and expectations for May…

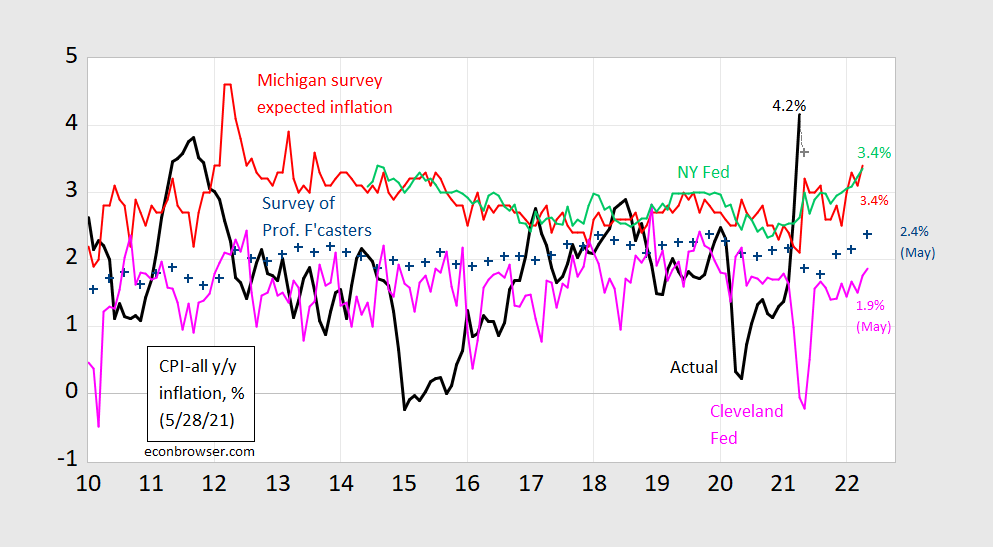

Figure 1: CPI inflation year-on-year (black), Bloomberg consensus for May inflation (gray +), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink). Source: BLS, Bloobmerg (as of 5/28), University of Michigan via FRED, Philadelphia Fed Survey of Professional Forecasters, NY Fed, and Cleveland Fed.

Michigan and NY Fed measures have ticked up in April to 3.4%. Cleveland Fed’s hybrid measure rose to 1.9% as of May.

Bloomberg consensus for May CPI inflation (year-on-year) is 3.6%, down from April’s 4.2%.

Saw gas per gallon at the pump today as low as $2.43. I suspect there’s a $2.41 out there somewhere but there’s only so many stations I drive by randomly. Nearby by me as high as $2.65, so the divergence is mildly surprising to me.

Michigan Survey of Consumers (red) shot up a lot around 2012. What was up with that?

Oh wait Romney-Ryan was running around telling everyone that Obama’s economic policies were socialist disasters. Funny thing – actual inflation never took off.

Anyone have any thoughts on this Ivermectin stuff?? It kinda had the slight smell of snake oil to me on a surface glance and the opinions were so strongly varying on it. Yet it seems like someone who is high up in the Emory School of Medicine would be a pretty reliable source:

https://timesofindia.indiatimes.com/blogs/voices/existing-affordable-drugs-could-rapidly-reduce-covid-19-cases-and-deaths-in-india/

If the alternative choice in India is throwing cold bodies into a log-jam of corpses in the nearest river, what exactly have you got to lose??

https://www.nytimes.com/2021/05/28/upshot/president-biden-6-trillion-budget-plan.html

May 28, 2021

One Thing Missing From the Biden Budget: Booming Growth

For all the administration’s focus on transformational policies, it’s not forecasting an outburst of economic potential.

By Neil Irwin

President Biden’s budget proposal includes billions of dollars for clean energy, education and child care — ideas being sold for their potential to increase America’s economic potential. One thing it does not include: an outright economic boom.

In the assumptions that underpin the administration’s budget, economic growth is strong in 2021 and 2022 — but strong enough only to return the economy to its prepandemic trend line, not to surge above the trajectory it was on throughout the 2010s.

