Q2 GDP will be released tomorrow morning, and Jim will be providing his insights on the numbers. Today, the IMF released its July 2021 World Economic Outlook forecasts, which gives us and opportunity to recap where we stand. [Updated 7/29, 1pm Pacific]

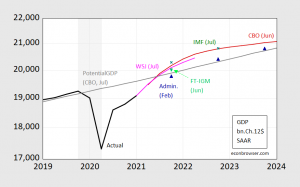

Figure 1: GDP as reported (black), Administration FY22 forecast (blue triangle), CBO June forecast (red line), FT-IGM (light green triangle), IMF July WEO (green x), potential GDP as estimated by CBO in July 2021 (thick dark gray line). Dates indicated denote when the forecasts were “locked down”. Source: BEA, OMB FY’22 Budget, WSJ July survey, and FT-IGM survey (June), CBO (February, July), IMF (July), and author’s calculations.

Updated Figure 1: GDP as reported on 7/29 in 2021Q2 advance release (black), Administration FY22 forecast (blue triangle), CBO June forecast (red line), FT-IGM (light green triangle), IMF July WEO (green x), potential GDP as estimated by CBO in July 2021 (thick dark gray line). Dates indicated denote when the forecasts were “locked down”. Source: BEA 2021Q2 advance release, OMB FY’22 Budget, WSJ July survey, and FT-IGM survey (June), CBO (February, July), IMF WEO (July), and author’s calculations.

