I talked through some issues regarding the competing recovery plans in this Wisconsin Public Radio interview. Here are some graphs to buttress my point that the Senate Republican plan is underpowered.

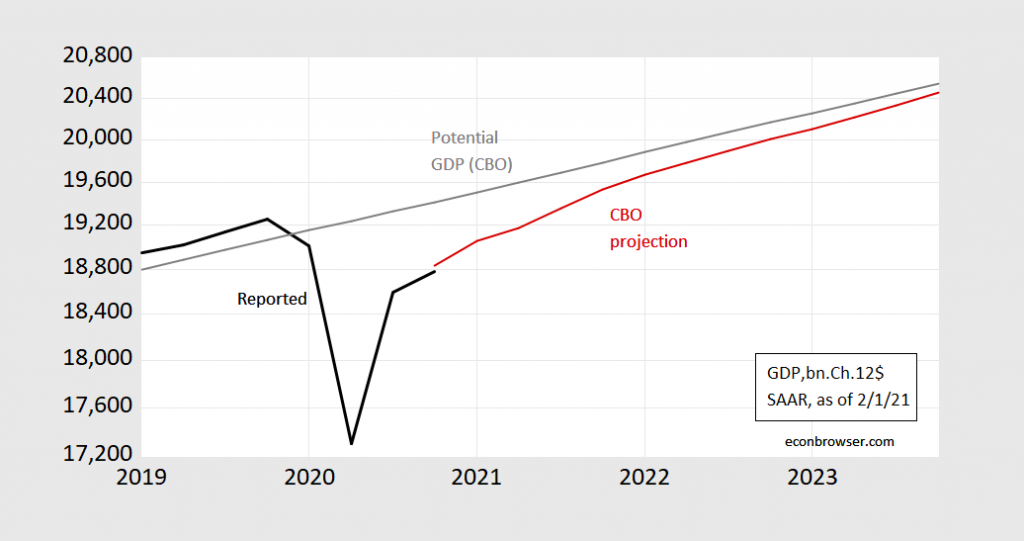

First, where is the economy? Facing a big output gap, even after all that previous fiscal stimulus.

Figure 1: GDP (black), CBO projection (red), and CBO estimate of potential GDP (gray), all in billions of Chained 2012$, SAAR. Source: BEA 2020Q4 advance, CBO, An overview of the Economic Outlook (Feb 1, 2021).

Discussion of size of plans is here, in the context of the output gap. CRFB argues that $1.9 trillion is too large. Using CBO’s pandemic/social distancing estimates with economic slack, it’s not clear to me that it’s too large. See Edelberg/Sheiner at Brookings for a contrasting view of the advisability of pursuing the Biden plan.

In any case, filling the aggregate demand hole is not quite the full story; we need to prevent firm bankruptcies, labor force erosion, extreme suffering, and the package is meant to accomplish that aim. In order to maintain the productive capacity of the economy, some spending is going to be needed.

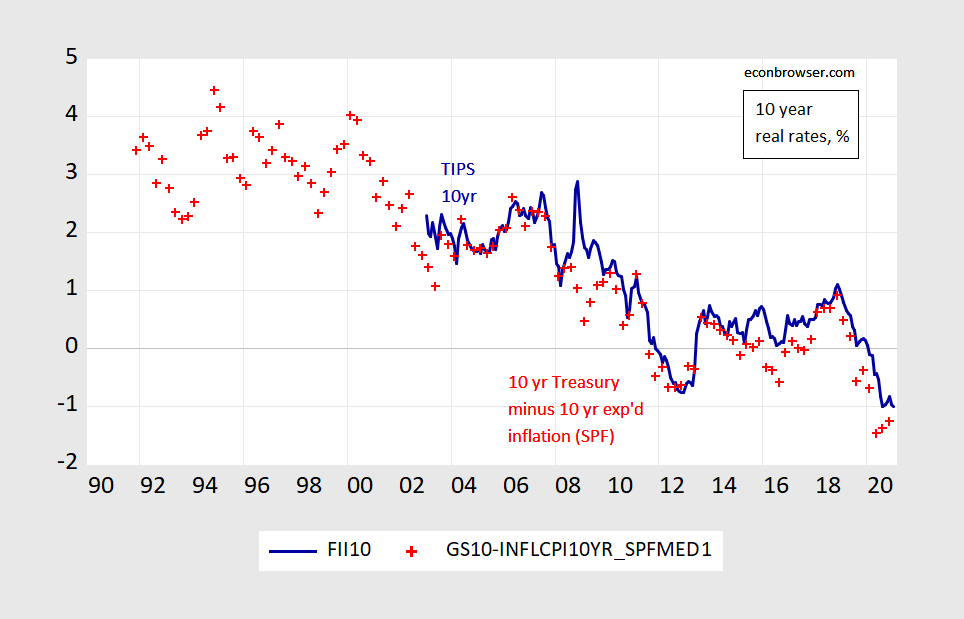

Second, does more stimulus make sense? What about all the accumulating debt? Consider the government’s borrowing cost:

