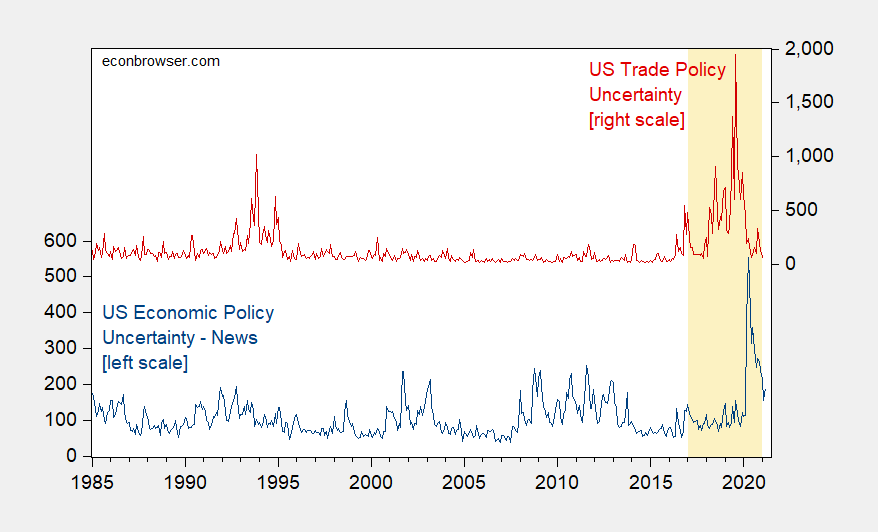

If you’re an economic policy analyst, you might get the feeling that the crazy-high uncertainty surrounding policy has abated. You might even feel that more profoundly if your portfolio includes trade policy…

Figure 1. US Economic Policy Uncertainty (news-based) (blue, left scale), US Trade Policy Uncertainty (red, right scale). EPU for March 2021 is for 3/1-3/26. Orange shading denotes Trump administration 2017M01-2020M12. Source: Baker, Bloom & Davis at policyuncertainty.com.

(Declining uncertainty in recent years has correlated with dollar value.)

It’s happy news. We should be thankful the orange abomination lost the race. I’m not the most religious guy, but I bet 3 days hasn’t gone by consecutively since November 3 where I didn’t thank God Joe Biden won the race. We should note and appreciate when good things happen. This is something to be thankful for, invested in equities or not.

What is the oft used sports phrase?? “Back from the brink”??

https://fred.stlouisfed.org/graph/?g=A5S7

January 15, 2018

Real Broad Effective Exchange Rate and Economic Policy Uncertainty for United States, 2000-2021

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=CnNZ

January 15, 2018

Real Broad Effective Exchange Rate and Trade Policy Uncertainty for United States, 2000-2021

(Indexed to 2000)