Medium term inflation expectations are muted, growth expectations are recovering slightly, and perceived risk seems contained.

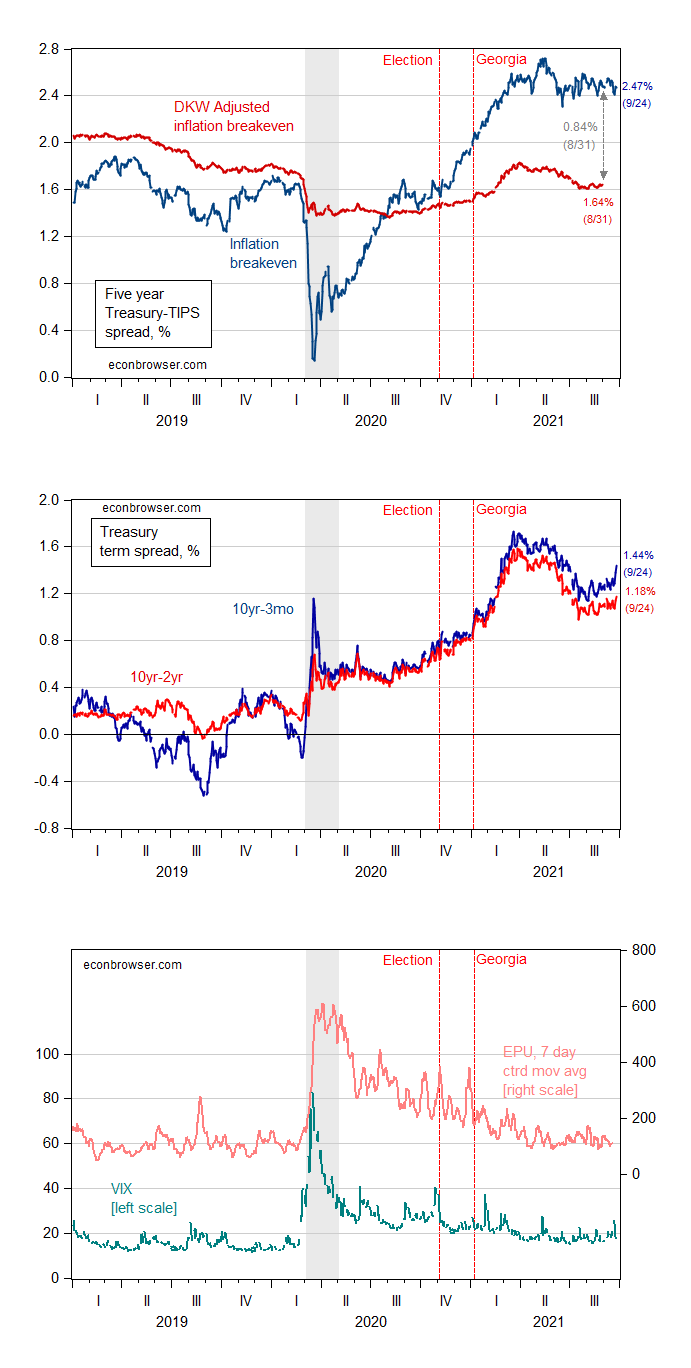

Figure 1: Top panel: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red), all in %. Middle panel: 10 year-3 month Treasury spread (blue), 10 year-2 year Treasury spread (red), both in %. Bottom panel: VIX (teal, left scale), Economic Policy Uncertainty, 7 day centered moving average (salmon, right scale). NBER defined recession dates shaded gray (from beginning of month after peak month to end of trough month). Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) , FRED, policyuncertainty.com, NBER and author’s calculations.

The top panel of Figure 1 shows that the standard breakeven for 5 year horizon has stabilized; the adjusted for inflation risk premium/liquidity premium indicator was also stable at end-August, indicating 1.18% inflation on average.

Expectations as proxied by term spreads suggest that growth trends bottomed out in mid-July, after peaking in mid-March. They’re now rising slightly over the last two weeks.

