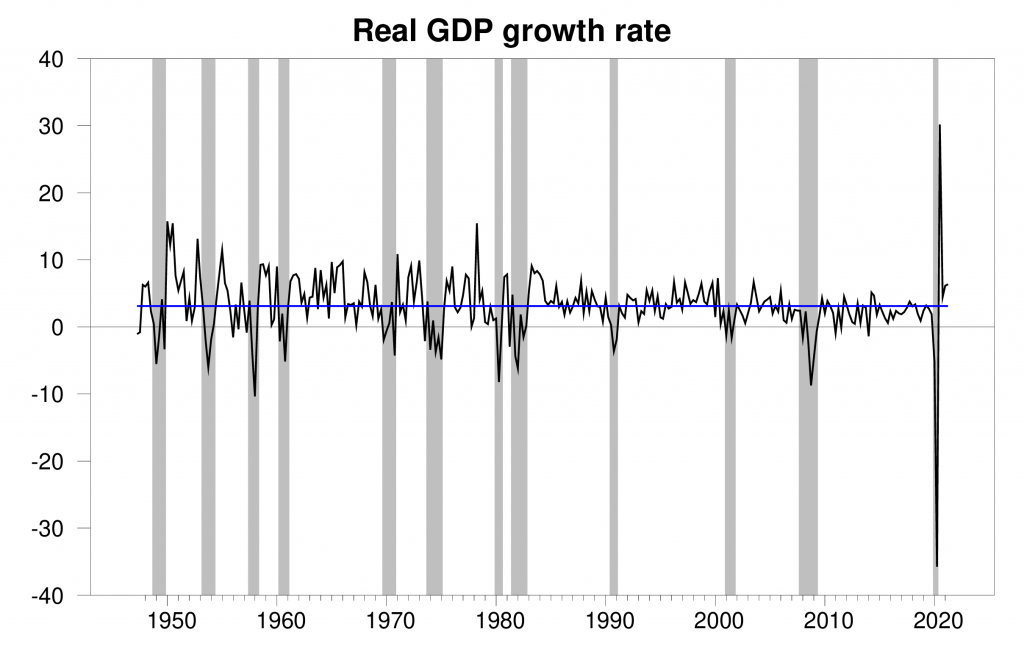

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 6.5% annual rate in the second quarter. That’s well above the 3.1% average growth that the U.S. experienced over 1947-2019. Kudos to Federal Reserve Bank of Atlanta economist Patrick Higgins, whose nowcast of 6.4% that Menzie highlighted yesterday anticipated today’s release on the nose.

Real GDP growth at an annual rate, 1947:Q2-2021:Q2, with the 1947-2019 historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

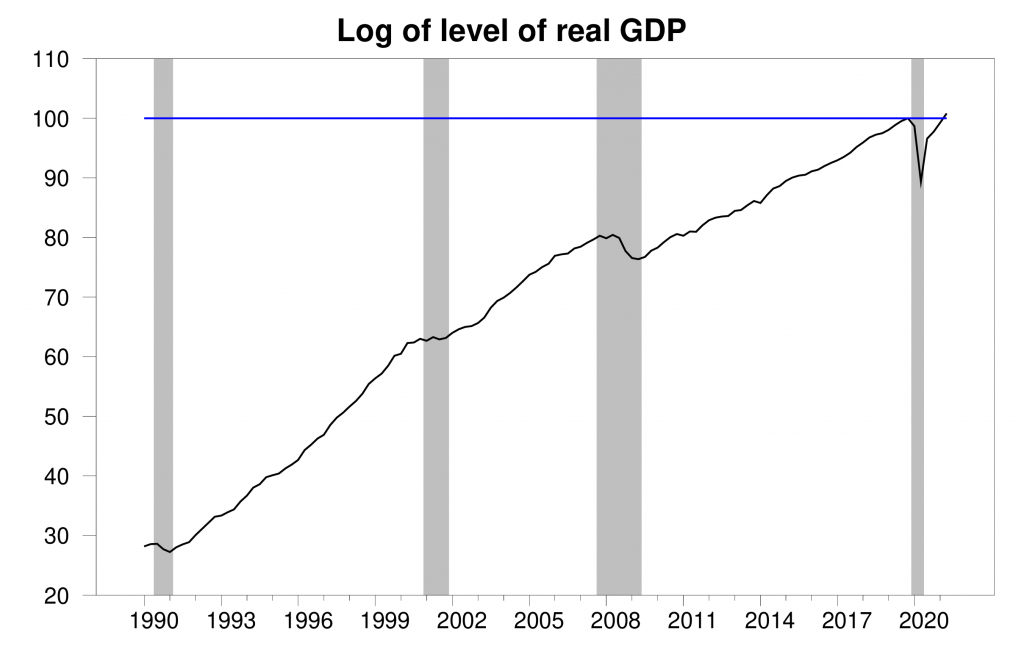

The Q2 growth puts the level of GDP at a new high, 0.8% above the peak that was reached in 2019:Q4 before the COVID recession began.

