Today we are pleased to present a guest contribution written by Hongyi Chen, Senior Advisor at the Hong Kong Institute for Monetary and Financial Research, and Pierre Siklos, Professor of Economics at Wilfrid Laurier University. The views expressed here are their own and do not reflect the official opinions of Hong Kong Institute for Monetary and Financial Research or any other institutions the authors are affiliated with.

Recent history will partly be remembered as disruptive because of a series of crises, two financial in nature and one health related, occurring at a time of rapid growth in computing technology. This is exemplified by the proliferation and growing sophistication of various forms of electronic payments. Yet, monetary authorities around the world were reluctant to become directly involved until discussions turned to asking whether ‘money’ might eventually be issued digitally. From these discussions emerged increased focus on central bank digital currency (CBDC).

In our study, we are interested in a digital currency issued by the central bank that complements the traditional role of supplying notes and coins in circulation. More precisely, we are interested in the macroeconomic impact of CBDC that might be used by the general public (we do not consider the case of cryptocurrencies). A bone of contention is the impact of CBDC on the conduct of monetary policy and the monetary transmission mechanism. Some observers contend CBDC take central banks more deeply into the realm of fiscal policy and credit allocation as well as serving as a vehicle to overcome the zero lower bound (ZLB) of interest rates a few central banks have already breached.

There has been a proliferation of papers dealing with the practical, technical, and legal issues surrounding the introduction of CBDC, as well as some theoretical studies that examine the hypothetical financial and macroeconomic impact of CBDC. One section is devoted to reviewing the wide array of issues raised by the potential introduction of CBDC. Many have been covered in a rapidly growing literature which is summarized in the paper. However, we do highlight one aspect that has been greatly under-emphasized. Most studies tend to ignore or downplay the problem of data storage. Digital forms of payment require that balances in CBDC be stored somewhere. The idea of centralizing such storage raises all sorts of risks, from privacy to security, but even if storage is decentralized the sheer potential size of storage required, not to mention its durability, are details that have not been adequately addressed to date (we provide an example of where this problem has emerged in the field of physics). These considerations, combined with the form of CBDC that is eventually introduced (i.e., token or account based), will also influence how CBDC impacts the money supply.

We rely on historical data to consider the range of inflationary effects of the most likely forms of CBDC to be introduced by the major central banks in the foreseeable future. In doing so, we generate counterfactuals using McCallum’s monetary policy rule because it is unencumbered by the ZLB and it also has the virtue of shifting focus to the central bank’s balance sheet. McCallum’s rule, which can be specified for any definition of a monetary aggregate, links money growth to notional nominal GDP growth, the velocity of money, and an adjustment component for deviations of observed from targeted nominal GDP growth. McCallum’s rule is used to simulate scenarios of different monetary policy stances in an environment where financial innovations take place. We rely on the history of rapid technological developments in transactions technologies to determine hypothetical future inflation paths and consequences for money growth.

As a starting point an argument can be made that CBDC may have an impact likened to the fallout from previous eras of financial innovations. However, it is quite possible that existing regulations, or the failure to adapt to a changing financial landscape, a fairly reliable interpretation of financial history, may also generate changes in finance that have yet to be contemplated. The combined impact of developments referred to above would show up at least in part in a shift away from some types of deposits in banking institutions.

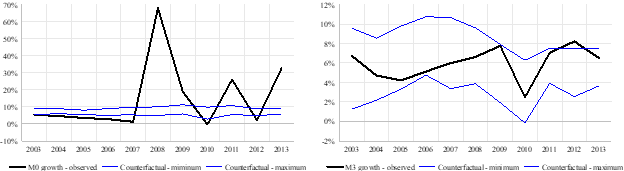

Our estimates for several advanced economies suggest that, even with financial innovations, the gap between observed and simulated money growth explains inflation movements quite well. When McCallum’s rule is simulated, conditional on a hypothetical view of the behaviour of velocity under conditions of financial innovation, in most cases the range of simulated estimates encompass observed money growth. The example below for the USA, illustrates the hypothetical range of money growth (M0 or M3) with CBDC under McCallum’s rule. The rule also provides, partly by construction, less volatile money growth than what has actually been observed. We conclude that CBDC need not impair inflation control regardless of the chosen monetary aggregate. We also examine the conditional volatility of money growth, under McCallum’s rule, in a CBDC regime. Our findings are that, even if CBDC are introduced, these need not prevent episodes associated with major financial crises from emerging that show up in the form of volatile money growth. Of course, our simulations are unable to capture novel ways policy makers might react to future crises as the results are conditioned on past history.

