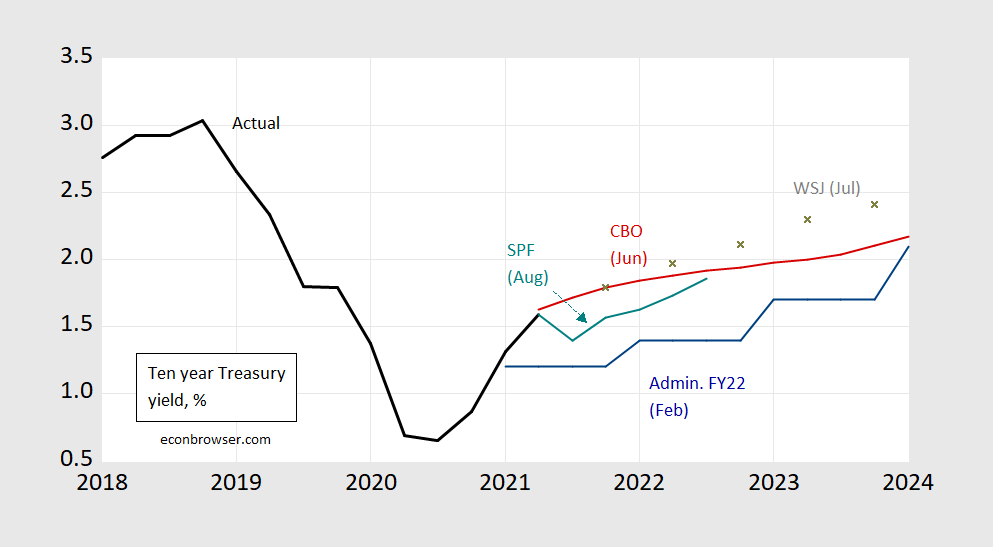

Earlier in the year, one fear was that excessive fiscal stimulus would push up inflation, push up long term yields. Professional forecasters don’t seem to view that outcome as imminent.

Figure 1: Ten year constant maturity Treasury yields (black), CBO (red), Administration (blue), Survey of Professional Forecasters August (teal), and WSJ July (gray x). WSJ rates pertain to end-of-quarter. Dates in graph pertain to forecast finalization of forecasts. Source: CBO An Update to the Budget and Economic Outlook (July), FY2022 Budget (June), Philadelphia Fed SPF (August), WSJ survey (July).

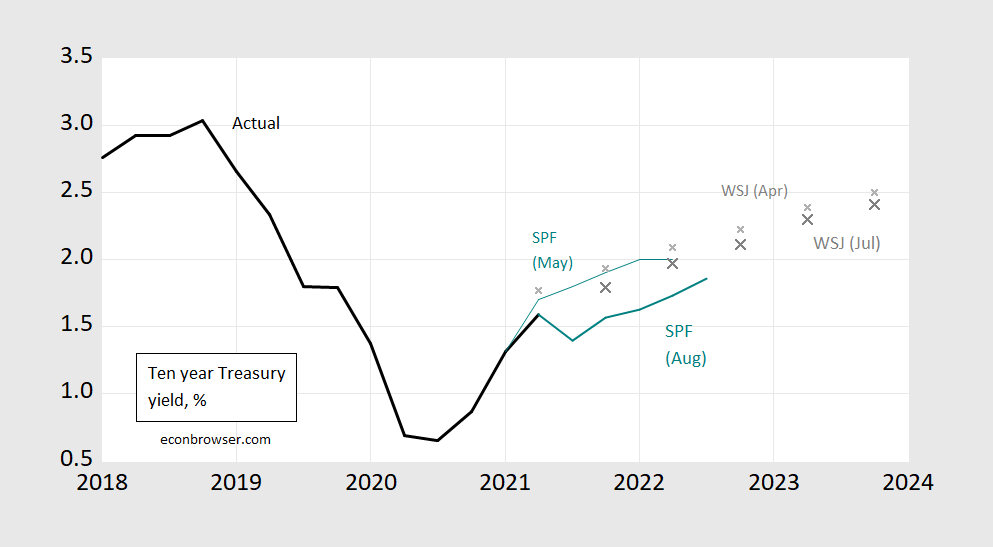

Since these are different forecasts, it’s difficult to see how expectations have changed. I show the last two SPF and WSJ forecasts in Figure 2.