100 times the natural logarithm of the level of real GDP, 1990:Q1 to 2021:Q2, normalized at 2019:Q4 = 100. A movement on the vertical axis of 1 unit corresponds to a 1% change in the level of real GDP. The value for 2021:Q2 of 100.8 indicates that real GDP in 2021:Q2 was 0.8% above the value in 2019:Q4.

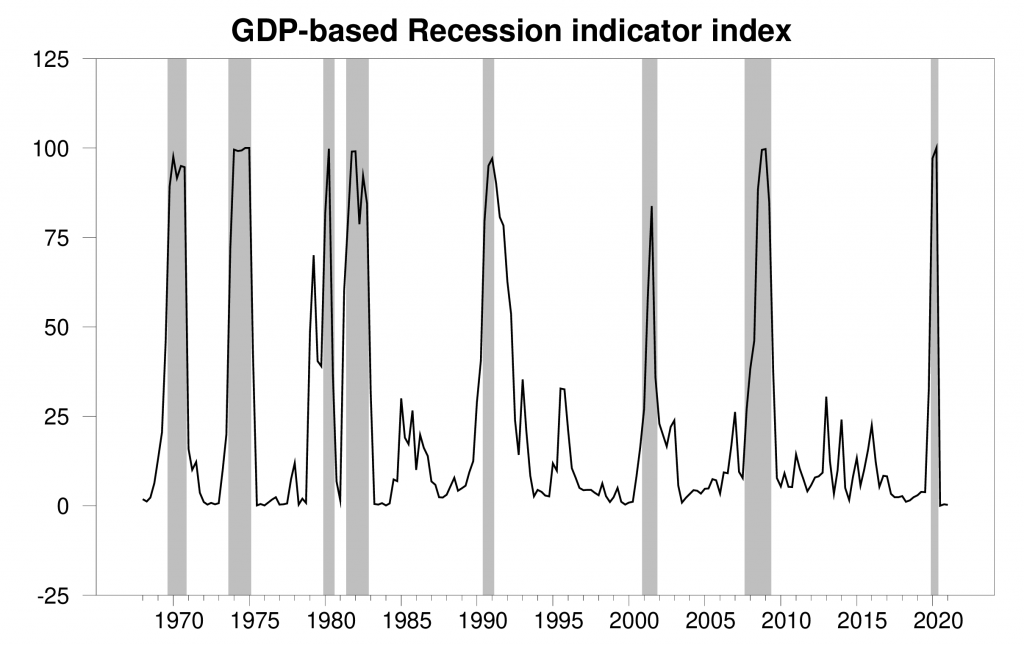

The new data put the Econbrowser recession indicator index at 0.2%, historically a very low value. The number posted today (0.2%) is an assessment of the situation of the economy in the previous quarter (namely 2021:Q1), where we use the additional quarter to allow for data revisions and to gain better precision. This index provides an automatic procedure that we have been implementing for 15 years for assigning dates for the first and last quarters of economic recessions. As we announced on January 28, the COVID recession ended in the second quarter of 2020. The NBER Business Cycle Dating Committee subsequently made the same announcement on July 19.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2021:Q1 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

