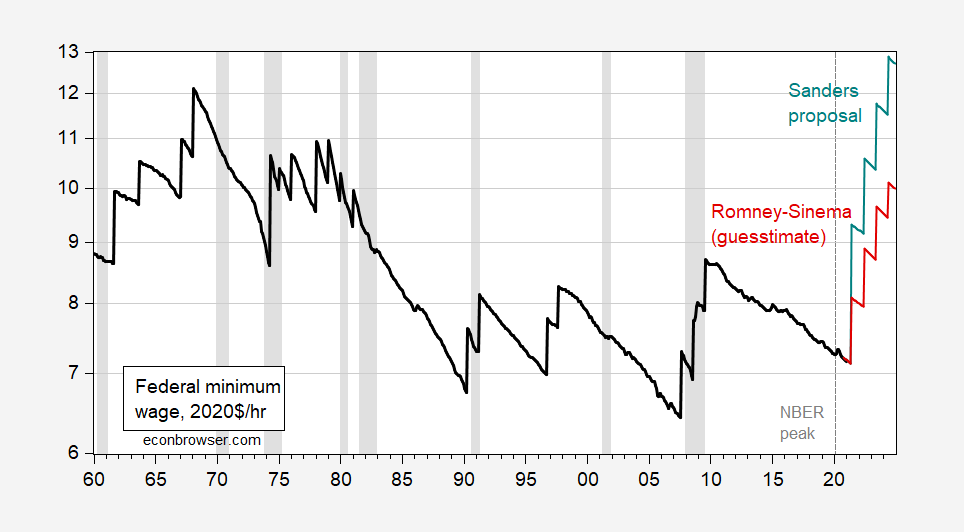

There’s a rumored plan by Senators Romney and Sinema to raise the minimum wage to $11. Assuming the phase is four years (as in the proposed Cotton plan to raise to $10) starting in June 2021, the trajectory of the real minimum wage looks like:

Figure 1: Federal minimum wage in 2020$ (black), under Romney-Sinema proposal, assuming 4 year phase in (red), and Sanders proposal (teal). NBER defined recession dates and NBER peak shaded gray. Quarterly CBO CPI projections interpolated by quadratic match. Source: BLS, CBO (February 2021), NBER, author’s calculations.

If the minimum wage is raised to $11 in June 2024, then the real wage will match that last seen in February 1980.

CBO has just revised their interactive tool for evaluating minimum wage proposals.

Oh gee – the Joe Manchin proposal. I see your $11 and raise you to $12.

then the real wage will match that last seen in February 1980.

It may not be everything that some Democrats want, but erasing forty-five years of lost income is nothing to sneeze at. If I were Biden I would take the deal. A higher minimum wage coupled with making the child tax credit permanent would go a long way towards relieving poverty.

2slug,

I agree, in principle, with your comment, but I think the child tax credit goes a bit too far:

Under the American Rescue Plan, families with children under 6 will receive $3,600 per child. Families with children ages 6 to 17 will receive $3,000 per child. Families can expect to see the money around July of this year through direct deposit or check.

Individuals who make up to $75,000 a year or joint filers making up to $150,000 a year qualify for the tax credit.

Children already count as exemptions on tax returns and $150K income isn’t exactly poverty. At some point, the massive giveaways have to be reined in and the focus placed on real needs and real improvements. The Niagara Falls approach to federal spending can only lead to fiscal chaos at some point. No amount of corporate taxation can make up the budget revenue difference and still keep the corporations competitive.

You clearly never had the responsibility of raising a kid. Just ask your mom – oh wait, she STILL is supporting you.

Hopefully 2slug has data to compare what we are doing v. what Western European nations are doing to support raising kids. Something tells me the comparison will shock your little right wing pea brain.

My youngest and his wife are FAR better off financially than we were at the same stage in life. Simple reason: no children (other than the dog and cat).

They’re good savers, have maxed out retirement plans, and don’t have to worry about balancing a mortgage with personal saving, contributing to a kid’s 529, or figuring out how to pay for teeth straightening.