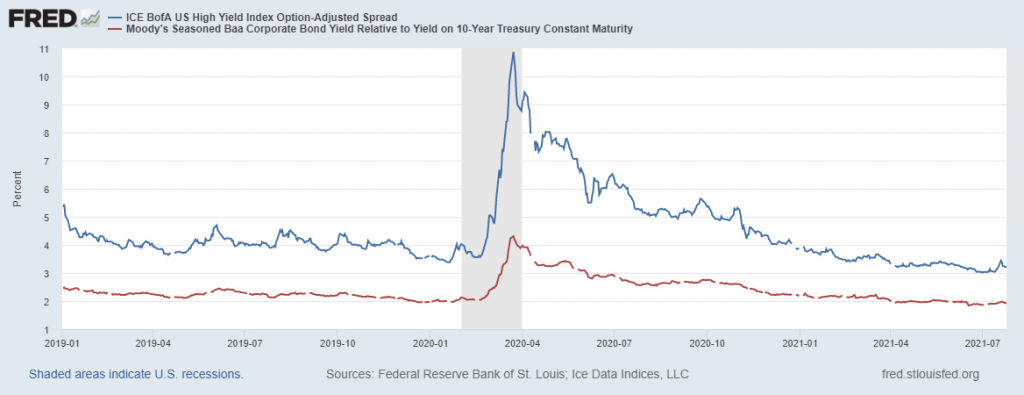

Finally, a market based measure of risk (the VIX) has is relatively quiescent. So too is the newspaper account based Baker-Bloom-Davis measure of policy uncertainty. This is true despite the rising political uncertainty regarding passage of the reconciliation and infrastructure bills, and more importantly, the raising of the debt ceiling. Credit spreads have also failed (so far) to evidence much reaction:

Notes: The ICE BofA High Yield Option-Adjusted Spreads (OASs) are the calculated spreads between a computed OAS index of investment grade bonds BB and below, and a spot Treasury curve. Source: FRED, accessed 9/25/2021.

“This is true despite the rising political uncertainty regarding passage of the reconciliation and infrastructure bills, and more importantly, the raising of the debt ceiling. Credit spreads have also failed (so far) to evidence much reaction…”

If memory serves, debt and spending squabbles have drawn less market rsponse in recent episodes, perhaps because they end up not learn more default and, in most cases, not shutting government for to very long. Politicians want each other, qnd their voters, to believe they’ll cut off their own noses, but the record sqys they won’t.

The problem is, these are the same Republicans who allowed Trump to milk his office for personal gain, rent out the Oval Office to Russia, cuase tens or hundreds of thousands od excess deaths for political gain and attempt an overthrow of the federal government. They have stepped away fom the precipice in the past, but they are different now. Democrats aren’t playing chicken with the same guys this time.

@ macroduck

Semi-random thought, but related to the politics. Wanted to tag along with you here, but couldn’t find anything better than my usual smart-aleck quips to attach. Both George Will and Michael Cohen have stated recently they don’t think donald trump will make an official run in 2024, Cohen stating that trump’s teasing out and “stringing along” a 2024 run is just a way to raise funds and stay in the conversation. George Will stating his thesis rather vociferously on the modern version of “Firing Line” with Margaret Hoover (a show I don’t like but may pause at, clicking around the channels) While I strongly disagree with both men on question, I thought their perspective, from both their backgrounds, deemed notation.

I don’t know their reasoning. Here’s what I think is obvious –

Pretending to be a future candidate raises money now. He has apparently dug his way out of debt, but why stop demanding money from his political followers? So Trump doesn’t have to have a preference now between running and pretending in order to benefit from letting the world think he’s running. If Trump doesn’t have to have a preference, wha makes Will and Cohen think they know Trump’s decision?

Trump will either run or he’ll play king maker. King maker is easier and he’s 75, but presidents have power and protection from federal prosecution. He could demand a public promise of a blanket pardon from GOP presidential wannabes. I think that’s likely.

I no longer believe I have insight into the behavior of Trump-like people, so I don’t have a personal view about whether he’ll run. Or run and then pull out so he can keep his cult alive. Will lives off his reputation for knowing thing, thus lacks crdibility, so I don’t have a strong sense that he actually knows any more than you or me.

Will is doing exactly the sort forecasting which Tetlock and friends showed to be worse than chimps throwing darts (a turn of phrase Tetlock apparently regrets).