In 2023, G.D.P. growth falls to 2 percent in the budget assumptions, then to 1.8 percent a year through the mid-2020s. That is lower than the 2.3 percent average annual growth rate experienced from 2010 to 2019.

The administration’s restrained outlook is consistent with projections by other forecasters, including at the Congressional Budget Office and in the private sector. But it means that the Biden White House is not — at least not formally — forecasting the kind of rip-roaring growth that characterized periods like 1983 to 1989 (with an average annual G.D.P. growth of 4.4 percent) and 1994 to 2000 (4 percent).

Those surges, among other things, helped propel two presidents to comfortable re-elections.

If the new projections were to prove accurate, it would imply two years of strong growth paired with moderate inflation as the nation recovers from the pandemic heading into the 2022 midterm elections, but then comparatively low growth in the run-up to the 2024 election.

The sober estimate contrasts with the approach Mr. Biden has taken to selling his agenda publicly. The framing of his signature plans for infrastructure and family support has been that they will enable the economy to become more vibrant and productive….

“But it means that the Biden White House is not — at least not formally — forecasting the kind of rip-roaring growth that characterized periods like 1983 to 1989”

The NYTimes has turned into the National Review. When this period started, we had a massive output gap. No – the Reagan years were not characterized by a surge in potential output by anyone who is an actual economist.

I think your National Review analogy is a little extreme (like most of your analogies). Irwin is just not that great of a writer. Frankly I find it hard to believe the man has an MBA. It’s not right-wing jargon, it’s just band-wagon analysis. No crime, just cliche. Irwin is not trying to be Simon Kuznets, he’s trying to be Micheal Lewis, and succeeding at neither.

Excuse me for the misspelling , Michael Lewis of “Moneyball” fame.

Yea – he is not that great of a writer. Nor is he very bright. The truth be told – the Reagan era saw a reduction in the growth rate of potential output. But you would not know that reading that National Review. And of course anyone reading Irwin would get the wrong idea as well. Krugman likely was not very happy with this horrific piece of writing.

https://jabberwocking.com/federal-budgets-never-do-much-to-spur-long-term-growth/

Paul Krugman and Kevin Drum gets this issue right. Neil Irwin should read what they wrote and apologize to the readers of the NYTimes for his latest nonsense.

Lol

https://pbs.twimg.com/media/E2ZjqfmVkAIBku-?format=png&name=900×900

@ EConned

There is some humor there, and I’ve made very similar statements related to EU central bank forecasts, stealing (as I often do) from the wisdom of an old school scholar named Ashoka Mody, but you realize, your graph is basically an amalgam of private forecasters, right?? Meaning that if your goal was to take a gut-shot at the Fed (I don’t know if that was your intention or not), you’ve failed in this aspect. It’s also worth noting, that a creature you have seemingly intimated to be one of your personal heroes in life, the orange abomination, was weeping and having a baby-fit during the entire four years of his one-term presidency that he needed lower rates from the Fed.

Of course I realize what the graph is that I posted. What’s your point?

You’ve failed by suggesting my post was somehow “ to take a gut-shot at the Fed”.

Please provide a single instance of me suggesting Trump is a “personal hero”. I’ll be waiting. Moreover, if it were true, how is that at all relevant to my reply? It’s not.

The meandering and absolutely hollow nature of 99% of your posts never fail to surprise me. Maybe you’ve had too much ivermectin? Lol

If you post a link without comment, you dont get to criticize others for guessing wrong on your intent. You posted for a reason.

@ Econned

I think someone is still b*tt-hurt I called him a Republican snowflake.

You say donald trump is not your personal hero, and yet you run to the defense of trump lapdogs such as Judy Shelton.

You say donald trump is not your personal hero and yet use phrases such as, and I quote verbatim “MAGA doesn’t live in an ivory tower”.