Figure 2: TIPS 10 year interest rate, % (blue), and 10 year Treasury yield minus 10 year expected inflation from Survey of Professional Forecasters, % (red +). Source: Federal Reserve, Philadelphia Fed, author’s calculations.

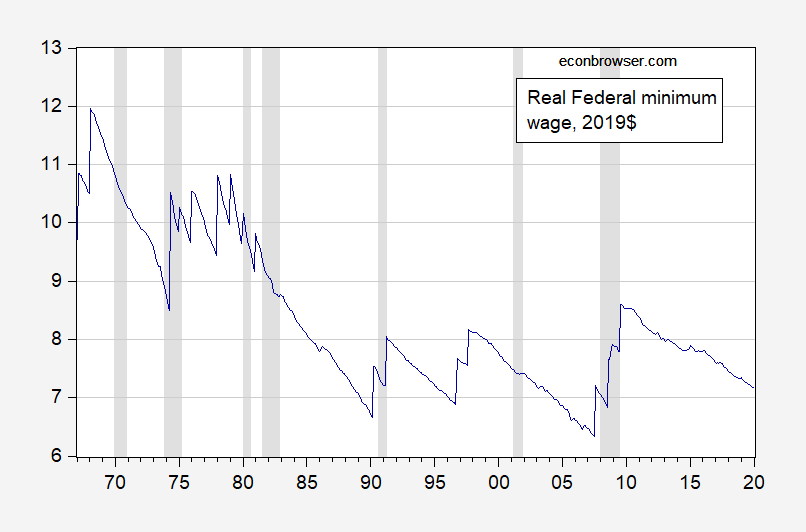

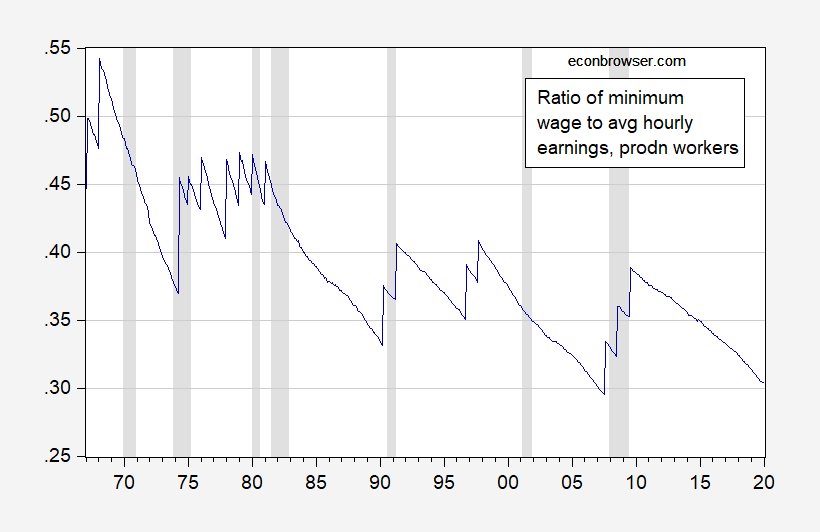

Third, what about the proposal to raise the the minimum wage? The real minimum wage has eroded over time, and is fairly low relative average hourly wages.

Figure 3: Federal minimum wage divided by CPI-all, in 2019$ (blue). NBER defined recession dates shaded gray. Source: BLS via FRED, NBER, and author’s calculations.

Figure 4: Federal minimum wage divided by average hourly earnings for private sector production and non-supervisory workers (blue). NBER defined recession dates shaded gray. Source: BLS via FRED, NBER, and author’s calculations.

