Employment in early January continues to decelerate to near standstill (BLS), as I suggested in November would happen if the US did not implement a coherent plan to contain the Covid-19 pandemic.

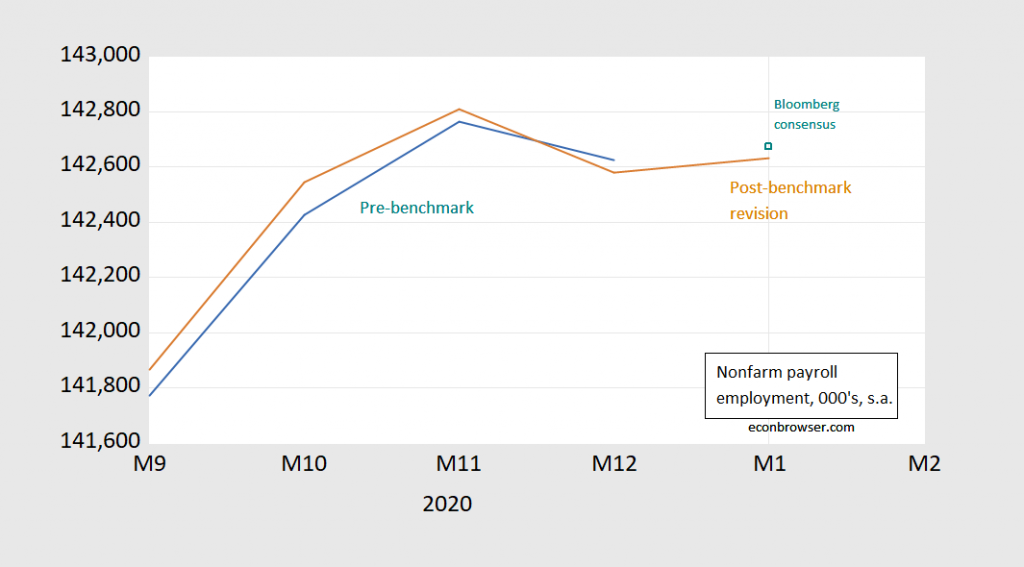

Figure 1: Nonfarm payroll employment, January release of 2/5 (brown), December release of 1/8 (teal), Bloomberg consensus for January as of 2/4, assumes no revision to December figure (teal square), all in 000’s, seasonally adjusted. February 5 release incorporates annual benchmark revisions. Source: BLS, Bloomberg accessed 2/4, and author’s calculations.

The 49,000 increase was very close the Bloomberg consensus of 50,000, but well below for instance the Goldman Sachs (2/4) estimates of 200,000 (GS estimate of consensus as 100,000).

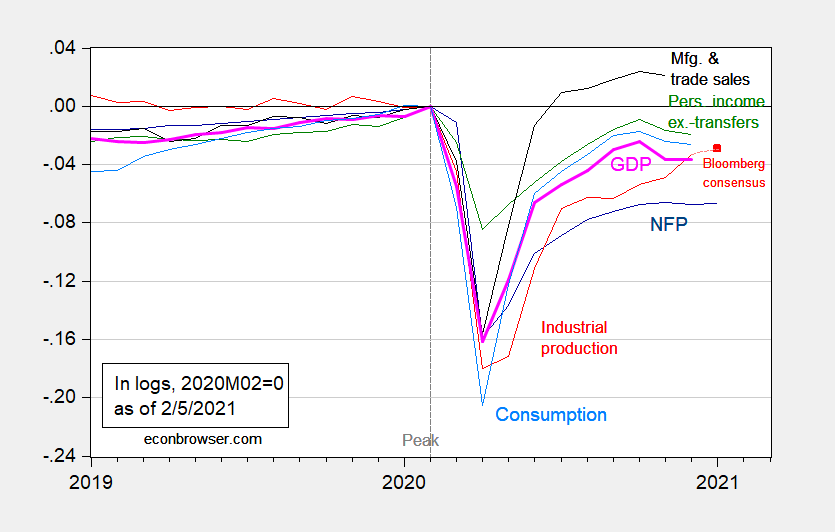

Notice the impact of these numbers for the snapshot of the macroeconomy.