Figure 1: Ten year constant maturity Treasury yields (black), Survey of Professional Forecasters August (bold teal), May (light teal), and WSJ July (large gray x), and WSJ April (small gray x). WSJ rates pertain to end-of-quarter. Source: Philadelphia Fed SPF (August, May), WSJ survey (July, April).

Long term yield projections have shifted down as prospects for economic activity have dimmed (so that real rates have declined), and market-based inflation fears have abated.

The inflation surge is still forecasted to be transitory, as discussed in this post.

Today, Goldman Sachs marked down its Q3 forecast, from a previous 9% (SAAR) to 5.5% (while upping Q4 by a ppt), based mostly on the impact of the delta variant, and partly to supply chain (East Asia, Chinese port, semiconductors) impacts.

OK. So I’ll admit. I’m confused by the BLS data. But before anyone takes delight in my admission, let me be clear that there is good reason for my confusion. The BLS data is internally inconsistent and contradictory.

So far I have found four different data sets where the BLS reports wages, earnings, etc. Two of them report MEDIAN earnings of about $1000 per week and two of them report AVERAGE earnings of about $1000 per week.

The Economic News Release, dated August 11, 2021 puts AVERAGE weekly earnings at $1,062.79 for July, 2021. Median earnings are not shown.

https://www.bls.gov/news.release/realer.t01.htm

The Economic News Release – Ususal Weekly Earnings Summary, dated July 16, 2021, says that “MEDIAN weekly earnings of full-time workers were $990 in the second quarter of 2021. AVERAGE earnings are not mentioned. https://www.bls.gov/news.release/wkyeng.nr0.htm

The Labor Force Statistics from the Current Population Survey, dated January 22, 2021, shows MEDIAN weekly earnings to be $984. AVERAGE weekly earnings are not shown.

https://www.bls.gov/cps/cpsaat39.htm

And finally, there is the May 2020 National Occupational Employment and Wage Estimates, dated March 31, 2021. It shows the annual MEAN wage to be $56,310 or $1082 per week. Implicitly the MEDIAN weekly wage is $806, derived from the fact that the median hourly wage is shown to be 75% of the average hourly wage. The annual mean wage calculation is probably too high, since it is a number calculated from the hourly wage multiplied by 2080 hours. It assumes a 40 hour work week, which is probably too high. If 35 hours per week is used, then the mean weekly wage drops to $947, the MEDIAN wage to $705.

https://www.bls.gov/oes/current/oes_nat.htm#00-0000

The bottom line is that the BLS publishes at least four different data sets with information that is inconsistent and contradictory. Of the four numbers hovering around $1000 per week, two are identified as MEDIAN and two are identified as AVERAGE.

So what exactly are people supposed to take away? Does the average worker make $1000 per week, or is the average wage $1000 wage? Data that collects both numbers shows a 25-30% difference between the two. They are most definitely NOT identical!

Personally, I decided to believe none of the above without outside, independent information.

Social Security makes its own determination of average and mean compensation using highly reliable IRS data. AVERAGE annual compensation in 2019 comes out to 51,916.27, just under $1000 per week. MEDIAN annual compensation in 2019 comes out 34,248.45, $658 per week.

Data from Social Security and from National Occupational Employment and Wage Estimates are relatively in line with each other and with the The Economic News Release, dated August 11, 2021. They are at odds with the other two MEDIAN data sets.

In my humble opinion, the BLS really needs to get its act together and establish a benchmark data series, which other data series must be consistent with.