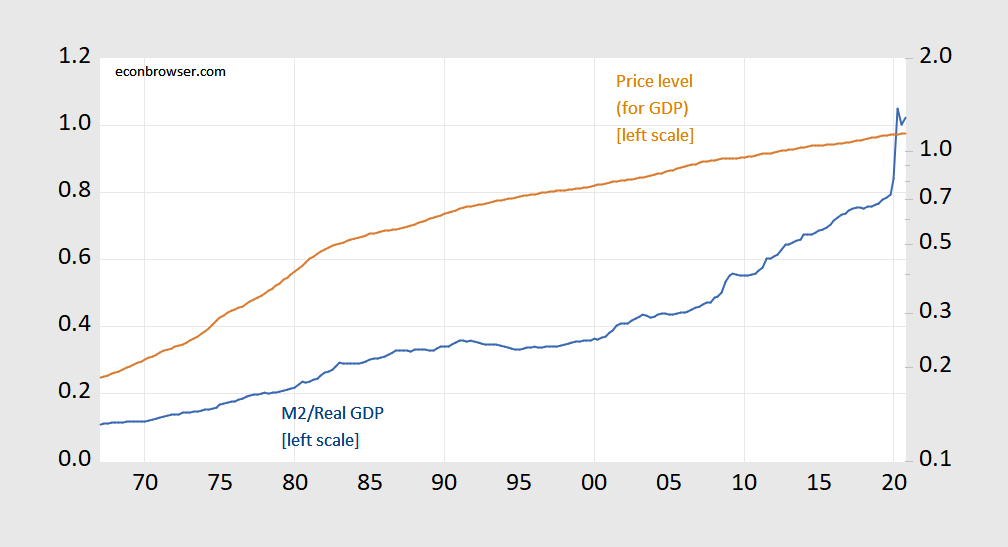

Fourth, what about the increase M2? What about inflation?

Figure 5: End of period M2 divided by real GDP (blue, left scale), and GDP deflator (2012=1), (brown, right log scale). Source: BEA, 2020Q4 advance, Federal Reserve, and author’s calculations.

The linkage between M2 and the price level is hardly tight. The increase in M2 might be sufficiently large — if maintained — to induce accelerated inflation. Whether that would be a big acceleration remains open (some acceleration would be welcome).

Addendum, 2/3/2021:

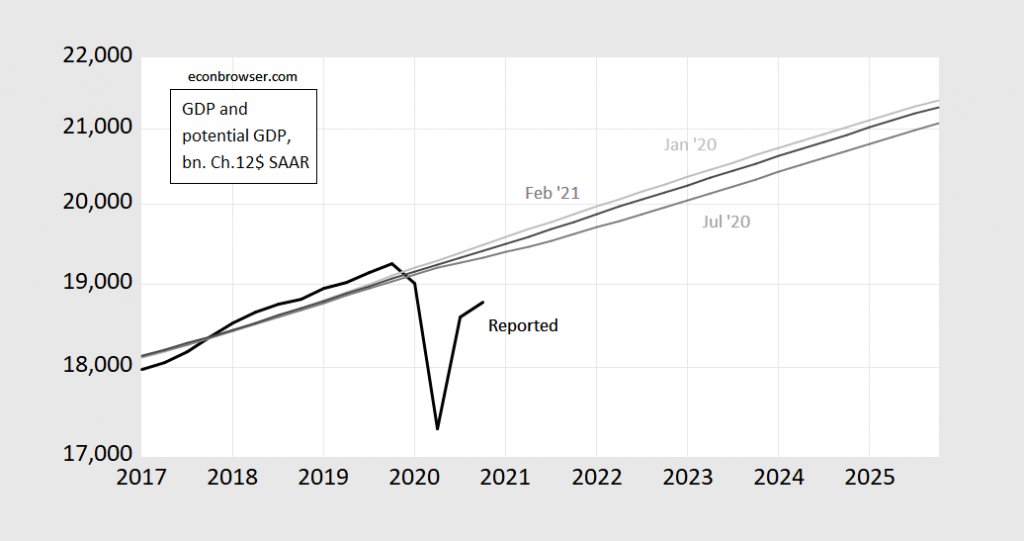

CBO has revised its estimates of potential. The latest estimate is above the July 2020 estimate, but still below the pre-pandemic estimate (January 2020).

Figure 6: GDP (black), January 2020 estimate of potential GDP (light gray), July 2020 (gray), and February 2021 (dark gray), billions of Chained 2012$, SAAR. Source: BEA, 2020Q4 advance release, CBO, various.