You can claim the Federal Reserve wasn’t the target of your barb, because I have now informed you who was involved in the Fed survey. Our ONLY other choice is that you were laughing at privateeconomic forecasters, many of whom make 6-7 figure salaries (or more) to do what they do. Which is why the Fed surveys those professionals. If they were your target, then you don’t like private forecasters?? I think readers of even just average intelligence know what your intent was.

See, your assumptions are based on poor logic and is one example of the problem I with internet “discussions”.

First, I’ve never once ran to the defense of Shelton. You’re confusing my citing a respected dictionary as support for a label for Shelton with me defending her. Your logic and assumption is flawed. Moreover, I’ve stated clearly that I’m not a fan of Shelton and glad she wasn’t confirmed by Senate to the full an empty FRB seat.

And, yes, “MAGA doesn’t live in an ivory tower”. This in no way signals support for Trump. Please go read the context and tell me how you disagree with it.

My reply wasn’t about my liking or disliking of anything or anyone. I posted the graph showing forecast error and bias of inflation because this is a post about inflation forecasts. And, I agree, anyone with average intelligence (who also aren’t into making strange and unfounded assumptions) should see this.

Econned, your post was an attempt at trolling. Perhaps if you are having trouble with internet discussion boards, you should re-examine your approach. If you want a more fruitful discussion then dont act like a troll.

LOL is such an insightful comment – not! At least you did not go off on the fear of hyperinflation (this time)!

Talk about “insightful”… I have NEVER gone off on the fear of hyperinflation (this time or any time) unless I was criticizing the commentary of another. Please direct me to a single instance of such. I’ll be waiting.

Can anyone tell me why sites like Peterson Institute put up RSS links on their site when the damned thing NEVER works over a period of MONTHS???? Attention Peterson Institute webmaster, fix your RSS feed link or take the damned thing down or just get your head out of your……..

Found this link in a Politico story on U.S. farm subsidies. Thought others might find it interesting:

https://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances/farm-sector-income-forecast/

A lot of detailed information. This is the kind of stuff CoRev and Sammy would pour over before writing some rant that totally misrepresents reality.

Note that first chart of net farm income from 2000 to today. This soared during the early Obama years only to retreat back to the historical average in the latter part of his tenure in the White House. Of course CoRev and Sammy would pretend 2014 was a normal period to tell us how awful Obama was for farmers. Classic National Review style misrepresentation!

They would have company in that endeavor. IIRC, from FDR’s Agricultural Adjustment Act onward, US ag policy has treated the period 1910-1914 as the reference period for AG commodity prices, despite the fact that those prices were considerably above their long term averages during that period. Therefore, farm income was higher than normal during those years as well.

I don’t hear or read as much about it now as I used to in the 70s, 80s and 90s, but this historical precedent meant that, every five years when we ‘needed’ a new age policy bill, farm lobbyists would don their hair shirts and hit the papers, TV, and Capitol Hill to plead poverty among the stalwart yeoman family farmers they represented to get higher target prices, lower loan rates, etc., in the new bill, by comparing to the reference years.

@ Dr. Dysmalist

I tend to agree with you on this, but this isn’t any thought that is revolutionary, An early 1980s Menzie Chinn, and even a young (and, at that time, assumably still sane) Peter Navarro might even say they beat you to the punch.

The more interesting question here is, why are Republicans seemingly more enthusiastic about handing out federal government welfare and setting out the hog trough to American farmers than they are in giving teachers a living wage?? Do Republicans find something more “conservative” about centrally planned price floors for food no one wants and empty children’s minds??

Farmers are viewed as businessmen, at lost small businessmen. That is appealing to republicans, snd makes the farmer feel important, because he is not thought of as a stoopid laborer. The farmer also controls the wages of the laborers in the field. Teachers are laborers, not management. Ever notice how the elementary school principal suddenly becomes a republicans, after years of teaching as a democrat! All about the roles of labor and management.