Figure 2: Nonfarm payroll employment (dark blue), industrial production (red), Bloomberg consensus for January as of 2/5 (red square), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (1/4/2021 2/1/2021 release), NBER, and author’s calculations.

More commentary at Calculated Risk.

Nonfarm payroll employment in January 2021 is 3 million less than that in January 2017, i.e., 2% lower (2.1% in log terms).

Private payrolls barely rose. Much of the new jobs seem to be school teachers going back to the class room.

https://cepr.net/jobs-2021-02/

February 5, 2021

Unemployment Falls to 6.3 Percent, but Job Growth Weak

By DEAN BAKER

Trump is the first president to leave office with a loss of jobs since Herbert Hoover.

The unemployment rate fell by 0.4 percentage points in January to 6.3 percent. Much of this decline was due to people leaving the labor market as the employment-to-population ratio (EPOP) only rose by 0.1 percentage point. The EPOP now stands at 57.5 percent, 3.6 percentage points below its year-ago level.

The establishment survey showed an increase of just 49,000 jobs, with the private sector only accounting for 6,000 of these jobs. There were sharp downward revisions to job growth for both November and December, so the level of private sector jobs reported for January was 198,000 below the November level.

The January employment level left the economy with 2,981,000 fewer jobs than when President Trump took office. This makes him the first president to leave office with a loss of jobs since Herbert Hoover.

[Graph]

The household survey continues to show unusual patterns among the unemployed. Long-term unemployment (more than 26 weeks) accounts for an extraordinary 39.5 percent of the unemployed. While the peaks in the Great Recession were higher, hitting 45.5 percent in April of 2010, in prior recessions the share of long-term unemployed typically peaked not much over 20 percent.

This indicates that many of the people who lost their jobs in the original shutdowns at the start of the pandemic still have not found new employment. In prior recessions, even severe ones, people tended to experience shorter spells of unemployment and then find new jobs.

On the positive side, there is an extraordinarily high share of the unemployed who report being on temporary layoffs….

So most of the key indicators have flattened out over the last several months. In a perverse way the output gap might be very close to zero….but not in the usual way we understand the term and not for the usual reasons.

CoRev got it backwards but you do seem to think potential GDP has declined to being barely over actual. You along with Larry Summers are ticking Jared Bernstein off in the worst sort of way.

I’ll throw out a new term I just invented…I’ll call it “structurally constrained potential GDP.” Just rolls right off the tongue, doesn’t it? I do think that the current output gap is close to zero because potential GDP is being pushed down for structural reasons. For example, legal limits on the number of people allowed in stores and restaurants, childcare responsibilities that keep parents out of the workforce, people in quarantine, long haulers, older people dropping out of the potential workforce until a vaccine is widely available, etc. Those are exogenously imposed structural constraints on potential GDP irrespective of any aggregate demand problem. But at the same time I don’t see that as a permanent problem. We should see those structural constraints ease by the end of the year, and that’s when we might see a widening of the output gap as potential GDP returns to its long run trend and outstrips the growth rate of actual GDP.

None of that means I am opposed to Biden’s $1.9T package. We still need to fund PPE and vaccinations and schools. And we still need to keep the unemployed afloat and available for work when their jobs return. And we will still need conventional demand stimulus after we get the pandemic under control.

2slugbaits: The idea of “structurally constrained potential GDP” is in Farhi et al., and a simple interpretation is in Blanchard’s textbook addendum.

Menzie Thanks. I hadn’t seen either. The Blanchard addendum captures my view almost perfectly…even right down to the idea that we need to start thinking in terms of two different sector GDPs rather than as a single GDP, although Blanchard didn’t put it quite as baldly as that. The only thing I would add to Blanchard’s paper is that we should also think in terms of Domar weights that connect demand for intermediate inputs to final demand. That said, Blanchard does hint at something like that when he discusses spillover effects between the affected and unaffected sectors.

2slugs, either my mind has been slow to catch on, or your explanation is better, or both, but I’ve gone from maybe halfway agreeing with you to almost complete agreement with you. Thank you for persisting in your argument.

