William Luther at AIER asks “Is Inflation Merely Catching Up?“:

…it is simply not the case that the observed inflation has merely been what was required for catching up. The price level today is greater than what it was expected to be in the absence of a pandemic and what the Fed implicitly said it would be given its two-percent inflation target. The price level has more than caught up with expectations. The question, now, is whether it will continue to grow so rapidly, remain elevated, or subside.

In other words, his answer to the question posed in the title is “no”. Whether it has pernicious effects depends on how persistent inflation is relative to expected.

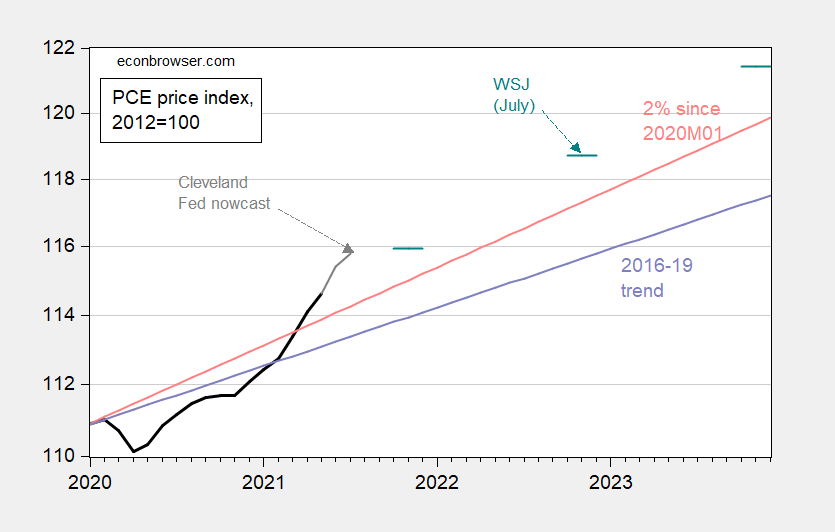

I have graphed the data for the PCE price index, the Cleveland Fed’s nowcast as of 7/26, and WSJ July forecast against the 2015M01-2021M01 trend Dr. Luther cites, as well as the 2% trend.

Figure 1: Personal Consumption Expenditure (PCE) price deflator (black), Cleveland Fed nowcast (gray line), WSJ survey mean (teal line), 2015M01-20M01 trend (light blue), 2% trend from 2020M01 (pink), all 2012=100, on log scale. Source: BEA, Cleveland Fed (accessed 7/26), WSJ July survey, and author’s calculations.

Using Dr. Luther’s trend it seems clear that the PCE price index has overshot as of today, if the Cleveland Fed’s nowcasts are accepted. With inflation persistently higher than 2% (as indicated in the WSJ’s July survey of economists), then the price level continues to diverge from trend.

As of July, the price level would be 1.3% above trend; and 1.5% by November 2023 (in log terms). Useful to compare with the fact that in April and May of 2020, the index was 1.2% below trend.

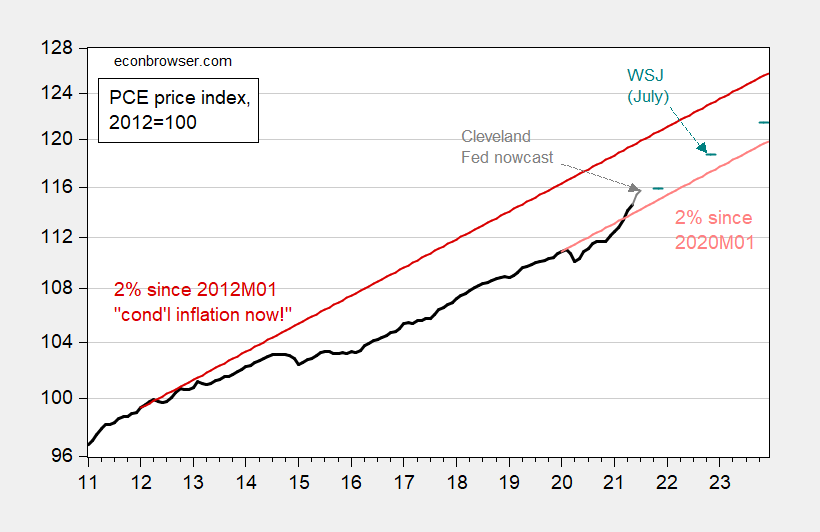

Back in January of 2012, Jeffry Frieden and I called for conditional inflation now! at 4%-6% for several years. That call (if for 2%) implies the following:

Figure 2: Personal Consumption Expenditure (PCE) price deflator (black), Cleveland Fed nowcast (gray line), WSJ survey mean (teal line), 2% trend from 2020M01 (pink), 2% trend from 2012M01 (red), all 2012=100, on log scale. Source: BEA, Cleveland Fed (accessed 7/26), WSJ July survey, and author’s calculations.

From that perspective, we have a lot of catching up to do. As of July, the price level would be 3.4% below trend; and 3.3% by November 2023.

Which one is the right comparison? Dr. Luther is right to interpret the shock as coming with the pandemic in early 2020. Moreover, Flexible Average Inflation Targeting (FAIT) can be dated as being effective in January 2020, so another reason to make that comparison. On the other hand, if we have been thinking trying to redress overly slow price inflation over the past decade in the wake of the Great Recession, then the calculations in Figure 2 are in some sense more appropriate.

The one thing that caught my eye in this AIER discussion was his claim that the optimal inflation rate is zero. Seriously? What was the literature he relied on? Here is where his link took us:

“This is the interactive application for The Reader’s Guide to Optimal Monetary Policy , written by Anthony M. Diercks”.

I’m sorry but how is Anthony Diercks and why should anyone bother with his little application?

As I have said before, Piketty noted that inflation is a twentieth century phenomenon. While there were periods of inflation in the nineteenth century, prices typically reverted to earlier levels. Few would complain about the rates of economic growth experienced back then.

There are lots of things worth worrying about more than the “right” rate of inflation, something that far too many economists spend far too much time obsessing about. It’s far better to leave it to the banksters to worry about the real value of their assets and liabilities.

JohnH,

You are dead wrong that “Few would complain about rated of economic growth experienced back then” (referring to the nineteenth century). The 1870s and 1890s both experienced depressions with substantial negative economic growth for several years, these decades worse than any others in US history than any others aside from the 1930s. Plenty of people complained about the negative growth during both of those periods of time.

They were also accompanied by outright deflation, falling prices, not inflation. This was what led to the “Cross of Gold” speech by William Jennings Bryan at the 1896 Democratic convention, one of the only two times that an opening speech at a convention led to the speaker, not up to then a candidate, getting the nomination by the party (the other time was for the GOP in 1940 with Wendell Wilkie and his “One World” speech).

I would think that a progressive with a strongly populist orientation would be on top of all this.

Barkley, it is entirely possible to have depressions and rapid economic growth. In the US, particularly after the Civil War, the US economy grew strongly in spite of depressions. In fact, per capital income doubled.

https://en.wikipedia.org/wiki/Economic_history_of_the_United_States#Late_19th_century

But when Piketty makes statement that inflation is a twentieth century phenomenon, he is looking at a broader picture than just the US.

As a progressive, I would prefer that economists obsess less about inflation and more about how to realize high real household income growth without inflation. This happens when growth in productivity gets passed along mostly to labor not capital, something that has not occurred much in the last half century.

JohnH,

That late 19th century growth was very uneven. Most of it was in the 1880s, probably the boomiest decade of all US history with the greatest growth for a decade of several major US industries, especially railroads. But it was surrounded by two seriously depressed decades. This was also a time of massive inequality and by the end of the century industrial concentration, the rise of the trusts that Teddy Roosevelt would bust later.

You are still misrepresenting economic performance during the 19th century? Come on dude – even your own dog is laughing at you.

“This was also a time of massive inequality and by the end of the century industrial concentration”.

Gee – Barkley just called out one of your incessant lies about the 19th century – a period you adore simply because we did not have sustained inflation. The income inequality back then was in part due to the monetary collapses that kept price inflation low on average. But a fact free gold bug like you can never address the reality of our economic history.

I would have thought you would have stopped this really dumb adoration of the gold standard era by now. But you persist with embarrassing yourself. So hey!