Moses,

Menzie is much younger than Navarro. Menzie was born in 1961 and got his PhD from Berkeley in 1991. Navarro was born in 1949. Menzie was the young economist in the 1980s, still a student. Navarro has had a longer time during which he has gone rotten.

James Kwak, are you out there brother?!?!?!?!? Come on Jamesy, even a hardcore Celtics fan thought that Smart gunk on Griffin was BS!!!!

Are you cheering for our Nets? So happy that those obnoxious Manhattan Knicks were silenced in the ATL. Go Hawks!!!

Mainly just a Durant fan, but I like Blake Griffin as well. I pull for the team because of those two. For the most part I have no geographical allegiance in sports. I gravitate to teams which have personalities I like. For example I like Scott Brooks a lot, who coaches the Washington Wizards, but I hate Russell Westbrook. So my strong dislike of Westbrook cancels out me pulling for the Wizards.

Durant should have been a Sonic. Well he was for a very short time. He should have stayed a Sonic. The Sonics should have stayed the Sonics.

https://www.nytimes.com/2021/05/28/opinion/us-dollars-currency.html

May 28, 2021

Wonking Out: The greenback rules. So what?

By Paul Krugman

Cryptocurrency was supposed to replace government-issued fiat currency in our daily lives. It hasn’t. But one thing I’m still hearing from the faithful is that Bitcoin, or Ethereum, or maybe some crypto asset introduced by the Chinese, will soon replace the dollar as the global currency of choice.

That’s also very unlikely to happen, since it’s very hard for a currency to function as global money unless it functions as ordinary money first. But still, it’s definitely conceivable that one of these days something will displace the dollar from its current dominance. I used to think the euro might be a contender, although Europe’s troubles now make that seem like a distant prospect. Still, nothing monetary is forever.

But does it matter? My old teacher Charles Kindleberger used to say that anyone who spends too much time thinking about international money goes a little mad. What he meant, I think, was that something like the dollar’s dominance sounds as if it must be very important — a pillar of America’s power in the world. So it’s very hard for people — especially people who aren’t specialists in the field — to wrap their minds around the reality that it’s a fairly trivial issue.

First things first: Dollar dominance is real. These days America accounts for less than a quarter of world G.D.P. at market prices; less than that if you adjust for national differences in the cost of living. Yet U.S. dollars dominate currency trading: When a bank wants to exchange Malaysian ringgit for Peruvian sol, it normally trades ringgit for dollars, then dollars for sol. A lot of world trade is also invoiced in dollars — that is, the contract is written in dollars and the settlement is also in dollars. And dollars account for about 60 percent of official foreign exchange reserves: assets in foreign currencies that governments hold mainly so they can intervene to stabilize markets if necessary.

As I said, this sounds like a big deal. The dollar is, in a sense, the world’s money, and it’s natural to assume that this gives the United States what a French finance minister once called “exorbitant privilege” — the ability to buy stuff simply by printing dollars the world has to take. Every once in a while I see news articles asserting that the special role of the dollar gives America the unique ability to run trade deficits year after year, an option denied to other nations.

Except that this just isn’t true. Here are the current account balances — trade balances, broadly defined — of a few English-speaking countries over the years, measured as a percentage of their G.D.P.:

https://static01.nyt.com/images/2021/05/28/opinion/krugman280521_1/krugman280521_1-articleLarge.png

We’re not the deficit kings.

Yes, America has consistently run deficits. Australia has consistently run even bigger deficits; the U.K. has fluctuated around, but has also run big deficits on average. We’re not special in this regard.

Still, can’t we borrow money more cheaply because the dollar is top dog? If so, it’s a pretty subtle effect. As I write this, 10-year U.S. bonds are yielding 1.6 percent; British 10-years 0.8 percent; Japanese 10-years 0.07 percent. Lots of factors affect borrowing costs, but if the fact that neither the pound nor the yen are major global currencies is a major liability, it’s not obvious in the data.