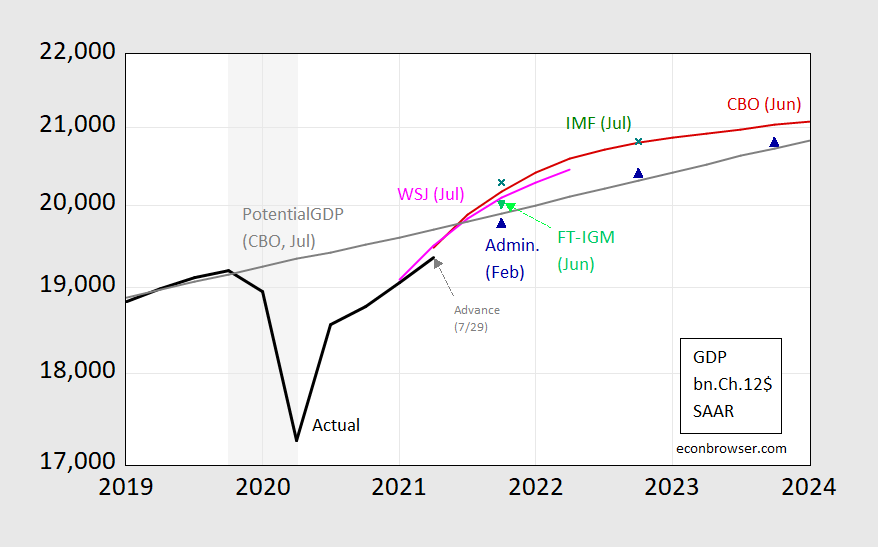

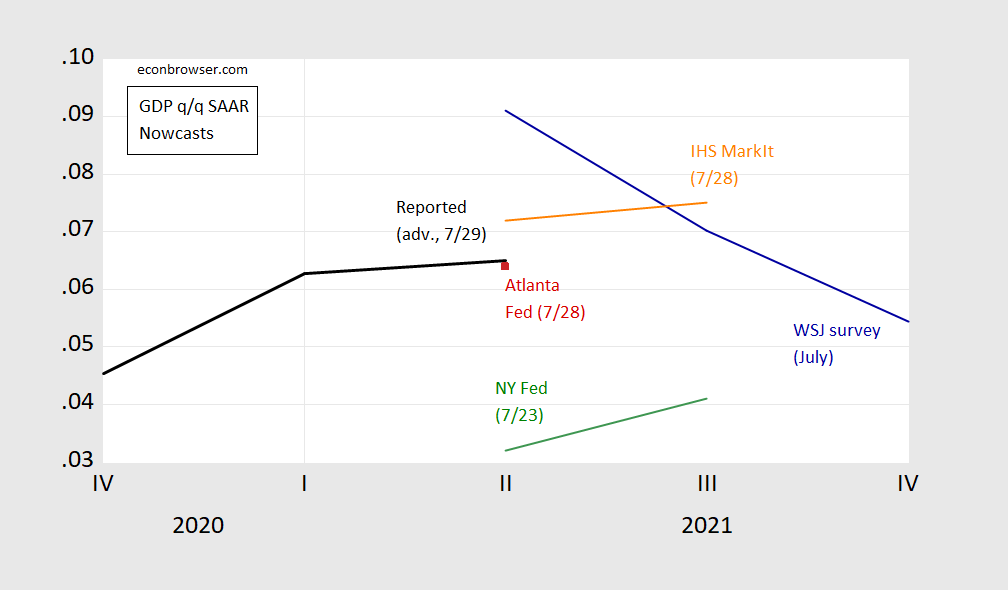

Nowcasts of Q2 GDP are 6.4% SAAR (Atlanta Fed, 7/28), 3.16% (NY Fed, 7/23), 7.2% (IHS-MarkIt, 7/28).

[Update 7/29:] The actual Q2 advance figure was 6.5%. Figure 2 shows the actual advance growth rate, and the nowcasts as well as the July WSJ consensus as of early July.

Figure 2: GDP growth rate as reported in 2021Q2 advance (black), GDPNow fm Atlanta Fed (red square), NY Fed nowcast (green), and IHS Markit (orange), and WSJ consensus forecast from July survey (blue), all q/q SAAR. Source: BEA 2020Q2 advance release, Atlanta Fed, NY Fed, IHS-Markit, and WSJ July survey.

I was thinking IHS Markit’s nowcast was unbelievably high, but apparently their nowcast is lower than the consensus forecast. That seems crazy to me. I’m gonna go with 5.8% here. Anyone who wants to criticize this number later has to put up a number by 12:00am Pacific time zone tonight or STFU tomorrow.

Well, I was 0.7% off/low. I’d say if the consensus number was around 8.5% (I even read 9% somewhere), being 0.7% off on the low side is nothing to hang my head about. Wish I coulda got a little closer, but not gonna hang my head too low comparing my number to the consensus numbers. You know, occasionally there’s a drop of intelligence to some of Uncle Moses’ Madness, now come on, you gotta give me that one. A little drop??

since your estimate was the equivalent of a dart throw, and not model based, being “close” is really no consolation. that said, not sure if any of the “consensus” numbers are any more than a dart throw versus a model. at least with a model, you have the ability to go back and investigate what possibly made your estimate too low or too high. with a dart throw (or simply a guess), it is hard to determine what went wrong with your estimate. makes it hard to improve when you throw your next dart.

Damn, you had to go and rain on my little parade didn’t you?? My carousel horsey was going real fast until you threw that corndog at my head. (half-way joking). Yeah, what you said is true enough. True enough.

Dusty Hill (ZZ Top) died at age 72. His music lives forever!

https://www.theguardian.com/music/2021/jul/29/dusty-hill-lifted-zz-top-into-greatness

Yeah, I saw that. That’s one of those ones that will make you feel old. They did “steal” alot of stuff from the old blues artists, but I do think Gibbons had/has enough of a unique sound and tone to call it their own. Even the keyboard sounds were somewhat unique. And I think they were semi-good about crediting their sources. Plus a little bit of that Texas sound which others more knowledgable could probably explain quite easy but it’s hard to put a finger on. Texas sound is very hard to describe but you are as hell know it when you hear it. Junior Brown, Stevie Ray Vaughn, Fabulous Thunderbirds, T-Bone Burnett. I think arguably Gary Clark Jr, and although some might argue Khruangbin even has a little bit tinge of the Texas Sound. Gotta listen careful though.

https://fred.stlouisfed.org/graph/?g=AuPx

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2021

https://fred.stlouisfed.org/graph/?g=AuPM

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2021

(Indexed to 2020)

Another one for the record books: Q-2 2021 GDP

The US economy grew 6.5% in the second quarter of 2021, or twice that pace if the calculation is made on a year-on-year basis: +12.2%, the fastest pace in more than 70 years. The surge comes on the back of the 9.1% real contraction of Q-2 2020, which was more than twice as ugly as the previous record for as far back as data are reasonably consistent (1948).