We’re pretty much 98% in agreement, with me being of stronger opinion donald trump will run in 2024. Not a George Will fan, but in light of him being Republican and a avid follower of politics for roughly 40 years, still thought it was noteworthy, even though I strongly disagree with him.

Really the only two occasions I can listen to George Will without feeling extreme nausea is when he’s talking pro baseball or about his son Jonathan, with which he has proven, we can never criticize George Will as a father, as he has proven his mettle on that individual score.

In the name of transparency, I will embarrass myself, and admit this (my) comment was inspired by a “reminder” made to me by a TV commercial for CBS’ “60 Minutes”.

macroduck predominantly accurately says: “Politicians want each other, and their voters, to believe they’ll cut off their own noses, but the record says they won’t.”

While I 99.99999999% agree with macroduck’s statement and attached sentiments, we should remember, roughly every 5 centuries of human existence, there are exceptions to the rule, and a politician will sacrifice their own future and political viability, for the benefit of the nation:

https://www.washingtonpost.com/opinions/2021/05/05/liz-cheney-republican-party-turning-point/

NY Times: “Republican Review of Arizona Vote Fails to Show Stolen Election. The criticized review showed much the same results as in November, with 99 more Biden votes and 261 fewer Trump ones.”

However this was just a recount of the votes, both illegal and possibly illegal. The audit also found 49,718 questionable votes.

Here is a breakdown of those 49,718 questionable votes:

23,344 mail-in ballots were counted from individuals who no longer lived at the address to which the mail-in ballot was sent. The audit called these “mail-in ballots voted from prior address” in the voter history phase. (critical impact)

9,041 more ballots returned by voters than received in the voter history phase. (high impact)

5,295 voters that potentially voted in multiple counties in the certified results phase. (high impact)

3,432 more ballots cast than the list of people who show as having cast a vote. The audit called this group of ballots “official results does not match who voted,” in the certified results phase. (medium impact)

2,592 more duplicates than original ballots in the ballot phase. (medium impact)

2,382 in person voters who had moved out of Maricopa County in the certified results phase. (medium impact)

2,081 voters moved out of state during 29 day preceding election in the voter history phase. (medium impact)

1,551 votes counted in excess of voters who voted in the certified results phase. (medium impact)

In Maricopa County out of 2.1 million votes, 1.9 million were early votes – mail in or drop boxes. Maricopa county, the subject of the audit, is only 62% of the Arizona vote. Bidens’ victory margin in Arizona was 10,457, or 20% of the questionable votes in Maricopa County alone.

Why the misleading story in the NY Times? Hmmmm….

https://www.breitbart.com/politics/2021/09/25/arizona-senate-draft-report-on-the-maricopa-county-election-audit-highlights-49000-questionable-votes-asks-ag-to-investigate/

https://fred.stlouisfed.org/graph/?g=pkLF

January 15, 2018

Interest Rates on United States High-Yield BB and Euro High-Yield bonds, 2017-2021

https://fred.stlouisfed.org/graph/?g=sKvA

January 15, 2020

Interest Rates on United States High-Yield BB and Euro High-Yield bonds, 2020-2021

‘Interest Rates on United States High-Yield BB and Euro High-Yield bonds, 2017-2021’

Before anyone think this is a meaningful comparison, do note that the interest rate on Euro denominated government bonds has been negative while the interest rate on US government bonds has been positive. And the credit spread on BB rated bonds is not exactly the same thing as the credit spread on “high yield” bonds. Sort of a weird apples and oranges comparison.

The interest rate on Euro High Yield Bonds is the sum of the credit spread and the interest rate on German government bonds. Please note that the latter has been low if not negative for quite a while:

https://fred.stlouisfed.org/series/IRLTLT01DEM156N

https://fred.stlouisfed.org/graph/?g=r3bm

January 15, 2018

Interest Rates on United States High-Yield BB and 10-Year Treasury bonds, 2017-2021

Lael Brainard giving a speech tomorrow. Wonder where I can catch that?? Fed official website??

