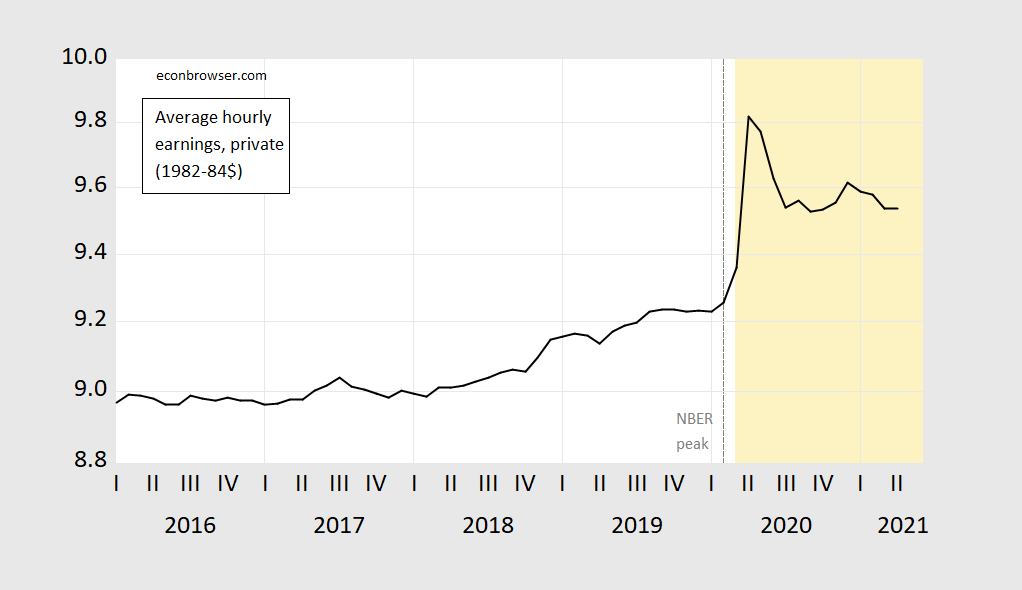

Relative compression vis a vis recent past (not controlling for composition), but still up since the onset of the pandemic.

Figure 1: Average hourly earnings in private sector, production and nonsupervisory employees, deflated by CPI (black, on log scale).NBER peak at dashed line, pandemic period shaded orange. Source: BLS via FRED, and author’s calculations.

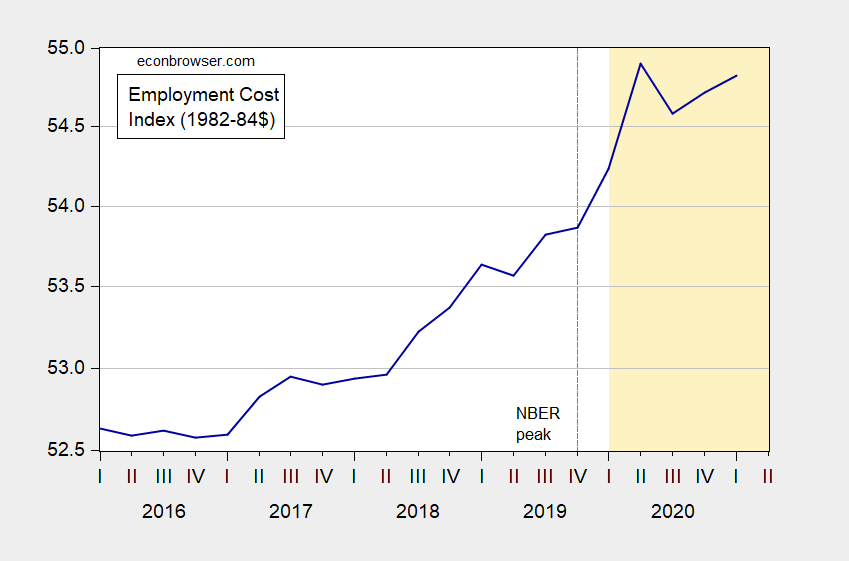

Figure 2: Employment cost index (2005=100) deflated by CPI (blue, on log scale).NBER peak at dashed line, pandemic period shaded orange. Source: BLS via FRED, and author’s calculations.