Private consumption expenditure (PCE) – everything households buy from the economy, including both goods and services – rose 16.2% year-on-year, a modern era record. Domestic demand, which is a measure of economic activity in which everything bought from outside the USA is added to the total, and everything sold to foreign economies is subtracted, rose a record 16.6% during the period.

Inflation, as measured by the change in PCE prices, rose 3.8%. It is the first increase beyond 3% in nearly a decade, and the second fastest since the early 1990s.

A note for the politically opportunistic inflation hawks: the money supply (M2) rose an average of 21.8% over the past four quarters, which PCE inflation increased by just 1.7%.

A note for the politically opportunistic inflation hawks: the money supply (M2) rose an average of 21.8% over the past four quarters, which PCE inflation increased by just 1.7%.

A note for the politically opportunistic national debt hawks: federal interest payments as a percent of total federal spending was 6.7% in the second quarter. That’s the fifth quarter in a row below 10%, and the only time it has been so low since modern records began in 1947. The overall federal debt held by the public has been declining this year, after peaking at 105.5% of GDP in Q-2 2020. It now stands at 98.3%.

“Inflation, as measured by the change in PCE prices, rose 3.8%.”

True but core inflation was only 2.5%.

The last two quarters have seen decent growth but a ways to go before we declare full employment.

Inflation, as measured by the change in residential construction prices, rose 14.5%.

“Inflation, as measured by the change in export goods prices, rose 25.3%.

“Inflation, as measured by the change in export goods prices, rose 14.3%.

all SAAR of course..

correction: Inflation, as measured by the change in import goods prices, rose 14.3%.

(that’s what i get for trying to save myself retyping a line..)

New housing a small weight in consumer price index. Export prices have a zero weight in consumer prices so what happened to import prices?

https://fred.stlouisfed.org/graph/?g=z21W

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2021

https://fred.stlouisfed.org/graph/?g=z21I

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2021

(Indexed to 2017)

Double-digit growth (annualized) in consumer service and non-durables consumption, nearly double-digit growth in durables – not to be repeated. Business fixed investment growth of 13% may be sustainable for a while longer. One slightly odd circumstance is that inventories and trade were simultaneous drags on growth. Bottleneck problem. There’ll be strong inventory catch-up.

By the way, notice Powell shrugging off short-term interest-rate moves as partly technical, not challenging the “credibility of our framework”? Smart boy.

By which Powell clearly meant market rates.

Good stuff. Last part, Funny……. He survived donald trump, right?? But so did Dr. Birx, so……. Maybe cutting rates to give an authoritarian U.S. leader political cover for bad trade actions is the American way?? [ cue Ethel Merman singing “God Bless America” ]

https://www.washingtonpost.com/business/economy/how-the-feds-interest-rate-cut-helps-trump-wage-his-trade-war/2019/07/31/db119e86-b3d6-11e9-8949-5f36ff92706e_story.html

https://apnews.com/article/38bd60d6f2f64f8daeb273b2042d03a8

Anytime you need to break trade agreements unilaterally in a way which drives American farmers into bankruptcy or has USA farmers panhandling from the federal government for social welfare, Powell will be there to tell you he also enjoys the taste of bleach. What an admirable guy. And he’s not even an economist, so we haven’t seen credentials this great for a job since Neera Tanden’s trial balloon for Head oF OMB. [ Happy sigh…… ] Good times……. But then Powell didn’t punch any Pakistani-Americans like Neera Tanden had, so, you can’t always have “the perfect resume”.

This reminds me, does anyone remember John Cuckrant of “Grumpy Economist blog” world-fame bawling like a 5 year old about inflation any of the times rates were cut under donald trump?? Asking for a friend.