Figure 1: Hypothetical Money Growth with CBDC Using McCallum’s Rule. Source: Chen and Siklos (2021).

This post written by Hongyi Chen and Pierre Siklos.

It is my understanding that MCCallum’s Rule works better during crises than the Taylor Rule. But it seems to rely more on some sort of reasonable stable monetary velocity. That seems to have broken down for the US for most measures of the money supply startng back in the mid-1980s, quite a while ago. I am unaware of any evidence suggesting it has gotten more stable recentliy.

While I am raising a question about the method of analysis here, I suspect they are right that central banks can manage to keep a CBDC they issue/manage from triggering some wild outbreak of inflation as some featr.

So what is new about central bank digital currency? I haven’t touched a coin or piece of paper currency in the last two years, maybe more.

So, FireEye can’t keep their s*** together, and I’m supposed to trust the government and TBTF bankers to accurately store my “digital currency”?? Do I have to give them my CC# first and then they’ll get back to me later??

https://techcrunch.com/2020/12/17/fireeye-breach-solarwinds-federal-agencies/

[this post edited for language – please remember blog policy regarding use of profanity – MDC]

I want to know how a digital cuurency (if defined as “any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet”) differs greatly from the current system of electronic payments and accounts. Say, for instance, we call a Fed digital currency the “dollar” and make it unchangeable onr for one with paper dollars? And that the Fed continues to pursue monetary policy along the same lines as today? And so on. How is a Fed digital currency different than the U.S. dollar?

If the answer is “not different”, then the author’s conclusion is not a surprise.

@ Macroduck

I’m assuming here, the way they are using the term (the authors of the post) the emphasis here is not on as a “storage account” or “storage of value”, but as a payment or system of payment for everyday activities. Where “Joe Six Pack” is using it like “Apple Pay” or something like that, on a mass basis throughout the general population.

ATM usage has gone down lately, a decent amount related to the virus, so banks and other finance outfits are licking their chops on turning this into some kind of a fee system where they have no actual transaction costs but are still charging you a usage fee for your own money (notice how negative interest rate research papers are all the rage, and the concept is being teased into the popular culture). This is one of those deals that I’ve talked about multiple times on this blog that we don’t need QAnon to manufacture conspiracy theories, as we have enough real ones to deal with.

Rogoff has at minimal implied that digital money is going to be a magical solution to crime too, which would be laughable if it didn’t create a visceral feeling of utter disdain in me. There’s no way Rogoff is so dumb he believes his own writings on that garbage, but he knows it sells well to the big bank crowd and usury finance outfits.

Digital currency in its most famous form is variously claimed to be a haven for criminality (https://academic.oup.com/rfs/article-abstract/32/5/1798/5427781?redirectedFrom=fulltext) or a haven for unclassified transactions, but certainly not for illicit ones (https://observer.com/2019/08/bitcoin-use-illegal-finance-mit-study-blockchain-ai/). But at least no pallets of paper money would change hands if Rogoff were in charge. So I guess that’s…better?

I’ll admit I get kind of old-fogey in my thinking sometimes, and there’s a sentimental attachment to paper currency on my part, just like I still like the feel and crinkly sound of an NYT paper in my hands, but that part of the argument for digital currency, really annoys the heck out of me. I would just ask have credit cards’ convenience made up for the destruction of lives they have caused?? I realize, in the sense of entreating people to join my argument I have done myself no favors making the credit card analogy, but the credit cards have ruined so many lives that the convenience has not made up for it. The suicides, house foreclosures, bank account wipe outs and people spending their entire lives giving a ratio of their earnings to credit card companies because they can’t figure out the basic concept of paying off the principal. I hate to use the word pet peeve~~let’s just call it a personal grudge I have.