The only thing I would clarify is that I don’t think there will be much friction on the labor supply side once vaccines are widely available and constraints on high-contact services, childcare, school attendance, etc., are eased. ISTR that, nearly every month near the end of the last expansion, the numbers strongly suggested that numerous people moved from out of the labor force one month to employed the next one. I think that labor supply can increase nearly step for step with labor demand. Long-haulers and those in quarantine will, sadly, be most of the exceptions.

I also think that most of the latent labor demand can come back quickly. I know that at my place of employment, at any one time, we’ve had roughly 20% of our employees on some kind of Covid leave for about 11 months with very few other people willing to take a temporary job to help us fill in the missing hours. Almost all of our people will be able to come back immediately as long as they still want the time slots they worked before. I think labor demand at other places can resume as quickly, or nearly so, once the structural constraints you’ve identified are relaxed.

You’re exactly right that we need the full $1.9T package for the frictions that will remain as well as to relieve the current and continuing suffering until that time.

Actually, 2slug, I think you coined this term, although clearly various people have been making a similar argument to yours, which looks pretty reasonable.

Yeah, Larry Summers. From where I sit, it seems that Summers has an innate drive to say something provocative and even obnoxious every few months, especially when Democratic policy proposals are in the news. It’s like he has a bug in his software. Maybe he feels that he is not getting enough attention or something.

Anyway, on the substance of his statements, the issue of the danger of imminent inflation has been covered in this space often. I think the evidence suggests that Summers is way off base here. The risk of runaway inflation is currently zero, the risk of inflation over 4% is currently negligible, and the risk of the disaster relief package being too small is rather high. If that’s all he has to contribute, he should just shut up. He’s being harmful, not helpful, in solving our current economic problems.

https://cepr.net/excessive-stimulus-and-other-things-larry-summers-worries-about/

February 5, 2021

Excessive Stimulus and Other Things Larry Summers Worries About

By DEAN BAKER

It seems that Larry Summers is worried * that the stimulus proposed by President Biden is too large. I will say at the onset that he could be right. However, at the most fundamental level, we have to ask what the relative risks are of too much relative to too little.

If we actually are pushing the economy too hard, the argument would be that we would see serious inflationary pressures, which could result in the sort of wage-price spiral we saw in the seventies. As someone who lived through the seventies, it actually wasn’t that horrible.

Okay, the fashions and hairstyles might have been horrible, and I was never a fan of disco, but the period as whole wasn’t that bad. We didn’t have mass starvation and homelessness, but yes, the inflation of the decade was definitely a problem and we would not want to see something similar in this decade.

But will the Biden stimulus really cause us to see a 1970s type wage price spiral? That seems hard to imagine. We have not seen serious problems with inflation for many decades. Here’s the picture going back to the late 1990s using the personal consumption expenditure deflator, the Federal Reserve’s preferred index.

[Graph]

As can be seen, the only period where it is above the Fed’s 2.0 percent target (remember, this target is an average) is 2006 and 2007, and even then it is only modestly above 2.0 percent, with no clear upward trend. There is zero evidence of anything like an inflationary spiral in these data. Again, that doesn’t mean it is impossible, just that we haven’t seen anything like it for a long time….

* https://www.washingtonpost.com/opinions/2021/02/04/larry-summers-biden-covid-stimulus/

If Democrats want to boost wages through legislation, they can offer a minimum wage hike that will die in the Senate or they can pass budget plans that can’t be filibustered. Put another way, they can do politics or policy. I favor policy.

While Summers bloviates and others are obsessed by inflation and interest rates, ITEP looks at the distribution aspects of Biden’s recovery plan:

“The plan would have a particularly dramatic effect on the poorest 20 percent, those who most need help. For this group, the combined effects of these proposals would equal more than 33 percent of the average income. This is another way of saying these proposals would increase the incomes of those in the bottom 20 percent by about a third on average.”

https://itep.org/new-analysis-cash-and-tax-provisions-in-bidens-economic-recovery-plan/

Good job ITEP!

Summers may be bloviating but then he is just imitating your act. Do you get off attacking the credibility of people smarter than you? Try making a coherent point (if you can) without the unnecessary and often dishonest attacks on other people’s motivations.