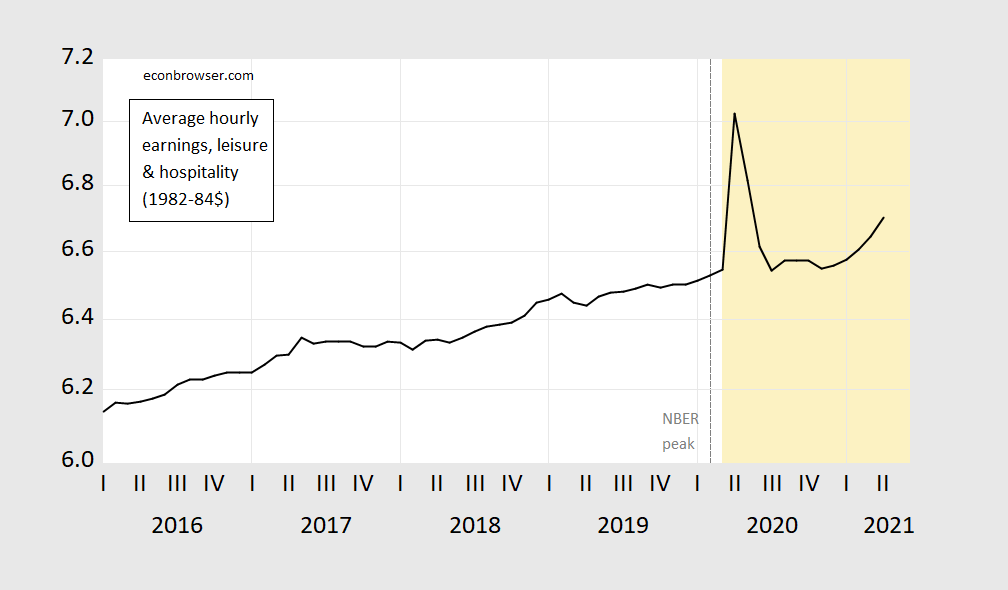

These are all averages, and will not account for compositional changes in the employment pool. Moreover, there are sectoral differences, and the number of hours (as opposed to some proxy for wages) will differ considerably over households. For one hard hit sector (leisure and hospitality), here is the evolution of real wages.

Figure 3: Average hourly earnings leisure and hospitality industry, deflated by CPI (black, on log scale).NBER peak at dashed line, pandemic period shaded orange. Source: BLS via FRED, and author’s calculations.

Addendum:

Here is Figure 1, in logs 2020M02=0, with conventional CPI deflated and CPI-chained deflated wages.

Figure 4: Average hourly earnings in private sector, production and nonsupervisory employees, deflated by CPI (black), and deflated by Chained CPI (teal), both in logs, 2020M02=0.NBER peak at dashed line, pandemic period shaded orange. Source: BLS via FRED, and author’s calculations.

“For one hard hit sector (leisure and hospitality), here is the evolution of real wages.”

Interesting chart showing how this real wage soared at the start of the pandemic only to quickly go back to where it was. Yea real wages for this sector have gone back up a wee bit. Of course the chicken hawks in the GOP joined by the chief economist for Fox and Friends (Princeton Steve) are all alarmed that UI benefits have led workers in this sector no to return to work.

Of course the thing holding people back a year ago is fear of the pandemic and that fear has not entirely disappeared. So the public policy solution would be to get even more vaccinations while the free market response would be a rise in real wages to induce more labor supply. Of course if you actually understood the market place – you would be fired as chief economist at Fox and Friends.

“Employment cost index (2005=100) deflated by CPI ”

ECI in real terms have risen a bit since 2017. How much has been wages v. fringe benefits?

It would be interesting to see real ECI over a longer period of time to judge this rise in context.

The composition issue is a big one,, and not just because it gives the impression of wage gains being stronger than they actually have been. The other composition problem is that lower income jobs were lost in such great numbers and it is low income households which are least able to deal with rising prices.