JohnH: OMG.

JohnH whines when he thinks data is not presented in enough detail. He also whines about the level of detail provided by BLS. Bottom line – he whines about everything.

Oh my, I spit out my coffee reading this. First of all John, I think it’s courageous of you to openly confess your confusion, despite the likely ridicule. We’ve all been there, but the more we asked the more we learned and the more knowledgeable we became. Though you might want to postpone the insinuations about data being faulty for after the readers and the authors have a chance to reply.

I might be mistaken but it seems that you consider average and median wage to be synonyms or you wouldn’t be surprised that they are different. Average (also called arithmetic mean) and median are two different measures of a central tendency (=representative value) of a variable. The formulas used to calculate them are different. To get average earnings you add up all the earnings and divide the sum by the number of earnings. This is (generally) a good way to calculate a representative number, but not in the case of earnings. The reason is that earnings have a funny distribution. Most people earn little and a few earn a lot. Those that earn a lot (disproportionately) increase the average earnings, making the average less representative of the population. One way of correcting for this is to calculate median earnings. Median earnings are defined as the earnings at which 50% earn less than the median earnings and 50% of them earn more. Median earnings are lower than average earnings because the median mutes the influence of extremely high earnings. Finally, if you want to mute the effect of high earnings by even more you might want to calculate mode earnings. Mode is defined as the amount of earnings that most people get paid. Since most people have (relatively) low earnings mode will be smaller than the median, which in turn is smaller than the average (the mean). I hope this helps.

The average and median are most definitely NOT synonyms. For wage data there is solid evidence that they are 25-30% apart. However, the BLS seems does not make it clear that they understand the difference, since $1000/week is either median or average depending on which data source you choose.

Yes, there are probably differences in methodology, such as the subset of the working population surveyed. But the optics are awful. And the final news release should make adjustments to produce consistent, credible data.

If the BLS data seems to confuse median and average, their credibility is shot.

JohnH: Again, OMG.

“The average and median are most definitely NOT synonyms.”

So did some 8 year girl finally mansplain this to you?

“If the BLS data seems to confuse median and average, their credibility is shot.”

Back in 2012 Jack Welch questioned the credibility of the BLS and he was rightfully trashed for his stupid and asinine suggestion. For a lying troll to also question their credibility is far worse. The BLS is not confused even if you constantly are.

When the BLS reports that $1000 is the median wage in one report and $1000 the average in another report, it is not I who am confusing average and median. The difference between average and median wage should be in the range of 25-30%, as reported in some of the reports.

Undoubtedly their are methodological differences that can explain the differences. However, the optics are horrible. Normally, adjustments would be made to compensate for methodological differences and make the outputs consistent and credible.

“When the BLS reports that $1000 is the median wage in one report and $1000 the average in another report, it is not I who am confusing average and median.”

I’ll bet the ranch that this is just another one of your 10 billion bold faced lies.

Link to these alleged reports where the BLS has allegedly been misleading. Now I’d bet the farm that when we get to read these alleged reports we will find that the BLS was crystal clear. Your stupidity goes not give you license to question their credibility.

John, It appears the bls reports median wages with full time worker data, and averages when it does not enforce full time in the data. This makes sense. Median has meaning when the subjects are controlled by full time status. It has much less meaning when measuring all workers, hence the use of average for that data. Not sure why you have been unable to distinguish the different types of datasets that have been reported. I see no conspiracy here. Seems to be a logical presentation of the data, with the intent of NOT providing misleading statistics. Just read the notes in the data.

Baffling: Either JohnH is too lazy to read the footnotes, or can’t understand them.

I would ask johnh to please refrain from anymore comments on the subject due to ignorance and laziness on his part.

“Not sure why you have been unable to distinguish the different types of datasets that have been reported.”

The readers of Mark Thoma’s blog know why JohnH struggles on matters like this. He spewed this stupid nonsense for years over at EconomistView.