Leave it pgl to dismiss the important distributional consequences of Biden’s recovery plan…and to intimate that ITEP’ piece is stupid and irrelevant.

Perhaps pgl is following the dictum of Robert Lucas: nothing [is] as “poisonous” to sound economics as focusing on income inequality, which seems to be why Summers gives it such shrift before essentially dismissing Biden’s plan as too risky.

JohnH: I do not see where pgl intimated the ITEP piece is stupid or irrelevant.

Thanks Menzie for noting that JohnH just made his comment up. But hey I’m used to this as he is a lot like Bruce Hall. Criticize anything he writes on the substance and off goes a tirade of accusations that I’m somehow bought and paid for by some weird cabal. Sort of QAnon that way.

Maybe it went way over your head what I’ve been saying about the 1960’s so let me draw this in crayon for you. I think the Great Society / War on Poverty was a very good thing. Of course we could have paid for it by reversing the 1964 tax cut particularly on high income people. But a doof like would never think about that.

Your last paragraph could have had some reference to WTF Lucas was saying. Since you did not I went to Google and found this interesting discussion:

https://hbr.org/2013/01/why-income-inequality-is-here

Before you falsely accuse me of not caring about income distribution issues, try reading it as I agree with this discussion. Like I have said many times – try making a substantive point someday without attacking people’s motivations with your stupid lies.

pgl,

Now now now, there you go, linking to commie talk out of the Harvard Business Review. And written by somebody from a (former) commie country!!! Shame on you!

The last time PCE Core was above 2.5% was 1993 and then it was on a downturn that bottomed out in 1998 at 1.3%. Inflation had been falling since 1988 when it was 4.5% so it was no problem even when it was relatively high 30 years ago. https://fred.stlouisfed.org/series/DPCCRV1Q225SBEA#0

Today, PCE Core has not been above 2% since 2007 when it hit a peak of 2.3% and then fell back under 2% where it had been since 1996. Why Larry is obsessing about the 1970s when PCE Core peaked at nearly 10% is not clear. Maybe he’s smoking some bad weed that is way stronger now than back in his disco days.

All true but go back to the 1960’s. Inflation was low for a long time before it took off. Of course the FED back then lacked the independence it has now.

That year on year decline in the EMPOP amount to 5.5 million jobs, give or take?

As to the Summer/Baker dispute Summers talks about a shortage of factors of production in criticizing the Biden plan, but does so in the context of the budget. It’s easy to confuse excess demand for factors of production with financial crowding out when discussing fiscal issues. I hope Summers didn’t mean to conflate the two. The claim that Covid stimulus could make the progressive agenda unaffordable would br disingenuous.

In fact, Summers and DeLong made the case some years ago that appropriate government spending can pay for itself in some cases:

https://www.brookings.edu/bpea-articles/fiscal-policy-in-a-depressed-economy/

It would be awkward for him to ignore his own work.

The best that Summers could argue is that excess demand for factors of production could result from a series of expansionary fiscal plans. Baker’s point is the salient one in that case. I’d love to see that point tested.

I might be wrong, but as I understand it Summers is arguing that Biden’s plan would crowd out additional spending on infrastructure and green initiatives. So I don’t read him as opposing the overall $1.9T price tag, but rather that the combined cost of a $1.9T price tag plus additional spending for infrastructure and green initiatives would be inflationary. For example, if infrastructure and green initiative spending costs $1.0T, then the total cost would be $1.9T + $1.0 = $2.9T. In other words, I think Summers wants to change the mix of overall spending.

For me the problem with Summers’ argument is that infrastructure and green initiative spending should actually increase future productivity, which would put downward pressure on any possible inflation. It’s not like infrastructure and green initiatives are optional consumption good luxuries such that not spending money on them ends up saving us anything. The rationale for that kind of spending is to avoid the higher costs of not making those kinds of investments. Summers is also making a bad political calculation. You can only use reconciliation once, so if Biden goes for a smaller American Rescue Plan in hopes of getting separate infrastructure & green initiative spending at a later date, then he’s sadly mistaken. McConnell will never let that happen.