Off topic for this post, relevant to earlier posts –

https://foreignpolicy.com/2021/09/24/china-great-power-united-states/

The assertion is that rising powers don’t engage in battle with more mature rivals, in this case, China with the U.S. Instead, powers which have come to the end of their (relative) rise take a “use it or lose it” attitude toward peak power. The risk, says the author, is that China is peaking, a least in relative terms, and will become aggressive.

The peak power observation is certainly worth considering. China is becoming the target of serious balance-of-power policies (TPP, Australia’s subs) which will constrain the spread of China’s regional hegemony. Demographics, debt, convergence all point toward slower growth. By the time China has 095 (or 09-V, i you prefer) subs in the water, Australia may have beaten China to the punch with Astute or Virginia-class boats.

China may not be up to playing wih the big boys, and could be prone to world-threatening tantrums for a while.

macroduck,

When I linked on all I got was about a paragraph plus the credentials of the authors, so I do not know what their argument is.

However, I suspect they may have made an elementary error: confusing levels with rates of change. It is clear, even if ltr’s links tend to skew inaccurately upwards on it, that the rate of China’s rise in the world on various fronts: economically, militarily, politically, is slowing down. But saying that its rate of rise is slowing down is most definitely not the same as that it is declining. Their economy and military and political influence all look to me to be still rising relative to the US and the rest of the world, while it also looks that their rate of rise is slowing, clearly symbolized by what looks to be a deceleration of their GDP growth, despite ltr’s pollyanna posts about their growth targets.

The idea that they are not somehow already a Great Power and may somehow fail to achieve that, which is what it looks like they are saying in the bit I could access, is just absurd and clearly wrong. For quite some time now many observers have said that we are in a G-2 world, one dominated basically by just the US and China, not a G-7 or G-20 one. Indeed, the PRC is already top dog on quite on quite a few measures, with its leads in those likely to still increase at least somewhat for some time to come. Just to stick to economics, I note that their real aggregate GDP is now probably more than 30 percent higher than that of the US, even as western media constantly refers to the US as having “the world’s largest economy,” true only nominally, with PRC likely to surpass the US on that in the not too far diatant future, even as its GDP growth rate seems to be slowing. And a matter reported on here by Menzie is that they are also tops in terms of shares of international trade and the number of nations for whom they are the top trading partner. China is already clearly a fully global Great Powee, even if Russia still has more nuclear weapons than they do. They are catching up on that measure too.

So, maybe they have some variables where China is going to be declining (the obvious candidate for that is population, but then most other leading powers are also looking at that happening as well), but I suspect they have stumbled into going from a story about their rate of rise slowing to a story of their actual position declining.

You can correct me if I am wrong on this, macroduck, which I may be. But this needs further explanation if indeed they are making a real case here, not one confused in the way I suspect they have done so. If indeed I have got this all wrong and they have a slam dunk on China actually declining on a bunch of important measures, well, I am sure our friend will be overjoyed to leap in here and declare that he agrees with you 98.327684 percent, :-).

What is it with you and web links?!?!?! Are you using a 1995 Compaq computer running on Blue Screen of Death Windows?? Let me guess, you’ve got a “Saved By the Bell” screensaver with Screech Powers face floating right to left on your monitor?? Too modern for you??? A “Patty Duke Show” screensaver??

So, Moses or macroduck, can either of you tell us what the main argument of these guys is? What is it besides population that China is going to actually decline in?

Now macroduck’s comments suggest that maybe their argument is that neighbors like Australia will react to their rise and move to oppose them, thereby slowing their rise. But this is exactly what the Thucydides Effect s all about that these authors are busy denying the relevance of and md seems to think they are so very wise. The TE is indeed a mater of existing powers moving to oppose the rise of a rising power, which is exactly what leads to war. See how as Germany rose in the late 19th and early 20th century, other powers, especially UK, moved to oppose it. We got WW I out of that one.

So now we have the Quad, with Australia, whom md mentions and maybe these authors focus on too, turning against PRC. And maybe India, Japan, Australia, and US can have a nice big war with China. But do note, as ltr has pointed out, just as there is a long list of nations that are criticizing many of the bad behaviors of China, they are able to get another 40 plus, including some nehgbors, especially Russia, to sign other notes praising them and denying the critics. I think the critics mostly have it right, but China has a rather large and formidable set of supporters who are not all running to buy US nuke subs like OZ is.