Which is why, of course, the various income security policies implemented during the pandemic are such a good idea. It’s probably not quantifiable, but economic stabilization policies in this recession seem better designed than in prior recessions.

Off topic: John Warner has died. Newt Gingrich is still alive. The world is now further out of balance.

Don’t forget Sam Rayburn, Carl Albert, Pat Moynihan, Dan Rostenkowski, and Henry Barbosa González. Those 5 were so awesome you have to count them each twice, so that makes minus 10 in world “balance”.

https://history.house.gov/Collection/Detail/29010?ret=True

https://www.amazon.com/Deception-Abuse-Fed-Gonzalez-Greenspans/dp/0292717857

Honorable mention James McDougal, Senatorial Aid to James William Fulbright, political fundraiser, great memoir writer, and all around hell of a guy. Heart attack inside a prison cell, age 57.

And NO, none of the above was meant in humor.

Molly Ivins’ ghost might crucify me for not mentioning at least one great female politician that has been lost~~Ann Richards.

I’m sure that there are a number of reasons why these are different:

• https://data.bls.gov/timeseries/CES0500000003?amp%253bdata_tool=XGtable&output_view=data&include_graphs=true

• https://www.bls.gov/news.release/realer.nr0.htm

But I’m presuming that most of the difference is accounted for by adjusting for inflation.

From April 2020 to April 2021, real average hourly earnings decreased 3.4 percent, seasonally adjusted.

The change in real average hourly earnings combined with a 2.7-percent increase in the average

workweek resulted in a 0.8-percent decrease in real average weekly earnings over this period.

The sneaky thing about inflation is that those who are least able to adjust for it are younger people. Some would argue that retirees are hit the hardest and that may be true for some, but in general I think retirees have more leeway in being frugal whereas students and younger families may start struggling if prices move up quickly… despite a somewhat artificial jump in average hourly wages when the lowest wage earners in restaurants and hospitality were laid off while some places were giving “hero pay” to those who stayed on during 2020 and getting wages bumped by new minimum wage laws in some states like Massachusetts and Virginia.

For most retirees, housing is not an issue.

• https://www.thebalance.com/inflation-may-be-understated-without-home-prices-5185542

Vehicle prices and cost of gasoline simply means maintaining the low-mileage old vehicle a little longer and traveling a little less.

• https://www.cbsnews.com/news/used-car-market-pricing-inflation/

Retirees will probably switch their eating habits from beef to chicken, but they’ll be okay. And they will eat out a little less.

• https://www.nytimes.com/2021/04/29/business/consumer-goods-prices.html

Clothing? Retiree can wear the same things for a decade.

Bruce,

More like switch from chicken to beef. There is a serious chicken shortage going on right now, the most serious meat item in shortage with prices rising. Pork also a bit short, but not beef. So, more likely subbng the other way.

I bought 6 pounds of high quality boneless chicken breasts for a mere $12 earlier this month. Today the price per pound was $4.59. OMG – hyperinflation. We are all going to die. But I did see a couple of young dudes figuring out how to buy less expensive meats, which tells me Brooklyn hipsters are a lot smarter than the punks who hang out in Bruce’s Michigan.

Of course they are different. But maybe you failed to notice how clearly BLS labels its graphs. Nominal v. real. Hourly v. weekly. I’m sorry but this is already way over your head. But WTF?

‘The sneaky thing about inflation is that those who are least able to adjust for it are younger people.’

Most kids I know are very aware of the options people have when faced with general inflation. Just because old man Bruce “no relationship to Robert” Hall still has not figured any of this out.

The sneaky thing about pgl is he focuses on the part that he can parse to say the opposite of what was said.

Younger people have options when inflation hits. They can go to less expensive colleges rather than the one they are qualified to attend. They can stay home with their parents rather than having their own place to live. They can ride a bicycle rather than purchase a car. Lots of options… sure. But not options that are necessarily positive ones. Is that your idea of “adjusting”?

How about young families? They can live in cramped quarters in areas they’d like to leave. They can depend on an old, but perhaps unreliable, vehicle. They can feed their children less nutritious, but less expensive, meals. Is that your idea of “adjusting”?