“The BLS data is internally inconsistent and contradictory.”

Pathetic. You are confused about what 2 + 2 equals.

“AVERAGE annual compensation in 2019 comes out to 51,916.27, just under $1000 per week. MEDIAN annual compensation in 2019 comes out 34,248.45, $658 per week.”

Even third graders know the mean and median are two different concepts. And most people get that mean will exceed median when the distribution is not “normal”. Do we need to explain what the concept of a normal distribution even is? Should we draw this in crayon for you?

Now there is another definition of “normal”. Your insistence on going on and on and on with respect to concepts you clearly do not understand is not normal.

“Personally, I decided to believe none of the above without outside, independent information.”

JohnH plays the Jack Welch card. Now who is going to give him that “independent information”. Kelly Anne Conway?

JohnH

August 20, 2021 at 9:16 am

JohnH double downs on his questioning the credibility of the BLS? Now this is uber troll time especially since JohnH lies all the time. JohnH suggests this time the BLS is confused. No – but JohnH is confused 24/7 on every topic under the sun.

Suggest a name change to “JohnH-YeahBut”.

“Rerun”

“OK. So I’ll admit. I’m confused by the BLS data. But before anyone takes delight in my admission,”

The only delight anyone might take from your admission that you’ve finally decided to admit confusion instead of launching into smarmy, smirky, half-(or less) informed declarations of why the rest of us, people who know much more about the subject than you do, are wrong and only you are correct. Admitting confusion can be a first step to learning.

“let me be clear that there is good reason for my confusion. The BLS data is internally inconsistent and contradictory.”

[Sigh]. Back to square one.

Or your understanding is incomplete, inconsistent, and contradictory. IOW, you fundamentally misunderstand.

“The annual mean wage calculation is probably too high, since it is a number calculated from the hourly wage multiplied by 2080 hours. It assumes a 40 hour work week, which is probably too high.”

Ok, this is a distraction or misdirection from the core issue you raised, but whatever. Not once, ever, in these comments have you demonstrated anywhere near enough of an understanding of economics in general or the labor market in particular for your opinion to matter a scintilla. Stay in your lane. You have much more fundamental misunderstandings to fix before you start diving into the weeds like this.

“Personally, I decided to believe none of the above without outside, independent information.”

[Le sigh, part deux] Back to monumentally arrogant, willfully ignorant declarations that you, A DILETTANTE, are so much better informed than the highly educated, highly skilled, highly experienced economists at BLS who’ve SPENT THEIR WHOLE DAMN CAREERS STUDYING THIS! (Yes, these capital letters mean I’m shouting.) Given that you still haven’t remedied your misunderstanding of the fundamentals, your choice here is not only unwise but downright irrational.

“In my humble opinion,”

Not once in your comment history have you been humble. Claiming it doesn’t make it so.

Now to some fundamentals. Have you actually gone back to the data series, plural, not just the graphs, and read the notes like our host suggested? Or have you simply plowed ahead with ignorance, arrogance, and malice aforethought? (I know which way I would bet.)

In a comment in the previous thread, baffling left you a huge clue about whether two data series were even examining the same subset of workers. We all know that you refuse to read for comprehension anything we write, so one of us posting it in a comment is futile.

You absolutely must make at least a token effort at understanding the data else you’ll further embarrass yourself for no apparent reason. If you don’t at least try to understand, you’re just ‘old man shouting at clouds.’

“Today, Goldman Sachs marked down its Q3 forecast, from a previous 9% (SAAR) to 5.5% (while upping Q4 by a ppt), based mostly on the impact of the delta variant, and partly to supply chain (East Asia, Chinese port, semiconductors) impacts.”