I’m not sure I entirely buy the CBO’s estimate of potential GDP. It looks like they are estimating potential GDP assuming the pandemic never happened. The CBO spreadsheet shows 2020 potential GDP as being higher than 2019 potential GDP. I find that a little hard to swallow because so many people have exited the workforce.

They are not just unemployed, but they exited the workforce. Those are not potential workers as long as the pandemic remains a threat, and if they’re not potential workers then they are not part of potential GDP. This isn’t just a case of there not being enough aggregate demand to employ those unemployed folks. In my view the American Rescue Plan should be more about trying to get potential GDP back on track and less about trying to close the gap between potential GDP and actual GDP. As a practical matter that means throwing everything but the kitchen sink into getting people vaccinated while keeping service sector workers afloat. It also means actively discouraging people from returning to work in service sectors that are likely to contribute to COVID spread; e.g., bars & restaurants, salons, entertainment, etc.

They may have exited the workforce but during a recovery they might just reenter. This was not a permanent reduction in the labor force participation rate. Of course the suggestion ala Princeton Steve that they could go back to work tomorrow is silly.

Some of us have suggested for a while that CBO is being conservative in their estimates of potential output.

My point is that they might not be able to reenter the workforce even if a job is available. For example, childcare is a binding constraint for many people. That effectively takes them out of the potential workforce so long as the pandemic is in control. That’s not a problem that you can fix by stimulating aggregate demand. Another factor is the reduced productivity of future workers due to the lasting health effects of the pandemic. There are a lot of long haulers out there who may never fully recover to their former productivity. That’s not an aggregate demand problem, that’s a potential GDP problem. And then there’s lost productivity due to “Zoom” meetings rather than face-to-face brainstorming. That “Zoom” problem will likely be a transient problem that will go away as the pandemic recedes, but it still represents a drop in problem solving and technical innovation, and that translates into a dip in potential GDP. And let’s not forget the adverse effects on today’s college and school aged kids. I don’t think there’s any serious question that the prevalence of online education will hurt the future productivity of workers. I could add to the list, but the point is that it’s hard for me to believe that the growth rate of potential GDP will be unaffected by the pandemic. I think that a more plausible path for potential GDP would have been a structural break after 2019.

I get your point now. You may want to explain this to Princeton Steve as he seems to think workers can simply go back to their old jobs the day after they got the vaccine.

Okay. And just to be clear, I’m certainly not arguing against a larger recovery package. If anything I suspect that $1.9T is too small. I just think the focus should be less on maximizing current period output and more about salvaging potential growth in the future. For example, that means we’ll likely have to spend a lot more on education and training to reverse the effects of the pandemic on future skills. It might mean an extra year of schooling, or free community college. Another example would be future healthcare costs.

2slugs, I think you are trying to redefine “Potential” to Actual” or near actual.

He is sounding a lot like people who criticized Bernie Sanders back in 2016. Gee CoRev – I never knew you were a Bernie Bro!

CoRev No, I’m talking about potential GDP. For various reasons the pandemic has reduced the number of people who are potentially available for work even if there is demand for their services. The pandemic has also affected what BLS calls “labor composition”, which basically captures intangible skills.

Hysteresis was a hot term during the 2016 debate over what potential GDP was. You are basically making this sort of argument. I recall the progressive supporters that CBO was grossly underestimating the growth in potential starting here and then noting running an economy hot would help eliminate the negative impacts from the weak economy during the Great Recession. Ending the virus soon and running the economy hot in 2021 might just alleviate the problems you are rightfully noting.

2slugbaits: I’ve added Figure 6 to the post; the February 2021 estimate is above the July 2020, but still below the January 2020 estimate.

Menzie Yes, I noticed that when comparing the Excel spreadsheets across the different vintages. But with each vintage the growth rate is still treated as more or less constant for each year as are the underlying labor force data and capital intensity factors. Intuitively I would expect potential GDP to follow a nonlinear path; viz., a dip in potential output thru 2021 and then a gradual recover that asymptotically approaches something like their Feb 2021 forecast. In other words, my problem isn’t with their estimate of potential GDP in 2023 and beyond, it’s with their estimate of potential GDP for 2021 and 2022.