I agree with your reading of Summers. I think Summers needs to clarify. If he is claiming a budget constraint while talking about excess demand for factors of production, he is conflating in a way that is misleading. There is no evidence that the federal budget faces any constraint now. We can have helicopter money and infrastructure.

BTW the two of you. Thanks for an informed discussion without the pretense that you know more than some economist. I say this because I suspect all of us are put off at the garbage routinely spewed by know nothings pretending to be know it alls exhibited above by the likes of JohnH.

Robert Waldmann is covering a lot of this with great links over at Angrybear.

Exactly right. Let’s go back to the 1960’s where we had a 3 part fiscal stimulus:

(1) the Great Society which was a great idea and not the cause of excess demand by itself;

(2) the Vietnam War buildup (which history shows was a mistake); and

(3) the 1964 tax cut which the CEA told LBJ should be reversed.

Even with all of that – all the FED done its job, we could have avoided the inflationary buildup. The same holds today.

This is a good critique of Summers. And unlike JohnH – you did not attack his character.

pgl,

BTW, as someone who has interacted with him on several occasions personally and knows some things about him that are not widely known but that I shall not waste peoples’ time with here, there are not unreasonable grounds for criticizing the character of Larry Summers. But those criticisms are indeed just a distraction from the substantive issues involved here.

Oh, and as it, even though one can criticize him personally, Larry Summers is a very smart guy who knows a lot and is right economics far more frequently than he is wrong. But this column of his does have problems, as is being well pointed out by various people here.

Employment to population ratio for the 25-54 year olds is only 76.4%. It should be 80.5%.

Latin American countries have recorded 4 of the 13 highest and 6 of the 24 highest number of coronavirus cases among all countries. Brazil, Colombia, Argentina, Mexico, Peru and Chile.

Mexico, with more than 1.8 million cases recorded, has the 4th highest number of cases among Latin American countries and the 13th highest number of cases among all countries. Peru, with more than 1.1 million cases, has the 5th highest number of cases among Latin American countries and the 18th highest number among all countries.

Mexico was the 4th among all countries to have recorded more than 100,000 and now more than 160,000 coronavirus deaths.

February 4, 2021

Coronavirus (Deaths per million)

US ( 1,406) *

Brazil ( 1,072)

Colombia ( 1,077)

Argentina ( 1,072)

Mexico ( 1,243)

Peru ( 1,256)

Chile ( 975)

Ecuador ( 841)

Bolivia ( 898)

Panama ( 1,238)

Costa Rica ( 520)

* Descending number of cases

February 5, 2021

Coronavirus

US

Cases ( 27,407,324)

Deaths ( 470,705)

India

Cases ( 10,815,222)

Deaths ( 154,956)

UK

Cases ( 3,911,573)

Deaths ( 111,264)

France

Cases ( 3,296,747)

Deaths ( 78,603)

Germany

Cases ( 2,276,371)

Deaths ( 61,661)

Mexico

Cases ( 1,899,820)

Deaths ( 162,922)

Canada

Cases ( 797,756)

Deaths ( 20,609)

China

Cases ( 89,669)

Deaths ( 4,636)

February 5, 2021

Coronavirus (Deaths per million)

UK ( 1,634)

US ( 1,417)

Mexico ( 1,256)

France ( 1,203)

Germany ( 735)

Canada ( 543)

India ( 112)

China ( 3)

Notice the ratios of deaths to coronavirus cases are 8.6%, 2.8% and 2.4% for Mexico, the United Kingdom and France respectively.

https://news.cgtn.com/news/2021-02-06/Chinese-mainland-reports-12-new-COVID-19-cases-XEyiWa46e4/index.html

February 6, 2021

Chinese mainland reports 12 new COVID-19 cases

The Chinese mainland recorded 12 new COVID-19 cases on Friday – 4 local transmissions and 8 from overseas, the National Health Commission said on Saturday.

No new deaths related to COVID-19 were registered and 81 patients were discharged from hospitals.

A total of 10 new asymptomatic cases were recorded, while 733 asymptomatic patients remained under medical observation.