Moses,

So I tried again and did get to read the article. It is pretty much as I thought. The one thing they see as an actual forthcoming decline in China is, yep, population. But they somehow miss that other major nations will have declining populations as well. Duh.

While trying to upend the original Pelopennesian War story of Thucydides, they admit that it has an “elemental truth.” Oooh. Then they try to poke at it with Athens getting too feisty even as they fail to show some sort of decline on the part of Athens. They are simply describing how the trap works.

They discuss the case I mentioned, Germany and UK and WW I, but astoundingly they get some very basic facts wrong, especially about economics. As it is, for all their credrentials, these guys are not economisrts and they make very incorrect statements. They try to claim that what was going on just before WW I was Germany slowing down, if not declining. Wrong wrong wrong. And they did not give a phoo about Russia, whose rapid growth was from low base leaving them way behind. They were not a player. It was all about Germany and UK, and the period 1895-1907 when they claim Germany was slowing down was when it was speeding up and definitively surpassing UK. In the 1870s UK had twice as much steel production as Germany. By 1914 Germany had three times that of UK. Germany slowing down? Far from it.

OTOH, it was true that Germany’s rise brought about a backlash and response from others that made it harder for them to assert themselves, But that is exactly what the trap is about. The rising power begins to scare other existing powers who then react, with the rising power reacting to the reaction. This is how things go to war, and this is exactly the process that is going on right now vis a vis China. Its rising power is bringing about a response from others, such as the Quad, just as I described. But this is exactly how the Thudydides Trap works.

This article is astoundingly stupid for coming from such credentialed people, quite aside from it messing up some basic facts, with there being others besides their total botch on what was happening with the German economy just prior to WW I. They are just dead wrong on that one.

BTW, I do not think that war is inevitable between US and China and hope it does not happen. But China is not in decline, even if it is slowing down. It will continue to move ahead of others around it, with this indeed probably further bringing responses like we are seeing now, especially if PRC continues to engage in aggressive actions towards neighbors as it has to India and in the South China Sea.

Moses,

In fact you are right that I am a semi-klutzy bungling out of it incompetent with regard to a lot of things, and have been for decades since I was quite young. My bumblings with links and stuff is part of that.

I know you want to think that this shows that anything I say is not reliable, and I do make mistakes, some of which you have even caught, even as on a lot of things you have been on the floor on your face. But as it is, this is part of my longstanding “absent-minded professor” schtick., which has been going on since before I was actually a professor. Yeah, it is probably part of my strong math orientation, even though I am not nearly as good of a mathematician as some of the famous ones who have been especially notorious for their eccentricities and non-functionality. And indeed, I have been on the receiving end of accusations of sexism from wives annoyed with me relying on them for assistance with my out of it bungling.

So, I know about some of the embarrassing eccentricities of some famous mathematical economists, which I shall not report here. But I shall give an example from math of this stuff with the associated sexism of an out-of-it mathy husband relying on a more organized wife. This is the late Alonzo Church, who was the major prof at Princeton of both my late old man, Barkley Senior, and the late Alan Turing. He did important things with both of them, the Church-Rosser Theorem and the Church Turing Thesis, neither of which I shall get into here, both of which are easily googled.. Anyway, he was a seriously brilliant mathematician, way beyond my ken.

But he was also wildly out of it in many ways. His eyesight was not all that great, with his eyes sunk deep into his head beneath his protruding and large forehead (large preftontal cortex that guy). So, sometimes when he was walking around and thinking about math he would just close his eyes so he would not get distracted, and with him not seeing all that well anyway One day when he was doing this, he was hit by a car as he was crossing a street with his eyes closed. Really. He ended up in the hospital. A nurse named Mary took care of him there and decided that she really liked taking care of him and married him. I can tell you that at dinner at their house, Mary did just about all the talking, a formidable woman, while Alonzo would sit there smiling, with his eyes open only part of the time.

So, next time you think you are really scoring a big hit by pointing out my bumbling on thing like links and some other odd things, note that you will be reminding people that indeed I am an absent-minded professor, with what implies, although I try not to try the patience of my wife too much with such things, :-).