Keep focused on your day trading.

Bruce Hall: Your discussion of “options” and switching doesn’t make sense to me. For older households, presumably higher costs induce them to switch to less desirable options, else given previous price patterns, they would’ve already adopted those consumption patterns.

Now, on the other hand, if you were asserting that the young find goods less substitutable — i.e., their indifference curves are more “Leontiev” in shape — well that might be the case. I’ve not heard that argument recently, but it would seem to me that with older households more reliant on things like medicines, hearing aids, certain foods, etc., I would’ve guessed (in a non-scientific way) the opposite.

Just trying to help you couch your arguments in some sort of coherent (to an economist) structure.

“older households more reliant on things like medicines”

We do know older people are more likely to have real issues with COVID-19 and some of the treatments are expensive. But remember – old folks who followed the advice of Dr. Donald Trump had the option of treating their illness with inexpensive bleach!

“Bruce Hall

May 28, 2021 at 7:20 am

The sneaky thing about pgl is he focuses on the part that he can parse to say the opposite of what was said.”

It ain’t my fault that you write such long winded contradictory BS. I did not misrepresent you unless you think presenting facts that undermine your spin is misrepresentation.

Now run along little boy as your preK teacher is not pleased that you have not done your writing homework.

Bruce Hall claims his 2nd link provides information that looks different from what Menzie post but here is the title of the relevant table:

“Table A-1. Current and real (constant 1982-1984 dollars) earnings for all employees on private nonfarm payrolls, seasonally adjusted”

This is PRECISELY what Menzie posted. Oh but he provided us with a graph and not a table so according to Bruce Hall says they look different.

Yet another incredibly pointless and very stupid comment from the peanut gallery.

pgl, sorry you have a problem with information. If you can get to the text pulled from the link, you can actually get to the point.

What a pathetically whiny and dumb comment. I read the BLS links properly. Now do not blame me that you are incapable of understanding basic labels.

How did I miss this one?

“Vehicle prices and cost of gasoline simply means maintaining the low-mileage old vehicle a little longer”

First of all – young people are often the people who own used cars. But let’s see – Bruce Hall’s solution to higher gasoline prices is to continue to drive an old low mileage car?

Seriously? I know he is stupid but THIS stupid. OK – maybe I decided to “parse” something but me thinks I captured what he was advocating. No wonder Ford has such troubles when he worked for them!

Piggly Wiggly, how did I miss your response to ““Vehicle prices and cost of gasoline simply means maintaining the low-mileage old vehicle a little longer”

When vehicle prices are rising faster than your income, you hold on to the vehicle longer. Higher gasoline prices only exacerbate the problem. But as a day trader gulping beers and watching highly paid ball bouncers play, you are probably unaware of the realities for many people.

Harvard’s https://tracktherecovery.org/ records a – 23.6% employment decline for low income workers as of April 20, 2021 compared to January 2020. There has been a + 5.2% employment gain for high income workers.

https://fred.stlouisfed.org/graph/?g=rAvU

January 15, 2018

Real Median Weekly Earnings for men and women, * 1980-2020

* All full time wage and salary workers

https://fred.stlouisfed.org/graph/?g=lMkl

January 15, 2018

Real Median Weekly Earnings for men and women, * 1980-2020

* All full time wage and salary workers

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=muKd

January 15, 2018

Real Median Weekly Earnings for White, Black and Hispanic, * 2001-2020

* Full time wage and salary workers

https://fred.stlouisfed.org/graph/?g=muKc

January 15, 2018

Real Median Weekly Earnings for White, Black and Hispanic, * 2001-2020

* Full time wage and salary workers

(Indexed to 2001)

Someone can correct me, but I see 30 Year U.S. Treasury quoted around 2.27% right now. Now I am sure some Russian propagandist at ZeroHedge or some QAnon conspiracy expert knows better, but that number doesn’t scream inflation to me. Now….. I know I don’t catch everything, but to me, that one just doesn’t scream out inflation.