I was hoping to read their forecast. Since you did not provide a link, I jumped on Google only finding similar news stories and twitter references with none of them providing a link to the GS forecast. Is it publicly available?

pgl: No, afraid not – it’s in a newsletter.

http://www.xinhuanet.com/english/2021-08/19/c_1310136577.htm

August 19, 2021

Over 1.9 bln doses of COVID-19 vaccines administered in China

BEIJING — A total of over 1.9 billion doses of COVID-19 vaccines had been administered in China as of Wednesday, data from the National Health Commission showed Thursday.

[ Chinese coronavirus vaccine yearly production capacity is more than 5 billion doses. Along with over 1.9 billion doses of Chinese vaccines administered domestically, another 800 million doses have been distributed internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

ltr, i certainly tire of your endless posting of irrelevant data, in an effort to promote what appears to be less effective vaccines.

that said, may i offer you an opportunity to provide something of value to the blog community here. i have heard that there appear to be some rather promising therapeutics for the treatment of covid coming out of china. i would welcome any references you have to these therapeutics, which would be helpful on the world stage.

https://news.cgtn.com/news/2021-08-19/Chinese-mainland-reports-46-new-confirmed-COVID-19-cases-12QwmsBSqFa/index.html

August 19, 2021

Chinese mainland reports 46 new COVID-19 cases

The Chinese mainland recorded 46 new confirmed COVID-19 cases on Wednesday, with 5 being local transmissions and 41 from overseas, the latest data from the National Health Commission showed on Thursday.

In addition, 30 new asymptomatic cases were recorded, while 508 asymptomatic patients remain under medical observation.

This brings the number of confirmed COVID-19 cases on the Chinese mainland to 94,546 with the death toll unchanged at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-08-19/Chinese-mainland-reports-46-new-confirmed-COVID-19-cases-12QwmsBSqFa/img/76e0cf8d9e88467c9a59c312d18f885d/76e0cf8d9e88467c9a59c312d18f885d.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-08-19/Chinese-mainland-reports-46-new-confirmed-COVID-19-cases-12QwmsBSqFa/img/915ac979b6244d7db0963411cad8969b/915ac979b6244d7db0963411cad8969b.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-08-19/Chinese-mainland-reports-46-new-confirmed-COVID-19-cases-12QwmsBSqFa/img/76b9399b65c341148dcdaac5cb9af567/76b9399b65c341148dcdaac5cb9af567.jpeg

https://www.worldometers.info/coronavirus/

August 19, 2021

Coronavirus

United Kingdom

Cases ( 6,392,160)

Deaths ( 131,373)

Deaths per million ( 1,924)

China

Cases ( 94,546)

Deaths ( 4,636)

Deaths per million ( 3)

https://www.nytimes.com/2021/07/16/books/review/jeffrey-e-garten-three-days-at-camp-david.html

July 16, 2021

How Richard Nixon Changed America’s Place in the World

By Justin Fox

THREE DAYS AT CAMP DAVID

How a Secret Meeting in 1971 Transformed the Global Economy

By Jeffrey E. Garten

On a late-summer Friday the 13th in 1971, President Richard Nixon, the Federal Reserve chair Arthur Burns, the secretary of the Treasury John Connally and several other top U.S. officials climbed aboard a helicopter on the White House lawn. They were headed to the presidential retreat at Camp David to plan what another of the helicopter passengers, the budget director George Shultz, called “the biggest step in economic policy since the end of World War II.” That step was the end of the American commitment to redeem other countries’ dollars for gold at $35 an ounce, a bedrock of the Bretton Woods system of mostly fixed exchange rates that had been in place since 1944.

Nixon’s abandonment of the gold standard has indeed gone down in history as a major economic turning point. Some decry it as the beginning of an inflationist era of fiat money. Others see in it the dawn of a neoliberal age in which democratically elected governments ceded power to crisis-prone, inequality-spawning financial markets.