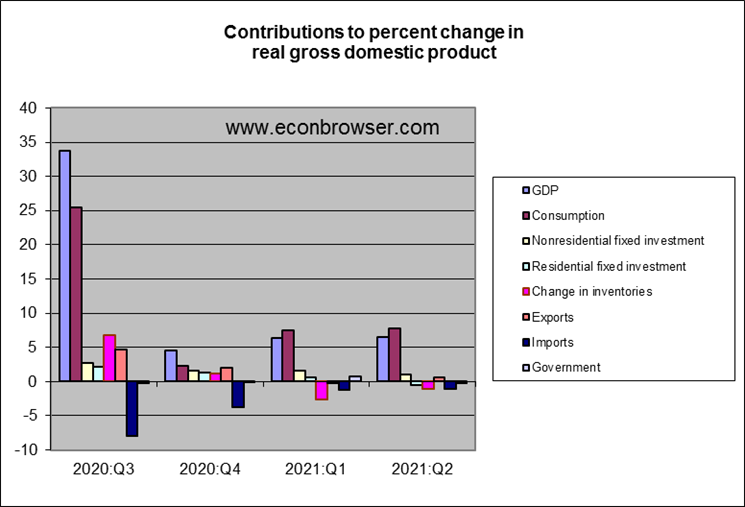

In terms of the breakdown of the Q2 GDP numbers, consumption spending, spurred by fiscal stimulus payments, led the way. It was a little disappointing to see residential fixed investment (which comes from construction of new homes) actually falling in Q2. The monetary stimulus from low interest rates has succeeded in spurring higher prices for homes. Tobin’s Q theory of investment predicts that this should stimulate new construction, boosting GDP through this mechanism.

I have a new research paper in which I argue that potential GDP, which I define as the level of output that would result if wages and prices were perfectly flexible, depends not just on traditional factors such as available workers, the capital stock, and production technology, but also on the match between specialization in those factors and the configuration of product demands. I’m seeing numerous accounts consistent with the view that problems with supply rather than a shortfall of demand are a key factor holding back aggregate growth at the moment.

Jim,

Your paper looks reasonable. Congrats. Another way of putting it is that there less substitutability of specific factors, such as highly specialized labor in the economy than has been widely presumed, which in a situation such as we are in now with lots of shifts of demand due to the pandemic, this is a problem for growth, at least in the short run.

“Another way of putting it is that there less substitutability of specific factors, such as highly specialized labor in the economy than has been widely presumed,”

i view this as employers being too specific about worker qualifications and too limited in their ability to train. too many managers try to solve the problem by hiring/firing contractors, rather than investing and retaining their own workers. that approach is not a long term solution.

“The monetary stimulus from low interest rates has succeeded in spurring higher prices for homes. Tobin’s Q theory of investment predicts that this should stimulate new construction, boosting GDP through this mechanism.”

If there were no supply constraints in the residential investment, this decline would certainly be a surprise. But since you raised sectoral shifts and “the match between specialization in those factors and the configuration of product demands”, what is the evidence from the housing construction market that supply constraints may be the issue here.

pgl:

This article mentions difficulty obtaining lumber, drywall and appliances.

Thanks for that. Menzie had noted the surge in lumber prices which thankfully has started to reverse itself. Let’s see how residual investment goes in Q3.

Lumber prices are below their level at the beginning of 2021 so no longer a factor. https://www.nasdaq.com/market-activity/commodities/lbs

OTOH, construction labor is in short supply. https://www.cnn.com/2021/07/08/economy/construction-worker-shortage/index.html

The crackdown on immigration at the southern border has exacerbated the shortage for construction and many other labor intensive industries.

“The construction industry shut down for a few months last year during the pandemic — but was quickly deemed essential, allowing paused projects to continue. But in that short time, the sector lost more than 1 million workers. The industry has recouped nearly 80% of its workforce since then, but is still down 238,000 workers from pre-pandemic levels as of June, according to the Labor Department.”

Moses posted a link to employment in this sector which was rising nicely but have declined in the last two months. Was this decline from a shortage of materials or was it construction workers deciding to exit the market. This issue needs more discussion.

I spoke with a contractor yesterday and he noted that while “lumber prices” may be lower, building supply companies still have a lot of inventory purchased at higher prices, so lumber prices at the retail level remain high.

“JohnH July 30, 2021 at 8:10 am

I spoke with a contractor yesterday and he noted that while “lumber prices” may be lower, building supply companies still have a lot of inventory purchased at higher prices, so lumber prices at the retail level remain high.”

Sometime is amiss here. Accountants talk about inventory valuation as the lower of cost v. market. Let’s translate the language of GAAP into actual economics. So what if a wholesale distributor had purchased his inventory at a high price. If market prices have fallen – only a fool would pay the higher price even at retail. In a word – the wholesale distributor eats the loss.

One would think JohnH would be doing back flips over wholesale distributors incurring the loss but I bet he is indeed one of the fools still paying premium prices!

Obviously pgl does not understand the real world. By building supply companies, I was referring to local retailers that sell lumber and other related materials. Where I live, the market is dominated by three companies. Pgl probably wouldn’t get this, so I’ll clue him in—an oligopoly.