Would you park your money at 2.30% on the dumb-a$$ assumption of oil headed up to $4 a gallon at the gas station?? “Princeton”Kopits wouldn’t do that. “Princeton”Kopits would put all his money long on bagels futures But what does “Mr. Market” say?? “Mr. Market” seems pretty happy around 2.3%.

I have been arguing this for a while. People start screaming inflation if rates rise a quarter point. But we simply are not at levels where interest rates are anywhere near problematic for the economy. Now they may become problematic for a particular individual’s current investment thesis, but that does not mean we have inflation. It simply means somebody is gonna have to put a little effort into their passive income stream.

Treasuries are low and there is little wage growth pressure.

Yes – nominal interest rates on 30-year government bonds are 2.3% which is compensated for that 2.3% long term expected inflation rate. No the hyperinflation clowns like Princeton Steve and Bruce Hall are screaming about.

But did you catch Brucie’s stupid comment that the kids cannot adjust to inflation? My son certainly gets he can get a decent nominal return to compensate himself for the modest expected inflation we have. Then again my son actually learned a little economics and finance before becoming an engineer. I hope Bruce has smart kids too even if it means their dad is a constant embarrassment to them!

pgl,

Not to mention maybe your son bought bitcoin at $3 and has held it since, :-).

Fred reports the 30-year break inflation rate for the past 11 years and the current rate is not at all high compared to where it has been since 2010:

https://fred.stlouisfed.org/series/T30YIEM

Given the total inability of Bruce Hall to read even a simple graph, I would hope Moses would be kind enough to walk him through this!

There’s a whole lot to unpack here that isn’t part of wages but might be related. I’ll probably garble it badly, but here it goes anyway.

1. There’s probably some component of this that’s driven by ongoing reticence to rejoin the workforce due to fear of COVID or fear of the vaccine. I expect this to be temporary.

2. The supply problems that are ongoing might have an impact on wages, but I’m not sure how. That has an impact on prices. I expect it to be temporary.

3. The strange nature of this last recession means that the usual signals will be buried in a whole lot of static caused by the suddenness of the economic drop, the steep rise back up to some point near the bottom of a more “normal” recession, and the rounds of stimulus that injected money into the economy and caused fewer people to fall out the bottom of the economy.

My usual signals are useless for now. I see lots of displaced people living in tents, while work is both hard and easy to find. The usual recovery hand wringing about a “jobless” recovery is nowhere around this time. I was confused going into this recession even before it was amplified by a pandemic. Now I’m confused coming out again. Maybe for once, it really is different. I doubt it. I probably just don’t understand it well enough.

I live in the suburbs, with occasional jaunts to the city for groceries, etc. I have never seen in my entire life, including after 2008, the number of homeless people wandering around, holding cardboard signs, and shoving around shopping carts, than I have in the last 2–3 months. Outside of 7 years outside the country, during which most of the U.S. was in an upturn, which I have no personal experience gauge on, that’s a damned long time. Black, white, male, female, old, in their 30s. A relatively wide gambit of people. Call it a shallow, narrow and limited way to judge things if you like~~~you can get highfalutin and discuss supply-side shocks etc, whatever gets you off~~~this is why no one is going to convince me we’re in for inflation. It’s REFLATION. Who is going to buy hamburgers at a mark up?? Who is going to buy a couch or even a car at a markup?? If it’s not some idiot housewife who was letting Oprah hit her panic button, or Bill Gates buying gluten free bread and maternal clothes en masse for “The Wayward Female MCSEs and Vagigis For Awkward Flurting CEO Project” I don’t know where the hell the demand will be coming from for this “horrid inflation” Maybe John “Grumpy Economist” Cuckrant can pull some out of his “I have to be right someday if I yell ‘Inflation!!!!!’ 1,500,000 times over a 15 year time frame” rabbit hat???

Moses,

It varies depending on where one is, but there certainly are a of reports of housing costs going up a lot, although this also varies across renting and owning as well as where one is. But it may be that where you are is one of those places seeing especially rapid housing cost increases, which could explain the higher rate of homelessness you are seeing.

I am not seeing much change in numbers of homeless on the streets here in sleepy old Harrisonburg in the boring and lost Shenandoah Mountains where awful econ profs mislead unfortunate students.