February 3, 2021

Coronavirus

US

Cases ( 27,150,457)

Deaths ( 461,930)

India

Cases ( 10,791,123)

Deaths ( 154,742)

UK

Cases ( 3,871,825)

Deaths ( 109,335)

France

Cases ( 3,251,160)

Deaths ( 77,595)

Germany

Cases ( 2,252,489)

Deaths ( 60,212)

Mexico

Cases ( 1,874,092)

Deaths ( 159,533)

Canada

Cases ( 789,651)

Deaths ( 20,355)

China

Cases ( 89,619)

Deaths ( 4,636)

February 3, 2021

Coronavirus (Deaths per million)

UK ( 1,586)

US ( 1,391)

Mexico ( 1,230)

France ( 1,187)

Germany ( 717)

Canada ( 537)

India ( 111)

China ( 3)

Notice the ratios of deaths to coronavirus cases are 8.5%, 2.8% and 2.4% for Mexico, the United Kingdom and France respectively.

https://news.cgtn.com/news/2021-02-04/Chinese-mainland-reports-30-new-COVID-19-cases-XBe9J6jKRa/index.html

February 4, 2021

Chinese mainland reports 30 new COVID-19 cases

The Chinese mainland recorded 30 new COVID-19 cases on Wednesday – 17 local transmissions and 13 from overseas, the National Health Commission said on Thursday.

Of the locally transmitted cases, 8 were reported in Jilin Province, 4 in Heilongjiang Province, 3 in Shanghai and 2 in Hebei Province, the commission said.

No new deaths related to COVID-19 were registered on Wednesday, and 135 patients were discharged from hospitals.

A total of 12 new asymptomatic cases were recorded, while 788 asymptomatic patients remain under medical observation.

The total number of confirmed COVID-19 cases on the Chinese mainland has reached 89,649, and the death toll stands at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-02-04/Chinese-mainland-reports-30-new-COVID-19-cases-XBe9J6jKRa/img/62883f1c64574d9f88b1e978a913a30c/62883f1c64574d9f88b1e978a913a30c.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-02-04/Chinese-mainland-reports-30-new-COVID-19-cases-XBe9J6jKRa/img/7e930a6cab23422fbe0413f3cc3a44a4/7e930a6cab23422fbe0413f3cc3a44a4.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-02-04/Chinese-mainland-reports-30-new-COVID-19-cases-XBe9J6jKRa/img/ed2b09f40dec4c1986e9df8dfe5c9dc0/ed2b09f40dec4c1986e9df8dfe5c9dc0.jpeg

Well, typical Menzie fashion. Government is the Alpha and Omega of prosperity.

No talk of the private sector, no talk of opening the economy, no talk of the supply side – a supply side that has been constrained by government fiat and diktat for many months.

There is an alternative view: the best “federal support” is for the federal and state governments to open the economy and let the private sector do its thing.

“Its thing” means – to invest, to hire, to plan, to produce, to purchase capital.

I know this is anathema in some circles, almost close to sedition in the current environment.

For example, here is one dissenting opinion, for those who are fair minded:

https://www.nationalreview.com/corner/stimulus-overkill/

There is also Phil Gramm’s article in the WSJ yesterday (can I mention this article without being called “enemy within”?).

As for the minimum wage, well, in usual Menzie fashion, he brushes aside criticism.

There is a big literature, though, unbelievable it may sound to a tenured professor in a school of public policy.

For example, try this NBER working paper: (Menzie, is an NBER WP good enough to mention as evidence?)

https://www.nber.org/papers/w28388

The title is: Myth or Measurement: What Does the New Minimum Wage Research Say about Minimum Wages and Job Loss in the United States?

But all this is for the fair minded, not for Berkeley PhDs blinded by the Progressive Ideological Narrative, who believe the government is the Beginning and the End of our prosperity.

Manfred: On the minimum wage, see this post.

You know there are quite a few posts on the minimum wage on Econbrowser; I do link to various studies, and have cited a meta-analysis as well. If only you read a bit before shooting from the hip, you might have realized that.

In addition, I have never used the term “Enemy within” on this blog. I think you have me confused with someone else (or just in a delirium of grievances).

It is pretty funny that Manfred’s “case” that you ignore the minimum wage literature includes a link to a paper you posted here. BTW – it is a very interesting paper, which I doubt Manfred even remotely understands.

He did link to something Veronique de Rugy about how the stimulus is too big even as she goes out of her way to suggest the multiplier is small. Bordo’s latest exhibits the same confusion. But again – I doubt Manfred understands the irony.

This is just a guess on my part but Manfred’s “enemy within” reference is probably he’s feeling hypersensitive because they were referring to the terrorists who violently stormed the American Capitol or those discussing the QAnon paranoid schizo from Georgia’s 14th Congressional district.