The total number of confirmed COVID-19 cases on the Chinese mainland has reached 89,681, and the death toll stands at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-02-06/Chinese-mainland-reports-12-new-COVID-19-cases-XEyiWa46e4/img/898cd1b836134b3a9cc073a933fa486f/898cd1b836134b3a9cc073a933fa486f.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-02-06/Chinese-mainland-reports-12-new-COVID-19-cases-XEyiWa46e4/img/392debb64ed74b2f9fcda6d106ba3419/392debb64ed74b2f9fcda6d106ba3419.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-02-06/Chinese-mainland-reports-12-new-COVID-19-cases-XEyiWa46e4/img/42e9e0641d3446e9a568a46525f38a85/42e9e0641d3446e9a568a46525f38a85.jpeg

Well….. it can’t be controlled…….. there’s always some riff-raff and undesirables that get involved in these contests:

https://news.harvard.edu/gazette/story/2021/02/harvard-grad-heads-to-super-bowl-alongside-his-football-heroes/

Menzie:

Clearly the virus continues to remain in control of the economy.

My own take is that all of the leading factors and sectors – interest rates including the yield curve, money supply, housing, manufacturing – show an economy revving in place, restrained by the pandemic.

I wonder if you would consider coming up with a back of the envelope dynamic projection of when the economy might take off based on how long it takes for vaccinations to bring us to “herd immunity.” E.g., plotting what is likely to happen if vaccinations grow to between 2 to 3 million shots a day over the next several months, intersecting with what has happened in the past when the above leading sectors were all pointing towards strong growth. It’s above my pay grade, but hopefully I have planted a bug in your brain!

Best regards, NDD

https://scholar.princeton.edu/sites/default/files/international_income_inequality_and_the_covid_v2_assembled_0.pdf

January, 2021

COVID-19 and global income inequality

By Angus Deaton

Abstract

There is a widespread belief that the COVID-19 pandemic has increased global income inequality, reducing per capita incomes by more in poor countries than in rich. This supposition is reasonable but false. Rich countries have experienced more deaths per head than have poor countries; their better health systems, higher incomes, more capable governments and better preparedness notwithstanding. The US did worse than some rich countries, but better than several others. Countries with more deaths saw larger declines in income. There was thus not only no trade-off between lives and income; fewer deaths meant more income. As a result, per capita incomes fell by more in higher-income countries. Country by country, international income inequality decreased. When countries are weighted by population, international income inequality increased, not because the poorest countries diverged from the richest countries, but because China—no longer a poor country—had few deaths and positive economic growth, pulling it away from poor countries. That these findings are a result of the pandemic is supported by comparing global inequality using IMF forecasts in October 2019 and October 2020.

Yes sir, and the Chinese government is likely responsible.

http://www.prienga.com/blog/2021/2/3/will-pandemic-victims-have-legal-recourse

And by the way, Baffs, you have a point about US involvement. Fauci was a principal proponent of gain of function research.

https://www.newsweek.com/dr-fauci-backed-controversial-wuhan-lab-millions-us-dollars-risky-coronavirus-research-1500741

“A Flu Risk Worth Taking”

Wa-Po op-ed by Fauci et al, Dec. 2011

https://www.washingtonpost.com/opinions/a-flu-virus-risk-worth-taking/2011/12/30/gIQAM9sNRP_story.html

As I argue in the post above, suits for damages should be allowed to proceed in civil courts. Let’s let the legal process work in determining origin and assigning blame.

I hope you are the attorney for any grotesque enough to sue Dr. Fauci as the judge will laugh your pathetic rear end of the court. Yes – let’s blame people who are trying to address this virus. That is sure to get you another appearance on Fox and Friends where they love pathetic slime buckets.

“SARS-CoV-2 , the virus now causing a global pandemic, is believed to have originated in bats. U.S. intelligence, after originally asserting that the coronavirus had occurred naturally, conceded last month that the pandemic may have originated in a leak from the Wuhan lab. (At this point most scientists say it’s possible—but not likely—that the pandemic virus was engineered or manipulated.)”