Well, Harrisonburg does have at least one sleepy-headed resident, I agree with you there.

It’s never a good idea to hand weapons over to your opponents. Yet somehow I often end up……. I still believe the origin of the virus most likely came from a “wet market”. However, I will grant you this lends the most credence to your love of CIA lapdog David Ignatius……. and……oh do I have to say it!?!??!?!?!?! Your lab leak theory, you annoying SOB:

https://www.wsj.com/articles/intelligence-on-sick-staff-at-wuhan-lab-fuels-debate-on-covid-19-origin-11621796228

Moses,

I genuinely appreciate your noting that I was basically right a year ago when you and pgl were in agreement that I was not. I understand at the time the whole thing got so politicized, especially after Trump made claims not justified by the intel, and then embedded all of it in racist blather for totally political reasons, clearly not caring at all about the actual issue of figuring out what happened.

I remind that back then I sais we would almost certainly not be able to find out how it got started because the Chinese has destroyed so much of the data we neeed to figure out. The one new thing, although there were some hints back then, is that maybe we can find out who the first patients were, and there are these reports that they were or may have been people working in the main Wuhan lab. But I suspect the Chinese will really block all this.

Unfortunatly for defenders of the CCP, like our own ltr, China’s behavior in regard to this has not only been bad from the start, but has gotten worse. There was the initial destruction of data and suppressing of various people in China who were making various reports and claims. But more recently we have seen very aggressive efforts to try to bully anybody raising these issues, with China making massive trade moves against Australia when they asked for further study on this matter. This is something they should be completely open to, not making these kind of moves on. They have very recently pulled some other things that are very much annoying other nations, such as going after people in EU for asking about the Uighurs even though EU decided not to call it genocide. This led to the end of the EU-China investment pact.

In today’s WaPo Fareed Zakaria, not a particularly anti-China columninst, reports on how opinion about China has massively shifted in the last two years in a bunch of countries. It is ironic. As of 2 years or so ago, China looked much better than the US, with Trump having massively alienated lots of people in US allies, with China looking like the upholder of international standards and reason. But its poor behavior regarding Covid and other matters has completely changed that, with nations like UK, Canada, Sweden, Australia, South Korea, and others going from having net favorable views of China, to strongly net negative views. They have really very seriously shot themselves in the foot.

In any case, I do not expect them to aid any effort to really figure this out, and I feat too much important information has simply gone missing and will remain that way. We shall never really know.

From the Zakaria column today, here are the poll results he reports, which compare 2017 with today regarding “negative views of China”:

US, 47% to 73%

Canada, 40% to 73%

UK, 37% to 74%

Australia, 32% to 81%

South Korea, 61% to 75%

Sweden, 49% to 85%.

BTW, I note that the shift of PRC behavior from internationally respected and reasonable to just the opposite with popular opinion turning sharply against the nation in the last couple of years seems to have coincided with Xi Jinping undoing recent practices of leaders there stepping aside after 10 years and claiming lifetime leadership, following Putin in this, and with Tramp openly declaring he would like to do this also, nobody taking him all that seriously. But this move towards greater authoritarianism seems to have presaged a slide into idiotic and destructive policies that have been massively destroying international respect and support for the PRC.

More rapid wage increases are likely and in fact are happening in selected sectors and jobs. The problem for other workers is that paying some workerz more while paying more for other inputs and facing bottlenecks in filling orders creates an incentive to restrain wages overall.

Once again, the mess of the pandemic makes a mess of the analysis, as yoi suggested. Given the managerial class we have and the incentives they face, I’d bet against a steady, broad-based acceleration in wage gains.

“For one hard hit sector (leisure and hospitality), here is the evolution of real wages.”

Of course “average” wages in this sector spiked. It is dominated by low and minimum wage workers. If you fire all of the low wage workers and keep the higher paid management, their “average” is going to spike — and then return to normal when the low wage workers are rehired.

“These are all averages, and will not account for compositional changes in the employment pool.”

