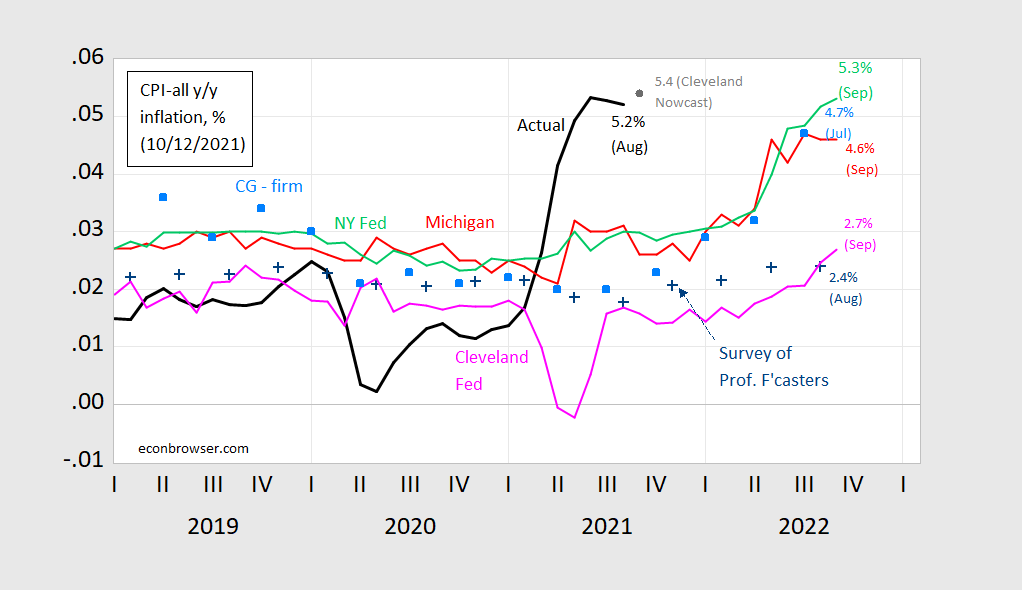

NY Fed’s consumer survey runs hot at 5.3%, hotter than MIchigan’s 4.6%.

Figure 1: CPI inflation year-on-year (black), Cleveland Fed nowcast as of 10/12 (gray circle), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed , Cleveland Fed, and Coibion and Gorodnichenko.

In general, both NY Fed and Michigan surveys are upwardly biased (see here).

This NY FED survey may be even more upwardly biased with people like Princeton Steve fretting over the cost of a bagel.

I heard the usual talking heads babbling about high shipping costs, which reminded me of certain comments from Barkley. I did find this informative story from Bloomberg:

https://www.bloomberg.com/news/newsletters/2021-10-11/supply-chain-latest-container-shipping-rates-are-drifting-lower

Maybe a post on this topic would be timely.

Just out. September 2021 – 5.4%YoY/0.4% MoM/Core 4%, wages/earnings up 0.8%.

Deflation would be more worrisome. Right?

https://fred.stlouisfed.org/graph/?g=sVz7

January 15, 2020

Consumer Price Index and Consumer Price Index Less Food & Energy, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=ECU6

January 15, 2020

Consumer Price Index and Food Prices, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=ECTY

January 15, 2020

Consumer Price Index and Energy Prices, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Index Rent and Owners’ Equivalent Rent, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=twAi

January 15, 2018

Real Average Hourly Earnings of All Private Workers, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=G5Ya

January 15, 2020

Real Average Hourly Earnings of All Private Workers, 2020-2021

(Indexed to 2020)

Top Health Insurance Companies

I still like the hot pink graph line the best/ trust it the most. Although maybe you could average them out?? But basically I’m running with that pink line.

For obvious reasons we usually cut out the volatile components of price changes when we talk about inflation. In the past that was simple enough – just remove food and oil to arrive at index numbers that should dictate economic policy. At this point in time a lot of other items have price volatility without any underlying reasons for expecting long-term price increases. In other words the indexes that used to be good for policy guidance are currently inflated and of little use. The only underlying general inflation push would come from increased wages. Some of that cost could be bleeding into prices and remain there (wages are sticky). However, the societal good of higher wages, will by far exceed the minimal problems from a slightly above target inflation rate.

Social Security COLA 5.9%. Two months ago the Seniors League forecast 6.2%. Not bad.