Now now now, Menzie. It is only lizard people drinking children’s blood in nonexistent pizza parlor basements in Washington who cannot see that indeed you did call the seriously victimized Manfred an “enemy within.” Only those not worshipping Satan can see the truth here of you profoundly victimizing poor Manfred.. So, ‘fess up!

Gee Manfred – I read this paper yesterday. When did you read it? BTW – I read it because Menzie featured it and you accused him of not being aware of the literature? DUH! Now if you get over your daily temper tantrums, you might notice my comment under Menzie’s post.

Now you did endorse Federal revenue sharing. I agree with that as does the Democrats. Could you do us a wee favor – get your Republican buddies to sign on!

Phil Gramm and Wendy Lee Gramm, the couple that defunded and might as well have dismantled both the SEC and CFTC. No doubt up for sainthood in TBTF banker circles. Deserving of at least 25% of the credit for the 2007–2009 financial crisis. Probably get free lunch and alcohol at any bank employee lunch cantina.

Correct me if I am wrong but didn’t Gramm have a degree in economics? I know St. Reagan had a BA in economics. Yes – a lot of nutcases have degrees in economics. Manfred I guess is working on having that status.

pgl,

Yes, even a PhD in econ from U. of Georgia and was a tenured prof at Texas A&M until he ran for Congress in 1978, eventually moving to the Senate and serving as Chair of the Finance Committee.

When the Southern Economic Association would have its conferences in Washington, which they used to do on a regular basis, Phil would show up at receptions to schmooze regularly, being still a member of the association. I had several conversations with him over bourbon and branch water, as they used to say. He could play the game pretty well, although I always found it pretty creepy talking with him.

Wait, wait – you are citing Neumark and Shirley not that excellent paper by Manning. From the NBER paper from two economists who are known to argue against higher minimum wages:

“There’s just no evidence that raising the minimum wage costs jobs, at least when the

starting point is as low as it is in modern America.” – Krugman (2015)

“[T]he literature after Myth and Measurement was about equally likely to find positive as

negative employment effects of the minimum wage, with the typical estimate very close to

zero.” – Card and Krueger (2015, p. xvi)

“There is considerable support for the competitive market hypothesis that an effective

minimum wage would result in lower employment… However, a few studies report zero or

even positive employment responses to higher minimum wages.” – Liu et al. (2016, p. 19)

Neumark leans heavily to the Liu view of the world aka labor markets are competitive. Try reading Manning carefully as that is not the only potential model for explaining what we see in the actual evidence. Meanwhile, I read this NBER paper to see how it stacks up to Manning’s which the NBER paper failed to cite for some reason.

This conclusion is a fair summary of what they did:

We set out to take stock of the U.S. minimum wage literature on employment effects beginning

with the New Minimum Wage Research in 1992, which moved towards more rigorous identification of minimum wage effects than the earlier, predominantly time-series data. We were motivated not by the conflicting studies in this literature – and indeed in this paper we do not focus on adjudicating between these conflicting studies. Rather, we were motivated by the sharply different summaries of what this literature says, because, surprisingly, economists seem to not even agree on which way the entire set of studies points

Oh wow! No independent analysis. Just a counting of what the conclusions of what each paper reached. Seriously Manfred – this is not even close to the level of thought in that Manning paper Menzie provided us to read. Now run along little boy and actually read some real analysis of the literature.

manfred, to be clear. you are advocating for opening up the economy in the middle of a pandemic. silly boy. look at how that turned out in sweden lately. they came to the conclusion, opening up their economy during the pandemic resulted in more deaths and still no help for the economy. you may live in a fantasy world, but most people will stay home during a pandemic, mandate or not. fully opening the economy is not the answer to the current problem. just ask the nurses and doctors in florida.

baffling: What’s a few dead workers, as long as corporate profits remain high?

Most corporations were willing participants in the shutdown. The sad reality was the push to reopen was more about ideology and culture wars than any valid economic argument. Businesses continued to operate remotely even in areas where shutdowns were eliminated.

https://www.nytimes.com/2021/02/03/us/astrazeneca-coronavirus-vaccine.html

February 3, 2021

The AstraZeneca vaccine is shown to drastically cut transmission of the virus.