I remember very clearly the week Powell got himself cornered. Doesn’t matter whether other policies are bad (soto voce, of course), the Fed will aim to stabilize the economy. Trump had softened his tone aftwr a bad few days in strocks, but plunged right back into the gutter aftwr Powell spoke.

My main problem was the timing, as I recall it was within 48 hrs, and probably closer to 24. How much more could you signal a life raft and/or “Yes, I’m willing to play ball with the orange psycho”.

Again, Powell knows people are watching, he knows he has a powerful title, what is he signaling to everyone when he rolls over like a baby chihuahua plays dead like that?? Economists can sugarcoat and whitewash that any way they like, it makes their entire profession look like a joke when you make that move within 24 hours of a major bilateral trade move. There’s no getting around it. It was cowardly and it was DUMB.

Trump for four years said he would get us very overdue infrastructure. Yes the incompetent blow hard failed. Biden gets strong bipartisan support for what is essentially the bare minimum so what does the big baby of Maro Lago do? Stamp his feet trying his best to derail the deal. Why? Because it will not his name on it. Boo hoo!

https://www.msn.com/en-us/news/politics/trump-calls-bipartisan-infrastructure-bill-loser-for-the-usa-as-mcconnell-supports-it/ar-AAMFVvG?ocid=uxbndlbing

trump does not want the bill to pass, because it will improve the country. any improvements will make it harder for him to run again in 24. it is very callous but very clear. trump wants an agenda that benefits trump, and not the nation. it is great if they coincide, but trump is not willing to take one for the team. it is easier to get away with this approach when you hold the office of president, than when you are on the outside looking in.

https://www.cepr.net/gdp-2021-07/

July 29, 2021

GDP Rises 6.5 Percent in Second Quarter, Passed Pre-Pandemic Level of Output

By DEAN BAKER

The profit share of corporate income rose 1.6 percentage points in the first quarter, countering claims of squeezed employers.

The economy grew at a 6.5 percent annual rate in the second quarter. This put GDP 0.8 percent above its last pre-pandemic quarter but still leaves it roughly 2.2 percent below its pre-pandemic trend.

Productivity Growth Still Strong

While the growth for the quarter was somewhat lower than had generally been expected, it would still likely imply strong productivity growth for the quarter. With the increase in hours worked likely to come in near 4.0 percent, the GDP figure would imply productivity growth near 2.5 percent. This is lower than the 4.1 percent rate from the first quarter of 2020 to the first quarter of 2021 but far above the 1.0 percent annual rate in the decade preceding the pandemic. If this sort of uptick in productivity growth could be sustained, it makes it unlikely that inflation would be a problem in the years ahead.

Profit Share Rises Sharply in First Quarter

This release included revised data for 2019 and 2020, as well as the first quarter of 2021. While revisions are often large and can reverse the story in the unrevised data, the revisions still show that profit share of corporate income falling from 2015 to 2020, with the 2020 share being the lowest since 2009. The revised data show a sharp uptick in profit shares from the 2020 average of 23.9 percent to 25.5 percent in the first quarter of 2021.

The quarterly data are erratic and subject to large revisions, so the first-quarter data has to be viewed with caution. (The profit data for the second quarter will not be available until the preliminary GDP report is released in August.) However, a rise in profit shares is inconsistent with the story of employers being squeezed by rapidly rising wages resulting from a labor shortage.

Saving Rate is 10.9 Percent in Second Quarter, Up from 7.5 Percent Pre-Pandemic Average

The saving rate continued to be very high in the second quarter. This is worth noting because it is after most of the pandemic checks were already sent. If people are going to spend large portions of the savings accumulated during the pandemic, then we should be seeing saving rates well below the pre-pandemic average. At least through the second quarter, this does not seem to be the case, meaning that this source of potential inflationary pressure is not currently a problem.

Spending on Consumer Services Drives Quarter’s Growth

Spending on services was the major factor driving second quarter growth, rising at a 12.0 percent annual rate and adding 5.1 percentage points to the quarter’s growth. Restaurants were the biggest factor in this growth adding 2.2 percentage points to GDP. Spending on recreation services added 0.8 percentage points to growth. Spending on goods also rose rapidly with spending on durable goods rising at a 9.9 percent rate and spending on nondurables rising at a 12.6 percent rate. This spending added 0.9 percentage points and 1.8 percentage points to growth, respectively.