And that makes all the difference.

https://fred.stlouisfed.org/graph/?g=w3Wk

January 15, 2018

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=Ee37

January 15, 2018

Consumer Price Index for food at home and food away from home, 2017-2021

(Percent change)

https://www.nytimes.com/2021/05/27/opinion/us-economy-growth.html

May 27, 2021

The Economy Is Spinning Its Wheels, and About to Take Off

By Paul Krugman

You’re driving to an appointment, but you’re running late, and you’re stuck at a red light. Being a law-abiding citizen, you won’t run the light, but you floor the gas pedal the second it changes.

And for a sickening instant — maybe because the pavement is a bit wet — your tires spin uselessly before they gain traction and your car lurches forward.

You say that this has never happened to you? Yeah, right. Anyway, wheelspin is a common phenomenon, and usually harmless. A few minutes after your awkward jack rabbit start you’re driving normally, having mostly forgotten the whole incident.

Which brings me to the current state of the U.S. economy. The business news these days is full of anxiety. Raw material prices are soaring! Businesses can’t find workers! It’s the 1970s all over again!

Chill out, everyone. Mostly we’re just experiencing the economic equivalent of a moment of wheelspin….

I thought this was an extremely well written story. I give the yahoo link because I presume it will be less-likely to have a paywall:

https://news.yahoo.com/cdc-not-investigate-mild-infections-182129232.html

I have had BOTH of the Moderna shots. All of my anti-bodies should have been fired up by May 31 (still wearing mask for next 4 days). I have been strongly leaning towards NOT getting the “booster shot” whenever it comes out, and probably going 3 years before getting another shot related to Covid-19. However, this article has me wondering a little now.

We are still in the early days. As more data emerges, we will have a clearer picture on if/when a booster is needed. The big issue are the variants. And we cannot control them but we can control how often they emerge by vaccinating as much of the world as quickly as possible. Places like brazil are now a covid producing stew. We need to limit this, because ultimately a vaccine resistant variant puts us back into the summer of 2020.

https://www.nytimes.com/2021/05/25/opinion/biden-free-community-college.html

Morning Joe is trying to cover a big scandal in NYC politics but they can’t get the name of Jean Kim right calling her Tara Reed. Rely on New York One guys:

https://www.ny1.com/nyc/all-boroughs/news/2021/04/30/scott-stringer-team-says-sexual-assault-accuser-works-for-andrew-yang

Here’s the deal. Scott Springer was the leading progressive candidate while Andrew Yang was the leading centrist candidate. Jean Kim is a member of the Yang Gang and she is also the person who accused Springer of sexual harassment. A lot of progressives turned on Springer at first but are now wondering about Ms. Kim’s allegations. And I thought our subways were dirty!

I find it so sweet how the GOP who’s policies have never shown any concern for the poor suddenly are all worried that inflation will “hurt the poor”. If current policies end up giving a poor person 10-20% increased salary, but also increase inflation to 3-4%, the poor will get out way ahead of the game. It is Wall Street that will hurt most from inflation picking up a bit. It’s pathetic to see certain economist doing the bidding of their masters by once again being worried that the rich may lose and the poor gain a slightly bigger slice of the pie.

Yeah, I agree. These people *forget*, or ignore, the fact that the rich have more options available than do the poor because, guess what?, they have more money than the rest, the majority, of us! Witness the rich families that fled cities, i.e., Covid-19 hot spots, for rural areas when the pandemic began. And the well-to-do who formed learning pods with a few other well-to-do families, hired a private teacher, and ensured that their precious babies gained an educational advantage over everyone else’s kids. And the Amazon Divide between those who can afford to use online shopping (with home delivery, of course) and the majority of people who can’t afford that, etc., etc. “More money=more options” is true whether the subject is a pandemic or inflation.

Even so, I think our best bet is to put up with some transitory ‘high’ inflation and hope that we finally get some pressure for higher wages. This is the same reason that, after the transitory period, we should be willing to accept persistent inflation that’s a little higher than we’ve had since the Great Recession. Higher wages will offer a few more options to a few more households. This is both right and necessary.

https://cepr.net/debts-deficits-and-patent-monopolies/

May 27, 2021

Debts, Deficits, and Patent Monopolies

By DEAN BAKER

Yes, it is spring. The flowers are blooming, the birds are singing, and the deficit hawks are whining. The proximate cause is President Biden’s new budget, which will push the ratio of government debt to GDP to its highest level ever.