To Jeffrey E. Garten, it was “the best that imperfect men could achieve operating in a caldron of political and economic change at home and abroad.” As he explains in “Three Days at Camp David,” something had to give in the rigid Bretton Woods structure. Far more dollars were in overseas hands than the United States had gold to redeem them at $35 an ounce. What’s more, fixed exchange rates failed to reflect the shifts in economic clout brought on by the rapid recovery of Japan and Western Europe. The so-called “Nixon shock” and the years of negotiations that followed brought floating currencies and more flexible international economic relations without a 1930s-style breakdown, and without entirely ceding U.S. pre-eminence….

https://fred.stlouisfed.org/graph/?g=GdKu

January 15, 2018

Real Narrow Effective Exchange Rate * and Net Exports as a share of Gross Domestic Product, 1971-2021

* (Indexed to 1971)

“Nixon’s abandonment of the gold standard has indeed gone down in history as a major economic turning point. Some decry it as the beginning of an inflationist era of fiat money.”

Yea – gold bugs like Judy Shelton hate floating exchange rates and often engage in incredibly dumb hyperbole.

“Others see in it the dawn of a neoliberal age in which democratically elected governments ceded power to crisis-prone, inequality-spawning financial markets.”

Case in point – JohnH.

I have posted on Econospeak about Nixon’s August 15 speech.

Something I did not add to that post was that a few days after it I gave a talk at UW, not an official one, but attended by a lot of students and even a few faculty, in which I described his talk as bringing about the end of the post-WWII Bretton Woods system. I was about to start my third year of grad school then and was specializing in international economics, although I would later shift my thesis topic to the area of urban and environmental.

“But before anyone takes delight in my admission, let me be clear that there is good reason for my confusion.”

No, there is not “good reason” for your confusion. The reason for your confusion is that you approached the subject with a massive bias. You saw what you wanted to see. You insisted that everybody else was wrong and you had to be right.

A little humility and a modicum of effort should be enough to understand the data you have so badly misunderstood. The endless flow of disjointed writing you smear all over the comment section amounts to considerable effort. Humility is what’s missing. You’ve demonstrated that lack of humility once again in claiming “there is good reason for (your) confusion.” No, there isn’t. You confused yourself.

JohnH would do well to adopt MAGA as his goal; I.e., Make Arithmetic Great Again.

JohnH used to call for more detailed reporting of the distribution of income. But when faced with reporting of median v. mean – it is now too much reporting? GEESH!

The 10 yr T-bond rate today was 1.24%. How long have professional forecasters been predicting a return to a 2% rate?

The idea that we will hit 2% in 2022 seems far fetched since the Fed has significant influence and has not indicated it wants a 2% rate any time soon. Perhaps the Larrys — Summers and Kudlow — would disagree, but I doubt Jay Powell wants another taper tantrum that would disrupt markets and slow the economy which is still down nearly 6 million jobs from Feb. 2020.

Kudlow on May 5, 2021: “Ms. Yellen is acknowledging the economy is booming. There is no crisis. There is no house on fire. There is no global warming existential threat. The COVID threat itself is waning. We are virtually at herd immunity.”

Here’s another look at that perennial favorite, the always-too-high yeild forecast chart: https://www.barrons.com/articles/see-the-10-year-treasury-if-you-factor-out-wall-street-optimism-1498161844

It’s from 2017. Over the 15 years to 2017, the average miss in the Philly professional forecasters’ 10-year forecast was +60 bps. Only twice in that period had the average estimate been too low.

Barron’s explains that optimistic growth estimates are too blame, further evidence that financial journalism can be just as flakey as interest rate forecasting.

This ranks up there with Donald Luskin’s 9/14/2008 oped declaring there was no danger of a recession.

the market seems to be in agreement that in the medium term, inflation numbers will return to lower values. i just don’t see anything that suggests rates should rise significantly, at least to problem levels. if we get year over year high wage increases, maybe. but we are not there yet. and the delta variant is going to keep a lid on excess growth. put your money in big tech that has been growing despite (or because of) the virus, for the next six months. states like texas and florida are ensuring the virus stunts growth for the next six months to a year.