Once you give up something physical and tangible you can take out of a bank, you’ve lost all (customer)leverage you have over that same institution to be honest with your holdings, and that’s the real motivation here. A lot of people knew supply side was garbage the moment it got labeled “supply side”, but it benefits the rich so the garbage idea gets “traction”. Guys like Milton Friedman and Arthur Laffer, and yes even Stephen Moore are not dumb in the sense of knowing which individuals give power to their ideas being accepted by the broader culture. That’s why the AEIs, Heritages, and Hoovers exist, to give cushy jobs and salaries to the guys who push these ideas and give them “legitimacy”.

BTW, I could make a solid argument, that “QAnon” and the Tea Party haven’t even done 1/10,000th of the damage those last 3 institutions~~AEI, Heritage, Hoover, etc, and their same “ilk” have done to this nation. And I am NO fan of “QAnon” or the Tea Party, I am just hammering down a very tenable point.

@ macroduck

Imagine you can’t take your money out of the bank in paper currency form, and things like this start to happen on a regular basis (arguably, it already is happening on a regular basis):

https://www.abc10.com/article/money/edd-and-bank-of-america-get-grilling-from-california-senate/103-ccf36723-cc6c-4778-a6ac-56fe369295da

Now….. you have two choices, remain at the bank you assumably thought was the best choice to keep your cash assets to begin with, or switch to another bank you are unfamiliar with or didn’t think was the best choice priorly. Now you’re going to switch to another “digital currency account” and you have no place to secure your money, other than a digital account. How you think that one is going to go?? Apparently cats like Rogoff think that when the bank robs you blind and penniless, it’s “not a crime” because ” ‘digital cash’ is going to eliminate all crimes”. Straight from the balding PhD’s mouth to the ears of your empty/frozen bank account.

I bet I know a big reason Menzie has this paper on the McCallum rule up here on the blog.

[ This is the part where I’m excitedly anticipating Menzie replying “No really, tell me why I put this guest post up, you wisenheimer (edited MDC)”]

OK, I don’t know if that comment will get up, but I should emphasize I was more poking fun of myself than trying to work Menzie up. I think the reason Menzie likes McCallum (and I am not necessarily against it except I don’t think “one answer fits all” ever really works on something this complex) is that natural log is a big part of the equation, and blog regulars know Menzie likes natural log, so I thought I would good-naturedly razz Menzie over that.

Lots of equations involve natural logs in time series economics, not a big deal, if anything the norm. Mathematically convenient.

Regarding McCallum of all the economists i have ever known he was probably the one who most strongly believed in a super strong version of rational expectations. I think he is not as strongly supporting of that now as he used to be, according to somebody I know who knows him well. But ratex is not a crucial part of this rule, which looks almost more like a variation on old-fashioned Friedmanite monetarism, which never depended on assuming rational expectations, although they are not at all inconsistent.

Senator Ron Johnson is spending his time at the Senate 1/6 hearings trying to blame the riots on Antifa and also on the brave police trying to hold back Trump’s terrorists. His source is the below letter from Michael Waller of the Center for Policy Security. Fair warning it is long winded and chock full of lies in the style of Princeton Steve’s rants:

https://thefederalist.com/2021/01/14/i-saw-provocateurs-at-the-capitol-riot-on-jan-6/

https://fred.stlouisfed.org/graph/?g=BkzA

February 25, 2015

Velocity of M2 money stock, * 1960-2014

* http://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

The velocity of M2 — the ratio of nominal Gross Domestic Product to a broadly defined version of the money supply — has turned out to be hugely variable.

Paul Krugman

http://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

February 25, 2015

Monetarism in Winter

By Paul Krugman

Brad DeLong is writing about “cognitive closure” on the right, and focuses on the case of Allan Meltzer, * the long-time monetarist standard-bearer and co-founder of the Shadow Open Market Committee. ** Meltzer has been predicting inflation, just around the corner, for six years; the experience apparently has had no impact on his conviction that he understands the economy better than the Federal Reserve. And he considers it rude and unprofessional when some of us point out how wrong he has been for how long.