Seems like they did better than a lot of the pros. Naturally pgl mocked the idea of paying any attention to them.

Another stupid off hand and unneeded comment about what I would allegedly say. I would say stop ruining good comments with this unnecessary garbage but then you are zero for 1 billion in terms of once and a while making an insightful comment.

Listen dude – you have some serious emotional problems. Please seek professional help.

What pgl said, Aug 17, 2017: “ The Senior Citizens League may be nice people but this is your go to group for forecasting inflation? Have your new buddies check you out for dementia.” This is NOT what he allegedly said.

Funny! Seniors League did a pretty decent job of forecasting inflation! Maybe the pros should ask them for some tips!

JohnH: Point of clarification – Social Security uses CPI – urban wage and clerical workers, not CPI urban all.

JohnH thinks they are the best forecasters ever. Maybe they are but could he bother to track the forecasting record over an extended period of time? Of course not.

Covid ran a stress test on capitalism and market forces – both failed.

Now how do we shore them up so we don’t get this kind of disruption next time around?

https://www.nytimes.com/2021/10/12/world/europe/uk-covid-deaths-inquiry.html

October 12, 2021

Britain’s Covid Missteps Cost Thousands of Lives, Inquiry Finds

Prime Minister Boris Johnson’s slowness last year to impose a lockdown and institute widespread testing had tragic results, according to a parliamentary report.

By Shashank Bengali

LONDON — Britain’s initial response to the Covid-19 pandemic “ranks as one of the most important public health failures the United Kingdom has ever experienced,” a parliamentary inquiry reported on Tuesday, blaming the government for “many thousands of deaths which could have been avoided.”

In a highly critical, 151-page report, two committees of lawmakers wrote that the government’s failure to carry out widespread testing or swiftly impose lockdowns and other restrictions amounted to a pursuit of “herd immunity by infection” — accepting that many people would get the coronavirus and that the only option was to try to manage its spread.

“It is now clear that this was the wrong policy, and that it led to a higher initial death toll than would have resulted from a more emphatic early policy,” the report concluded.

Although many of its findings were already known, the report grew out of the first authoritative investigation of Britain’s pandemic response. The inquiry, led by lawmakers from Prime Minister Boris Johnson’s own Conservative Party, described a litany of failures by his government in the months after the first coronavirus cases were detected in Britain in January 2020….

https://fred.stlouisfed.org/graph/?g=FvUs

January 15, 2018

Sticky Consumer Price Index less Shelter and less Food & Energy, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=FvRm

January 15, 2018

Sticky Consumer Price Index less Shelter and less Food & Energy, 2020-2021

(Percent change)

http://www.news.cn/english/2021-10/13/c_1310242796.htm

October 13, 2021

China’s foreign trade maintains robust growth, reports improved quality

BEIJING — China’s foreign trade maintained robust growth with strong resilience and improved quality in the first three quarters of the year, backed by the country’s steady economic development.

China’s total imports and exports expanded 22.7 percent year on year to 28.33 trillion yuan (about 4.38 trillion U.S. dollars) in the first three quarters of 2021, official data showed Wednesday.

The figure marked an increase of 23.4 percent from the pre-epidemic level in 2019, according to the General Administration of Customs (GAC).

Both exports and imports continued double-digit growth in the first nine months of the year, surging 22.7 percent and 22.6 percent from a year earlier, respectively.

The fundamentals of China’s long-term economic growth have not changed, GAC spokesperson Li Kuiwen told a press conference, noting stable domestic production and consumption demand provided strong support for the growth of China’s foreign trade.

As the pace of the global economy and trade picked up, demand in the international market contributed to China’s foreign trade expansion, Li said, adding that price hikes of international commodities also pushed up China’s imports….

ltr,

Washington Post reported today that the problems of Evergrande have now spread to several other property firms that have joined it in failing to make debt payments on time. People are still hoping that the PBOC and other authorities will keep this spreading problem from going too far, but it looks that some forecasters are lowering their growth forecasts for PRC as a result of this latest development, although not by all that much, maybe a half percent or so.

Of course this is not a foreign trade matter, with the link you provided focusing mostly on foreign trade elements, although maintaining that “the fundamentals of growth” remain in place with no mention of any possible question marks to that from anything like a major financial problem that is worsening.