If all companies tacitly agree not to lower prices until they have recouped their costs at a desired markup on a FIFO basis, retail prices won’t fall until at least one of the companies goes through the high cost inventory.

Welcome to the real world, pgl.

“Where I live, the market is dominated by three companies. Pgl probably wouldn’t get this, so I’ll clue him in—an oligopoly. If all companies tacitly agree not to lower prices until they have recouped their costs at a desired markup on a FIFO basis, retail prices won’t fall until at least one of the companies goes through the high cost inventory.”

If this is his understanding of industrial organization, JohnH is dumber than I gave him credit for. Dude – you are saying their desired markup was not maximizing profits pre-pandemic. In other words, you are saying those 3 companies are really really incompetent.

Nobody expects prices to go back to where they were—it’s always this way, according to them—which says to me that the oligopolists have learned from the pandemic that they can gouge consumers a lot more than they had previously thought, which could have a lot to say about future inflation.

This makes me think that perhaps inflation is actually something to be concerned about. Perhaps liberal economists shouldn’t be so dismissive and eager to explain recent inflation away. After all, we live in an economic environment where companies with pricing power control a lot of shelf space. If they have learned that they can price gouge more, we can expect them to take advantage, not that the market fundamentalists that rule the roost could give a whit, unless it affects them personally.

In any case it won’t hurt my TIPS and I-bond portfolio.

https://fred.stlouisfed.org/series/JTS2300JOL

Off topic but important. I just heard that 1/3 of the House Republicans have not gotten the vaccine. And yet their leader gave an angry speech condemning the call for masking in Congress. We need better political leaders.

I would bet that nearly are all vaccinated but won’t admit it to their base. No wonder they are angry at masking.

I heard ordinary citizens having to get the vaccine in secret so as to not dry the ire of their MAGA hat wearers. Weird times.

pgl,

30% among gop members of congress do risk assessment not in line with covidian commandments

heck, nurses is closer to 40% diverging risk assessment as are 40% nyc teachers. maybe lack of safety…. data.

masks are the novo scapula, vaxxes are self flagillation……

consumer risk of vaxx as well as any other covidian commandment is too high outside the 84 + already frail

#DoNotComply

It has been confirmed. You work for Putin!

Hopefully paddy is following his own advice and not getting vaxxed.

Private residential investment slowed in Q2, not a surprise, but accounted for 4.7% of output in the quarter. Down from 4.8% in Q1, tied with Q4, otherwise the largesr sharr since Q2 2007. Not shabby.

The pace of slowing in home sales strongly suggests that the class of buyer who would and could over-bid has largely been satisfied. A housing price roll-over is a reasonably reliable predictor of recession, but not a useful one as it happens relatively seldom. Special circumstances this time may mean is isn’t reliable right now.

ltr (anne) provided a link to Dean Baker’s latest under Menzie’s post but stopped the quoting before investment. Here is what Dean said about residential investment:

Residential Investment Falls at 9.8 Percent Rate

After three quarters of extraordinary double-digit growth, residential investment fell sharply in the quarter. This likely reflects shortages of building materials that are limiting construction in many areas. Residential investment is still up by 16.3 percent from pre-pandemic levels.

The USA continues it mystifying tradition about being the ONLY nation to use annualised figures not annual figures which are more volatiles and using the advanced estimate which includes estimates of various categories..

We superior types only use figures from data collected and rarely if ever used annualised figures.

Speaking of tradition, you know you are required to stand on a soapbox, yes? Nothing to see here, folks.

Americans know how to divide by 4. Maybe they do not Down Under!

“The USA continues it mystifying tradition about being the ONLY nation to use annualised figures not annual figures”

You must be really dismayed when confronted with miles per gallon instead of liters per 100 kilometers.

Annual figures give your average rate over the last four quarters. It tells you nothing about the most recent quarter if you are looking for changes to the trend. An annualized quarterly rate tells you what’s happening right now, not three quarters ago.

And annualizing the quarterly rate allows you to use the same denominator when comparing the most recent quarter to the most recent year, so the rates are equivalent. Would you use miles per hour for long trips and miles per minute for short trips? No, you use the same denominator for both. That’s the reason for annualizing the quarterly rate.

Well said but I have to confess that gasoline prices confused me when I took a trip to France in 1993. I got francs/$ but I forget they were posting prices per kilogram and not gallons. One conversion at a time!

pgl,

They post by liter, not by kg.