Comparing yourself with Alan Turing. Oh my. I’m surprised you didn’t try to draw parallels to John Nash. Gottfried Leibniz?? No…… Leibniz might hurt your fragile sensitivities. Jesus Christ?? What do you think, can Jesus meet the standards of your self-delusions?? Perhaps you feel your unfair “crucifixion” by other commenters bringing attention to your blunders and misguided China shadow banking night terrors makes the nails in Jesus’ hands and feet seem like a kind of “petty thing”.

I think rambling fits, but the better self-descriptor would probably be narcissistic blowhard. But somehow unintentionally comedic.

Oh, I am a much lower version of it as are most of the eccentric mathematical economists around, whose weird behaviors are not nearly as dramatic as those of more famous figures like Nash (who did get an econ Nobel). You are just annoyed that I have undercut one of the little games you have been playing here for so long. Catch me goofing up? Yeah, just me being an absent-minded professor again, oof!

Anyway, clearly you need to inform the taxpayers of Virgiinia about this, that they have an absent-minded professor on one of their faculties who has shown he does not know what SAAR is on a blog and even cited an article from Quora, not to mention making other goofs and misspellings. They will rise up and demand my removal, I am sure. It truly is shameful that anybody pays me anything to do anything at all.

In the meantime, I am right that these guys trying to claim China is about to actually decline in various ways thus disproving the Thucydides Trap really messed up and in fact provided a desctiption of how the trap actually works by stimulating a backlash from existing powers. I expected them to confuse levels and rates as they did, but I did not expect them to be as massively ignorant about basic historical economic facts, such as those regarding Germany’s growth.

And as for China’s shadow banking system, you are the one not providing any information about it, although you have shown us the PRC government is eager to publicized mitigation efforts despite your saying they would keep those secret, with you in this latter guise ending up agreeing with me that there is a lot of important stuff related to this that we do not know the details about and that are not getting reported on, although you prefer to argue it is the solution to the problem rather than the problem itself that is being kept secret. Oh, that is rich.

Moses,

Oh, since you mistakenly think I am comparing myself to Alan Turing despite my clear remarks to the contrary, I shall annoy you with more observations and name dropping on all this, tsk tsk.

I never met Turing. He died when i was too young. But curiously enough he was probably less eccentric than many others of his level and dealing with similar matters. He certainly was less so than his major prof, Alonzo Church, whom I did know. As it was, in his day what was viewed as his biggest issue is something now we find tragically sad, that he was hounded for his gayness into committing suicide.

As it is, while I never met him, I not only met but got to know quite well several of his top assistants at Bletchley Park in WW II. These were absolutely fascinationg people, but I shall not drop their names, nor shall I describe their eccentricities, although they had them. None of them remain among the living at this time, and when I knew them was before their work at BP became public kinowledge, all that stuff remaining super classified until about the end of the 1980s.

https://fred.stlouisfed.org/graph/?g=F7YK

August 4, 2014

Real per capita Gross Domestic Product for European Union, United States, China and India, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=F7YP

August 4, 2014

Real per capita Gross Domestic Product for European Union, United States, China and India, 1977-2020

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=GAyH

August 4, 2014

Real per capita Gross Domestic Product for China, United Kingdom, Australia and Canada, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=GAyL

August 4, 2014

Real per capita Gross Domestic Product for China, United Kingdom, Australia and Canada, 1977-2020

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=GC6D

August 4, 2014

Real per capita Gross Domestic Product for China, Indonesia, Philippines, Thailand and Malaysia, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=GC6H

August 4, 2014

Real per capita Gross Domestic Product for China, Indonesia, Philippines, Thailand and Malaysia, 1977-2020

(Indexed to 1977)

[ What China really seems to have learned and come to know is how to grow and how to model growth for other developing countries. ]

http://www.news.cn/english/2021-09/24/c_1310205635.htm

September 24, 2021

WIPO expert says China is becoming a global innovation leader

China has made continuous progress from ranking 14th last year to 12th this year and is now “knocking at the door of the GII top 10,” according to WIPO’s “Global Innovation Index (GII) 2021.”

GENEVA — A consistent innovation policy, increased spending on education and science and the ability to translate all these into sound results are behind China’s current role as a global innovation leader, a senior official from the World Intellectual Property Organization (WIPO) told Xinhua on Thursday.