No one should complain about child deductions or exemptions. The ones who do also seem to be convinced pro lifers who recognize the importance of children. At least, until birth.

Bruce Hall does this a lot but notice how this lying troll once again quoted something without telling us what he was quoting. Google helped me bring this up:

https://www.cbsnews.com/news/child-tax-credit-stimulus-covid-relief-bill-2021-03-16/

I will let everyone else read the entire story just to see how Bruce Hall cherry picked quotes once again. Let me add only two important points this liar skipped:

This child tax credit is temporary. Raising kids is a longer term commitment. And many estimates are that raising a single kid adds $8600 per year to a family’s cost of living. Of course most kids eventually move out and get jobs.

Pity Bruce Hall’s mother – she is still supporting her son.

Bruce Hall It’s more complicated than that. The prior Child Tax Credit (CTC) was especially generous to high income folks and was highly skewed against lower income households. The Biden CTC is significantly more generous for lower income households and about the same for the highest quintile. I suspect that you didn’t know that the previous CTC was primarily a giveaway to upper middle class households. Biden flattened the benefits across the quintiles.

https://www.taxpolicycenter.org/taxvox/child-tax-credit-grows-lift-millions-children-out-poverty

The Niagara Falls approach to federal spending can only lead to fiscal chaos at some point.

We’re a long way from Niagara Falls. More like Minnehaha Falls: https://www.britannica.com/place/Minnehaha-Falls

No amount of corporate taxation can make up the budget revenue difference and still keep the corporations competitive.

I don’t believe the CTC is being funded through higher corporate taxes. You’re confusing the ARP and the AJP. In any event, corporate taxes are only paid on gross profits, the existence of which assumes a corporation is in fact competitive and profitable. And has been pointed out before, the Trump corporate tax cuts did not increase the kind of investment that leads to higher productivity. Those tax cuts simply went to stock buyouts for fat cat executives.

Bruce Hall Children already count as exemptions on tax returns

Exemptions? Really? Who does your tax returns?

I think Bruce relies on the same slime ball firm Trump uses – Mazars.

I always thought children could be claimed as exemptions. Of course, it’s been 20 years since the last of my sons left home, so maybe the rules changed.

https://www.thebalance.com/personal-exemptions-3193153

Married people who filed jointly could claim two personal exemptions, one for each spouse, plus exemptions for each of their dependents.

Perhaps I missed the boat and forgot to claim those child tax credits twenty years ago, but I don’t remember them being applicable. Oh well.

btw, what’s pgl’s problem. He seem awfully envious about something.

Bruce Hall Yes, the rules changed with Trump’s tax overhaul. Tax credits replaced deductions for kids. That’s why child tax credits apply to married couples with incomes less than $150K; i.e., the deductions used to apply to those making $150K as well. Making the CTCs permanent and at a higher level effectively creates a guaranteed income floor for families. That’s a good thing.

envious of ??? Oh wait – I am envious of your ability never to source any of your claims. Yea – I have to trace down the actual article and provide a link so others can see how you have cherry picked it. Hmmm – the grocery story had no cherries this morning as your cherry picking cornered the market. Yea a little envy. Snicker.

The last increase in the Federal minimum wage might look like a decent bump when compared to the level in 2007 but when compared to the real wage in 1968, it looks more than wages paid in China. The 1980 standard is better but still incredibly low.

Now hopefully you have already done your usual excellent research debunking the latest know nothing nonsense re the cost of raising kids ala Bruce Hall.

Slugger,

Agreed. In a negotiation, ask for a ton, settle for a half ton. If, by some quirk of fate, you get the whole ton, even better. Don’t walk away with nothing.

The kid subsidy is aimed at alleviating child poverty. Here, too, ask fo a ton. Nothing bad will happen if you get everything you ask.