Not likely that it was engineered or manipulated. But leave it to Princeton Steve to continue this hate filled, racist, and dishonest campaign that the Chinese scientists deliberately started this pandemic. Maybe someone should sue your a$$.

civil suits and monetary liability complaints are not a reasonable path to a solution. they are a predetermined path to confrontation. steven, you have the same problem that peter navarro has. you want to pick a fight with china, and will look for any reason to provide escalation. it was a losing position for navarro. it will be the same losing position for you, steven. it is bad policy to want a predetermined outcome. it limits your possible responses. we got involved in iraq the second time because of a predetermined path to confrontation.

https://scholar.princeton.edu/sites/default/files/international_income_inequality_and_the_covid_v2_assembled_0.pdf

January, 2021

COVID-19 and global income inequality

By Angus Deaton

Introduction

The COVID-19 pandemic has threatened the lives and livelihoods of less-educated and less-well paid people more than those of more educated and better paid, many of whom can stay safely at home and continue to work. The increase in domestic income inequality has been counteracted by large scale government income support programs in the US and in many other countries.

International income inequality is another matter, and there seems to be a widespread belief that the pandemic has or will increase inequalities in income between countries. In one of many such examples, Goldin and Muggah (2020), writing for the World Economic Forum say “inequality is increasing both within and between countries.” UNDP (2020) writes “The virus is ruthlessly exposing the gaps between the haves and the have nots, both within and between countries.” Stiglitz (2020) lays out the rationale: “COVID-19 has exposed and exacerbated inequalities between countries just as it has within countries. The least developed economies have poorer health conditions, health systems that are less prepared to deal with the pandemic, and people living in conditions that make them more vulnerable to contagion, and they simply do not have the resources that advanced economies have to respond to the economic aftermath.”

This argument seems compelling, but it is good to check out the data, which is what I do in this paper. I demonstrate that global inequality—defined as the dispersion of per capita income between countries taking each country as a unit—has not increased but decreased, and that it has done so because of the pandemic. Alternatively, if global inequality is measured with each country weighted by its population, between-country income inequality has increased, not because poor countries have seen more rapidly falling incomes than rich countries, but because China has done so well. The rapid growth of China has, for decades, decreased population-weighted between-country inequality, because it has lifted more than a billion people up from the bottom of the world income distribution. But China is no longer a poor country in global terms, so that when it grows more rapidly than other countries, as it did in 2020 during the pandemic, it no longer decreases global inequality, but increases it.

For reasons that are only partially understood, and may include measurement error, poorer countries have so far suffered fewer COVID deaths per capita than have richer countries. Moreover, each country’s loss in per capita national income between 2019 and 2020 was strongly related to its per capita COVID death count. These two facts together mean that per capita incomes have, on average, fallen more in countries with higher per capita incomes in 2019; poorer countries have done relatively well. As a matter of logic, this need not narrow international income inequality, but it has in fact done so. Country by country, per capita incomes are closer to one another now than in 2019.

China (but not India) had few deaths and experienced positive economic growth in 2020. Before the pandemic, China’s rapid growth had lifted more than a billion people up from the bottom of the global income distribution, and has long been responsible for a reduction in global income inequality when each country is weighted by its population. But this effect has been attenuating as China’s income has risen. Today, out of the world’s population of 7.8 billion, 4.4 billion live in countries whose per capita income is lower than China, while only 2.0 billion live in countries whose per capita income is higher than China. That the negative effect of Chinese growth on weighted global inequality would eventually turn positive was predicted by Deaton (2013) and Milanovic (2018). During the pandemic, the Chinese economy grew while most other economies shrank, the reversal happened, and population-weighted global inequality increased.

Contrary to pre-existing trends, the pandemic reduced global unweighted inequality, and increased global population-weighted inequality. That my findings are consequences of the pandemic is supported by comparing inequality measures using IMF income estimates pre- and post-pandemic….

Paul Krugman starts his new blog with revisiting the Volcker disinflation and that Friedman-Phelps augmented Phillips curve debate:

https://paulkrugman.substack.com/p/stagflation-revisited

Thanks for sharing this. I wasn’t aware. I guess he’s not going to offer an RSS for this—which implies, as much as he wants to deny it, he might make it into a money-making thing in the future. It’s all about getting the email just like freebies on mobile phone are about getting people to forfeit personal info for free in the apps. In his case I’ll resentfully sign up. This is where we’re going, what can you do???