As per the WIPO’s “Global Innovation Index (GII) 2021” released on Monday, China is still the only middle-income economy among the world’s top 30 most innovative countries. It has established itself as a global innovation leader and is approaching the top 10.

According to the report, China has made continuous progress from ranking 14th last year to 12th this year and is now “knocking at the door of the GII top 10.” This year, China also reached the top three in the Southeast Asia, East Asia and Oceania (SEAO) region for the first time.

According to Sacha Wunsch-Vincent, co-editor of the GII, China’s success story can be explained by its consistent and persistent innovation policy planning and execution for more than three decades, as well as by the fact that it has impressively increased spending on education, science and technology.

But, more importantly, it is the country’s ability to translate pro-innovation policy and innovation inputs into sound results, such as intellectual property, innovative products and high-tech exports.

“The speed with which China has built well-known high-tech firms, mostly in the information and communication technology (ICT) sector or the white goods sector, including large home appliances, etc., which are known around the world, has been impressive,” Wunsch-Vincent said.

“The way these companies have consistently invented, filed for and used intellectual property, including trademarks, brands and design, is an important differentiating factor too.”

He underlined that China has overtaken Japan, Germany and the United States in the number of international patent applications by origin, scaled by gross domestic product (GDP), and its lead is striking when considered in absolute terms. The same is true for the number of trademarks and industrial designs by origin as a percentage of GDP….

* https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2021.pdf

Factors included in the WII: ease of paying taxes, ease of access to credit, electricity output.

China is an innovation leader because of excess credit expansion, excess CO2 emissions and tax collections. Yippee! Oh, and lots and lots of patent filings of dubious value. Same old China.

The “peak power” question is legitimate. No amount of the standard ltr wallpaper changes that.

“Credit spreads have also failed (so far) to evidence much reaction”

I like your graph on credit spreads (which has ltr producing graphs that are apples and orange comparisons for some reason). Notice how credit spreads spiked at the onset of the pandemic. This got noticed by a few smart folks. The goods news is that this credit spread spike subsided.

Oil Tightness or Inflationary Impulse?

There is quite a bit of head scratching among my readers about what exactly is going on. So, let me add some more speculation about oil and macro trends.

One reader asked whether higher oil prices were just inflation or reflected tight fundamentals. I answered that the EIA is showing 6.84 mbpd of OPEC and other spare capacity, of which, say, 4 mbpd should be readily available. On paper, at least, there is plenty of spare capacity. This was countered by the fact that the Saudis had been supporting sales from crude inventory draws since 2016 and that spare capacity may therefore be illusory, with fundamentals materially tighter than appreciated.

It is fair to say that Saudi crude inventories measured by turnover days are low by historical standards. Even during the tight markets of the early to mid 2000s, the Saudis carried about 18 days of crude stocks. That number has fallen to 14.3 days per the most recent JODI data, and if Saudi production levels returned to normal, say 10.5 mbpd, the Saudis would be short 50 mb of crude inventory compared to normal. On the other hand, Saudi inventory runoff was only about 50,000 bpd during the pandemic, less than 1% of production. It does not really support the notion that Saudi productive capacity is materially impaired. The EIA’s estimate of spare production capacity therefore looks reasonably sound, but it is fair to ask whether OPEC & Co will fully deploy it.

Interestingly, Saudi inventory trends mirror the DUC situation here in the US, with the inventory of drilled but uncompleted wells now markedly below normal. Whereas the Saudis have run produced crude inventories below normal levels, US shale producers have run drilled but not completed inventories in the ground below normal. The plain vanilla read is that the industry is going to find itself flat-footed as demand recovers next year, with the implication of high oil prices heading into H1 2022, all other things equal.

But will all other things actually be equal? The inflation thesis is something we have not seen in the US since the 1970s and early 1980s.