Yesterday as I was watching the loud mouth pathetic POS Jim Jordan berate Dr. Fauci, I was wondering why no one just told this clown to shut his mouth. Well it seems that Maxine Waters did exactly that!

https://talkingpointsmemo.com/news/jordan-fauci-waters-house-hearing-coronavirus

Well folks, here is a public announcement from our great MAGA Supreme Court.

https://www.wsj.com/articles/supreme-courts-bridgegate-ruling-casts-shadow-on-federal-fraud-cases-11618232407

As if anyone didn’t already know it, the Supreme Court would like you to know, if you’re Black and rob $5 from the local 7-11, the full force of the law will be upon you, and if you’re Black and have 8 ounces of marijuana under the driver’s seat of your car, you will sit in jail forever and have the prison guards beat your brains in every other night. But if you are white and F— over people driving through NYC, and make it impossible for ambulances and fire trucks to provide service to communities, and people die in the process, you are “All American” MAGA white, and the Supreme Court of the United States sees you as “God’s personally chosen”. So as long as you’re NOT Black, just keeping on robbing people blind and causing deaths in your neighboring communities, because you now have the blessing of all of our “fine” U.S. Supreme Court Justices. You have talent on loan from God~~so use it wisely when raping, pillaging, robbing and causing the deaths of the locals. “God” wouldn’t want it any other way. That’s what ABC/Disney network’s PAID commentator Chris Christie says anyway, and why would I doubt him??

The person most responsible for BridgeGate – Krispy Kreme Chris Christie – faced no charges and in fact to got to serve in the Trump White House. Which I guess is fitting as that White House was nothing more than a mob boss and his crew.

https://www.nytimes.com/2021/04/16/opinion/economy-inflation-retail-sales.html

April 16, 2021

Krugman Wonks Out: The Case for Supercore Inflation

It’s going to be a year of bottlenecks and blips.

By Paul Krugman

If Thursday’s retail sales report is anything to go by — and it is — we’re about to see a really big boom. Between stimulus checks and vaccinations, we’re very likely headed for a year of growth faster than anything since 1984. Happy times are here again!

But what about inflation? The debate we’ve been having over whether the American Rescue Plan is excessive is kind of surreal for those who remember the macro debates after 2008; this time, economists on the other side are neither knaves nor fools. There are indeed reasons to be worried about inflationary overheating. In fact, even those of us who think it will be OK expect to see above-normal inflation this year. We just think it will be a blip.

What do I mean by that? In 2011-12 it was fairly easy to debunk inflation worries by pointing to “core” inflation, which excluded volatile food and energy prices. Obviously we’ll be looking at the same measure this time. But there are reasons to think we’ll see a transitory surge in core inflation too, which doesn’t represent a deeper problem.

And it seems to me that we should make that argument now, so as not to be accused of making excuses after the fact. This is a good time to identify which aspects of inflation might worry us, and which shouldn’t.

So let’s talk about why we needed a concept like core inflation to begin with, and why we might need an extended concept — supercore? — this time.

Inflation: It’s all about the inertia

Most official U.S. economic data extend back only to 1947 (labor markets, income distribution) or 1929 (G.D.P. and all that). Consumer price data, however, goes all the way back to 1913. So we can take a very long view of inflation, which looks like this:

https://static01.nyt.com/images/2021/04/16/opinion/160421krugman1/160421krugman1-jumbo.png?quality=90&auto=webp

The 70s were different.

Spikes in inflation aren’t a new thing. There was huge inflation during World War I; there were bursts of inflation during World War II, after the war when price controls were lifted, and again during the Korean War. However, all of these inflation surges were brief. It wasn’t until the 1970s that we got an extended period of high inflation.

And unlike previous bouts of inflation, the 70s inflation was sticky: It didn’t go away as soon as a wartime boom was over. Instead, inflation became embedded in the economy, so that bringing it down required putting the economy through a wringer. Paul Volcker slammed on the monetary brakes in 1979, not taking his foot off until 1982, and the economy went through years of very high unemployment:

https://static01.nyt.com/images/2021/04/16/opinion/160421krugman2/160421krugman2-jumbo.png?quality=90&auto=webp

Getting rid of embedded inflation is hard.

But wait: I just used evocative language without really explaining what it means. What are we talking about when we talk about “embedded” inflation?

The somewhat paradoxical answer is that embedded inflation, which is the kind of inflation we really need to worry about, is inflation in prices that don’t change very often.