Thanks. I made the comment while still waking up for the early morning run. One would think someone wanting for Olympic track and field would get the metric system. DUH!

Housing investment in the U.S. has been weird for a long time. How long? At least since the late 1700’s when Charles Bulfinch was losing money on real estate developments in Boston. Our more recent history–say, back to 2000—has been distinguished by the Boom, the Bubble, the Bust, and a period that I like to call the Clawback–which I think has dominated the Pandemic and post-Pandemic (can I say post?). The ongoing materials and labor crunch has been a function of the excessive caution of the Clawback period. Nearly every developer, every lender, every contractor, and every supply company carries scars of the Bubble and the Bust and behaves with caution and resists the leveraged investment of the Bubble period. My rough guess is that we have a housing deficit of 5-8 million units that SHOULD have been built (or significantly renovated) in prime metro areas. Regulatory constraints can’t explain this entire deficit, although I don’t mind using stupid regulations as a punching bag whenever I can. With respect to the current numbers, things look okay, and absent a Zombie war, next year will be good for residential investment because projects that were deferred this year will keep going. I hope.

Just a point about the median estimate and the Atlanta Fed GDPNow estimate. The GDPNow estimate is updated every time new GDP component data are released. In the two days prior to the release of Q2 GDP data, the GDPNow estimate fell from 7.6% to 6.4%. At 7.6%, the GDPNow estimate was within the range of survey estimates. Then it wasn’t.

Published median estimates may be updated as new data come in, but because they also take into account estimates which aren’t updated, they reflect outdated information. Many participants in surveys only send estimates to the survey once a week, so while their internal forecast may be as good as the GDPNow estimate, the median estimate doesn’t reflect the change.

All of which is to say that the focus on median GDP estimates in the financial press can be misleading. The economy isn’t necessarily weaker or stronger than well-informed market pros expected. They have the capacity to do what the St. Louis Fed does. Neither hand-wringing nor celebration is appropriate merely because actual GDP growth rate diverges from the median.

The up-to-date character of GDPNow, along with its good design, accounts for it nearly always providing a better forecast of GDP than survey medians.

Well, nearly always better in the days just before GDP data are released.

CBO tracks it forecasting record:

https://www.cbo.gov/system/files/2019-10/55505-CBO-forecasting-record.pdf

Have fun!

Do these forecasters keep records of their forecasts v. how real GDP actually fared? Someone needs to publish whether their forecasts are biased as well as that RMSE thing.

“JohnH

July 31, 2021 at 8:22 am

Nobody expects prices to go back to where they were—it’s always this way, according to them—which says to me that the oligopolists have learned from the pandemic that they can gouge consumers a lot more than they had previously thought, which could have a lot to say about future inflation.”

I’m sorry but this making up BS as you go is more evidence that you do not understand economics.

#1 – the number of stores in your little town is not evidence of oligopoly power. OK True Value and Home Depot may be ripping you off but there is something called internet shopping.

#2 – but let’s assume everyone in your town is as incompetent as you so your two of three stores have monopoly power which you and your neighbors are stuck with because you are dumb. Have you ever tried to model this out? Of course not.

Try this simple model for your simple mind.

Demand: Price (P) = a – b*Q(quantity of lumber)

Marginal cost = the sum of the cost of lumber plus the cost of distribution (c).

Marginal revenue = a – 2*b*Q

Now every business person with a brain pre or post pandemic knows to equate marginal revenue with marginal cost. Simple algebra (I know – another subject you flunked) has

P = (a – c)/2. Your precious markup = P – c, which indeed is above operating expenses under monopoly.

Now if we had a permanent increase in lumber prices, the markup would decline even in JohnH’s stupid view of the world.

Of course the real world has transitory changes in lumber prices. Now I bet True Value would try to pass along the entire transitory increase along to dimwitted customers like JohnH. But Home Depot would steal their market share when lumber prices fell by telling the few smart people in JohnH’s town to come buy from them at the lower price.

Of course JohnH in his utter ignorance would continue to be ripped off by True Value as the owner of True Value knows their favorite customer is just that stupid.

Menzie in his rebuttal to Victor Hanson’s rant that noted lumber prices had spiked to $80 a unit:

‘I think Dr. Hanson is a bit behind the time…I price 4’x8′-1/2″ at about $48 at Home Depot’

JohnH – July 31, 2021 at 8:22 am

“Nobody expects prices to go back to where they were”

I guess True Value is indeed ripping JohnH off on lumber prices! Someone is not paying any attention to anything at all.