I think we will see some parallels between the Chinese and US housing markets coming up in the next 30 to perhaps 60 days. The collapse of Chinese real estate developer Evergrande was the result of authorities there tightening standards to quell excessive speculation and risk. Of course, this ostensibly sound step to reduce risk triggered the very meltdown it was intended to avoid. The irony is that the Chinese government is now trying to induce other developers there, including those owned by the state, to buy out the properties which Evergrande was unable to sell. Or put another way, the government is now trying to quietly bail out the industry because it was taking steps to try to ensure it would not have to bail out the industry. This has a tragi-comic feel, but it won’t be limited to China.

The Fed is going to try to taper, cratering the housing and stock markets as we can see in the news today, with yields spiking and tech stocks tanking, even as inflation is surging through the economy. Thus, the Fed will either have to let interest rates rise and see housing tank, or ‘facilitate normalization of the market’ while buying every mortgage it can lay its hands on. This again has a tragi-comic feel, and it might be even funnier if it weren’t happening to us. Fed Chair Powell will go down as the modern version of Arthur Burns, and they’ll have to disinter Paul Volcker’s lengthy remains to get the situation back under control at some point.

The comparisons do not stop there, with President Biden increasingly compared to the hapless Jimmy Carter, the man who lost Iran for the US and presided over a few pretty lousy years in terms of the economy and inflation. (I would note that Jimmy Carter, by the fiscal numbers, was actually a pretty good president, but no one was ever thanked for plugging his achievements.) Biden, meanwhile, manages to combine Carter’s ineptitude in foreign affairs with complete incompetence at home. The Afghanistan and illegal immigration vortex is spreading from the White House to the Democratic House and Senate, with Nancy Pelosi looking about ready to toss in the towel on Biden’s signature legislation. Imagine how much more colorful all this gets when the housing and stock market tank in the next several weeks.

In my February 18th note, I wrote this:

Along the way, expect the Fed’s error of construction to be exposed. By mistaking an outage for a recession, the Fed will have committed to a monetary policy too easy for the problem. As the pandemic fades and the US demand pops like a champagne cork, interest rates will suddenly prove to have been set too low. What will the Fed do? Whatever they do, they will do it from the crucifix.

Now you know what I meant.

Well, it looks like Kopits, John “Grumpy Economist” Cuckrant, and Barkley Junior have solved this whole thing. It’ll all be revealed in their latest book “Larry, Darryl, and Darryl Explain Phantom Inflation”. Coming to a Dollar Tree store near you.

Steven,

Well, the oil market has done some creeping up recently, with Brent crude actually briefly scraping $80 per barrel before pulling back to about $78. I think the Saudis do not want it to get too high an stay there because of their worries about this pushing demand side to substitute a whole lot, but they probably do not mind a somewhat higher price than the roughly $70 per barrel that had been holding for some time.

I note that there are some traders out there forecasting a $200 per barrel price by end of 2022. I am not getting on that particular barrel, although maybe you want to. That would get our Moses really excited and frothing at the mouth.

Anyway, I think you push some other arguments too far. The evidence is very strong that most of the current inflation is heavily coming from the supply chain problems side. These do keep getting extended, so the inflation is not over. But it really does look like this is temporary, with the market indicators of expectations that Menzie keeps showing supporting that. This is not a Carter situation, and if you are telling your clients that, you are misleading them, although if they are overwhelmingly GOPs, they may like seeing that and may be stupid enough not to notice when the forecast fails to come through.

On the housing market, this is indeed the area where there seem to be longer term price issues, with rentals, with the possibility of a housing price decline in US, although I think are overstating how much interest rates are going to rise with the taper. Market so far seem to like that, and interest rates have barely budged. You may be overselling an impending US housing crash.

As for Everegrande, well, we are all still trhying to figure that one out. it looks like foreign exposure not to great, with BlackRock and HABC and a few other apparently exposes foreign firms having already taken a pricing in hit on this matter. All accounts say Chinese trying for a “controllled implosion,” but we shall see if they can manage that, although it does look like they are not going to bail Evergrande out. it will go, so the issue will come down to how controlled that implosion will be. Analysts at Nomura are claiming the bigger hit will be on housing prices in China, which could slow growth there more. But, as I have pointed out repeatedly here to much criticism from our good friend, Moses, there is a lot to this we do not know.

Anyone care to comment on how we currently have ~2.5% CPI inflation and how it gets to the 5Y average 1.64%? What doe the market need to think will happen?