Now, the pound used to be a major international currency. It wasn’t overtaken by the dollar as a reserve currency until 1955. It was still a major player into the late 1960s. But then its role quickly evaporated. By 1975 the pound was basically just a normal advanced-country currency, used domestically but not outside the country.

So did the value of the pound take a big hit when that happened? No. Here’s the real pound-dollar exchange rate — the number of dollars per pound, adjusted for differential inflation — since the early 1960s:

https://static01.nyt.com/images/2021/05/28/opinion/krugman280521_2/krugman280521_2-articleLarge.png

The pound is dead, long live the pound.

There have been some big fluctuations over time, reflecting things like Margaret Thatcher’s tight-money policy and Ronald Reagan’s mix of tight money and deficit spending. But the pound has in general been much stronger since it stopped being a global currency than it was before. That’s not a big mystery: It probably reflects London’s continuing role as a global financial hub in an era of financial globalization. But again, it’s hard to see evidence that losing global currency status made much difference.

So is the dollar’s status completely irrelevant? No. The dollar’s popularity does give America a unique export industry — namely, dollars themselves. Or more specifically, Benjamins — $100 bills, which bear the portrait of Benjamin Franklin.

These days the ordinary business of life is largely digital; many Americans rarely use cash. Even the sidewalk fruit and vegetable kiosks in New York often take Venmo. Given that lived reality, it’s jarring to learn just how much currency is in circulation: more than $2 trillion, or more than $6000 for every U.S. resident.

What’s all that cash being used for? One important clue is the denomination of the notes out there:

https://static01.nyt.com/images/2021/05/28/opinion/krugman280521_3/krugman280521_3-articleLarge.png

It really is all about the Benjamins….

Here’s the real pound-dollar exchange rate — the number of dollars per pound, adjusted for differential inflation — since the early 1960s:

https://fred.stlouisfed.org/graph/?g=EkBQ

January 15, 2018

Price of an American Dollar in United Kingdom Pounds by GDP Implicit Price Deflator in United Kingdom / GDP Implicit Price Deflator in United States, 1960-2016

— Paul Krugman

While Paul Krugman writes: “Here’s the real pound-dollar exchange rate — the number of dollars per pound, adjusted for differential inflation — since the early 1960s,”

https://fred.stlouisfed.org/graph/?g=EkBQ

January 15, 2018

Price of an American Dollar in United Kingdom Pounds by GDP Implicit Price Deflator in United Kingdom / GDP Implicit Price Deflator in United States, 1960-2016

an alternate FRED graph shows:

https://fred.stlouisfed.org/graph/?g=EkK6

January 15, 2018

Real United States / United Kingdom Foreign Exchange Index in the United Kingdom, 1960-2018

(Indexed to 1960)

I do not understand this difference in graphs.

https://www.imf.org/en/Publications/WEO/weo-database/2021/April/weo-report?c=193,112,111,&s=BCA_NGDPD,&sy=1980&ey=2020&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2021

Current Account Balance as percent of Gross Domestic Product for Australia, United Kingdom and United States, 1980-2020

http://www.xinhuanet.com/english/2021-05/29/c_139977321.htm

May 29, 2021

Over 600 mln COVID-19 vaccine doses administered across China

BEIJING — Nearly 603 million doses of COVID-19 vaccines had been administered across China as of Friday, the National Health Commission said Saturday.

[ Vaccine doses are being administered in China at a quickening pace that is now about 20 million a day. ]

It might be nice if you ever discussed efficacy of the SinoVac. Over and over you refuse. I wonder if the reason is that its efficacy is around 60% whereas AstraZeneca is over 75%.

https://www.healthline.com/health/astrazeneca-vs-sinovac

What is the efficacy of these shots?

It’s “efficacy” is that It helps Xi Jinping and the CCP to not appear to be what they actually are–useless, worthless, and an ugly stain of black stinky dofu Chinese citizens cannot get off their clothes.