow any of the federal funds allocation laws?? There’s no reason for states to follow the rules if the federal courts/law don’t enforce it.

Disagreements between the various factions in the Republican Party increase uncertainty, which has a deleterious effect on economic activity, as you’ve illustrated numerous times in the past.

It doesn’t matter whether Trump’s first tweet (ending negotiations) or his following tweets (indicating that he wants a deal) reflect Trump’s “reality. Tweet 1 alone reduces uncertainty at the expense of baking in lower growth. Tweets 2+ do nothing to unite the conservatives. All the tweets together add to the uncertainty.

Prospects are not good for the short term, and that in turn constrains prospects for the medium term. For the long term, I’ll consult J. M. Keynes

i have no idea how anyone can forecast anything right now; we don’t even know who will be president next year…and as Bill McBride is fond of pointing out, the trajectory of the recovery will be determined by the virus, and we don’t know how that will play out either…new cases appear to be rising again, both in the US and globally, so it doesn’t appear the virus is done with us yet…

What we have learned in 2020 is what J.M. Keynes taught us in 1936: deficit spending causes GDP growth. With the FY2020 deficit exceeding $3 trillion at over 15% of GDP, even the most pessimistic prognosticators predict steady growth from 4Q2020 for another year. Of course this assumes that Pres. Biden does not undertake a 75% reduction of the deficit as Pres. Obama did and that Speaker Pelosi forgets about the PayGo rules that Dems enacted in 2010. Perhaps the Dems will also forget the “glory years” of the Clinton administration when there were budget surpluses that ended in a recession. If we are really lucky, we might even get some additional infrastructure spending by “recklessly spending money we don’t have.”

Meh, you could cut the deficit and still grow. I reject your point.

Rage,

The way that can happen is if it is accompanied by a substantial loosening of a previously tight monetary policy. So in 1993-94 President Clinton raised taxes and cut spending, without a singe Republican in Congress voting for his fiscal policy, and many, led by Newt Gingrich making multiple oud public statements about how this would inevitably lead to a recession, and they rode this to a victory with GOP taking control of Congress.

But, funny thing, monetary policy had been tight for a long time due to the massive deficits Reagan and Bush Senior were running, so with the tightened Clinton fiscal policy, Alan Greenspan and the Fed substantially loosened monetary p0olicy, dropping interest rates enough to more than offset the contractionary fiscal policty, with the late 90s being one of the top boom periods the US economy has seen.

Needless to say, Trump has bludgeioned the Fed into lowering interest rate and reversing the tightening they were doing, all with aneye to his reelection, although once the pandemic hit the Fed moved to substantial loosening on its own. But the bottom line is that US monetary policy is about as expansionary as it can get, so indeed a fiscal tightening might lead to a GDP slowdown, given thate is no longer any room for further monetayr expansion. Trump has shot the wad on both fiscal and monetary policy.

Monetary loosening was irrelevant. It was Y2k plus peak boomer spending. Monetary loosening creates bubbles.

Dead wrong, Rage, although everybody here well knows that you are one of the most incompetent commenters on economic matters regularly showing up on this blog, well below several of the full-on Trumpist commenters here, although I am not going to get into which seem to know more than you do and which do not.

As it is, this is the first time I have heard from anybody this completely idiotic theory you have put forward here. Nobody agrees with you. It was the Fed, not the baby boomers. When it has the capacity to do so, the Fed can overwhelm a fiscal policy, but only when it has the room to move. We have seen this on several occasions.

Some other examples include the back and forths in Reagan’s first term. Fed Chair Volcker helped tank Carter by his tight monetary policy, and then when Reagan came in he tried to reverse the poor economy with his tax cuts, but Volcker was not having it and held his hard monetarist line to kill the 1970s inflation. Volcker beat Reagan, and in 1982 the economy plunged into a deep, if short, recession, with the unemployment rate topping 10% before it ended.

Then we had August, 1982, when the Dow was around 700, its lowest in a long time, and the incoming Mexican fin min, Jose Silva de Herzog (distant fake relative or our “Moses”?), showed up in New York to tell the bankers there that if interest rates did not come down, and fast, Mexico would default on its debts to NY banks, which were large in those days numbers. Then he went to Washington with banker phone calls accompanying him. This led to a deal: Reagan agreed to cancel a final round of tax cuts and Volcker agreed to end his “monetarist experiment” and cut interest rates.

So, Rage, this was a minor tightening of fiscal policy that coincided with a major loosening of monetary policy. It led to a larger single increase in GDP in 1983 than we have seen since, which gave Ragan his “Morning in America.”

Sorry, Rage, you have no idea what you are talking about. I do not think you are a Russian bot like some here think. I think you are just very stupid.

Your not right. Never will be. The 90’s was the last capital spending rush. The last time auto sales really grew. Had higher growth to credit than the 80’s, which led to a boom in tax revenue. You need to take head out of Fed backside.