JohnH has always been a gold bug. So why do you think he actually cares about reliable economic data?

There is a difference with being a gold bug and being someone who doesn’t understand the point of an obsession with inflation. But pgl doesn’t get nuance.

I liken inflation to measurement of body temperature. When I go to the doctor, my temperature might be 97.6 or it might be 99.0. No one is concerned. They only take note and record it. But if the temperature rises above 100, doctors start to show concern.

But economists are a different breed. If inflation is 0.5% or 2.8%, far too many economists make it sound like impending disaster, because the rate is different from their arbitrarily set ideal of 2% (arbitrary because there is nothing inherently normal about it. The nineteenth century did not need it for economic growth, yet growth was impressive.)

IMO there should be a range, say between -2% and +4% inflation where economists simply take note and move on to study more important, generally neglected problems, like how to get productivity gains passed along to labor or how to preserve workers real income gains after the Fed induces a recession following a hot economy.

JohnH: I generally agree with your main point that we shouldn’t obsess about inflation; however we do have a body of theory that indicates that unexpected negative inflation cet. par. is a bad thing because of the impact on collateral constraints, and hence effects via the financial accelerator.

“But economists are a different breed. If inflation is 0.5% or 2.8%, far too many economists make it sound like impending disaster, because the rate is different from their arbitrarily set ideal of 2%”

Of course no economist does this. Unless you think the idiot talking heads at CNBC are economists, this statement of yours is a lie. Pure and simple. But JohnH lying to make a “point” is nothing new.

“But economists are a different breed. If inflation is 0.5% or 2.8%, far too many economists make it sound like impending disaster, because the rate is different from their arbitrarily set ideal of 2% (arbitrary because there is nothing inherently normal about it.”

maybe you need to further classify which types of economists feel this way. in general, you seem to be describing an economist with a conservative perspective rather than a more liberal perspective. in addition, the two camps do not treat the deviation symmetrically. as menzie noted, there is a difference in view when we trend toward deflation rather than higher inflation, especially between the two camps.

JohnH opens mouth and inserts foot again:

“But economists are a different breed. If inflation is 0.5% or 2.8%, far too many economists make it sound like impending disaster, because the rate is different from their arbitrarily set ideal of 2% (arbitrary because there is nothing inherently normal about it. The nineteenth century did not need it for economic growth, yet growth was impressive.)”

First of all we had negative inflation early on in 2020 followed by above 2% inflation after we came out of the pandemic slow down. Now I know of ZERO economists who were freaking out over any of this. JohnH wants us to believe all economists were freaking out but he failed to note the name of a single one.

But note he continues to praise the 19th century growth record even though every economic historian knows of the multitude of depressions that occurred. Now as many times that you have noted this – JohnH can no longer plead ignorance. Which means he is indifferent to the pains of depression aka a gold bug.

“maybe you need to further classify which types of economists feel this way. in general, you seem to be describing an economist with a conservative perspective rather than a more liberal perspective. in addition, the two camps do not treat the deviation symmetrically. as menzie noted, there is a difference in view when we trend toward deflation rather than higher inflation, especially between the two camps.”

Baffling said this better than I did. Yes Cochrane and certain gold bug freaks flip out when inflation hits 3%. But so does JohnH.

Great Britain after WWI tried to get its price level back down and the results of its return to the gold standard was a disaster. The early writings of Keynes noted this but then people like JohnH and the gold bugs never heard of Keynes.

After making this claim about 500 times now, you still haven’t shown us these links where JohnH proclaims himself a goldbug. Thoma’s site is still online. Why don’t you just show us ONE of these comments??

William Luther’s macroeconomic views are what one would expect from someone who took economics at George Mason. But it is this endorsement of private investment over public investment that is a real Laugher:

https://www.aier.org/article/the-myth-of-the-crowding-out-myth

His whole argument assumes away externalities of any sort. I guess one could also argue we do not need vaccines in the absence of COVID-19. Could someone wander over the George Mason and ask their economic facility to consider the real world?