Even with the strong second-quarter growth, spending on consumer services was still 3.3 percent below the pre-pandemic level. By contrast, spending on durables (largely cars) was 28.6 percent higher, while spending on nondurables was 11.9 percent higher. It is likely that we will see weak growth in durable goods spending going forward, while services still have room for rapid growth.

Investment Remains Strong ….

https://fred.stlouisfed.org/graph/?g=F1Uy

January 15, 2020

Personal Consumption Expenditures price index, PCE less food & energy, PCE services and PCE goods, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=F1UA

January 15, 2018

Personal Consumption Expenditures price index, PCE less food & energy, PCE services and PCE goods, 2017-2021

(Percent change)

https://www.cepr.net/gdp-2021-07/

July 29, 2021

GDP Rises 6.5 Percent in Second Quarter, Passed Pre-Pandemic Level of Output

By DEAN BAKER

Investment Remains Strong

Nonresidential investment grew at an 8.0 percent rate in the quarter. Equipment investment and investment in intellectual products both grew considerably more rapidly, rising at a 13.0 percent and 10.7 percent rate, respectively. Structure investment fell at a 7.0 percent rate. This likely reflects changing work and shopping patterns, as more people continue to work from home and shop online. Equipment investment is now 6.3 percent above the pre-pandemic level, while investment in intellectual products is 9.0 percent. Structure investment is 20.4 percent lower.

Residential Investment Falls at 9.8 Percent Rate

After three quarters of extraordinary double-digit growth, residential investment fell sharply in the quarter. This likely reflects shortages of building materials that are limiting construction in many areas. Residential investment is still up by 16.3 percent from pre-pandemic levels.

Core PCE Deflator Was Up 3.4 Percent Over the Last Year

We did see some uptick of inflation this quarter, with the core Personal Consumption Expenditure (PCE) deflator rising 3.4 percent. This is likely to prove transitory as the economy works through shortages in many sectors associated with its rapid reopening.

[Graph]

Prospects for Continued Strong Growth Look Good, with Mix Shifting

This report is again overwhelmingly positive. We are likely to continue to have very strong growth, at least through the rest of 2021; although the mix will be very different. Consumer services will continue to grow rapidly, especially if the pandemic can be controlled. Spending on cars and other consumer durables is likely to weaken, as people who bought cars during the pandemic are not likely to buy another one this year or next. However, there will be some backlog demand, as suppliers rush to make-up shortages in this quarter. There will be a similar story with housing, where we are likely to see construction move back close to first quarter levels.

There will also be a lot of demand restocking inventories. Declining accumulations subtracted 1.1 percentage points from this quarter’s growth after reducing the first quarter’s growth by 2.6 percentage points.

Inflation is a concern, but with strong productivity growth, and a shift in income shares from wages to profits, it seems like it will be a transitory issue.

I wonder how this works out for specialization of labor??

https://www.theguardian.com/us-news/2021/jul/29/eviction-moratorium-expiration-renters

Maybe they can find a “special” laborer (or group of laborers bedded side-by-side on the ground) to camp out on Lou Dobbs’ ranch at night???~~~ and then work for pennies on Lou Dobbs’ ranch when the sun pops up?? If not there’s always donald trump’s casinos and golf courses. Because….. just because. They’ll have to work harder if they want a redundant job at the Fed Res pumping out redundant papers though. Or maybe they can be a lawyer pretending to be an economist. In certain socio-economic stratospheres, ANYTHING is possible.

https://www.nytimes.com/2021/07/30/health/covid-cdc-delta-masks.html

July 30, 2021

C.D.C. Internal Report Calls Delta Variant as Contagious as Chickenpox

Infections in vaccinated Americans also may be as transmissible as those in unvaccinated people, the document said, and lead more often to severe illness.

By Apoorva Mandavilli

The Delta variant is much more contagious, more likely to break through protections afforded by the vaccines and may cause more severe disease than all other known versions of the virus, according to an internal presentation circulated within the Centers for Disease Control and Prevention.