But there’s one thing that struck me in particular about the last entry *** in Brad’s bill of particulars, where Meltzer says this:

“The Fed’s third major error is its baffling inattention to the growth of monetary and credit aggregates. Central banks supply the raw material on which financial markets build the credit and money magnitudes. The reason given for neglecting these aggregates is usually a claim they are unstable. That is true only, if at all, of quarterly values. It is not true of medium- and longer-term values, as many researchers have shown.”

I’m not sure what Meltzer is saying here, exactly. Surely the claim is not so much that the aggregates are unstable as that the relationship between those aggregates and variables of interest — like inflation — is unstable. Now, where might the Fed have gotten that idea? …

Take that chart through 2020 – GDP/M2 fell to less than 1.13.

https://fred.stlouisfed.org/graph/?g=BkzX

January 15, 2018

Velocity of MZM * Money Stock and 10-Year Treasury Rate, 1962-2018

* https://en.wikipedia.org/wiki/Money_supply

Money with zero maturity. It measures the supply of financial assets redeemable at par on demand. Velocity of MZM is historically a relatively accurate predictor of inflation.

Thinking respectfully about McCallum’s rule, I have no sense that it offers an advantage over a cleaner Taylor-Mankiw rule application:

http://krugman.blogs.nytimes.com/2010/08/22/the-taylor-rule-and-the-bond-bubble-wonkish/

August 22, 2010

The Taylor Rule and the “Bond Bubble” (Wonkish)

By Paul Krugman

Here’s a thought for all those insisting that there’s a bond bubble: how unreasonable are current long-term interest rates given current macroeconomic forecasts? I mean, at this point almost everyone expects unemployment to stay high for years to come, and there’s every reason to expect low or even negative inflation for a long time too. Shouldn’t that imply that the Federal Reserve will keep short-term rates near zero for a long time? And shouldn’t that, in turn, mean that a low long-term rate is justified too?

So I decided to do a little exercise: what 10-year interest rate would make sense given the CBO projection of unemployment and inflation over the next decade? (CBO also makes interest rate projections — but you’ll see in a minute why I want to roll my own.)

What we need, first of all, is a Taylor rule. I decided to use the simplified Mankiw rule, which puts the same coefficient on core CPI inflation and unemployment. That is, it says that the Fed funds rate is a linear function of core CPI inflation minus the unemployment rate….

https://technode.com/2021/02/24/china-test-digital-currency-transactions-with-thailand-uae/

February 24, 2021

China to test digital currency transactions with Thailand, UAE

By Eliza Gkritsi

China, Hong Kong, Thailand, and the United Arab Emirates announced they will be testing central bank digital currencies in cross-border payments.

Why it matters: The collaboration between the four countries is a milestone in the digital yuan’s development. Nailing down cross-border payments is a key step in achieving a long-term strategic goal of using the digital RMB to internationalize China’s currency.

The digital yuan is the closest of the four countries’ digital currencies to launch, making it likely to take center stage in the trials.

Details: The project, dubbed m-CBDC Bridge, will explore the potential of blockchain in international CBDC transactions. It aims to develop a proof-of-concept prototype that uses the distributed ledger technology to process in real time cross-border transactions that involve multiple currencies, a joint press release said.

The Bridge will also explore possible use cases in cross-border payments using domestic and foreign currencies….

https://news.cgtn.com/news/2020-12-12/Why-is-China-moving-to-digital-RMB–W3n61i8Wvm/index.html

December 12, 2020

Why is China moving to digital RMB?

China’s idea of introducing a digital renminbi (RMB) took the world by surprise. Pilot programs have so far been launched in four cities and at 2022 Winter Olympics venues in the country. This is one of the building blocks of China’s move towards “world market” status and greater involvement in setting the framework of the global economy.

What is the digital RMB?

It is simply a digital form of China’s physical currency. Powered by blockchain technology, it is distributed by China’s central bank to second-tier providers including state-owned banks and online payment providers, such as Alipay and WeChat Pay.

These second-tier providers are authorized to transfer digital currency to individuals and businesses that can then make payments with money in their digital wallets.

Why move to a digital RMB? …