By Marc Santora and Rebecca Robbins

The vaccine developed by the University of Oxford and AstraZeneca not only protects people from serious illness and death but also substantially slows the transmission of the virus, according to a new study — a finding that underscores the importance of mass vaccination as a path out of the pandemic….

https://www.nytimes.com/interactive/2021/02/04/world/europe/covid-vaccine-uk-rate.html

February 4, 2021

Vaccines Could Blunt U.K. Epidemic in Weeks

Britain is on track to deliver a first dose to everyone by the end of June. But vulnerable groups accounting for the vast majority of deaths could be vaccinated much sooner.

By Allison McCann

LONDON — Britain is on a pace to give the first shot of a two-dose coronavirus vaccine to its entire population by the end of June, if it can avoid supply and logistical issues that threaten to slow one of the world’s fastest rollouts.

The most vulnerable will get their first doses much sooner — likely over the next two weeks — which could dramatically reduce deaths.

Professor Chinn,

Any thoughts on the Thursday, 2/4/2021 issue of the WSJ opinion piece, “The Short March Back to Inflation”?

Per paragraph 1, “There is a long history of high budget deficits being associated with inflation.”

Looking at annual data, 1949 to 2020 Y/Y percentage change in CPI (FRED series CPIAUCSL), I can’t see much of a relationship between CPI Y/Y inflation rate and the deficit as a % of GDP. I used the FRED series (fyfsgda188s) for deficit as % of GDP

AS: I respect Bordo’s work, but in the absence of a reference to statistical analysis, I’d be a bit dubious. That’s because we know a few supply shocks can cloud any apparent correlation, and to me it’s money creation (not just money base creation) in the context of a budget deficit that matters – and only if one’s near potential GDP. We live in an era where the real natural rate of interest is low, so I’m not sure that inflation is imminent this time around, and even if some were, whether it’d be a bad thing (I think something closer to 4% inflation is better than 2%, as I’ve noted several times on this blog).

Maybe asking Bordo to predict an exact level of inflation is expecting too much~~from anyone. But would it be a lot to ask if Bordo were to tell us what level of inflation he deems as “bad” or “too high”?? He’s the first person I remember ever reading as portraying post WW2 growth as a bad thing, with “15% inflation”, but never once says where he himself places the margins in a 2021–2024 context.

I checked what FRED said about the 10-year breakeven rate. Gee expected inflation has finally exceeded 2% – barely. I guess that means HYPERINFLATION is just around the corner. Oh my!

From the same oped by Michael Bordo and Mickey Levy:

‘Combined with the Fed’s expansive monetary policy, the government’s income supports have generated a surge in money supply and excess household savings.’

EXCESS household savings? What they are saying is that households are not consuming some of these temporary tax cuts. A lack of aggregate demand stimulus is going to created excess demand? WTF?

Yes the FED has temporarily increased the money supply. It can quickly turn that around if needed. Now Bordo should remember than in the late 1960’s, the FED knew fiscal stimulus had gotten crazy with the 1964 tax cut, the Great Society fiscal stimulus, and then the massive Vietnam War buildup. Heck the CEA was telling the President that as early as Dec. 1965. And yet the FED bent to political pressure not to raise interest rate.

This FED is different. Bordo of all people should get this.

https://www.wsj.com/articles/the-short-march-back-to-inflation-11612378471

February 3, 2021

The Short March Back to Inflation

Like today, policy makers of the 1960s had bigger worries than prices. Then a spike crushed the economy.

By Michael D. Bordo and Mickey D. Levy – Wall Street Journal

There is a long history of high budget deficits being associated with inflation, and Washington’s current profligate spending and the Federal Reserve’s expansive monetary policy may be pushing the U.S. down that path. In the U.S. and world-wide, the link between deficits and inflation has been most apparent during wartime, as the fiscal burdens of combat spur central banks into inflationary financing. But there are also peacetime instances. Now, after a decade of modest inflation that has made many expect it will always stay low, a rise in inflation may come as a surprise….

https://fred.stlouisfed.org/graph/?g=AJSz

January 30, 2018

Total Federal Debt as a share of Gross Domestic Product and Consumer Price Index, 1966-2020

(Percent and Percent change)

https://fred.stlouisfed.org/graph/?g=qSdj

January 30, 2018

Monetary Base, M2 Money Stock and Consumer Price Index, 2007-2020

(Indexed to 2007)

Can anyone explain to me why we need a stimulus package of 9% of GDP when GDP is 4% below normal and unemployment is only 6.3%? And the incoming Israeli data shows just 0.06% of Israelis fell ill — none seriously — after two vaccine doses?

https://www.jpost.com/health-science/covid-just-006-percent-israelis-sick-after-two-shots-no-one-serious-study-657871

Unemployment is only 6.3%? Lord you are one stupid fool. That statistics is so misleading for reasons noted in the BLS report if you bothered to actually read it.