It is interesting that Luther highlights the Golden Gate Bridge. Hey I lived in SF and that bridge is a marvel. But I wonder if this uber free marketer realizes that the construction of the bridge was financed by government issued bonds.

figure 2 illustrates why i am not concerned much with inflation, at this point in time. certainly not concerned enough for some major change in policy meant to address inflation (as in reduce it). there is still a realistic possibility that cleveland fed curve falls below the 2020 trend line in the next year or so. that would be worse, compared to inflation being above the 2020 trend for a while. not going to get to the 2012 trend until the long run, in which case…

@ baffling

Quit worrying about unimportant things like virus death rates and how people are going to pay their housing bills and get lunch in their tummies. True intellectuals (such as myself) are wondering who will finish higher in the SEC football after the conference transfer, OU or ……… Oh damn, I can barely say it without puking stomach bile…… Texas Longhorns????

Just to be clear, you are worried about who will come in second place. THE Ohio State University Buckeyes are the logical first place choice.

THE Ohio State! Sort of like those rich kids in Palo Alto who attend Stanford and cheer for THE CARDINAL.

Of course there are more than one person on most football teams but the kids at Stanford are above the rest of us!

Can’t decide if you are ribbing me or not. Ohio State is in the Big 10 and is usually referred to as “OSU” if not verbally referred to as “Ohio State”. Certainly they would not be referred to as “OU”.

Damn, we don’t have ANY football fans on this blog??

just giving you a hard time. everybody knows there is THE Ohio State University Buckeyes, and then everybody else. I guess you never watch nfl football and player introductions?

anyways, oklahoma and texas better be careful what they wish for. it will be harder to recruit against alabama when the tide gives you a beating every year. better to be top dog in your conference than take a beating from your rival every year. just ask michigan how that feels.

i miss the old days when the bowl games actually meant something beyond college playoffs. there was a time rose bowl champion was a big deal.

I’m afraid to inform you that only you and pgl call them “THE Ohio State” in a football context, because every football fan knows no one is talking about the one in Athens. I hope you don’t go around saying “THE Earl Campbell” when talking with your Texas friends.

I do think it will be challenging though, because I remember when the Nebraska Cornhuskers thought they were going to set the world on fire in the Big Ten. Didn’t quite turn out like how they imagined back in 2012. You might be interested to know, in the 4 times Alabama has played OU post-2000, OU has won 3 games of the 4 vs Alabama. On a “neutral” field (say Arlington’s AT&T stadium with the ticket sales split 50/50), I don’t think that’s a match up Nick Saban wants anything to do with.

That’s a really funny joke about mixing up the SEC with the Big Ten. I’ll have to share that one at a sports bar sometime. Nothing like a “What conference is Ohio State in??” joke to crack up a crowd of football fans.

Luther provides one of the more concise explanations that I’ve seen of the rationale for aiming at inflation overshoot after a period of undershoot. I also find this quite nicely said, though I think he is too sanguine about too low an inflation target:

“Whatever the optimal rate of inflation is, the welfare consequences of consistently targeting a rate that is a little too high or a little too low are probably small. Far more important is that inflation is in line with expectations.”

I think the timeframe he employs may be misleading, because he only considers the pandemic period. Inflation undershoot has been a feature of the U.S. economy (among others) since late 2008. The Fed had already adopted the goal of reinforcing the credibility of its symmetrical 2% inflation target by overshooting 2% for a time before the Covid pandemic and its associated inflation undershoot. Unless the hullabaloo over inflation this year has lead to a change in thinking on the FOMC, Luther’s timeframe may lead readers to mistaken expectations of Fed policy in the medium term. Fed policy may remain easier for longer than Luther’s presentation suggests.

Consider the large amount of reverse repos going on, “Fed Policy” is not that loose right now. Too many look at interest rates and debt burying(which QE is). They miss the bigger issue.

Reverse repos are the bigger issue??? Seriously?!

If you are wondering what old G-Bott was babbling about – here is the story on reverse repo demand:

https://www.marketwatch.com/story/feds-reverse-repo-program-sees-demand-soar-to-just-under-1-trillion-overnight-11625079189

As far as his made up term “debt burying” I will leave it to him to explain this bizarre expression.

That’s why you’re here Bott, to reveal the hidden signs. Was the loogie from Hernandez or McDowell??