Inflation persistence: The staggering truth

Some goods, notably things like oil and wheat, have constantly changing prices. But many don’t. There’s a large economic literature on how often prices change (here’s a summary); it’s important to distinguish between changes in base prices and occasional sales. When you do that, you find that many firms are reluctant to change prices too often; the median consumer price changes only around once every 7-11 months. And wages and salaries are normally set for a year.

Why is this true? Why does the frequency of price changes vary so much across goods? Those are deep, hard questions, which I have no intention of trying to answer.

Instead, let’s focus on the consequences of intermittent price adjustment, which takes place in a staggered way — that is, all prices don’t change at the same time.

Imagine an individual seller which changes prices infrequently, say once a year, but tries to keep its average price over time in line with costs and the prices charged by competitors. And imagine that this seller has been operating for a while in an environment in which the overall level of prices is rising at a moderately fast clip, say 10 percent a year. Then this seller’s price will look like this over time:

https://static01.nyt.com/images/2021/04/16/opinion/160421krugman3/160421krugman3-jumbo.png?quality=90&auto=webp

Staggering toward inertia….

https://fred.stlouisfed.org/graph/?g=t4UH

January 15, 2018

Advance Retail and Food Services Sales, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=ubPM

January 15, 2020

Advance Retail Sales excluding Food Services, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=DaP9

January 15, 2018

Consumer Price Index, 1914-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=w3Wk

January 15, 2018

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=DaZv

January 15, 2018

Consumer Price Index and Personal Consumption Expenditures Price Index less Food & Energy, 2007-2021

(Percent change)

Marjorie Taylor Greene and Paul Gosar clarify what MAGA and America First has always meant – only white people allowed:

https://www.msn.com/en-us/news/politics/gop-reps-marjorie-taylor-greene-and-paul-gosar-create-america-first-caucus-that-emphasizes-anglo-saxon-political-traditions/ar-BB1fJiIw?ocid=uxbndlbing

BTW – this ugly woman who cheat on hubbie with any hick nearby is from a part of North Georgia where no one with a brain goes – unless one is wearing the white sheets of the KKK! I bet she even celebrates Eric Rudolph’s birthday.

https://twitter.com/JosephEStiglitz/status/1383068516388122626

Joseph E. Stiglitz @JosephEStiglitz

Dear @POTUS

With your leadership, we can ensure that COVID-19 vaccine technology is shared with the world. Supporting the emergency waiver of COVID-19-related intellectual property rules will give all people a chance to live in a world free from the virus.

https://www.project-syndicate.org/commentary/president-biden-support-a-peoples-vaccine-2021-04-by-gordon-brown-et-al-2021-04

President Biden, Support a People’s Vaccine | by Gordon Brown, et al – Project Syndicate

Over the past year, the world witnessed unprecedentedly rapid development of safe and effective COVID-19 vaccines, largely owing to US public investment. And now it is clearly in America’s national…

10:43 AM · Apr 16, 2021

https://cepr.net/patents-and-the-pandemic-can-we-learn-anything/

April 12, 2021

Patents and the Pandemic: Can We Learn Anything?

By Dean Baker

I realize that I may seem obsessed with the topic of patents (and copyrights), but it really is a big deal, and few people seem to appreciate the issue in its larger economic context. I have written about the inefficiency and corruption associated with these monopolies for decades, but if there was ever a time when public attention should be focused on reforming the system, it is now.

With the pandemic costing millions of lives around the world, and costing our economies trillions in lost output, we really should be asking whether the current system serves us well in producing vaccines, tests, and treatments. Incredibly, public debate is so dominated by the pharmaceutical industry and its allies, we are primarily seeing celebration of the system’s dubious claims to success, rather than discussions of the way in which the system was and is failing us in addressing the pandemic. We also should be discussing the lessons for possible alternatives.

Starting with the failures, while we should all be glad that we now have several effective vaccines, which a large percentage of the U.S. population has now received, the fact is that only a small portion of the world’s population has been vaccinated. In Latin America less than one percent of the population has been vaccinated and in Sub Saharan Africa the figure is less than one percent….