Dr. Rochelle P. Walensky, the director of the agency, acknowledged on Tuesday that vaccinated people with so-called breakthrough infections of the Delta variant carry just as much virus in the nose and throat as unvaccinated people, and may spread it just as readily, if less often.

But the internal document lays out a broader and even grimmer view of the variant.

The Delta variant is more transmissible than the viruses that cause MERS, SARS, Ebola, the common cold, the seasonal flu and smallpox, and it is as contagious as chickenpox, according to the document, a copy of which was obtained by The New York Times.

The immediate next step for the agency is to “acknowledge the war has changed,” the document said. Its contents were first reported by The Washington Post on Thursday evening.

The document’s tone reflects alarm among C.D.C. scientists about Delta’s spread across the country, said a federal official who has seen the research described in the document. The agency is expected to publish additional data on the variant on Friday….

https://www.nytimes.com/2021/07/29/opinion/covid-vaccinations-republicans.html

July 29, 2021

How Covid Became a Red-State Crisis

By Paul Krugman

Less than a month ago President Biden promised a “summer of joy,” a return to normal life made possible by the rapid progress of vaccinations against Covid-19. Since then, however, vaccination has largely stalled — America, which had pulled ahead of many other advanced countries, has fallen behind. And the rise of the Delta variant has caused a surge in cases all too reminiscent of the repeated Covid waves of last year….

[ Covid is an all-state crisis. This should be clear. There were more than 90,000 new coronavirus cases detected throughout the country yesterday. ]

https://twitter.com/washingtonpost/status/1421156015563759621

The Washington Post @washingtonpost

Vaccinated people made up three-quarters of those infected in a massive Massachusetts covid-19 outbreak, pivotal CDC study finds

https://www.washingtonpost.com/health/2021/07/30/provincetown-covid-outbreak-vaccinated/

CDC study shows three-fourths of people infected in Massachusetts covid-19 outbreak were vaccinated

1:09 PM · Jul 30, 2021

I thought that some of Menzie’s largely silent female readers (where are you?? This comment section isn’t as vicious as it appears) might appreciate seeing/reading this paper.

https://www.nber.org/system/files/working_papers/w28679/w28679.pdf

I still think if you read Ellen Pao’s book (I skimmed about 80% of it) she made some egregious errors in judgement in her workplace. But it doesn’t mean she didn’t have a point, or that in some ways she wasn’t kind of driven into a corner which would have made anyone more inclined to make some poor choices. I will give her credit for laying out some facts of her personal life in there, she could have chosen to skip~~which makes her autobiography much more authentic than many of its same type (or any type of autobiography really). So I applaud her on those grounds, in the writing of her book.

Moses,

Oh great, this blog’s most notorious sexist, especially against older powerful women (see your latest misguided blast at Pelosi on a more recent thread) is assuring “Menzie’s largely silent female readers” that “This comment section isn’t as vicious as it appears.” What a joke coming from probably the worst promulgator of viciousness here.

Oh, and then we have your ongoing inability to accept that ltr is almost certainly anne of Economists View, who is almost certainly female, and far from silent. Gag.

http://www.xinhuanet.com/english/2021-07/30/c_1310097353.htm

July 30, 2021

Over 1.61 bln doses of COVID-19 vaccines administered in China

BEIJING — More than 1.61 billion doses of COVID-19 vaccines had been administered in China by Thursday, the National Health Commission said Friday.

[ Chinese coronavirus vaccine yearly production capacity is now 5 billion doses. Along with over 1.619 billion doses of Chinese vaccines administered domestically, another 700 million doses have been distributed internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.theguardian.com/us-news/live/2021/jul/30/congress-eviction-moratorium-us-politics-biden-democrats-republicans-latest-news

Folks, I don’t generally tell people what to read, but I’ll tell you one nice thing about “The Guardian” newspaper. Even though it’s a British paper they cover American news very well, and there’s no paywalls—-i.e. it’s FREE, and if you want to make a contribution to help make that available to people who can’t always access good quality news, “The Guardian” takes contributions.