You’ve made a bit of a mess by mushing together some policy jargon without quantification or a framework. “Not that loose” can mean different things to different people and you haven’t said what it means to you.

The Fed’s framework includes a low, but positive, nominal funds rate. Reverses are a tool for enforcing a rate floor to avoid negative rates. QE takes up the slack when positive nominal rate cannot provide as much stimulus as the Fed sees as necessary. I assume you know that, but your comment suggests you don’t.

Within the limits the Fed has set for policy, policy is easy. In reality, policy is pretty darned easy, too. The Fed’s balance sheet stands at about 35% of GDP, the highest ratio in the post-WWII era. Fed reverses are, in fact, a symptom of very easy policy.

I should have said in my earlier comment that Menzie’s Figure 2 makes the point that Luther’s timeframe misses. If one compares the area below the 2% line for the inflation miss since 2008 (0r 2012, in Menzie’s Figure 2), it is much large than the area above the line in this year’s overshoot.

In his defense, recall this:

“Here are my assumptions:

The pandemic was unexpected prior to February 2020.

Americans entered into long-term contracts prior to February 2020.

Americans entering into contracts prior to February 2020 expected x percent inflation.

Americans updating their contracts after February 2020 have done so under the expectation that the Federal Reserve would attempt to deliver an average rate of inflation in line with previously established expectations so as not to encourage over- or under-production.”

This strikes me as appealing to the overlapping contracting model put forth by John Taylor in his younger days when he was an actual economist. Unless contracts are written for periods greater than a decade, what happened in 2009 would not be relevant at least in terms of this type of modeling.

Carl Cameron may have worked for Faux News but his answer to why Tucker Carlson is lying about the vaccines is spot on!

https://www.cnn.com/videos/media/2021/07/19/tucker-carlson-vaccines-carl-cameron-newday-vpx.cnn/video/playlists/business-media/

BTW Tucker Carlson went off last night on the officer who defended the Capitol on 1/6 and happens to be black and a witness before the hearing today. It seems Tucker is offended that a black law enforcement official might have complained about racists at some point. Yea Tucker is a flaming racist and thinks being racist is the American Way. MAGA!

Regarding William Luther, he is not at George Mason. That is where he got his PhD. He is not at Florida Atlantic University, where he moved when he became director of the AIER, or whatever it is.

BTW, he has written a lot about cryptocurrencies, of which he is a big fan.

Oh, he was at Kenyon College after GMU and before this recent move to Florida Atlantic. He is a nice guy in person and reasonably smart, although I happen to disagree with a lot of his ideas on these matters.

@ Bogus Barkley

That’s strange, because more than one of Luther’s bios says he is an Associate Professor at Florida Atlantic University. What do you know that all of Luther’s profiles don’t??

Moses Herzog: I think he meant to write “he is at Florida Atlantic University” given the context, and the previous sentence in his comment.

I could see that as the case. That business/economics Dept seems to be getting more attention lately, wonder what is going on there?? Isn’t that one of the ones that was being included in the WSJ survey?? I suppose one could argue that’s a wide umbrella, but seems at least a semi honor.

Wait, I’m thinking of a different one I forgot the name ATT or IIT NC?? I think it may be on the HBC list, but it just kind of fascinated me it seemed to be getting more attention the last couple years.

Yes, Moses, I typoed “not” rather than “now” in my first comment, although if one looks at my next comment it is pretty clear I know he is at Florida Atlantic. You did not read the second comment before you posted this claim that I somehow do not know Luther is at Florida Atlantic?

Moses is freaking out over where Luther may have taught? I’m sorry but it seems old uncle Moses has TOTALLY LOST IT!

I trust you guys realize that William Luther’s CV is on line:

https://www.williamjluther.com/resources/CV.pdf

Not that hard to find and it does shows all the places where he taught as well as the courses. Plus a lot more.

“he was at Kenyon College after GMU and before this recent move to Florida Atlantic.”

I linked to his CV and this sounds right to me.

Anyone watching this Olympics?? SImone Biles acting a little….. maybe this is too harsh….. but….. flaky. Maybe a reason will surface later.

You know less about gymnastics than even basketball. OK – you were the caption of your chess team so I bow down to your expertise on competitive sports!