The question is whether this should bother anyone who has a life? The projections show that the debt to GDP ratio will rise to 117 percent of GDP in 2031. If that sounds scary, consider that Greece’s debt to GDP ratio is over 180 percent. And, the bond vigilantes don’t seem to be too bothered by this. The interest rate on long-term Greek debt is 0.8 percent, compared to the 1.6 percent on U.S. Treasury bonds.

Of course if we really want to go big we can look at Japan, where the debt to GDP ratio is approaching 250 percent of GDP. It is paying 0.08 percent interest on its long-term debt.

But let’s get to the issue at hand, how patent monopolies are like government debt. At the most basic level, we have to understand that patent (and copyright) monopolies are a way the government pays for things it wants. Instead of using government funds to pay drug companies to develop new drugs and vaccines, we reward them with a patent monopoly. (Actually, in some cases, like Moderna, we do both. We pay them and give them a patent monopoly.)

In the government’s accounting we treat patent monopolies and spending very differently. The grant of a patent monopoly does not appear in the government’s budget, so we can award these monopolies as an alternative to direct spending if we want the deficit to appear smaller.

We sometimes have literally gone this route of using a patent monopoly, or an equivalent grant of exclusivity, as a substitute to direct spending….

“The grant of a patent monopoly does not appear in the government’s budget, so we can award these monopolies as an alternative to direct spending if we want the deficit to appear smaller.”

Yep but think about putting an excess profits tax on these monopoly profits. Instead of taxing them at 21%, why not tax them at 70%?

Of course if those profits come from operations abroad, FDII taxes them at 13.125% not 21%.

We must change this tax code.

https://news.cgtn.com/news/2021-05-28/The-post-pandemic-whiplash-awaiting-the-world-s-poor-10CSZ3rZODu/index.html

May 28, 2021

The post-pandemic whiplash awaiting the world’s poor

By Kaushik Basu

The world is currently transfixed by the second wave of the COVID-19 pandemic sweeping through many regions, especially Asia, Africa, and South America. But, focused as we are on the public health crisis, we risk overlooking pandemic-related economic problems that could plague developing countries long after the wave has receded.

At the global level, the International Monetary Fund has warned of a “Great Divergence,” whereby rich countries recover strongly while others flounder. Recent evidence suggests that several advanced economies, notably the United States, and a few developing countries, like Vietnam, Thailand, and Bangladesh, seem to be pulling out of the crisis and could grow faster than they did before the pandemic. But many emerging economies and low-income countries are likely to languish for a long time.

A Great Divergence is visible even within economies. The pandemic has punished sectors such as hospitality, travel, and tourism, and boosted others like pharmaceuticals, digital platforms, and networking technology.

It is therefore not surprising that many rich people, including those who are good at navigating equity markets, have actually emerged from the crisis better off, while the poor have borne the brunt of its impact.

Therein lies the real danger. Unlike a pandemic that puts rich and poor alike at risk, the kind of economic crisis currently simmering in much of the developing world does not affect the rich as much and therefore does not generate headlines and is easy to disregard – that is, until it can no longer be ignored….

Kaushik Basu is professor of economics at Cornell University.

Biden announces New Bargain:

https://cnsnews.com/article/national/susan-jones/biden-floats-new-cliche-new-bargain

Let’s hope this is closer to the New Deal than that Grand Bargain.

Bruce Hall thinks old people have more options to deal with rising prices than young people. In light of the back and forth, I thought it might help if we checked on the nominal cost of medical care over the past decade:

https://fred.stlouisfed.org/series/CPIMEDSL

Prices up 31% or 2.75% per year. Now what options do old people who rely more on medical care than the kids do have? I guess Bruce Hall might argue that they just not take expensive medicines.

Now they might die but we have seen how Bruce Hall consistently dismiss the vast number of deaths to the elderly from COVID-19. So yea – they do have options I guess.