And BTW – potential GDP is growing and the gap may be greater than 4%. BTW – other factors could push aggregate demand down. BTW – most estimates of the multiplier for the current situation is less than one.

But why am I talking to you as you have made clear – stupid statistics trump the lives of ordinary people in your Ivory Tower.

Steven Kopits: (1) What is the multiplier with economic slack and social distancing? (2) the output gap using CBO estimates is 3% now, but when will the output gap disappear — it’s not until early 2025 according to CBO, so you want to think about applying the total $1.9 trn to that entire period; (3) do you know the output gap *is* 3%, or could it be larger (boy, you are pretty sure you know what the output gap is, despite your inability to understand potential GDP); (4) do we want to fill and output gap or do we want to maintain capacity (by preventing firms from going out of business, by preventing people from exiting the labor force)? If it’s just to fill the output gap, we shouldn’t be doing *any* PPP. (5) what is the cost of overshooting potential (i.e., what do you think is the slope of the Phillips Curve)? (6) what is the cost in terms of financing the resulting government debt?

I think you have your answer in the responses to these 6 questions.

Under another thread, Steve is ducking all of these questions repeating his own ill informed commentary. But nice try getting him to focus.

And yet both Phil Graham and Larry Summers seem to agree with me.

https://www.wsj.com/articles/wrong-stimulus-wrong-time-11612568558?mod=hp_opin_pos_1

Steven Kopits: Who is Phil Graham?

I have the highest respect for Summers’ academic work (as illustrated by the many citations of his work on this blog), but he has made some policy errors in the past – the underpowering of the ARRA is case in point.

Wrong Graham or Gramm, sorry.

Well, Larry doubles down here.

https://www.washingtonpost.com/opinions/2021/02/07/my-column-stimulus-sparked-lot-questions-here-are-my-answers/

Steven Kopits Quit calling it a “stimulus package” and you’ll find it easier to understand. A lot of that $1.9T is going to the overall vaccination effort along with measures needed to combat the pandemic until we get the virus under control. Also, just because Congress appropriates monies in one year does not mean that the Treasury issues checks for that same amount of money in that year. For most appropriation categories the Executive departments must “obligate” the monies, not disburse the monies. In plain English that means they have to let contracts by the end of the year, and those contracts could be with the private sector or with other government entities. The actual monies may not be disbursed out of the Treasury up to another five years beyond that date. As to the stimulus component itself, the lesson learned from the 2009 Obama experience is that you can only count on one bite at the apple even though the economic recovery will likely take a few years to completely close the output gap. In an ideal world you would implement a series of smaller packages on an “as required” basis. But we don’t live in that world. We live in McConnell’s world, so you have to ensure your one bite at the apple is large enough that it gets you through the entire recovery time. Remember, Obama’s ARRA crossed three fiscal years but had run out of steam by late 2010. Obama mistakenly accepted a smaller stimulus package in the naive believe that McConnell would allow a second bite at the apple.

FWIW, I’m not a big fan of every element in the American Rescue Plan but I can live with it as is.

Two stimulus packages of 13% of GDP in six months or so. It’s a lot, Slugs.

$2,000 per student to re-open schools? That’s $40,000 to re-open Ms. Smith’s second grade homeroom class. Not the grade. Not the school. One classroom.

That’s a lot of money.

Larry Summers is being weird as this title suggests:

https://www.msn.com/en-us/money/markets/larry-summers-has-some-weird-fears-about-the-biden-relief-plan/ar-BB1dqExw?ocid=uxbndlbing

Is he saying fiscal stimulus is TOO BIG? Not really – he is saying he wants less temporary relief so we can go bigger on the long-run infrastructure projects and the New Green Deal. Now we could do both if we had the guts to raise taxes. Summers knows that so maybe it was good that Jared Bernstein brushed this scattered thinking off.

How do things like deferred mortgage and rental charges get factored into the “output gap”? How about things like increased local and state government spending that raises the possibility of the need for layoffs if relief is not granted? I have a difficult time articulating this but it just seems that these are not normal times and the typical analysis of aggregate numbers may miss key factors?